Just when FTX victims finally received repayment, the cryptocurrency market suffered another heavy blow. Bybit announced that it had been hacked and a cold wallet was stolen of about $1.5 billion worth of ETH. The outside world believed that it might be the work of North Koreas Lazarus Group.

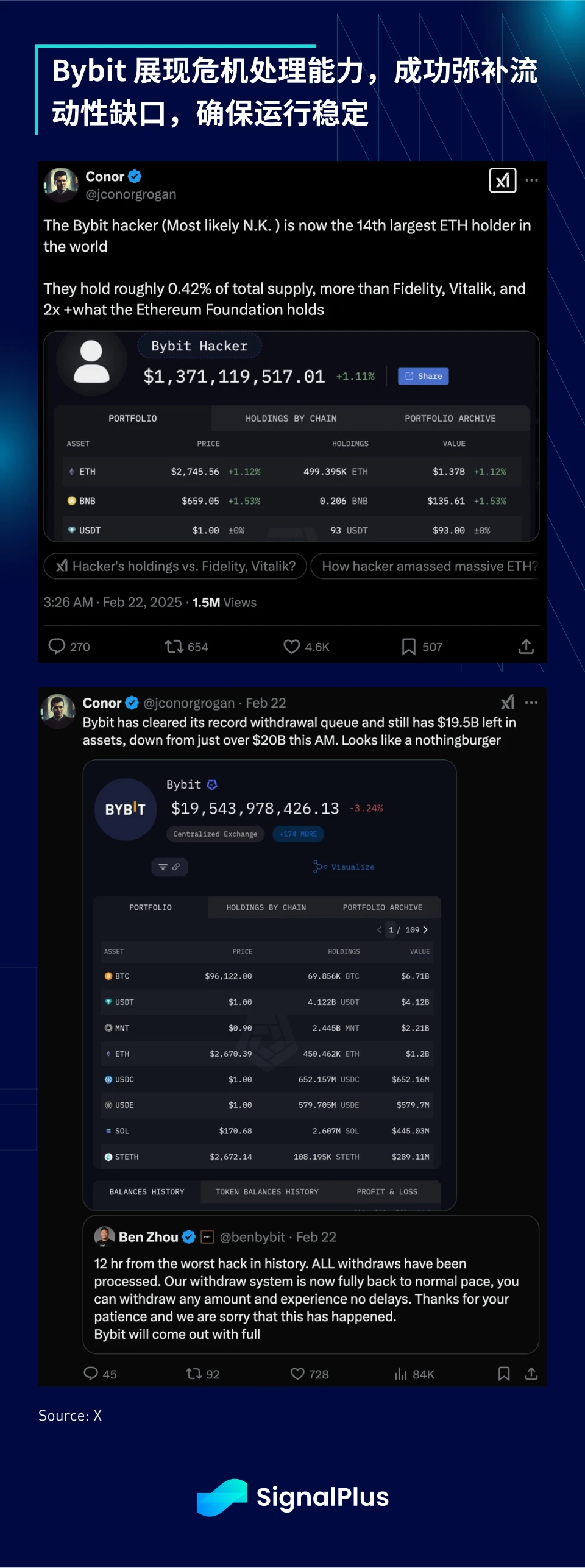

More than 400,000 ETH were stolen, making it the largest cryptocurrency theft in history. The hacker also became one of the worlds largest ETH holders, even surpassing Vitalik, Fidelity, and the Ethereum Foundation.

If this incident had happened a few years ago, it would have caused a massive panic and chain reaction in the market, but this time the incident was properly handled within 24 hours, including Bybit management issuing a clear public statement in a timely manner to ease public concerns and ensure that the withdrawal request of about US$5.5 billion was carried out smoothly. In addition, the entire cryptocurrency community quickly united to support Bybit through the funding gap through short-term loans, and finally successfully stabilized the situation and market prices without much impact (at least for now).

