1 Introduction

ZEROBASE is a real-time zero-knowledge proof network designed for fast proof generation, decentralization, and compliance. The network can efficiently generate zero-knowledge proofs in just a few hundred milliseconds in a number of products under the ZEROBASE ecosystem, such as zkLogin, zkDarkPool, zkVote, and zkCEX , to support large-scale commercial applications. ZEROBASE also extends its influence to traditional industries, developing a privacy-centric credit system to support underwriting investigations for low-income people in the United States and cross-border medical users.

Relying on cryptographic technologies such as Zero-Knowledge Proof (ZK) and Trusted Execution Environment (TEE) and their powerful functions, ZEROBASE has spawned a new business model - ZEROBASE Staking, a stable income staking product based on a real-time zero-knowledge proof network and risk-neutral funds . This product aims to redefine Staking based on zero-knowledge proof technology and double trust and returns.

ZEROBASE Staking products have been carrying the mission of innovating the industry since their inception. Given the lack of similar products on the market, we know that only through personal practice can we know the advantages and disadvantages of the product and the pain points of users. After the launch of ZEROBASE Staking V1 , we received a lot of feedback from users. The most important of these are the following two points:

1. When users encounter emergencies, they need to solve their liquidity needs.

In traditional staking products, when users stake their funds, they are already in the contract. If users want to withdraw these funds from the contract, we must arrange for a position closing or withdrawal to withdraw the funds. But in fact, arranging a position closing or withdrawal is not a simple matter, and the process takes a lot of time.

When stablecoins such as USDT or USDC are deposited into the ZEROBASE Vault contract, ZEROBASE will mint LP Tokens for users . LP Tokens represent the users equity share in ZEROBASE, and can also be used as collateral to borrow real USDT or USDC in loan contracts , perfectly solving the users liquidity needs.

At the same time, we believe that the LP Token flash withdrawal model designed by ZEROBASE will provide a scalable liquidity enhancement mechanism for the CeFi ecosystem.

2. Using ZK to solve the verifiability of CeFi funding strategies

Users injecting liquidity into the ZEROBASE Staking product can enhance the security of the ZEROBASE proof network while obtaining stable and substantial returns. The income from ZEROBASE Staking mainly comes from the following two core channels:

Risk-neutral arbitrage : ZEROBASE works closely with liquidity funds to map assets to the Binance exchange through Ceffu ’s MirrorX function for funding rate arbitrage.

Real-world ZK fees : The ZEROBASE proof network provides ZK proof acceleration services, generates efficient and reliable ZK proofs for various business scenarios, and charges fees for this service, thereby injecting more value into the Staking ecosystem.

As an industry pioneer, naturally many users cannot fully trust ZEROBASEs funding strategy, especially risk neutrality. Therefore, we use zero-knowledge proof technology to prove to users that our funding strategy is safe and compliant . True gold is not afraid of fire, and our zero-knowledge proof will be open to all users. Anyone can obtain real-time zero-knowledge proof reports on the official website to verify whether ZEROBASEs funding strategy is safe and compliant.

Based on the above issues, ZEROBASE Staking V2 brings enhanced features and an upgraded staking experience, setting a new standard for ZEROBASE Staking:

LP Token : Users will receive LP Token when they deposit, representing their stake in the ZEROBASE Staking product.

Lending function : Users will be able to pledge LP Tokens and borrow USDT/USDC with their holdings.

Risk-neutral ZK functionality for trading strategies : New ZK functionality for risk-neutral validation of trading strategies will be launched alongside the open source release of the circuit code.

Automatic withdrawals : The contract now supports automatic and fast withdrawals with the same applicable fees. Normal withdrawals (without fees) take 14 days.

Proof Browser : Introducing a proof browser that enables users to transparently verify zero-knowledge proof results.

2 Core Competitiveness

Liquidity has always been a core issue in the Web3 field, especially in the competition among various DeFi platforms, where liquidity mining has become a key weapon. Users provide liquidity to DeFi platforms, obtain liquidity certificates, and obtain token rewards from the platform by staking these certificates. These rewards not only compensate users for the risks they take in the process of providing liquidity, but also encourage the ecological development of the platform.

