On the afternoon of February 19, 2025, the Securities and Futures Commission (SFC) of Hong Kong officially released the Virtual Asset Roadmap to address various problems encountered in the development of the current Hong Kong virtual asset trading market.

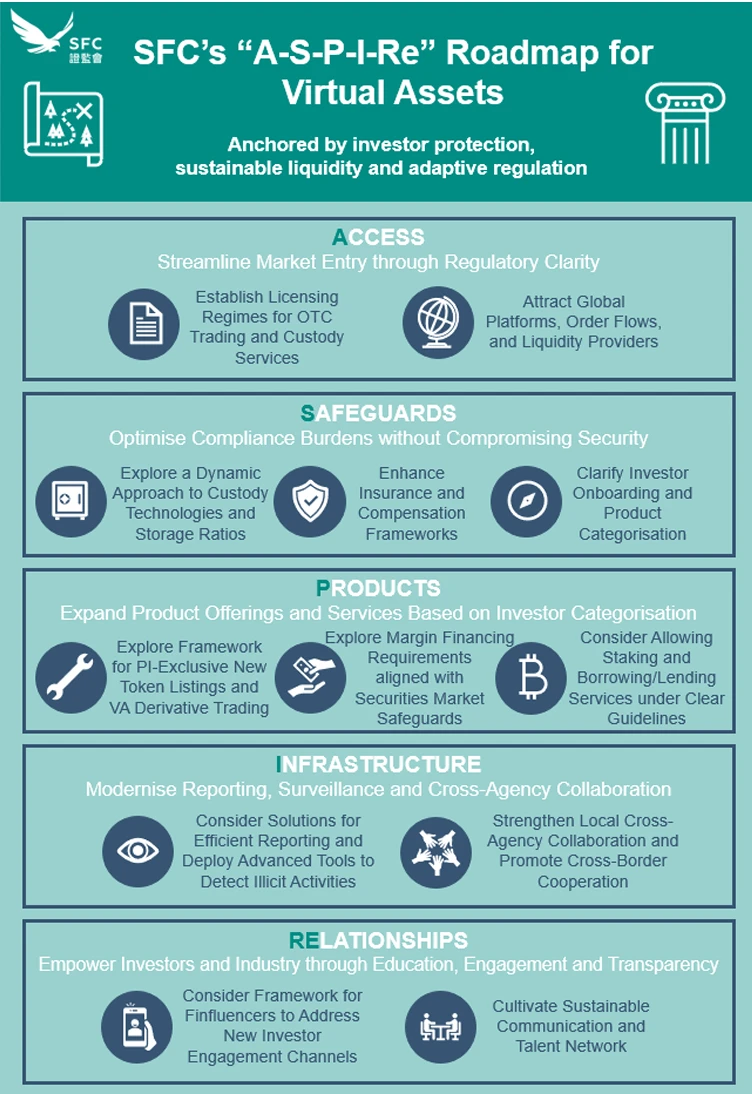

This roadmap, also known as ASPI-Re, proposes 12 major measures based on the five pillars required for the development of Hong Kongs virtual asset market, namely access, safeguards, products, infrastructure and relationships, conveying to investors and institutions the overall development and regulatory direction of Hong Kong in the next few years.

As a professional lawyer team that continuously tracks the latest developments in the global Web3 and cryptocurrency fields, Crypto Salad has been personally involved in the practice of Hong Kongs virtual asset trading market. This time, we will take the opportunity of interpreting this roadmap in depth to sort out the current situation, difficulties and future development signals of Hong Kongs virtual asset trading market from the perspective of Web3 professional lawyers.

1. What is the background for the formulation of the “ASPI-Re” roadmap?

As one of the global financial centers, Hong Kong began to gradually explore the regulatory framework for virtual assets as early as 2018. In 2023, the SFC took the lead in bringing virtual asset transactions under the regulatory scope, requiring virtual asset trading platforms (VATPs) to obtain licenses, and introduced investor protection measures consistent with traditional finance. In April 2024, Asias first batch of virtual asset spot exchange-traded funds (ETFs) were successfully listed on the Hong Kong Stock Exchange. It can be said that Hong Kong has always been at the forefront of innovation and regulation of virtual asset transactions.

