Market Overview

Main market trends

Overall market overview

The market is currently in a state of extreme panic, with the sentiment index falling from 53% to 7%. Coupled with the Federal Reserves hawkish stance (expectations for rate cuts fell from 4 to 2), it triggered about $1 billion in forced liquidation, indicating that the market is undergoing a significant deleveraging process.

DeFi Ecosystem Development

The DeFi sector saw its first negative TVL growth in nearly two months (-2.21%), but the market value of stablecoins continued to grow (USDT + 0.55%, USDC + 1.44%), indicating that despite the market correction, basic liquidity is still continuing to flow in, and stable income projects such as machine gun pools are sought after.

AI Agent

The market size of the AI Agent track has reached US$9.9 billion, and the focus of investment has shifted from speculative AI Meme coins to infrastructure construction. This shift shows that the market is gradually maturing and the project direction is becoming more rational and practical.

Meme Coin Trends

The heat of the Meme coin market has obviously cooled down, and funds have begun to withdraw on a large scale, indicating that market speculation sentiment has decreased and investors are more inclined to look for projects with substantial application value. This may mark the end of the Meme coin craze.

Public chain performance analysis

Amid sharp market fluctuations, the public chain sector has demonstrated strong resilience and has become the first choice for investors to seek risks, reflecting that the markets confidence in infrastructure remains strong.

Future Market Outlook

As the Christmas holiday approaches, market liquidity is expected to decline. Investors are advised to adopt a defensive allocation strategy, focusing on BTC and ETH. At the same time, they can pay attention to DeFi stable returns and AI infrastructure projects, but they need to be wary of the risk of increased volatility during the holidays.

Market Sentiment Index Analysis

The market sentiment index fell from 53% last week to 7%, which is in the extreme panic range.

Altcoins underperformed the benchmark index this week, showing a sharp decline. Affected by leveraged positions, the market saw forced liquidation of more than $1 billion in positions, and long positions were significantly deleveraged. Given the current market structure, it is expected that Altcoins will keep pace with the benchmark index in the short term, and the probability of independent market movement is low.

Altcoins tend to flip upward when they are in extreme panic ranges.

Overview of overall market trends

The cryptocurrency market is in a downtrend this week, with sentiment indicators at extreme levels of panic.

Defi-related crypto projects performed outstandingly, showing the markets continued focus on improving basic returns.

The AI Agent track project has received high public sentiment this week, indicating that investors are beginning to actively look for the next market outbreak point.

This week, Meme track projects generally fell, and funds began to withdraw from Meme coin projects, reflecting the markets enthusiasm for Meme coins gradually waning.

Hot Tracks

AI Agent

The market is in a downward trend this week, and all tracks are in a downward trend. Although the prices of most tokens in the AI Agent track are also in a downward trend this week, it is the most discussed in the market. Previously, the market attention of AI Agent was mostly focused on Meme token projects with AI Agent, but now it is slowly shifting to the construction of AI Agent infrastructure.

Since traditional VC coin projects are not popular in the market in this cycle, and Meme coin projects cannot bring sustained growth to the market, the AI Agent track is currently very likely to lead the market development in the future, because the AI Agent track not only includes AI Meme, but also includes many other tracks such as AI DePIN, AI Platform, AI Rollup, AI infra, etc., which can all be combined with AI Agent. Because essentially, each blockchain project is a manifestation of a smart contract, and the birth of AI Agent is to improve and enhance smart contracts. Therefore, AI Agent and Crypto are the best combination.

