BitMEX Alpha: Exploiting Implied Volatility Skew

Original author: BitMEX

Welcome back to our weekly options strategy series. Today we will share a unique trading opportunity presented by significant differences in the Bitcoin options market.

The implied volatility (IV) of Bitcoin call options is currently surging, while put options appear to be undervalued.

In this article, we will analyze this IV skew phenomenon and propose a strategy that could potentially profit from rising put option IV. With the current market heavily skewed toward calls, we think this contrarian strategy could be particularly rewarding!

Let’s start the analysis.

Bitcoin Implied Volatility (IV) Skew Analysis

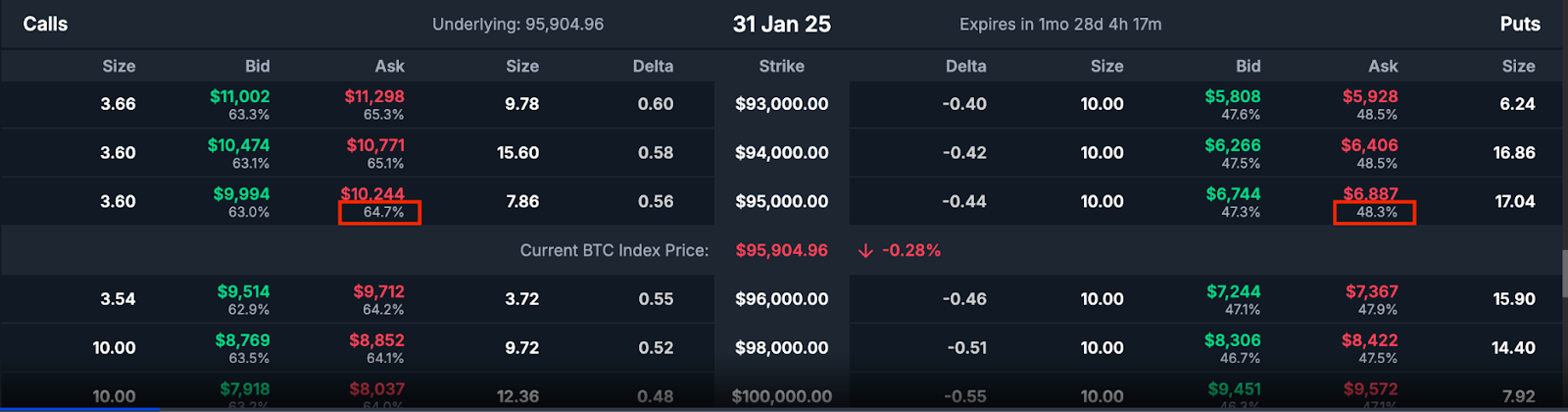

As shown in the above BitMEX options table for BTC options expiring on January 31, 2025, the IV skew between call and put options is about 25%, with the IV of call options being significantly higher.

This indicates strong demand for call options, reflecting bullish market sentiment or the need to hedge against upside risk. This significant skew highlights the supply-demand imbalance, making put options relatively cheaper and creating potential opportunities for volatility trading strategies.

Consider the Ratio Put Spread Strategy

If you believe that BTC put options will become more expensive and/or that BTC price will experience a significant correction over the next two months, we recommend considering the Ratio Put Spread strategy.

This trading strategy aims to exploit multiple market dynamics:

Take advantage of volatility skews, particularly OTC put options, by profiting from potential increases in IV. Due to the skew, these options currently have lower premiums, meaning they will increase in value more quickly when volatility spikes, especially during market sell-offs.

It also provides a smart directional trade with limited downside risk, allowing traders to benefit from any significant drop in BTC below $82,000. To manage risk effectively, the structure includes selling an at-the-money put option, which helps offset the cost of the two out-of-the-money put options purchased, thereby reducing the net debit and limiting upfront risk.

