Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

The world has suffered from the Ethereum Foundation (EF) for a long time.

As the communitys disappointment with ETHs weak performance in this cycle gradually accumulated and eventually erupted, calls for the rectification of EF became increasingly louder.

Over the past few days, the entire Ethereum community has been discussing EF’s leadership structure, personnel composition, operating model, and financial plan. The current EF Executive Director Aya Miyaguchi has been criticized by the community, and Vitalik himself has been under great pressure to publicly state that large-scale changes are being made to EFs leadership structure.

On Monday, the discussion deepened. Founders and executives of several leading Ethereum projects came out to denounce EF for many sins. The intensity of their words showed that the major project owners had long been resentful of Ethereum’s performance.

The following is a collection of opinions from all sides compiled by Odaily Planet Daily.

Synthetix, Infinex founder: EF should require L2 to use revenue to buy back ETH

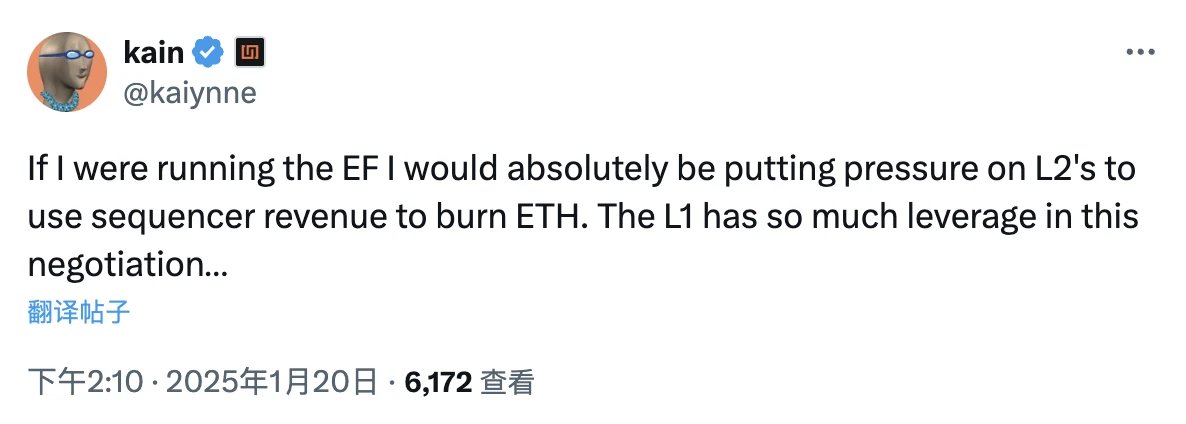

Kain Warwick, founder of Synthetix and Infinex, took the lead in launching the attack.

On Monday afternoon, Kain posted on X: “If I were to run EF, I would definitely put pressure on Layer 2 to use sorter revenue to destroy ETH. Ethereum has a big advantage in this negotiation….”

Curve founder: EF should abandon L2 strategy immediately

Following Kain, Curve Finance founder Michael Egorov also jumped out to attack Layer 2, but his wording was more radical.

On Monday afternoon, Egorov posted on X that EF’s top priority should be to abandon the Layer 2-centric roadmap and focus on expanding Layer 1.

In a subsequent discussion with community members, Egorov also bluntly stated: “Layer 2 is not a moat, but a Band-Aid.”

Aave founder: 12 measures to save EF

In the evening, Aave founder Stani Kulechov issued a long article on X saying that he had read the EF annual budget report and believed that EF needed to be thoroughly reformed in 12 aspects to achieve better sustainability:

Immediately cut cash burn from $130 million to $30 million;

reducing the number of employees to 80;

Carefully review who is allowed to stay. Remove senior positions, consultants, any part-time roles, interns, free riders, cockroaches and parasites;

No advisors or any conflicts of interest;

Ensure that 80% of employees are technical personnel;

All technical teams were split into small 5-person teams, each focusing on specific areas and specialties;

The leadership should be a committee of 5 people, selected based on performance, one of whom will be the chairperson and responsible for the VB;

A portion of the non-technical team should be dedicated to financial management (done in-house);

Diversify financial investments into various long-term sustainable assets (LRSTs), as well as DeFi and non-DeFi projects with good fundamentals and profitability, and built on Ethereum;

Diversify staking income into stablecoins and invest funds in DeFi;

Borrow from Aave to manage finances and make scheduled sales when ETH outperforms other assets;

Create a sustainable revenue model from transaction or staking fees to fund a reasonable EF budget.

