The much-anticipated Trump 2.0 did not disappoint, with the president-elect pulling off a series of high-profile moves in just a few days, including a “very good” phone call with Chinese President Xi Jinping, a reprieve on the TikTok ban, and the incredible launch of the “official” $TRUMP token on Solana, providing a preview of what the “investment” vibe will be like over the next four years.

Even by crypto’s wild standards, the astronomical rise of the $TRUMP memecoin is unprecedented, and we believe it sets a dangerous (and unhealthy) precedent for the entire industry, especially at a time when mainstream institutions are only beginning to recognize the legitimacy of crypto.

Here’s a quick recap of the $TRUMP token launch that dominated global attention over the past 72 hours:

$TRUMP launched without warning on Friday night, when most people weren’t paying attention.

The token was launched on Solana with the clear intention of maximizing its memecoin impact.

Twitter users said that $TRUMP-related websites and addresses were set up weeks ago, indicating that this was a well-planned operation.

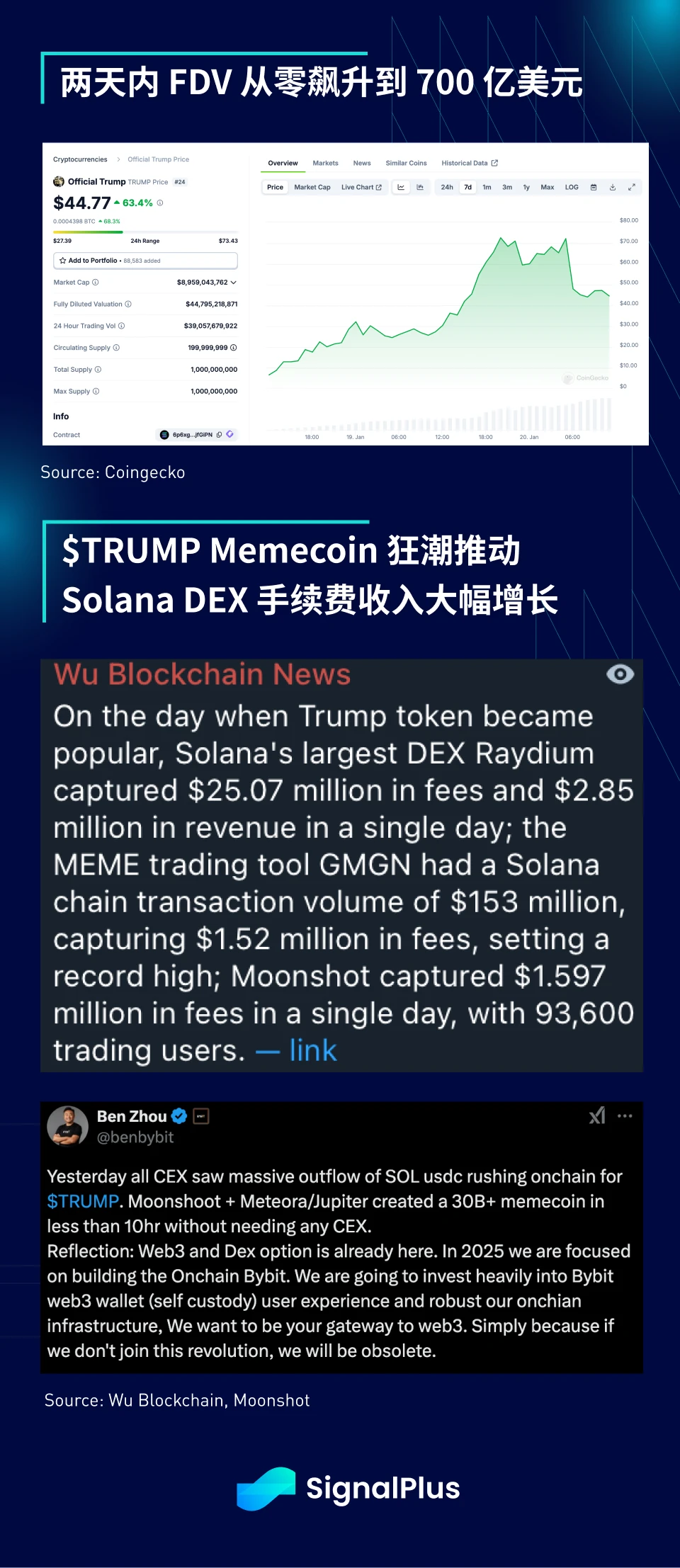

The token’s market capitalization soared to around $14 billion (FDV soared to around $70 billion) within hours of launch, making it one of the largest tokens in existence out of thin air and breaking all capital market records.

