Market Overview

Overall market overview

This week, the crypto market showed a wide range of fluctuations, and the market sentiment index dropped from 35% last week to 10%, entering the extreme panic range. The market value of stablecoins continued to grow (USDT reached 138.9 billion, USDC reached 51.9 billion), indicating that institutional funds are still continuing to enter the market; the poor market sentiment was mainly affected by Trumps failure to introduce cryptocurrency-related policies in a timely manner after taking office. Although Trump signed a bill on cryptocurrency and the SEC abolished SAB-121 on Thursday, it did not significantly boost market sentiment, causing most tokens to fall more than the market, and Altcoins performed weaker than the benchmark index overall.

DeFi Ecosystem Development

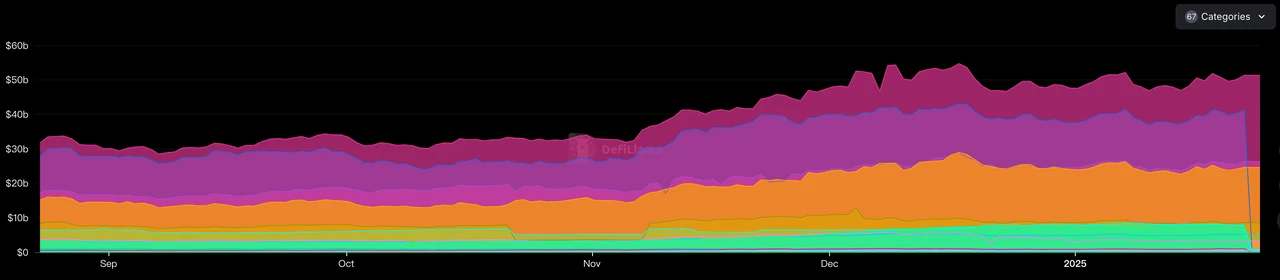

The DeFi sector performed outstandingly, with TVL increasing from $53.5 billion to $53.8 billion, an increase of 0.56%, showing positive growth for two consecutive weeks. Mainly due to the rise in the price of underlying assets and project point incentives, the on-chain APY generally increased, among which Sumer.money, Meteora and other projects performed well in terms of TVL, indicating that investors began to refocus on the basic income in the DeFi field.

AI Track Development

Affected by Trumps announcement of a $500 billion AI infrastructure plan, the total market value of the AI sector reached $41.9 billion, but then fell back due to low market sentiment. In terms of projects, Virtuals Protocol, Swarms, etc. continue to promote technological innovation, focusing on the layout of autonomous trading agents, multi-agent collaboration frameworks and infrastructure construction. At the same time, emerging narratives such as TEE technology applications and agent economic systems are gradually gaining attention.

Meme Coin Trends

This week, the focus of the Meme coin market was on TRUMP and MELANIA, the official tokens issued by Trump and Melania on Solana. This led to a large amount of market funds and attention being concentrated on these two tokens, causing other Meme coins to fall sharply, showing the highly speculative and herd-like characteristics of the Meme coin market.

Public chain performance analysis

In the public chain ecosystem, Solana and Tron performed the best, especially Solana, which benefited from the issuance of TRUMP tokens, with the supply of stablecoins on the chain reaching a record high of $10.138 billion. At the same time, emerging public chains such as Sonic, Core and BSquared continued to innovate in the fields of DeFi and AI, showing good potential for ecological development.

Future Market Outlook

Looking ahead to next week, the market will focus on important events such as the Federal Reserve FOMC meeting, PCE price index and technology stock earnings. The market is expected to maintain a volatile trend, but investors are generally optimistic about the opportunities brought by the gradual clarification of cryptocurrency policies after February. DeFi and AI tracks are expected to continue to benefit from improved fundamentals and policy support, while competition in the public chain ecosystem will further intensify.

Market Sentiment Index Analysis

The market sentiment index dropped from 35% last week to 10%, entering the extreme panic range.

Altcoins performed weaker than the benchmark index this week, and most tokens fell more than the market. This is mainly because investors are generally waiting for the introduction of the Crypto bill and policy in Trumps new policy. Although Trump signed a bill on cryptocurrency and the SEC abolished SAB-121 on Thursday, it did not significantly boost market sentiment. Therefore, investors are currently more cautious about investing in the market, resulting in poor overall market sentiment. Given the current market structure, Altcoins are expected to keep pace with the benchmark index in the short term.

