1. Risk of loss of income due to stablecoin legislation

As of November 28, 2024, the market value of USDT is approximately $132.3 billion. It is expected that the stablecoin market will exceed $2.8 trillion by 2028. The regulatory dynamics of stablecoins have attracted much attention from the market. The market value of USDT is shown in the figure below:

On June 7, 2022, U.S. Senators Cynthia Lummis (R-Wyoming) and Kirsten Gillibrand (D-NY) introduced the Payment Stablecoin Act. Gillibrand called it landmark bipartisan legislation that creates a clear regulatory framework for payment stablecoins that will protect consumers, promote innovation, and advance the dominance of the U.S. dollar while maintaining a dual banking system. The LG Act may be one of the most important regulatory bills introduced for USDT in recent years.

The bill will allow non-depository trust companies (non-banks) to issue stablecoins through their own channels when the nominal value of all their tokens is less than $10 billion. The Lummis-Gillibrand Act stipulates that stablecoin issuers with a scale of more than $10 billion must be depository institutions authorized as national stablecoin issuers to be allowed to practice legally. Under the Lummis-Gillibrand Act, centralized stablecoin companies like Circle (USDC, $33 billion issued) or Paxos (PAXD) will have two options: either through non-bank financial institutions at the state level, or become depository institutions that become national payment stablecoin providers at the federal or state level, similar to MMFs or primary dealers in traditional financial institutions. In the LG Act, only stablecoins that can be redeemed for sovereign currencies at any time, are anchored by non-crypto assets, and are used for MoE are defined as payment stablecoins. Only payment stablecoins such as USDT (depository institution type) and USDC (non-depository institution type) are under the jurisdiction of the LG Act. Algorithmic stablecoins and over-crypto-collateralized stablecoins (DAI, etc.) are not included.

At the same time, the LG Act also contains long-arm jurisdiction clauses, which means that these laws will apply to companies outside the United States. Although Tether is registered in BVI, it is expected to be subject to the Act because USDT is widely circulated among American investors and exchanges, and the Act directly determines that Tether and USDT also fall within the scope of application. Tether has stated that it does not provide services to American customers because it does not issue tokens directly to these companies and individuals, but American policymakers are unlikely to approve of this way of circumventing regulation.

Therefore, Tether is at risk of being banned from practicing by the U.S. Treasury or SEC. The LG Act requires depository institutions to issue and redeem payment stablecoins after obtaining prior approval from federal or state banking regulators. They must be collateralized by high-quality liquid assets (such as U.S. dollars, U.S. Treasury bonds) of no less than 100% of the issued face value, and publicly disclose the number of unredeemed payment stablecoins and detailed information on the assets supporting payment stablecoins and their values on a monthly basis. Upon request from customers, they are obliged to redeem all outstanding payment stablecoins at face value with legal currency. If Tether triggers such potential obligations, or fails to fulfill its redemption and disclosure obligations, resulting in being banned from engaging in U.S. dollar-related business (Tether has no legal license in the United States, resulting in it having no nominal direct business in the United States, but its business involving the United States is essentially illegal), it will cause severe fluctuations in the value of USDT, causing it to decouple from the U.S. dollar and enter a death spiral similar to UST.

In addition, the SECs attitude towards Tether is also ambiguous. Gary Gensler once publicly stated that he believes only BTC is a commodity, and other cryptocurrencies are securities. He has also repeatedly expressed serious concerns that stablecoins will disrupt the US financial market. If Tether is regarded as a security and included in the regulation, it will undoubtedly be a heavy blow to USDT, which has gray industries as one of the main components of its circulation. This news may become an opportunity for USDT and fiat currency to decouple and lead to a run.