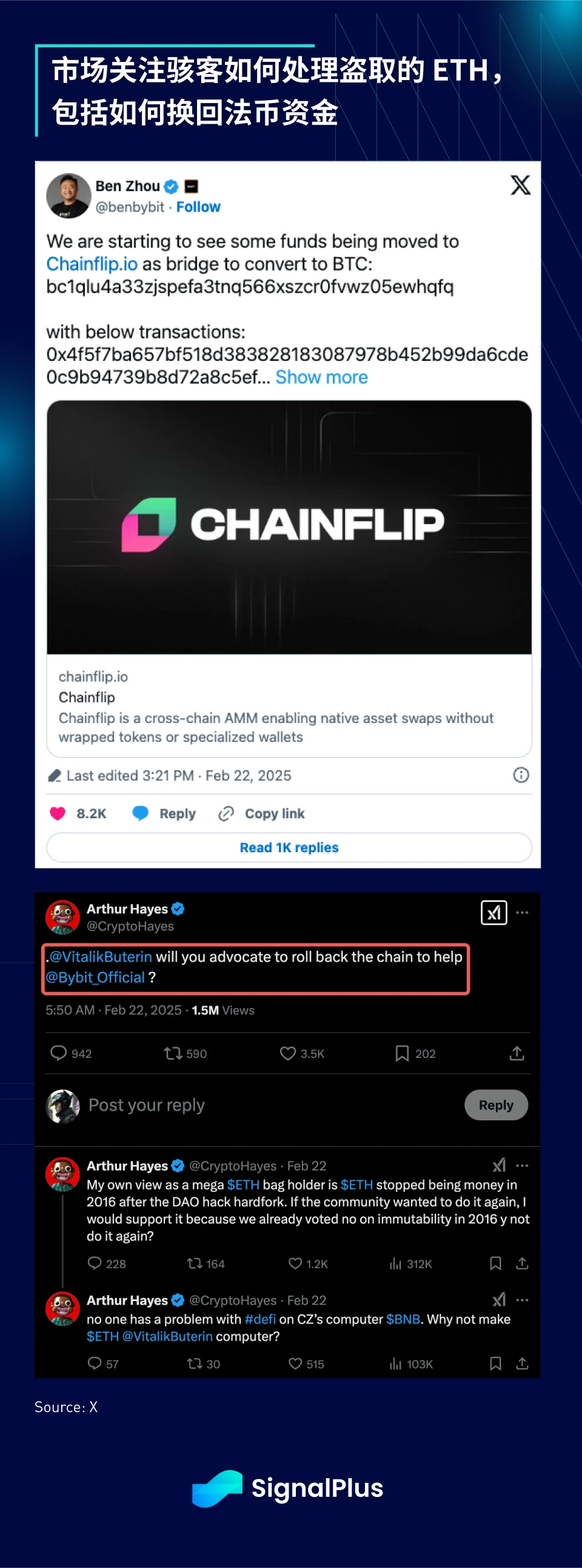

However, there is still a question in the market: what should be done with the 400,000 ETH now stored in these contaminated wallets? OFAC may soon take sanctions to prevent these funds from re-entering the system, however, hackers have begun to launder funds through cross-chain bridges and various AMM protocols, which may trigger a wider range of regulatory measures and affect Ethereum’s acceptance among compliance institutions.

In addition, there are even calls for a rollback in the market to undo transactions stolen by hackers. However, this brings up disputes about centralization and feasibility, and it will be difficult to reach a consensus in the short term.