The top five AI Agent projects by market value are:

DeFi Track

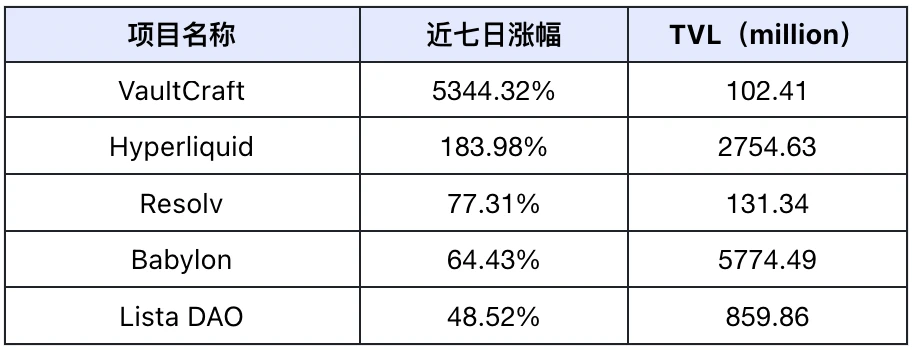

TVL Growth Ranking

The top 5 TVL growth rates of market projects in the past week (excluding public projects with smaller TVL, the standard is more than 30 million US dollars), data source: Defilama

VaultCraft(VCX):(Recommendation Index: ⭐️⭐️)

Project Introduction: VaultCraft is a public blockchain project based on Algorand that aims to reduce the cost for participants in storing and launching networks. VaultCrafts design utilizes Algorands Proof-of-Stake consensus protocol.

Latest development: This week, VaultCraft launched stETH 4X leveraged Looper based on Lido Finance, supporting Base, Arbitrum, Optimism and Ethereum multi-chain deployment, and realized direct staking from L2 to the mainnet through Chainlink CCIP, providing users with up to 7%+ APY, and established a partnership with Matrixport and obtained 1,000 BTC custody business, which made its TVL grow rapidly. At the same time, it reached a strategic cooperation with Safe and CoWSwap.

Hyperliquid (HYPE): (Recommendation index: ⭐️⭐️⭐️⭐️⭐️)

Project Introduction: Hyperliquid is a high-performance decentralized financial platform that focuses on providing perpetual contract trading and spot trading services. It is based on its own high-performance Layer 1 blockchain and uses the HyperBFT consensus algorithm, capable of processing up to 200,000 orders per second.

Latest development: The overall market experienced dramatic fluctuations this week. Before Wednesday, the market continued to hit new highs. After the Federal Reserve meeting ended on Thursday, the overall market fell sharply. The dramatic fluctuations created a very good trading environment for users who want to participate in contract trading to obtain high returns. As a result, many on-chain users have joined Hyperliquid to participate in transactions, making the number of open contracts of Hyperliquid exceed US$4.3 billion. This week, Hyperliquid responded to market demand and added leveraged trading functions for multiple popular currency trading pairs such as VIRTUAL, USUAL, and PENGU, supporting up to 5 times leverage, which attracted more on-chain users to participate in transactions.

Resolv (no token issued): (Recommendation index: ⭐️⭐️)

Project Introduction: Resolv is a Delta neutral stablecoin project that revolves around the tokenization of a market neutral portfolio. The architecture is based on an economically viable and fiat-independent source of income. This allows competitive returns to be distributed to the protocols liquidity providers.

Latest developments: This week, Resolv completed its integration with Base, significantly reducing transaction costs and increasing transaction speeds. It launched lending services for USR, USDC, and wstUSR through Euler Finance, and launched a USR-USDC liquidity pool on Aerodrome. At the same time, it adjusted the Spectra YT revenue points to 15 points per day, optimized the reward mechanism, launched the Grants program and confirmed the first three recipients. At the same time, through in-depth cooperation with projects such as Base, Euler Finance, and Aerodrome, the platforms competitiveness in the DeFi field has been strengthened.

Babylon (unissued coin): (Recommendation index: ⭐️⭐️⭐️⭐️⭐️)

Project Introduction: The Babylon project is a project that aims to use the security of Bitcoin to enhance the security of other proof-of-stake blockchains. The core concept is to activate idle Bitcoin assets through a trustless staking mechanism, solving the contradiction between Bitcoin holders pursuit of asset security and participation in high-return projects.

Latest development: Although the market price fluctuated violently this week, BTCs performance was very strong and remained at a high level. In addition, users are generally optimistic about the subsequent development of BTC, so they are more determined to hold and want to liberate the liquidity of BTC, so they will choose more interest-bearing projects based on BTC. This week, Babylon deepened the application of ZK scalability technology through cooperation with Layeredge, and established a strategic partnership with Sui to promote the construction of a modular ecosystem.

