Key Takeaways:

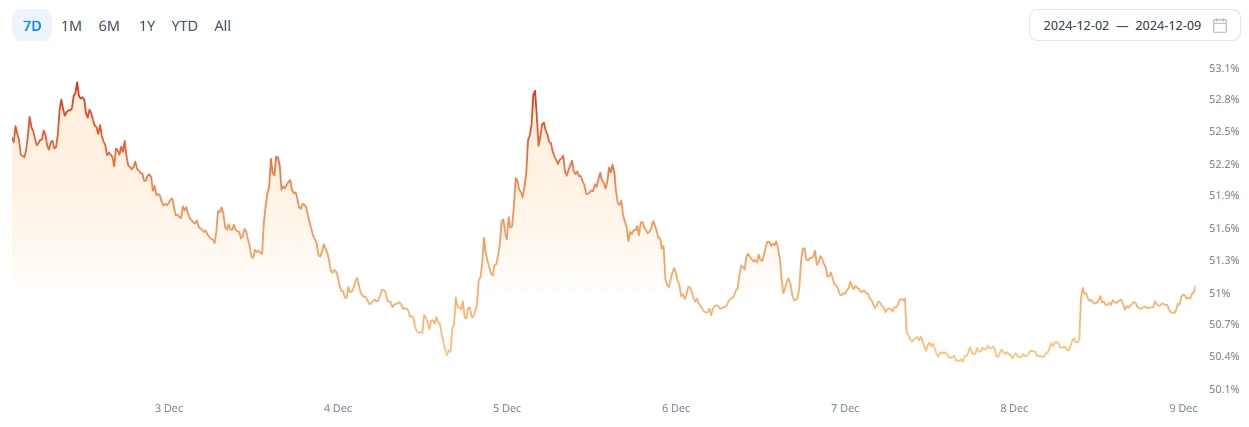

The total market value of global cryptocurrencies is $3.84 trillion, up 5.2% from $3.63 trillion last week. The market value of Bitcoin is $1.98 trillion, accounting for 51.44%.

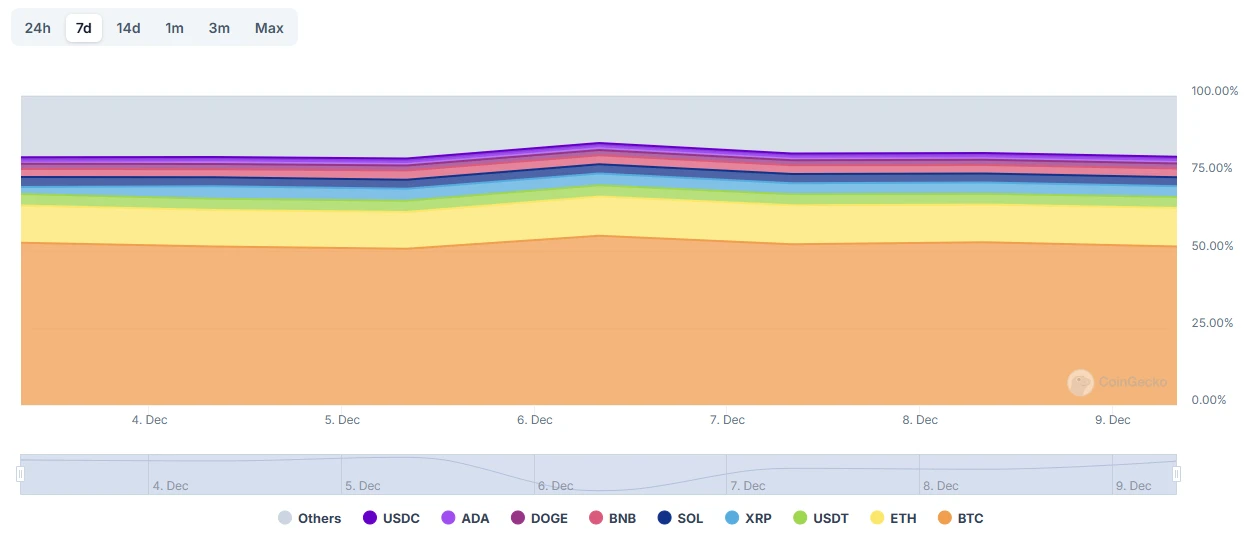

The total market value of stablecoins is $204 billion, accounting for 5.32% of the total market value of cryptocurrencies. Among them, the market value of USDT is $138 billion, accounting for 67.6% of the total market value of stablecoins; followed by USDC with a market value of $41 billion, accounting for 20% of the total market value of stablecoins; and DAI with a market value of $5.37 billion, accounting for 2.6% of the total market value of stablecoins.

