1. Outlook

1. Macro-level summary and future forecasts

Last week, global markets experienced dramatic fluctuations due to the Trump deal, with both the U.S. dollar and U.S. stocks rising significantly. Although Trump will officially take office as the 47th president of the United States on January 20, 2025, the market has already begun to react in advance, anticipating the impact of the policies he may implement.

Looking ahead, the macro market is expected to face increased volatility, and we need to pay close attention to upcoming economic indicators and the policy trends of the Federal Reserve.

2. Cryptocurrency market changes and warnings

The cryptocurrency market has experienced an unprecedented strong rebound, stimulated by the dual positive factors of Trumps successful election as the US president and the Federal Reserves active measures to cut interest rates by 25 basis points. This policy combination has greatly boosted investor confidence and has led to a rapid recovery in the cryptocurrency market. Among them, Bitcoin, as the market leader, has performed particularly well, breaking through the important psychological barrier of $80,000 in one fell swoop.

It is worth noting that the hot short-term market sentiment may also hide certain risks. Driven by optimism, the potential risks of the market may be ignored, and once the market falls back, it may trigger a chain reaction.

3. Industry and track hot spots

After the dust settled on the US election, the election of former President Donald Trump seemed to have given the cryptocurrency market a shot in the arm. Bitcoin prices rose sharply in a short period of time, breaking through the $80,000 mark at one point. Market analysts believe that this rebound is mainly due to the markets optimistic expectations of the regulatory policies that the new government may implement. Many investors and industry observers expect that the new governments policies may be more friendly, which will help the development and mainstream acceptance of the cryptocurrency industry.

As DeFi (decentralized finance) enters the 4.0 stage, the industrys focus has shifted to improving transaction efficiency and user experience. WazirX, Indias largest cryptocurrency exchange, announced plans to launch its own decentralized exchange (DEX) to address the security issues of centralized exchanges and improve transaction transparency. In addition, the highly anticipated second beta version of MapleStory Universe is about to be launched, which brings new opportunities to the GameFi (game finance) field. Gamers and users are paying close attention to this development, looking forward to GameFi bringing new interactive experiences and investment opportunities.

2. Market hot spots and potential projects of the week

1. Performance of hot tracks

1.1. Trump takes the throne! Will US regulation become more crypto-friendly?

BlackRock’s spot Bitcoin (BTC) ETF recorded an impressive $1 billion in trading volume within 20 minutes of the opening of trading on November 6, driven by the news of President-elect Donald Trump’s victory in the U.S. presidential election. The surge reflects the market’s confidence in the pro-crypto policy administration led by Trump. The market’s interest in crypto assets has risen after Trump defeated the incumbent Vice President Kamala Harris.

According to Bloomberg Senior ETF Analyst Eric Balchunas, trading volume of the iShares Bitcoin Trust (IBIT) has risen rapidly, pushing the overall spot Bitcoin ETF to a record day.

After months of sideways trading, Bitcoin broke through an all-time high above $75,000 early on November 6, benefiting from market expectations of new government support policies.

During the campaign, Trump repeatedly expressed support for cryptocurrencies, proposing the establishment of a national Bitcoin reserve, pardoning Silk Road founder Ross Ulbricht, and planning to adjust the leadership of the Securities and Exchange Commission (SEC).

BlackRock’s IBIT, which manages $30 billion in assets, is now the largest spot Bitcoin ETF, surpassing similar funds from Fidelity and Grayscale.

Trump’s victory marks a major shift for the crypto industry, with many expecting new regulatory reforms to promote mainstream acceptance of cryptocurrencies and drive industry growth. Bitcoin prices continue to trade above $74,500, reflecting the market’s optimism, as crypto users look to Trump’s pro-crypto policies to shape the industry’s future.

Summarize

The new administration is expected to be more supportive of the crypto industry, especially since Trump has repeatedly expressed friendliness to the crypto industry during his campaign. This shift may include new leadership at the SEC and a possible end to restrictive policies like Operation Chokehold 2.0. If these changes are implemented, the industry will usher in greater institutional investment and widespread acceptance. The crypto industry can now focus on innovation and is no longer hindered by regulatory obstacles, which may accelerate its mainstreaming process.

The regulatory reset will level the playing field for projects to succeed or fail on their own merits. Users are advised to adopt a disciplined strategy to distinguish between projects with potential and those that are likely to underperform. For early adopters who invest in cryptocurrencies amid uncertainty, the outlook is brighter than ever.

1.2. DeFi 4.0 is coming. What changes does the new generation of DeFi system need?

DeFi 4.0 usually refers to the fourth stage of the development of decentralized finance (DeFi). Compared with the previous three generations, it focuses on the overall improvement of DeFis efficiency, flexibility, security and user experience. This stage of DeFi mainly focuses on the following key aspects:

Intelligence and Automation

DeFi 4.0 emphasizes adding more intelligent and automated elements to the protocol. For example, the introduction of AI-driven strategies enables smart contracts to better adapt to market changes, user needs, and risk control. Through automated tools, DeFi 4.0 can manage liquidity and automatically regulate asset allocation more efficiently, thereby providing users with higher returns and lower risks.Multi-chain interoperability

DeFi 4.0 places more emphasis on cross-chain interoperability. Through solutions such as bridging technology and cross-chain protocols (such as Cosmos and Polkadot), assets and protocols of different blockchain networks can be interconnected. Users can easily operate on different chains and are no longer limited to the ecology of a single chain.Improved user experience The new generation of DeFi protocols pays more attention to user experience and simplifies the interaction process. For example, by introducing a more intuitive interface, low-threshold operation guides, convenient mobile phone operations, and even removing complex private key management, it is easier for new users to get started with DeFi. In addition, some DeFi 4.0 protocols are also trying to introduce designs that do not require gas fees to reduce transaction costs.

