What is freedom to you? Is it the ability to break free from economic constraints? Is it the ability to reclaim your time and live your life on your own terms? Or is it the freedom to choose your own path? Freedom takes many forms, but at its core it is a force that propels us forward.

Throughout history, the pursuit of freedom has shaped countless societies and economies. From breaking free to breaking through boundaries, true freedom is never static. It is a dynamic force that transcends national boundaries and gives individuals unlimited possibilities. In the digital age, this force has found a new expression, that is, free mobility.

As a decentralized and borderless asset, Bitcoin has redefined the flow of wealth, created a world where value flows freely and without barriers, and ushered in a new era of financial independence, allowing individuals to break free from the constraints of the traditional financial system.

Free liquidity is the inevitable development direction of Bitcoin. It combines the globalization of technology with the human desire for freedom, promoting the permissionless and borderless expansion of value across digital platforms, bringing an unstoppable force.

Wealth and freedom = a lasting and close relationship

Throughout history, wealth and freedom have always been inseparable. Gold once symbolized autonomy and independence, driving trade and economic prosperity. However, the physical limitations of gold, such as its heavy volume and reliance on a centralized financial system, make it difficult to truly unleash the potential of freedom. Although modern financial tools, such as paper money and electronic payments, promise to improve efficiency, the price behind them is centralized control.

Todays fiat currency system, especially the US dollar, as the pillar of global trade, occupies an important position in the global economy, but is often used as a geopolitical tool, causing a lot of controversy. The actual situation of economic sanctions and financial blockades shows that the centralized currency system cannot provide freedom for everyone. The foreign exchange control of the RMB further restricts its liquidity in the international market. The stability of these currency systems depends on the political environment and power structure. Once these foundations are shaken, the liquidity of wealth will face severe tests.

The emergence of Bitcoin has broken this traditional monopoly. As a decentralized digital currency, Bitcoin is no longer subject to power structures, but operates based on global consensus. From a free trade tool on the Silk Road, to becoming a safe haven in Venezuela, to helping Nigeria bypass foreign exchange controls, Bitcoin has not only redefined the concept of wealth, but also established itself as a bridge to freedom. Its birth marks a fundamental change in the way wealth flows and reveals the infinite possibilities of decentralized finance.

Bitcoin’s Achilles’ Heel

Although Bitcoin represents free liquidity, its current ecosystem faces many challenges and significant vulnerabilities. Over-reliance on speculative trading and circular financing activities has created a zero-sum game situation, where value often stagnates in circulation and does not truly drive sustainable growth. As the price of Bitcoin rises, its circulation velocity (a key indicator of the frequency of Bitcoin transactions) continues to decline.

