Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

Recently, in the market led by Bitcoin, in addition to the old altcoin sector, DeFi project tokens have also generally performed well. Take CRV (Curve) as an example. In the past month, it has risen from 0.2 USDT to a maximum of 1.24 USDT, an increase of more than 500%. According to Token Terminal data, Curve Finances annualized revenue in the past 30 days was close to 37 million US dollars, a month-on-month increase of nearly 23%.

The common characteristics of such tokens are that the tokens have been in circulation for many years, the proportion of unlocked tokens is small, and the sustainability of protocol revenue has also been verified over time. In addition to CRV, which types of tokens meet these characteristics? Odaily will conduct statistics in this article.

Basic information

The data in this article is based on DefiLlama and CoinGecko, where:

Project selection: Top 60 projects with the highest 24-hour revenue in DefiLlama;

Data selection: 24-hour and 30-day revenue of the protocol (DefiLlama), market value of protocol tokens and FDV (CoinGecko)

Other situations: There are special situations where the protocol has not issued coins, is about to issue coins, or mixes tokens with multiple protocols. The author will verify and judge through other information.

Due to the large amount of data, no graph is shown. For the complete data of the 60 projects, please see the link: https://docs.google.com/spreadsheets/d/1He_Ms6NZ434Qt7lMC6ozGC71kszdVC_P_L6lDUKY5OI/edit?usp=sharing

