Key Takeaways

The total market value of global cryptocurrencies is $3.59 trillion, up 2.5% from $3.5 trillion last week. As of January 20, 2025, the total net inflow of US Bitcoin spot ETFs was about $38 billion, with a net inflow of $890 million this week; the total net inflow of US Ethereum spot ETFs was about $2.66 billion, with a net inflow of $190 million this week.

The total market value of stablecoins is $216 billion, accounting for 6% of the total market value of cryptocurrencies. Among them, USDT has a market value of $137.4 billion, accounting for 64.7% of the total market value of stablecoins; followed by USDC with a market value of $46.5 billion, accounting for 21.5% of the total market value of stablecoins; DAI has a market value of $5.4 billion, accounting for 2.5% of the total market value of stablecoins.

This week, the total TVL of DeFi is 120.3 billion US dollars, an increase of 1.3% from last week. According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 53.14%; Solana chain accounting for 9.32%; Tron chain accounting for 5.72%.

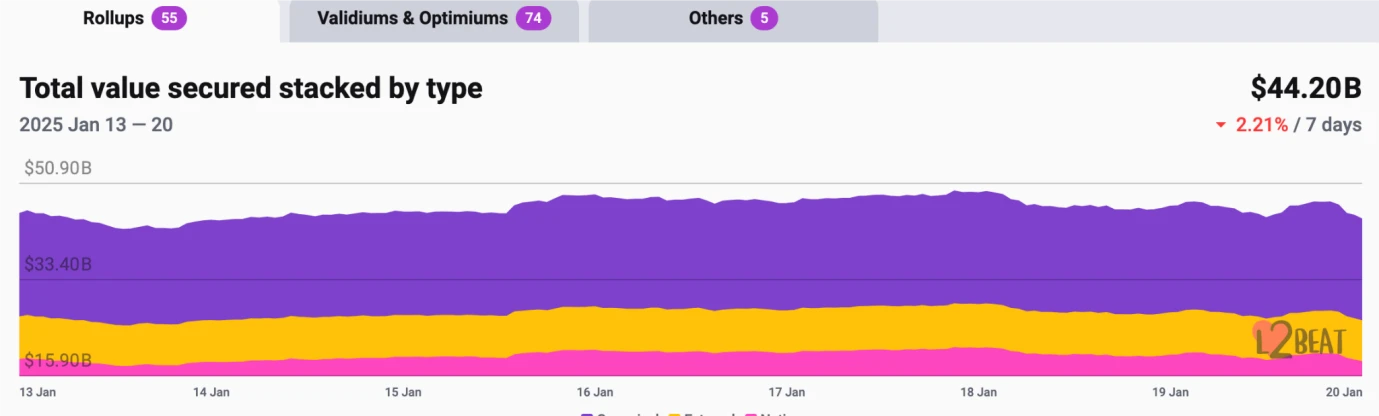

From the on-chain data, among the daily transaction volumes of Layer 1 public chains this week, SOL transaction volume increased the most significantly, up 800% from last week, possibly due to the influence of TRUMP tokens. In terms of transaction fees, ETH transaction fees increased the most, up 2011% from last week. In terms of daily active addresses, there is an overall growth trend, and SOL has a significant growth trend, up 46% from last week. Ethereum Layer 2 total TVL reached 44.2 billion US dollars, down 2.21% from last week.

Innovative projects to focus on: Hyperfly : Hyperliquids DeFAI project, which helps users execute complex trading strategies on Hyperliquid using simple English commands; seeds : the building blocks of the agent network state, based on Ethereum, with tokens allocated to 100%, etc.; ASYM : a real-time monitoring AI Agent that can generate profits and return them to ASYM.