Overview of overall market trends

The cryptocurrency market has been in a volatile trend this week, with the sentiment index entering an extremely panic range.

Defi-related crypto projects have performed better than projects in other sectors, showing the markets continued focus on improving basic returns.

Public opinion about AI projects was high this week, indicating that investors are beginning to actively look for the next market outbreak point.

Hot Tracks

The rise of AI: From Trumps $500 billion infrastructure to 90% of on-chain transactions being intelligent, Web3 is ushering in the first year of the AI revolution

This week, as Trump announced a $500 billion AI infrastructure plan over the next four years, the overall AI sector rebounded, but then fell back because the overall market sentiment was not very high.

In the past week, each project has not stopped innovating due to the huge market fluctuations. Among them, Virtuals Protocol updated the value accumulation mechanism, Swarms set up a 10 million token ecological fund and planned to launch new features, AI16Z expanded the Near and Avalanche ecology, Holoworld launched Launchpool, and AIXBT continued to occupy the top of Kaitos attention list. It can be seen that each project is still steadily advancing its development. At present, the market mainly revolves around autonomous trading agents (such as Co d3 x, Almanak), multi-agent collaboration frameworks (Spectral Lux) and infrastructure construction (Virtuals SDK). At the same time, emerging narratives such as TEE technology application verification, Agent economic system formation and cross-chain Agent ecological integration are gradually beginning to attract market attention.

According to Messaris forecast, by the end of 2025, it is expected that 90% of on-chain transactions will no longer be manually operated by real people, but will be completed by a group of artificial intelligence agents. These intelligent agents can not only make micropayments based on real-time data, but also continuously optimize liquidity pools and reasonably distribute rewards, thereby achieving more efficient and intelligent operations. It can be foreseen that the Crypto market will soon enter the AI era.

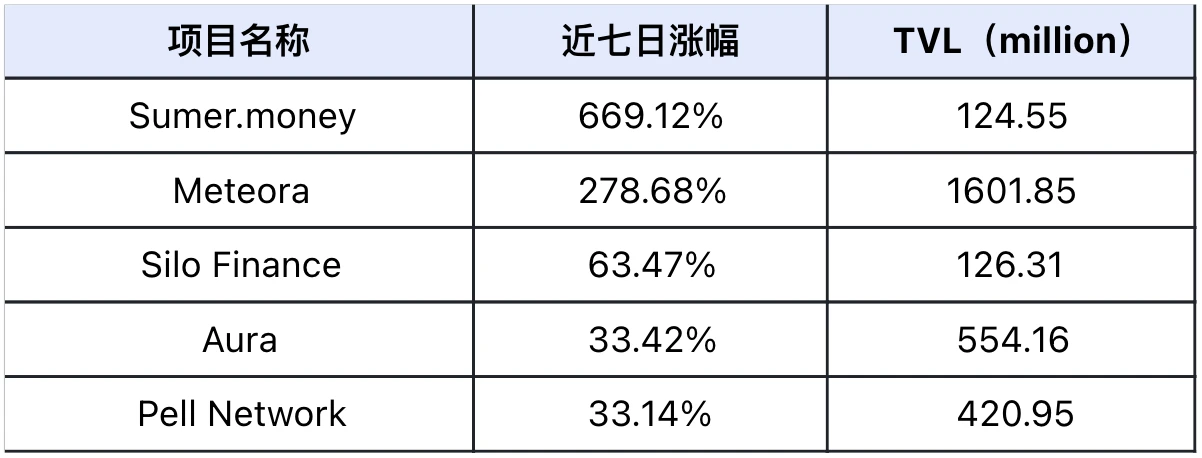

DeFi track TVL growth ranking

The top 5 TVL growth rates of market projects in the past week (excluding public projects with smaller TVL, the standard is more than 30 million US dollars), data source: Defilama

Sumer.money (unissued coin): (Recommendation index: ⭐️⭐️⭐️)

Cooperate with many projects to launch NFT mint activities

Project Introduction: Sumer.money is a cross-chain synthetic asset protocol with a lending market, deployed on supported chain networks. Sumer.money supports the creation of SuToken (synthetic assets of USD, ETH, and BTC), providing users with a credit card-like experience.

Latest developments: Sumer Moneys TVL successfully broke through the 100M milestone this week. At the same time, Sumer Money has reached cooperation with BeraSkool, Bera Horses and Kingdomly to launch NFT mint activities in terms of ecological expansion, and strategically joined Core DAOs Core Ignition program. The team revealed the optimization strategy of Sumer Money Multipliers (suBTC) through AMA and is actively preparing a new funding pool design plan; Sumer.money maintains community activity through Twitter interactive competitions.