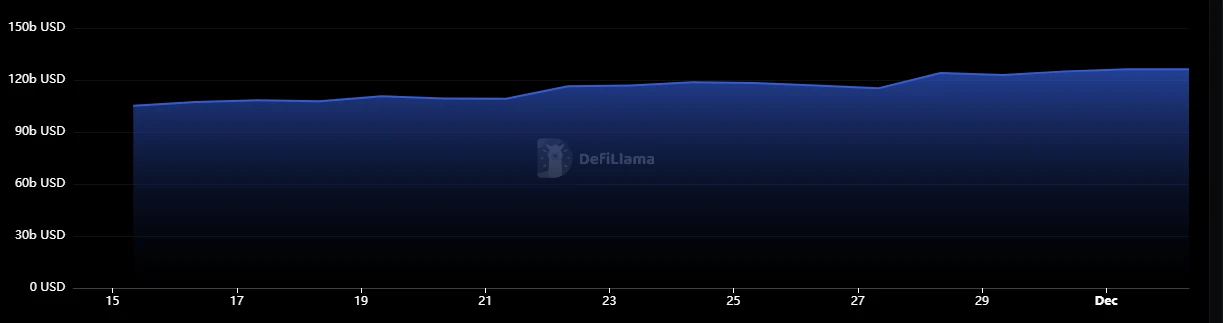

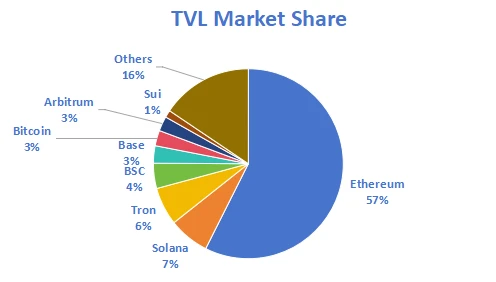

This week, the total TVL of DeFi is 137.4 billion US dollars, an increase of 8.8% compared with last week. According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 57%, Solana chain accounting for 7%, and Tron chain accounting for 6%.

From the data on the chain, the daily trading volume of ETH and BNB has a downward trend, and SOL has not changed much overall. In addition, the daily trading volume of SUI chain has a clear upward trend, an increase of 75% compared with $120 million last week. From the growth trend of daily active addresses, BNBs daily active addresses have increased significantly this week, with an increase of 10.4%. ETH DeFi TVL is $78.9 billion, and the circulating market value is $447.2 billion, which is still far higher than other public chains.

Innovative projects to watch: Jade.Money : Jade is a decentralized stablecoin platform that allows users to mint $JSD. $JSD is a yield-earning stablecoin that is exchangeable with $USDC at a 1:1 ratio. By depositing USDC into Jade, users can earn income while maintaining the stable value of their assets; Nerocity: Nerocity is a platform built on the Solana blockchain that allows the creation and deployment of autonomous AI agents. As a decentralized launchpad, it allows creators to quickly deploy artificial intelligence agents that can interact with users on Telegram and X; Econyx AI: Optimize token economics with AI agents, which balance supply, demand, and growth of tokens and provide a sustainable economic mechanism.

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

The total market value of global cryptocurrencies is $3.84 trillion, up 5.2% from $3.63 trillion last week.

Data source: Cryptorank

As of press time, Bitcoin (BTC) has a market cap of $1.98 trillion, accounting for 51.44%. Meanwhile, stablecoins have a market cap of $204 billion, accounting for 5.32% of the total cryptocurrency market cap.

Data source: coingeck

2. Fear Index and ETF Inflow and Outflow Data

The cryptocurrency fear index is at 78, indicating greed.

Data source: coinglass

3. ETF inflow and outflow data

As of December 9, 2024, the total net inflow of US Bitcoin spot ETFs was approximately US$33.4 billion, and the total net inflow of US Ethereum spot ETFs was approximately US$1.4 billion. On December 8, Nate Geraci, president of The ETF Store, said on the social platform that the Ethereum spot ETF had net inflows for 10 consecutive days. The inflows on two of the two days were the highest since its launch in July, indicating that consultants and institutional investors have just begun to pay attention to this field.