Table of contents

Key Takeaways

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratio

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

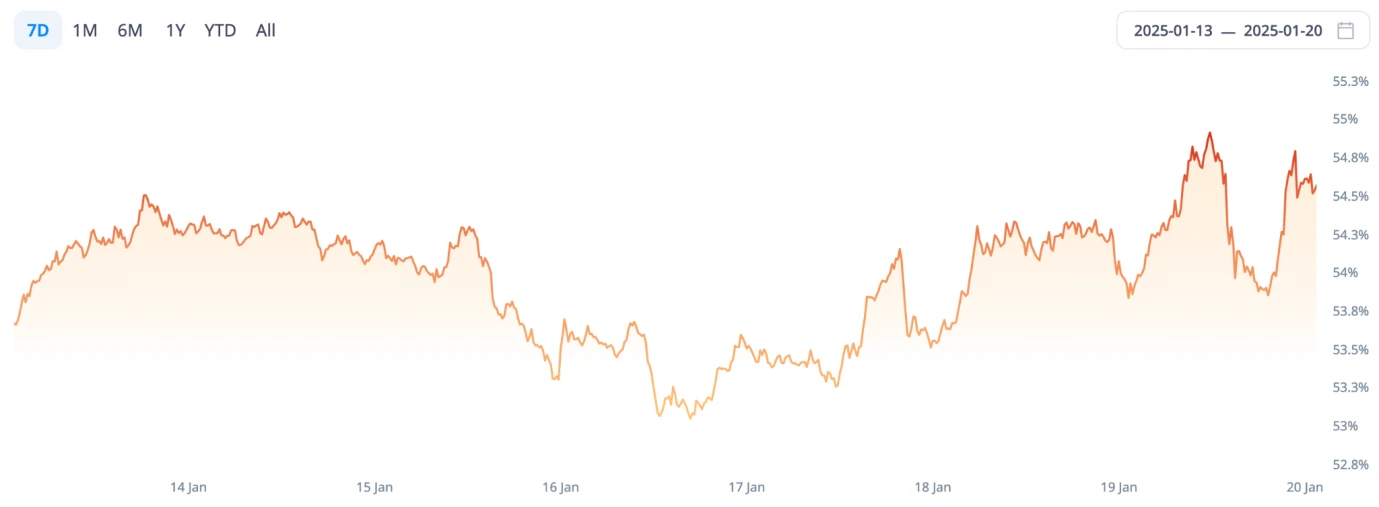

The total market value of global cryptocurrencies is $3.59 trillion, up 2.5% from $3.5 trillion last week.

Data source: Cryptorank

As of press time, Bitcoin’s market cap is $1.97 trillion, accounting for 54.93% of the total cryptocurrency market cap. Meanwhile, stablecoins have a market cap of $216 billion, accounting for 6% of the total cryptocurrency market cap.

Data source: coingeck

2. Fear Index

The Crypto Fear Index is at 76, indicating greed.

Data source: coinglass

3. ETF inflow and outflow data

As of January 20, 2025, the U.S. Bitcoin spot ETF has a total net inflow of approximately US$38 billion, with a net inflow of US$890 million this week; the U.S. Ethereum spot ETF has a total net inflow of approximately US$2.66 billion, with a net inflow of US$190 million this week.

Data source: sosovalue

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Current price is $3,182, the highest price in history is $4,878, and the decline from the highest price is about 34.64%

ETHBTC: Currently 0.031809, the highest in history is 0.1238

Data source: ratiogang

5. Decentralized Finance (DeFi)

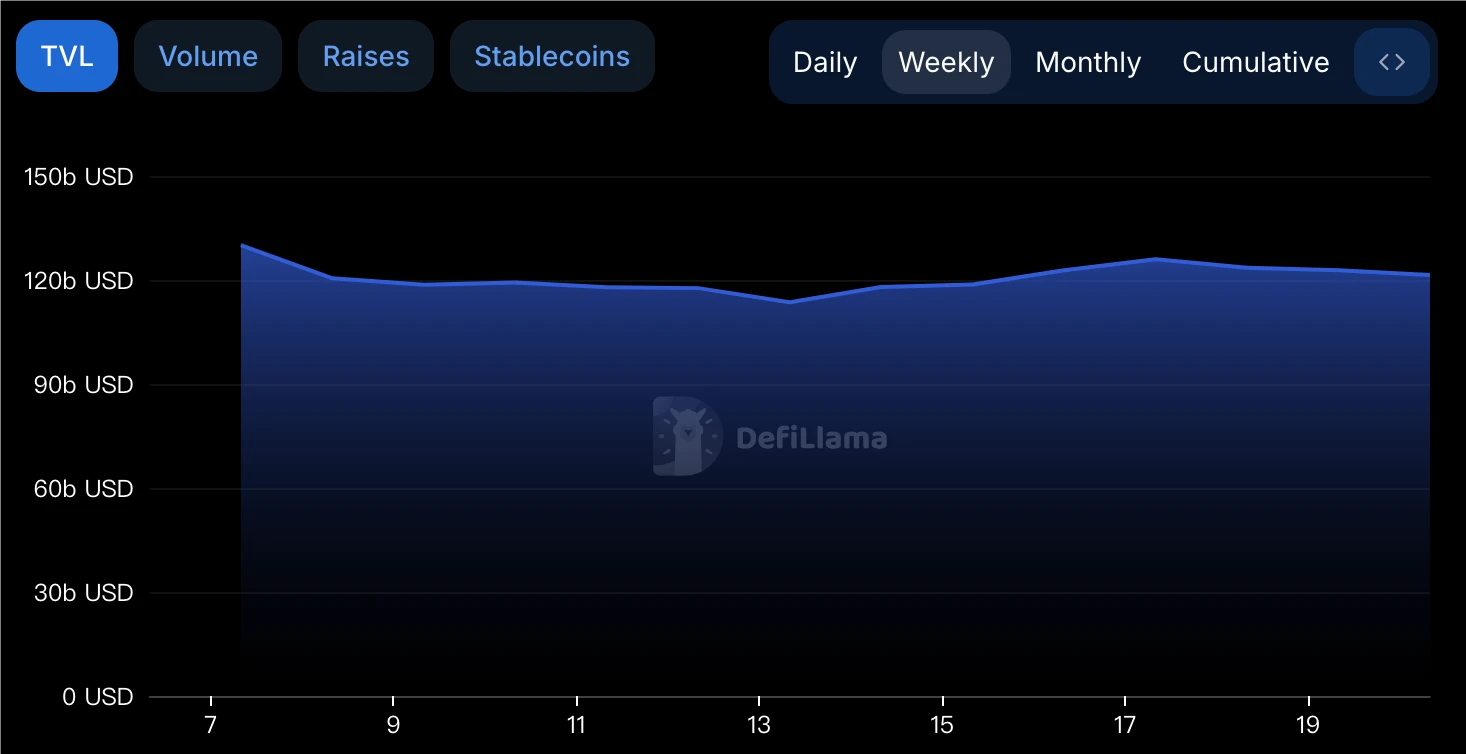

According to DeFiLlama, the total TVL of DeFi this week is $120.3 billion, up 1.3% from last week.