How to implement your market view

Trading strategy:

Sell 1 BTC $96,000 ATM put option expiring on January 31, 2025

Buy 2 BTC $90,000 OTM put options expiring on January 31, 2025

Scenario and benefit analysis

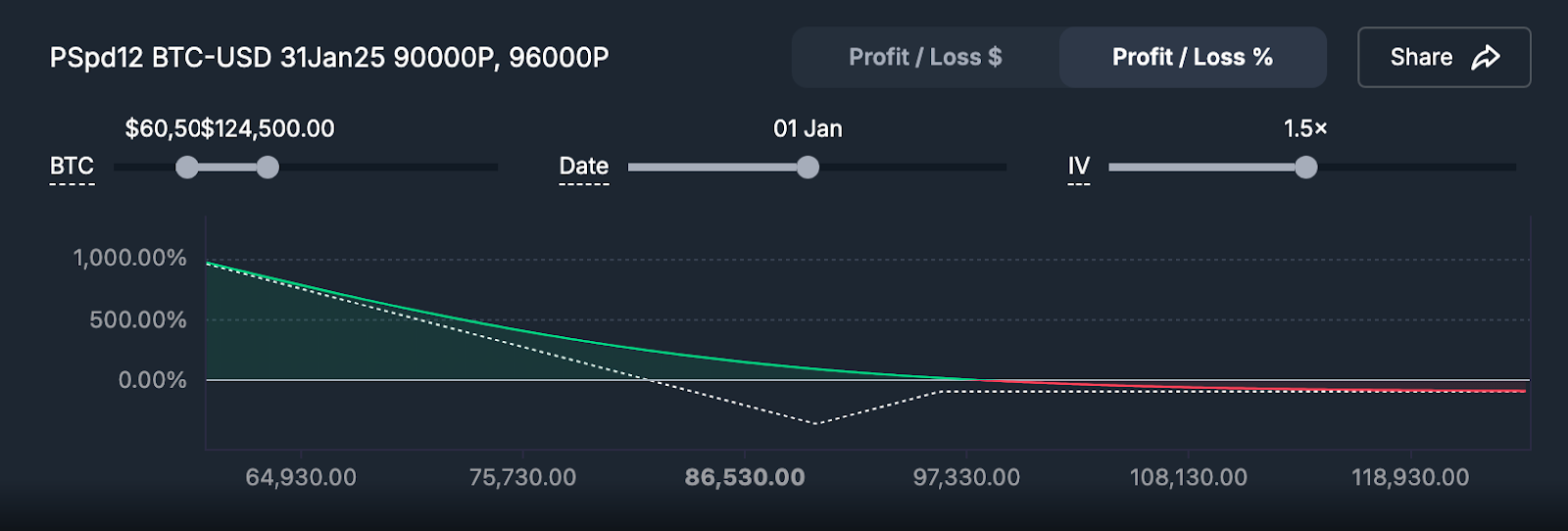

This trade can be profitable in two ways. First, through a spike in IV before expiration - which should ideally happen as early as possible to minimize the negative effects of time decay (the decrease in option value as expiration approaches). Second, through a significant drop in BTC price, causing our 2 out-of-the-money put options to become in-the-money and generate profits.

Scenario Analysis:

IV Rise: The trade benefits from rising IV on put options, especially out-of-the-money strikes.

BTC falls sharply: Significant downside price action amplifies the value of the $90,000 put option, while the $96,000 put option offsets the cost.

IV Decline: The trade suffers when the IV of the put option decreases, especially if the out-of-the-money strike price experiences greater IV compression.

BTC rises strongly: Significant upside price action hurts the trade as it reduces the value of both put options.

Scenario 1: IV never spikes during the trading period

If IV never spikes during the trading period, the only way for the strategy to be profitable is if Bitcoin drops significantly.

Scenario 2: IV spike occurs

If the medium-term IV can spike by 50% before the option expires, we will have a nice profit as long as BTC is trading below $97,000 and we are able to close our position. You can use BitMEX’s strategy simulator to simulate the different effects of time decay and IV spikes on your profits.

Risks and considerations

1. Maximum loss:

The trade would incur a maximum loss if Bitcoin traded at $90, 000 on the expiration date.

2. Skew compression:

If the IV skew narrows (e.g., the IV of the out-of-the-money put option drops further relative to the at-the-money IV), the trade may lose its edge.

3. Directional risk:

A modest decline (e.g., $92,000-93,000) could result in a partial loss as the loss on the at-the-money put sold exceeds the gain on the out-of-the-money put bought.

4. Time decay:

Time decay works against purchased out-of-the-money puts, requiring a sufficient IV increase or price movement to overcome this drag.

Summarize

This ratio put spread strategy exploits the current IV skew and provides a structured way to profit from rising and potentially falling Bitcoin volatility. This is an attractive strategy for traders who anticipate rising uncertainty or bearish price action but want to limit upfront costs and downside risk. However, to optimize profitability and mitigate risk, IV and price action must be closely monitored.