Ethereum is a groundbreaking blockchain platform whose influence has long surpassed cryptocurrency itself. Today, it has become the core pillar of decentralized computing, driving innovation in finance, gaming, supply chain management, governance, and other fields, and penetrating into emerging fields such as artificial intelligence (AI), decentralized science (DeSci), and real-world asset tokenization (RWA). As the infrastructure of Web3, Ethereum has firmly occupied the leading position in blockchain technology.

The core highlight of Ethereum is smart contracts, which are protocols that can be automatically executed when conditions are met. These contracts form the basis of the booming decentralized applications (dApps) on Ethereum. Currently, Ethereum has supported thousands of dApps, covering decentralized finance (DeFi), non-fungible tokens (NFTs), games, real estate, healthcare and other fields. Ethereums powerful programmability has attracted a large number of developers, built a vibrant ecosystem, and continuously pushed the boundaries of blockchain technology.

Table of contents

The Scalability Trilemma: How to Balance Security, Decentralization, and Scalability

Ethereum’s Evolution: From “Merge” to Now

The Current Status and Development of Layer-2 Solutions

Emerging application scenarios and their far-reaching significance

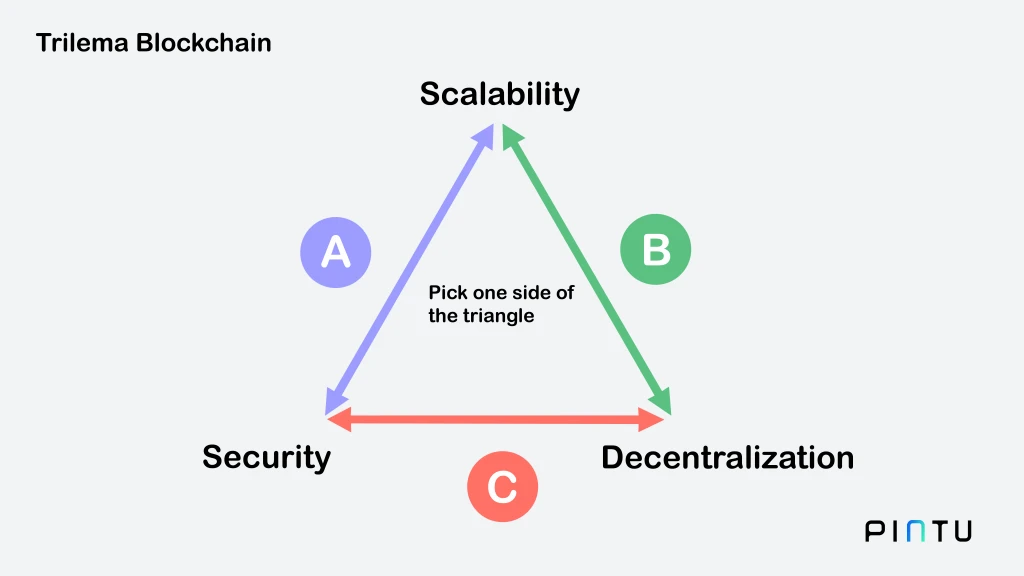

The Scalability Trilemma: How to Balance Security, Decentralization, and Scalability

Ethereum has been struggling to solve a core problem - how to find a balance between the following three aspects:

Security: Ensure that the network can resist various attacks and remain robust.

Decentralization: Make the control of the network widely distributed to avoid the risk of centralization.

Scalability: Able to efficiently handle increasing transaction demands.

Image Credit: Pintu

The real-life trilemma

During the DeFi (decentralized finance) boom in 2020, Ethereums network was once congested. Protocols like Uniswap and Compound became popular, but with them came skyrocketing gas fees, with single transaction fees as high as hundreds of dollars, which discouraged many small users.

The NFT craze of 2021 has also put Ethereum under pressure. A surge in trading volume on popular platforms such as OpenSea has caused fees for minting and trading NFTs to soar, while network processing speeds have slowed down. These problems highlight the challenges Ethereum faces in scalability while ensuring security and decentralization.

In order to deal with these problems, Ethereum introduced Layer-2 expansion solutions and sharding technology. However, how to truly achieve a perfect balance between the three is still an important issue for the future development of Ethereum.

Ethereum’s Evolution: From “Merge” to Now

Merge (2022)

The merger is an important turning point in the history of Ethereums development, which realizes the transformation from proof of work (PoW) to proof of stake (PoS). This upgrade reduces Ethereums energy consumption by more than 99%, making it one of the most environmentally friendly blockchains. Through PoS, users only need to stake ETH to participate in network security, which lowers the threshold for participation and further improves the degree of decentralization.