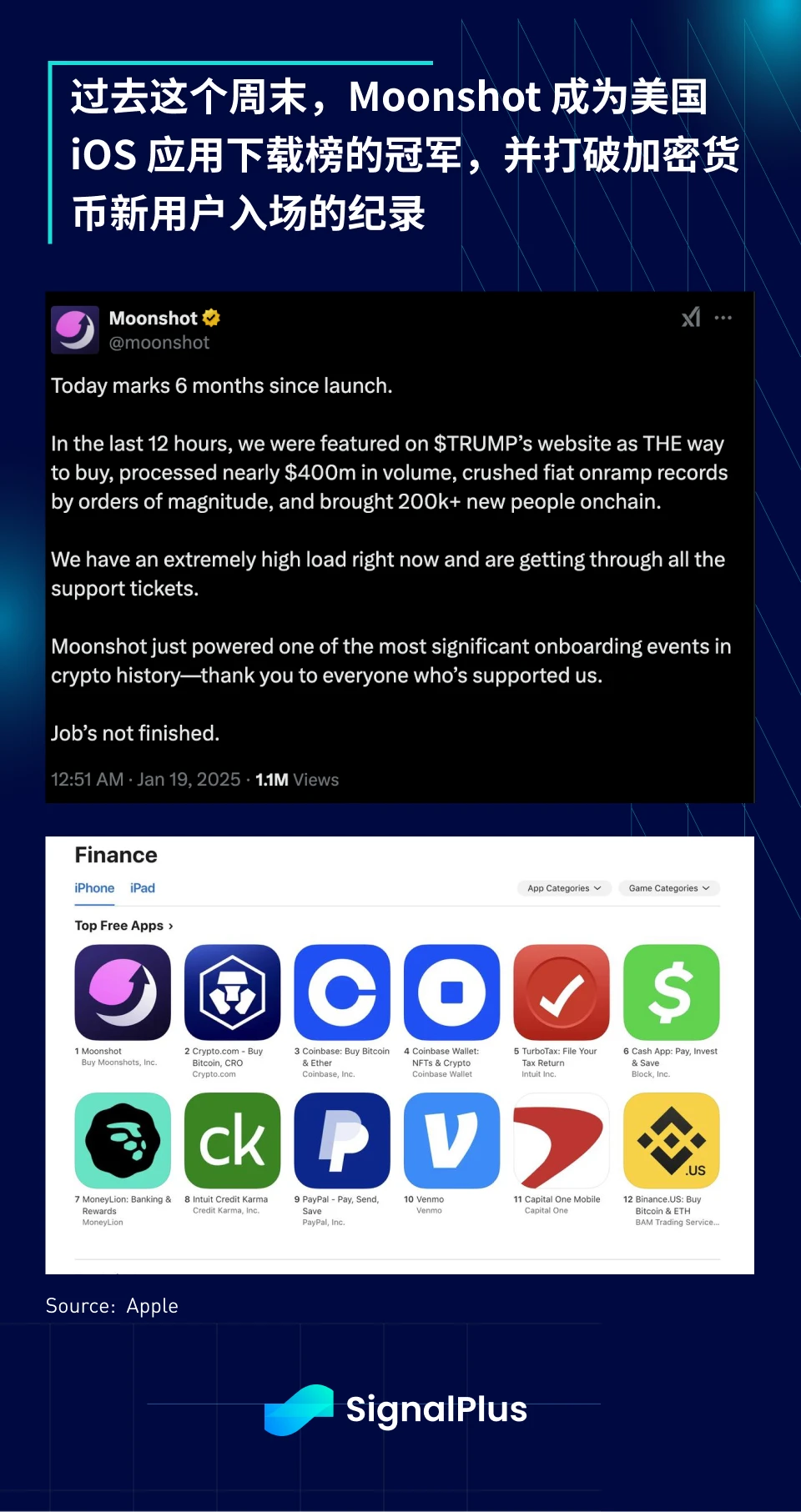

DEX trading dominated, with Solana’s largest DEX generating around $25 million in fee revenue in a single day, while Moonshot became one of the most downloaded iOS apps in the US, attracting nearly $500 million in trading volume and 200,000 new users.

