Original author: Kairos Research

Original translation: Luffy, Foresight News

summary

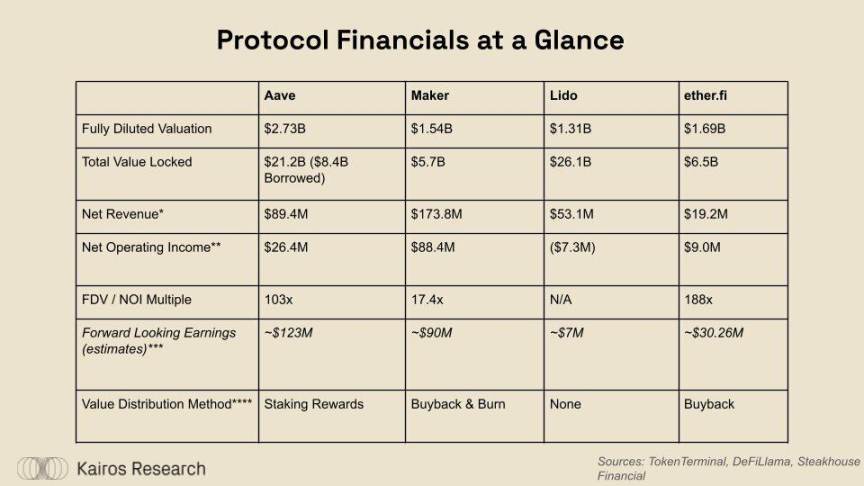

This report aims to explore some of the most influential DeFi protocols from a financial perspective, including a brief technical overview of each protocol and a deep dive into their revenues, expenses, and token economics. Given the unavailability of regularly audited financial statements, we used on-chain data, open source reports, governance forums, and conversations with project teams to estimate Aave, Maker (Sky), Lido, and ether.fi. The table below shows some of the key conclusions we reached throughout the research process, giving readers a comprehensive understanding of the current status of each protocol. While the price-to-earnings ratio is a common way to judge whether a project is overvalued or undervalued, key factors such as dilution, new product pipelines, and future profit potential can tell a more complete story.

Notes: 1. The DAI savings rate is included in the cost of revenue, but not in Aaves security module; 2. Ether.fi token incentives are not included because they are in the form of airdrops; 3. This is a rough result estimated through the growth rate, interest rate, ETH price appreciation and margin of new products (GHO, Cash, etc.) and should not be regarded as investment advice; 4. Aave is currently seeking to improve token economics, including AAVE repurchase and distribution

The analysis concludes that we are witnessing some protocols shifting to sustainable profitability after years of liquidity bootstrapping and moat building. For example, Aave has reached a turning point, achieving profitability for several consecutive months and is rapidly developing a new, higher-margin lending product through GHO. Ether.fi is still in its infancy, but has accumulated more than $6 billion in total locked value, ensuring it ranks among the top five DeFi protocols in terms of scale. The liquidity re-hypothecation leader has also learned from some of Lidos shortcomings and launched a number of other auxiliary products with higher interest rates to make the most of its billions of dollars in deposits.

Problem Statement and Definition

Since the rise of DeFi in 2020, on-chain data and analytical method tooling has steadily improved, with companies such as Dune, Nansen, DefiLlama, TokenTerminal, and Steakhouse Financial playing a key role in creating real-time dashboards on the state of crypto protocols. At Kairos Research, we believe that an important way to cultivate credibility within the industry is to drive standardization across protocols and DAOs to demonstrate financial performance, health, and sustainability. Profitability is often overlooked in cryptocurrency, but value creation is the only way to sustainably align every participant within a protocol (users, developers, governance, and community).

Below are some of the terms we will use throughout this study to try to standardize the approximate costs of each protocol.

Total Revenue/Expenses: Includes all revenue generated by the protocol, belonging to users of the protocol and the protocol itself.

Commission rate: The percentage of fees charged by the protocol to users.

Net Revenue: The protocol revenue remaining after paying fees to protocol users and deducting revenue costs.

Operating expenses: Various protocol expenses, including salaries, contractors, legal and accounting, audits, gas costs, grants, and possible token incentives.

Net Operating Revenue: Net USD revenue after deducting all costs incurred by the protocol and token holders, including token incentives related to protocol operations.

Adjusted Earnings: One-time expenses are added back to earnings to more accurately project future earnings, minus known future costs that are not currently expressed through earnings.