Lista DAO(LISTA):(Recommendation index: ⭐️⭐️⭐️)

Project Introduction: Lista DAO is a liquidity staking and decentralized stablecoin project based on the BSC chain, which aims to provide users with crypto asset staking income and decentralized stablecoin LISUSD lending services.

Latest developments: This week, Lista DAO launched Gauge Voting and Bribe Market features, allowing veLISTA holders to participate in LISTA emission decisions for liquidity pools. It also announced strategic partnerships with 48 Club_Official and defidotapp, especially in the BNBChain ecosystem to explore new opportunities, while advancing the integration of PumpBTC as collateral in the Innovation Zone through the LIP #012 proposal. In addition, Lista DAO attracts users through a weekly distribution of approximately $230,000 in veLISTA rewards and high APR compounding incentives, and through a competitive lending rate of 5.25%. This week, Lista DAO and FDLabsHQ launched a winter event with a total of 7,000 USDT, and provided slisBNB and clisBNB airdrop opportunities for BNBChain holders.

To sum up, we can see that the projects with faster TVL growth this week are mainly concentrated in the stablecoin income sector (machine gun pool).

Overall performance on the track

The market value of stablecoins has grown steadily: USDT has increased from $145.1 billion last week to $145.9 billion, an increase of 0.55%, and USDC has increased from $41.5 billion last week to $42.1 billion, an increase of 1.44%. It can be seen that although the market has fallen this week, both USDT, which is mainly in the non-US market, and USDC, which is mainly in the US market, have increased, indicating that the entire market is still maintaining a continuous inflow of funds.

Liquidity gradually increases: The risk-free arbitrage rate in the traditional market continues to decline as interest rates continue to fall, while the arbitrage rate of on-chain Defi projects continues to increase due to the increase in the value of cryptocurrency assets. Returning to Defi will be a very good choice.

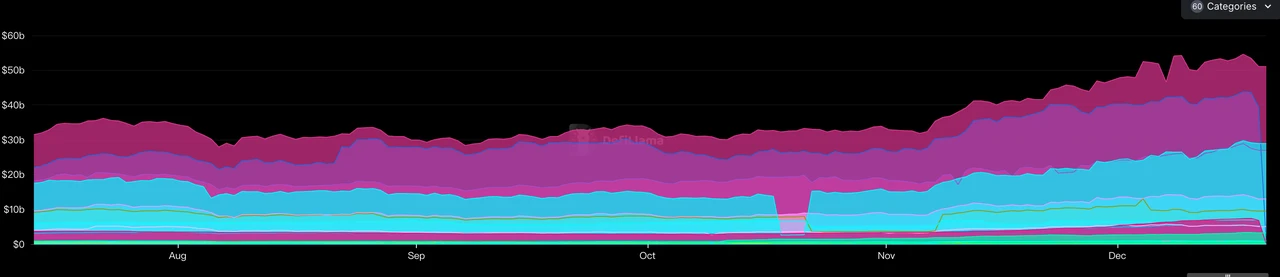

Defi TVL of each track (data source: https://defillama.com/categories)

Funding situation: The TVL of Defi projects has increased from US$54.1 billion last week to US$52.9 billion now, and has experienced negative growth for the first time in the past two months, with a negative growth of 2.21%. The main reason is that the entire market has fallen sharply this week, causing many contracts and loans to be forced to be liquidated, resulting in a decline in the TVL in the Defi track, breaking the continuous upward trend in the past two months. In the next two weeks, we should focus on the overall TVL changes and pay attention to whether the downward trend continues.

Deep analysis

Driving force for growth:

The core driving factors of this round of increase can be summarized as the following transmission path: the market entered a bull market cycle, driving up liquidity demand, which in turn pushed up the basic lending rate level, magnifying the profit space of the arbitrage cycle strategy in the DeFi protocol. Specifically:

Market environment: The bull market cycle brings an increase in overall liquidity demand

Interest rate: The base lending rate has risen, reflecting the markets pricing expectations for funds.

