Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

Bitcoin hits a new high again!

As time enters January 2025, Bitcoin finally ushered in a long-awaited breakthrough. It has been 1 month and 3 days since the historical high of US$108,000 set on December 17, 2024.

In just one month, Desci and AI Agent took turns to appear on the stage, but no one expected that the new high point this time would still be the Trump effect - in the past few days after Trumps genuine Meme coin was launched , over-the-counter liquidity has poured in through USDC, SOL, etc. Crypto news has triggered heated discussions on social media platforms and traditional news media, and Trumps coin issuance has become a hot topic of conversation.

According to OKX , the price of BTC successfully broke through the previous high at around 3 pm today, reaching 109,800 USD, with a daily increase of more than 10%; the price has now fallen back to around 108,400 USD, with a 24-hour increase of about 3.36%. Odaily Planet Daily will sort out the recent market views in this article to explore the main driving force of this new high and the views of industry insiders.

The magic and durability of the “Trump effect”

Since winning the presidential election last November, the crypto market has been continuously stimulated by the Trump effect, and the price of BTC has hit new highs one after another. After nearly three months of various verifications, the market seems to have believed that Trumps crypto-friendly attitude is more than just talk. This has been indirectly confirmed by his appointment of cabinet members, personal remarks, and the recent release of the genuine Meme coin project. He himself is quite proud of this.

Trump attributes stock market gains and Bitcoin record highs to the Trump effect

“You’ve seen results that no one expected,” Trump said at the rally , before calling it the “Trump effect.” “The stock market is up significantly since the election, small business optimism is up a record 41 points, to a 39-year high. Bitcoin is breaking new all-time highs.”

The stock market continued to rise over the past year, reaching a high in early December shortly after the election. The SP 500 peaked at 6,090 on December 11, while the Nasdaq reached a high of 20,204 on December 16.

Trump said today: Within hours of my inauguration, I will be signing dozens of executive orders, close to 100 to be exact.

Earlier, according to Bloomberg , Bitcoin rose again on Friday due to market rumors that Donald Trump may soon issue an executive order to make cryptocurrency a national priority. It is said that Trump may announce the establishment of his previously promised cryptocurrency advisory committee in the executive order he issued , giving the cryptocurrency industry a say in his government. Investors expect that any announcement from the new government next week will drive Bitcoin prices up and potentially set new highs, but Wall Street has warned that although Congress and the White House will support cryptocurrency in 2025, which will inevitably support innovation in the industry and asset classes, it may take some time for the market to feel the impact. Trump also revealed that he plans to issue an executive order to elevate cryptocurrency to a policy priority and give industry insiders a say in his government.

David Sacks, the White House AI and cryptocurrency director appointed by Trump, previously wrote that the unfriendly rule against cryptocurrency has ended, and a new era of cryptocurrency innovation in the United States has just begun. Zaheer Ebtikar, founder of the crypto fund Split Capital, said : “The market is currently pricing in Trump’s inauguration and his bullish stance on cryptocurrencies.”

Countdown to Crypto Reserve Building: Polymarket predicts a 58% probability

According to Polymarket data , the probability of Yes on the platform to whether Trump will create Bitcoin reserves within 100 days of taking office has surged to 58%, while the probability of Yes in the same period yesterday was only 43%.

Trumps second son Eric Trump disclosed his holdings of BTC, ETH, SOL and SUI

Eric Trump, the second son of President-elect Trump , emphasized in an interview that he and his father Trump will work together to position the United States as a global center for cryptocurrency.

Eric criticized the current administrations handling of cryptocurrencies, accusing regulators such as U.S. SEC Chairman Gary Gensler of waging a holy war on the industry: The cryptocurrency community in the United States has been under a full-scale attack by Gary Gensler and many others. Biden is nowhere to be seen. Kamala (Harris) is nowhere to be seen. They dont understand what cryptocurrency is. Frankly, they launched a holy war on the community. And then all of a sudden my father came along. He also mentioned Trumps support for cryptocurrencies and called his appearance at the Bitcoin conference a key moment for the industry. Eric is optimistic about Bitcoin and other digital currencies, calling himself very bullish. Although he declined to make specific predictions about Bitcoins future price, he disclosed that his holdings include BTC, ETH, SOL, and SUI.

The “New Crypto Population” Created by the Trump Token

DWF Labs co-founder Andrei Grachev wrote , “Trump is doing the best publicity for the cryptocurrency market. I won’t care about specific tokens, even if some of them are sold off or pulled up, but I will focus on the fact that millions of ordinary people have seen a clear signal from the President of the United States that cryptocurrencies are lucrative.”

Combined with the previous news that Trump issued currency occupied the headlines of major social media platforms and traditional news media at home and abroad, Trumps influence on cryptocurrency has undoubtedly spread to the global level.

