Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

This morning, Trumps vote margin and winning rate in the presidential election continued to rise. As of 11:17 (UTC+ 8), Polymarket predicted that Trumps probability of winning the US presidential election exceeded 90%, and the entire Bitcoin and crypto market rose accordingly.

At 11 oclock, Bitcoin quickly broke through its historical high, setting a record of 75,000 USDT again , with a 24-hour increase of nearly 10% (so far, BTC has not disappointed any Hodler).

At the same time, Ethereum broke through 2,600 USDT, with a 24-hour increase of 6.8%; SOL broke through 180 USDT, with a 24-hour increase of 13.8%.

The total market value of cryptocurrencies has risen sharply. According to CoinGecko data, the total market value of cryptocurrencies has risen to 2.6 trillion US dollars, a 24-hour increase of 6.72%.

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has liquidated $452 million, of which the vast majority are short orders, amounting to $346 million. In terms of currencies, BTC liquidated $244 million, DOGE liquidated $39.7 million, and ETH liquidated $37.66 million.

New high

Why is Trumps chance of winning the US election so closely related to the trend of the crypto market ? The core reason is that Trump and his team have promised to take a more liberal attitude towards cryptocurrencies than the Democratic Party. For example, he will not allow the creation of CBDC (digital dollar) to avoid restricting the financial freedom of Americans; he will establish a strategic reserve of Bitcoin, and the US government under his leadership will no longer sell Bitcoin and will hold Bitcoin for a long time; he also pointed out that the United States will set up a special working group specifically responsible for cryptocurrency policy - the Bitcoin and Cryptocurrency Presidential Advisory Committee.

(Odaily Planet Daily Note: For details, see If Trump is elected president, what encryption bills will be passed? )

On the other hand, Trump will also have a significant impact and change on the macroeconomic trends of the United States. According to Jinshi, the next US president will fill multiple vacancies, and Powells term as chairman of the Federal Reserve will end in May 2026. Trump or Harris will be able to choose the next leader of the Federal Reserve .

Mark Spindel, chief investment officer at Potomac River Capital and a historian who studies the Fed and politics, noted in a recent interview that this is an important fork in the road for the Fed. He added that if the Trump team wins, they will obviously be very proactive. During his presidency, Trump has frequently attacked Powell and publicly pushed the central bank to do what he wants, even hinting at negative interest rates , and Trump has hinted that he might do more if he wins a second term.

Options data: $80,000 mark becomes a key price, and selling calls dominate

Options data showed traders concentrated bets around the $80,000 bitcoin strike price, with strong selling of short-term call options as traders used options premiums to prepare for possible price moves.

“The dominance of sold call options suggests traders are strategically collecting premium, while the focus on the $80,000 target highlights a potential turning point for Bitcoin ,” said Forster.

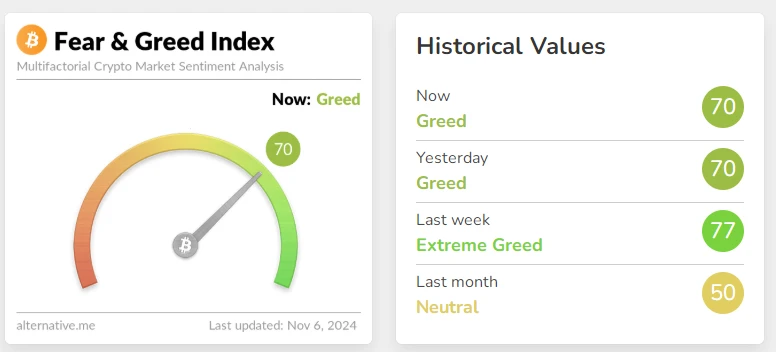

Public sentiment is frenzied, and the fear index is hovering at a high level

Alternative data shows that todays Fear and Greed Index rose to 70, and the level is still Greed , while the level last week was Extreme Greed.

Odaily Planet Daily Note: The panic index threshold is 0-100, including indicators: volatility (25%) + market trading volume (25%) + social media heat (15%) + market research (15%) + Bitcoins proportion in the entire market (10%) + Google hot word analysis (10%).

What to watch after the election?

After the election, the most critical event this week is the announcement of the Federal Reserve’s interest rate decision, and Federal Reserve Chairman Powell will hold a monetary policy press conference.

In terms of time, affected by the US election and winter time, the Federal Reserve will announce its interest rate decision at 03:00 am Beijing time on November 8 (Friday) .

As usual, the Federal Reserve holds interest rate meetings on Tuesday and Wednesday and announces the results of the meeting in the early hours of Thursday morning Beijing time, but this time it coincides with the US election, so the Federal Reserves interest rate meeting was postponed for one day. The 2024 US election voting will begin at 13:00 on November 5 (Tuesday) Beijing time.

How much will the interest rate be cut?

Jan Hatzius, chief economist at Goldman Sachs, said the Federal Reserve will follow through on its previous hint of two rate cuts by the end of the year, especially after a weaker-than-expected jobs report last week. He expects this to continue through the first half of 2025.

We expect the Fed to deliver four consecutive rate cuts in the first half of 2025, ultimately taking rates to 3.25%-3.5% , but we have greater uncertainty about both the pace of the Feds rate cuts and its ultimate target next year, Hatzius said in a report published Sunday, adding that his forecast is about 50 basis points higher than the market consensus.

According to Jinshi, investors are expecting Federal Reserve Chairman Powell to cut interest rates by 25 basis points this week to keep the rate cut plan on track despite some stubborn signs of inflation and mixed signals about the job market. This weeks FOMC meeting was a refreshingly simple decision, and the case for a rate cut remains valid, said Michael Feroli, chief economist at JPMorgan Chase, in a report. Fed watchers expect Powell to reach a consensus around a small rate cut after a big rate cut in September.