Data source: defillama

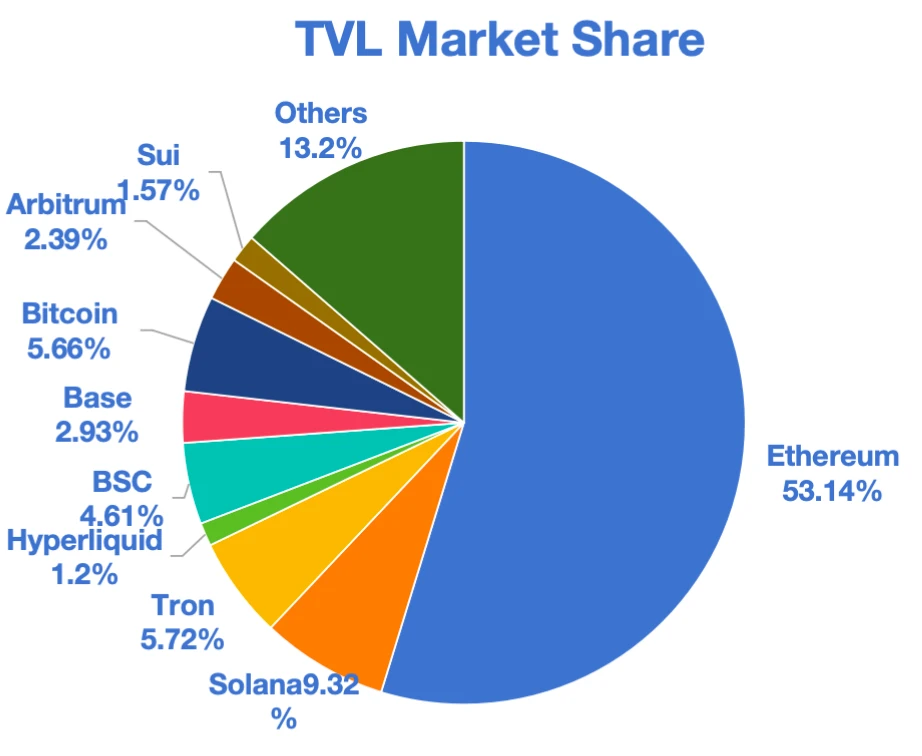

According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 53.14%, Solana chain accounting for 9.32%, and Tron chain accounting for 5.72%. The overall share is relatively stable, and the Ethereum chain is still the leader in the DeFi field.

Data source: CoinW Research Institute, defillama

Data as of January 20, 2025

6. On-chain data

Layer 1 Data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of January 20, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators for measuring the activity of public chains and user experience. In terms of daily trading volume, except for the SUI chain, the trading volume of other public chains has been on the rise this week. Among them, SOLs trading volume has increased the most significantly, which may be affected by the TRUMP token, with an increase of 800% compared with last week. In terms of transaction fees, ETH transaction fees have increased the most, with an increase of 2011% compared with last week.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the users trust in the platform. From the perspective of daily active addresses, the overall trend is increasing, and SOL has a significant growth trend, with an increase of 46% over last week. From the perspective of TVL, SOL has a significant growth trend, with an increase of 30% over last week.

Layer 2 Data

According to L2B eat data, the total TVL of Ethereum Layer 2 reached 44.2 billion US dollars, with an overall decline of 2.21% this week compared with last week.