Consistent with the DeFi protocol, ZEROBASE staking will also issue its own platform tokens to users who provide liquidity.

However, the issuance of platform tokens will bring about the problem of selling pressure : when the supply of platform tokens is too high, the selling pressure increases and the price of the token falls, which in turn affects the annualized rate of return of users and reduces the enthusiasm of users to participate. If there are not enough incentives, users will often choose to exchange platform tokens for stablecoins or other mainstream assets, which will have a negative impact on the long-term development of the platform.

To solve this problem, we have proposed a breakthrough solution: through risk-neutral liquidity arbitrage and flexible liquidity value- added services, we can ensure the long-term stable development of the platform, attract more liquidity, and ensure that users obtain continuous value growth in the process of long-term holding of platform tokens, thereby safeguarding the long-term interests of users.

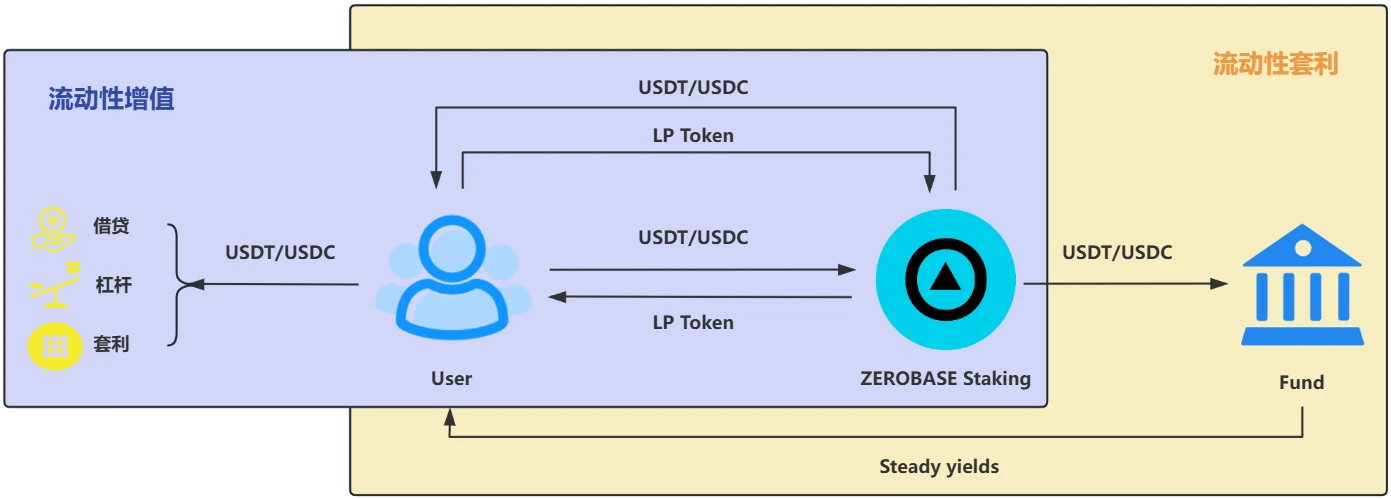

In the liquidity arbitrage mechanism, users pledge USDC/USDT to the ZEROBASE Staking platform, obtain liquidity certificates LP Token, and participate in the platforms liquidity value-added services. ZEROBASE Staking allocates the liquidity funds provided by users to hedge fund investment strategies verified by zero-knowledge proofs, generating high-yield and risk-neutral returns for users.

In the liquidity value-added mechanism, users obtain USDC/USDT by staking liquidity certificates LP Token to the ZEROBASE Staking platform, and participate in liquidity arbitrage operations that meet their needs to meet their liquidity needs.

2.1 Risk-neutral liquidity arbitrage

What is liquidity arbitrage?

On the ZEROBASE Staking platform, users can stake USDC/USDT tokens, and the platform provides users with high-yield, risk-neutral and verifiable hedge fund investment services based on these liquidity. Through this service, the users staked funds will be transferred from the fund to Binance through MirrorX to achieve optimized investment strategies and risk management.

