The day after the FOMC decided to cut interest rates, the Bank of Japan announced that it would maintain its interest rate policy unchanged. BTC continued to climb above 63,000, with a daily increase of 2.33%, but failed to break through the key resistance of 64,000. On the other hand, ETHs performance made it the protagonist of today. After being complained about its weak growth many times, a wave of pull-ups at noon caused the currency price to break through the $2,500 mark and finally closed at 2,561 (+ 5.05%), showing strong upward momentum when ETF Flow did not improve. Next, we may need to further observe the increase in exchange reserves to prevent selling pressure caused by supply and demand imbalances.

Source: TradingView, BTCUSDT vs. ETHUSDT intraday trend comparison

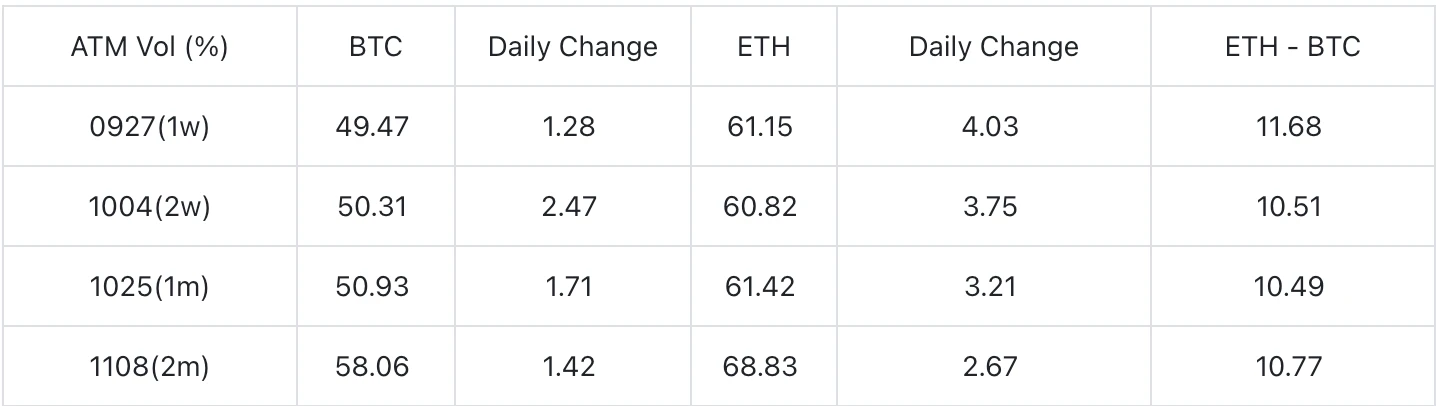

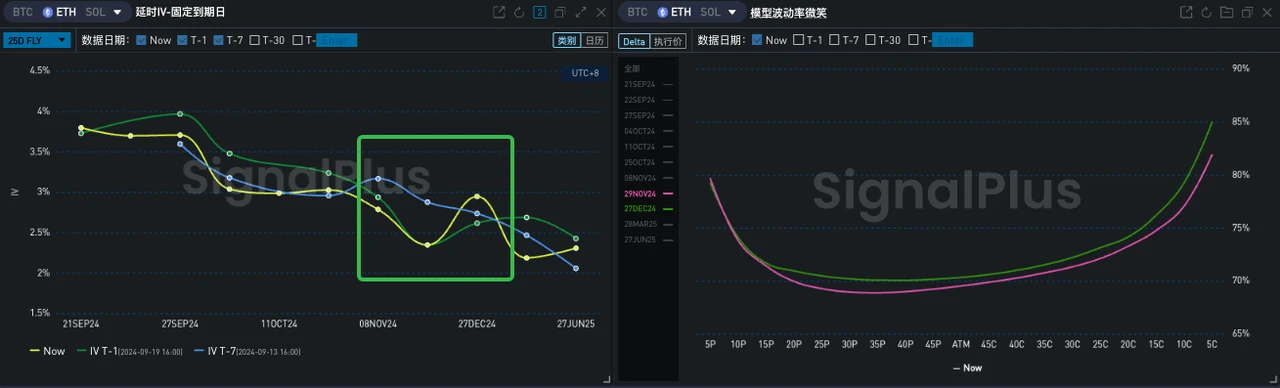

From the perspective of implied volatility, most of the uncertainty at the front end has dissipated since the policy shoe landed, but the high actual volatility brought by the continuous upward trend still supports the front end curve. Although the next two days are weekends, it still cannot dispel traders concerns about potential hedging costs. However, it is also observed that after todays settlement, a large number of sellers have flocked to