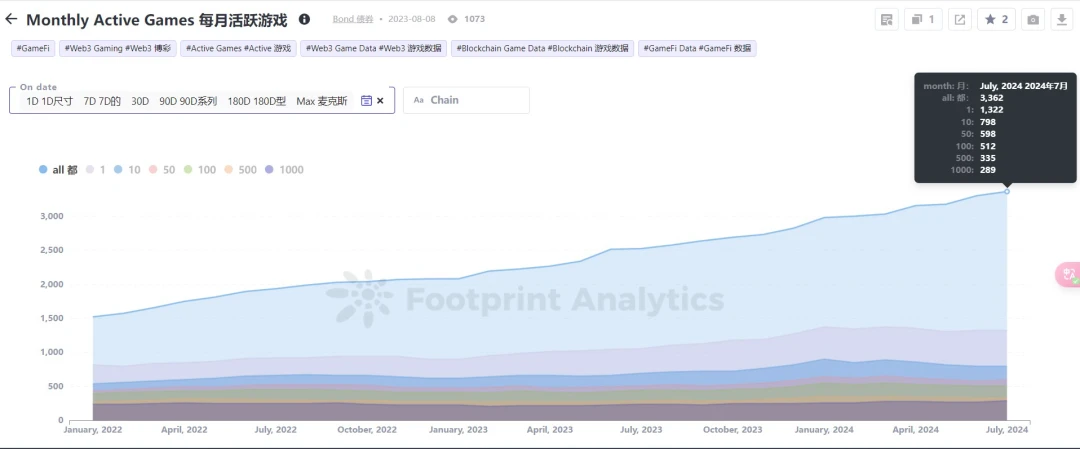

The development of overseas Web3 games is also facing various complex obstacles. According to Footprint Analytics July Web3 game research report, there were 3,362 Web3 games in July, of which only about one-third remained active, and only 289 of them attracted more than 1,000 monthly active on-chain users (MAU). This has also triggered market discussions on the sustainable development of Web3 games.

Active users are the foundation of Web3 games continued revenue. Therefore, in addition to earning revenue by directly selling props in the primary trading market, project owners will also use various methods to improve the sustainability of revenue. For example, some project owners designed a dual token system during development to ensure the stability of the games economic system. In addition, in order to enhance the liquidity of the in-game economy, the opening of a secondary market has become one of the important factors affecting the operation and development of blockchain games.

The 76th Mankiw Afternoon Tea organized by Mankiw Law Firm recently invited senior practitioners of Web3 games to discuss the compliance issues faced by Web3 games at various stages, including a discussion on the secondary market.

At present, the industry generally adopts the method of cooperating with third-party platforms to build secondary markets, but Mankiw has also received many inquiries about self-built secondary markets. Based on this, Mankiw wrote this article to explore the different strategies of self-built and third-party cooperation in secondary markets, and provide corresponding compliance suggestions.

Why set up a secondary market

The secondary market is a platform that allows players to freely trade in-game assets (such as NFTs, virtual props, etc.), providing players with the opportunity to generate value for rare items or virtual assets.

The secondary market plays the following four roles in Web3 games:

Improve asset liquidity. The secondary market provides players with a platform to trade NFTs, game props, and other virtual assets, allowing them to buy, sell, or exchange them freely. This function not only improves asset liquidity, but also increases players investment and stickiness in the game ecosystem.

Increase user participation and benefits. Through the secondary market, players can create value in the game, such as profiting by trading rare items or selling upgraded assets. This sense of participation and profit opportunities attract more users to join blockchain games and promote the development of the game community.

Ensure market pricing and value discovery. The secondary market adjusts the price of blockchain game assets through supply and demand, so that the market value of assets can be more accurately reflected. This is beneficial to both project owners and players, because transparent market prices help improve the trust of the entire ecosystem.

Promote the continuous circulation of the in-game economy. The existence of the secondary market makes the in-game economic system healthier and more sustainable. Players can recover funds and reinvest through continuous transactions, thereby maintaining the vitality of the in-game economy.

Comparison of the advantages and disadvantages of self-built and third-party

The secondary market is crucial to the sustainability of Web3 games. So, how should project owners choose the appropriate way to build the game between self-built and third-party?

A complete Web3 game secondary market mainly includes four dimensions: front-end user interface, back-end management system, smart contract layer and blockchain network. We can make an intuitive comparison between the two through the table below.

It can be seen that the core advantage of self-built secondary markets lies in the project partys complete control over the platform. From market rules, fee structure to user experience, the project party can customize the design according to its own needs. This flexibility enables the project party to deeply integrate brand building strategies and enhance user loyalty and market stickiness. For example, for the previously popular Starshark, self-built secondary markets help project parties build brand image, provide a highly consistent user experience with the main brand, and increase users sense of belonging and interaction frequency.

However, the complex compliance requirements faced by self-built secondary markets, such as the formulation of trading rules and fund review, will cause the technology and resource costs invested by the project party to rise sharply. Under the addition of multiple layers of contracts, the market liquidity will be correspondingly limited. Without stable buyers and sellers, the price of assets may fluctuate greatly, affecting user trust and leading to an increase in customer complaints. In addition, the project party who builds the secondary market by itself needs to solve the asset and information transmission between the underlying chain and the outside world and create a cross-chain bridge, which further increases the technical cost.