Privacy protection and compliance

DeFi 4.0 focuses on protecting user privacy and adapting to regulatory requirements. For example, the protocol introduces privacy technologies such as zero-knowledge proof (ZKP) and MPC (multi-party computing) to protect user data while meeting regulatory requirements for privacy protection in some regions. In addition, DeFi 4.0 may introduce KYC (know your customer) processes to ensure compliant transactions without affecting user privacy.Compared with previous DeFi protocols, DeFi 4.0 is more efficient in liquidity management, and can dynamically adjust liquidity to respond to market fluctuations and provide higher capital efficiency. Innovations in this area include dynamic AMM (automated market maker), protocol liquidity, and optimized yield aggregators.

Community Governance and Decentralized Autonomous Organizations (DAOs)

DeFi 4.0 emphasizes community and decentralized governance structure, and DAO (decentralized autonomous organization) occupies a more important position in protocol governance. Community members can participate in the decision-making process of the protocol through governance tokens or other governance mechanisms, making the improvement and development of the protocol more in line with the interests of users.Continuous innovation and experimentation

DeFi 4.0 introduces a large number of experimental features, such as adaptive stablecoins, unsecured lending, complex derivatives, etc. It not only focuses on innovation in the financial market, but also attempts to expand and integrate DeFi in other fields (such as games, social networking, metaverse, etc.).

Summarize

Overall, DeFi 4.0 represents a smarter and more open DeFi ecosystem, which can not only improve user experience and security, but also promote the popularization and application of decentralized finance around the world.

1.3. Indian cryptocurrency exchange WazirX announces plans to launch a decentralized exchange (DEX)

Indian cryptocurrency exchange WazirX has announced plans to launch a decentralized exchange (DEX) in response to security concerns raised by recent record-breaking cryptocurrency thefts. Decentralized exchanges are not centrally controlled and allow users to trade directly from their wallets, thereby improving security by reducing reliance on a single entity. WazirX has taken this step to provide a safer and more resilient trading platform in response to growing calls for improved security measures in the crypto industry.

The move to DEX is in line with the crypto industrys trend toward decentralization, especially after recent high-profile hacks exposed the vulnerabilities of centralized exchanges. By enabling peer-to-peer transactions, WazirXs DEX is expected to reduce the risk of large-scale attacks and provide users with greater control over their funds. This announcement reflects WazirXs response to the current heightened security awareness in the crypto space.

Summarize

The process of recovering the stolen funds has been fraught with challenges, with WazirX and its former custody partner, Liminal, engaged in a public dispute over liability. Both sides have traded accusations, with WazirX claiming that Liminal failed to maintain security standards, while Liminal has countered that mismanagement at the exchange led to security lapses. The unresolved dispute has left users in limbo, with both companies still dealing with the fallout from the incident. The plan to launch a DEX represents WazirX’s attempt to address security risks and rebuild trust by embracing decentralization.

The shift could signal that more exchanges will prioritize a decentralized model, especially as users grow wary of the security of centralized platforms.

1.4. The second test of Web3 version of MapleStory MapleStory Universe is here, will GameFi regain its glory?

MapleStory Universe is based on the rich legacy of the MapleStory IP, which has emerged in the Web3 gaming space with an exhilarating adventure experience and has established a strategic partnership with Avalanche. This partnership brings blockchain technology to the forefront, transforming the classic MMORPG gaming experience with innovative NFT elements.

MapleStory Universe introduces a new concept where all in-game items are presented in the form of NFTs, giving players digital ownership and the ability to trade these assets within the game ecosystem. The integration of NFTs and decentralized applications (DApps) has enabled the use and value of in-game items to break through traditional boundaries. The partnership with Avalanche, a leading blockchain protocol, provides a strong and scalable infrastructure for this innovative gaming ecosystem.

MapleStory Universe inherits the classic charm of its predecessor and combines it with advanced blockchain technology to provide a dynamic, secure and rich gaming experience for both old and new players. This new project marks an important milestone in the evolution of online games and sets a new standard for player interaction and community building.

Summarize

MapleStory Universe expands its boundaries through multiple innovative components, each designed to uniquely enhance the player experience. At its core is MapleStory N, a version of the original game combined with blockchain technology, which elevates the experience of the classic MMORPG through modern technology. For mobile players, MapleStory N Mobile brings MapleStory NFTs to mobile devices, enabling a seamless gaming experience across platforms.

2. Inventory of potential projects of the week

2.1. What are the features of Vlayer, which a16z led the $10 million investment in?

Introduction

vlayer is committed to unleashing the potential of web3 through powerful data infrastructure. vlayer simplifies zero-knowledge proofs, making privacy and verification tools more accessible to developers. By integrating web2 data into web3 applications, vlayer supports the construction of a decentralized, secure, and efficient Internet.

vlayer was built to solve two major problems: industry bottlenecks and developer experience. While web3 promises a decentralized, privacy-preserving world, it still lags behind web2 due to poor integration with web2 data. vlayer aims to solve this problem and unlock the full potential of web3. Additionally, many products lack good documentation and are difficult to use. vlayer was built by developers for developers, with a focus on ease of use.

Technical Analysis

vlayer introduces new features for Solidity smart contracts:

Time travel: Executing smart contracts on historical data.

Teleport: Execute smart contracts across different blockchain networks.

Web Attestation: Access authenticated web content, including APIs and websites.

Email Proof: Access verified email content.