Buying continues, selling decreases: national, corporate, and individual buying are expected to increase

“Never Sell Your BTC” has gradually become a consensus among many countries, institutions, enterprises and even individuals. “Bitcoin is very valuable, don’t sell it easily after buying it” has become the most profound lesson learned by many people after experiencing a series of bull and bear cycles.

Even the crypto mining companies that have always relied on “mining, selling and withdrawing” to sustain their strength have chosen to “hoard coins and wait and see” this year rather than directly “dumping the market”.

MicroStrategy: 11th consecutive week of hinting at increasing BTC holdings

MicroStrategy founder Michael Saylor wrote yesterday: Things will be different tomorrow, and attached a picture of Saylors Bitcoin purchase tracking chart, suggesting that he is increasing his BTC holdings again for the eleventh consecutive week.

It has to be said that todays historical high may have been expected by Michael, and it has a lot to do with his buying operation.

According to Cointelegraph on January 16, MicroStrategy has increased its holdings of nearly 200,000 BTC in the past 10 weeks, far exceeding the 120,000 BTC increased by BlackRock in the same period.

MicroStrategy Buy Green Dot Chart

The historical cumulative net inflow of Bitcoin spot ETF has reached 37.103 billion US dollars, and the ETF net asset ratio has reached 5.78%

According to SoSoValue data, as of January 17 , the total net asset value of the Bitcoin spot ETF was US$114.818 billion, the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) reached 5.78%, and the historical cumulative net inflow has reached US$37.103 billion.

According to official data from BlackRock, as of January 15, BlackRocks Bitcoin exchange-traded fund IBIT held 554,311.086 BTC, with a market value exceeding US$55 billion, reaching US$55,464,006,965.44.

Salvador: A HODLer’s Firm Belief

On-chain data display Today, El Salvador increased its holdings by another 11 BTC (US$1,113,508), bringing its total holdings to 6,043.18 BTC, worth US$608,264,513.

Wintermute predicts UAE and Europe will follow US in building Bitcoin reserves

Wintermute released a forecast for 2025, saying that this year cryptocurrencies will be more deeply integrated into traditional finance (TradFi) through exchange-traded funds (ETFs) and corporate holdings, the UAE and Europe may follow the United States in establishing BTC strategic reserves, a public company will sell debt or equity to buy ETH to imitate MicroStrategys (MSTR) Bitcoin acquisition policy, and a systemically important bank will offer spot cryptocurrency trading to customers.

U.S. listed crypto mining companies doubled their Bitcoin holdings to nearly 92,473 in one year

According to data from TheMiningMag, last year, the Bitcoin holdings of US listed crypto mining companies doubled, reaching a total of 92,473 BTC at the end of December, worth $8.6 billion. The largest number is MARA Holdings (MARA), which holds 44,893 BTC, almost half of the total holdings. MARA is the second largest company among listed companies, second only to MicroStrategy (MSTR) with 450,000 BTC.

According to Bitcoin Treasuries, three other mining companies hold more than 10,000 BTC: Riot Platforms (RIOT) holds 17,722 BTC, Hut 8 (HUT) holds 10,171 BTC, and CleanSpark (CLSK) holds 10,097 BTC. Not all miners follow the HODL strategy. IREN (IREN), TeraWulf (WULF), and Core Scientific (CORZ) all hold very little Bitcoin or none at all.

Canadian listed company Goodfood adopts BTC as financial reserve asset

Goodfood Market Corp. (TSX: FOOD), a Canadian listed company, announced a strategic shift in its financial management, intending to adopt Bitcoin investment as a financial reserve asset to strengthen its balance sheet and create long-term shareholder value. The company has completed an initial investment of approximately $1 million in Bitcoin through a spot ETF, and plans to strategically increase its holdings by investing part of its future residual cash flow in Bitcoin. It is reported that Goodfood is a Canadian digital native catering solution brand. The companys CEO Jonathan Ferrari said that Bitcoin reserves can protect against inflation and rising food costs, and have the potential of digital capital.

Futu Survey: Holding two BTC can bring more sense of security, and virtual currency is becoming the first choice for asset allocation of the new generation in Hong Kong

Futu released the 2025 Hong Kong Individual Investor Survey Report, revealing that virtual currency is gradually becoming the preferred asset allocation of the new generation. Among them, 77% of Generation X virtual currency investors (born in 1980 or earlier) are optimistic about the long-term appreciation potential of Bitcoin, and Generation Z (born between 1997 and 2006) pay more attention to the transaction convenience and security of virtual currency investment and believe that compared with the million-dollar down payment demand for home purchases, holding two bitcoins can bring more sense of security. They are three times more optimistic about the prospects of virtual assets than real estate.