Data source: CoinW Research Institute, sosovalue

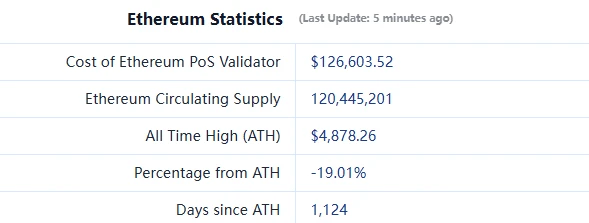

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Currently $3,954, historical high $4,878

ETHBTC: Currently 0.039685, the highest in history is 0.1238, a drop of about 67.9%

Data source: ratiogang

5.Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $137.4 billion, up 8.8% from last week.

Data source: defillama

By public chain, the three public chains with the highest TVL are Ethereum chain accounting for 57%; Solana chain accounting for 7%; and Tron chain accounting for 6%.

Data source: CoinW Research Institute, defillama

Data as of December 9, 2024

6. On-chain data

The data of the current major public chains ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspectives of daily transaction volume, daily active addresses, transaction fees and total locked value (TVL).

Data source: CoinW Research Institute, defillama, Nansen

Data as of December 9, 2024

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators to measure the activity of the public chain and user experience. In terms of daily trading volume, ETH and BNB trading volumes have a downward trend, while SOL has not changed much overall. In addition, the SUI chains trading volume has increased significantly, with a 75% increase from $120 million last week. This also reflects that as the SUI token breaks new highs, the on-chain trading volume has also changed significantly.

Daily active addresses: Daily active addresses reflect the ecological participation and user stickiness of the public chain. From the perspective of daily active addresses, SOL still ranks first. From the growth trend of daily active addresses, BNBs daily active addresses increased significantly this week, with an increase of 10.4%.

Total locked value (TVL) and circulating market value: reflects the maturity of DeFi and the degree of trust users have in the platform. From the perspective of TVL, ETH is still the absolute leader in the DeFi field, with its DeFi TVL reaching US$78.9 billion and circulating market value reaching US$447.2 billion, still far exceeding other public chains.

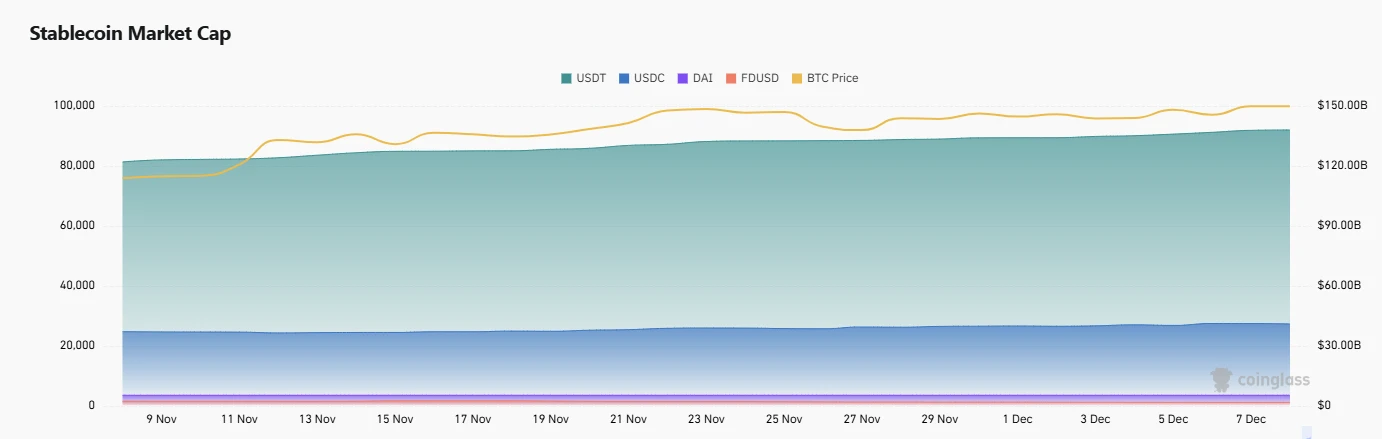

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is $204 billion, a record high, with an increase of 5.6% in the past week. Among them, the market value of USDT is $138 billion, accounting for 67.6% of the total market value of stablecoins; followed by USDC with a market value of $41 billion, accounting for 20% of the total market value of stablecoins; DAI has a market value of $5.37 billion, accounting for 2.6% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of December 9, 2024

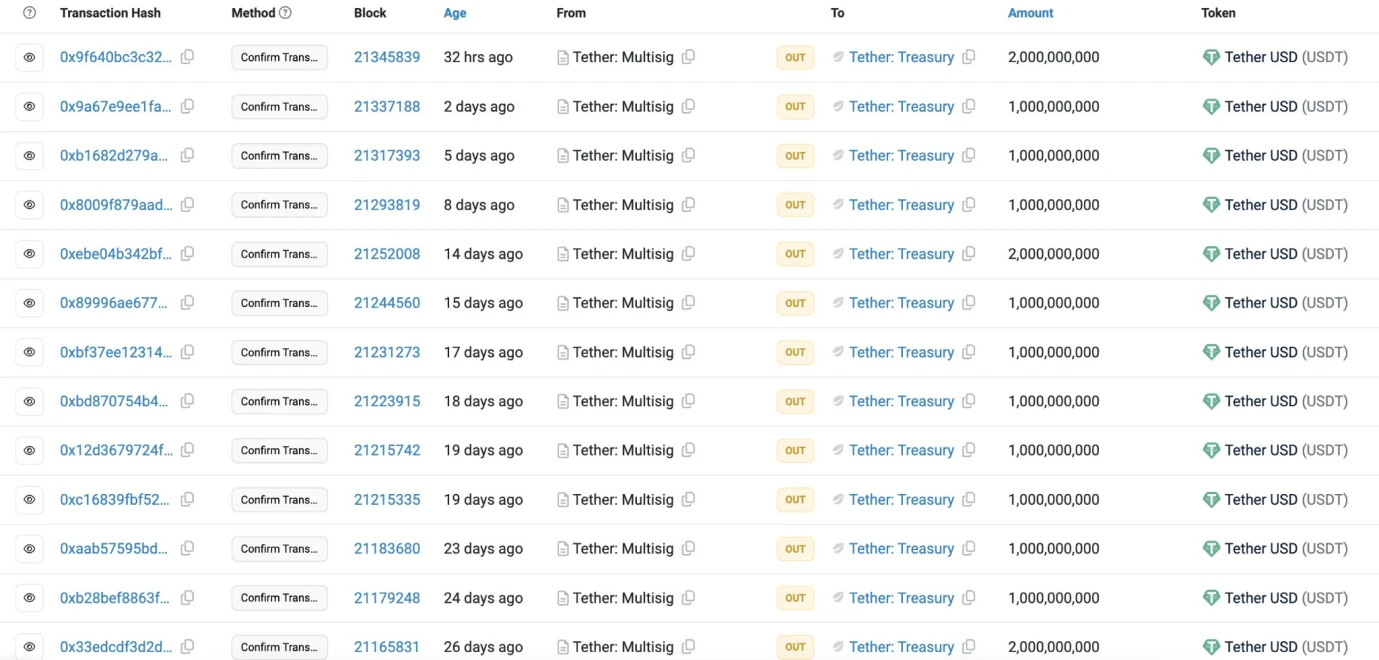

According to Cointelegraph data, Tether has minted a total of 20 billion USDT since November 6.

Data source: Cointelegraph

2. Hot money trends this week

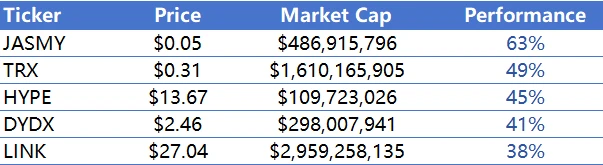

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, Coingeck

Data as of December 9, 2024

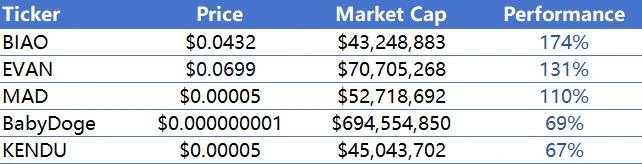

Top 5 Meme Coins That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of December 9, 2024

2. New Project Insights

Jade.Money : Jade is a decentralized stablecoin platform that allows users to mint $JSD. $JSD is a yield-generating stablecoin that is 1:1 redeemable with $USDC. By depositing USDC into Jade, users can earn yield while maintaining the stable value of their assets.

Nerocity: Nerocity is a platform built on the Solana blockchain that enables the creation and deployment of autonomous AI agents. As a decentralized launchpad, it allows creators to quickly deploy AI agents capable of interacting with users on Telegram and X.