Meteora (no token issued): (Recommendation index: ⭐️⭐️⭐️)

Enhance user experience by launching the Liquidity Ratio Slider feature

Project Introduction: Meteora is a DeFi project based on the Solana blockchain that aims to improve capital efficiency and trading experience by optimizing liquidity. It provides tools for decentralized liquidity management, including automated trading, fee analysis, and anti-sniper robot protection for token issuance.

Latest Developments: Meteora launched the innovative Liquidity Ratio Slider function on the technical level this week, simplifying the operational process for users to adjust asset liquidity allocation; in terms of ecosystem construction, LP Army has shown a diversified development trend, attracting users from different languages and regions to participate in liquidity provision, and cooperate with the Starseed team; in terms of community operations, by holding LP Army community conference calls and Office Hours and other activities, it continues to strengthen interaction and communication with users, demonstrating the projects continuous innovation capabilities and global development strategy in the DeFi field.

Silo Finance(SILO):(Recommendation Index: ⭐️⭐️)

Launch S-ETH and S-USDC to increase user benefits

Project Introduction: Silo Finance is a decentralized, permissionless lending protocol that provides a secure and efficient money market by leveraging isolated elements. Silo is designed to solve the main pain points of existing lending protocols, and the security flaws of shared pools are solved by isolating each lending pool.

Latest developments: Silo Finance launched two important markets, S-ETH and S-USDC, this week, providing users with a wealth of trading options. The S-USDC market offers an annualized rate of return of up to 5,425%, while stS/S silo offers a stable return of 7.9%. At the same time, it has established a strategic partnership with Solv Protocol and successfully become the second largest protocol of Sonic Labs, controlling 20% of Sonic USDC supply and 10% of stS supply. Silo Finance attracted user participation this week through the innovative Sonic points mechanism and diversified income strategies.

Aura(AURA):(Recommendation index: ⭐️⭐️)

StableSurge was launched, and the innovative anti-anchor mechanism was effective, with capital efficiency soaring to 1: 1.58

Project Introduction: Aura Network is an NFT-centric public chain project that aims to accelerate the adoption of global NFTs by the blockchain Internet. Aura Network provides an open system that maximizes interoperability and integrates NFTs into the infrastructure layer of the metaverse.

Latest developments: Aura launched the StableSurge Hook technology in cooperation with Balancer this week. This innovative mechanism effectively prevents de-anchoring risks through a price increase tax mechanism, while increasing the returns of LP holders during market fluctuations. Balancer v3 Boosted Pools will be launched on the platform soon, providing users with diversified sources of income, including rewards in multiple dimensions such as trading, lending, and T-Bills. At the same time, it has cooperated with GnosisChain and provided up to 5% GNO cashback incentives. Aura has demonstrated significant capital efficiency in governance, indicating that every $1 of incentives invested can bring $1.58 in output, and distributed more than $300,000 in incentives to vlAURA voters in the recent two-cycle, demonstrating the projects continued innovation capabilities and good operational efficiency in the DeFi field.

Pell Network(PELL):(Recommendation index: ⭐️⭐️⭐️)

Pell Network layout full-chain BTC heavy pledge

Project Introduction: Pell Network aims to create a decentralized token economy security leasing platform for the Bitcoin ecosystem. By building an aggregated native BTC Stake and LSD re-staking service, stakeholders are allowed to choose to verify new software modules built on the Pell Network ecosystem.

Latest Developments: Pell Network has focused on improving the functionality of the PELL token and the integration of the EGLD re-collateralization protocol this week. It has also partnered with SovereignChains to launch the innovative Omnichain Bitcoin re-collateralization network, and has entered into an exclusive partnership with Hatom Protocol to provide algorithmic lending solutions for the MultiversX ecosystem. It has also established strategic partnerships with Atlas_Nodes and P2P validator to jointly promote the development of Bitcoin re-collateralization. At the same time, Pell Network is actively preparing for the issuance of an IDO on xLaunchpad.

To sum up, we can see that the projects with faster TVL growth this week are mainly concentrated in the machine gun pool projects.

Overall performance on the track

Liquidity gradually increases: The APY of on-chain Defi projects has increased significantly due to the rise in the price of underlying assets and the use of points by various Defi projects. Therefore, for investors who are optimistic about the long-term prospects of the Crypto market, returning to Defi will be a very good choice.