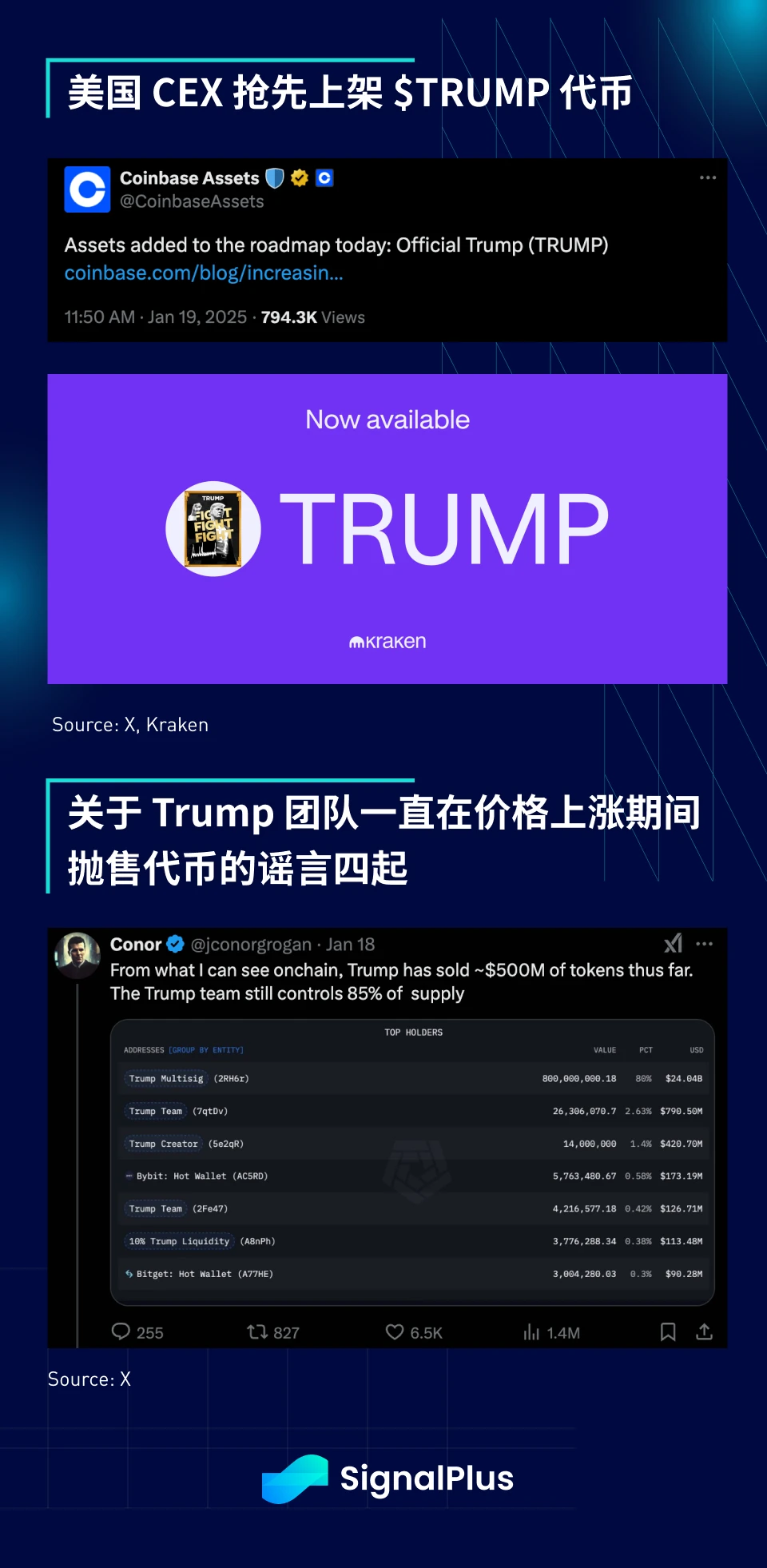

Major US exchanges (Kraken, Coinbase) broke with convention and were the first to list $TRUMP tokens, and the USs influence in the cryptocurrency field continued to grow in this cycle.

According to various on-chain analyses, rumors are swirling as to whether the $TRUMP team has been selling tokens on the way up.