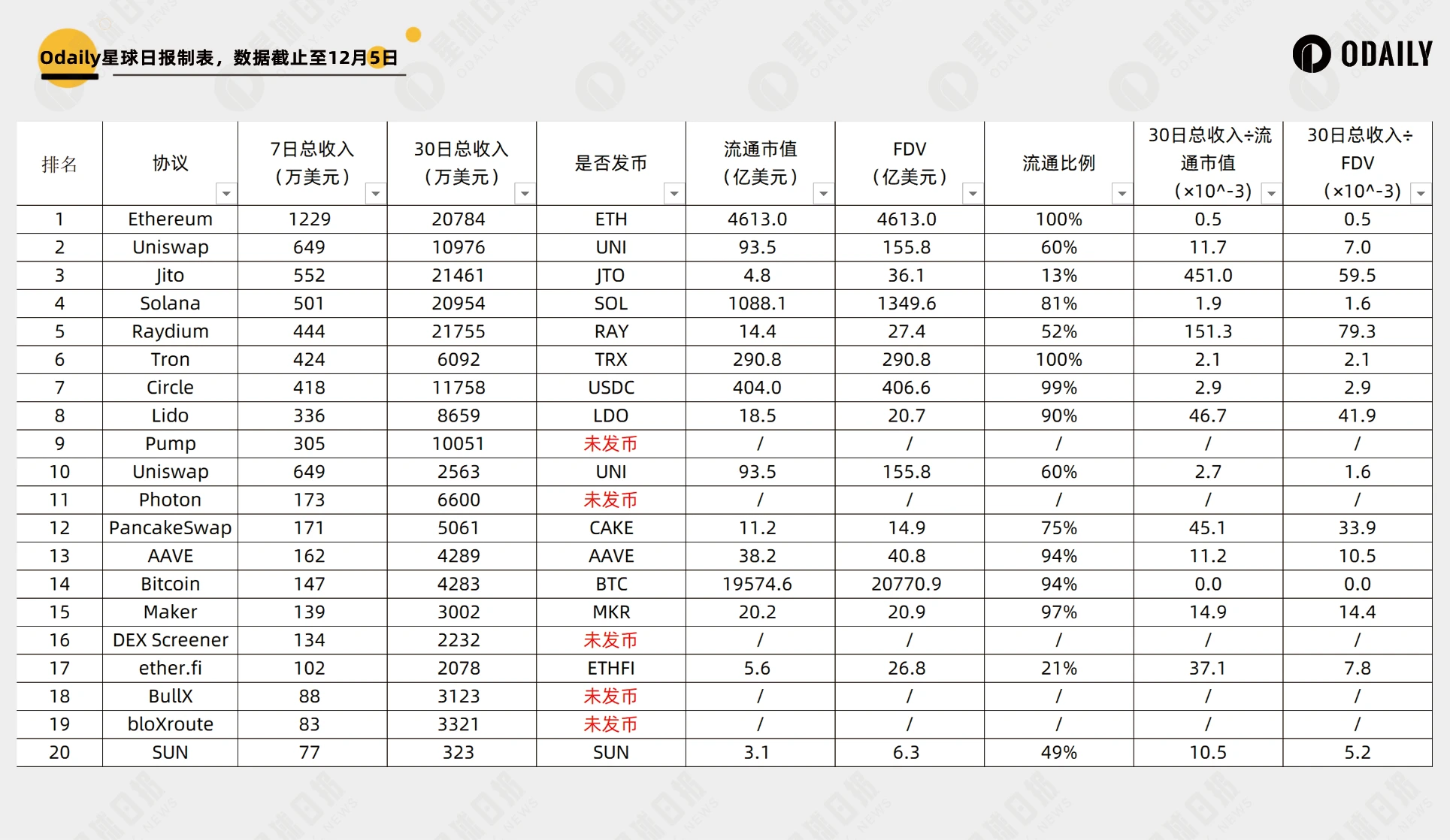

Top 20 revenue projects

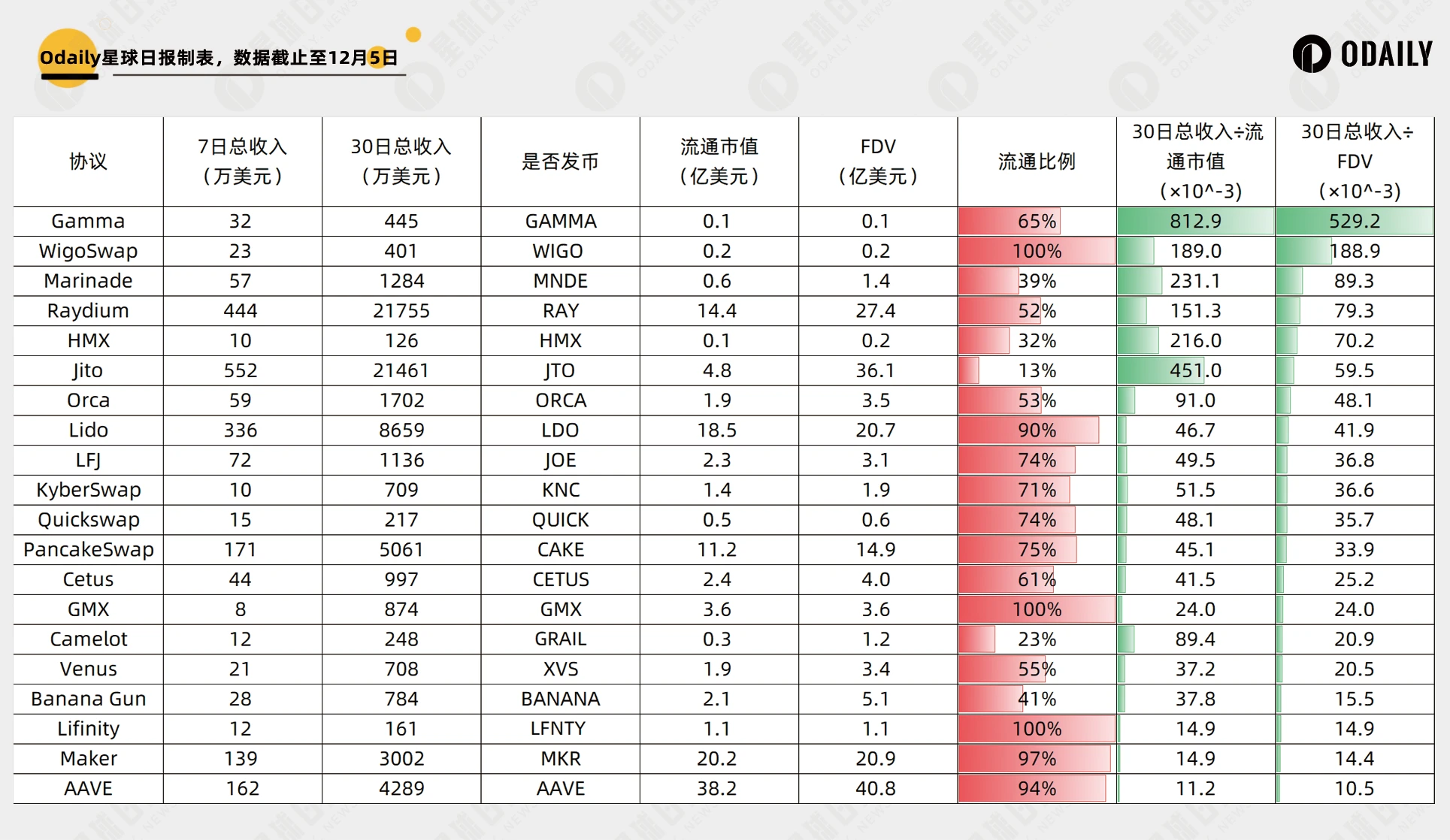

The top 20 projects are shown in the figure below. We can see several points from the table:

TOP income projects are mainly divided into three categories: network (chain), DeFi and Meme tools;

Most tokens have been unlocked by more than half, with only JTO (Jito) and ETHFI (ether.fi) having a lower unlocking ratio;

Meme tools have not issued tokens, accounting for 20% of the top 20. Among them, Pump, Photon, and BullX are fee income and are all on the Solana chain. DEX Screener mainly earns advertising income from Meme tokens.

There are only two projects whose 30-day total revenue ÷ circulating market value exceeds three digits, namely Jito and Raydium, both on the Solana chain;

(Note: Uniswap Labs ranked tenth, and the second place was the Uniswap protocol itself.)