Funding situation: The TVL of Defi projects has increased from US$53.5 billion last week to US$53.8 billion now, an increase of 0.56%. The TVL of various Defi tracks has shown positive growth for two consecutive weeks. This is mainly because the market was generally optimistic about Trump’s inauguration as US President in the first quarter, so funds have entered the Defi industry, and the APY of various Defi projects has increased, which has also attracted the participation of on-chain funds, thereby driving the TVL of the Defi market to rise.

Other track performance

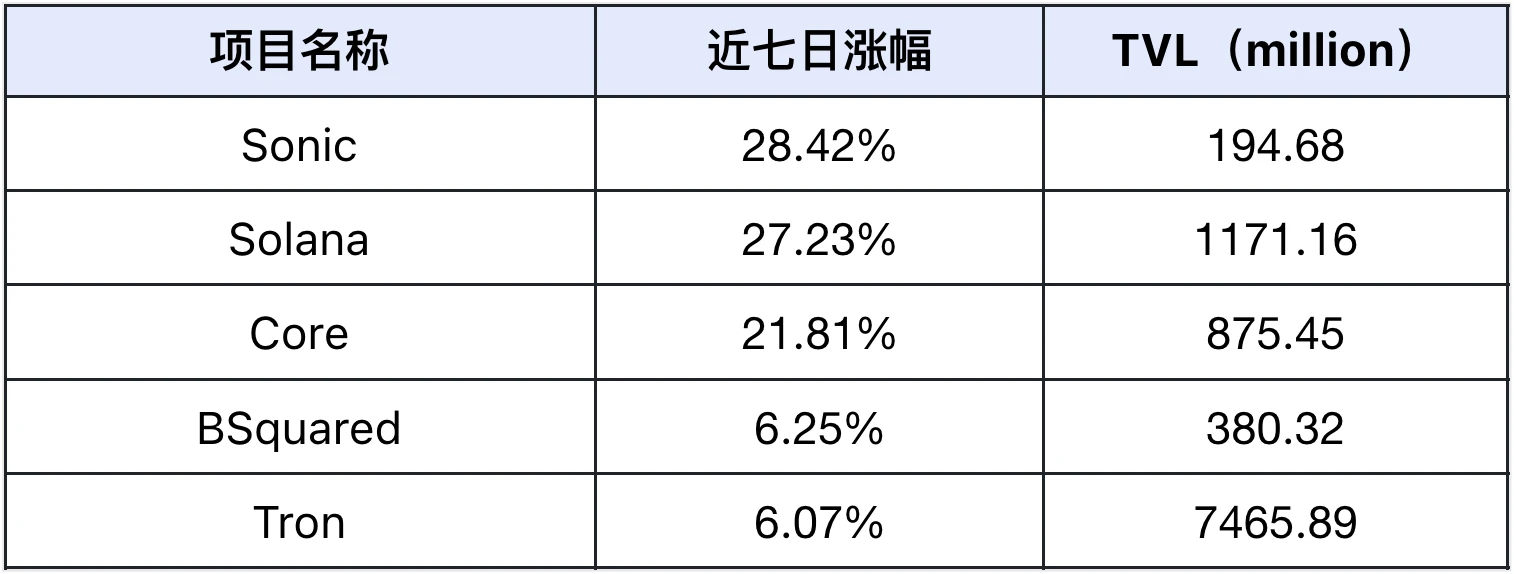

Public Chain

The top 5 public chains with the highest TVL growth in the past week (excluding public chains with smaller TVL), data source: Defilama

Sonic: Sonic dual exchanges go online to ignite ecological heat: integrating Chainlink cross-chain functions, $250,000 DeFAI hackathon boosts AI Agent development

Sonic successfully integrated Chainlinks cross-chain and data feed capabilities this week, and cooperated with OrderlyNetwork to provide stronger cross-chain liquidity support. At the same time, Sonics token $S was successfully listed on two major mainstream exchanges, OKX and Binance, bringing a very good wave of traffic to Sonic. At the same time, Sonic launched the DeFAI hackathon event with a prize pool of US$250,000 to encourage developers to build AI agent applications. In addition, Sonic has established partnerships with multiple platforms such as KuCoin, OKX, and TrustWallet to support token migration, and continues to strengthen community interaction by hosting events such as AMA.