Relevant data also show that the five most popular trading sectors in 2024 are AI technology, new energy, WSB hot concept stocks, virtual currency concept stocks and health and medicine.

A look at industry insiders’ views: The industry still has room for 100-fold development, and BTC is expected to exceed $270,000

Coincidentally, industry insiders also have their own opinions on BTC holdings and price ceilings. The following are representative views:

OKX Star joked that if you don’t hold 5 to 10 BTC, you can’t be a KOL. Holding BTC is the basic threshold for practitioners.

Recently, at the OKX New Years Eve Dinner event in Da Nang, OKX CEO Star delivered a speech via video, saying that the scale of Bitcoin ETF capital inflow has surpassed that of gold ETF, and the current market value of Bitcoin is only one-tenth of that of gold, indicating that the industry may have a hundredfold development space in the future. In addition, when talking about the performance of BTC returns, he joked: Within an acceptable range, holding Bitcoin is the basic threshold for industry practitioners. If you dont have 5 to 10 Bitcoins, its best not to say that you are a KOL.

Coinbase Chief Legal Officer: Bitcoin Could Become Foundational to the Global Economy Like Gold

Coinbase Chief Legal Officer Paul Grewal.eth said in a post that Bitcoin could become the foundation of the global economy like gold and would become the core of national security because Bitcoin holdings could change the balance of power between countries. Now is the time to build a strategic reserve of BTC.

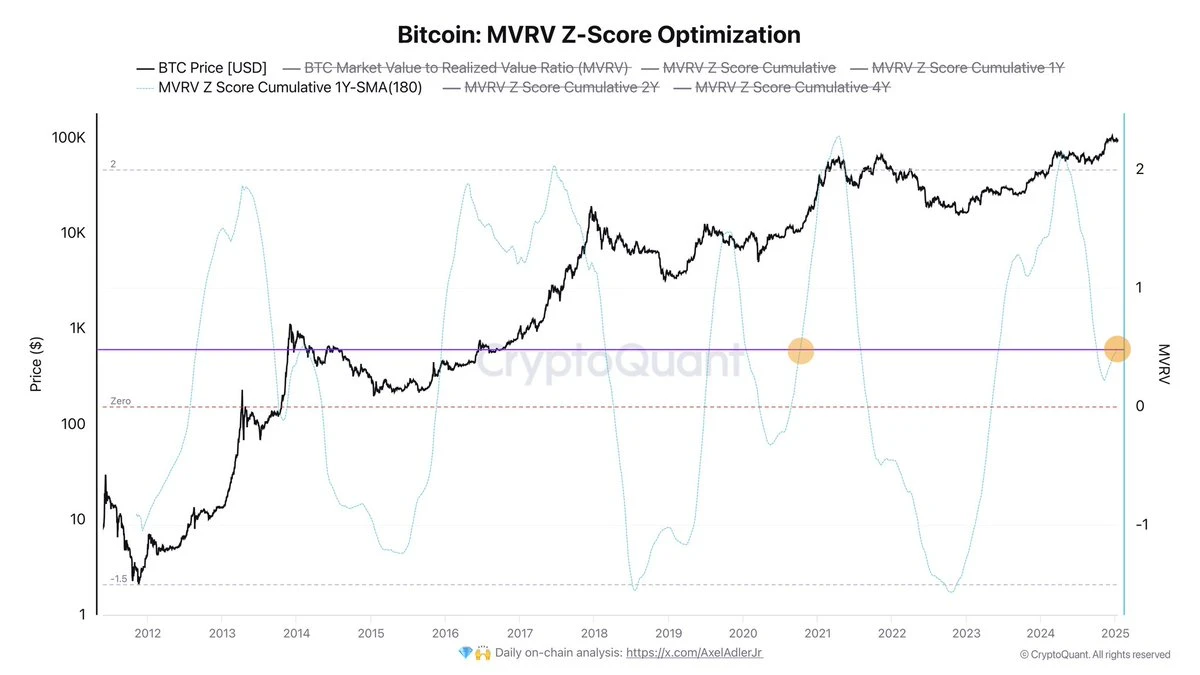

Analyst: 180-day MVRV Z-score indicates BTC is not yet extremely overbought and is expected to rise sharply

Currently, Bitcoin is approaching a critical moment in its quest to breakout higher. If successful, analysts expect a massive rally to occur, resulting in new all-time highs in rapid succession. Investors are particularly optimistic because historically, the year after the halving has produced the highest returns for BTC, making this phase crucial for long-term growth.

CryptoQuant analyst Axel Adler noted that the BTC market is still in a growth phase, which is supported by the MVRV Z-score smoothed by the 180-day moving average. This indicator, which is often used to assess market conditions, shows that Bitcoins price has not yet reached an extreme overbought level, leaving room for a sharp rise.