On the income side: the yield of the circular arbitrage strategy has expanded, and the intrinsic income of the protocol has significantly improved. This transmission mechanism has strengthened the intrinsic value support of the DeFi sector and formed a healthy growth momentum.

Potential risks:

As the market has been on an upward trend recently, investors are more concerned about yields and lending leverage, but ignore the risk of falling. This week, the Federal Reserve unexpectedly adjusted the rate cut from 4 to 2 times next year, causing the market to fall rapidly, resulting in more than $1 billion in contracts and loan assets being liquidated, causing losses to investors. This risk of liquidation is likely to lead to chain liquidations, causing prices to fall further and more assets to be liquidated.

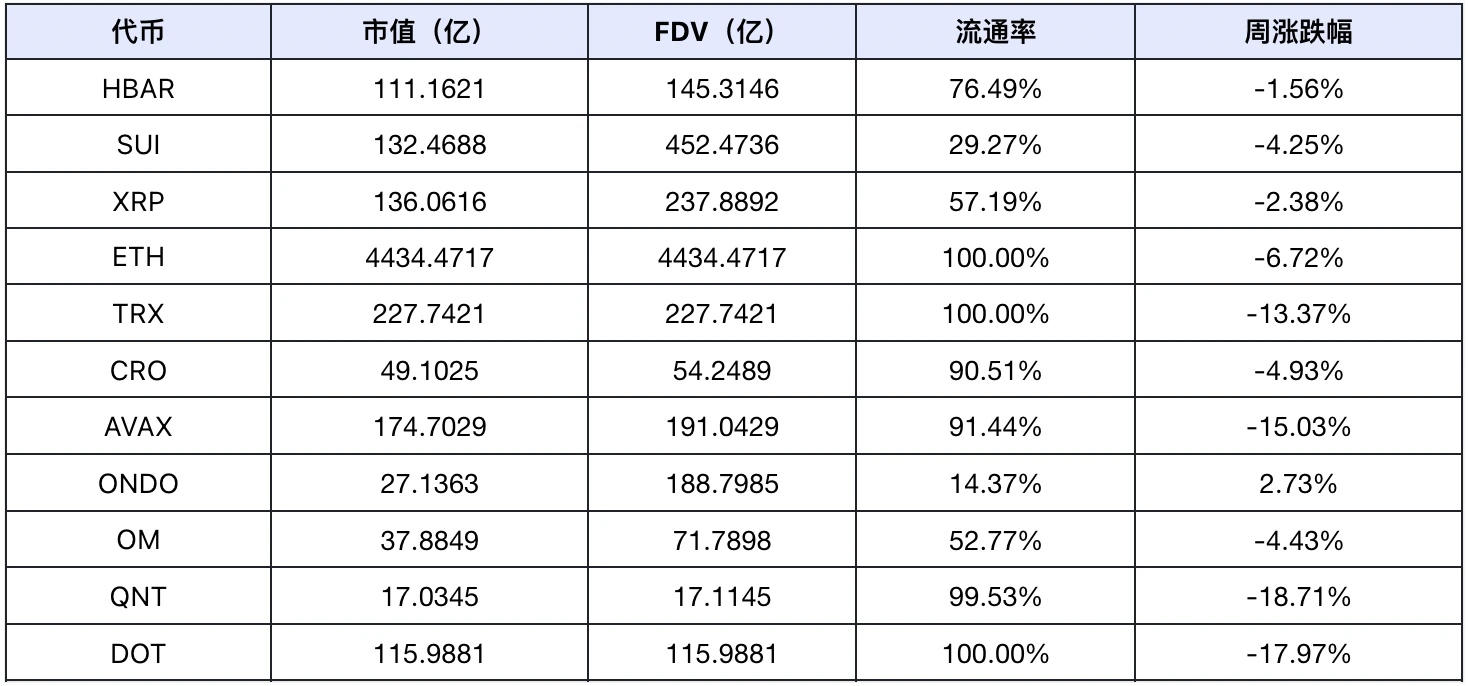

Other track performance

Public Chain

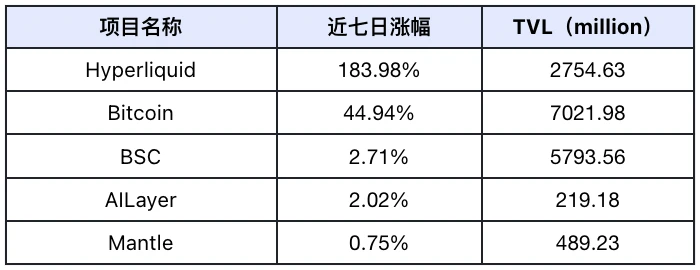

The top 5 public chains with the highest TVL growth in the past week (excluding public chains with smaller TVL), data source: Defilama

Hyperliquid: The overall market experienced dramatic fluctuations this week. Before Wednesday, the market continued to hit new highs. After the Federal Reserve meeting ended on Thursday, the overall market fell sharply. The dramatic fluctuations created a very good trading environment for users who want to participate in contract transactions to obtain high returns. As a result, many on-chain users have joined Hyperliquid to participate in transactions, making the number of open contracts of Hyperliquid exceed US$4.3 billion. This week, Hyperliquid responded to market demand and added leveraged trading functions for multiple popular currency trading pairs such as VIRTUAL, USUAL, and PENGU, supporting up to 5 times leverage, which attracted more on-chain users to participate in transactions.