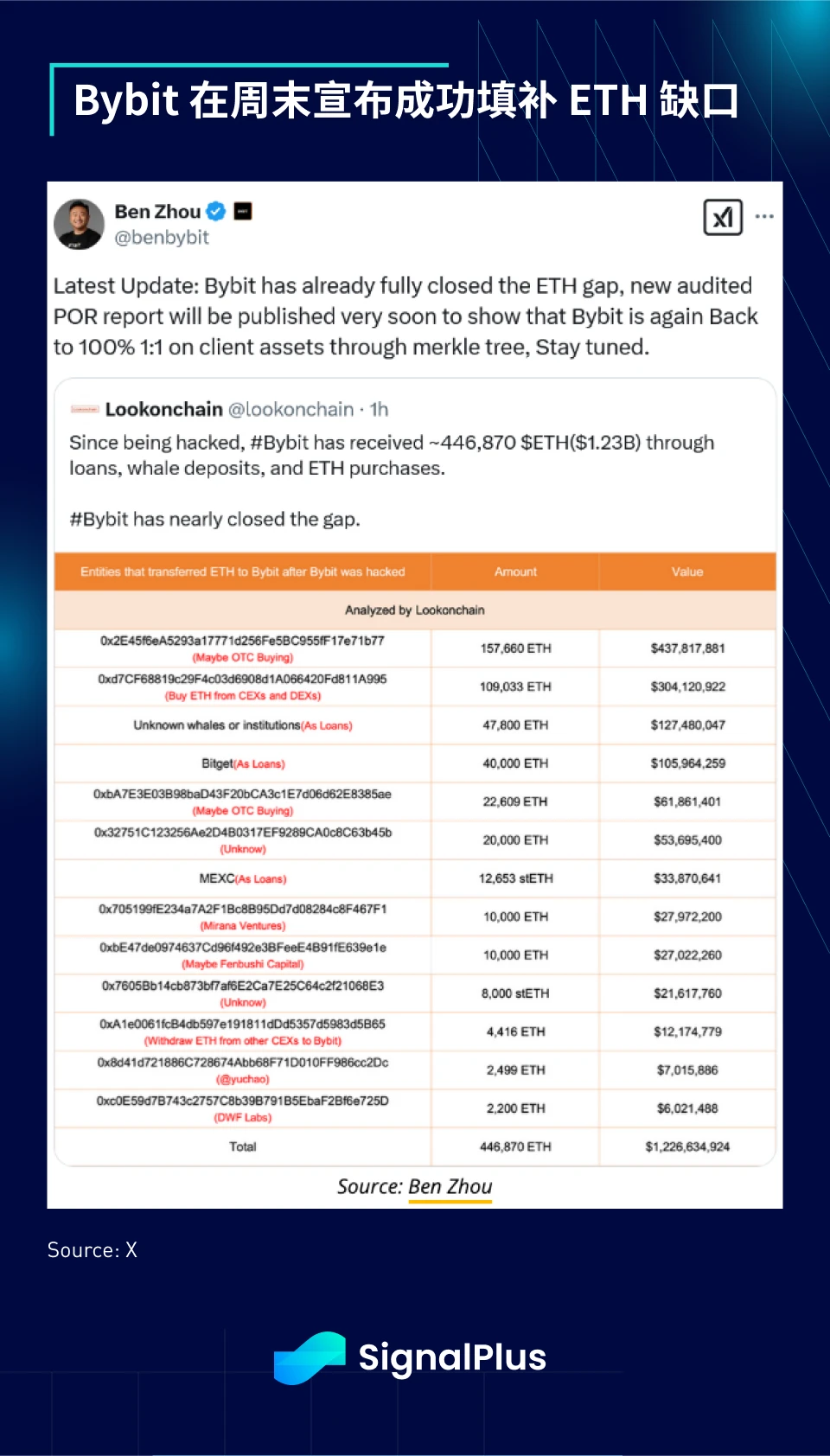

There have been many speculations in the market about how to fill this ETH gap, but Bybit announced over the weekend that it had taken a variety of measures to resolve the funding gap, temporarily allaying market concerns.

Just hours before Bybit was hacked, Coinbase announced that the SEC had dropped its lawsuit against it, bringing an end to a lengthy legal battle. In addition, the regulator recently approved the first stablecoin security offering (YLD), which will offer a floating interest rate of SOFR - 50 bps.

