Original|Odaily Planet Daily

Author: jk

On January 21, local time in the United States, Mark Uyeda, a member of the U.S. Securities and Exchange Commission (SEC), replaced Gary Gensler, the chairman of the SEC who officially left office on Monday , and will serve as acting chairman until Paul Atkins (Trumps official nominee to replace Gensler) completes the Senate confirmation process. On the same day, Mark Uyeda announced the establishment of a cryptocurrency working group with the goal of developing a clear and well-defined regulatory framework for U.S. crypto assets, which has been long awaited by the crypto industry. On January 22, local time, the nomination of the Commodity and Futures Trading Commission, another major regulator of cryptocurrencies, was also released, and Harry Jung (also an Asian) was designated as the person in charge of crypto assets.

As soon as the news came out, the industry was in an uproar. In this article, Odaily Planet Daily will analyze for readers what the backgrounds of these two Asian leaders, Mark Uyeda and Harry Jung, are? Why will this be a big benefit?

Who is Mark Uyeda? Will Mark Uyeda become Mark Uyeda?

After Trump was sworn in as president, his team quickly nominated SEC Commissioner Mark Uyeda (Republican) as acting chairman. According to a memo issued by the White House on January 20, this appointment was one of many federal agency leadership adjustments in the new administration.

The first thing that can be confirmed is that Mark Uyeda is a clearly pro-crypto official.

Mark Uyeda (first from left) is sworn in as SEC Commissioner. Source: YouTube

He has more than 15 years of experience working at the SEC and has supported the industrys position on several events related to the general direction of the crypto industry. But unlike Crypto Mom Hester Peirce, Mark Uyeda is not so famous in the industry.

But what did he do?

He voted in favor of the ETF’s SEC review.

He and Peirce opposed a decision of the SEC in December 2023. At that time, Coinbase requested that the SEC put the rules on cryptocurrency regulation on the formal agenda and formulate clear regulatory rules. However, the SEC rejected the request. Uyeda and Peirce believe that the SEC has the responsibility to respond positively and formulate clear rules.

He has expressed strong opinions on the SEC’s role in the digital asset space. He has often criticized the SEC majority’s regulatory actions against the crypto industry, such as the so-called Staff Accounting Bulletin No. 121 (SAB 121), which made it difficult for banks to serve digital asset customers. He has expressed support for repealing the policy, and the decision is now within his purview.

As well, he previously developed connections to the crypto space through his consulting business in Washington.

From the official statement of the SEC, we can see that Mark T. Uyeda was born in Orange County, California. He received a bachelors degree in business administration from Georgetown University in 1992 and a law degree from Duke University School of Law with honors in 1995. In the early part of his career, he worked as a lawyer in Washington and Los Angeles, and later joined the California securities regulator, the Office of the California Corporate Affairs Commissioner, as chief counsel. During Trumps first term, he served in senior leadership positions at the U.S. Treasury Department and the U.S. Department of Labor. He also served as an expatriate counselor to the U.S. Senate Committee on Banking, Housing, and Urban Affairs. At the SEC, he served as senior counsel to Chairman Jay Clayton, legal counsel to Commissioners Michael S. Piwowar and Paul S. Atkins, and assistant director and senior special counsel of the Investment Management Division, and finally became an SEC commissioner on June 30, 2022.

“After serving as Commissioner since 2022 and having been involved with the SEC as a staff member since 2006, I am deeply honored to serve in this capacity,” said Mark T. Uyeda. “I have great respect for the knowledge, expertise, and experience of the SEC and its staff. The SEC’s mission is critical – protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation, which plays a critical role in driving innovation, creating jobs, and fulfilling the ‘American Dream.’”

By the way, his full name is Mark Toshiro Uyeda, which is obviously a Japanese surname. According to the Japanese-American naming method of putting the Japanese name in the middle name, his Chinese translation should be Ueda Junlang .

According to usual practice, although the acting chairman has the same powers as the official chairman, usually the acting chairman may choose to postpone major decisions and wait for the new chairman to take office. In other words, Mark Uyeda is likely not to make major decisions such as approving an ETF before the new chairman takes office, but will wait until Paul Atkins takes office. If any readers are curious about the new SEC Chairman Paul Atkins, I recommend reading this article: One article to understand the new SEC Chairman Paul Atkins: Crypto industry carnival in advance?

Gary Genslers untimely departure

Gary Gensler resigned on the day Trump was sworn in, as previously announced. Almost all of the senior legal officials who worked under Gary Gensler, including those in the enforcement department and the general counsels office, have left, and it can be inferred that his entire team has left . It is reported that the SECs chief economist Jessica Wachter and general counsel Megan Barbero have also left, and chief accountant Paul Munter is expected to leave on January 24.

And the mere fact that Gary Gensler is leaving is enough for the crypto industry to rejoice.

Following these departures, the CFTC now has a 2:2 split between bipartisan commissioners compared to its sister agency, the Commodity Futures Trading Commission (CFTC), where Republican commissioners outnumber the lone Democratic commissioner by a 2:1 ratio.

Mark Uyeda has been critical of Gary Genslers rulemaking and enforcement methods since he became a Republican commissioner of the SEC in June 2022. However, on the day Gensler left, the commissioners gave the former chairman enough decency: Although we as commissioners have different positions on policy issues, our differences always remain dignified. Chairman Gensler is committed to bipartisan cooperation and respectful exchange of ideas, which promotes our ability to serve the American public.

For details about Gensler’s parting words, see: “ Countdown to leaving office, SEC Chairman Gary Gensler responds to 11 key issues in the crypto market .”

The US version of MiCA: a clear and unambiguous regulatory framework for crypto assets

On Tuesday, Mark Uyeda announced the formation of a “Cryptocurrency Task Force” that aims to “develop a comprehensive and clear regulatory framework for crypto assets.” Hester Peirce, a well-known “Crypto Mom,” will lead the task force. According to a press release published on Tuesday, the goal of the task force is to provide clarity on registration requirements and provide practical solutions for businesses trying to register.

The SEC’s statement was very brief and powerful, as excerpted below:

Mark T. Uyeda, Acting Chairman of the U.S. Securities and Exchange Commission (SEC), today announced the establishment of a cryptocurrency task force dedicated to developing a comprehensive and clear regulatory framework for crypto assets. SEC Commissioner Hester Peirce will lead the task force.

…

The working group is composed of outstanding staff from various departments of the SEC and will work with internal staff of the Commission and the public to establish a reasonable regulatory direction for the SEC that is consistent with legal boundaries.

To date, the SEC has primarily regulated cryptocurrencies in a retroactive and reactive manner through enforcement actions, often employing novel and untested legal interpretations. This approach lacks clarity on registration requirements and practical solutions, leads to confusion about legality, and fosters an environment that is hostile to innovation and conducive to fraud. The SEC can do better.

The Working Group is focused on helping the Commission draw clear regulatory boundaries, provide practical registration paths, develop a sensible disclosure framework , and deploy enforcement resources wisely.

The Task Force will operate within the legislative framework established by Congress and will provide technical support as Congress amends that framework. The Task Force will also coordinate with other federal departments and agencies (including the Commodity Futures Trading Commission) , states, and international partners.

“I look forward to Commissioner Hester Peirce’s efforts in leading cryptocurrency regulatory policy, which spans multiple divisions and offices across the SEC,” said Acting Chair Uyeda.

“This task will take time, patience, and a great deal of hard work. It can only succeed if the Task Force is able to gain input from a broad range of investors, industry participants, academics, and other interested parties. We look forward to working closely with the public to promote a regulatory environment that protects investors, facilitates capital formation, maintains market integrity, and supports innovation,” said Commissioner Hester Peirce.

The working group plans to host future roundtables and welcomes public input via Crypto@sec.gov .

Whether it is a clear and explicit regulatory framework, or the SECs refusal to adopt a retroactive and passive regulatory approach (such as allowing Coinbase and exchanges to operate directly at the beginning, but immediately filing a lawsuit when problems arise), it is something that the entire crypto industry is eager for. It can be seen that the regulatory-friendly period for the crypto industry has completely arrived, and the United States will introduce a series of clear regulatory methods for crypto assets to clarify what can and cannot be done, thereby bringing the crypto industry from the Wild West to more standardized financial compliance products.

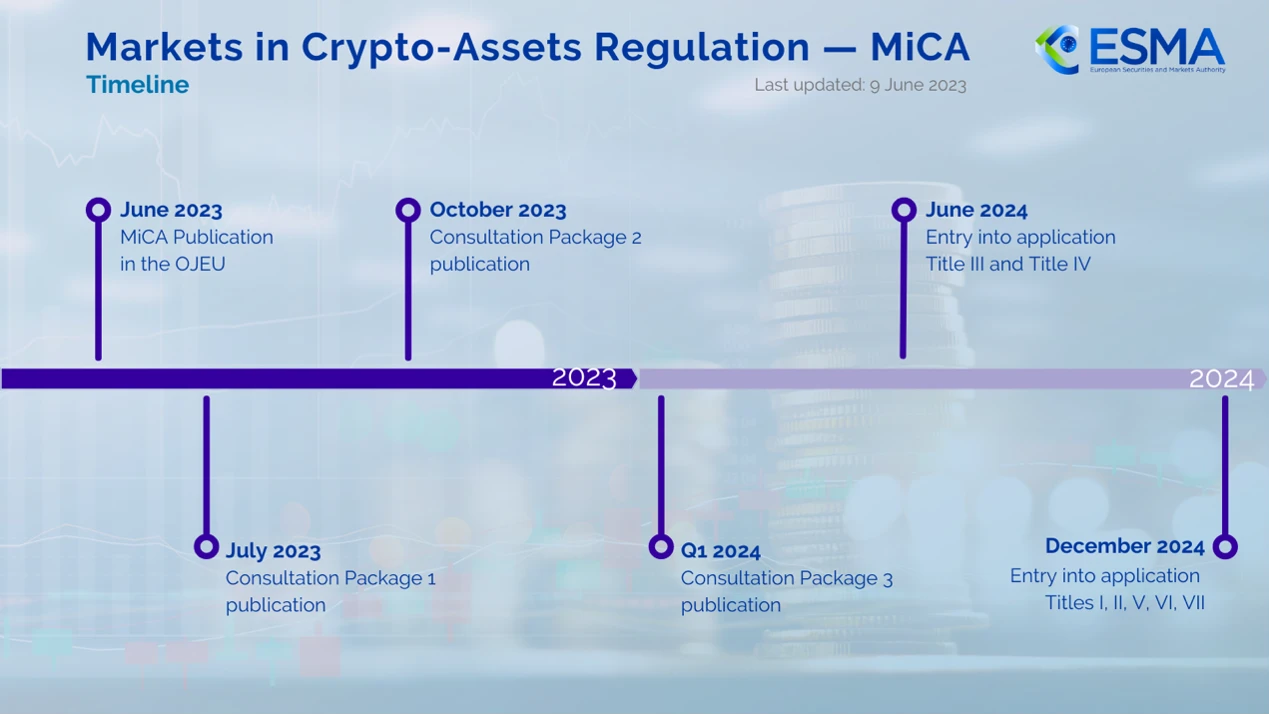

How long is this cycle? By comparing the EU version of the crypto regulatory framework, we can see that the EUs crypto asset market regulation (also known as the MiCA framework) was first published in June 2023, and then after many industry information and applications, it was officially implemented at the end of 2024. So, relatively speaking, if Mark Uyedas working group can also have the same efficiency, then we will see the regulatory framework officially introduced during this Trump term , and the entire industry will benefit from it.

EU MiCA implementation timeline. Source: European Securities and Markets Authority

CFTC: Harry Jung, another pro-crypto figure

CFTC? SEC? Who do they manage and what do they manage?

Before introducing the second Asian executive, let us first explain the difference between the CFTC and the SEC.

The SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) are two major institutions in the U.S. financial regulatory system, and their responsibilities and regulatory scope are very different. The main task of the SEC is to regulate the securities market , protect investors, and maintain market fairness and transparency. It is responsible for supervising financial products defined as securities such as stocks, bonds, options, and regulates the activities of stock exchanges, investment advisors, and securities brokers. The core basis of its supervision is the Securities Act and the Securities Exchange Act, which clarify the definition of securities.

On the other hand, the CFTC focuses on the regulation of commodity futures and derivatives markets . Its responsibility is to ensure that futures, options and derivatives markets are fair and transparent while preventing market manipulation. The CFTCs regulatory basis is the Commodity Exchange Act (CEA), which defines the concepts of commodities and derivatives and provides the CFTC with regulatory powers.

However, the emergence of crypto assets has blurred the regulatory boundaries of the SEC and CFTC. Crypto assets have been jumping back and forth between the definition of securities and commodities; Bitcoin and Ethereum are considered commodities by the CFTC because they are often used as a store of value or a means of paying for gas, similar to commodities such as gold. However, some crypto tokens, especially those issued through ICOs, may be more similar to securities because they involve investors investing money in an entity and expecting to receive returns through the efforts of others. Under the SECs Howey test, such assets may be classified as securities.

An important reason why crypto assets are in flux between the SEC and CFTC is that current laws do not clearly define the classification of crypto assets. Both the SEC and CFTC regulate crypto assets based on their respective legal frameworks, but since crypto assets may have the attributes of both securities and commodities, the regulatory scope of the two is inevitably overlapping (and competing for power). So, this is why a clear regulatory framework mentioned above is so important.

Who is Harry Jung?

According to the CFTC announcement, Acting Chairman Caroline D. Pham announced today that Harry Jung will become the Acting Chief of Staff. While serving as the Chief Advisor to Acting Chairman Caroline Pham, he will lead the CFTCs work in the fields of cryptocurrency, decentralized finance (DeFi), and other digital assets, and continue to advance related work based on his time as the designated federal official of the CFTC Global Markets Advisory Committee.

Harry joined the CFTC in 2023 as Counsel and Senior Policy Advisor to then-Commissioner Caroline D. Pham. Prior to joining the CFTC, Harry held several positions at Citigroup, including as a member of the Office of the CEO and the Office of the Chief Administrative Officer (CAO) , and as Head of Capital Markets Regulation in the Regulatory Strategy and Policy Division. In this role, he briefed the executive team on key market developments and impacts and coordinated enterprise-wide working groups to address emerging issues and global policy forums. Harry also coordinated firm-wide working groups on emerging issues and global policy forums and led regulatory interactions with U.S. prudential regulators and capital markets regulators on digital assets. In addition, he led multiple cross-business and functional projects in the areas of regulatory liaison and inspection management within the Compliance Department.

Prior to joining Citigroup, Harry worked at Morgan Stanley, where he conducted internal compliance examinations and developed policies for new activities in the wealth management business. He also worked at FINRA, where he led the examination of broker-dealers to ensure compliance with securities regulations.

Judging from Harry’s background, he is also a crypto-friendly official who has entered the regulatory level from the industry. This can also fully verify that Trump’s commitment to the crypto industry is gradually being realized, starting with the fact that all key positions are filled by crypto-friendly people.