Original article by Stacy Muur

Compiled by | Odaily Planet Daily Golem ( @web3_golem )

VCs always invest in narratives and marketing, and VC investment activity is a good way to understand which narratives smart money is betting on in the coming quarters. This article shares the projects that received large financing in Q4 2024. Lets explore which protocols attracted VC attention in the first two months of Q4 2024.

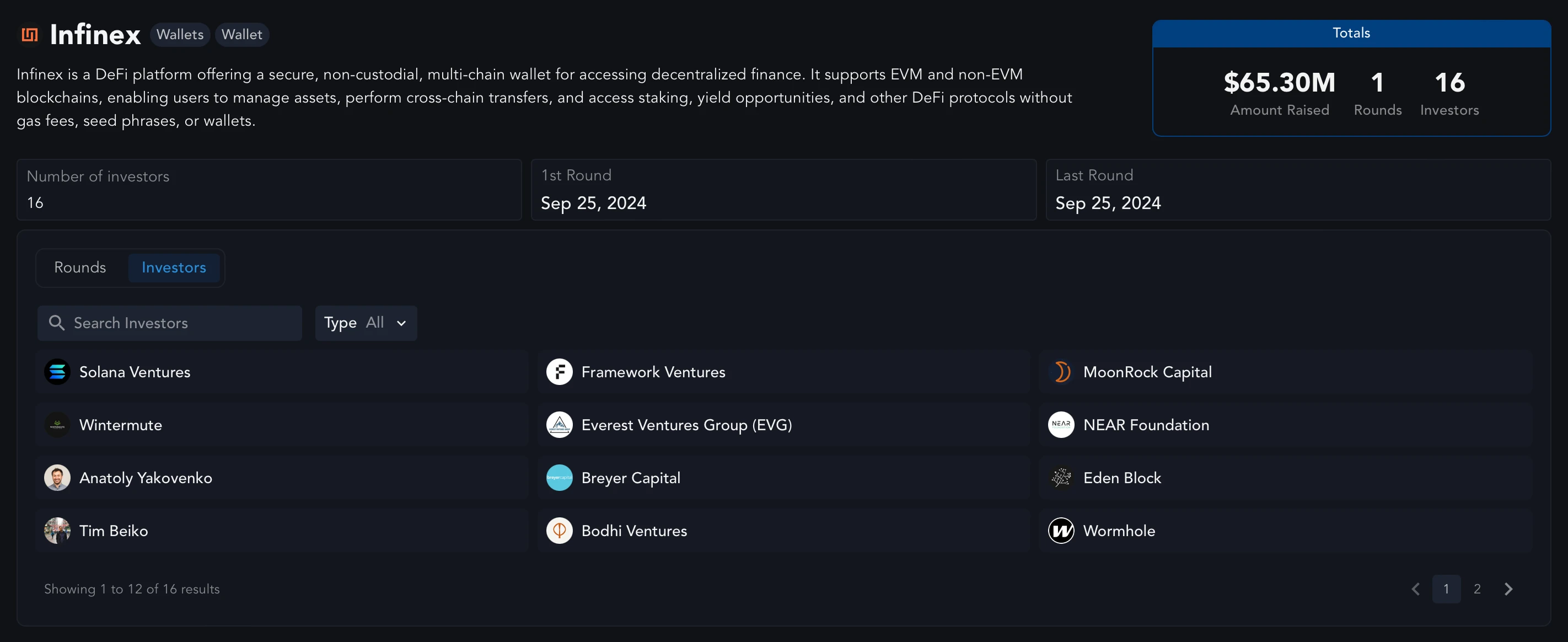

Infinex

Financing

Total funding: $65.3 million

Latest round: $65.3 million (September 25);

Investors: Framework Ventures, Solana Ventures, Wintermute, Eden Block, Moonrock Capital, Bankless Ventures, etc.

Brief Introduction

Infinex is a secure, user-friendly platform that simplifies access to DeFi and on-chain protocols. It offers intuitive cross-chain wallets and non-custodial accounts protected by keys and biometrics.