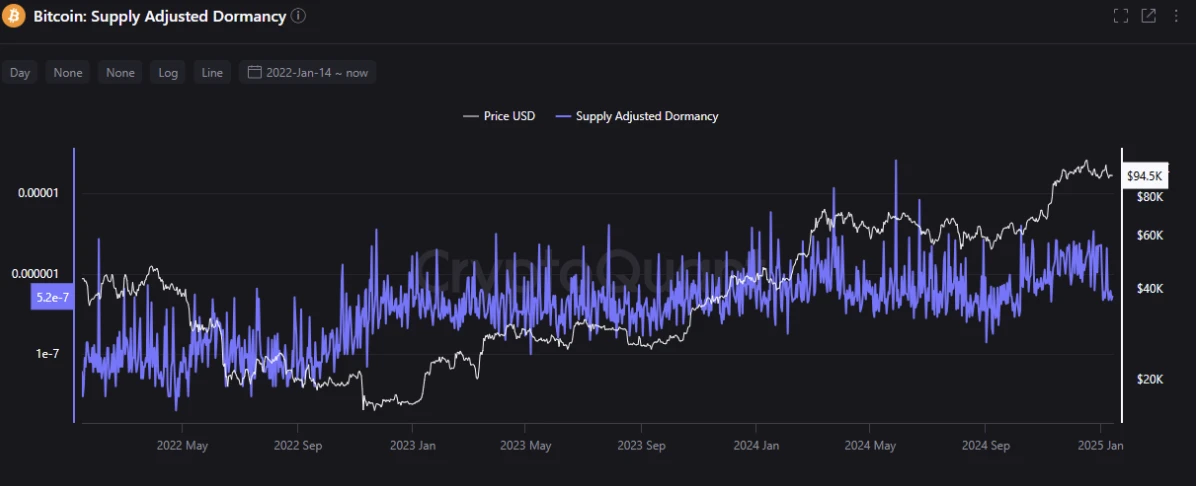

According to CryptoQuant, Bitcoins circulation velocity has dropped to 14.4, reflecting a significant slowdown in capital turnover since 2022. This trend shows that the number of transactions in the market is decreasing and liquidity is becoming more concentrated. The market is no longer a vibrant place for on-chain activities, but is dominated by large holders and speculative behavior, making the Bitcoin ecosystem more fragile and vulnerable to external shocks.

Furthermore, the supply-adjusted dormancy metric reveals a worrying trend: on-chain activity surges when prices rise, but as prices pull back, dormancy levels rise sharply. This cyclical behavior highlights the absence of long-term liquidity support and exposes the market’s reliance on short-term speculative interest.

Further complicating matters is the role of institutional investors. Companies like MicroStrategy hold large amounts of Bitcoin, more than 423,650 BTC, making them one of the largest holders. While their participation provides short-term price momentum, it also poses systemic risks. If these institutions decide to take profits, their selling could set off a chain reaction that leads to increased market volatility.

To achieve true free liquidity, Bitcoin must transform from its current fragile, speculation-driven structure to a deeply integrated ecosystem that is vibrant and capable of creating value. This evolution will make Bitcoin no longer just a financial asset, but a free asset that will release its true value when it flows freely in a network with real utility.

BTCFi provides the foundation for this, transforming Bitcoin’s consensus on freedom into dynamic liquidity, thereby driving meaningful economic activity.

Building sustainable free mobility

How do we unlock $100,000 worth of Bitcoin and direct it from its holders into a valuable ecosystem that can drive real economic activity and growth?

As Bitcoins role in the global financial system continues to grow, its value is no longer tied solely to short-term market fluctuations, but increasingly dependent on its long-term integration into the global economy. The key to achieving this goal is to build a stable, innovative, and self-sustaining financial ecosystem. This system should be built on three pillars:

Build based on user needs

Providing new utility in a high-growth ecosystem

Connecting with the real world

These three pillars will drive the growth and widespread adoption of Bitcoin. By advancing these core foundations, Bitcoin will not only serve as a store of value, but will also become the cornerstone of true free liquidity.

1. Build based on user needs

In order for Bitcoin to break through and stabilize above $100,000, it must evolve from simply “digital gold” to an asset that can meet the needs of a diverse range of users in the global economy. This evolution requires bridging two key user groups:

Large holders (whales):

Focus on security and stable returns

Bitcoin needs to be put to use through lending, staking and yield generation

Need institutional-grade security while maintaining asset productivity

Active ecosystem users:

Emphasis on permissionless and barrier-free transactions

Bitcoin needs to be able to flow freely between different chains

Need to use decentralized financial tools without central control

BTCFi bridges these two needs by:

Providing a secure yield-generating protocol for large holders

Providing cross-chain liquidity solutions for active traders

Provide decentralized lending and staking modules that meet the needs of both

By connecting these user needs, BTCFi transforms Bitcoin from a static store of value into a dynamic asset, enabling it to flow freely within the crypto economy while maintaining the security and returns demanded by holders.

2. Providing new utility in high-growth ecosystems

Let’s look at how free liquidity is enabled through the high-growth ecosystem in BTCFi. Two groundbreaking protocols play an important role in this evolution: Solv and Zeus, each playing a different role in unlocking the true potential of Bitcoin.

Solv shows how Bitcoin holders can create sustainable value while maintaining security. Through connections to the broader BTCFi ecosystem, including protocols such as Bedrock, Lombard, and Pell Network, Solv transforms static Bitcoin holdings into productive assets. Think of it as a sophisticated yield engine where holders can safely re-stake their Bitcoin across multiple protocols and participate in the growth of the DeFi ecosystem while maintaining the security they need.