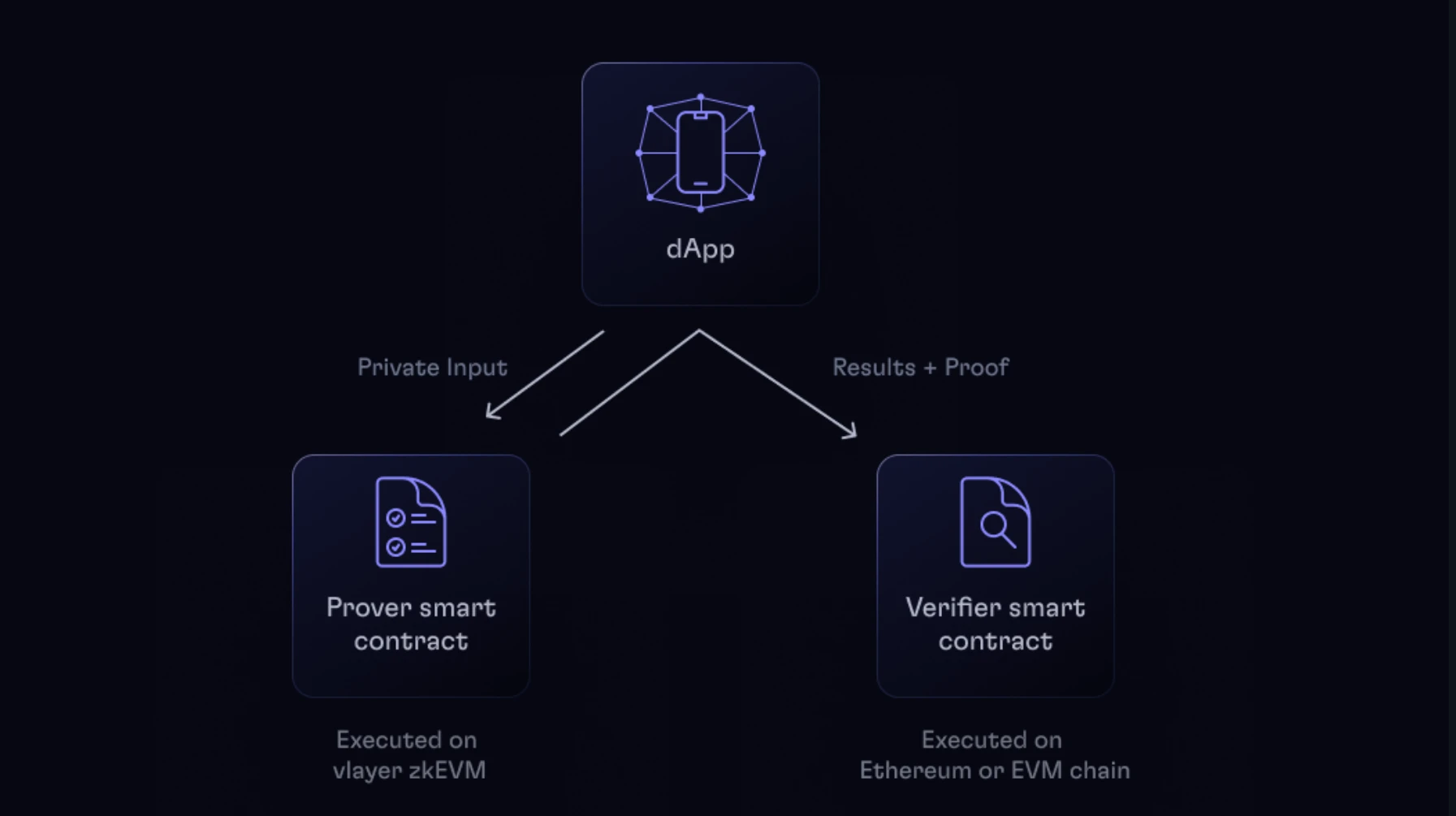

Prover and Verifier

To implement these features, vlayer introduces two new contract types: Prover and Verifier.

The Prover code runs on the vlayer zkEVM infrastructure. The structure generated by this operation is the proof data.

Verifier is used to verify the generated proof and run the code on an EVM-compatible chain.

Both contracts are developed using the Solidity programming language.

vlayer contract execution process

The typical vlayer execution process includes three steps:

The application initiates a call to the Prover contract, which is executed off-chain on the zkEVM. By default, all inputs to this call are private and not published on-chain.

The calculation result and the proof are passed to the on-chain contract for execution. All outputs returned by the Prover contract are public data and are published on the chain as parameters of the Verifier contract.

The Verifier contract verifies the data sent by the prover (using the proof submitted by the client) and then executes the Verifier code.

Prover Contract

Vlayer’s Prover contract has the following unique properties:

Verifiability: It can be executed off-chain and its results cannot be forged, ensuring the authenticity of the calculation.

Privacy: Inputs are private by default and will not be published on the chain, protecting user data privacy.

No Gas Fees: Not subject to conventional transaction size restrictions, and exempt from traditional on-chain operation fees.

Verifier Contract

Verifier smart contracts are used to verify the correctness of calculations generated by Prover without revealing their underlying information. Such contracts can be used to implement more complex workflows, such as privacy-preserving decentralized financial (DeFi) applications or confidential voting systems.

Once deployed on the blockchain, the verification logic is immutable, ensuring consistency and permissionless access.

Summarize

Vlayer unlocks all on-chain and off-chain data and integrates it into Solidity smart contracts as verifiable statements. This innovative architecture and minimalist design provide an unparalleled developer experience. Prover is executed off-chain and introduces four new features: time travel, teleportation, web proof, and mail proof. Verifier is executed on-chain. It receives the verified parameters returned by Prover to trigger any function on the chain. Provide Ethereum developers with the ability to verify and integrate off-chain data within smart contracts through zero-knowledge proofs.

2.2. BTC staking reform leader: Solv Protocol

Introduction

Solv Protocol is the leading Bitcoin staking platform, powered by its innovative Staking Abstraction Layer (SAL). Through SolvBTC, a Bitcoin reserve pool for everyone, the potential of over $1 trillion in Bitcoin assets is unlocked. With SolvBTC.LSTs (Liquid Staking Tokens), Bitcoin holders can access diverse income opportunities and easily participate in the DeFi ecosystem without sacrificing liquidity. As a comprehensive entry point for BTCFi, Solv paves the way for institutions and traditional funds to confidently enter the crypto space.

Solv Protocol is backed by notable investors such as Binance Labs, Blockchain Capital, Laser Digital, and has passed comprehensive security audits by top companies such as Quantstamp, Certik, SlowMist, Salus, and Secbit.

Technical Analysis

What is SAL?