However, CryptoSallu believes that the development of Hong Kongs virtual asset market has still faced some difficulties and obstacles to be resolved, which are mainly reflected in the following points:

Market activity: 2024 is a year of surging market value and trading volume of virtual assets, with a global market value of over 3 trillion US dollars and an annual trading volume of up to 70 trillion US dollars. Although Hong Kong has transparent regulatory policies and support from financial technology innovation, its virtual asset market size has been relatively limited. As of December 6, 2024, the total trading volume of Hong Kongs crypto spot ETF exceeded 58 million US dollars, which is a record high. The reason is that there is a lack of sufficient industry giants and capital inflows, and it faces the dilemma of small market is not active and large market is not open.

Market access restrictions: As the Asia-Pacific financial center with the highest participation of Chinese investors, the identity access of mainland investors is restricted. This results in the mainland investor group being unable to participate in compliance despite having the largest potential scale. Users from other regions generally choose to trade in their own jurisdictions or on mainstream global exchanges. Therefore, the Hong Kong market is separated from other international financial centers on the trading side.

In response to this dilemma, members of the Hong Kong Legislative Council also proposed on February 20 that they would continue to actively promote and improve the relevant regulatory framework as soon as possible. They believe that there is room for further relaxation of supervision to allow the virtual asset industry to grow bigger.

Product categories: The categories of Hong Kongs virtual asset trading market are limited, mainly concentrated in mainstream currencies such as Bitcoin and Ethereum, and the transaction volume of other currencies is relatively small; licensed trading institutions have limited development in the field of derivative innovation, and now licensed exchanges and traditional financial products have limited development of derivatives. Tokenized funds are in the process of new exploration.

On the other side of the global market, the United States has already taken the lead in the virtual asset market and trading volume. Since Trump took office this year, he has quickly issued and implemented a series of favorable virtual currency policies, and received full cooperation from regulatory agencies such as the SEC.

Therefore, for Hong Kong, if it wants to further open up the situation, the development direction and strategy from 2025 to 2027 are crucial. Hong Kong needs to find new breakthroughs as soon as possible to cleverly respond to the competition in global virtual assets.

II. Overview of the “ASPI-Re” Roadmap: Five pillars support the new ecosystem of virtual assets

The ASPI-Re roadmap launched by the SFC proposes five pillars and 12 measures to plan and solve the current problems facing the Hong Kong virtual asset market in a targeted manner.

1. Pillar A (Access) - Simplifying market access and providing a clear regulatory framework

Objective: To establish a clear and transparent licensing framework to attract high-quality global virtual asset service providers to Hong Kong.

Initiatives:

1. Consider establishing a licensing system for OTC trading and asset custody services, and consider formulating a licensing system for custodians;

2. Allow the establishment of a two-tier market structure that separates trading and custody, and promote the entry of institutions and liquidity providers into the Hong Kong market.

2. Pillar S (Safeguards) - Strengthening compliance prevention and control

Objective: Provide clear regulatory guidance to align virtual asset markets with traditional financial (TradFi) frameworks.

Initiatives:

1. Study the regulatory framework for new token listings and virtual asset derivatives trading for professional investors;

2. Clarify investor access requirements and product classification to ensure that investors obtain products that are suitable for their risk tolerance;

3. Adjust the ratio requirements of cold and hot wallets, and introduce diversified insurance and compensation mechanisms.

3. Pillar P (Products) – Expand product categories, investment tools and service innovation

Objective: To provide multi-level, differentiated investment tools based on the risk tolerance of different investors.

Initiatives:

1. Plan to explore new coin listings and virtual asset derivatives trading exclusively for professional investors;

2. Explore virtual asset margin financing requirements to align with risk management measures in the securities market;

3. Consider providing staking and lending services under clear custody and operating guidelines.

4. Pillar I (Infrastructure) – Upgrading regulatory infrastructure

Objective: To enhance market supervision capabilities, utilize advanced data analysis and monitoring tools, and enhance cross-institutional collaboration and market monitoring capabilities.

Initiatives:

1. Deploy a data-driven blockchain monitoring platform and consider adopting a straight-through digital asset information reporting solution to detect illegal activities;

2. Promote cross-border cooperation with global regulators.

5. Pillar Re (Relationships) – Facilitating investor communication and education

Objective: To enhance investors’ and industry participants’ knowledge of virtual assets and their risk control capabilities through extensive information exchange and education and training.

