Data analysis: Why did $ubc surge 9 times overnight?

$ubc (9psiRdn9cXYVps4F1kFuoNjd2EtmqNJXrCPmRppJpump) was launched on 11-26 8:07, and rose to 25 M on the same day. Then it fell to 11.4 M at 23:37 in the evening and began to rise, reaching a maximum of 113.1 M. What factors led to the 9-fold surge overnight?

Let’s first clarify UBC’s narrative:

UBC is to ensure that autonomous AI can have fair access to computing resources, and Kinos is the operating system for AI agents to run. Currently, more than 20 AI agents are running, which are used to write books, create music, and code, etc. Among them, 10 AI agents wrote the book "Terminal Velocity".

The dev of ubc and kinos is NLR @LesterPaints , who is the co-founder and CTO of DigitalKin, a French artificial intelligence company. The company was founded 2 years ago and cooperates with NVIDIA.

a16z's AI partner @venturetwins tweeted on 11-21 2:13 about the book UBC is writing and his GitHub.

$ubc coin is the ecosystem's only token, created by NLR on pumpfun.

Rising time: 11-26 23: 37 ~ 11-27 4: 26

1. Twitter Data

As usual, we first analyze the spread of Twitter and filter out all tweets with a time between 11-26 8:07 and 11-27 4:26 and more than 500 followers. The data acquisition time is 11-27 11:51:05.

The first tweet was sent by NLR @lesterpaints on 11-26 21: 44: 14, with 15326 views, and he used a video to talk about the vision. Then he sent a tweet at 22: 01: 24 to post the official Twitter account of $ubc coin, with 11898 views. He sent a third tweet on 11-27 02: 43: 24, which detailed the reasons for creating $ubc on @pumpfun , with 48014 views.

NLR’s tweets are the best in terms of both time and reach, which inspires us to keep an eye on the official and dev Twitter accounts.

The second tweet was sent by @misterraycrypto on 11-26 22: 21: 47, with 20842 views, mainly talking about what UBC is doing. His second tweet on 11-27 02: 16: 35 was read 14267 times, and the content was $UBC breaking through 30M. At the same time, the data showed that the users were basically whales, and the 24-hour capital inflow ranked first.

The third tweet was sent by @alexmasoncrypto on 11-26 22:50:25. He himself was doing a $1 to $1000 challenge. His private channel called 2.3M $ubc at 9.29am, and the public channel called 22M at 20:37pm.

The fourth tweet was sent by @whalewatchalert on 11-27 02: 01: 28, with 15212 views, reporting that a $zerebro whale bought 32.34K of $ubc.

These are the key tweets that spread good data. Combining the time they tweeted and the price situation on the K-line, it is impossible to make an effective association. We can only use them as good sources to obtain key information.

