Original author: UkuriaOC, CryptoVizArt, Glassnode

Original translation: Wuzhu, Golden Finance

summary:

On average, BTC investors are experiencing relatively smaller unrealized losses compared to previous cycles, indicating relatively favorable overall conditions.

However, unrealized losses for short-term holders remain quite high, indicating that they are the main risk group.

Profit and loss activity remains very light, and key indicators such as sell-side risk ratios suggest that volatility may increase in the near term.

Market downturn

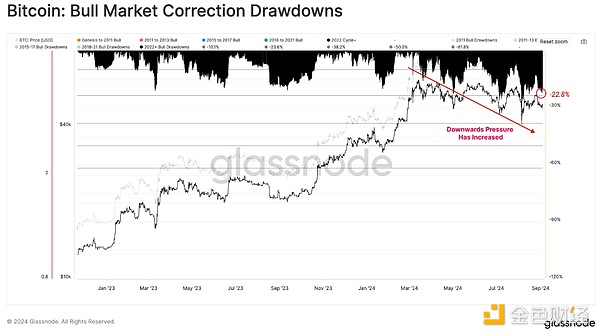

The past six months have seen stagnant price action and depressed investor sentiment. However, the past three months have seen a dramatic change, with downward pressure increasing and leading to the market experiencing its worst decline of this cycle.

However, from a macro perspective, the spot price is currently around 22% below its all-time high, a relatively small drop compared to historical bull runs.

Current market pressure

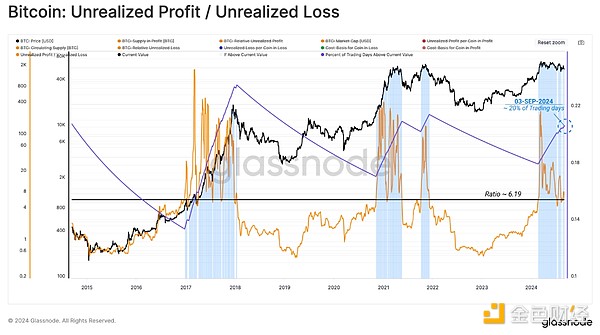

As downward price pressure increases, it would be wise to evaluate the unrealized losses held by investors to assess the financial stress they are experiencing.

Looking at the broader market, unrealized losses remain at historically low levels. Total unrealized losses represent just 2.9% of Bitcoin’s market cap, which is also historically low.

This suggests that even amid the ongoing price decline, investors overall remain relatively profitable.

If we take the ratio of total unrealized profits to total unrealized losses, we can see that profits still outweigh losses by a factor of 6, supporting the above observation. On about 20% of trading days this ratio is above the current value, highlighting the surprisingly solid financial health of the average investor.

Short-term concerns

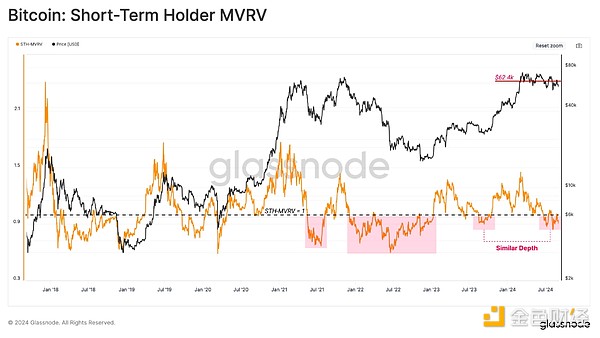

The group of short-term holders, representing new demand in the market, seems to be bearing most of the market pressure. Their unrealized losses are dominant and have continued to increase in size over the past few months.

However, even for this group, the size of their unrealized losses relative to market capitalization is not yet in line with a full-blown bear market, and is closer to the turbulent 2019.

We can support the above observation by evaluating the STH MVRV ratio, which has fallen below the breakeven value of 1.0. During the recovery rally after the FTX failure, the indicator traded at levels similar to August 2023.