The “merger” not only improves energy efficiency, but also lays the foundation for future scalability, such as deep integration of sharding technology and Layer-2 solutions. It marks Ethereum’s move from its high-energy consumption early model to a more sustainable and efficient future.

EIP-1559 and the deflationary nature of ETH (2021)

The EIP-1559 upgrade is part of the Ethereum London hard fork, which redesigned the fee mechanism. This improvement effectively reduces the supply of ETH by introducing a dynamically adjusted base fee and destroying a portion of the transaction fees. This deflationary feature strengthens ETHs position as a store of value while making transaction fees more transparent and predictable.

Shanghai Upgrade (2024)

The Shanghai upgrade allowed Ethereum stakers to withdraw their staked ETH for the first time, greatly improving the liquidity of the entire ecosystem and attracting more users to participate in staking. By solving the long-standing liquidity problem, this upgrade further demonstrated Ethereum’s emphasis on user experience and decentralization.

Gas fees are still a problem

Despite many technological advances, gas fees remain a major challenge for Ethereum. During the NFT boom or the surge in DeFi applications, network congestion caused fees to soar, which ordinary users often cannot afford. These problems highlight the need for Layer-2 expansion solutions and further optimization of the Ethereum core protocol.

Image Credit: Finshots

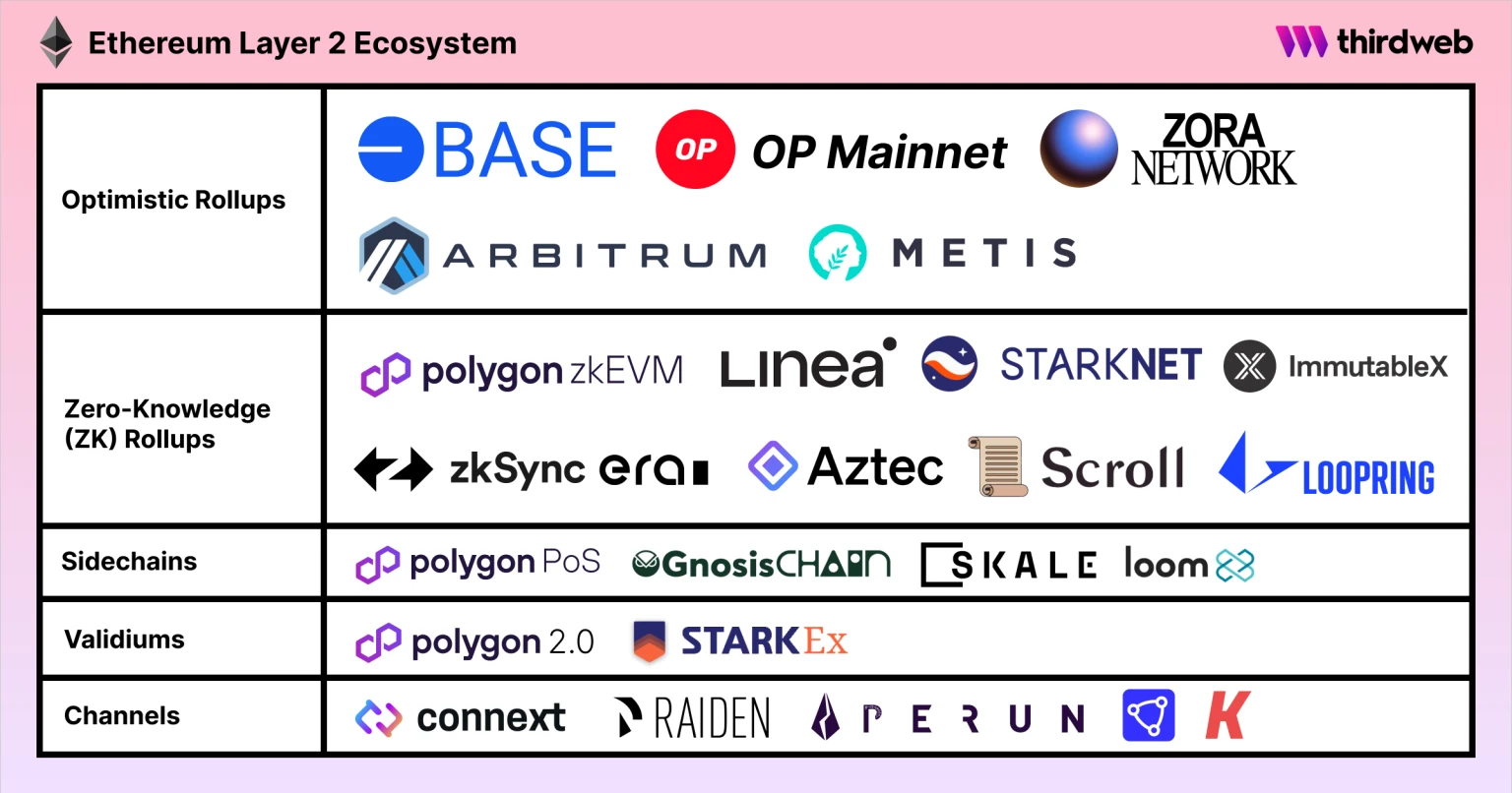

The Current Status and Development of Layer-2 Solutions

Layer-2 solutions have become the key to Ethereums scalability problem. These technologies run on top of the Ethereum main chain, and by moving transactions off-chain, they not only increase speed but also significantly reduce transaction costs while maintaining the security and decentralization of the main chain. These innovations allow Ethereum to support more users and applications.

Image Credit: Thirdweb

Optimistic Rollups

Optimistic Rollups assumes that transactions are valid by default and only verifies them if they are challenged within the specified dispute period. This approach greatly improves efficiency while ensuring security.

Optimism : Known for its simplicity and developer-friendliness, it has attracted a large number of DeFi protocols and dApps, and has become a popular choice due to its seamless compatibility with Ethereum.

Arbitrum : Recognized for its advanced fraud proof mechanism, it is widely used in areas such as decentralized exchanges and gaming platforms.

zk-Rollups

zk-Rollups leverage zero-knowledge proof technology to verify transactions while ensuring privacy and security, making them ideal for high-throughput and privacy-focused applications.

StarkNet: Known for its strong scalability and rich ecosystem, it supports various financial and gaming applications.