2. On-chain data during the rise

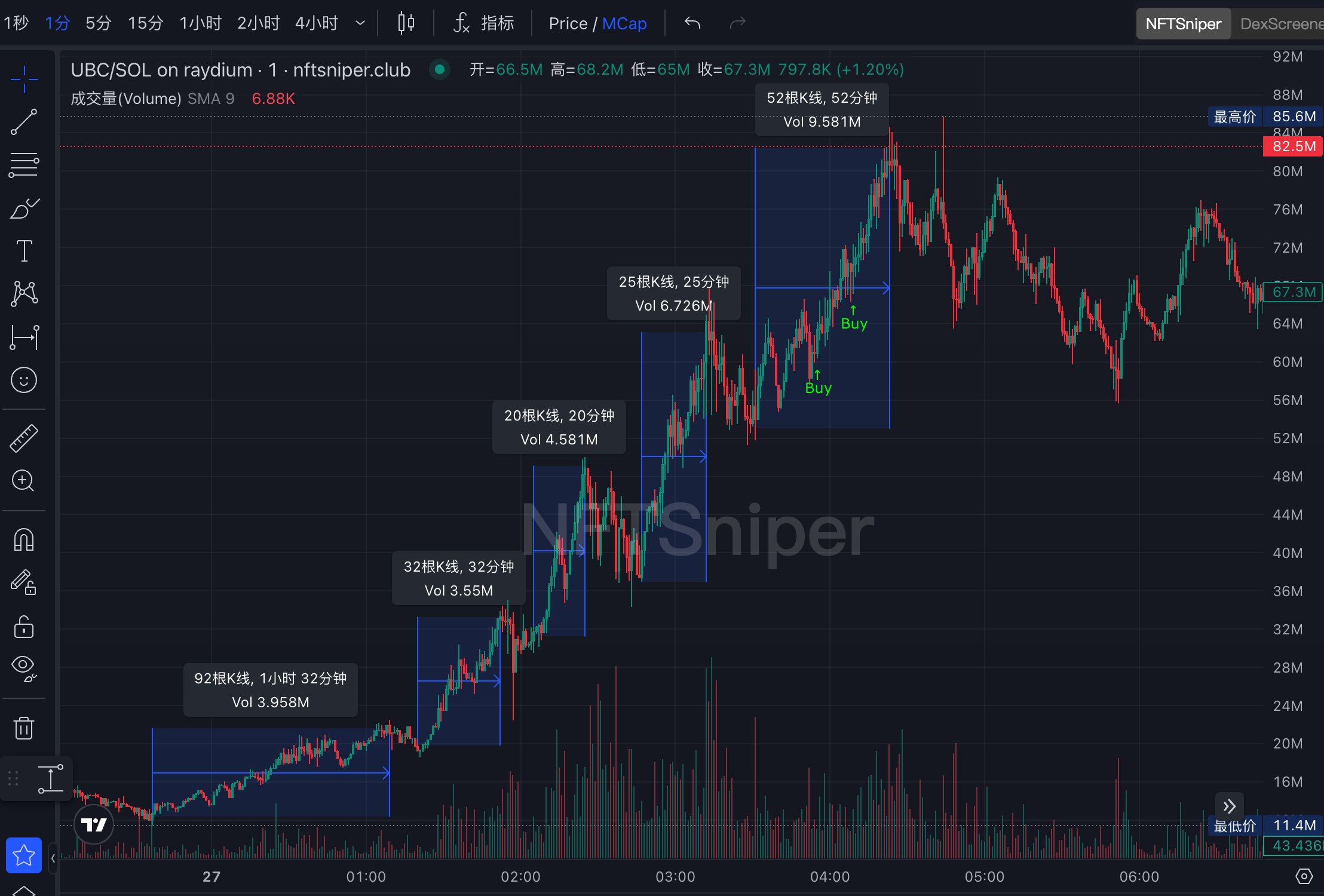

We divide the rising part into 5 segments, as shown in the figure, and analyze which addresses played a key role in the price increase in each segment.

The first period is from 11-26 23:36:00 to 11-27 01:10:00

The address with the highest purchase is BH84Uo2YAnyWRUWeWyfFzttRmE51V682xUaD6NrLHM88, which bought 15 lots in total, with a value of 170,000 U. After the purchase, the position is in the top 16, with a current yield of 300%, and it has not been sold yet.

The second largest purchase address is GUT2KtprxxgmRERjJhd11y8W6EPD9YDyyU9CaMVTXxKY, with a total of 12 purchases worth 113,000 U. After the purchase, the position is in the top 25, with a yield of 370%, and it has not been sold yet.

The third largest buying address is 5t9Q4ia71sCQmg5TEtiQPerBpez773Poub1vXd4nezRQ, which bought 46,000 u in this range. This address also bought multiple transactions at 16:00 and sold some at the high point. Now its holdings are Top 23.

The second period is from 2024-11-27 01:21:00 to 2024-11-27 01:52:00

The address with the largest purchase is CLhxXDchUtnwsn62Vp4zP1f2sRFXyZq2VjzvSeFRc93t, which bought 14 transactions with a value of 137,000 u. It also bought multiple transactions before and after this period, with a total of 265,000 u. Its current position is Top 16 and has not been sold yet.

The second largest purchase address is 2PSSWvjNmgyB9fJXhBDtku2uPBBNbyQF8CDimdRKNsK5, which bought 8 lots at a price of 100,000 u. After this period of time, it bought 2 more lots. The total holding is Top 41 and has not been sold yet.