This is different from the liquidity mining of DeFi platforms, which uses platform tokens and transaction fees as rewards. In ZEROBASE Staking, users main income comes from the arbitrage of funding rates in the Binance exchange, rather than relying on the price fluctuations of platform tokens and the trading volume of the liquidity pool.

Hedge funds usually provide higher risk-neutral returns, but they also have limitations such as opaque investment strategies and difficulty for users to trust them. While providing high returns, ZEROBASE uses zero-knowledge proof technology to achieve a risk-neutral and verifiable investment mechanism, ensuring that users can obtain safe and predictable returns during the participation process.

2.2 Flexible liquidity value-added

What is liquidity appreciation?

Users who provide liquidity USDC/USDT to the ZEROBASE platform will receive liquidity certificates LP Token, which is the platform token of ZEROBASE. These platform tokens can be flexibly used in lending, leverage, arbitrage and other operations within the ecosystem based on user wishes, meeting user liquidity needs and further tapping into profit potential.

In order to avoid the selling pressure of platform tokens, ZEROBASE has designed an innovative liquidity value-added service. Users can use the platform tokens they have obtained as collateral to borrow and lend in ZEROBASE Staking without having to sell the platform tokens directly. This mechanism effectively avoids selling, helps maintain the stability of token prices, and ensures that users annual income is not affected.

Through flexible liquidity value-added services, ZEROBASE provides users with comprehensive liquidity support, allowing users to deploy assets at any time during the investment process, while reducing liquidity risks and the risk of declining returns in capital turnover, creating a more stable investment environment.

2.3 Others

In addition to the above core competitiveness, ZEROBASE staking will also continue to improve user experience in the following aspects:

Stable income: Targeting the stablecoin track, it naturally has the advantage of low risk of stablecoins.

Technology empowers practicality: ZEROBASE is driven by zero-knowledge proof technology innovation, focusing on building a real-time, decentralized and compliant zero-knowledge proof generation network, closely focusing on actual business scenarios. On this basis, ZEROBASE Staking is rooted in ZK, a disruptive application project, and has completely gotten rid of the speculative nature of pure coin speculation, and is committed to creating sustainable value for users and providing a stable return on investment.

Efficient execution mechanism: adopt standardized and efficient code design to minimize Gas consumption while ensuring code readability. Reducing Gas consumption can directly reduce users transaction costs, speed up transaction execution, shorten waiting time, and improve user experience. In addition, Gas optimization helps alleviate network congestion and improve the overall efficiency and sustainability of the blockchain ecosystem.

Comprehensive query mechanism: Users can check the reward calculation method, current staking amount and available withdrawal time at any time to ensure information is open and transparent. By querying the staking amount and reward information, users can flexibly adjust the staking amount or period according to their goals, thereby optimizing the rate of return; the withdrawal available time query function helps users know when they can withdraw funds, avoid failures or extra waiting due to improper operation time, and improve operation efficiency.

Pausability and ownership control: Implements pause functionality and ownership management for enhanced security.

Flexible Configuration: Supports pluggable configuration schemes, allowing custom interest rates, support for multiple tokens, and setting the waiting time between user withdrawal requests and successful withdrawals.