zkSync : Focusing on user experience, it is a popular choice for developers to quickly attract new users.

Polygon

Polygon provides a full set of Layer-2 expansion tools, including Plasma chains, side chains, and zk-Rollups. Its ecosystem supports thousands of dApps, covering areas such as NFT , games, and DeFi. Polygon is known for its flexibility and low cost, and is one of the top choices for developers and users.

Base

Base is a Layer-2 solution launched by Coinbase, based on Optimistic Rollups technology, emphasizing simplicity of operation. Base focuses on helping Web2 enterprises quickly integrate into the Web3 ecosystem and extending the potential of Ethereum to traditional business areas.

Rapid development of ecology

Layer-2 networks like Polygon , Optimism , Arbitrum , and Base have developed into active ecosystems, hosting a large number of dApps, DeFi platforms, and NFT markets . These networks not only alleviate Ethereum s scalability bottlenecks, but also effectively reduce Gas fees, making high-performance applications more accessible and attracting users from all over the world.

Challenges and future directions

Although Layer-2 solutions have greatly improved Ethereums scalability, there are still some problems that need to be solved:

Interoperability: Seamless asset transfer between Layer-1 and Layer-2 still needs further optimization.

User education: More publicity efforts are needed to help users and developers understand and adopt Layer-2 technology.

Integration of zkEVM: New technologies such as the zero-knowledge Ethereum virtual machine (zkEVM) are expected to further strengthen the collaboration between Layer-1 and Layer-2, bringing Ethereum’s usability to a higher level.

Layer-2 solutions are an important part of Ethereum s future development, as they find a better balance between the platforms decentralization, security, and scalability.

Emerging application scenarios and their far-reaching significance

Ethereum ’s programmability and flexibility have brought unprecedented innovation to multiple industries, gradually laying the foundation for a decentralized future. By 2025, Ethereum’s influence has penetrated into the following areas:

finance

Ethereum remains the leader in decentralized finance (DeFi). Protocols like Aave , Uniswap , and MakerDAO allow users to borrow, trade, and earn interest without the need for an intermediary. These platforms break down the barriers of traditional finance and provide more opportunities for regions that do not have access to banking services.

Supply Chain

Projects like OriginTrail are using Ethereum to provide transparent and traceable management for supply chains. Through commodity tokenization and automated processing of smart contracts, companies can not only track products in real time, but also reduce the risk of fraud. OriginTrails decentralized knowledge graph enables seamless interoperability of data between industries.