Infinex aims to bridge the gap between centralized finance and DeFi, making cryptocurrency accessible to everyone.

Data source: Messari

Early Participation Opportunities

Accounts can now be created using security keys. The platform allows users to bridge tokens to Arbitrum, Optimism, Solana, Polygon, Base, and Ethereum. Users can also perform token swaps through Curve, and in the “Earn” section, users can deposit assets into various yield protocols.

An interesting feature is the “Bullrun” game, where users can buy cards and earn points daily based on the price changes of the cryptocurrency in those cards. It is currently in testing, and the first season of the game’s events is coming soon.

Related links

Website | dApp | Twitter | Whitepaper | Fundraising Announcement

Huma Finance

Financing

Total funding: $46.3 million

Latest round: Series A, $38 million (September 1);

Investors: HashKey Capital, Circle, ParaFi Capital, Fenbushi Capital, Distributed Global, etc.

Brief Introduction

Huma is an income-backed lending protocol that enables businesses and individuals to connect with global investors on-chain and use future income as collateral. It provides credit services such as revolving credit lines and accounts receivable factoring. In addition, it also uses decentralized signal processors and rating agents for credit underwriting and risk management.

Early Participation Opportunities

The project launched a points mining program for providing USDC to any pool. Users can also earn points from other projects such as Scroll in these pools. To deposit USDC, users need to complete KYC/KYB verification.

