Key indicators: (January 13th 4pm -> 20th 4pm Hong Kong time)

BTC/USD rose 14.8% (93.5k USD -> 107.3k USD), ETH/USD rose 5.1% (3.22k USD -> 3.38k USD)

BTC spot technical indicators at a glance:

The price of the currency found strong support near $92,000 several times, including a brief break below $90,000 but then quickly rebounded. Since then, it has been rising all the way and ended the week by breaking through $100,000, accumulating enough momentum before Trumps inauguration. After breaking through $100,000, the price of the currency experienced several retreats but then rebounded, setting a new historical high with a large positive line before Mondays settlement, and pausing slightly before the next psychological barrier of $110,000.

From a technical perspective, the market will only activate more upward momentum after fully breaking through $110k and reaching our initial target range of $115-120k. Otherwise, if the upward breakthrough fails to achieve the desired result, the market will temporarily move in a large range of $90-110k, which also means that there will be quite volatile single-line price movements in the next few weeks.

Market Theme:

In the macro market, weak producer price index (PPI) data released on Tuesday set the stage for slightly weaker-than-expected consumer price index (CPI) data on Wednesday, easing market concerns that the Federal Reserve would not cut interest rates even once.

The market is looking for opportunities to buy crypto before Trump takes office anyway. Rumors of a pro-crypto policy have been circulating since last week. Against a friendlier macro backdrop, the market didn’t hesitate to temporarily push Bitcoin back to $106k on Friday night. What happened over the weekend (need I say Trumpcoin…) wasn’t a big deal, but it has the potential to hurt Bitcoin’s reputation during the Trump administration, given the sudden increase in wealth for the Trump team. Although SOL was the beneficiary in the short term, Bitcoin still outperformed other altcoins in the end. ETH surged against BTC in a short period of time on the news that “Trump WLFI bought 14.4k ETH” but then quickly faded.