Data source: L2Beat

Data as of January 20, 2025

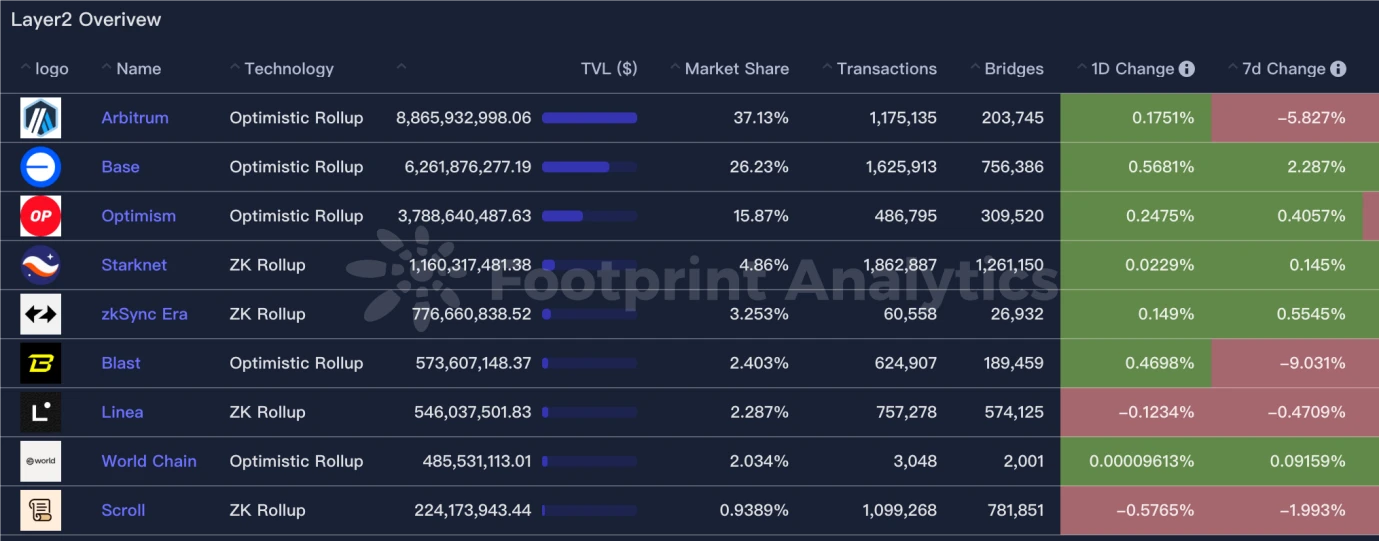

Arbitrum and Base occupy the front row with 37.13% and 26.23% market share respectively.