Initiatives:

1. Build a cooperation mechanism with financial influencers and standardize investor publicity channels;

2. Establish a sustainable industry communication and talent training network to promote long-term market development.

3. Crypto Salad Concept

The global virtual asset market has undergone a critical reshaping in 2024. This year, a series of factors, such as the sharp rise in technology stocks, the continuous expansion of payment channels, changes in the global liquidity situation, and the relaxation of crypto regulation caused by the Russia-Ukraine war, have intertwined and collided with each other, giving rise to many new market chemical reactions and gradually surfacing the hidden problems under the new situation.

From the perspective of the participants, the market presents a situation where institutional investors and retail investors coexist. However, some whales with too high a proportion of holdings have brought market manipulation risks. For holding giants such as BlackRock and MicroStrategy, the top 2% of Bitcoin wallet addresses actually control about 95% of the supply. At the same time, there are many ancient wallets with extremely low holding costs, which further aggravates the imbalance of the market and limits the overall market activity.

In terms of trading models, differentiation is very serious. Centralized trading platforms (CEXs) account for half of the global trading volume, but the market structure has already taken shape, with mainstream exchanges such as Binance and Coinbase in a dominant position, and it is difficult for new entrants to get a share. Although decentralized trading platforms (DEXs) can meet specific needs, they lack standardized protection measures, causing users to face risks such as smart contract vulnerabilities and fraud.

Looking ahead to 2025, the virtual asset market is about to open a new chapter. Hong Kong, as the financial center of the Asia-Pacific virtual asset trading market, has suffered the impact of the outflow of industry elites, which has led to a shortage of talent, capital and industry. Despite this, its industry scale is still relatively limited and the market has not yet been fully opened, so it is urgently needed to seek new breakthroughs and changes in the global competitive environment.

The ASPI-Re roadmap released by the Hong Kong SFC this time has many commendable new contents in terms of balancing supervision and promotion.

First, supervision has been comprehensively strengthened. While cryptocurrencies bring economic promotion and financing convenience, they also provide opportunities for criminals to launder money due to their own characteristics. In particular, the high anonymity of the OTC trading market and the rapid liquidity of cross-chain transfers make it difficult to track traditional anti-money laundering methods. Therefore, Hong Kong has previously implemented a licensing management system for virtual asset trading platforms and launched regulatory recommendations for OTC transactions at the beginning of this year.

The roadmap also mentions the consideration of developing a custodian licensing system. So far, Hong Kong has basically achieved comprehensive supervision of virtual asset trading platforms, including investor access requirements, regulatory framework for virtual asset derivatives, using advanced data analysis and monitoring tools, considering adopting a straight-through digital asset information reporting solution to detect illegal activities, and promoting cross-border cooperation with global regulators to achieve global virtual asset data circulation.

In addition to the above-mentioned regulatory requirements, the ASPI-Re roadmap proposes more measures to promote the market, and has made comprehensive strategic considerations from trading mechanisms, market concepts to investor education.

For example, considering allowing virtual asset pledge, once implemented, it will form a triple positive situation of capital appreciation, enhanced asset liquidity and increased cash flow income. Investors can use pledged virtual assets as collateral through banks and other financial institutions, just like traditional assets, to obtain liquidity. At the same time, this model can also enable investors to enjoy the capital appreciation brought by ETH pledge, and enjoy the benefits of cash flow by virtue of the liquidity of funds obtained by pledge.

In addition, the SFC also emphasized the importance of investor education, which is an extremely important link that many regulators have previously ignored. As we all know, the cryptocurrency industry is an industry with a very rapid pace of development and change. In just over a decade, it has grown from a niche asset that no one cares about and no one is optimistic about to a major asset that is now being pursued by global capital giants and even included in the national strategic reserve for investment layout. It has quickly completed the journey that other assets have taken decades or even hundreds of years to complete.

In Hong Kong, a region with a population of nearly 10 million, although many people understand the concepts of virtual assets and cryptocurrencies, relatively few people truly understand and actively participate in them. Even some retail investors who have already invested in them lack the corresponding knowledge system and risk identification ability. Therefore, only when investor education keeps up can Hong Kongs virtual asset development blueprint truly flourish.

Therefore, if all the measures and goals in this ASPI-Re roadmap can be successfully implemented, Hong Kong will inevitably create a virtual asset investment environment with higher market activity, more emerging and diverse investment strategies, and more transparent and secure supervision in the next few years. From its global ecological niche, Hong Kong is also expected to occupy an important position in the global virtual asset layout and lead the innovation and development of the global virtual asset market.

This article only represents the personal views of the author and does not constitute legal advice or legal opinion on specific matters.