Related links

Website | dApp | Twitter | Documentation | Funding Announcement

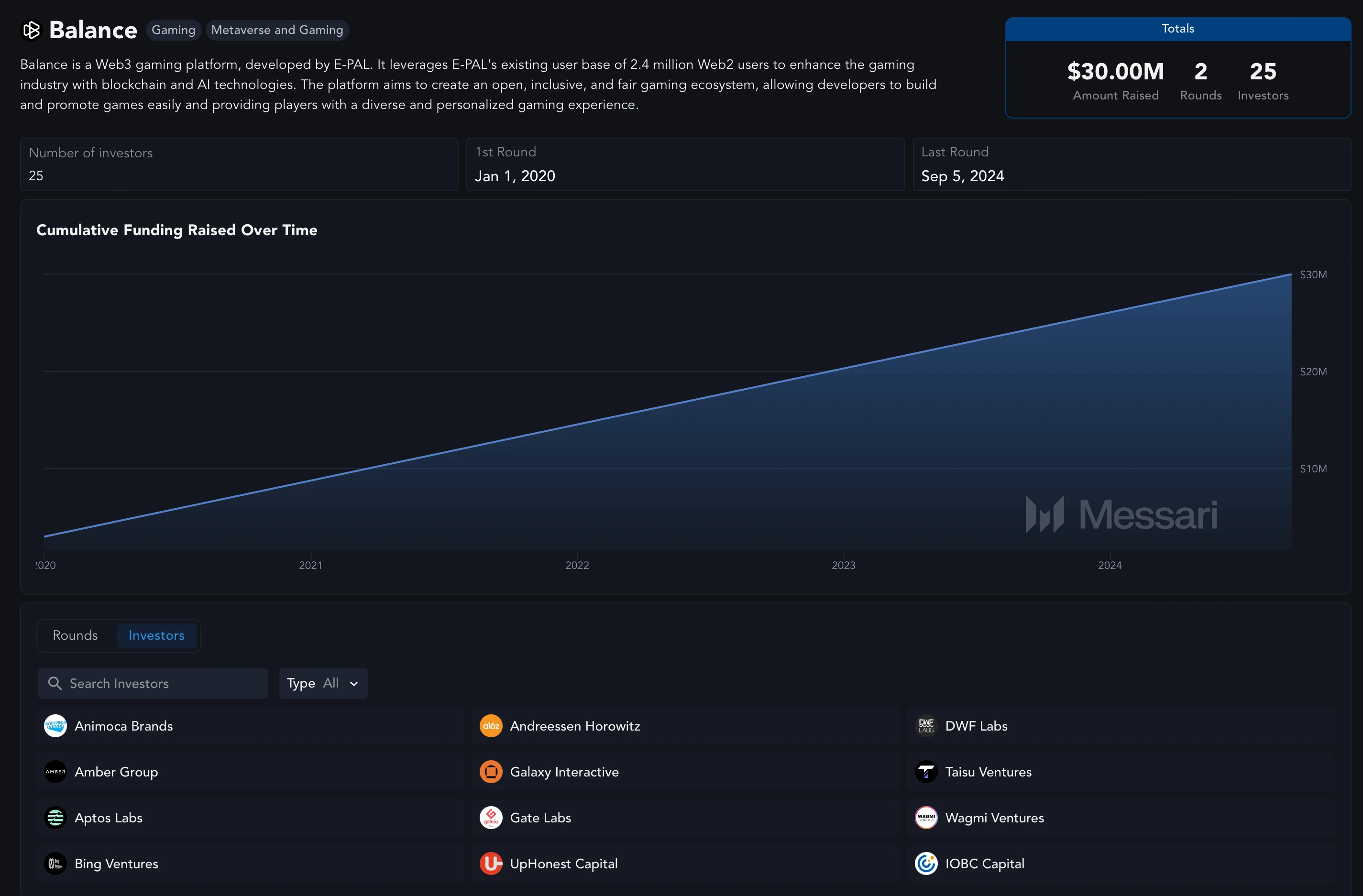

Balance

Financing

Total funding: $30 million

Latest round: $30 million (September 4);

Investors: Andreessen Horowitz (a16z), Animoca Brands, Amber Group, etc.

Data source: Messari

Brief Introduction

Developed by the E-PAL team, Balance is a Web3 gaming platform that aims to change the gaming industry through blockchain and AI technology.

With traffic from 2.4 million Web2 users, Balance is committed to building an open, inclusive, and fair gaming ecosystem. The platform enables developers to build and promote games more efficiently, providing players with a diverse and personalized experience. This approach aims to drive growth in the Web3 gaming space.

Early Participation Opportunities

Currently, users can play platform games and join events, which have daily social tasks and interactions with the projects social media that enable users to earn points.