Former Ethena Growth Manager: EF should focus on DeFi

Seraphim, the former head of growth at Ethena who just stepped down and also the former head of development at Lido, also wrote a post about his views on the EF reform.

Seraphim mentioned that Ethereum needs two ways to save itself. One is that EF should focus on DeFi, and the other is that Consensys, headed by Ethereum co-founder Joseph Lubin, should follow Microstrategys approach to BTC. As long as these two points can be achieved, ETH will soon break through $6,000.

Wintermute founder: Ethereum’s potential death spiral

Although Wintermute, the industrys top market maker, is not exclusive to the Ethereum ecosystem, it is directly involved in market making for a large number of Ethereum ecosystem projects, so its statement also has a significant impact on Ethereum.

In the evening, founder and CEO Evgeny Gaevoy wrote a post about Ethereum’s potential death spiral.

Evgeny said that the biggest internal contradiction of Ethereum is that the more ETH is used for gambling and the more financial-related Dapps run on Ethereum, the higher the price of ETH and the higher the security; conversely, if there is no gambling and ETH is only used for transfers in Zazulu, then the price of ETH will be very low and the security will be very low. As the price of ETH drops, fewer and fewer Dapps will think that Ethereum is still safe and will flee to other chains, further reducing the price of ETH, which may be a very large death spiral.

Therefore, any blockchain must include gambling, speculation, and broader financial applications as part of its offering or it will be deemed unsafe.

Amid public outrage, EF chose to sell again...

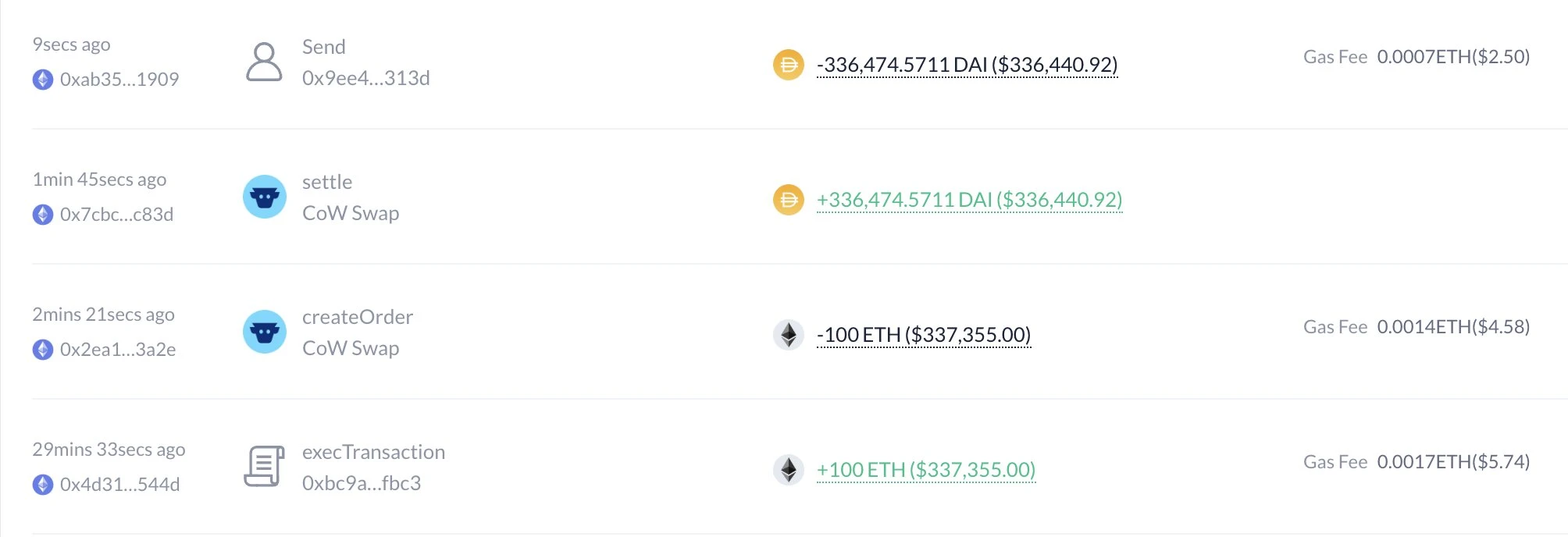

As the community collectively condemned the incident and public anger was hard to calm, EF once again chose an unexpected action.