II. Regulatory risks related to U.S. Treasury bond pledges

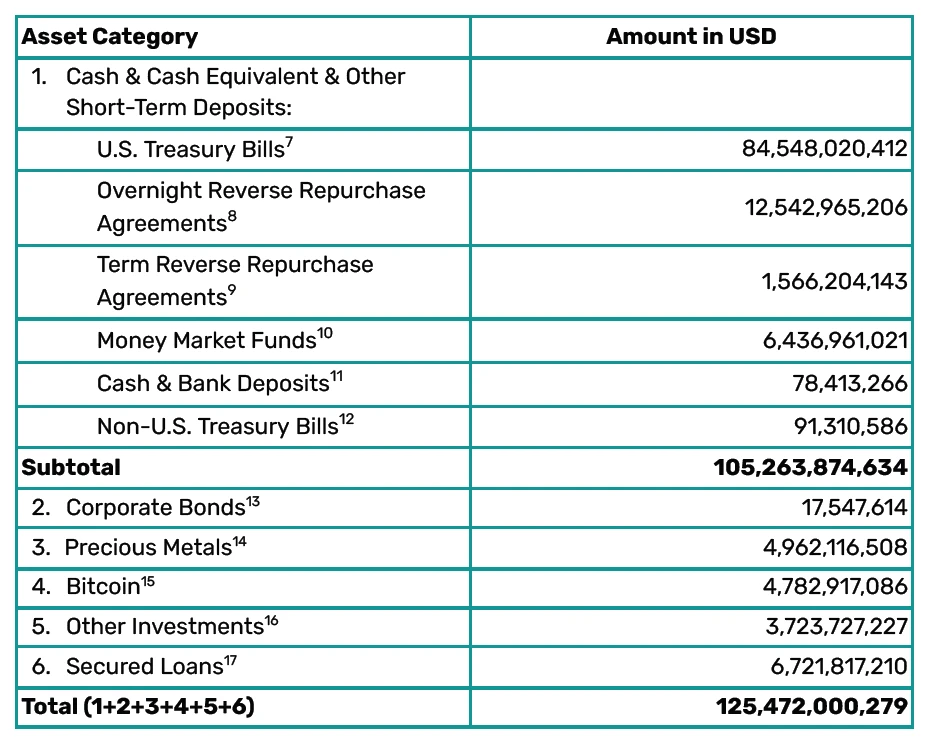

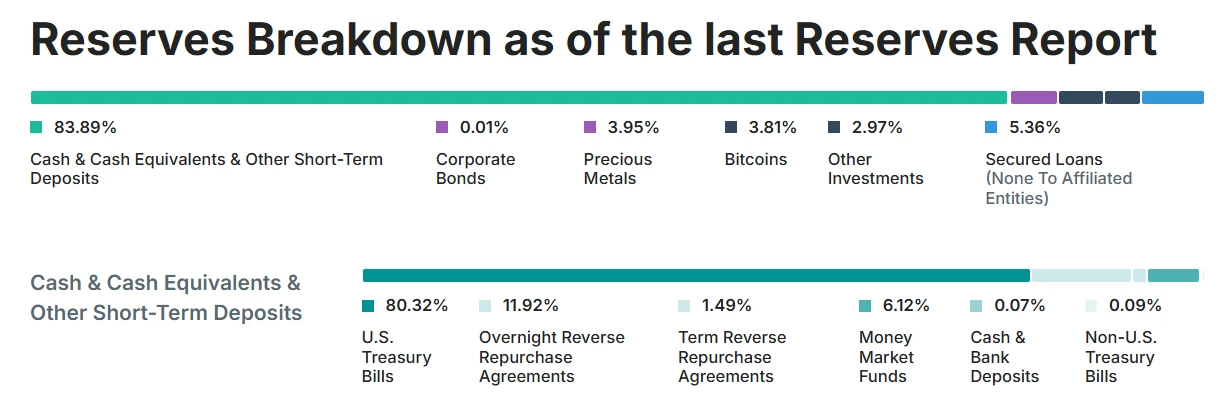

At present, the anchoring mechanism between USDT and the US dollar can be described as an excess reserve mechanism, that is, each USDT has a low-risk underlying asset with a value greater than 1 US dollar as collateral, and the excess is Tethers net assets (Tethers asset side is pledged assets such as US Treasury bonds, and its liability side is the USDT it issues). At the same time, due to the widespread use of USDT, a large number of arbitrage traders will actively arbitrage when the USDT price deviates slightly, in disguise to maintain the stability of the USDT price. Tether publishes a reserve asset audit report every quarter, the size and composition of which are shown in the following figure:

However, Tether holds a large amount of U.S. Treasury bonds and derivatives, which gives it the central bank status in the crypto world, but also raises many questions about whether it will threaten the effectiveness of the traditional monetary policy transmission chain, and has even attracted the attention of U.S. financial regulators. Although the U.S. interest rate corridor system has evolved from the logic of scarce reserves to the logic of excess reserves and excess reserves after QE, ONRRP is currently the most important buffer for the Federal Reserves liability side to absorb TGA and other excess liquidity and a reservoir for building a solid floor for the interest rate corridor. After further issuance of T-bills, interest rate hikes, QE Taper and QT, the current balance is also gradually declining. In the second quarter of 2024, the balance of ONRRP has rapidly dropped from the historical high of 2 trillion in 2022 to about 600 billion U.S. dollars. As QT deepens, it is expected that the exhaustion of ONRRP has become a high probability event. In this context, even if it is still in the 0 elasticity range of the curve, Tethers ONRRP agreements of more than 10 billion and the balance of more than 100 billion US Treasury bonds and MMFs can already be considered to have a scale that is of practical significance for the stable operation of US monetary policy. Tether is a company registered in BVI, nominally refuses to engage in US-related business, and is not subject to US legal supervision. Therefore, it is not nonsense for traditional regulatory authorities and media to believe that it poses a certain threat to the order of the US interest rate corridor system and that it is an ant hole in the long dike of US monetary policy.