Related links

Website | dApp | Twitter | Documentation | Funding Announcement

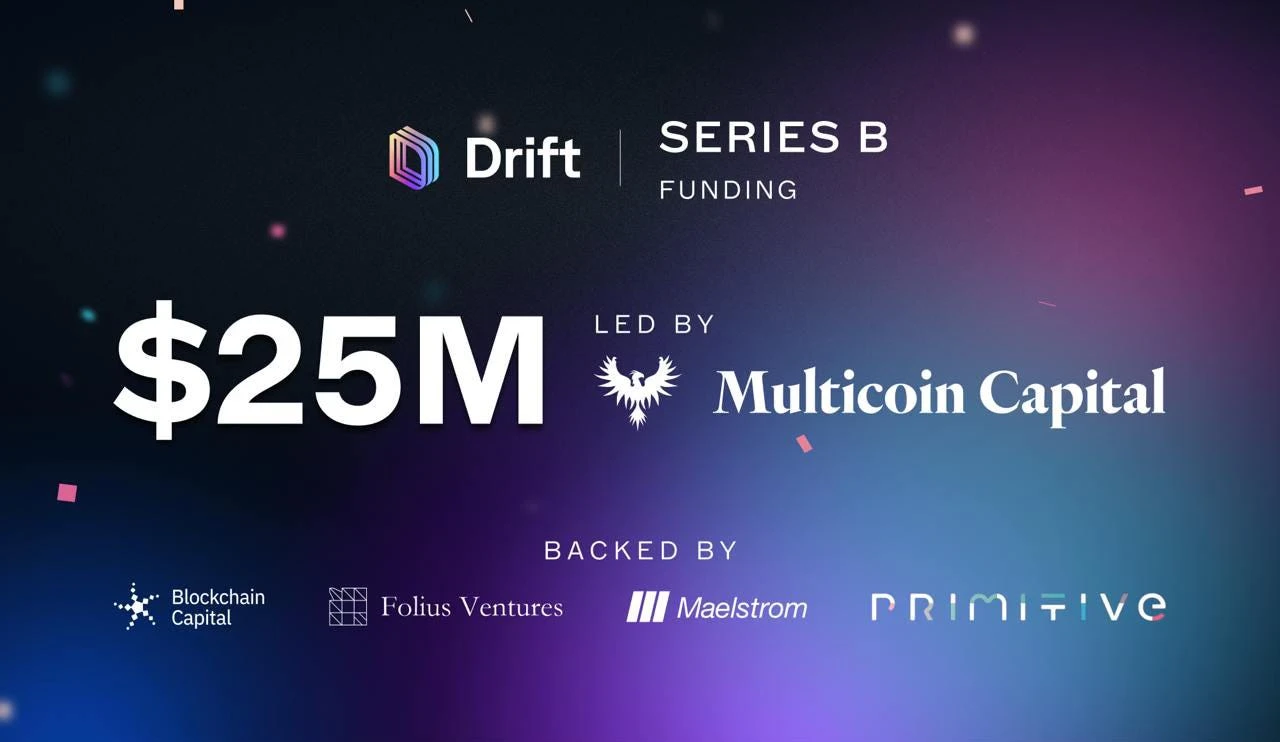

Drift Protocol

Financing

Total funding: $52.3 million

Latest round: Series B, $25 million (September 25);

Investors: Multicoin Capital, Blockchain Capital, Folius Ventures, Primitive Ventures.

Brief Introduction

Drift Protocol is a decentralized Solana perpetual and spot DEX. Key features include a cross-margin risk engine, instant auction liquidity, on-chain perpetual and spot order books, and a decentralized order book (DLOB) for enhanced liquidity. Recently, it expanded into prediction markets and now competes with Polymarket and Azuro.

Early Participation Opportunities

The project recently turned to opening a prediction market on the platform. Since there are no ongoing airdrop events, users can participate in these events. To participate, visit the homepage BET section and select the event you want to bet on.