Bitcoin: This week, the market reached a new high in the first half of the week, but then fell sharply after Thursday. The prices of the entire market fell significantly. The decline of BTC during this period was smaller than that of other projects. Users bought BTC in order to hedge risks. At the same time, market users are more optimistic about the future rise of BTC and hold BTC more firmly. Therefore, in the process of holding BTC, they will choose to invest BTC in the BTCFi project to earn additional income. Therefore, users have begun to deposit BTC assets into the BTCFi project to earn income, which has led to an increase in Bitcoins TVL.

BSC: This week, BNB Chain introduced new projects such as Seraph_global, SpaceIDProtocol and cococoinbsc to join the ecosystem, actively promoted the integration of AI and Web3 in the gaming field, strongly supported the development of Meme projects, and provided $50,000 in liquidity support to CHEEMS and $HMC projects through the Meme Heroes LP program. At the same time, it launched a daily Memecoin airdrop plan including GOUT, MALOU, BUCK, $WHALE and other projects, and launched a Meme Innovation competition with a total of $200,000.

AILayer: AILayers activities this week mainly focused on community operations and ecological cooperation: it cooperated with OrochiNetwork to carry out a Giveaway event; launched a Mini App ranking event to increase user engagement; continued to attract community participation through interactive activities such as Would You Rather Challenge and Riddle of the Week; and held an EP 31 AMA event with the theme of How AILayer Revolutionizes Bitcoin with AI, showcasing the projects vision for the combination of AI and blockchain.

Mantle: Mantle achieved an important breakthrough this week by integrating Compound III, bringing $USDe lending functionality to users and supporting ETH and BTC as collateral assets. By expanding the Mantle Scouts Program to 40 top industry Scouts, launching the Mantle Meetup program, and launching a large-scale Moes Rager incentive event with a total of 1 million MNT, Mantle successfully attracted more than 110,000 users to participate through the Yield Lab project, generating a total of 2.5 million transactions, bringing on-chain traffic to Mantle.

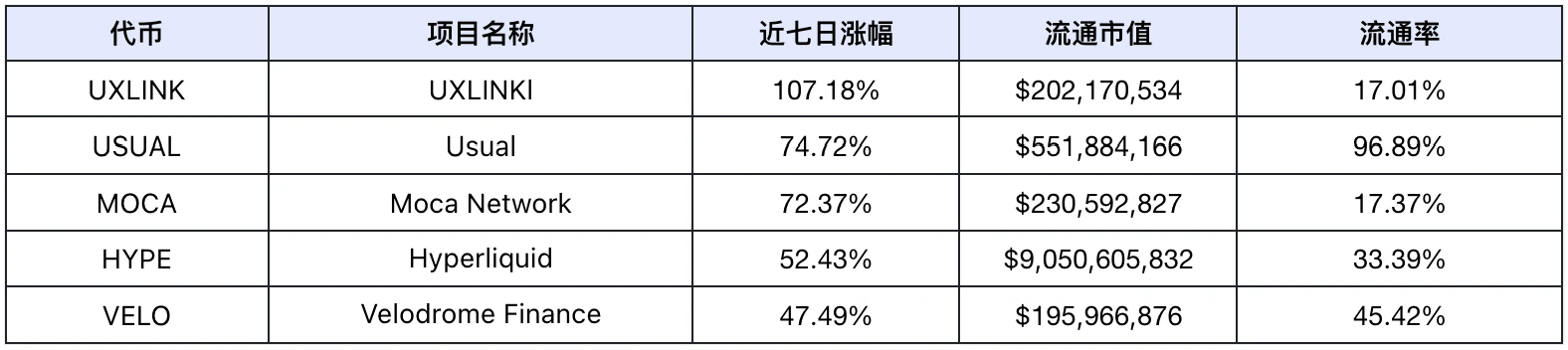

Overview of the Rising Stars

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

This week, the list of rising tokens showed a sector concentration feature, and most of the rising tokens belong to the public chain track.

UXLINK: UXLINK reached a strategic cooperation with DuckChain this week and received investment support from UFLY_Labs to jointly build the Social Growth Layer (SGL). The number of LINE platform users exceeded the 2 million user mark, and UXLINK hit a record high in Upbit trading pairs. UXLINK launched a large-scale airdrop event with a total amount of US$500,000, covering more than 20 Web3 projects, and continued to attract new users through joint activities with trading platforms such as OKX.

USUAL: This week, Usual launched an innovative USD 0++ holder incentive vault and delta-neutral strategy, providing users with an APY yield of up to 76% -82%, while maintaining a stable high-yield performance in Curves USD 0/USD 0++ and USD 0/USDC pools, averaging more than 50%. Usuals TVL has recently achieved rapid growth, climbing from 750M USD to 800M USD. After the third week of the reward plan, the TVL rose by 44%, while the minting rate dropped by 28%, bringing a deflationary effect to the USUAL token. At the same time, the Usual project emphasized that 90% of the tokens are allocated to the community, and the DAO retains a transparent operating model of 100% of the income.

MOCA: This week, Moca released Moca 3.0, which introduced the concept of integrated account and launched AIR Kit, committed to solving the problem of fragmented Web3 user identities. Moca reached an important cooperation with SK Planet to integrate Moca into the OK Cashbag application, reaching 28 million Korean users in one fell swoop. At the same time, the token MOCA will soon be launched on Upbit and Bithumb, two major Korean exchanges. Moca has significantly improved user experience and ecological participation through in-depth cooperation with Nifty Island and the launch of Fixed Mode to optimize the MocaDrop mechanism.

HYPE: The overall market experienced dramatic fluctuations this week. Before Wednesday, the market continued to hit new highs. After the Federal Reserve meeting ended on Thursday, the overall market fell sharply. The dramatic fluctuations created a very good trading environment for users who want to participate in contract transactions to obtain high returns. As a result, many on-chain users have joined Hyperliquid to participate in transactions, making the number of open contracts of Hyperliquid exceed US$4.3 billion. This week, Hyperliquid responded to market demand and added leveraged trading functions for multiple popular currency trading pairs such as VIRTUAL, USUAL, and PENGU, supporting up to 5 times leverage, which attracted more on-chain users to participate in transactions.

VELO: Velodrome reached a cooperation with the Soneium platform developed by Sony Block Solutions Labs this week to expand Velodrome to this new generation Layer 2 solution based on the Optimism Superchain, while making important progress in liquidity construction. Inkonchain locked 2.5M veVELO and provided $1.4M in incentive funds, in addition to providing liquidity support for Mode Networks proxy tokens.

