Original author: BitMEX

Brief Overview

The cryptocurrency market had a lackluster week, and it seems the October bull run is yet to come.

This week, despite new highs in the U.S. stock market, major cryptocurrencies remained largely flat. The memecoin sector saw a notable recovery, led by POPCAT. Uniswap also performed well after launching its Unichain second-layer network solution, showing that the market is responding positively to technological advances in the DeFi space.

In our trade analysis section, we will dive deeper into the Unichain announcement and analyze its potential impact on $UNI price targets.

Data at a Glance

Coins that perform well

$POPCAT (+ 22.1%): Catcoin surpasses Dogecoin

$UNI (+16.1% ): Uniswap launches Unichain — the project’s biggest announcement in 3.5 years

$WIF (+11.9% ): $WIF shows signs of breakout

Underperforming Coins:

$W (-11.2%): Last week’s biggest winner turned into this week’s biggest loser

$ENA (-9.1%): $ENA has continued to decline since the airdrop two weeks ago

$BONK (-8.8%): $BONK falls out of favor with new cat meme coin

News

Macro:

ETH ETF weekly outflow: -$12.3 million ( source )

BTC ETF weekly inflows: +$139.5 million ( source )

US job growth exceeds expectations; unemployment rate falls to 4.1% ( Source )

CPI inflation was higher than expected last month – but still at its lowest level in 3.5 years ( source )

HBOs Satoshi Unveiled program received a lukewarm response, and the crypto market reacted tepidly ( source )

Trump rejects Fox News invitation to participate in second presidential debate with Harris ( source )

Thailands Securities and Exchange Commissions new draft rules allow mutual funds and private equity funds to invest in digital assets ( source )

project

Crypto.com confirms receipt of Wells Notice from the SEC and has filed a lawsuit against the SEC ( Source )

Uniswap launches second-layer network Unichain ( source )

Swell Network: Users can now check their SWELL token eligibility ( source )

Puffer Finance will start airdropping on October 15th and will last until January 15th ( source )

Telegram CEO posted a message to celebrate his 40th birthday and said he would share relevant experiences in the next few days ( Source )

Stripe launches Pay with Cryptocurrency feature in the United States, supporting stablecoins including USDC and USDP ( source )

HBO lists 7 reasons why Peter Todd might be Satoshi Nakamoto, despite his denials ( source )

Google has integrated ENS, allowing users to search for .eth domains and check balances ( source )

Grayscale launches Aave Fund ( source )

The Jupiter mobile app is now available on iOS, with an Android version coming soon ( source )

Trading Insights

NOTE: The following does not constitute financial advice. This is a compilation of market news and we always encourage you to do your own research before executing any trades. The following is not intended to convey any guaranteed returns and BitMEX cannot be held responsible if your trades do not perform as expected.

Learn more about Unichain

On Thursday, Uniswap announced the launch of Unichain and $UNI staking, marking a major milestone for the project. Let’s take a deeper look at the technology and its potential impact on UNI’s price.

UNIchain is an L2 built on the OP Stack that aims to solve key challenges in DeFi and blockchain expansion. This new second-layer solution introduces cutting-edge features with the goal of improving market efficiency, mitigating maximum extractable value (MEV) risks, and facilitating seamless cross-chain interactions. Some of the key highlights of Unichain include:

1. Efficient block construction:

UNIchain introduces verifiable block construction developed in partnership with Flashbots to ensure transparency in block construction. This enables faster block times (200-250 milliseconds) by breaking each block into four flashblocks while also mitigating the risks associated with MEV.

It separates the roles of block ordering and block construction, making block order transparent and trustless, and leverages **Trusted Execution Environments (TEEs)** for added security.

2. Flashblocks:

Flashblocks can reduce latency and the adverse selection risk faced by liquidity providers. This provides a low-latency trading experience that is critical to AMM and other DeFi applications.

Flashblocks ensure that transactions are processed faster and more efficiently, allowing DeFi platforms to operate optimally without exposing users to MEV risks such as sandwich attacks.

3. Trustless transaction rollback protection:

By simulating transactions in a TEE environment, UNIchain can detect and remove transactions that will be rolled back, ensuring that users do not pay for failed transactions, thereby improving user experience and reducing friction.

4. Unichain Verification Network (UVN):

The $UNI token gains additional utility by being a staking token for UVN.

UNIchains decentralized verification network reduces reliance on a single sorter, which can avoid risks such as block equivalence or invalid block proposals. Validators participate in block verification by staking UNI tokens, ensuring faster economic finality and cross-chain settlement.

The network will validate blocks faster and is designed to help streamline cross-chain liquidity.

5. Integration with OP Superchain:

UNIchain is built on top of the Hyperchain, enabling seamless liquidity movement and interoperability between rollups on the OP Stack. This makes cross-chain interactions faster and cheaper, solving the problem of liquidity fragmentation.