The third period is from 2024-11-27 02:05:00 to 2024-11-27 02:25:00

The address with the highest purchase volume is FjoTCAFMKStE18gBHVJdgNHXLhWvYExDdcek7Hiisyai, which purchased 8 transactions in total, with a value of 64,000 U. This address also made multiple purchases in the following period. The final position is Top 46, which has not been sold yet.

The fourth period is from 2024-11-27 02:47:00 to 2024-11-27 03:12:00

The address with the largest purchase is Eqxr8e3tuavYEV5xbomqkCrrkJ69xVaGNm5ZwKc4k2aZ, with a total of 14 purchases worth 158,000 u. It has multiple purchases before and after this range, and its total holdings are in the top 20, which has not been sold yet.

The second largest purchase address is EkXQ8cxbf5AoJSvQqmvAfLHDxB1qakiSS9FuTn1cdqBM, with a total of 27 purchases worth 109,000 u. It has multiple purchases before and after this range, and sold some at the high point. The current position is Top 28.

The third largest purchase address is 7JqxsZ89cAAzLY7qcZTQ1gkPcnurEaw6QaXr6RG31t1u, which bought 8 transactions in total, with a value of 90,000 U. This address bought in the early stage and has now cleared its position, making a profit of 117,000 U.

The fifth period is from 2024-11-27 03:31:00 to 2024-11-27 04:23:00

The address with the highest purchase volume is CTRWQ3mn1VSPdZgJdA3GiLCcBo1vA24gPnZGma89mrKn, which purchased 23 times in total, with a value of 217,000 u. There were several more purchases after this period, and the current position is Top 9, which has not been sold yet.

The second largest buying address is 7JJjwVewyw9PPNw9soxdgj8UJGiB1h7kYSHp1aHsKaQb, with a total of 8 purchases worth 199,000 u. There were purchases and sales before the rise, and the current holding is Top 29.

The third largest purchase address is 6K2d9LvM3i47P9FxzEQP4hXZwiHA2c2wgfzGTeTvJqj8, which bought 4 lots in total, with a value of 176,000 U and has not sold any.

The above addresses play a key role in driving up prices during the rise. Of course, some addresses are not listed one by one. If you have positions, you need to keep an eye on when these addresses will ship. Their positions are in the front row, and if they ship, the impact on prices will be great.

3. Whale positions before the rise

I am quite curious about which whales still have large positions from the opening to the bottom at 23:37 on 11-26. Their operations are of great reference value to our buying and selling.

The first address is FTg1gqW7vPm4kdU1LPM7JJnizbgPdRDy2PitKw6mY27j, which bought 100 sols within half an hour of opening. It is currently the top 1 position with a yield of 7091% and no cents have been sold.

The second-ranked address is 5wagRVSuUBZqDhBVR899emmu7WRWMVAEShdwjyGYJBKi, which bought 30,000 U in total and sold part of it. The remaining holdings are the top 4, with a yield of 4210%.

The third address is 24JaAVF4xVPcDPNwR4kyR4pcra9uuLJnc2bwATSH5KVh, which bought 10,000 U in total and sold some of them. The remaining holdings are the top 3, with a yield of 13516%.

The fourth address is BteM1tDqVK1WkySReqR3dGKFA1FZtzjHmrLQrCopwH4D, which bought 40 sols. It currently holds the top 5 stocks with a yield of 11554%, and no coins have been sold.

The fifth address is 3HtWz7iMnbSJtrG4Jq5A3FcJoEN5gEZz95hkUPXBgNeG, which bought 100,000 u in total. It currently holds the top 8, with a yield of 612%, and no coins have been issued.

Through the above analysis, we can draw the following conclusions:

1. Pay attention to the official and dev Twitter in time so that we can get the most timely information.

2. Keep an eye on the address in the second part that plays a key role in the price increase to guide us in selling.

3. When most of the whales in the third part still hold positions, if the fundamentals are good, it can be used as a reference indicator for buying.

4. In the process of analyzing Twitter data, it was found that some tweets compared $radio(B4gipVUHKJ7keVN3MWEYDQCHjkdoXGsbmZoTSJDZpump) with $ubc. The current market value of $radio is 4.5 M, and the K-line pattern is falling. You can pay attention to the follow-up.