The Staking Abstraction Layer (SAL) is the core infrastructure of Solv Protocol. It abstracts the complexity of staking Bitcoin across multiple ecosystems and provides a unified interface for Bitcoin holders. Through SAL, users can access multiple yield-generating strategies on different blockchains while holding Bitcoins liquid staking token - SolvBTC.

Through integration with various DeFi platforms and ecosystems, SAL simplifies the process for Bitcoin holders to diversify their yield strategies, ensuring that users still maintain exposure to BTC.

Ecological perspective

There is a fundamental difference between Bitcoin (BTC) staking and Ethereum staking: due to the lack of an official staking mechanism on the BTC network itself, the staking process relies on multiple independent staking protocols. This forms a decentralized structure in which different stages (such as LST issuance, staking transaction generation and execution, and revenue distribution) are completed by different roles in different network environments. In particular, there are four key roles in the BTC staking process: LST issuer, staking protocol, staking guardian, and revenue distributor.

Therefore, a unified and standardized system is essential to coordinate these roles to ensure the transparency and security of the entire process from the deposit of BTC assets to the final accumulation of benefits or incentive distribution of the value of LST tokens. This coordination is essential to protect user assets, ensure smooth acquisition of benefits, and avoid risks.

Pledge Agreement

Since BTC staking is achieved through third-party staking protocols, these protocols are one of the key players in the Bitcoin staking ecosystem. There are three main types of BTC staking protocols:

Layer 1 or Layer 2 chains built on BTC use Proof of Stake (PoS) as their consensus mechanism. This type of protocol is similar to Ethereums staking mechanism.

Protocols that accept BTC assets as collateral and provide various decentralized services, such as oracles or cross-chain bridges. These protocols are similar to the re-staking protocols in the Ethereum ecosystem and are part of the broader concept of Active Validation Services (AVS).

General staking protocols, including various DeFi protocols that accept BTC assets and generate yield through these assets. The staking opportunities provided by these protocols are similar to those of DeFi protocols that use Ethereum assets.

LST Issuer

The issuance of Liquid Staking Tokens (LST) is the entry point for BTC staking, providing users with the ability to stake BTC while maintaining the liquidity of the asset through LST. Therefore, LST issuers play a key role in the success of BTC staking, just like Lido on Ethereum.

However, BTCs LST issuance is a bit more complicated than Ethereums because it involves the interaction between the EVM (Ethereum Virtual Machine) chain and the BTC mainnet. For example, LST is usually issued on the EVM chain, while most of the actual staking transactions occur on the BTC network. Therefore, a transparent and secure mechanism is needed to gain the trust of users, which is why the role of staking validators was introduced into the ecosystem.

Pledge Guardian

The Staking Guardian is a new role introduced by the Staking Abstraction Layer (SAL) into the Bitcoin staking ecosystem. As a core component, it ensures the transparency, integrity, and security of the staking process. Staking validators have multiple responsibilities in the staking process, including asset custody, transaction verification, and transaction co-signature.

By separating the construction of the pledge transaction from its verification and signature, the pledge guardian ensures that the pledge transactions initiated by roles such as the LST issuer are accurate, thereby ensuring that the users assets are correctly pledged according to their intentions. When the user cancels the pledge and redeems the asset, the pledge guardian also verifies the transaction to ensure that the asset is accurately returned to the specified address to prevent any asset loss.

Profit distributor

The multi-chain nature of BTC staking significantly increases the complexity of revenue distribution. Potential returns for users include not only rewards from the staking protocol, but also additional incentives provided by LST issuers. These rewards may come from tokens of the BTC mainnet, the EVM network, or even from tokens in the Cosmos ecosystem (such as Babylon). In addition, the timing and method of revenue distribution vary: some rewards are reflected in the LST price, some require additional collection processes, and some are issued in the form of points, which can only be redeemed after a certain period of time.

Typically, LST issuers are the primary yield distributors to users. However, as complexity increases, the role of the yield distributor has diversified, and many third-party institutions can participate in this process. This includes entities responsible for converting rewards to BTC, converting points to tokens and facilitating their collection, and even providers of yield derivative markets. Together, these different entities make up the broad role of a yield distributor.

Technical Architecture

The Staking Abstraction Layer (SAL) is a modular architecture that enables secure and efficient BTC staking through key components that interact with the Staking Parameter Matrix (SPM). The core modules of SAL include LST generation service, staking verification service, transaction generation service, and revenue distribution service, all of which rely on SPM to define transaction rules, verification standards, and revenue calculation methods.

Together, these components form a robust framework that ensures security, transparency, and efficiency in the BTC staking and LST issuance process, enabling users to maximize staking returns while reducing risks associated with the staking process and cross-chain interactions.

Diversified revenue channels through SAL

The Staking Abstraction Layer (SAL) enables Bitcoin holders to earn diversified and dynamic returns without sacrificing liquidity. Through SALs cross-chain capabilities, users can unlock multiple yield-generating opportunities, transforming Bitcoin from a passive store of value asset to a productive asset in DeFi. The following is a detailed analysis of the main sources of income provided by SAL:

1. Re-staking income

Bitcoin holders can earn native token rewards by staking Bitcoin on protocols that rely on Bitcoin’s economic security, such as:

Babylon

EigenLayer

Symbiotic

These networks leverage Bitcoin’s security to provide users with incentives to earn benefits from Bitcoin’s economic security.

2. Validator Rewards

Users can participate in the security maintenance of the Bitcoin Layer 2 network by running a validator node or delegating Bitcoin. Validator rewards are the main source of income for these platforms, including:

CoreDAO

Stacks

Botanix

By participating in staking on these networks, Bitcoin holders can earn native token rewards while actively supporting the security of the decentralized ecosystem.

3. Trading strategy

SAL allows Bitcoin holders to use market-neutral trading strategies on DeFi platforms, thereby mitigating the risks posed by market volatility. Strategies for generating income include:

GMX: Provides liquidity in a decentralized perpetual exchange, and users earn Bitcoin income by providing liquidity.

Ethena: Implement a basis trading strategy to use Bitcoin in a market-neutral manner to obtain stable returns and avoid direct risks of market volatility.