This tells us that the average new investor is holding unrealized losses. Generally speaking, the market is expected to weaken further before the spot price recovers its STH cost basis of $624K.

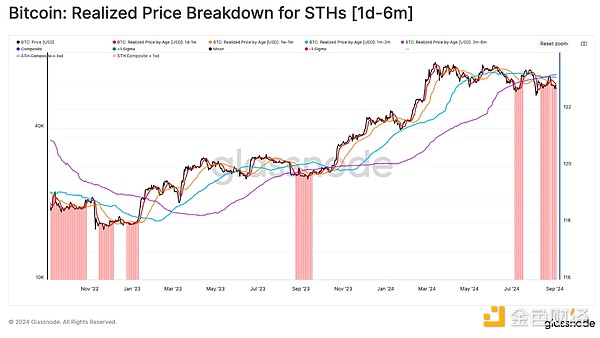

We can increase our confidence in this assessment by examining a subset of the STH investor population. Currently, all age groups in the STH population are holding unrealized losses, with an average cost basis of:

1 d-1 w: $59.0 k (red)

1w-1m: $59.9k (orange)

1 m-3 m: $63.6 k (blue)

3m-6m: $65.2k (purple)

Investor reaction

Assessing unrealized losses can provide insight into the pressures that investors in the market are facing. We can then supplement this with an analysis of realized profits and losses (locked-in) to better understand how these investors are responding to this pressure.

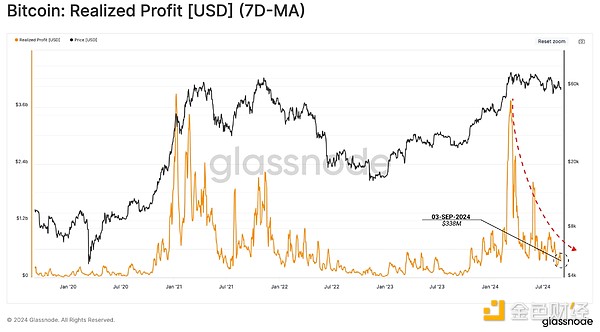

Starting with realized profits, we can see that there was a massive drop after the all-time high of $73,000, suggesting that most of the coins spent since then have locked up smaller and smaller amounts of profit.

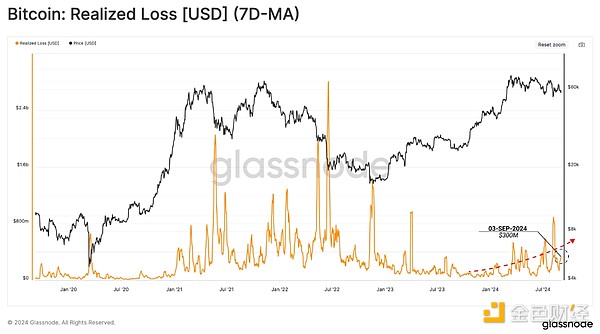

Turning to realized losses, we notice an increase in loss events and volumes are rising to higher levels as the market moves down.

Loss-making events have not yet reached the extreme levels seen during the mid-2021 sell-off or the 2022 bear market. However, the gradual move higher does suggest that some fear is creeping into investor behavior patterns.

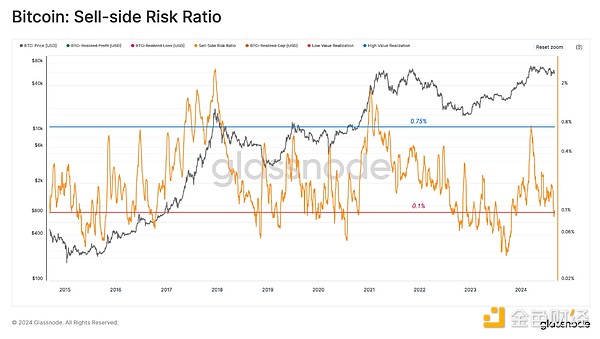

From the perspective of the sell-side risk ratio, we can see that the total realized profits and losses are relatively small compared to the overall market size. We can interpret this metric under the following framework:

High values indicate that investors have spent tokens with large profits or losses relative to their cost basis. This situation indicates that the market may need to re-balance and will typically follow high volatility price action.