Data source: footprint

Data as of January 20, 2025

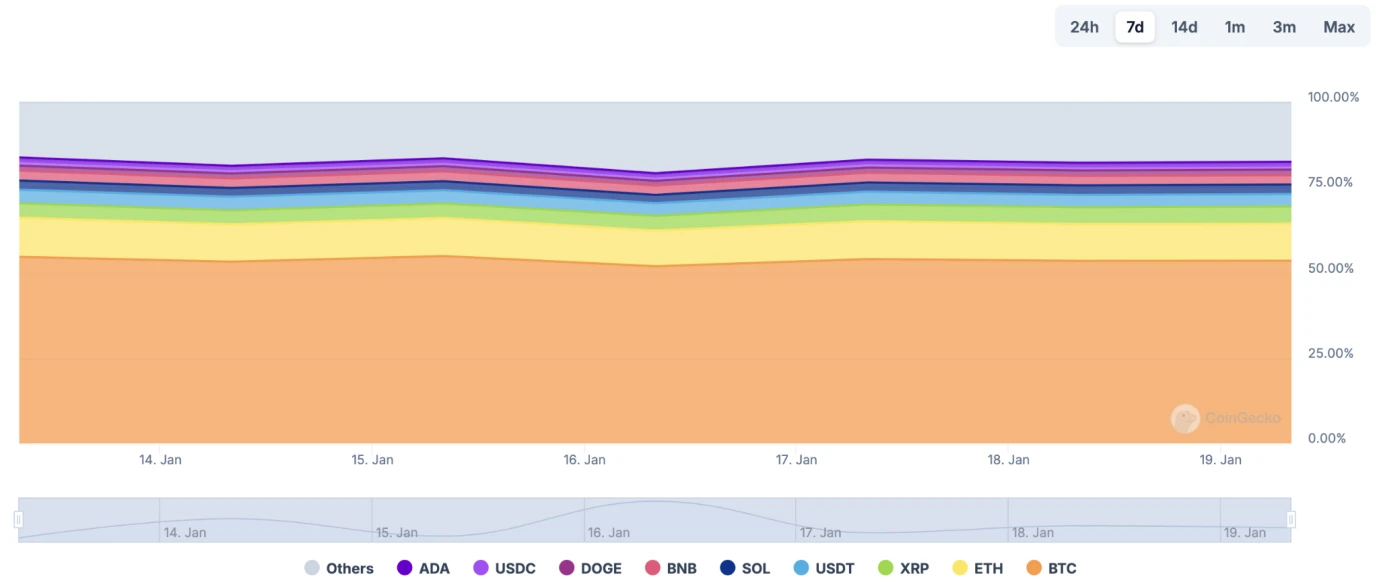

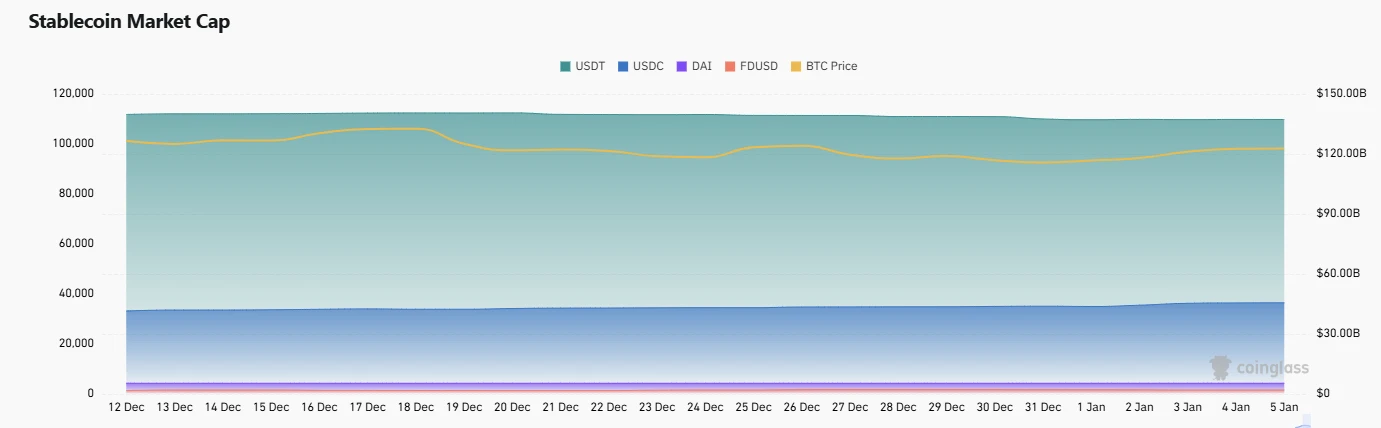

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is now $216 billion. Among them, the market value of USDT is $137.4 billion, accounting for 64.7% of the total market value of stablecoins; followed by USDC with a market value of $46.5 billion, accounting for 21.5% of the total market value of stablecoins; and DAI with a market value of $5.4 billion, accounting for 2.5% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of January 20, 2025

