Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

Meme trading on Solana is often considered a PvP battlefield with fast trading rhythm and fierce market fluctuations. But on the other hand, what we often see in the news reports is that a smart money address has achieved a thousand-fold increase after holding the currency for several days or even dozens of days.

So, which trading style is more correct? Is the winning factor diamond hands, high multiples or other trading characteristics? Odaily will conduct data backtesting in this article to try to find the holy grail of Meme trading.

Basic Situation

Data Source

This article selected the most recent 2,000 transactions of MOODENG and LUCE, deduplicated the addresses, and screened all transactions made by these addresses, with the screening criteria being profits greater than $5,000 and losses greater than $2,000 (Note: This screening criterion comes from the in-depth analysis system in Meme Cultivation Manual: Rebirth: I Want to Be a Diamond Hand (Part 3) ). Finally, there are 1,084 addresses and 8,858 transactions .

(In addition: The author initially selected the earliest 2,000 transactions of MOODENG and found that only 89 addresses completed these 2,000 transactions, revealing a strong conspiracy atmosphere, but it is not within the scope of discussion in this article. Readers can conduct their own research. In order to ensure the randomness of the address, the most recent 2,000 transactions were selected.)

Transaction Characteristics

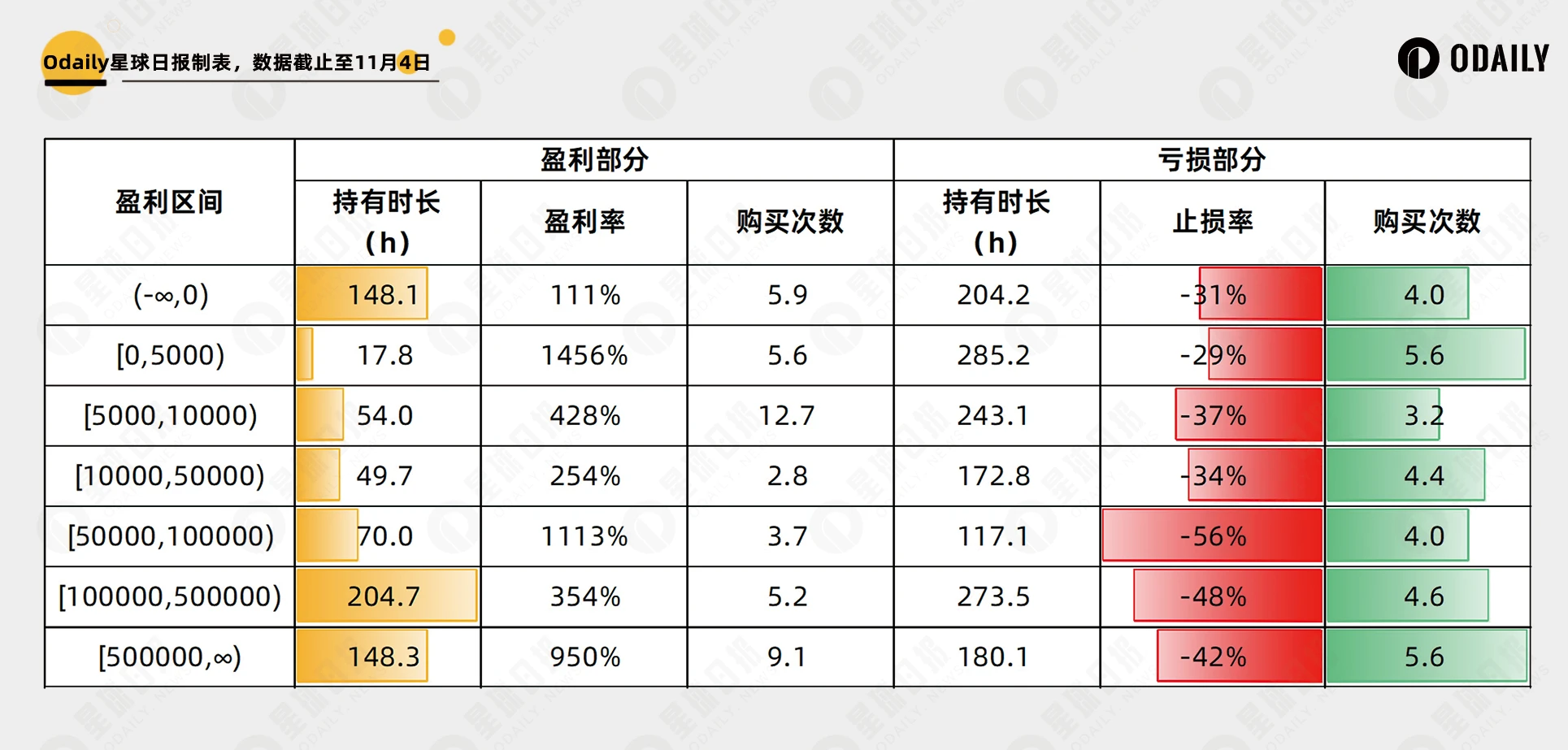

According to the final total profit of the token, this article divides all transactions into two categories: profit and loss, and then counts the number of profitable transactions of each wallet.

Token holding period: the time interval from the first purchase to the first sale

Profitability: Total profit of tokens ÷ Total investment cost of tokens

Number of purchases: How many purchases were made before the first sale

Statistics for losing trades include:

Token holding period and purchase times are the same as above

Stop loss rate: total token loss ÷ total token investment cost

Among them, the token holding time represents the diamond hand coefficient, the profit rate and stop loss rate represent the profit and loss ratio preference of the address, and the number of purchases represents the two tendencies of whether to buy once after seeing the opportunity or to dilute the cost through multiple transactions.

Diamond hands, high odds? What are the winning factors?

For readers who are not interested in the process, you can directly check the conclusion as follows. The addresses with high profits have obvious differences in the holding time of the profitable part and the stop loss rate of the loss part, showing a holding patience far exceeding that of regular addresses, and a wider stop loss condition .