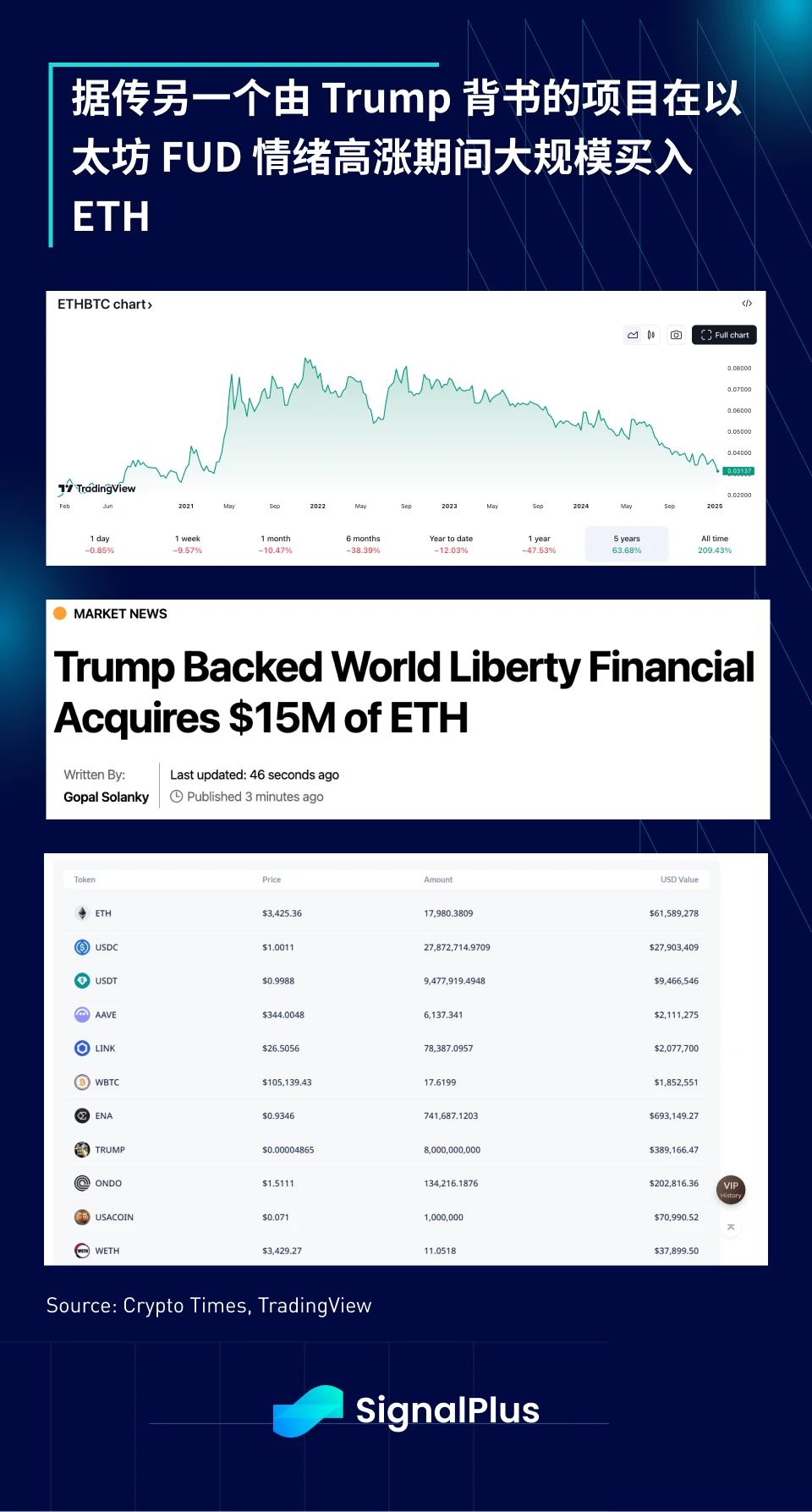

Amid a lot of FUD surrounding Ethereum (ETH), which is lagging behind, Trump’s World Liberty Financial team made headlines over the weekend by buying around 15 million ETH, further raising questions about its recent motives.