Jupiter: Providing liquidity and yield farming opportunities to minimize risk exposure to market volatility.

These market neutral strategies provide stable Bitcoin returns through innovative trading methods, making Bitcoin an active asset in DeFi.

Summarize

The introduction of SAL enables users to participate in Bitcoin staking and earn income without having to understand the technical details of each underlying protocol. This standardized staking framework not only improves the convenience of staking, but also achieves liquidity integration through cross-chain collaboration, promoting the widespread use of Bitcoin in DeFi. More importantly, SAL forms an efficient and collaborative system by integrating the four key roles in the staking ecosystem - LST issuers, staking protocols, staking validators, and income distributors.

From a broader financial perspective, SAL not only solves the technical problems of staking, but also brings about the liquidity reconstruction of pledged assets. Currently, a large number of assets on the Bitcoin network are in a dormant state. Although its market value has reached trillions of dollars, the proportion actually used for staking and financial activities is relatively low. The launch of SAL enables Bitcoin assets to be more widely used in financial activities by improving the standardization and transparency of staking.

3. Industry data analysis

1. Overall market performance

1.1 Spot BTCETH ETF

Analysis

Bitcoin spot ETFs had a net inflow of $1.63 billion from November 4 to November 8. Among them, Grayscale ETF GBTC had a net outflow of $25.45 million per week, and the current historical net outflow of GBTC is $20.19 billion. The Bitcoin spot ETF with the largest weekly net inflow last week was BlackRock ETF IBIT, with a weekly net inflow of $1.25 billion, and the current total net inflow of IBIT is $27.39 billion. The second is Fidelity Bitcoin ETF FBTC, with a weekly net inflow of $295 million, and the current total net inflow of FBTC is $10.76 billion.

The outlook for Bitcoin ETFs and the entire cryptocurrency market has improved significantly following Trumps victory in 2024. This change stems primarily from Trumps pro-cryptocurrency policy commitments, including the possible replacement of current U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler, who is known for his strict regulatory stance on cryptocurrencies. If Trump appoints a more pro-cryptocurrency SEC Chairman, the approval of Bitcoin ETFs could be accelerated, which would attract more institutional and retail investors to participate.

Analysis

Ethereum spot ETF had a net inflow of $154 million from November 4 to November 8. Among them, Grayscale Ethereum Trust ETF ETHE had a weekly net outflow of $10.8 million, and the current historical net outflow of ETHE is $3.14 billion. The Ethereum spot ETF with the largest weekly net inflow last week was Blackrock Ethereum ETF ETHA, with a weekly net inflow of $94.44 million, and the current historical total net inflow of ETHA reached $1.44 billion. The second was Fidelity Ethereum ETF FETH, with a weekly net inflow of $42.72 million, and the current historical total net inflow of FETH reached $557 million.

After Trumps victory, the prospects of Ethereum ETFs were widely optimistic, mainly because the market expected his policies to bring a more friendly regulatory environment to the crypto industry. Trumps campaign promise to support blockchain innovation may promote regulatory relaxation, such as replacing the current SEC chairman who has strict crypto regulation. This move may increase the investment appeal of crypto assets including Ethereum. In addition, Trumps plan to cut taxes and support self-custody measures has also inspired market confidence. Overall, investors expect more relaxed policies to increase interest in crypto assets such as Ethereum.

Ethereum spot ETF had a total net outflow of $10.9256 million as of November 1, EST

1.2. Spot BTC vs ETH price trend

Analysis

Last week was a decisive week for the future of the capital market. The US election and the Feds interest rate decision that week were decisive factors for Bitcoin to hit a new high and continue to hit $80,000. Bitcoin continued to rise amid the active buying sentiment in the market, first breaking through $76,000 and becoming the focus of global crypto users. This rise was driven by multiple factors, including the victory of the crypto-friendly Trump and the Feds continued interest rate cut of 25 bps in November. At the same time, CCTVs coverage of Bitcoin also played a positive propaganda effect on the market, which may have attracted more retail investors to enter the market. In addition, the market expects that the Federal Reserve may continue to maintain a relatively mild monetary policy, which is further beneficial to cryptocurrencies. However, given that Bitcoin has broken through the integer mark of $80,000 at the time of publication, there is currently a lack of reference resistance. Therefore, once the buying volume begins to shrink, it is the time for the correction to start. As for the support range after the correction, it can be referenced to around $76,500.

For Ethereum, last weeks 33% increase set a record for the highest weekly gain in the second half of this year, thanks to the Trump administrations favorable regulation of the crypto market. If the current SEC chairman is fired as promised, and if the new SEC leadership is more open to crypto assets, it may accelerate the approval of Ethereum ETFs and other crypto products, thereby attracting more capital inflows. Therefore, this week, we need to pay attention to the strong resistance range of $3220 to $3380, which is likely to become the resistance point for the callback to start, and the strong support below can be focused on around $2850.