Cut losses and let profits run

Livermore once said: After many years on Wall Street, after making and losing millions of dollars, I want to tell you this: My ideas never made me money. It was always persistence that made me money.

The most obvious feature that distinguishes the top addresses from other addresses is that the holding period is much longer than that of regular addresses , showing a clear positive correlation, which is about 6-8 days, which is similar to the fermentation period of the top tokens on Solana.

However, we also see that the holding time of addresses with overall losses is very similar to that of addresses with profits exceeding US$500,000. Upon verification, these losing addresses involve a total of 817 profitable tokens. It is impossible to review the trend of each token, but from the data, we can see that the profit difference comes from the profit rate, that is, the wrong object has been drilled.

Another factor that clearly has a positive correlation is the stop loss rate . As profits increase, the stop loss is also relaxed, but the differences between different intervals are not obvious.

Interpretation of irrelevant factors

Surprisingly, the profit rate has no direct relationship with the profitability of the address , and its Pearson correlation coefficient is only 0.04 , which means that there is almost no linear relationship between the two. When the profit rate is uncertain, it means that the total profitability of the address is related to the win rate, that is, seeing the target and holding for a long time are the root causes of the profitability differentiation of the address .

Another factor that is significantly unrelated to the profitability of an address is the number of purchases. It doesn’t matter if you buy once or trade multiple times to dilute the cost. The reason why I focus on the number of transactions is that I previously proposed in Meme Cultivation Manual: Rebirth: I Want to Be a Diamond Hand (Part 3) that it is best to avoid following multiple purchases when following orders, and this view has been further confirmed after a week of testing.

Therefore, the number of purchases can be ignored when evaluating the profitability of an address, but it should be considered as a key factor in determining whether it is suitable as a copycat.

summary

This article analyzes the factors that are the key to success in Solana Meme trading from a macro perspective. It is a further in-depth analysis of the previous article A Thousand Solana Smart Wallets: Who is Making a Huge Profit? What Can We Learn from It? The conclusion is also clearer - Diamond Hands are the core and key to achieving top-level profits . However, for readers with limited funds, it may be difficult to imitate such strategies. Users are advised to make further judgments based on their own circumstances.