3. Pledge System

3.1 System Architecture

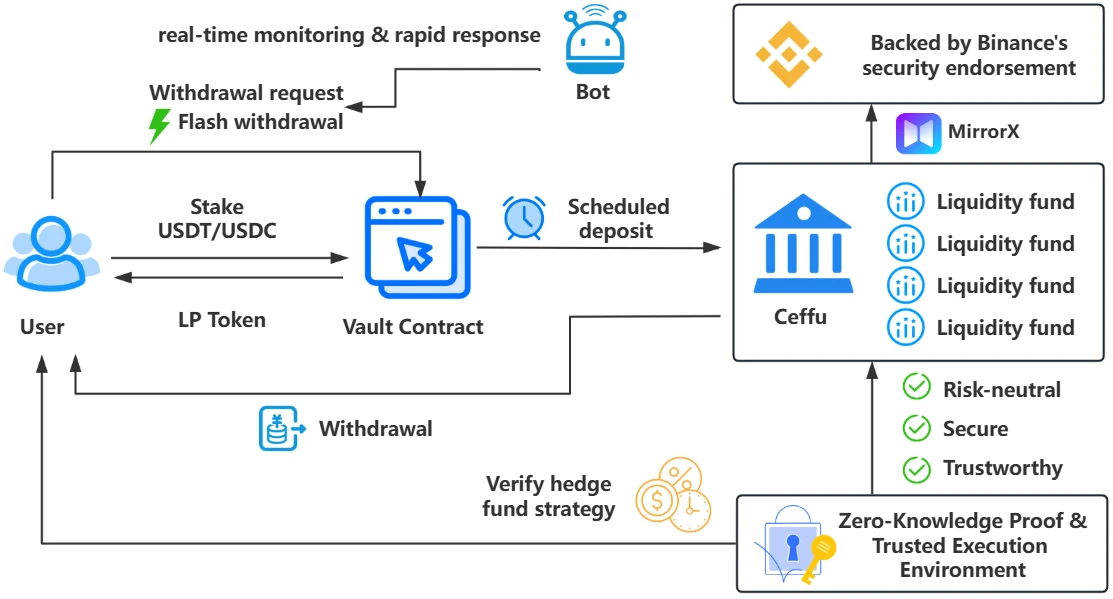

Staking layer: The core logic of the staking layer is implemented by Vault Contract, which provides safe, convenient and fast deposit and withdrawal functions. When users want to redeem funds from the staking layer, they need to go through a 14-day redemption waiting period. During this period, the Vault Contract will intelligently arrange liquidation or withdrawal operations to ensure the orderly return of funds.

Income layer: The liquidity that users inject into the Vault Contract will be used to generate income. The income comes from two aspects, Ceffu and hedge fund investment.

Security layer: The security layer serves the pledge layer and the yield layer. ZEROBASE works with Ceffu (Binance Custody), which focuses on building enterprise-level custody and liquidity solutions for institutions, to securely integrate CeFi returns. ZEROBASE is based on zero-knowledge proof technology to ensure the risk neutrality, security and compliance of hedge fund investment strategies.

Pledge value-added layer: In view of the fact that users have to wait 14 days to withdraw funds from the pledge layer, the pledge value-added layer came into being to alleviate users urgent withdrawal needs. Users pledge stablecoins such as USDC/USDT in the pledge layer and obtain corresponding pledge certificates LP Token. These certificates can participate in lending, leverage, arbitrage and other operations within the ecosystem to further tap the potential for income.

3.2 Pledge Process

The staking networks that users can choose include: Ethereum, BNB Chain, Arbitrum, Polygon, Avalanche, Optimism, and Base Chain. More networks will be supported in the future based on user needs.

The overall process from staking to successful withdrawal is as follows:

1. Token Staking

The tokens supported by the user pledge system currently only support stablecoins such as USDT and USDC, and will be expanded in the future based on market demand. Users can repeat the pledge operation multiple times.

Users deposit stablecoins such as USDT/USDC for pledge and obtain LP Tokens. The LP Tokens held by users are their equity shares in the ZEROBASE ecosystem. These equity tokens can be mortgaged, loaned or redeemed in the ZEROBASE ecosystem, expanding the users capital utilization rate.

2. Reward Distribution

In the logic of the Vault Contract, the system will redistribute the assets at fixed time intervals according to the configured strategy. For example, at 12:00 a.m. every day, the liquidity injected by users into the Vault contract will be transferred to Ceffu for trading arbitrage to obtain potential value-added services. These additional returns can fully cover the rewards that users deserve.

Ceffu will map liquidity to the Binance exchange through the MirrorX function to ensure asset security. In addition, zero-knowledge proof and trusted execution environment technology will support the entire process to ensure the risk neutrality, security and credibility of arbitrage operations.

Rewards are calculated and distributed regularly based on the staked amount and time.

3. Withdrawal

At some point in the future, the user submits a withdrawal request to the Vault Contract. Then, they need to wait for a 14-day buffer period to ensure that the liquidity fund has sufficient time to cut liquidity. The portion that has not been withdrawn will continue to generate rewards.

The bot listens to withdrawal requests from users and reallocates assets within 14 days. By default, the bot gets funds from Ceffu, but in theory any source is allowed. After the 14-day waiting period is over, users can withdraw their funds from the withdrawal contract.

ZEROBASE Staking provides a Flash Withdraw feature that allows users to instantly withdraw funds from the deposit contract with a transaction fee of 0.5%. Note: Withdrawals are only possible if there are sufficient funds in the deposit contract. Please check the contract balance before operating.

3.3 Liquidity Arbitrage

Risk-neutral and verifiable fund investment strategy

ZEROBASE provides a risk-neutral and verifiable staking investment service, aiming to invest users’ pledged funds in risk-secured hedge fund investments through precise quantitative assessment.

ZEROBASE will invest the users pledged funds in risk-secured hedge fund investments. In ZEROBASEs hedge fund investment plan, investment weights and risks are assessed through precise quantification , and user assets are dispersed and allocated to a variety of investment strategies based on the quantification results, thereby achieving effective risk diversification. While optimizing the potential for returns, it provides users with comprehensive risk protection.

Although the investment strategy of hedge funds has a certain confidentiality, ZEROBASE can verify the quantitative data such as investment weights and risks of investment strategies through zero-knowledge interval proof technology. Trustworthy verification refers to whether the fund managers investment strategy, asset weights and risk control comply with predefined rules, and achieve verifiability for investors and platforms, ensuring that all operations are performed within the agreed scope and enhancing investors trust. It is precisely because the risks are transparent and verifiable that reliable risk protection can be provided to users.

Specifically, we pay close attention to and value the two most important indicators that users care about: risk neutrality and leverage . In order to enhance user trust and transparency, ZEROBASE is specially designed to intuitively display these key information on the front-end page. Users can easily and securely verify the authenticity and compliance of these indicators by obtaining the corresponding zero-knowledge proof.

Risk Neutrality Check

A risk-neutral strategy usually refers to achieving long-short hedging by maintaining the nominal values of long and short positions similarly , and ensuring that the total Delta (i.e. the impact of asset price changes on account equity) is close to zero, thereby achieving a state of risk balance.

In a portfolio, ZEROBASE calculates the investment weight and risk factor of each asset, as well as the correlation between the various investment risks, and estimates the overall risk level of the portfolio based on these investment weights and risk factors. To enhance transparency and credibility, ZEROBASE uses zero-knowledge interval proof technology to verify these risk data to ensure that investment risks meet preset limits without revealing specific risk values . Through these measures, investors can obtain reliable protection of the risk level of their portfolios while pursuing high returns.

Leverage check

Checking the leverage ratio is an important consideration for investors in terms of risk management, capital efficiency, compliance requirements, and investment strategy optimization. Excessive leverage ratios will amplify investment risks. After in-depth market research and comprehensive considerations, ZEROBASE decided to set the leverage ratio within the range of less than or equal to three.

Based on zero-knowledge interval proof technology, ZEROBASE effectively verifies whether the leverage ratio strictly complies with the safety range we set without revealing the specific value of the leverage ratio.

What can users see?

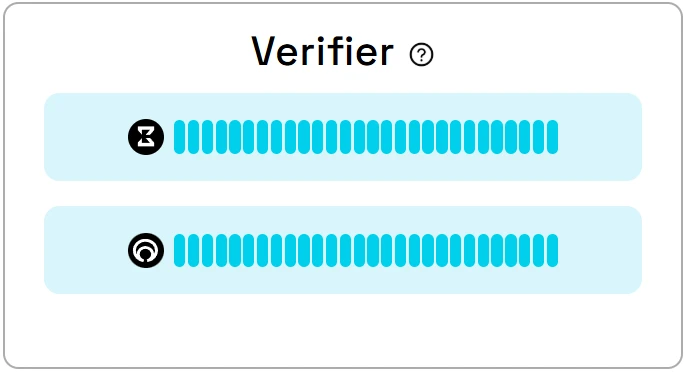

On the ZEROBASE Staking page, users can see whether the hedge fund strategy is risk neutral. The proof is generated by the ZEROBASE Prover network and verified by zkVerify and Nebra . When the strategy is risk neutral, the progress bar is blue; if the risk neutrality is broken, the progress bar turns red.