the market to lower the premium of the past two days, causing BTC ATM IV to fall rapidly from 50.46%/44.81% (21 Sep/22 Sep) at the settlement time. Now the biggest uncertainty has come to the US presidential election. After the callback in the previous two days, the far-end IV has rebounded sharply along with the entire curve. BTC has returned to the level of a week ago, while ETH has encountered a larger increase.

Source: Deribit (as of 20 SEP 16: 00 UTC+ 8)

Source: SignalPlus

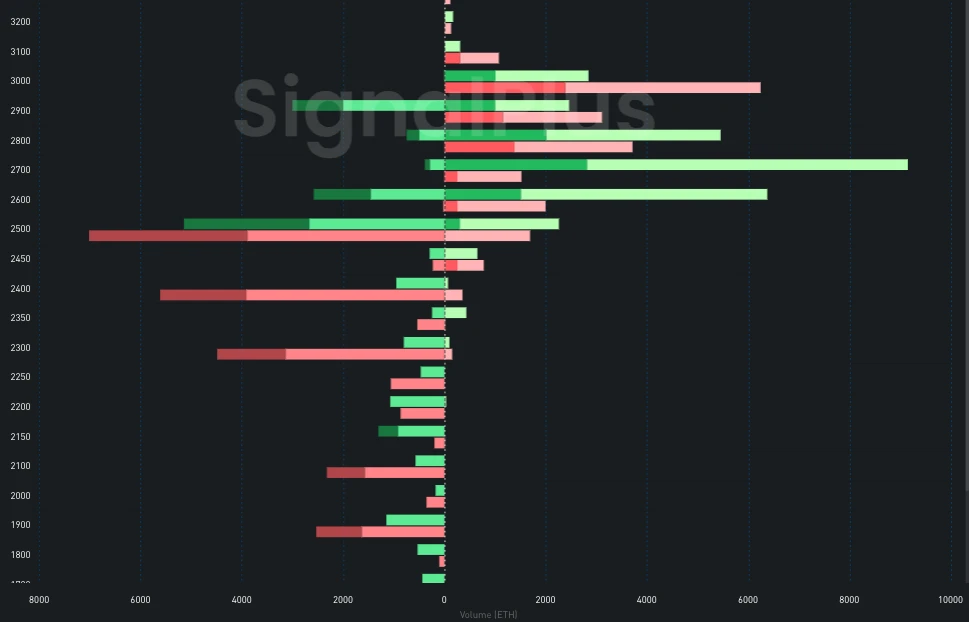

From the perspective of volatility slope, the positive effect of the interest rate cut policy has caused Vol Skew to flatten significantly. ETHs eye-catching performance today has raised the slope level to the highest point in the past month. The local buy Call and sell Put transactions at the end of September were particularly obvious. Perhaps it can attract some high-point profit-taking or selling operations before the weekend is approaching.

Source: SignalPlus

Source: SignalPlus, ETH 27 SEP transaction distribution

From the curvature point of view, BTC and ETH both reached a trough on 29 NOV, which was in sharp contrast to the peak of the following month, leaving a cross-period Vol Premium premium on Wing.

Source: SignalPlus

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com