As cryptocurrency payment and transfer services become more mainstream, the market is expected to see more of these stablecoin products launched as savings alternatives.

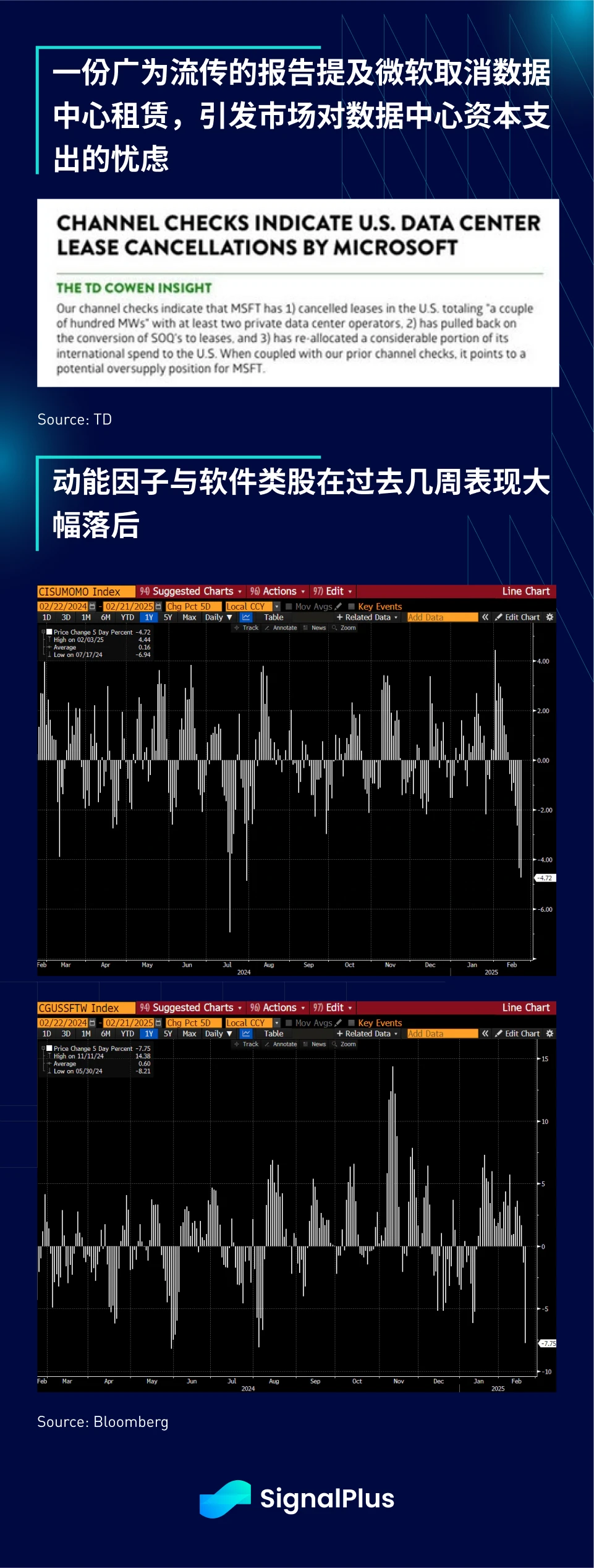

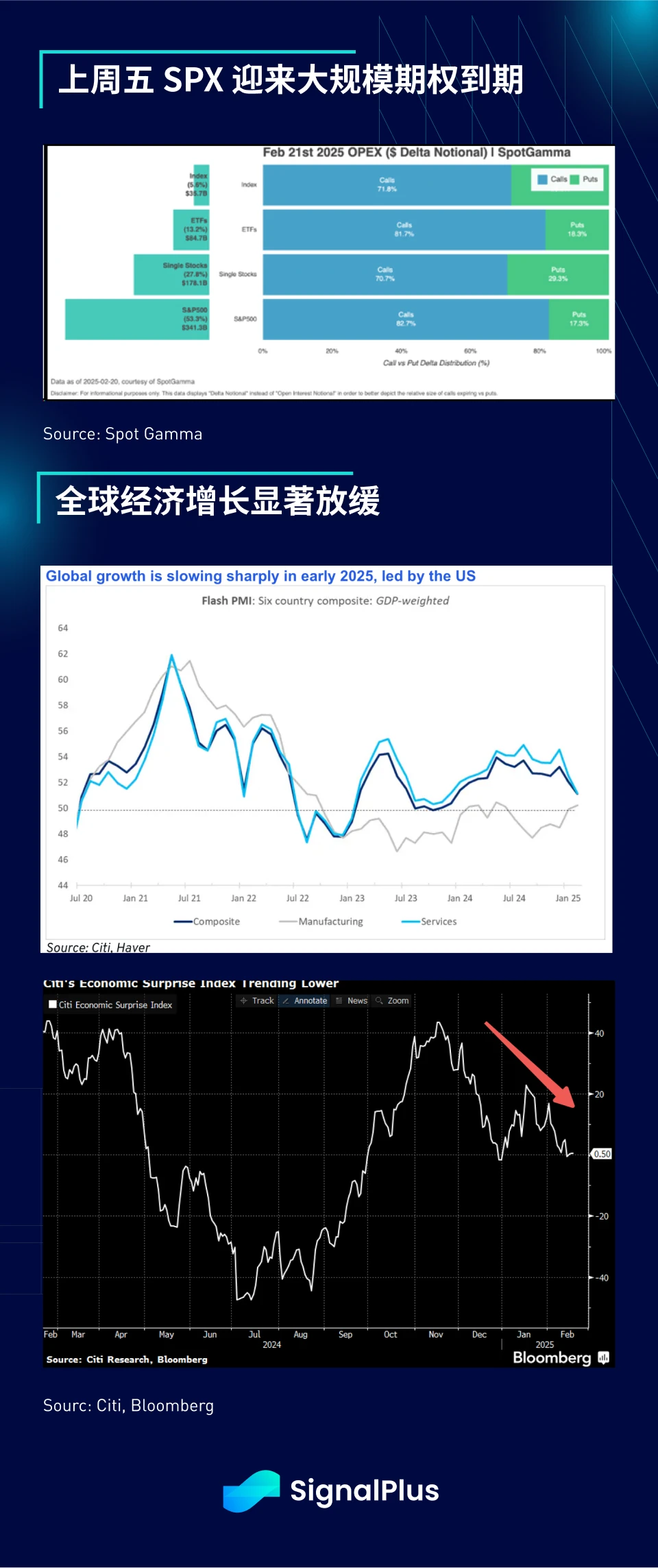

Back to TradFi, US stocks came under heavy selling pressure last week (-1.5%) amid poor economic data (weak Citi Economic Surprise Index, sluggish UM Consumer Confidence Index), weak Walmart earnings (weaker consumer spending), concerns over high data center spending (Microsoft canceled data center lease), $2.7 trillion in options expiration, uncertainty over the fiscal adjustment bill, news of new coronavirus variants, and concerns about a (right-wing) AfD victory in the German election.