Solana: Trump and his wife landed on Solana, sparking a meme craze, and the supply of stablecoins on the chain broke 100 billion, setting a new high

Solanas core work this week mainly revolves around the expansion of the stablecoin ecosystem. The supply of stablecoins on the Solana chain reached $10.138 billion, setting a record high. Solana also cooperated with E Money Network to enable more than 150 merchants around the world to use Solana stablecoins for payment and get rewards. Multicoin Capital released a research report on Solanas advantages in the capital market, emphasizing its technical advantages of low latency and tight spreads. In terms of ecological construction, Solana also added Indie.fun as a community fundraising platform exclusively for Solana games. The most important thing is that this week Trump and Melania issued their own official Meme coins TRUMP and MELANIA on Solana, which brought huge traffic and capital to Solana.

Core: Core takes a three-pronged approach to deepen the BTC consumer chain: join hands with SumerMoney to strengthen lending, Coretoshi NFT innovative incentives

This week, Cores work mainly revolved around three directions: first, in terms of ecosystem construction, it established a deep partnership with SumerMoney to enhance the platforms lending function; second, in terms of product innovation, it optimized the Sparks reward mechanism through Coretoshi NFTs, while continuing to attract Bitcoin inflows to consolidate its position as a Bitcoin consumer chain; finally, in terms of marketing, it plans to hold a DAO Gallery event in Tokyo and launch the Core Ignition event to increase user engagement and platform activity.

BSquared: B² Network joins hands with 0G_labs to build a decentralized AI operating system and lay out the BTC native AI Agent ecosystem

B² Networks work this week focused on the layout of the AI track: first, it reached a strategic cooperation with 0G_labs and Gaianet_AI to jointly develop a decentralized AI operating system; secondly, through cooperation with ElizaOS_ai, ai16z dao and other projects, it deepened the technical integration of Bitcoin and AI Agent; at the same time, it also teamed up with utxostack to launch the Lightning Genesis airdrop event, showing the projects development dynamics in multiple dimensions such as AI infrastructure, application ecology and community building.

Tron: After Sun Yuchen became the crypto advisor to the Trump family, Tron made a high-profile appearance at three major events in the Washington power center

Following Trons founder Justin Suns appointment as an advisor to the Trump familys cryptocurrency project World Liberty Financial, as Trump took office as US President this week, Tron this week focused on participating in a series of high-profile events in Washington, DC, including important occasions such as Crypto Ball, Presidents Reception and Candlelight Dinner, through in-depth dialogues with policymakers and industry leaders to promote the compliance development of cryptocurrencies and the widespread adoption of blockchain technology.