Analyst: BTC has broken out of the cup-and-handle pattern, indicating a potential upside target of $276,400

According to analyst Ali Martinez, BTC has broken out of a cup-with-handle pattern, signaling a potential upside target of $276,400.

Previously, Ali wrote yesterday that in the past 4 days, more than 20,000 BTC have been withdrawn from exchanges, with a value of more than 2 billion US dollars.

It can be seen that transaction activities on the chain are unprecedentedly active.

Alis Insights

Glassnode: Bitcoin’s recent correction is a cooling-down phase, and the bull market is far from over

Glassnode recently reported that Bitcoin’s recent pullback reflects a cooling phase, but relatively low investor stress levels suggest the bull run is far from over.

The report pointed out that the number of BTC currently in a state of floating loss fluctuates between 2 million and 3.5 million, which is much lower than the 4 million during the mid-2024 low, indicating that the market conditions are not so bad. In contrast, the number of BTC with floating losses recorded in the history of early bear markets ranged from 4 million to 8 million. The market value to actual value (MVRV) ratio is an important indicator of unrealized profits in the market, and it is currently 1.32. This shows that Bitcoin holders have an average floating profit of 32%. Although the market has fallen from its highs, this indicator shows that market sentiment is basically optimistic.

The report also pointed out that historical analysis shows that the MVRV peak has declined with each successive market cycle, reflecting the increasing maturity of the Bitcoin market and the decreasing intensity of speculation. Currently, Bitcoin is trading above the 1-year average of $90,900, but below the bullish ceiling of $112,600, indicating that the market is still in a bullish phase.

In addition, the report also pointed out that Bitcoins market behavior has changed over time. Reduced volatility, increased institutional participation, and new spot demand driven by ETFs have contributed to a more stable market structure. Despite the current adjustments, indicators show that the Bitcoin market remains resilient and the overall outlook is positive.

Matrixport: The Feds dovish tone and Trump support the markets upward trend

Matrixport said that last weekend, the launch of the TRUMP meme coin set off a trading frenzy on centralized exchanges, with major platforms launching the coin at a record speed. However, the subsequent launch of the MELANIA coin quickly reversed market sentiment, and the coin price plummeted, causing heavy losses to buyers on Sunday. This violent volatility has driven a surge in overall trading volume, with the weekend trading volume of Binance, the worlds largest exchange, soaring from $15 billion to $50 billion.

“The surge in trading volume is well documented. The dovish tone of last week’s Federal Reserve meeting, coupled with President Trump’s enthusiastic support for cryptocurrencies, sets the stage for further upside volatility in the market. Just as 2023 and 2024 were significant years for the crypto industry, 2025 could continue or even surpass this exciting momentum.”

Contract cleanup: Contract liquidation volume exceeds $2.5 billion in the past week

It has to be said that this breakthrough to a new high is also closely related to the contract liquidation in recent days.

On January 15, Coinglass data showed that in the past 24 hours, the entire network had a liquidation of $184 million, and a total of 69,712 people had their positions liquidated; of which long positions were liquidated for $61.3997 million and short positions were liquidated for $123 million. BTC liquidated $56.7154 million and ETH liquidated $36.3376 million.

On January 16, Coinglass data showed that in the past 24 hours, the entire network had a liquidation of $325 million, and a total of 110,468 people had their positions liquidated; of which long positions were liquidated for $107 million and short positions were liquidated for $219 million. BTC liquidated $73.1963 million, ETH liquidated $66.5948 million, and XRP liquidated $33.2455 million.

On January 18, Coinglass data showed that in the past 24 hours, the entire network had a liquidation of $285 million, and a total of 95,432 people had their positions liquidated; of which long positions were liquidated for $92.1504 million and short positions were liquidated for $193 million. BTC liquidated $96.3463 million and ETH liquidated $36.0471 million.

On January 19, Coinglass data showed that in the past 24 hours, the entire network had a liquidation of $519 million, with a total of 199,513 people being liquidated; of which long orders were liquidated for $381 million and short orders were liquidated for $137 million. ETH liquidated $71.2909 million and SOL liquidated $65.6693 million, both exceeding BTC (liquidation of $59.0002 million); it is worth mentioning that TRUMP liquidated $22.3393 million.

On January 20, that is, today, Coinglass data showed that in the past 24 hours, the entire network had a liquidation of $1.082 billion, and a total of 364,334 people were liquidated; of which long orders were liquidated for $829 million and short orders were liquidated for $254 million. ETH liquidated $198 million, BTC liquidated $165 million, and TRUMP liquidated $130 million.

According to rough statistics, the contract liquidation volume of the entire network in the past week was at least over 2.5 billion US dollars. This round of cleanup also once again warned high-risk preference investors that the market is entering a period without historical reference, and they should be cautious about increasing leverage in the face of potential high volatility in the future.