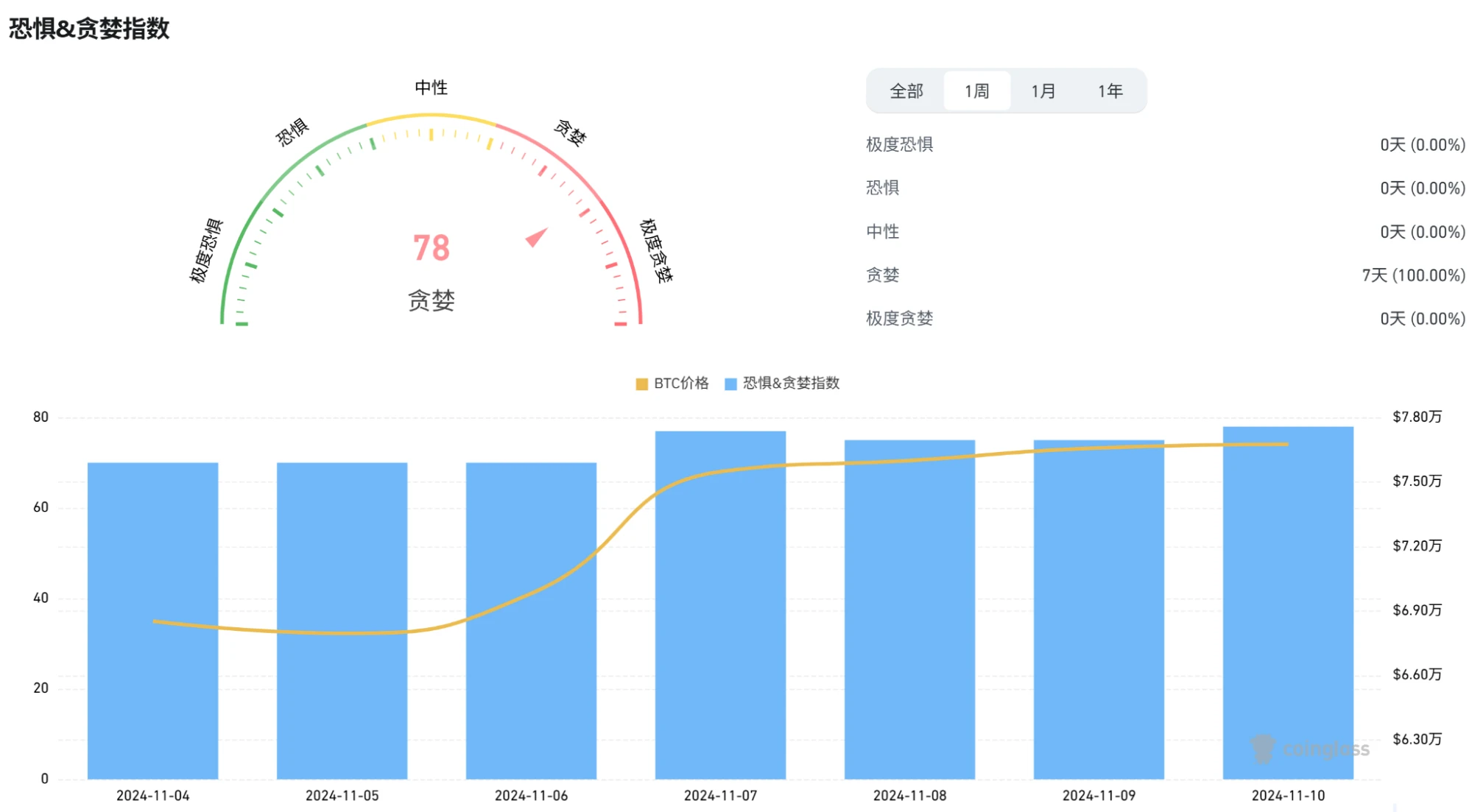

1.3. Fear Greed Index

Analysis

Last week, the greed index soared to 78 due to the sharp rise in the market, which is infinitely close to the quarterly greed range. From a risk perspective, this is a dangerous signal. Often when the greed index exceeds 80, it means that the markets fomo sentiment is too serious, and the probability of short-term drastic fluctuations will increase infinitely. Therefore, you should pay attention this week, do not chase the rise, allocate positions rationally, and be alert to downside risks.