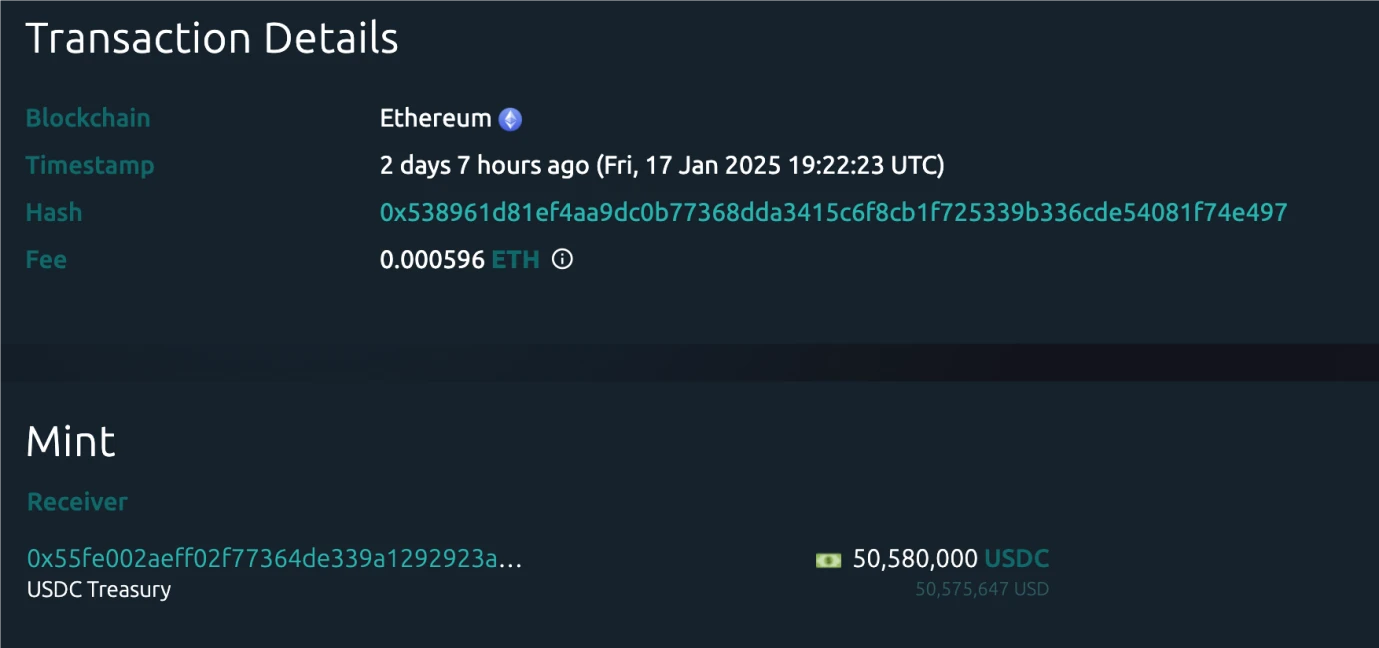

According to Whale Alert data, the USDC Treasury issued a total of 1.17 billion USDC this week, an increase of 80% from the total amount of stablecoins issued last week.

Data source: Whale Alert

Data as of January 20, 2025

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of January 20, 2025

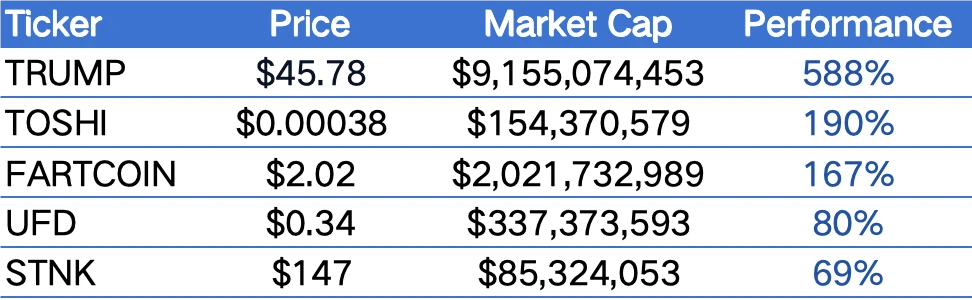

Top 5 Meme Coins That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of January 20, 2025

2. New Project Insights

Hyperfly : Hyperliquids DeFAI project helps users execute complex trading strategies on Hyperliquid using simple English commands. Powered by AI Agent, it enables precise and efficient cryptocurrency trading.

Seeds : The building blocks of the agent network state, based on Ethereum, the token is allocated to 100%, and airdrops will be launched soon. Seeds establish the basic genome for the agent, making it the protagonist in the large-scale AI RPG.

ASYM : A real-time monitoring AI Agent that generates profits and returns them to ASYM. It can monitor pumpdotfun tokens, analyze trends, and execute trades using price prediction models.

3. New Industry Trends

1. Major industry events this week

Ethereum L2 network Fuel will start the second phase of Genesis Drop and FS-1 activities. The second phase of Genesis Drop will airdrop 150 million FUEL, and the qualification review and application will be carried out from January 30 to March 2, 2025; the FS-1 activity will also airdrop 150 million FUEL, and liquidity providers on MIRA, Swaylend, Fluid, Ruscet, Spark and Griffy can receive additional rewards. The first season will last 45 days and end on March 1.