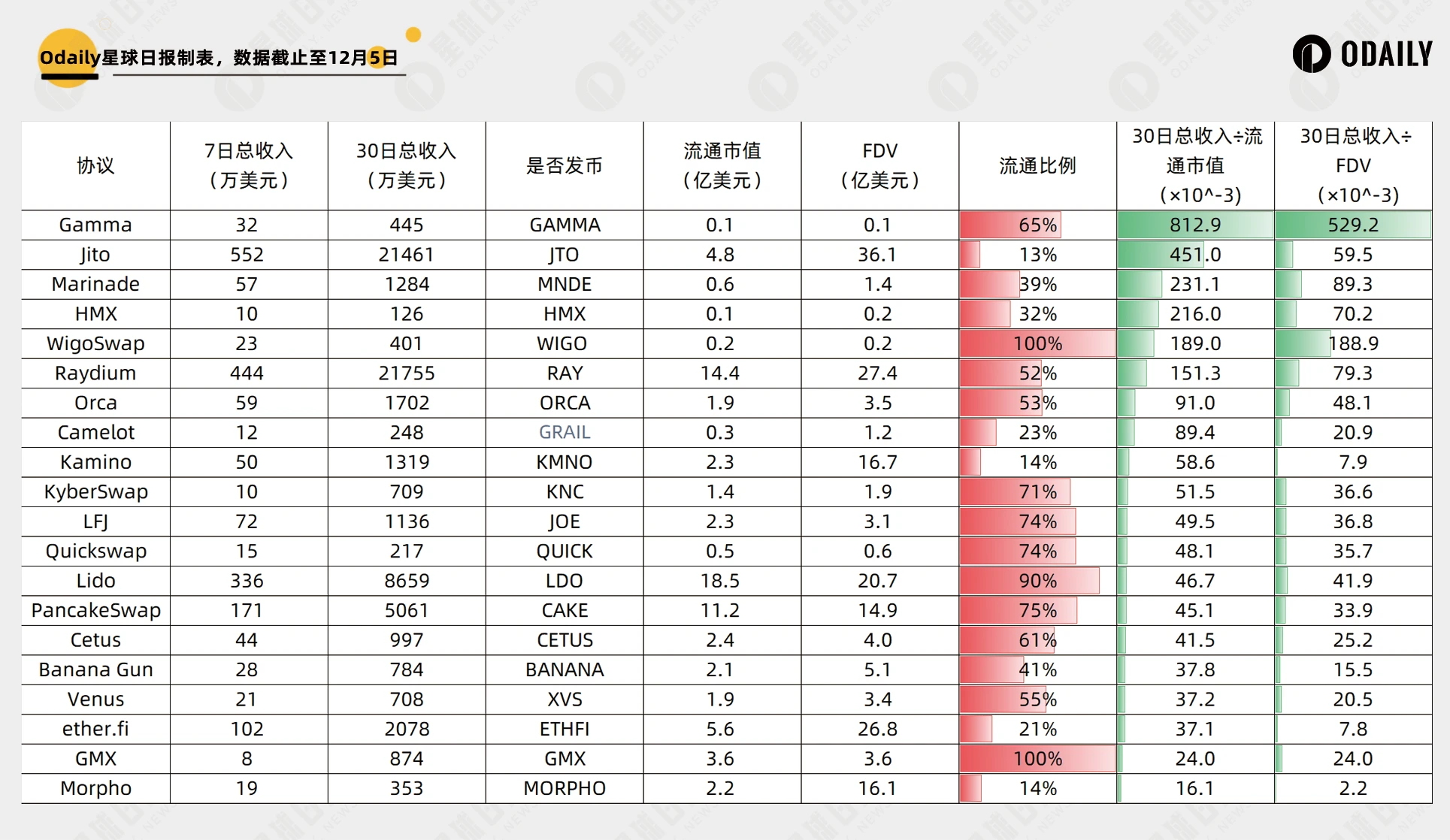

Who has the best value for money?

Excluding projects that have not issued tokens, the table below is ranked in descending order based on 30-day total revenue ÷ circulating market value.