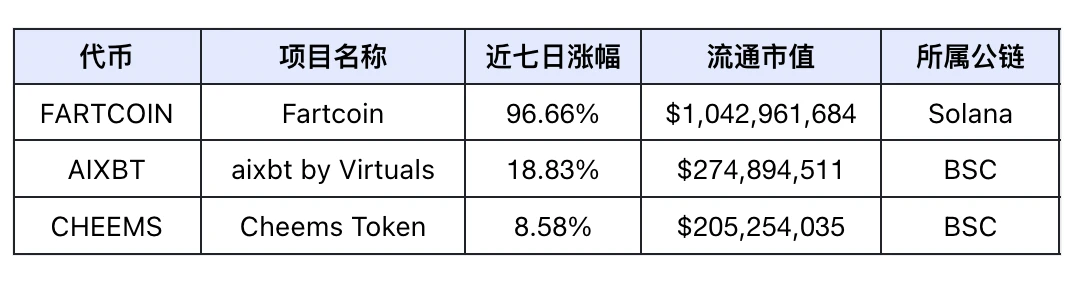

Meme Token Gainer List

Data source: coinmarketcap.com

This week, the Meme project was greatly affected by the market decline. In the first half of the week, it did not follow the market to rise. After the decline on Wednesday, it fell sharply with the market. As a result, few Meme coins showed an upward trend this week. It is obvious that the markets attention and funds are not in the Meme coin track at this stage.

Social Media Hotspots

Based on the top five daily growth data from LunarCrush and the top five AI scores from Scopechat, we got the statistics for this week (12.14-12.20):

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: Lunarcrush and Scopechat

According to data analysis, the L1s project received the most attention on social media this week. After the Federal Reserve adjusted its forecast of interest rate cuts next year from four to two on Thursday, it fell sharply. The entire market fell along with the broader market, and the decline of each public chain was smaller than that of other tracks. When the entire market fell, the performance of each public chain was often better than that of other tracks. In addition to buying BTC and ETH for risk hedging, most market investors invested in various public chains. When the decline ended and the price rose, each public chain generally rose before other projects.