As for the quality of Tethers underlying assets, the proportion of cash and equivalents has increased slightly in recent years, but only 80% of them are U.S. Treasury bonds with extremely high liquidity. The overall liquidity level is relatively average, which is also one of the reasons why USDT has frequently been questioned in recent years.

3. Tether faces competition risks from stablecoins issued by Paypal and traditional financial institutions (such as banks, etc.)

Stablecoins can effectively capture value. They have unique value in mobile payments and cross-border payments, including anonymity, speed, decentralization and versatility, as well as value stability. As a pioneer in pledging stablecoins to communicate different trading pairs, Tether has not only captured the above-mentioned value increments and user needs, but also bridged the serious slippage problem caused by using only BTC as an intermediary for different trading pairs in exchanges, and even laid the foundation for the introduction of smart contracts, becoming the most indispensable infrastructure in the crypto world. Due to its anonymity and high versatility, USDT has inevitably become one of the most important mediums of exchange (MoE) in the black industry. However, in contrast to the industry dividends enjoyed by Tether as an industry leader, companies that are able to cross this industry barrier also have a strong desire to enter the field of pledged stablecoins to share a piece of the pie. Tethers net profit in the third quarter of 2024 alone reached US$2.2 billion. For traditional Internet payment business leaders such as Paypal and traditional commercial banks, in addition to the rich return prospects of the payment stablecoin business itself, payment stablecoins can be seamlessly connected with their main payment business, exerting extremely strong synergy.

At present, Tethers most significant moat in the pledged centralized stablecoin industry is its strong reserves. While achieving excess pledge coverage, its underlying assets are all highly liquid, low-risk U.S. Treasury bonds, Treasury derivatives (MMF) on the liability side of the Federal Reserve, and a small amount of Bitcoin. However, as discussed above, the central bank (issuing digital currency) and commercial banks are far more powerful than Tether in terms of capital adequacy. As a pure pledged stablecoin, Tethers business model does not place very high demands on the issuers Crypto-native business thinking. It only needs to use the capital resources in hand to subsidize the public chain to attract on-chain users, and then enter the on-chain packaged asset trading pairs, and attract centralized exchange users to use stablecoins through cooperation with exchanges (rate discounts, etc.) (similar to Binances promotion of XUSD and FDUSD), and at least a portion of the share can be taken from Tether. The potential competition faced by Tether (more from non-native players in the currency circle) poses a great challenge to its business.

4. Litigation Risk

In addition to the above risks, Tether also faces a number of potential lawsuits and risks of being investigated. In 2021, the U.S. Department of Justice intervened in the investigation of Tether. In 2022, the Tether case was transferred to Darmian William, a prosecutor in the Southern District NY. William specializes in well-known large cases in the crypto field (SBF, FTX, etc.). The reason why the U.S. Department of Justice investigated Bitfinex and Tether is mainly because it is suspected of violating sanctions and anti-money laundering regulations, as well as Bitfinexs misappropriation of Tether funds. Specifically, the Department of Justice is investigating whether Tether is used by third parties to fund illegal activities such as drug trafficking, terrorism and hacking, or to launder the proceeds generated by these activities. At the same time, the U.S. Treasury Department is also considering imposing sanctions on Tether because USDT is widely used by individuals and groups sanctioned by the United States, including Hamas and Russian arms dealers. In addition, Tethers transparency has also been questioned as it has long been accused of suspected money laundering and lack of audit transparency. The focus of the investigation is on whether Tethers financial operations are legal and whether it properly reports the liquidity and underlying supporting assets of its assets. Due to the above reasons, Bitfinex and Tether have long used some gray shadow banks such as Crypto Capital for savings and custody, creating a vicious cycle of compliance risks.

In addition, Tether is facing multiple lawsuits, including a lawsuit filed by several crypto traders against Tether, accusing it of jointly manipulating crypto market prices in violation of the Commodity Exchange Act (CEA) and the Sherman Antitrust Act (Sherman Act). The plaintiff stated in the complaint that Tether and Bitfinex pushed USDT into the market through large and carefully arranged purchases and promotions and created the illusion of strong demand to push up the price of cryptocurrencies; it also included Celsius, a well-known crypto lending company, suing Tether, claiming that Tether improperly liquidated approximately $2.4 billion in Bitcoin before bankruptcy. Tether responded that the lawsuit was extortion and stated that its actions were in compliance with the terms of the agreement and that Celsius did not provide collateral as required before liquidation. The above lawsuit is also likely to have an adverse impact on Tether.