The cross-chain interoperability platform Wormhole has opened the first phase of the W Staking Reward Program (SRP) and simultaneously launched the second phase. The first phase of rewards allocated more than 50 million W, and a total of 58,415 addresses meet the reward conditions.

Jupiter consultant Kash Dhanda tweeted that the Jupuary 2025 airdrop query portal is now online. The number of wallets eligible for the claim is about 2 million, the total airdrop is 700 million, and the airdrop will be carried out in a layered manner.

Web3 user security network GoPlus Foundation released details of GPS token airdrop and eligibility criteria. The airdrop will be distributed in four seasons, with 3% distributed in the first season. Airdrop inquiries and claims will be open on January 16. The total supply of GPS tokens is 10 billion, and the token economic model is: community and development (24.67%), ecosystem growth (10%), market and growth (6%), airdrop (10%), liquidity (7%), consultants (3%), team (20%), and early supporters from 2021 to 2024 (19.33%).

Decentralized AI platform Nodepay announced that the claim and staking portal for its token Nodecoin (NC) is now open.

2. Big events coming up next week

GraFun launched a new token issuance mechanism Alpha Launch. The first use case of this mechanism is the BNB chain artificial intelligence agent token BAD Coin, which is scheduled to be launched on GraFun on January 20, 2025.

Swell’s Wavedrop 2 claims are expected to open on January 22, and Wavedrop 1 claims will also reopen on Swellchain at the same time.

Jupiter founder meow said that Jupuary (i.e. JUP airdrop event) is expected to take place before Catstanbul, Jupiter community event, scheduled to be held from January 25th to 26th.

Catton AI, the token of Telegrams AI-based gaming platform, will be launched on BNB Chain on January 26, 2025. Catton AI will integrate Wise Monkey IP and launch intelligent AI NPC. 50% of the total supply of CATTON will be used for ecological airdrops, including: 37% to MONKY holders, 10% to Catton AI players, 2% to FLOKI holders, and 1% to ApeCoin DookeyDash players.

3. Important investment and financing last week

Helio, with a financing amount of US$170 million, has investors including MoonPay. Helio is a Web3 payment platform. Through Helio, merchants, dApps, and creators can safely and conveniently accept decentralized encrypted payments on Solana, Ethereum, and Polygon, and receive payments directly from customers without middlemen and at low fees. (January 13, 2025)

Alterya, with a financing amount of US$150 million, has investors including Chainalysis. Alterya is a web3 security platform that helps crypto service providers protect their users and prevent authorization fraud by detecting complex scams targeting their real users. Its wallet threat intelligence bridges on-chain and off-chain signals, enabling institutions to effectively reduce fraud and dispute rates while enhancing trust and reducing reputational risks. (January 13, 2025)

Sygnum, with a financing amount of US$58 million, has investors including Fulgur Ventures. Sygnum is a digital asset bank with a Swiss banking license and a Singapore asset management license. It enables institutional and private qualified investors, businesses, banks and other financial institutions to invest in the emerging digital asset economy with full trust. Customers can use their deposited Swiss francs, US dollars, euros and Singapore dollars to invest in leading digital assets. (January 14, 2025)

Phantom, Series C, raised $150 million, with investors including Paradigm, Sequoia Capital, Andreessen Horowitz, Variant Fund, etc. Phantom is a user-friendly crypto wallet that allows users to safely and easily store, purchase, send, receive, trade tokens and collect NFTs on the Solana blockchain. (January 16, 2025)

Komainu, Series B, raised $75 million, with investment institutions such as Blockstream. Komainu is an institutional-grade digital asset custodian. With market-leading technology and compliance processes for different custody structures and regulatory environments, Komainus infrastructure allows all parties to participate, sign contracts and conduct transactions in a trusted environment. (January 16, 2025)