Protocol Overview

We will provide a detailed analysis of the core products provided by each of the key protocols in this report, covering the most mature protocols in a range of crypto segments.

Aave

Aave is a “decentralized, non-custodial liquidity protocol where users can participate as suppliers, borrowers, or liquidators.” Suppliers deposit crypto assets to earn lending yield and gain lending power themselves so they can leverage or hedge their deposited positions. Borrowers are either overcollateralized users seeking leverage and hedging, or taking advantage of atomic flash loans. Borrowers must pay a fixed or floating interest rate for the specific asset they borrow. Aave’s protocol fee is the total interest paid on open (unrealized), closed, or liquidated positions, which is then divided between lenders/suppliers (90%) and the Aave DAO Treasury (10%). In addition, Aave will allow “liquidators” to liquidate positions when positions break their specified loan-to-value ratio caps. Each asset has its own liquidation penalty, which is then divided between liquidators (90%) and the Aave DAO Treasury (10%). A new product offered by Aave, GHO, is an overcollateralized, crypto-backed stablecoin. The introduction of GHO allows Aave to provide loans without relying on third-party stablecoin providers, giving them greater flexibility in interest rates. In addition, GHO cuts out the middleman and allows Aave to earn all the borrowing interest from outstanding GHO loans.

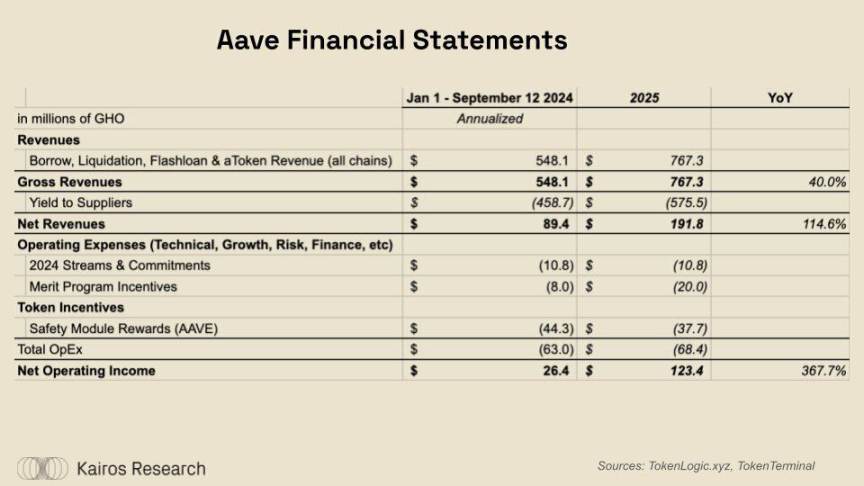

Aave transparently displays all revenue, expenditure, and other data of the DAO through the TokenLogic dashboard. We extracted the Financial Revenue data from August 1 to September 12 and annualized these numbers to obtain a net income of US$89.4 million. To arrive at the total revenue figure, we rely on TokenTerminals income statement data to estimate profit margins. Our forecast for 2025 is mainly based on assumptions, including that the upward trend in crypto asset prices will lead to increased lending capacity. In addition, in our model, Aaves net profit margin has increased due to the potential replacement of third-party stablecoins by GHO and improvements to the protocol security module, which will be further explained later.

Crypto’s leading lending market is on track to have its first profitable year in 2024. Multiple signs point to Aave’s profitability potential: supplier incentives have dried up, and active lending continues to trend upward, with active borrowings exceeding $6 billion. Aave is clearly a huge beneficiary of the liquidity staking and re-hypothecation markets, as users deposit LST/LRT, lend ETH, exchange ETH for liquidity staking tokens, and then repeat the same process again. This cycle allows Aave users to earn a net interest margin (APY associated with LST/LRT deposits - Aave borrowing interest) without taking on significant price risk. As of September 12, 2024, ETH is Aave’s largest outstanding lending asset, with active loans across all chains exceeding $2.7 billion. We believe that this trend driven by the concept of proof-of-stake + re-hypothecation has changed the landscape of on-chain lending markets, greatly increasing utilization of protocols like Aave in a sustainable way. Before re-hypothecation-driven circular lending became popular, these lending markets were dominated by leveraged users who tended to only borrow stablecoins.

The launch of GHO creates a new, higher margin lending product for Aave. It is a synthetic stablecoin where borrowing fees do not need to be paid to suppliers. It also allows DAOs to offer slightly below market interest rates, driving demand for borrowing. From a financial perspective, GHO is undoubtedly one of the most important parts of Aave to focus on in the future, as this product has:

High upfront costs (technology, risk, and liquidity)

The costs of audits, development work, and liquidity incentives will slowly decrease over the next few years.

Relatively large upside potential

The outstanding GHO supply is $141 million, which is only 2.35% of Aave’s total outstanding loans and 2.7% of DAI supply.

Currently, non-GHO stablecoins (USDC, USDT, DAI) lent on Aave are close to $3 billion

A lending market with higher profit margins than Aave

While there are other costs to consider when issuing a stablecoin, it should be cheaper than having to pay a third-party stablecoin provider.

MakerDAO’s net revenue margin is 57%, while Aave’s is 16.31%

Aave Protocols native token AAVE has a fully diluted valuation (FDV) of $2.7 billion, representing ~103x its estimated annual revenue of $26.4 million, but we think this will change in the coming months. As discussed above, favorable market conditions will increase lending capacity, spur new demand for leverage, and potentially be accompanied by liquidation revenue. Finally, even if GHOs market share growth is simply a result of cannibalization of Aaves traditional lending market, it should have an immediate positive impact on margins.

MakerDAO

MakerDAO (now renamed Sky) is a decentralized organization that supports the issuance of stablecoins (DAI) by pledging various cryptocurrencies and real-world assets, so that users can both leverage their assets and allow the crypto economy to obtain a decentralized stable value store. Makers protocol fee is the stability fee, which consists of the interest paid by borrowers and the income generated by the protocol allocated to the yield assets. These protocol fees are distributed to MakerDAO and depositors who deposit DAI into the DAI Savings Rate (DSR) contract. Like Aave, MakerDAO also charges a liquidation fee. When a users position falls below the required collateral value, the assets are settled through an auction process.

MakerDAO has thrived over the past few years, helped by liquidations during the speculative volatility of 2021. But as global interest rates rise, MakerDAO has also created a more sustainable, less risky business line, and introducing new collateral assets such as US Treasuries enables Maker to increase asset efficiency and generate returns above standard DAI lending rates. When exploring the DAO’s spending, we clearly understand the following:

DAI is deeply rooted in the entire crypto ecosystem (CEX, DeFi), which allows Maker to avoid investing millions of dollars in liquidity incentives.

DAOs do an excellent job of prioritizing sustainability

Throughout 2024, Maker is on track to generate approximately $88.4 million in net protocol revenue. MKR is valued at $1.6 billion, just 18 times that net revenue. In 2023, the DAO voted to modify the protocols token economics to return a portion of the proceeds to MKR holders. As DAI continues to accrue borrowing rates (stability fees) to the protocol, Maker has accumulated a system surplus, which they aim to keep at around $50 million. Maker introduced a smart burn engine that uses surplus funds to buy back MKR in the market. According to Maker Burn, 11% of the MKR supply has been bought back and used for burns, protocol-owned liquidity, or vault construction.

Lido

Lido is the largest provider of liquidity staking services on Ethereum. When users stake ETH through Lido, they receive “liquidity staking tokens” so that they can avoid both the waiting period for unstaking and the opportunity cost of not being able to use the staked ETH in DeFi. Lido’s protocol fee is the ETH revenue paid to verify the network, which is distributed to stakers (90%), node operators (5%), and the Lido DAO Treasury (5%).

Lido is an interesting case study for DeFi protocols. As of September 10, 2024, they have 9.67M ETH staked through their protocol, which is approximately 8% of the entire ETH supply, more than 19% of the staking market share, and a total locked value of $22 billion. However, Lido still lacks profitability. What changes can be made to enable Lido to cash flow in the short term?

In the past two years alone, Lido has made tremendous progress in cutting costs. Liquidity incentives are very important in bootstrapping stETH, and advanced users will naturally gravitate towards LST as it has the best liquidity in the entire ecosystem. We believe that with stETH having an impressive moat, the Lido DAO will be able to further reduce liquidity incentives. Even with cost cutting, a $7 million profit may not be enough to justify a $1 billion+ FDV for LDO.

In the coming years, Lido will have to seek to expand revenue or cut costs to reach its valuation. We see several potential growth paths for Lido, either ETH staking continues to rise from 28.3% or Lido works to expand outside the Ethereum ecosystem. We believe the former is likely to be achieved over a long enough timeframe. By comparison, Solanas staking rate is 65.5%, Suis is 79.5%, Avalanches is 49.2%, and Cosmos Hubs is 61%. By doubling ETH staking and maintaining its market share, Lido would be able to generate another $50M+ in net revenue. This assumption is overly simplistic and does not take into account the compression of ETH issuance rewards as staking rates increase. While Lidos current market share increase is also possible, we see Ethereums social consensus casting serious doubts on Lidos dominance in 2023, marking the peak of its growth trajectory.

ether.fi

Like Lido, ether.fi is a decentralized, non-custodial staking and re-staking platform that issues liquid receipt tokens for users deposits. ether.fis protocol fees include ETH staking income and active verification service income, which are used to provide economic security through the Eigenlayer ecosystem. ETH staking income is distributed to stakers (90%), node operators (5%), and ether.fi DAO (5%), and then Eigenlayer/re-staking rewards are distributed to stakers (80%), node operators (10%), and ether.fi DAO (10%). ether.fi has many other auxiliary products that can generate significant income, including Liquid, which is a library of re-staking and DeFi strategies designed to maximize depositors returns. Liquid charges a 1-2% management fee on all deposits, which will be counted into the ether.fi protocol. Additionally, ether.fi recently launched a Cash debit/credit card product, allowing users to use re-collateralized ETH to make payments in real life.

As of September 2024, ether.fi is the undisputed market leader in liquidity re-staking with a TVL of $6.5 billion across its re-staking and yield products. We attempt to simulate potential protocol revenue for each of its products using the following assumptions in the above financial statements:

Assuming the current ether.fi stake remains constant for the rest of the year, the average TVL staked in 2024 will be around $4 billion

The average ETH staking yield will drop by about 3.75% this year

EIGENs pre-IPO FDV is approximately $5.5 billion, and the re-staking rewards are scheduled to be distributed at 1.66% in 2024 and 2.34% in 2025, which means that ether.fis direct revenue from EIGEN is: approximately $38.6 million in 2024 and approximately $54.4 million in 2025

By looking at EigenDA, Omni, and other AVS reward programs, we estimate that a total of ~$35-45 million in rewards will be paid to Eigenlayer re-stakers, with an annual yield of 0.4%

Cash is the most difficult revenue source to model because it has just been launched and there is a lack of transparent precedent in the space. We and the ether.fi team will make a best estimate for 2025 based on booking demand and the cost of revenue for large credit card providers, and we will monitor this closely over the coming year.

While we know that the ETHFI token incentive is a cost of the protocol, we decided to leave it at the bottom of the financial statement for the following reasons: these fees are heavily invested upfront due to airdrops and liquidity bootstrapping, these fees are not necessary costs for business development, and we believe that EIGEN + AVS rewards are sufficient to offset the cost of ETHFI incentives. Given that the withdrawal function has been enabled for some time, ether.fi has seen significant net outflows, and we believe that the protocol is closer to achieving long-term sustainable TVL goals.

Token value accumulation and scoring system

Beyond simply assessing the profitability of these protocols, it is worth exploring where each protocol’s revenue ultimately flows. Regulatory uncertainty has been a driving factor in the creation of a multitude of revenue distribution mechanisms. Dividends to token stakers, buybacks, token burns, accumulation within treasuries, and many other unique approaches have been employed in an attempt to keep token holders engaged in protocol development and incentivized to participate in governance. In an industry where token holder rights are not equivalent to shareholder rights, it is imperative that market participants thoroughly understand the role their tokens play in the protocol. We are not lawyers and do not take any position on the legality of any distribution method, simply exploring how the market would react to each method.

Stablecoin/ETH Dividends:

Pros: Measurable benefits, higher quality returns

Disadvantages: taxable events, gas consumption, etc.

Token Buyback:

Pros: Tax exemption, continued purchasing power, growing funds

Disadvantages: prone to slippage and front-running, no guarantee of returns for holders, funds concentrated in native tokens

Buyback and destruction:

Pros: Same as above, increased revenue per token

Disadvantages: Same as above + no funding growth

Treasury accumulation:

Advantages: Increase the protocol operation space, achieve fund diversification, and still be controlled by DAO participants

Disadvantages: No direct benefit to token holders

Token economics is obviously an art, not a science, and it is difficult to know whether distributing earnings to token holders is more beneficial than reinvesting them. For simplicity, in a hypothetical world where the protocol has maximized growth, having tokens that redistribute earnings would increase the internal rate of return for holders and eliminate risk every time a payout of some kind is received. We will explore the design and potential value accrual of ETHFI and AAVE, both of which are currently undergoing token economics improvements, below.

Looking ahead

Aave

Currently, with GHO supply at 142 million, the weighted average borrow rate for GHO is 4.62%, the weighted average stkGHO incentive payout is 4.52%, and 77.38% of the total GHO supply is staked in the Security Module. Therefore, Aave earns 10 basis points on $110 million worth of GHO and 4.62% on the unstaked $32 million. Given global interest rate trends and the stkAAVE discount, there is certainly room for the GHO borrow rate to fall below 4.62%, so we have also added forecasts for the impact on GHO of 4% and 3.5%, respectively. Aave should have many opportunities to promote the growth of GHO in the coming years, and the figure below predicts how the path to $1 billion in outstanding GHO loans will affect protocol returns.

While Aave has growth potential, Marc Zeller has also proposed a temperature check within Aave’s governance forum to improve the protocol’s payouts as well as the native token AAVE. The premise of the improvements is that Aave is quickly becoming a profitable protocol but is currently overpaying for an imperfect security module. As of July 25, Aave had $424 million in its security module, primarily comprised of stkAAVE and stkGHO, both of which are imperfect assets that cannot cover bad debts due to slippage and decoupling risk. Additionally, through token issuance, the protocol is incentivizing secondary liquidity for AAVE so that slippage can be minimized if stkAAVE must be used to cover bad debts.

This concept could change radically if the DAO votes to use aTokens like awETH and aUSDC as security modules while isolating stkGHO to only pay off GHO debt. stkGHO would never need to be sold to cover bad debts, just confiscated and burned. The aforementioned aTokens are extremely liquid and make up the majority of the protocols debt. If undercollateralized, these staked aTokens could be confiscated and burned to cover bad debts. The goal of this proposal is to reduce spending on security modules and liquidity incentives. Zeller further explains the role of stkAAVE under the new plan in the figure below.

If this proposal passes, it should have a favorable impact on the AAVE token as it will have more stable demand while also allowing holders to earn rewards without the risk of stkAAVE being seized to cover bad debts. We are unsure of the tax implications of the staking contract, but it greatly benefits long-term AAVE holders through continued purchasing power and redistribution of tokens to stakers.

ether.fi

Given ether.fis success in quickly creating a sustainable business model, it is tempting to establish multiple profit initiatives. For example, the protocols development team and DAO acted very quickly to propose that the company buy back ETHFI from 25%-50% of the revenue generated by the Restaking Liquid products for liquidity provision and fund reserves. However, given the lack of AVS rewards, the large startup costs invested upfront, and the fact that most of its product suite is brand new, using 2024 revenue data to calculate a fair valuation may be futile and complicated.

The ETHFI token has a FDV of $1.34 billion and is expected to be slightly profitable this year (excluding liquidity incentives), which makes it very similar to Lidos LDO. Of course, ether.fi must stand the test of time, and the protocol has the potential to become profitable faster than Lido and has a higher ceiling given the continued success of the broader product. The following is a conservative analysis of how AVS rewards will contribute to protocol returns. AVS reward returns are the rewards that re-stakers receive from AVS spend alone.

As seen on Lido, liquidity staking/re-staking is a highly competitive industry with relatively thin margins. Ether.fi has fully recognized this limitation and is exploring building a wider range of yield-ancillary products while taking market share. Here are the reasons why we think these other products fit into its broader re-staking and yield generation thesis.

Liquid: We firmly believe that LRT advanced users are familiar with DeFi Lego blocks and want to maximize their returns, thus attracting them to products that can automate their DeFi strategies. Once AVS rewards are truly online, dozens of risk/reward strategies and a new form of native returns will emerge in the crypto economy.

Cash: Similar to LST, LRT is a superior form of collateral than regular ETH, and they have sufficient liquidity. Users can use liquidity re-collateralization as a yield-bearing checking account, or borrow assets at almost zero cost for daily expenses.