2. Public chain data

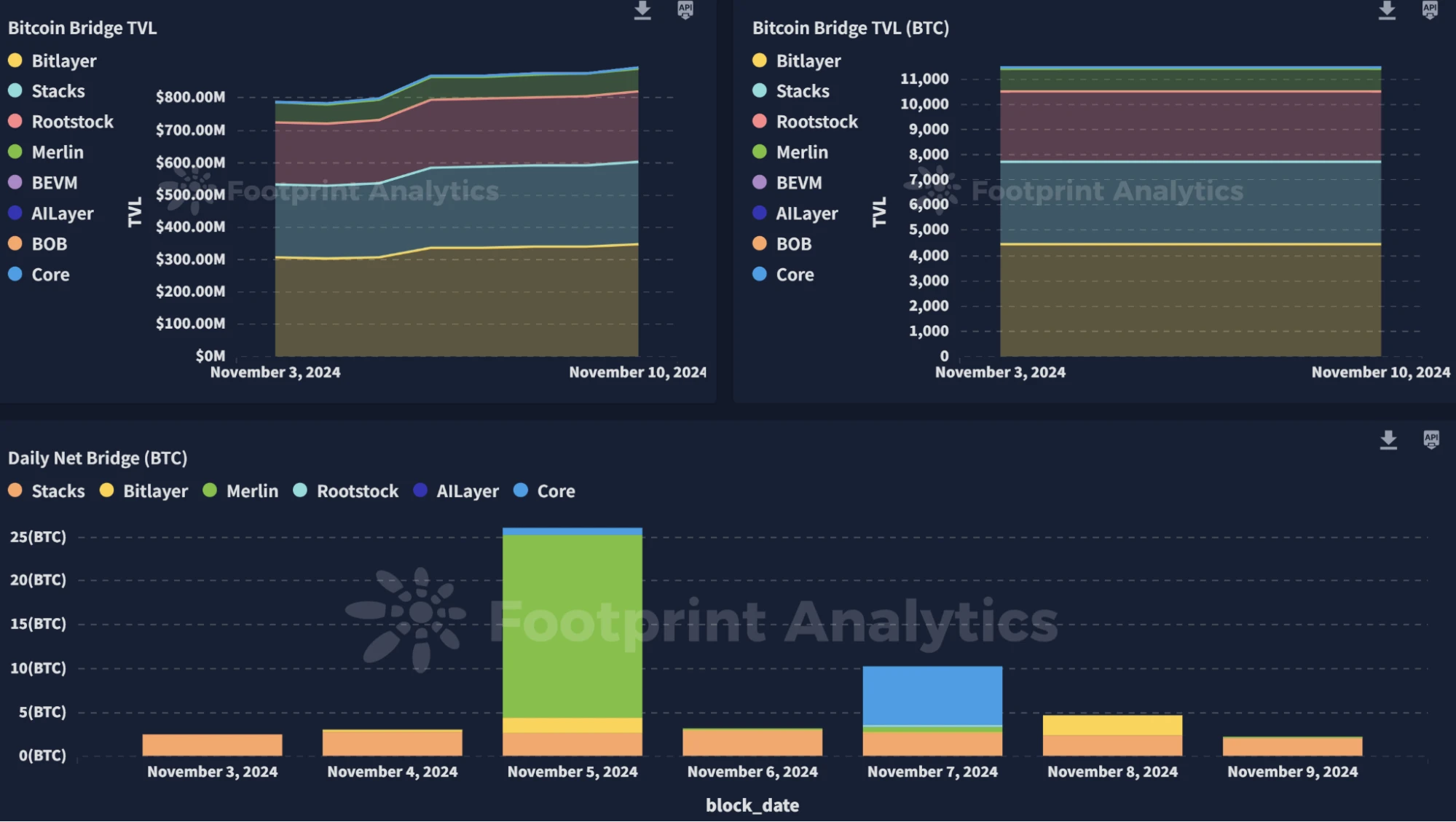

2.1. BTC Layer 2 Summary

Analysis

In terms of BTC ecology, Bitcoin Layer 2 (L2) technology has made significant progress. In particular, the Nakamoto upgrade of Stacks has improved transaction speed and scalability, reducing the processing time from 10 to 30 minutes to about 5 seconds. This upgrade will further support DeFi applications of Bitcoin L2, attracting market attention. At the same time, with the halving of Bitcoins block rewards and the rising demand for new features (such as BRC-20 and ordinals), the user and developer community of the Bitcoin L2 ecosystem has grown significantly, which has driven the increase in L2 network activity.

Co-founder Muneeb Ali wrote, “We have established a new Stacks entity, Bitcoin L2 Labs, with $20 million in funding to focus on core development. Adriano DiLuzio (formerly of Algorand Labs) will serve as CTO and lead the development of Stacks Core and SBTC.”

Bitcoin L2 Labs will form a dedicated team to accelerate the development of Stacks. Key initiatives on the roadmap include accelerating sBTC development, launching the “Orange Hat” program to support ecosystem security, and implementing improvements to achieve more efficient and transparent core development.

2.2. EVM non-EVM Layer 1 Summary

Analysis

Last week, due to the favorable overall market environment, the TVL on the public chain rose by more than 16%, breaking the highest point in nearly 2 months. Last week, the total locked value (TVL) on the Ethereum chain rose by 33%, thanks to the record high locked value of second-layer networks (such as Arbitrum, Optimism, etc.). These L2 platforms provide users with a faster and more cost-effective trading environment, attracting a large amount of capital inflows and driving the growth of TVL on the Ethereum mainnet.

Solana and BNBchain continue to maintain a net outflow trend. They have been in the negative TVL range for four consecutive weeks this month. For Solana, the reason for the outflow of funds is the fluctuation of user activity in decentralized finance (DeFi) applications and the overall volatility of the crypto market. Despite the outflow of funds, on-chain indicators show that user activity remains resilient, the trading volume of decentralized exchanges (DEX) on Solana has increased, and the trading volume of perpetual contracts on the chain has set a record high for a single day. In the past 24 hours, the total transaction volume of perpetual contracts on the Solana chain reached US$2.289 billion. Among them, Jupiters transaction volume was US$1.87 billion, accounting for 82% of the total transaction volume.

In contrast, the BNB chain saw a more severe drop in activity, with a 37% decrease in on-chain activity and a significant drop in DApp transactions, affecting its TVL. One of the key factors was a 25% decrease in transaction volume on major DEXs on the BNB chain, such as PancakeSwap. The lower network fees and reduced DApp participation on the BNB chain may make it less attractive than Ethereum and Solana, which have high user engagement despite volatility.

2.3. EVM Layer 2 Summary

Analysis

Last week, in terms of L2, except for Base, which achieved a positive growth of more than 7% in TVL, the other protocols did not make much progress. Scroll finally stopped its decline after two consecutive weeks of TVL outflow of more than 20%, with only a negative growth of 9% last week, showing an optimistic trend of recovery. Base continued to build its ecosystem last week and achieved good results. Meme project RBP.fun will airdrop RBP tokens to Playmarket users and holders of US election concept coins (TRUMP, MAGA and PEOPLE, etc.). After receiving the airdrop, users can participate in the red and blue staking pool guessing, predict the results of the US presidential election, and win staking rewards.

Its on-chain derivatives exchange SynFuture announced the launch of the Perp Launchpad platform, which is a platform designed specifically for launching the perpetual futures market, and a $1 million grant program to promote new token projects on the blockchain.

Wow, the Meme token launch platform on Base, was opened and operated in the early morning of the 8th. Wow is built on Base. All pools on Wow are generated by users, and the tokens in the pool are not subject to any pre-sale or team allocation restrictions. Each purchase or sale transaction related to any token deployed on Wow is subject to a 1% protocol fee. The reward contract will then distribute the collected fees to each party. The current distribution structure is as follows: 50% to the token creator; 20% to the protocol party; 15% to the platform referrer; 15% to the order referrer.

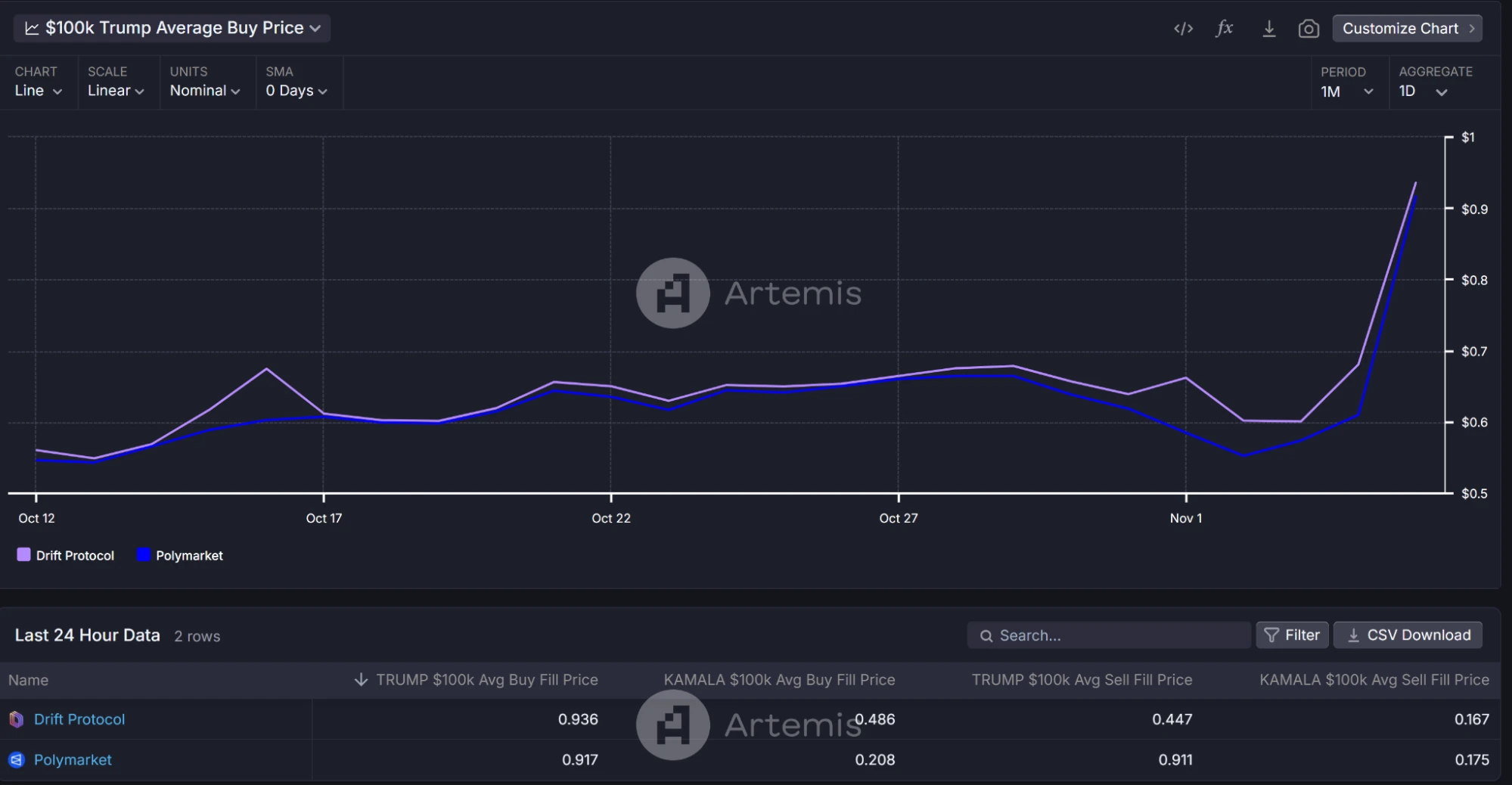

2.4. Prediction Market Summary

Analysis

Crypto prediction market Polymarket confirmed that the result of its election prediction market is Trumps victory, because the Associated Press, Fox News (FOX) and NBC have all confirmed the election results (call the election), which meets its result recognition conditions. French trader Théo once bet heavily on the crypto prediction market Polymarket that Trump will win a second term. According to the platforms data, he will earn at least $48.5 million from this bet.

According to The Block, a screenshot of the Polymarket settlement page shows that the platform said, We expect to conduct airdrops in the future, and users who reinvest their bonuses in other markets may be eligible for higher rewards and airdrops in the future. If you stay, you will be very happy.

4. Macro data review and key data release nodes next week

Although inflation expectations have retreated in the short term, long-term inflation expectations have risen slightly. The University of Michigan survey showed that consumers inflation expectations for the next year and five years are 2.6% and 3.1%, respectively, indicating that consumers concerns about short-term price increases have eased.

The University of Michigan’s consumer sentiment index climbed to a seven-month high in early November, showing consumers’ optimism about the future of the economy and their personal finances.

Market expectations for the Feds possible interest rate cuts in the future have increased, especially in the face of poor economic data. Analysts pointed out that if the unemployment rate does not continue to rise, the Fed may choose to ignore inflation fluctuations in the fourth quarter and tend to maintain its loose monetary policy.

Important macro data nodes this week (November 11-November 15) include:

November 12: US October NFIB Small Business Confidence Index

November 13: US October unadjusted CPI annual rate

November 14: U.S. initial jobless claims for the week ending November 9 (10,000); U.S. October PPI annual rate

V. Regulatory policies

This week, the US election finally decided the winner, and Trumps election became a weather vane for the current and future direction of the crypto market. Because Trump has made many friendly remarks about the crypto industry before, the main news this week is positive from the US, and the most critical one is to what extent Trump will implement his 11-point crypto policy in the future. Other regions are waiting to see the direction of US policies and have not introduced any new policies, but it is expected that there will be intensive and varying degrees of favorable policies in the last month of this year and in Q1 2025.

USA

On November 6, U.S. Senator Cynthia Loomis said that the U.S. government will establish a government-owned Bitcoin reserve. In July this year, Cynthia Loomis proposed the 2024 Promoting Innovation, Technology and Competitiveness through Optimizing National Investment (BITCOIN Act). The bill sets a plan to purchase up to 200,000 bitcoins per year, with the goal of establishing a reserve of up to 1 million bitcoins. These assets will be held for at least 20 years.

On November 9, the U.S. SEC once again postponed its decision on whether to approve the New York Stock Exchange (NYSE)s request to list Ethereum ETF options. The SEC stated in the filing that the postponement is intended to conduct more analysis and public comments, especially on whether the proposed rule changes comply with the requirements of the Securities Exchange Act. The SEC emphasized concerns about the potential impact of the proposal on preventing market manipulation, protecting investors, and ensuring a fair trading system, which fall under Section 6(b)(5) of the Securities Exchange Act.