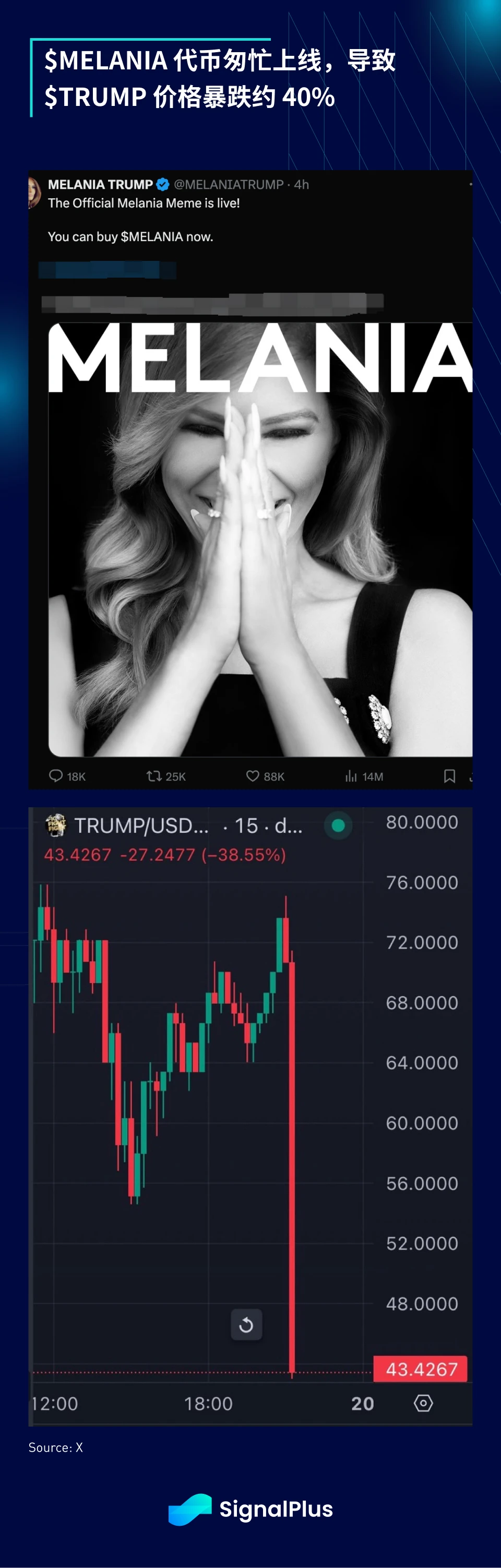

Just as the market was preparing for the opening of the US stock market on Monday and looking forward to the first day of the President signing an executive order, his team dropped another completely unexpected bombshell: the hasty launch of the $MELANIA token caused the price of $TRUMP to plummet by 40% and dragged down the entire ecosystem. Now the question is, will there be a $BARRON token?

As both TradFi and crypto market observers struggled to comprehend the “wisdom” of the incoming president launching a memecoin days before his inauguration, any remaining rational thinking was completely shattered with the launch of $MELANIA. Leaving aside the legality issue, these opportunistic actions may have seriously damaged the legitimacy we have worked hard to accumulate over the past 18 months. Not only that, memecoins are essentially a zero-sum game (temporary wealth effect), and the surge in $TRUMP/$MELANIA has sucked a lot of liquidity from the system and exposed a large number of late-comers to significant capital risks.

We are concerned about this and hope that these meme-driven developments will take a back seat and allow the industry to refocus on institutional-related formalization processes.

Back to the “boring” normal markets, Trump 2.0 will begin against the backdrop of an extremely strong US economy (Atlanta GDP model predicts ~3% in Q4) and US stocks near all-time highs. Given Trump’s erratic stance on tariffs, expect more erratic but direct policies on tariffs, immigration, fiscal spending and even personnel changes in the future. There are currently rumors that Vivek Ramaswamy is ready to exit DOGE in preparation for the Ohio Governor’s race.

Wall Street expects Trump to sign 50-100 executive orders on the day of his inauguration, and the specific impact on the US market will depend on the details of the signed orders. Since September, the market has been performing well, with asset prices generally rising, and the stock market also performed well last Friday due to friendly CPI data and BTC gains.

Despite some relief on Friday, the bond market may face greater challenges ahead as the Federal Reserve continues to deal with loose financial conditions, a strong underlying economy and thorny inflation issues. New Fed official Beth Hammack expressed concerns about sticky inflation in a recent interview with the Wall Street Journal, echoing the recent strong performance of employment, new housing starts and industrial production data.

This week is destined to be a crazy week, I wish you all good trading!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com