Related links

Website | dApp | Twitter | Documentation | Funding Announcement

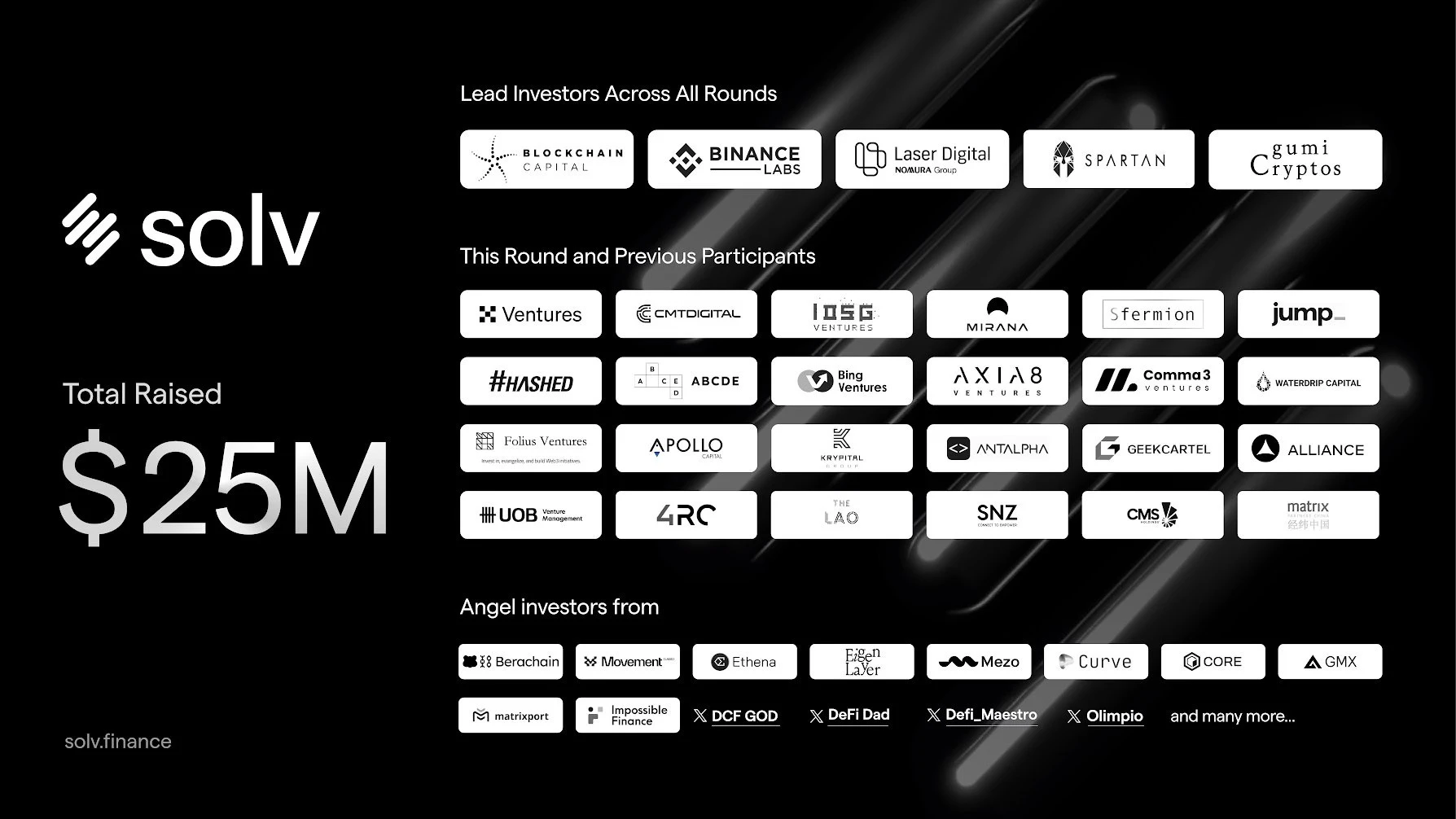

Solv Finance

Financing

Total funding: $22 million

Latest round: Strategic financing, $11 million (October 14);

Investors: Blockchain Capital, CMT Digital, OKX Ventures, gumi Cryptos, Laser Digital.

Brief Introduction

Solv Protocol is a decentralized platform that bridges liquidity between DeFi, CeFi, and TradFi. It provides diversified asset classes and yield opportunities in a secure and transparent manner. The platform enables global institutional and retail investors to access trusted crypto investments through a trustless infrastructure powered by ERC-3525.

Early Participation Opportunities

Solv Protocol has launched a mining pool where users can earn points by staking BTC. As a reward, users will receive SolvBTC.BBN and earn points from Babylon, while enjoying two airdrops.

Related links

Website | dApp | Twitter | Documentation | Funding Announcement

Helius

Financing

Total funding: $34.35 million

Latest round: $21.75 million (September 19);

Investors: Founders Fund, Haun Ventures, 6th Man Ventures, Chapter One, Foundation Capital, Spearhead.

Brief Introduction

Helius provides Solana RPC (Remote Procedure Call) powered by top-tier hardware, ensuring reliable and optimized performance for applications. With global coverage and dedicated nodes and Geyser plugins, Helius provides excellent 24/7 support for developers. This ensures a seamless experience for users, including advanced options for traders, Bot developers, and exchanges.

Early Participation Opportunities

Currently, there are no special events for users, but users can explore the project documentation and developer platform on their own.