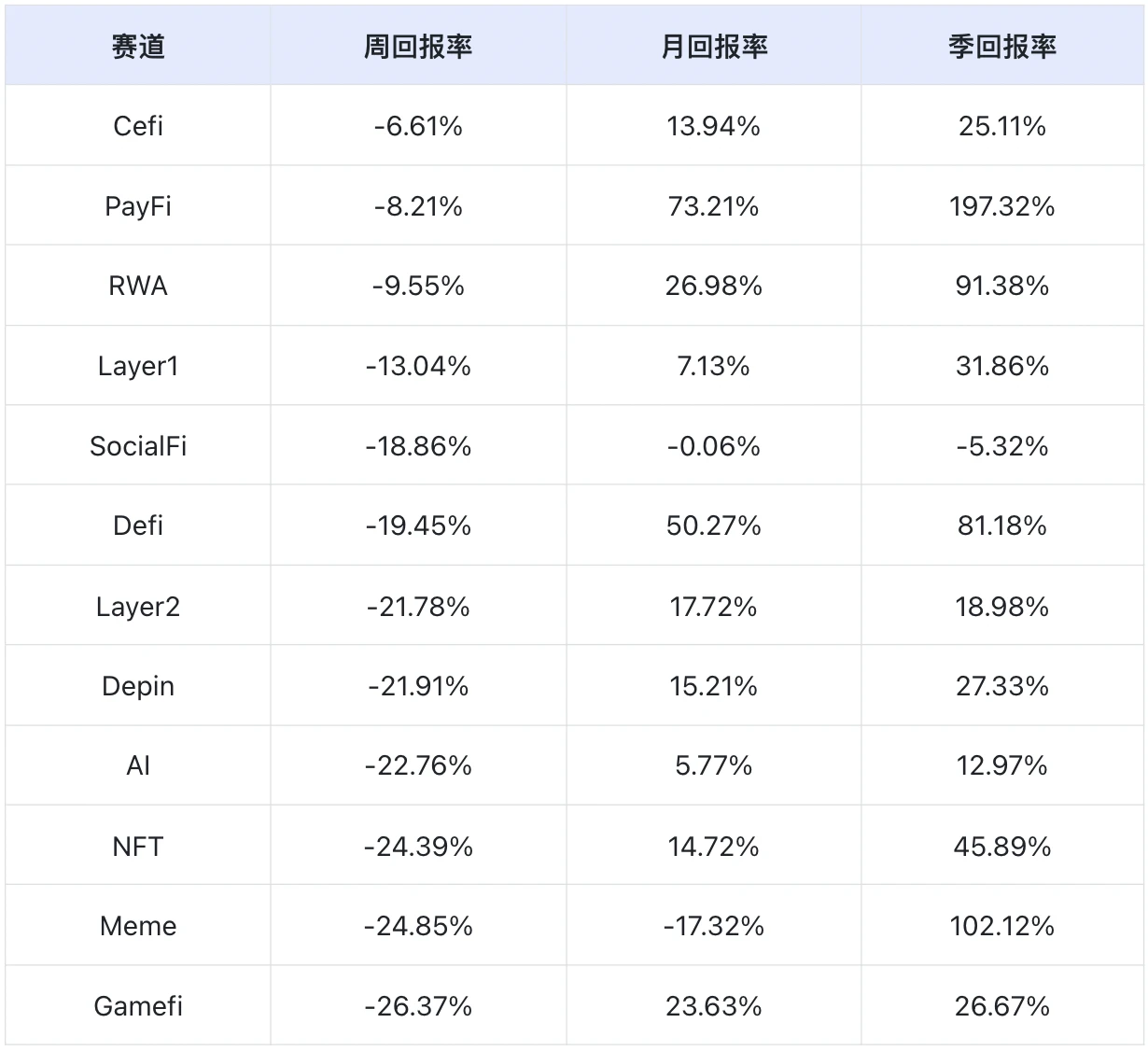

Overall overview of market themes

Data source: SoSoValue

In terms of weekly returns, the Cefi track performed the best, while the Gamefi track performed the worst.

Cefi track: BNB and BGB account for a large proportion in the Cefi track, accounting for 86.07% and 5.45% respectively, and a total of 91.52%. This week, Binance has been continuously listing new coins, maintaining a more influential token in the market every day, which has brought a lot of traffic to Binance. At the same time, BNB performed better than the market, falling 2.58% stronger than BTC and ETH. At the same time, Bitgit has performed well recently, continuously listing hot tokens, and its token BGB rose 37.93% against the trend this week, thus driving the performance of the entire Cefi sector.

Gamefi track: In this cycle of this year, the Gamefi track has not received much attention from the market, and thus little capital and traffic have entered, resulting in the lack of the previous wealth-making effect of the Gamefi track, which has led to a decreasing level of attention. Among the tracks, IMX, BEAM, GALA, SAND, and AXS account for a total of 82.14%. This week, the performance of these coins was weaker than the market, resulting in the worst performance of the Gamefi track.

Crypto Events Next Week

Thursday (December 26) U.S. weekly jobless claims

Outlook for next week

Macroeconomic factors analysis

Next week is the Christmas holiday in the United States, and there will be few macro data released.

In previous years, during the Christmas and New Year holidays, the US-dominated market saw a decline in purchasing power and increased market volatility.

Sector rotation trend

DeFi Track

Although the current market environment is poor, investors generally expect that the market will rise in the first quarter of next year, so most investors are still reluctant to sell their tokens. At the same time, in order to increase the income from holding coins, they have participated in the machine gun pool project to increase their income.

AI Section

The AI Agent track has received continuous attention from the market, and the market size has reached US$9.9 billion

Web2 and Web3 ecosystems are accelerating integration, and the integration of data networks and functional AI agents with existing encryption products is accelerating

Investment strategy advice

Maintain defensive allocation, increase the allocation of top assets BTC and ETH, and enhance the risk-averse properties of assets

While hedging risks, you can participate in some high-yield machine gun pool Defi projects

Investors are advised to remain cautious, strictly control their positions, and do a good job of risk management.