Original author: Crypto, Distilled

Original translation: TechFlow

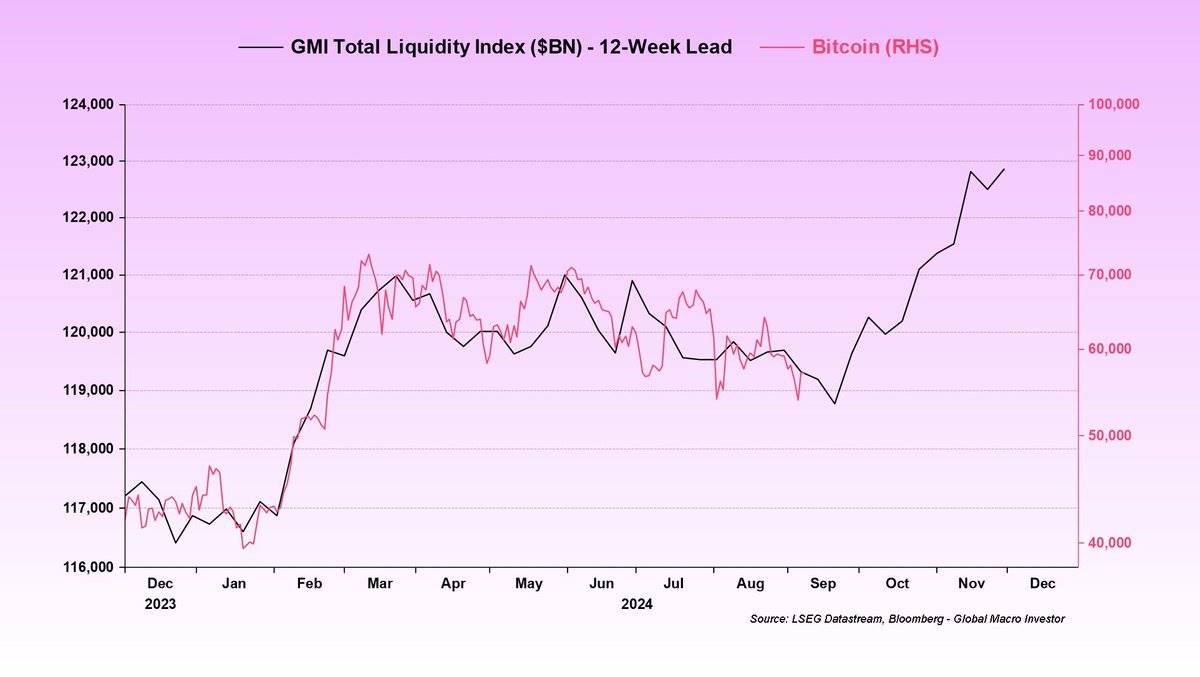

The global M2 money supply has reached an all-time high, however, the price of BTC remains sluggish.

Liquidity is not flowing into the cryptocurrency market as investors prefer safe assets such as gold.

Will this change? (Thanks @BittelJulien )