How high can $UNI go?

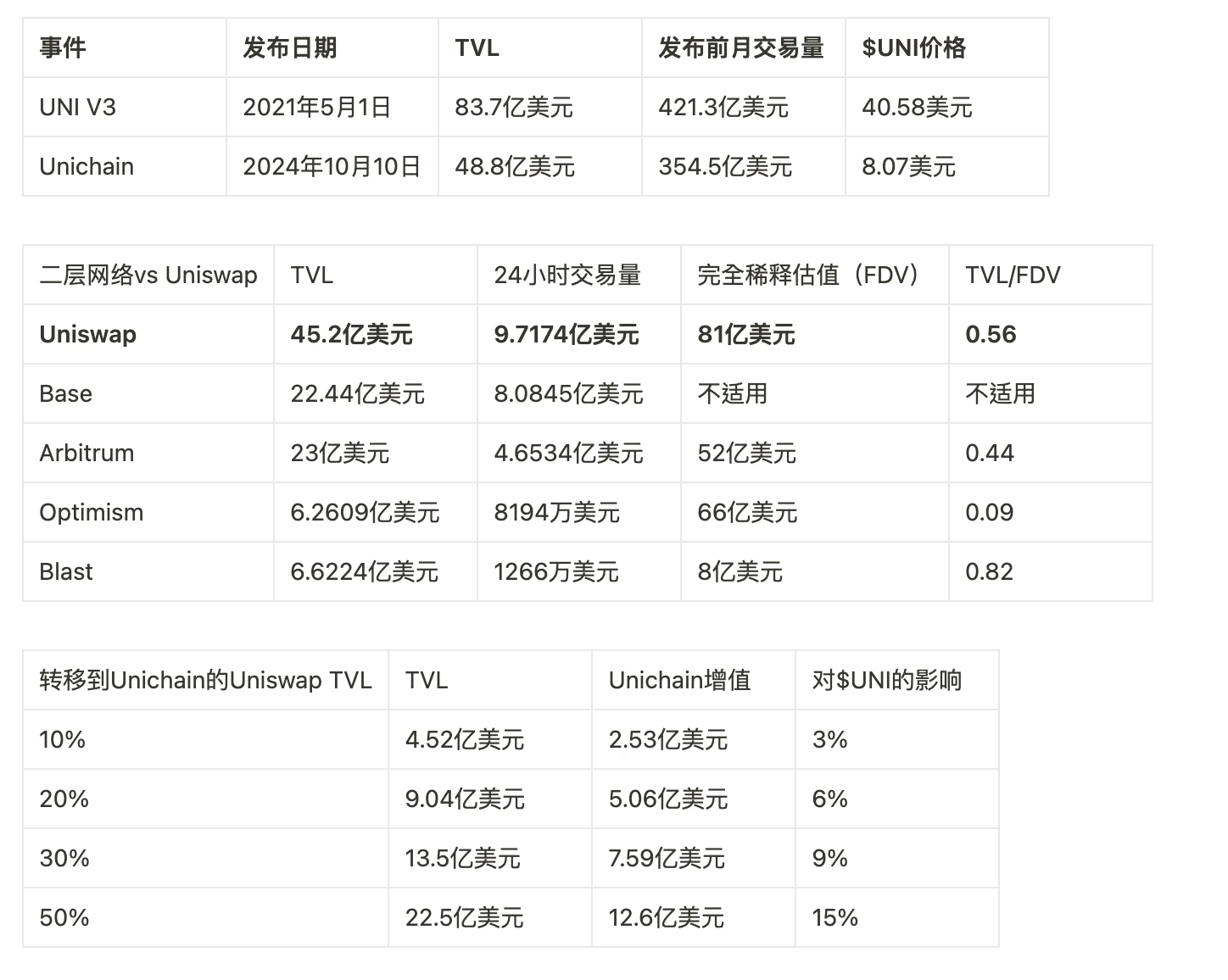

It has been three years since Uniswap’s last upgrade, UNI V3. During the launch of UNI V3, the price of $UNI briefly peaked at around $42 shortly after the announcement. However, there is a significant difference between this price and market valuations.

To assess the potential price growth of $UNI now, we looked at what would happen if UNI could move a significant portion of its current total locked value (TVL) and trading volume to the L2 scheme. We compared this scenario to the existing L2 network to estimate UNIs potential additional L2 valuation:

in conclusion

Overall, Uniswap is an important cornerstone of the DeFi ecosystem, as the application itself is multiple times the size of the largest staking in the crypto space. If Unichain successfully migrates over 30% of its current TVL from other chains to its own chain, the price impact could be significant. However, if only ~10% of TVL/volume is migrated, Unichain may not have much of an impact on $UNIs price, considering its already an $8 billion token.