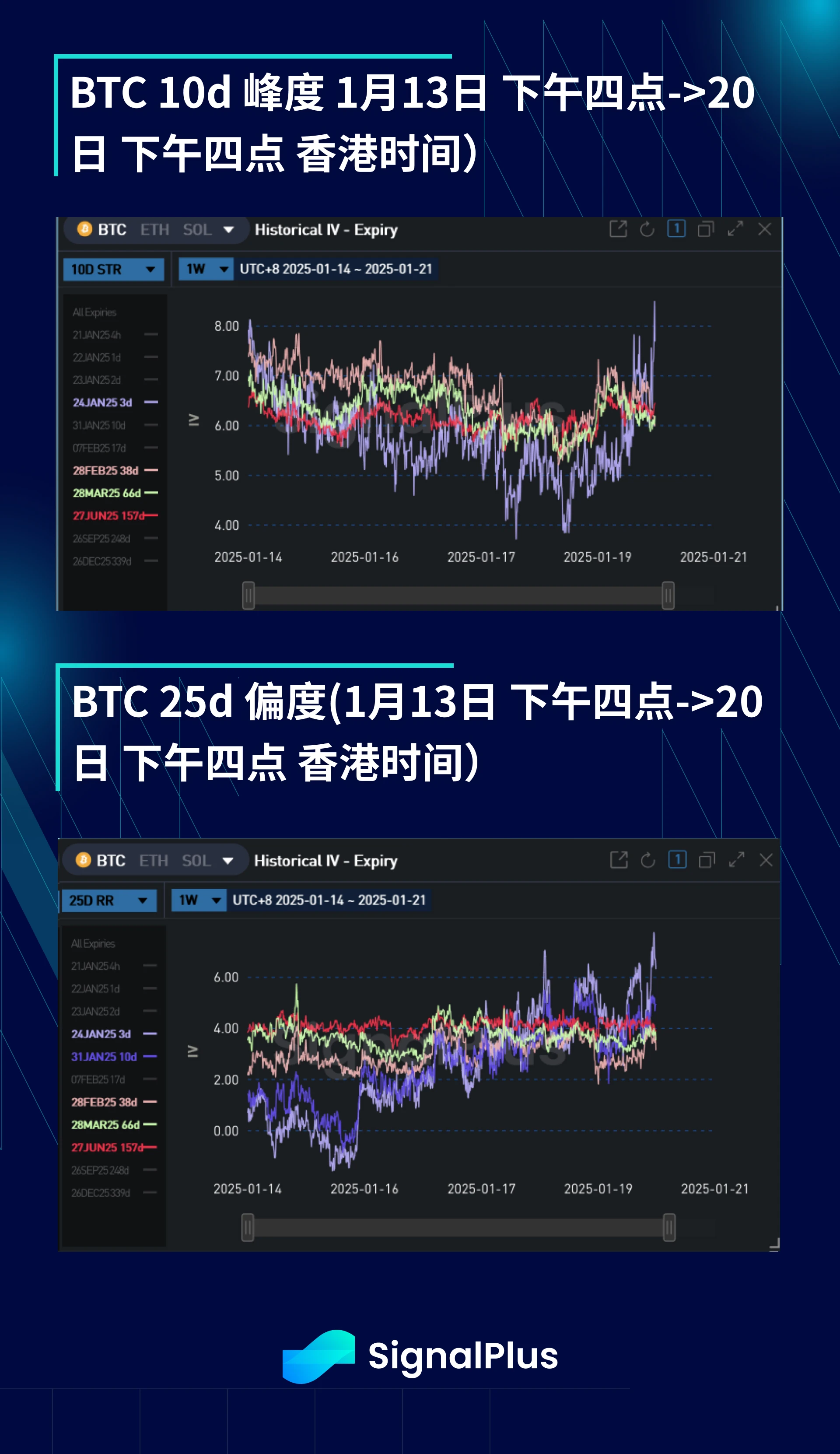

BTC ATM Implied Volatility:

In the middle of last week, volatility pricing for the inauguration event began to increase. Initially, daily volatility was only priced at about 80-82 points (equivalent to a 3.2% price fluctuation) but gradually increased, stabilizing at 90 points of volatility over the weekend. However, before settlement on Monday, volatility rose sharply by 5%, pushing volatility on the day of the inauguration to 110 points (equivalent to a 4.5% price fluctuation). Considering that the price did move so much in a short period of time, it is difficult to argue too much with this pricing.

At the far end of the term structure, volatility swings are still quite high, especially for the February and March maturities, where it seems that there is a lot of flow on both sides, causing the curve to fluctuate 2 points up and down in a short period of time. In general, the implied volatility for these maturities is roughly around 60 points, which is quite high considering that the actual volatility was close to 45 in the 72 hours before the event. But the market may be considering the term premium brought about by the uncertainty of the Trump administrations plans for cryptocurrencies.

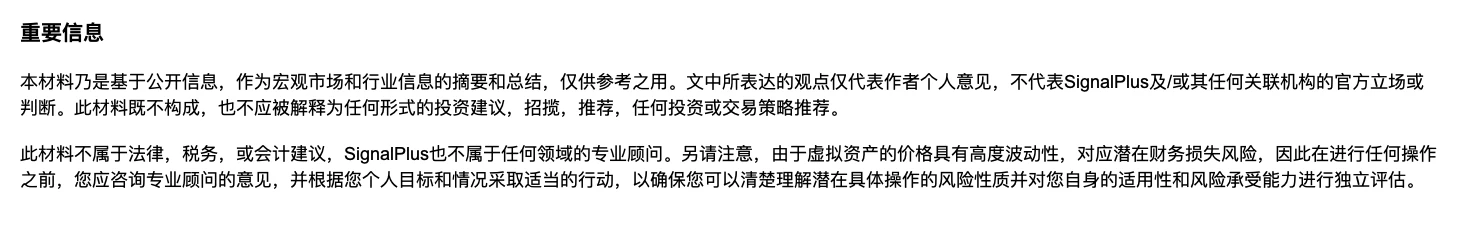

BTC Skewness/Kurtosis

Overall, the skewness has gradually increased this week due to demand from the upside, especially as the price of the currency withstood the impact below $90k and returned to $100k. The most notable demand on the upside is the expiration date of the Gamma term that includes the inauguration, considering the tail risk brought by the potential strategic savings policy on the upside. However, at the far end of the term structure, the price action of the skewness is more moderate, as the market has not rolled the call spreads held or added more single-leg upside positions, suggesting that the market has heavily deployed too many positions from the flow at the end of December and expects to continue rolling after the price of the currency breaks through $120,000.

Gamma terms have seen little kurtosis except for the inauguration demand. New upside demand has been mainly executed through call spreads or call butterflies, with net positions providing wing buying pressure to the market. However, given our highly volatile realized volatility and the local range defined at $90-110k, we believe that being short in the range and long outside the range is a better strategy.

I wish you all good luck in trading in the coming week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com