Medical

Ethereum -based solutions such as Medicalchain are revolutionizing the way medical data is stored and managed. Patients can have full control over their electronic medical records and decide who can access the data, while reducing the risk of privacy breaches and data misuse.

game

Blockchain games like Gods Unchained are leading the Play-to-Earn trend. Through a card system on the blockchain, Gods Unchained allows players to earn rewards with real value. With Ethereum s Layer-2 solution, these games not only run more smoothly, but also significantly reduce transaction costs for players.

Artificial Intelligence (AI)

Decentralized AI platforms such as SingularityNET are giving value to machine learning algorithms and data sets through Ethereum . Developers can transparently share and monetize their algorithms, and this collaborative approach promotes innovation and openness in the field of AI.

Decentralized Physical Infrastructure Network (DePIN)

Projects such as EnergyWeb and Chorus Mobility use Ethereum to tokenize infrastructure assets such as renewable energy networks and autonomous transportation systems. Through smart contracts and token incentives, these projects achieve efficient and fair resource allocation while transferring infrastructure management rights from centralized institutions to the broader community.

Decentralized Science (DeSci)

Projects like Molecule are reshaping how scientific research is funded and collaborated on. By tokenizing intellectual property, Molecule enables more decentralized funding for medical research while facilitating collaboration between researchers.

Real World Assets (RWA)

Platforms like RealT make real-world assets accessible through tokenization. RealT allows users around the world to purchase fractional ownership of U.S. real estate, lowering the barrier to entry for traditional investments.

Looking ahead

The Ethereum ecosystem is constantly evolving, with a clear roadmap to solve current problems while paving the way for future innovations. With scalability, decentralization, and user-friendliness as its core goals, Ethereum is working hard to consolidate its position as a leader in the blockchain industry.

Image Credit: Cryptoast

Sharding

Sharding is one of Ethereum’s most anticipated upgrades. It divides the network into smaller, more manageable “shards,” each of which is an independent chain. Sharding significantly increases the network’s throughput by processing transactions in parallel, supporting the Ethereum ecosystem to meet the needs of millions of users and dApps.

Danksharding

Danksharding is a further optimization based on sharding, which reduces redundancy and improves communication efficiency between shards by improving data storage and retrieval methods. This technology will significantly improve the efficiency of Ethereum , making it more competitive in terms of transaction capacity, and even competing with some new blockchain platforms known for their high performance.

Verkle Tree

Ethereum plans to replace the existing Merkle tree with the Verkle tree. This new encryption structure can significantly reduce the amount of data that nodes need to store. This improvement will enable more users to easily run full nodes, further enhancing the decentralized nature of the network.

zkEVM Integration

The addition of zero-knowledge Ethereum virtual machine (zkEVM) will achieve seamless connection between Layer-1 and Layer-2. zkEVM can not only improve the operating efficiency of decentralized applications (dApps), but also maintain the security and compatibility of Ethereum . This technology will help further reduce transaction costs and improve user experience.

Pectra Upgrade

The Pectra upgrade, expected to be launched in early 2025, will bring several key improvements to further enhance Ethereum’s transaction efficiency and user experience.

Account abstraction: Users can bundle multiple transactions and pay gas fees with any ERC-20 token.

Data availability improvements: effectively reducing Layer-2 transaction fees. These updates will make Ethereum easier to operate while lowering the barrier to entry for users.

Decentralized Governance

Ethereum is moving towards a more decentralized governance approach, giving community members a greater voice in the development of the network. Through an on-chain voting system and a decentralized autonomous organization (DAO), Ethereums future decisions will rely more on the community. This mechanism ensures that the evolution of the network always remains consistent with its core concept of decentralization.

Challenges

Despite its clear planning and strong technical support, Ethereum still faces many challenges:

Competitive Pressure: Blockchains like Solana and Avalanche continue to innovate, attracting users with lower fees and higher speeds.

Regulatory compliance: As regulatory frameworks for blockchain technology are gradually taking shape in various countries, Ethereum needs to find a balance between compliance and decentralization.

User education: It is still a long-term task to let more ordinary users understand and accept the technical advantages of Ethereum.

By actively addressing these challenges and relying on a clear technical roadmap, Ethereum is further consolidating its position as a leader in the blockchain industry. In the future, Ethereum will continue to lead the development direction of decentralized technology.

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , and contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.