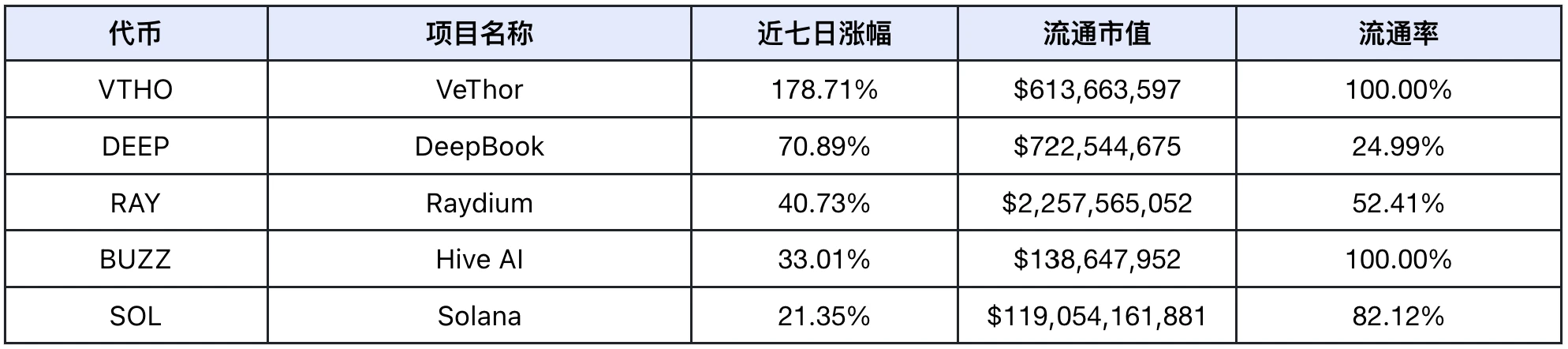

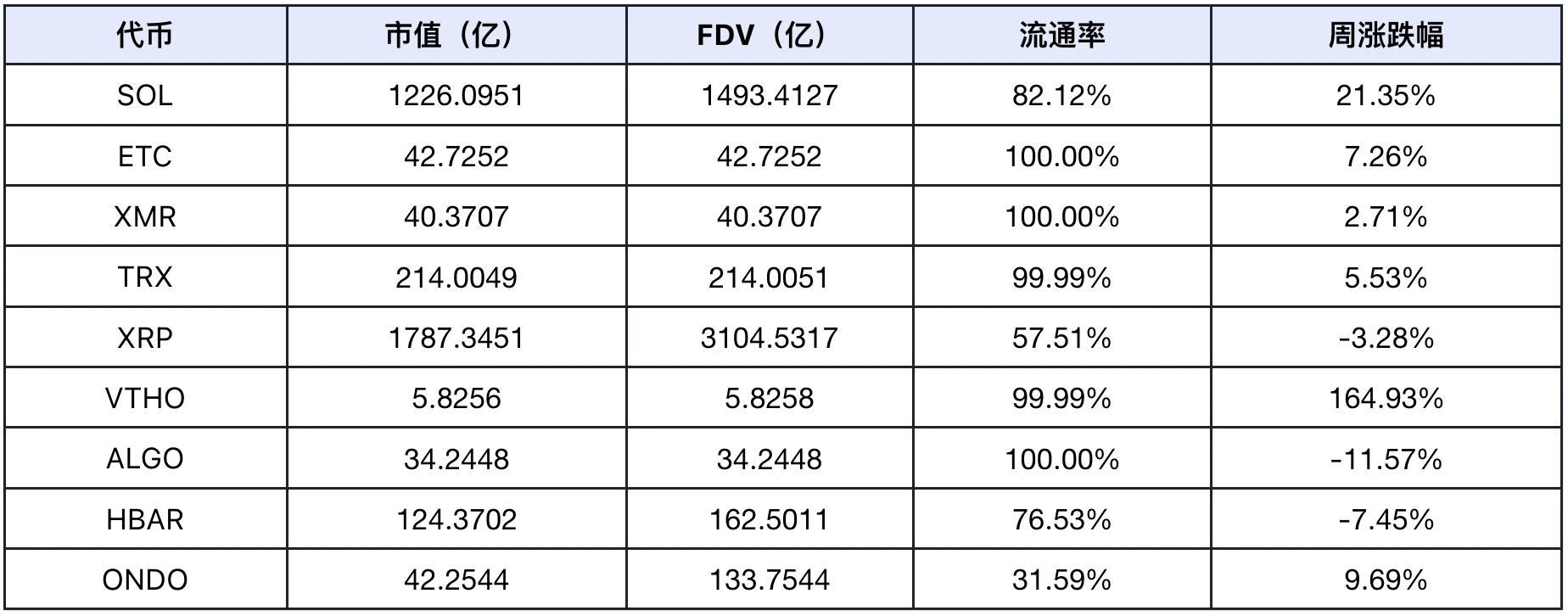

Overview of the Rising Stars

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

VTHO: VeThor launches B3TR protocol upgrade to enhance security, UFC cooperation continues to increase NFT ecological layout

This week, VeThor promoted key protocol upgrades on the technical level and launched the B3TR function to strengthen platform security and daily application scenarios. In terms of ecosystem construction, it demonstrated vitality through continued cooperation with UFC and support for NFT innovative projects. At the same time, it optimized the staking and reward distribution mechanism to improve user experience and actual yield. VeThor also deepened its layout in the field of sustainable development through cooperation with Mugshot, reflecting VeThors balanced development strategy between technological innovation and practical application.

DEEP: DeepBook V3s daily transaction volume breaks $52.6 million, setting a new record. The low fee advantage consolidates Suis position in DeFi infrastructure

DeepBook achieved an important milestone of $52.6 million in 24-hour trading volume after the V3 version this week. This achievement not only confirms the maturity of its technical architecture, but also reflects the important position of the platform in the DeFi field. By continuously emphasizing the advantages of low handling fees and the brand positioning of I am the pulse of DeFi, DeepBook has further consolidated its position as the core DeFi infrastructure in the Sui ecosystem. DeepBook is making substantial progress in the field of decentralized trading through optimized user experience and stable technical support.