Around 6:20 pm, the address 0xd77...1f4 used by EF to sell ETH in small amounts and at high frequency sold 100 ETH again, with an average selling price of US$3,364.

As a long-term ETH holder, it is hard for me to imagine why EF would carry out such an operation with a low total value but great symbolic significance at such a sensitive time point, especially when the community actively suggested that EF use staking income instead of direct selling, and this plan has been acknowledged by Vitalik to be further explored.

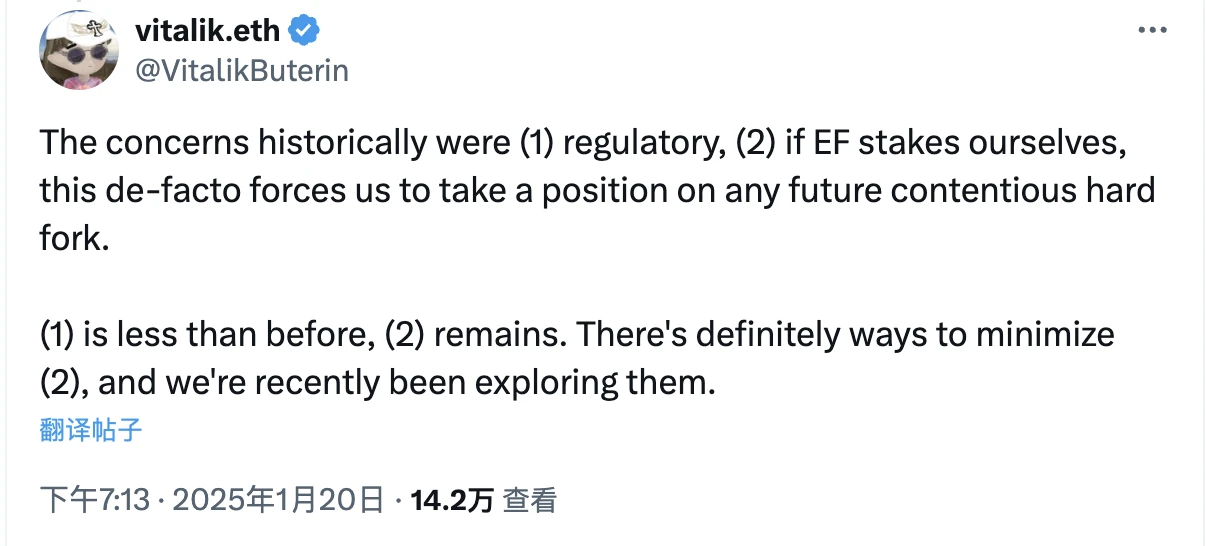

You read that right. As the top organization in the Ethereum ecosystem, EF has not even staked its ETH. Vitalik explained that he was worried about regulatory issues and EF’s neutrality. If EF staked itself, it would force them to take a stand on any future controversial hard forks.

I won’t say much about the regulatory issue for now. In fact, with the overall relaxation of the regulatory environment, this has gradually become less of a problem.

As for the second point, does this explanation really hold water? When Solana is pressing forward and the competition has reached a life-and-death stage, EF is even trying to avoid suspicion for future unwarranted situations.

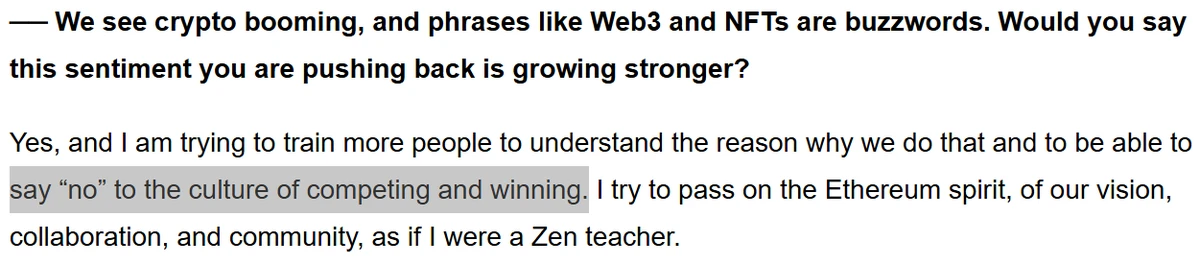

Oh, and EF doesn’t seem to care about competition either. Today, the Ethereum community dug up what Aya Miyaguchi said in an interview: “I’m training people to say no to the culture of competition and winning.”

I am speechless. I hope the day of real change will come soon.