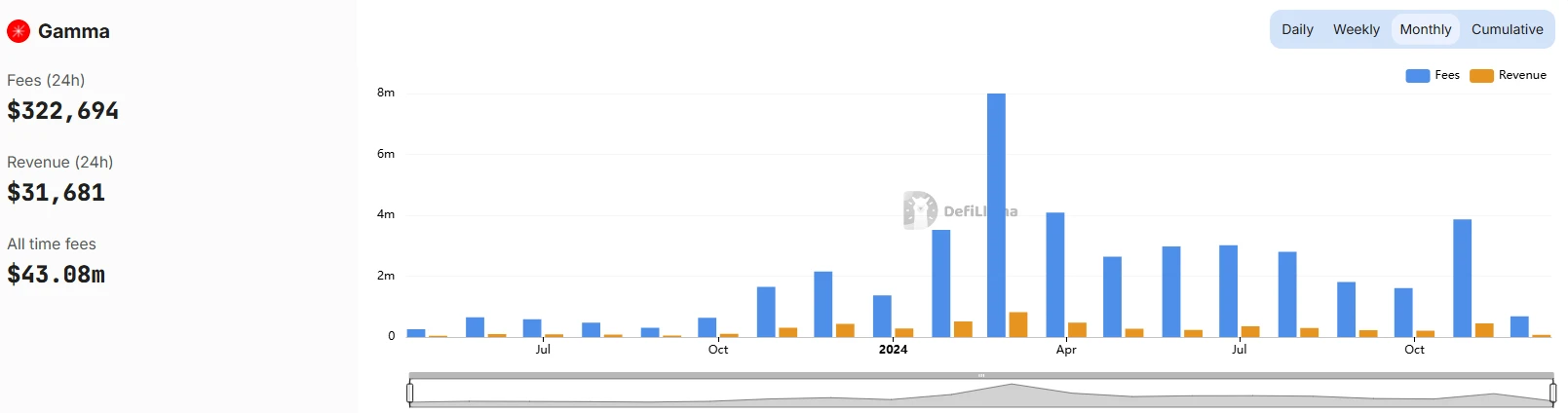

Among them, the more niche projects are Gamma, which ranks first, and WigoSwap, which ranks fifth. Gamma is a liquidity management protocol on ZKsync. The protocol income has been relatively stable for a long time, with monthly income of about US$1 million to US$4 million, and token stakers have the right to obtain a share of Gammas treasury income.

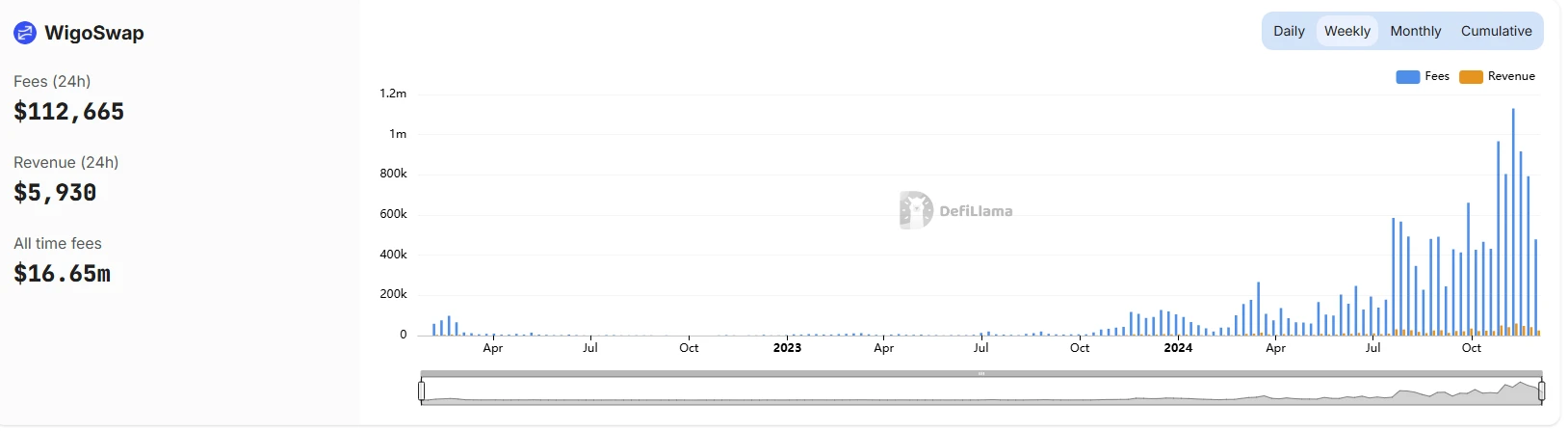

WigoSwap is the DeFi Hub on the original Fantom. It will be renamed DeFive as Fantom transforms to Sonic. The protocol business will also expand to multiple fields such as Swap, task platform (similar to Galaxy), asset trading market, and games.

WigoSwap’s revenue has only recently started to grow, and its sustainability is unclear, but it is worth paying attention to with the arrival of Sonic.

In terms of token use cases, according to official documents, WIGO is only used as a circulating token within the ecosystem, and no description of income rights is seen.

The other protocols are well-known products (LFJ is the original Trader Joe), so I will not elaborate on them here. You can focus on the marginal turning points of their data. The 30-day total revenue ÷ FDV is as follows.