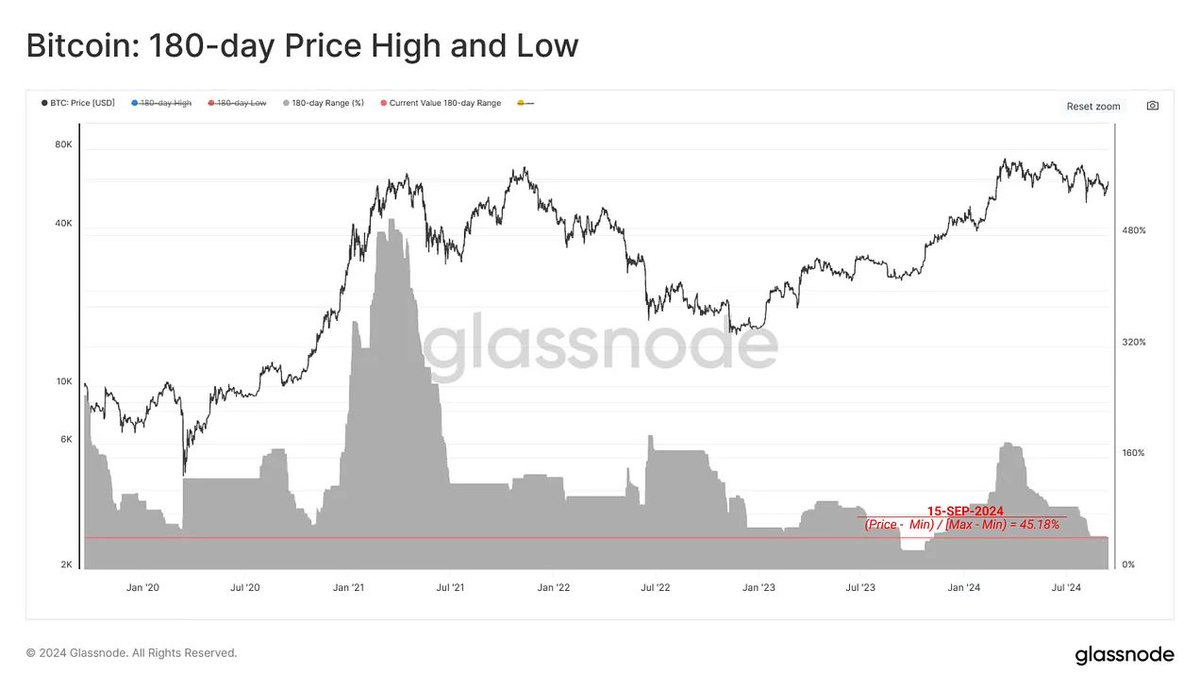

Currently, BTC has been fluctuating in a clear range for 6 months.

Volatility is narrowing, like a tight spring.

In fact, only August 2023 and May 2016 had tighter BTC price ranges, which lasted 180 days.

(Thanks @glassnode )

The rising dominance of stablecoins since August reflects this risk-averse mentality.

Investors seek safe havens in safe assets amid macro uncertainty.

Stablecoins dominate trading pairs, acting as a substitute for investor demand.

Overall stablecoin supply is close to an all-time high of $160.4 billion.

This indicates the accumulation of USD capital within the crypto ecosystem.

However, this capital has not yet flowed into risky assets, suggesting that investors remain cautious.