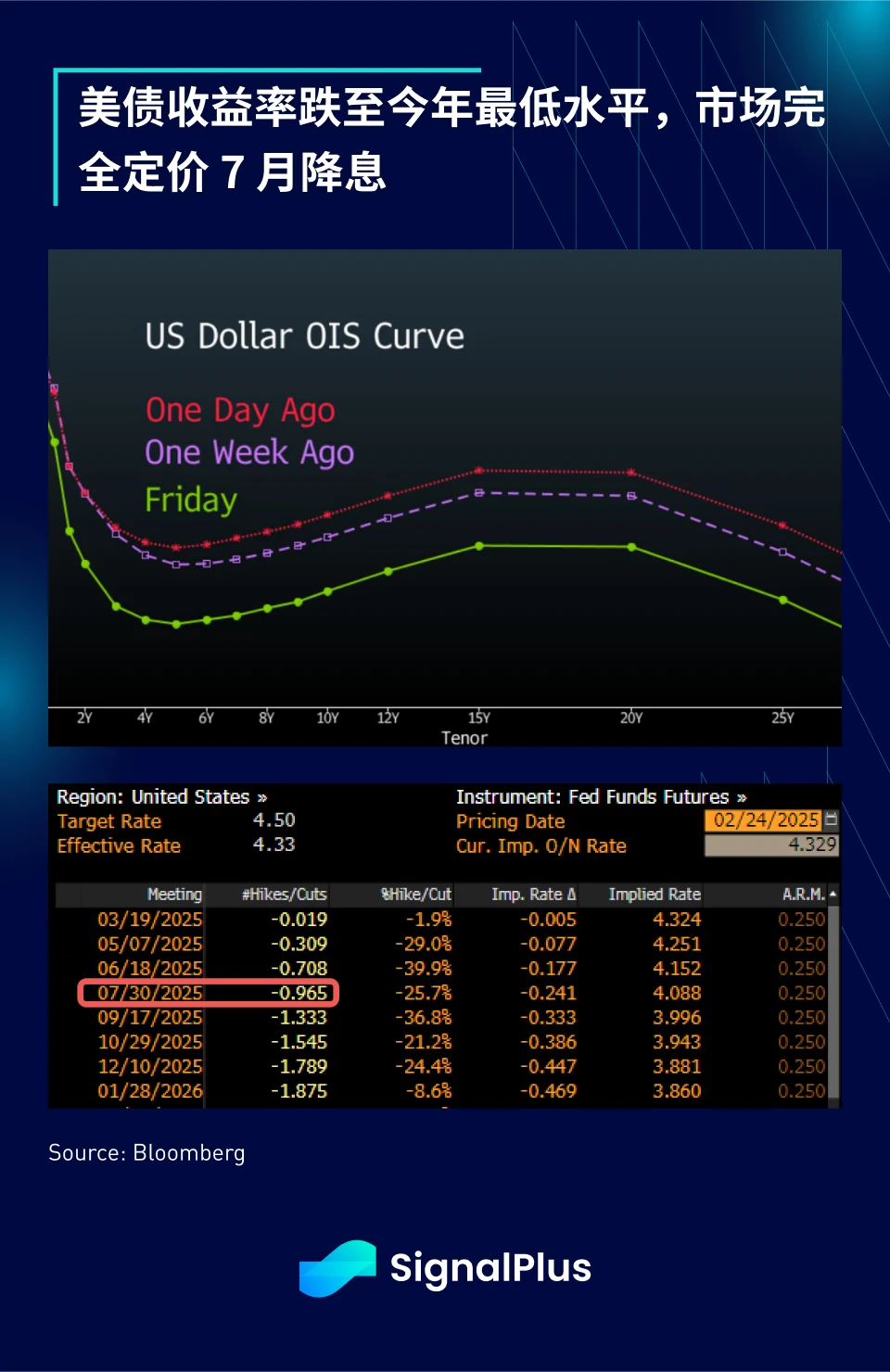

Market concerns about an economic slowdown have driven fixed income assets to benefit, with U.S. Treasury yields falling more than 10 basis points last week. The market has now fully priced in a July rate cut, and the probability of a June rate cut has also risen to 70%.

Next, the economic slowdown narrative may dominate the market in the short term, with stocks and bond prices rising in tandem again, and the correlation between the two is close to the highs of the past 12 months. As the market refocuses on the Feds loose policy, bad news is good news will return again, which may bring benefits to gold and BTC.

The most important market event this week may be Nvidias earnings report, which is expected to hit a new record high of $38.32 billion in quarterly revenue, a year-on-year increase of 73%. Good luck with your trading!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com