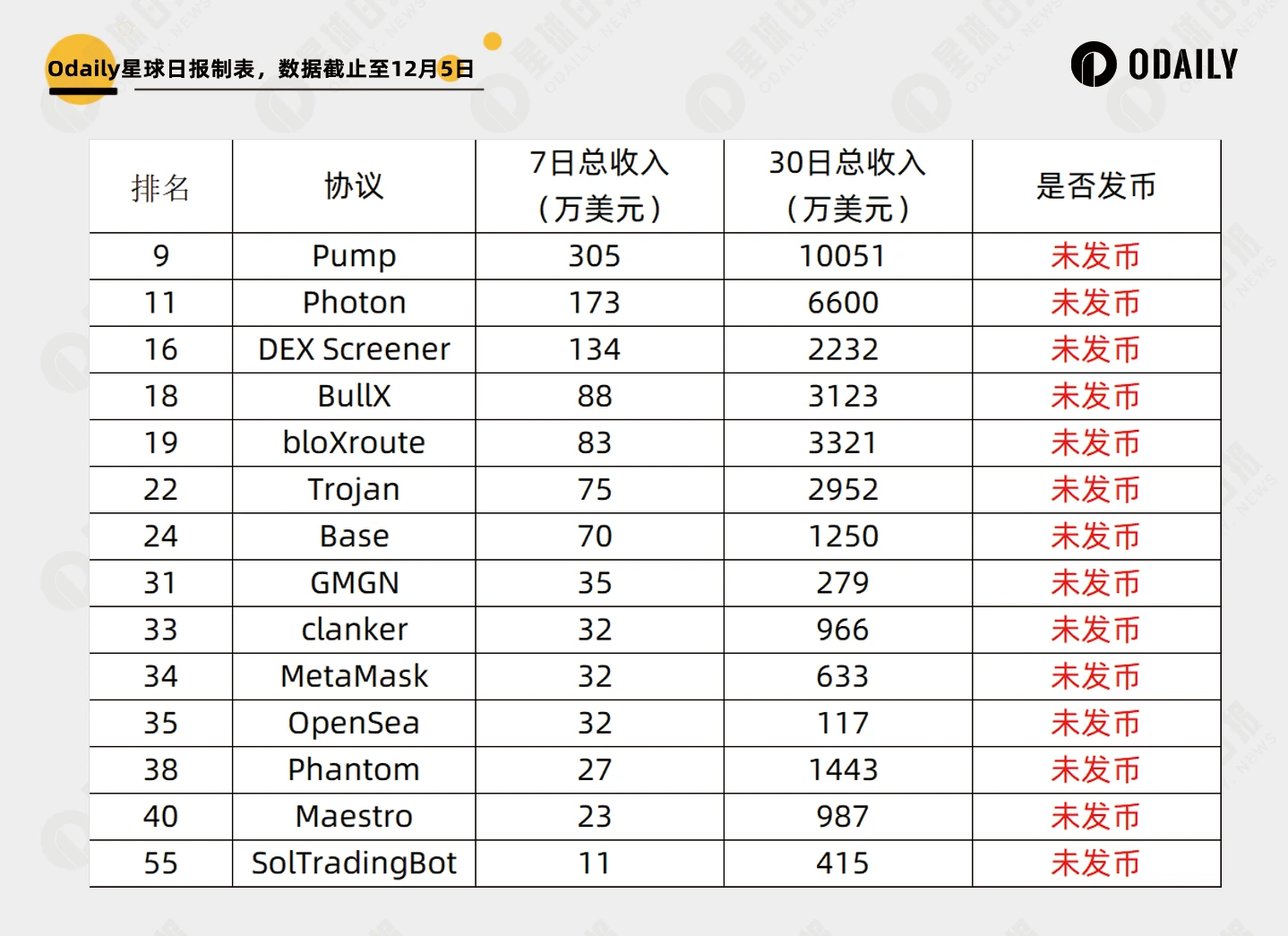

Do un-coined projects have any chance?

The top 60 projects in terms of revenue that have not issued tokens are shown in the figure below. It can be seen that most of them are Meme tools, and the probability of issuing tokens is relatively low. Currently, only Pump and OpenSea have a high probability of issuing tokens, but the cost-effectiveness of both of them in actively brushing volume is very low. Readers are advised to look for opportunities outside the table.