5. Alternatives: USDC and other stablecoins

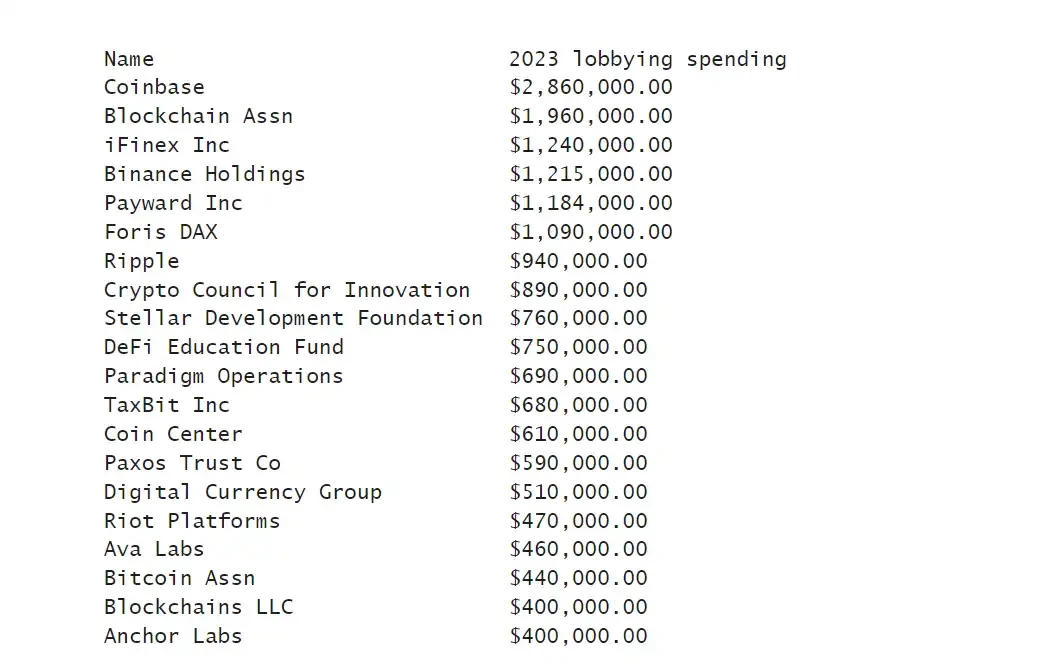

It is worth noting that even with the above-mentioned unfavorable factors, USDT still occupies the vast majority of the market value of the stablecoin market and is currently the most widely circulated and most widely used stablecoin. The probability of major problems suddenly appearing in the short term is low, and Tether and its parent company Bitfinex have invested large sums of money in lobbying outside the parliament in recent years (as shown in the figure below).

At the same time, after Trump was elected, he clearly expressed his dissatisfaction with anti-cryptocurrency policymakers such as Gary Gensler, and nominated Howard Lutnick, who has a close relationship with Tether, as the candidate for Secretary of Commerce. Lutnicks financial company Cantor Fitzgerald is Tethers custodian and has also carried out a $2 billion loan project with Tether. Therefore, after Trumps election, it can be considered that the risk of Tether being stopped by US policy authorities has been further reduced.

However, assuming that due to US regulatory policies and other reasons, Tether suffers a major blow and the black swan scenario of USDT being decoupled from the US dollar occurs, other stablecoins represented by USDC are the first choice to fill the important ecological niche of USDT in terms of deposits and withdrawals and trading pair anchors.

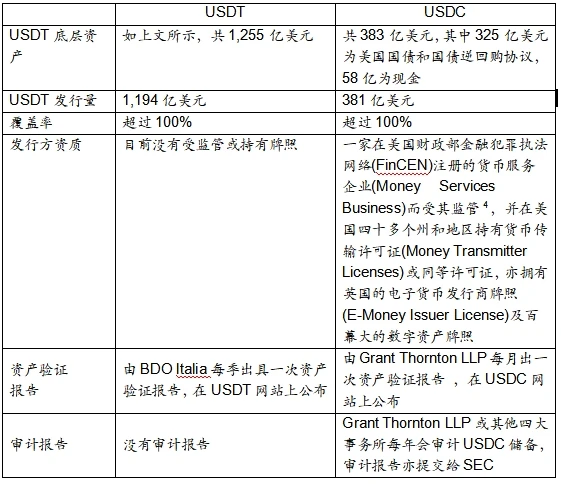

In general, USDC strictly follows US regulatory rules and is more transparent, but its weakness is that its circulation and acceptance are obviously inferior to USDT. USDC will comply with the SECs requirements and comply with the standards of listed companies for third-party annual audits, and disclose its underlying asset status weekly and is audited monthly by the Big Four. In contrast, USDT does not have a strict audit and supports monthly disclosure of asset status. The comparison between USDT and USDC is shown in the following table: