In the past few years, there has been a debate in the market about integrated network vs modular network.

The advantage of an integrated network is that its architecture, ecology, and liquidity are more unified, making it easier to create network effects, but its disadvantages are that it is difficult to expand capacity and relatively lacks flexibility. A modular network can achieve more efficient expansion and more flexible fine-tuning by unbundling layers such as consensus, data availability (DA), execution, and settlement, but a layered architecture has always been difficult to solve the problem of fragmentation in applications, liquidity, and security.

Solana and Ethereum can be regarded as the main representatives on the road to integration and modularization respectively. The former has always implemented the single-chain logic and successfully cultivated the most dynamic and wealth-effective single-chain ecosystem in the industry; the latter focuses its development on the Rollup layered route, and is committed to building a Layer 1 + Layer 2 pan-Ethereum ecosystem.

In this cycle, the secondary performance of SOL and ETH showed a clear difference. It seems that the market has gradually become tired of the fragmented modular architecture and is increasingly inclined to integrated solutions. On January 24, even Ethereum co-founder Vitalik made a vague statement about the Layer 2 route in his own article , believing that Ethereum itself, as Layer 1, should also accelerate expansion.

At least at this stage, the former has the upper hand in the debate of integrated network vs modular network.

However, Solana, as a representative of integrated public chains, is not perfect. Its core limitation is the lack of native data availability and reliance on external storage to save historical transaction data, which leads to latency and reliability issues in data access. In addition, under high load, Solana still faces the risk of network congestion or downtime, affecting overall stability. Therefore, the market demand for integrated architecture is not only high throughput, but also requires optimization in performance, data availability, and ecological integration.

In this context, Supra came into being with a more thorough integrated public chain concept. While ensuring high performance, Supra natively supports data availability, fundamentally solving the shortcomings of the integrated architecture. Its goal is to build a fully vertically integrated public chain that provides a complete blockchain infrastructure within a single network, including consensus, execution, data storage, oracles, cross-chain interoperability and other functions, to ensure that developers and users can have a smooth and seamless experience. With the growing market demand for more stable and efficient infrastructure, Supra is becoming a new direction for the development of integrated public chains.

Supra: The Ultimate in Integrated Networking

Supra itself is a high-performance blockchain that achieves a high throughput of 500,000 transactions per second with sub-second consensus latency using the new Moonshot consensus protocol, but its greatest feature lies in its integrated architecture.

Supras basic development philosophy can be highly summarized as fully vertically integrated , that is, providing almost all blockchain-related services on a single network to ensure that users and developers have a unified and smooth user experience.

As a late-developing public chain, Supra can evaluate the previous integrated network vs modular network game process from a higher-dimensional perspective and directly absorb the experience. In Supras view, the key to the integrated network gradually winning the market lies in the unification of development (to developers) and usage (to users) experience, but Supra is more radical and believes that the degree of unification of traditional integrated networks is still insufficient - in the actual development and operation environment, most Dapps still rely on multiple third parties that provide oracle, cross-chain communication, on-chain randomness and other services, which objectively causes integration complexity, security risks and development costs. For this reason, Supra hopes to build a fully vertically integrated blockchain that supports native oracles, randomness, automation and cross-chain communication, thereby providing developers with a more powerful, more coordinated and easier-to-use underlying network.

In order to further improve the applicability of a single network, Supra will simultaneously support multiple mainstream virtual machines such as EVM, SVM, MoveVM, Cosmos, etc., so that developers from different ecosystems can migrate directly to Supra without secondary construction.

In addition, in order to solve the problem of insufficient flexibility of traditional integrated networks, Supra also provides an application chain solution called a container. Each Supra container allows developers to customize governance models, gas tokens, and economic incentive models, but in order to prevent liquidity fragmentation problems similar to Ethereum Layer 2, each Supra container supports sharing the Supra Layer 1 liquidity pool and can call the pool resources of the Supra main network at any time. In this way, developers can use Supra containers to build exclusive application environments without worrying about the loss of unity due to liquidity fragmentation.

Supra core architecture dismantled

To understand the architecture of the Supra network, we can start from the following key innovations:

Moonshot consensus engine: Moonshot is Supras original consensus protocol. In Moonshot consensus, the delivery, sorting and execution of transactions can be run in parallel, which effectively reduces processing time and achieves a high throughput of 500,000 transactions per second and sub-second consensus latency.

Tribe and Clan Node Architecture: Supra uses a hierarchical architecture called Tribe and Clan for node management. Tribe represents a tribal collection of many large nodes, while clan refers to a collection of randomly selected small nodes within a tribe. This is a dynamic node management and coordination system designed to achieve efficient parallel processing in multi-tasking scenarios.

Distributed Oracle Protocol (DORA): Supra will transmit and provide demand-based (pull-based) and streaming (push-based) data services through its DORA, including cryptocurrency price oracles, foreign exchange rates, stock indices, and weather data. This data not only serves the Supra blockchain, but also supports other blockchain networks.

Distributed Verifiable Random Function (dVRF): Similar to DORA, Supra will also provide demand-based and streaming distributed verifiable random functions (dVRF) for generating and distributing random number services.

Automation: Supra supports pre-setting automated transactions at specific time nodes or on-chain events (including off-chain events transmitted by DORA), allowing users to set operational strategies in advance for potential different situations.

IntraLayer: Supra can use the multi-signature cross-chain protocol HyperLoop and the trustless interoperability solution HyperNova to connect other Layer 1 and Layer 2 ecosystems, thereby achieving multi-chain interconnection in a more secure form.

Multi-VM: This is the multi-virtual machine support mentioned above, which supports all mainstream development environments in the industry, including EVM, SVM, MoveVM, Cosmos, etc.

Container: The application chain solution mentioned above allows developers to create a dedicated application execution space DappSpace, and freely customize the execution environment without bridging or splitting liquidity.

Supra History

What many people don’t know is that Supra is actually an academic blockchain. Dr. Aniket Kate, the chief research officer who leads the team’s research and development, is one of the inventors of KZG Polynomial Commitments, a technology widely recognized in the field of cryptography and has been widely used in the expansion routes of multiple projects including Ethereum.

Supras predecessor was the oracle service SupraOracles and the middleware service layer IntraLayer. However, in the actual development process, the Supra team gradually discovered that relying on an isolated service alone was not enough to meet the markets complex needs for a complete blockchain infrastructure. Therefore, the team decided to go a step further and turn to the most basic dimensions such as architecture and consensus to build a blockchain that can truly handle the explosion of applications, users, and liquidity.

Supra has raised US$42 million through multiple rounds of financing in the past, with investors including Animoca Brands, Coinbase Ventures, Galaxy Interactive, Hashed, HashKey, Huobi and other well-known institutions.

In August 2024, Supra launched its incentivized testnet and processed more than 9 million transactions through interactive tools such as Dice Vision and Astro Predictions. Its Blastoff event attracted more than 510,000 users to participate.

In November 2024, the Supra networks native token SUPRA officially launched TGE and was soon listed on mainstream exchanges such as ByBit, Kucoin, Gate and MEXC. According to CoinGecko data, as of the time of writing, SUPRA is temporarily reported at $0.01037, with a circulating market value of approximately $75.89 million and a full circulating market value of approximately $823 million.

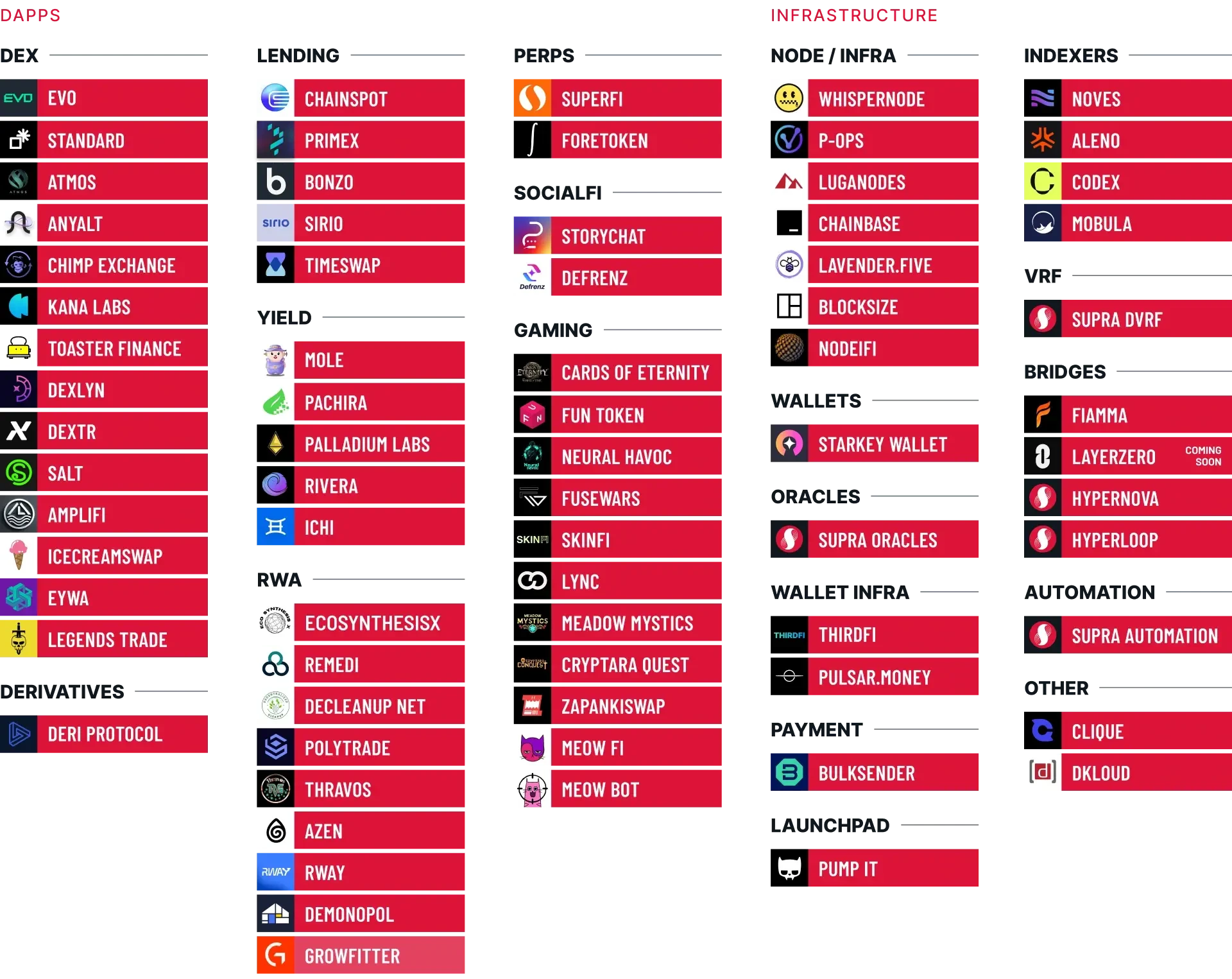

Past industry development rules have proven that high-quality underlying networks can always attract more developers and foster a more diverse ecosystem. Supra official data shows that although only about half a year has passed since the test network was launched, more than 70 projects are under construction on Supra, covering infrastructure, wallets, nodes, payments, lending, DEX, Launchpad, Yield, RWA, derivatives, social, games and other categories.

The industry is accelerating, and Supra is ready to go

After entering 2025, the market trend has exceeded many peoples expectations. Although there are continuous positive factors at the macro level, due to the overall market deleveraging and the fading of meme hype, the altcoin market except Bitcoin has experienced a significant correction, and SUPRA has not been spared.

But it is undeniable that with the inauguration of the pro-crypto Trump cabinet, the advancement of strategic cryptocurrency reserves, and the continued inflow of major cryptocurrency ETFs, the industry is moving towards compliance and mainstreaming with an irreversible trend.

Looking ahead, the next few years may be the most relaxed growth environment and the most friendly operating environment in the history of the industry. During this golden time, it is expected that more and more users and funds will continue to enter the market, which will bring new challenges to the load capacity of the existing blockchain and the development of applicable experience.

Spura has already prepared for this. When the market has low demand for the performance and experience of the underlying network, the differences between the major blockchains may not be obvious, but as the demand increases exponentially, Supras latecomer advantage will gradually emerge. At that time, perhaps it will be the real value discovery cycle of Supra.