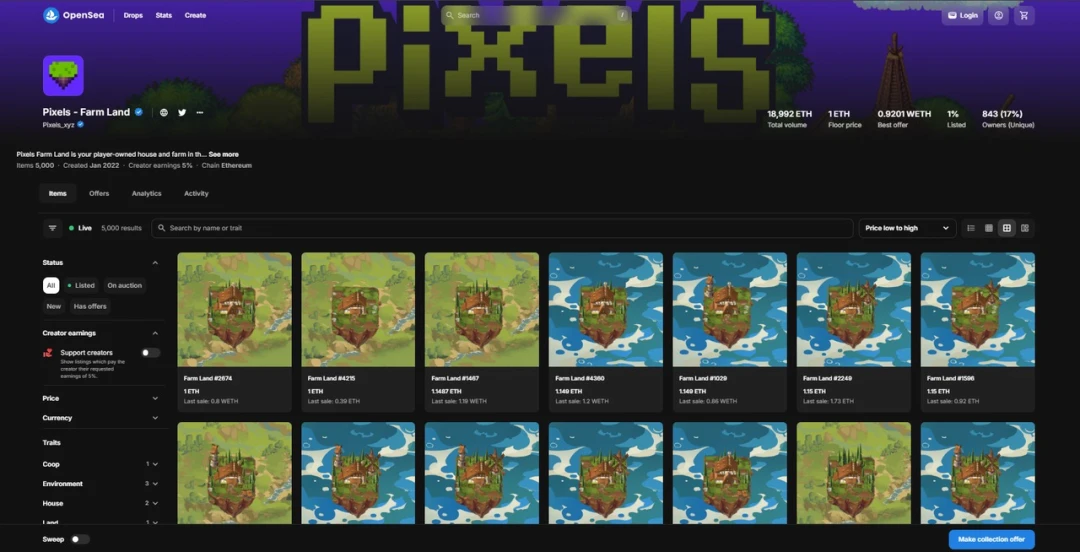

In contrast, cooperation with third-party secondary markets can significantly reduce legal and compliance risks. Isolating the core business of the project party from the secondary market can avoid direct involvement in currency transactions, so that once price fluctuations or losses occur, users are more likely to regard it as market behavior rather than the responsibility of the project party, thereby reducing the risk of rights protection. This approach allows the project party to maintain a certain distance from secondary market trading activities in law, especially in terms of potential criminal liability, reducing the possibility of being held accountable. At the same time, market isolation can also prevent possible legal issues in the future, especially those involving virtual currency transactions and supervision. Large platforms such as OpenSea and Magic Eden have established mature KYC and AML compliance systems and have assumed most of the regulatory responsibilities. In addition, large platforms usually have a complete copyright protection mechanism that can quickly handle potential infringement disputes and reduce the risk of project parties facing copyright issues directly.

Although cooperation with a third party means that there are certain restrictions on market rules, fee structure and user interface, and it is difficult to customize it completely according to ones own needs, large third-party platforms have a broad user base and a complete trading ecosystem. At the same time, the platform generally supports multiple public chains. By cooperating with these platforms, project parties can quickly obtain market liquidity and use the existing user base to expand market coverage. This cooperation model is particularly beneficial for projects in the early stages of development, which can quickly enter the market without having to build a liquidity foundation on their own.

Mankiw Lawyer Comments

Projects suitable for self-built secondary markets

Self-built secondary markets are suitable for projects with strong technical teams, abundant resources, and the desire to deeply control the brand and user experience. For projects that already have a large number of users and are able to bear the pressure of compliance and operation, self-built secondary markets are an option worth considering. However, it should be noted that in the process of customizing transactions, the exchange of RMB should be avoided. Whether the official provides a monetization channel for game points or tokens, or allows cash transactions between users, there is a high risk of criminal involvement.

Projects suitable for cooperation with third parties

For projects in the early stages of development, it is a safer choice to prioritize reducing compliance risks and quickly obtaining market liquidity. Cooperating with a third-party platform is also the practice of most blockchain game project parties. This model can not only quickly enter the market, but also reduce technical and operational burdens and reduce initial investment costs. However, it is worth noting that when operating a blockchain game project on a third-party platform, users may think that the project party is associated with the platform. The project party can clearly define the independence of both parties through a clear user agreement and cooperation statement, thereby reducing misunderstandings.

Mixed mode possibilities

Some projects can consider cooperating with third-party platforms in the early stage, and gradually turn to building their own secondary market after the business matures. For example, Pixeis, which currently ranks first in the popular blockchain game list, adopts this model.

This approach helps project owners to gradually accumulate technology and market resources while ensuring liquidity and compliance, and ultimately achieve a smooth transition. However, it should be made clear that project owners should avoid connecting in-game points to third-party secondary markets for trading. Even if the points are not on the chain, they have certain token attributes, and project owners also need to bear data synchronization, privacy, security issues, and additional customer complaints that may arise from this. Therefore, restricting the withdrawal interface and ensuring that off-chain tokens are only used to purchase in-game items can prevent the token from being identified as a cash-out tool, thereby reducing compliance risks.

Attorney Mankiws Summary

In general, when choosing a secondary market model, blockchain game project owners need to make decisions based on their own resources, technical capabilities, and compliance needs. For projects that want to quickly enter the market and reduce compliance risks, cooperating with a third-party platform is the best solution; for projects that pursue brand independence and deep user control, building their own secondary market is more advantageous. Regardless of the model chosen, project owners need to combine long-term development goals, formulate flexible secondary market strategies, and control corresponding compliance issues to cope with the ever-changing market and regulatory environment.