RAY: Raydium seizes the opportunity of Trump concept currency to launch 10x leverage contract, and distributes 200,000 USDS weekly to stimulate liquidity

As the Solana ecosystem has become popular this week, Raydium, as a well-known DEX on the Solana chain, has also received a great boost this week. Raydium has followed the market trends and launched $MELANIA and $TRUMP perpetual contracts that support 10x leverage, expanded its Perps trading product line, and renewed the USDS reward program, providing 50,000 USDS+ 750 RAY rewards per week in the SOL-USDS Vault, 100 RAY rewards per week in the SOL-USDS 0.03% pool, and 150,000 USDS rewards per week in the USDS-USDC Vault. Through these initiatives, it continues to attract user participation and improve platform liquidity.

BUZZ: Hive AI upgrades Swarm distributed architecture to achieve multi-agent collaboration, and Market Agent intelligently tracks top trader strategies

This week, Hive AI implemented a multi-agent collaborative working mechanism through the innovative Swarm distributed architecture, significantly improving the overall system performance. The Token Analysis Agent updated the charting tools and token data UI, and launched an experimental portfolio page to enhance the liquidity management support for the Raydium protocol. Hive AI provides users with more comprehensive portfolio analysis and profit discovery capabilities by continuously accessing more protocol data. In particular, Hive AI has realized intelligent analysis of the trading behavior of top traders through Market Agent, demonstrating its unique advantages in the field of cryptocurrency data processing and intelligent analysis.

SOL: Trump and his wife landed on Solana to set off a meme craze, and the supply of stablecoins on the chain broke 100 billion to a new high

Solana was greatly benefited this week by the launch of Trump and Melania’s own official meme coins TRUMP and MELANIA on Solana, which brought Solana a huge influx of traffic and funds. The supply of stablecoins on the Solana chain reached $10.138 billion, setting a record high. Solana also cooperated with E Money Network to enable more than 150 merchants around the world to use Solana stablecoins for payment and obtain rewards. Multicoin Capital released a research report on Solana’s advantages in the capital market, emphasizing its technical advantages of low latency and tight spreads. In terms of ecological construction, Solana also added Indie.fun as a community fundraising platform exclusively for Solana games.

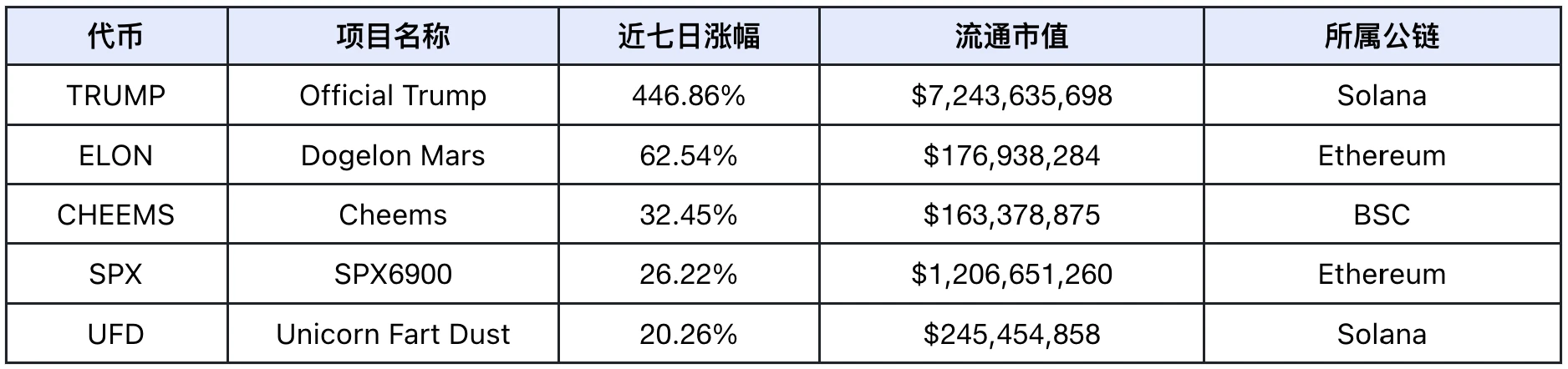

Meme Token Gainer List

Data source: coinmarketcap.com

The market was in a wide range of fluctuations this week. After Trump and Melania issued their own official Meme coins TRUMP and MELANIA on Solana, most of the funds and attention in the market were attracted to them, and in a short period of time, most other tokens in the market, especially other Meme coins, fell sharply.