Low values indicate that most tokens are spending relatively close to their breakeven cost basis, indicating that a certain level of equilibrium has been reached. This situation usually indicates that the breakeven within the current price range has been exhausted, usually describing a low volatility environment.

The sell-side risk ratio has dropped to a low level, indicating that most on-chain transactions are trading very close to their original purchase price. This indicates that profit and loss activity is gradually saturated within the current price range.

Historically, this suggests expectations of increased volatility in the short term, similar to what was seen in 2019.

Driving the cycle

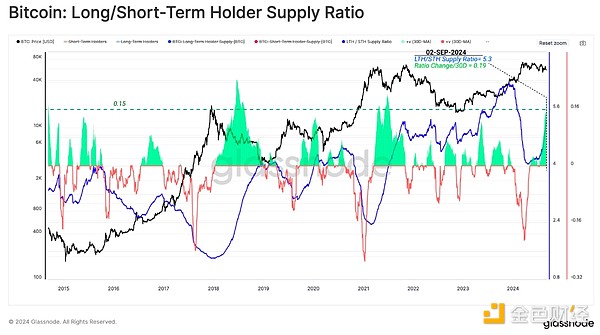

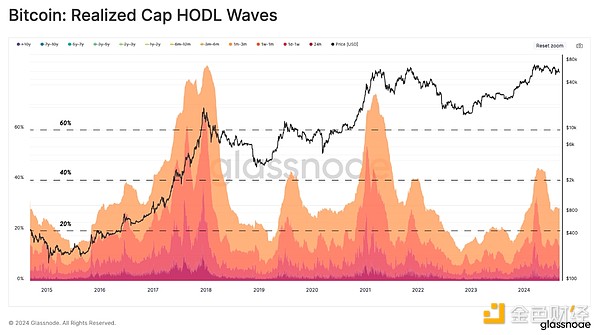

In the downtrend, patience and holding became the dominant market dynamics. A large number of long-term holders tokens were spent to earn profits from the March ATH, creating a net excess supply.

LTH has recently slowed down the pace of profit taking, with the supply accumulated during the ATH run-up maturing into long-term holders. However, historical examples of LTH supply increases like this show that this typically occurs during transitions to bear markets.

Combined with the above observations, we note that the wealth held by new demand investors has declined in recent months as tokens mature and transition into long-term holders.

The percentage of wealth held by new investors is not reaching the highs experienced during previous ATH distribution events. This could suggest that the 2024 peak is more in line with the mid-cycle highs of 2019 rather than the macro highs of 2017 and 2021.

To summarize our analysis, we will refer to a simplified framework for thinking about historical Bitcoin market cycles using key on-chain pricing levels:

Deep bear market: the price is lower than the actual price. (red)

Early bull market: Prices trade between the actual price and the true market mean. (Blue)

Enthusiastic Bull Market: Price is trading between ATH and the true market mean. (Orange)

Euphoric Bull Market: Price is above the ATH of previous cycles. (Green)

In this framework, price action remains within a warm bull market structure, which is a constructive observation. However, in the event of a localized downturn, the $51,000 pricing level remains a key area of interest that must hold for further appreciation to occur.

Summarize

Bitcoin is currently only down 22% from its all-time high, which is much smaller than the decline in previous cycles. Ordinary BTC investors are still making a lot of profit, highlighting the robustness of their holdings.

Nonetheless, the short-term holder group continues to incur higher unrealized losses, indicating that they are the primary risk group and the expected source of sell-side pressure in a downturn.

Apart from this, profit taking and loss activity remains very light, suggesting that our current range is saturated, and key indicators such as the sell-side risk ratio are also saturated, hinting that volatility may increase in the near term.