Econyx AI: Using AI agents to optimize token economics, AI agents balance supply, demand, and growth of tokens, providing a sustainable economic mechanism.

3. New Industry Trends

1. Major industry events this week

Gravity releases Litepaper, will be launched on testnet in Q1 2025: Gravity, the L1 blockchain launched by the Galxe team, released Litepaper, and will be launched on testnet in Q1 2025. The team said that Gravity can achieve over 1 billion hash operations per second, millisecond finality time and parallel EVM operation functions, and provide enterprise-level security through the re-staking protocol, while taking into account seamless cross-chain interoperability.

Wormhole launches staking reward program, with an initial reward of 50 million W: Wormhole, a cross-chain interoperability platform, announced the launch of the W staking reward program (SRP) on December 4, supporting Solana and all EVM chains. Users who participate in governance staking can receive rewards, and the initial reward pool will allocate no less than 50 million W tokens.

The first round of rewards for Manta Gas Gain is open for collection, with an average income of more than $1,000 for a single address: The first round of rewards for the Gas Gain event launched by the modular L2 project Manta Network is open for collection. The top 400 users can apply for it on the Gas Gain official website. The actual average income for a single address exceeds $1,000.

XION announces token economic model, community and Launch account for 15.19%: Layer 1 project XION released a token economic white paper, introducing its token model based on the Proof of Abstraction mechanism. The total supply of XION tokens is 200 million, and the initial circulation is 25,559,333, accounting for 12.78%. In the token distribution plan, ecological incentives and project incubation account for 23%, strategic investors account for 27%, the team accounts for 20%, protocol development and foundation account for 15%, and the community and Launch account for 15.19%.

Trump nominates Paul Atkins as SEC Chairman: US President-elect Donald Trump has selected Paul Atkins as Chairman of the Securities and Exchange Commission (SEC). If this appointment is finally confirmed, it will be an important step for Trump to fulfill his campaign promise and bring a more friendly regulatory environment to the cryptocurrency industry.

2. Big events coming up next week

Ethereum Layer 2 Superseed started token sale on December 9th.

Magic Eden Foundation announced that the ME token will undergo a TGE on December 10th.

Sui ecological lending protocol Suilend will launch the token SEND on December 12.

Optimism Governance Season 6 will last until December 11, 2024. The theme of Season 6 is Optimizing to Support the Superchain.

Cardano (ADA) will unlock about 18.53 million tokens on December 11, accounting for 0.05% of the current circulation and worth about $22 million;

The new Bitcoin fair value accounting rules of the U.S. Financial Accounting Standards Board (FASB) require that companies will officially adopt Bitcoin fair value accounting in fiscal years beginning after December 15.

3. Important investment and financing last week

Public, Series A, raised $135 million, with investment firm Accel. Public announced the launch of cryptocurrency trading services in 2021. Previously, individual investors using the platform could only trade stocks and ETFs listed in the United States, but now it has expanded to cryptocurrencies, government bonds, and art. (December 3)

Brighty, Series A, raised $10 million, with investment from Futurecraft Ventures. Brighty is an all-in-one application that combines digital banking and crypto banking, where users can save, send, spend and earn up to 10% per year in stablecoins, with daily payments. Brighty is committed to enabling individuals to buy cryptocurrencies and enter the crypto economy more safely. (December 3)

Union, Series A, raised $12 million, with investors including gumi Cryptos Capital, LongHash Ventures, Borderless Capital, Blockchange Ventures, Foresight Ventures, Dispersion Capital, TRGC, Gate Ventures, etc. Union is an efficient interoperable protocol that connects all blockchains and rollups in any ecosystem. It is based on consensus verification and does not rely on trusted third parties, oracles, multi-signatures, or MPC. (December 4)

Interlace, Series B, raised $10 million, led by Bitrock. Interlace is an enterprise-level global card issuing and digital asset management company headquartered in Singapore. Founded in 2019, it provides cross-border, cross-currency, and cross-system financial solutions for Web3, cross-border e-commerce, B2B trade, developers, etc. (December 4)

Earos, Pre-Seed round, raised $10 million, led by Lemon Ltd. Earos is a platform that uses digital twin technology to tap the potential of AI Agents. It is currently building a decentralized AI ecosystem that integrates the AI Agent model layer, allowing global nodes to collaborate in artificial intelligence model training, deployment, and verification. Developers can also create and deploy their own AI agents. It is reported that the project will use tokens to provide rewards for participants who provide computing power, verify AI agent workstations, and run nodes. (December 4)