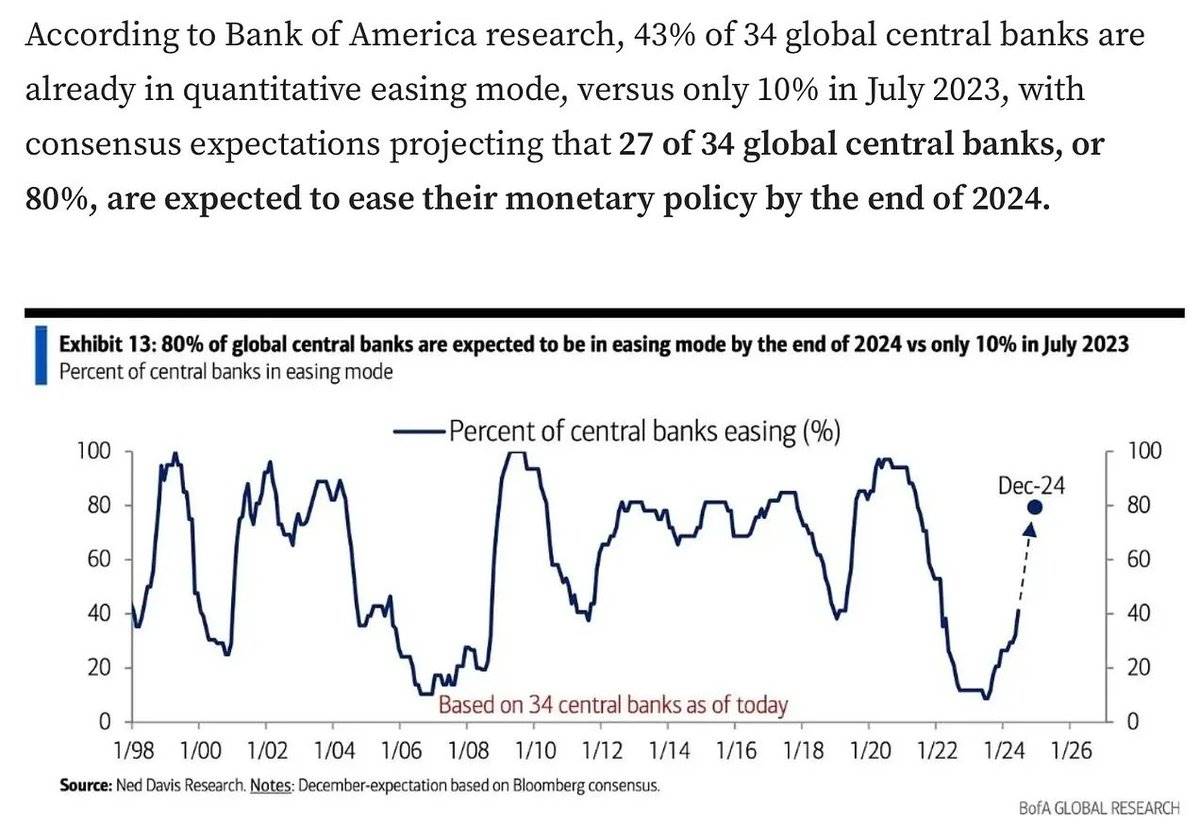

That caution is likely to wane as central banks cut interest rates.

The shift in sentiment towards risk appetite could prompt capital inflows from stablecoins to altcoins.

This will inject liquidity into the crypto markets and could drive prices higher.

Such a shift could reignite trading activity.

At the same time, gold has a significant correlation with M2, further consolidating its role as a recession hedge.

As the money supply increases, demand for gold also rises, cementing its status as a safe-haven asset.

In August, gold rallied on recession fears while risk assets weakened.

Interestingly, BTC and gold often fluctuate alternately, with one rising while the other is consolidating.

Gold prices are up more than 5% this month.

When gold’s uptrend pauses, it could signal a shift in risk appetite sentiment, triggering a rally in BTC.

Despite being often referred to as “digital gold,” BTC moves in line with $NDX.

Its performance is similar to that of high-risk technology stocks.

The correlation between BTC and $NDX has always been strong and has strengthened recently.

(Thanks @AxelAdlerJr )

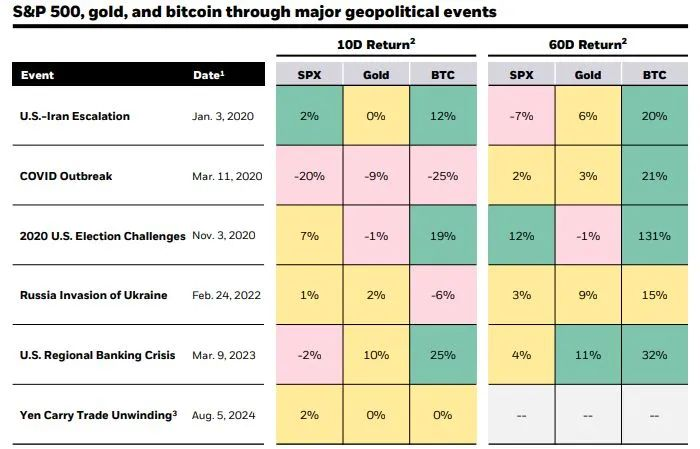

However, a recent report from BlackRock suggests otherwise.

BTC typically reacts negatively to short-term uncertainty when major events occur.

However, even as gold and the SP 500 underperformed, BTC’s 60-day return remained positive.

Despite short-term volatility, BTC may prove resilient over the longer term.

However, due to its shorter history as an institutional asset, more data is needed.

Further analysis is needed to fully assess BTC’s performance during periods of uncertainty.

However, BTC has been following liquidity and rising with monetary easing.

43% of central banks have already started implementing easing policies and liquidity is increasing.

This could quickly drive investment in risky assets like BTC.

Summarize

Liquidity is growing rapidly, but the crypto market is still waiting for the sentiment to shift from risk-averse to risk-on.

Central bank policies could spark this change, injecting idle capital into the crypto market.

The rise can be dramatic, but recession fears remain (non-financial advice).