Another example of the concept of free liquidity is Zeus, which breaks down the barriers that have traditionally limited Bitcoin to a single blockchain. Zeus makes Bitcoin truly borderless, enabling it to flow seamlessly between different blockchain ecosystems and DeFi protocols. This cross-chain functionality means Bitcoin can always pursue opportunities, whether it is higher yields on one chain or emerging DeFi innovations on another. Zeus essentially transforms Bitcoin into a liquid asset that can adapt and move at any time based on the development of the digital economy.

Together, these two protocols demonstrate how BTCFi can go beyond basic trading and lending. Other supporting protocols, such as Babylon and Shell Finance, add more layers of utility, providing lending markets and yield opportunities, further enhancing Bitcoins liquidity. This creates a virtuous cycle. The more Bitcoin flows in these high-growth ecosystems, the more value is generated, and the more its promise as a truly free-liquid asset is realized.

3. Linking with the real world

Bitcoin’s path to $100,000 is not through speculation, but through deep integration with the real world. Real sustainable growth requires Bitcoin to drive real economic activities: payments, settlements, and applications with real assets.

In this process, multi-chain infrastructure becomes critical. With Solana and other active ecosystems leading the way, Bitcoin can finally break free from its traditional limitations. Imagine Bitcoin flowing as freely as information does today, easily moving between different blockchain environments and real-world applications.

At the forefront of this real-world convergence stands PayFi, Solana’s strategic initiative that bridges Bitcoin with everyday economic activity. Think of PayFi as the critical “translator” between the crypto and traditional worlds: making Bitcoin truly a useful tool for everyday life. Through PayFi, Bitcoin can finally fulfill its promise to be more than just a digital asset, becoming an actual tool for commerce, from simple payments to complex financial settlements.

The transition from speculative gains to real-world utility represents the most important evolution of Bitcoin. When Bitcoin can drive actual economic activity, it creates sustainable value that speculation cannot. This is an important step for Bitcoin to become an integral part of the global economy.

From staking to your morning cup of coffee

Imagine starting your day like this. Your Bitcoin holdings are generating income, and in just a few minutes, you can use those earnings to buy a morning cup of coffee. That’s exactly what BTCFi makes possible. Your Bitcoin easily transforms from an appreciating asset to an everyday currency, demonstrating true free liquidity.

Coffee is just one example, of course. Recalling that famous 10,000 BTC pizza purchase, now worth millions of dollars, no one wants to be the next cautionary tale in the crypto space about spending Bitcoin on consumer goods. The key is not spending Bitcoin directly, but how its benefits can flow seamlessly into everyday transactions.

The integration of Bitcoin and the real world: building tomorrows infrastructure

The real power of Bitcoin comes when it starts to finance the future. Through lending mechanisms, your Bitcoin can help build solar farms, finance sustainable housing projects, or support DePIN.

Here’s how it works: Bitcoin holders can lend their assets to carefully screened real-world projects, earning returns while supporting actual development.

Want to fund green energy projects? Your Bitcoin can do that. Want to support housing construction? Your Bitcoin can do that, too.

Every lending opportunity builds a bridge between digital wealth and physical progress while generating returns for borrowers.

It is here that Bitcoin transcends the identity of digital gold and becomes a force for real-world development and innovation. By connecting Bitcoin holders with real investment opportunities, BTCFi creates a virtuous cycle: digital freedom drives physical progress, which in turn strengthens digital value.

Through these practical applications, Bitcoin has achieved its original intention: to become a truly liquid asset that flows easily between the digital and physical realms, creating value at every step. This is the most mature form of free liquidity, and the power of Bitcoin not only transcends blockchain, but also penetrates into all levels of global economic development.

Freedom finds a way

BTCFi’s era of free liquidity marks the beginning of Bitcoin’s true evolution. Through protocols like Solv and Zeus, Bitcoin is breaking free from the shackles of speculation. Through PayFi and integration with the real world, it is bridging the gap between the digital economy and the real economy.

This is the promise of free liquidity: Bitcoin flowing purposefully through the economy, powering everything from everyday income to global infrastructure. The technology is ready, the infrastructure is maturing. All that remains is for us to embrace the next phase of the Bitcoin journey. Where freedom is stored, but also where freedom can flow, creating value in the real world.

The era of free mobility has arrived.