Social Media Hotspots

Based on the top 5 daily growth in LunarCrush and the top 5 AI scores in Scopechat, here are the stats for this week (1.18 – 1.24):

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: Lunarcrush and Scopechat

TRUMP coin caused market volatility and capital diversion, and Layer 1 projects took the lead in stabilizing and rebounding with high DeFi yields

According to data analysis, Layer 1 projects received the most attention on social media this week. The overall market trend showed a wide range of fluctuations this week. After Trump issued his own official Meme coin TRUMP on Solana last weekend, liquidity in the market was quickly withdrawn by TRUMP, and active funds on the chain poured into the Solana chain, causing projects in various tracks to fall. When Trump took office on Monday, Crypto was not involved in the swearing-in ceremony and the bills signed in the first two days. Although Trump signed a bill on cryptocurrency and the SEC abolished SAB-121 on Thursday, it did not significantly boost market sentiment, so various projects experienced varying degrees of decline. However, after a brief decline, the various Layer 1 projects, because of the markets optimism about the future market conditions and the increase in APY of Defi projects on various chains, attracted more on-chain users to participate. In addition, most Defi projects use the tokens of various Layer 1 projects as targets, which caused the market to shift its attention and funds to various public chain projects.

Overall overview of market themes

Data source: SoSoValue

Based on weekly returns, the Defi track performed the best, while the Gamefi track performed the worst.

Defi track: There are many projects in the Defi track. In the sampling of SoSoValue, LINK, UNI and AAVE account for the largest proportion, reaching 43.36%, 18.11% and 13.07% respectively, totaling 74.54%. This week, LINK, UNI and AAVE rose by 11.42%, 2.13% and 7.86% respectively, resulting in the largest increase in the entire Defi track among all tracks. And with the drastic price fluctuations this week, many arbitrage opportunities have been generated on the chain, so the Defi track projects performed best this week.

Gamefi track: In this cycle of this year, the Gamefi track has not received much attention from the market, and thus little capital and traffic have entered, resulting in the lack of the previous wealth-making effect of the Gamefi track, which has led to a decrease in its attention. Among its tracks, IMX, BEAM, GALA, SAND, and AXS account for a total of 71.99%. The performance of these coins has dropped sharply this week, resulting in the worst performance of the Gamefi track.

Crypto Events Next Week

On Thursday (January 30), the Federal Reserve FOMC announced its interest rate decision; the number of initial jobless claims in the United States for the week ending January 25; the Federal Reserves interest rate decision (upper limit) in the United States until January 29; Plan B Forum El Salvador 2025; Ethereum Ziirich 2025; Tesla releases its fourth quarter and full-year financial report for 2024.

On Friday (January 31), the U.S. core PCE price index annual rate for December was released; OneKey Card announced that it will gradually stop its services.

Outlook for next week

Macroeconomic factors analysis

There will be many financial events next week, including the Federal Reserves interest rate meeting, the US December core PCE price index annual rate, and the US listed companies entering the earnings season. The market has basically fully priced in that the Federal Reserve will keep interest rates unchanged at the January interest rate meeting. The US December core PCE price index annual rate to be announced later is one of the indexes that the Federal Reserve is more concerned about, which will have a certain impact on the Federal Reserves next interest rate meeting to a certain extent. In addition, after the US listed companies enter the earnings season, the good or bad earnings of the seven US technology giants will cause fluctuations in the market in the short term, so it is expected that the market will continue to fluctuate next week.

Sector rotation trend

Although the current market sentiment in the DeFi track is poor after repeated fluctuations in recent weeks, investors generally expect that after February this year, as the relevant Crypto policies are gradually announced, the market will see a general rise. Therefore, most investors are still reluctant to sell their tokens. At the same time, in order to increase the income from holding coins, they have participated in machine gun pool projects to increase their returns.

The AI Agent track of the AI sector has not received sustained attention from the market. The market value has begun to decline for the first time. The current market value is 15 billion US dollars, down nearly 5.66% from last week. This week, due to Trumps announcement of investing 500 billion US dollars in the next four years to carry out AI infrastructure plans, the AI sector has rebounded as a whole, but this rebound trend has not continued, indicating that the current market sentiment is poor. Market investors are generally waiting for the introduction of Crypto bills and policies in Trumps new policy, so they are more cautious about investing in the market at present. However, as an industry supported by the US government in the next four years, the AI track still has great development potential in the future. And according to market research reports, by the end of 2025, it is expected that 90% of on-chain transactions will no longer be manually operated by real people, but by a group of artificial intelligence agents. It can be foreseen that the Crypto market will enter the AI era in the future.