Related links

Website | dApp | Twitter | Documentation |Funding Announcement

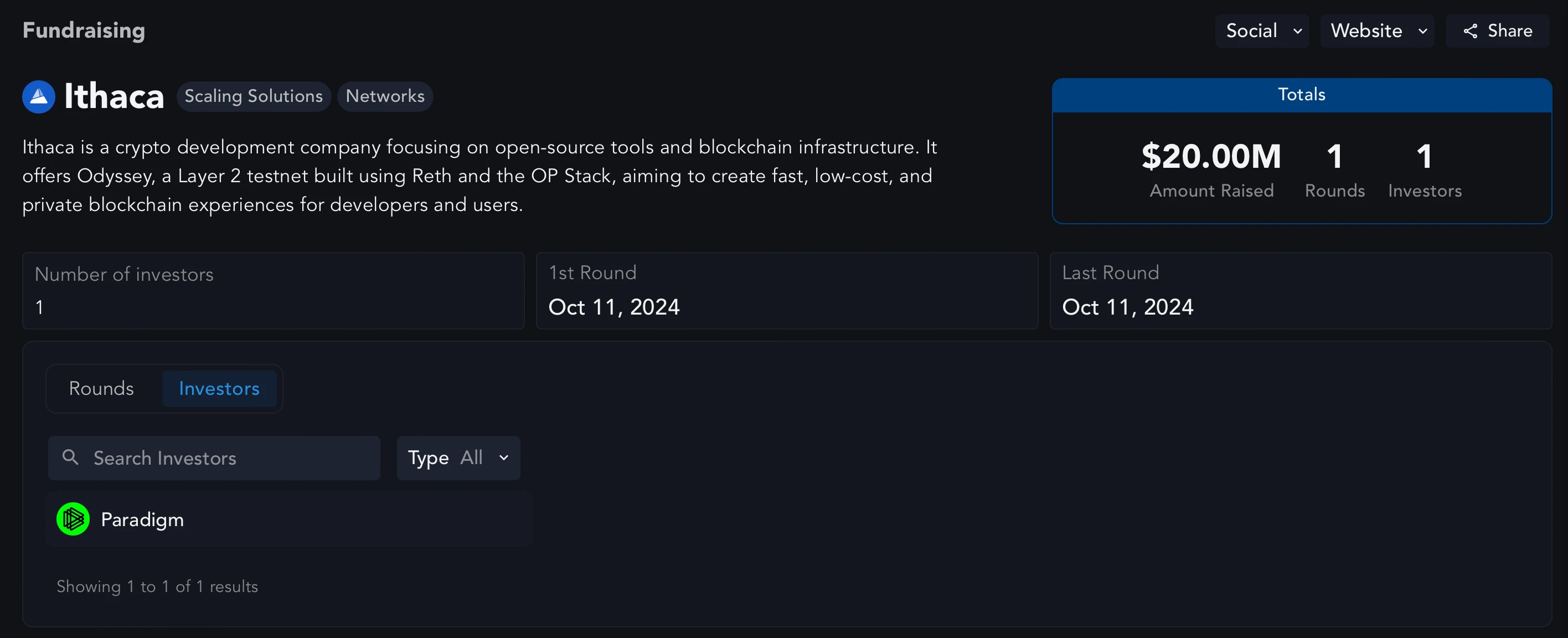

Ithaca

Financing

Total funding: $20 million

Latest round: $20 million (October 11);

Investors: Paradigm.

Data source: Messari

Brief Introduction

Ithaca aims to advance decentralized technology by co-designing a powerful open source developer tool stack. It leverages blockchain technology to create innovative solutions for building dApps, L2, and developer frameworks.

One of Ithaca’s key initiatives is Odyssey, a testnet that facilitates seamless development and experimentation in DeFi and beyond. Ithaca’s mission is to simplify and scale the decentralized crypto frontier for developers and users.

Early Participation Opportunities

The project has now launched the Odyssey testnet, where users can easily bridge tokens from Sepolia to the project’s network. Detailed guides can be found on the website and CryptoRank .

Related links

Website | dApp | Twitter | Funding Announcement

Hypernative

Financing

Total funding: $25 million

Latest round: Series A, $16 million (September 3);

Investors: Quantstamp, CMT Digital, Borderless Capital, Boldstart Ventures, Bloccelerate, Re 7 Capital, etc.

Brief Introduction

Hypernative is a Web3 security platform that provides real-time monitoring and risk management tools to protect blockchain projects from potential threats. Using artificial intelligence and machine learning, it analyzes on-chain and off-chain data to detect more than 200 risks. These include smart contract vulnerabilities, bridge security vulnerabilities, and market manipulation.

By identifying risks before they escalate, Hypernative allows developers and organizations to take proactive steps to ensure the security and stability of their decentralized applications.

Early Participation Opportunities

The project is currently in closed beta. Users can apply for a trial and get the latest information by following its social media channels.