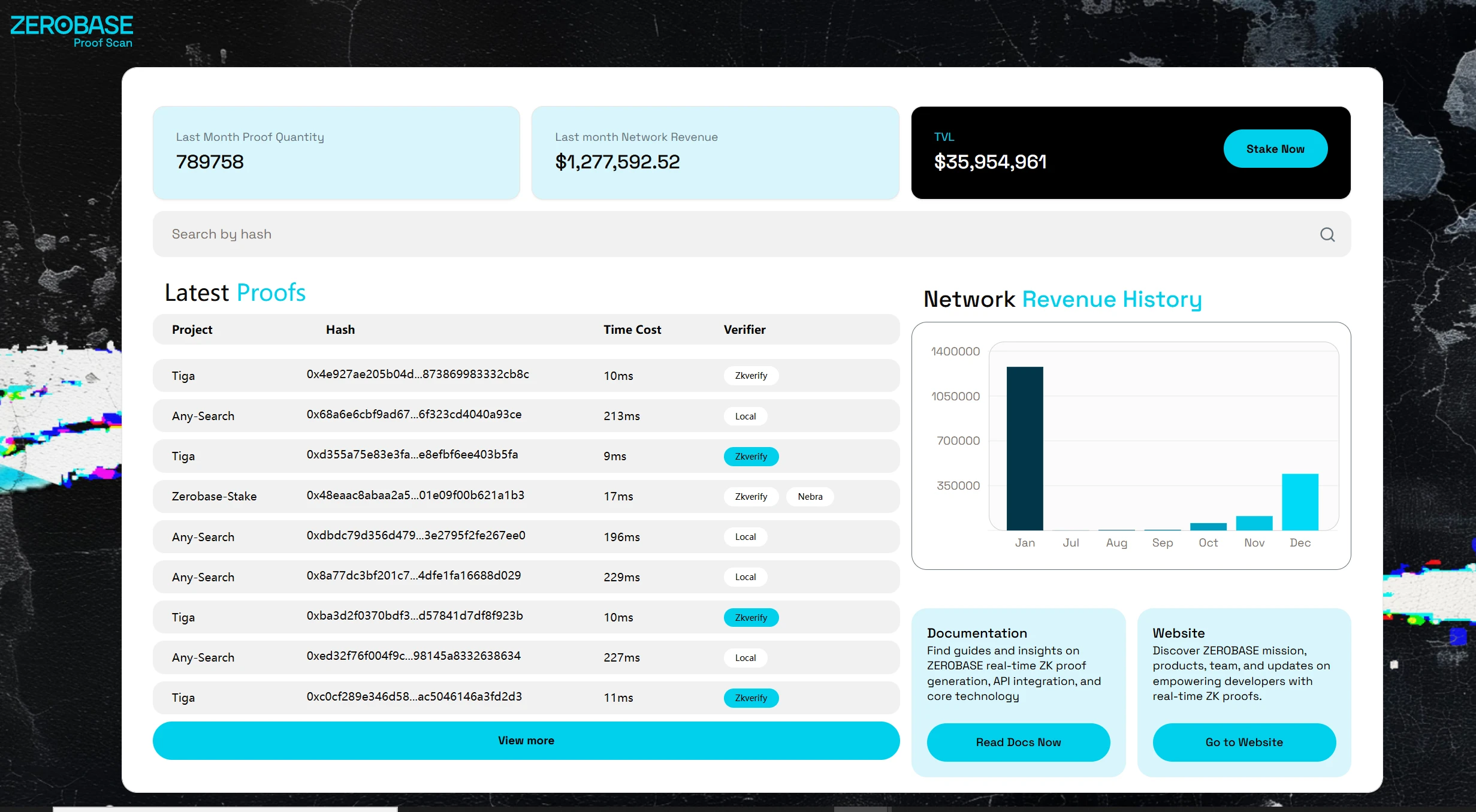

In the Proof Browser, users can view the number of proofs and network income for the last month, as well as the latest, specific proofs.

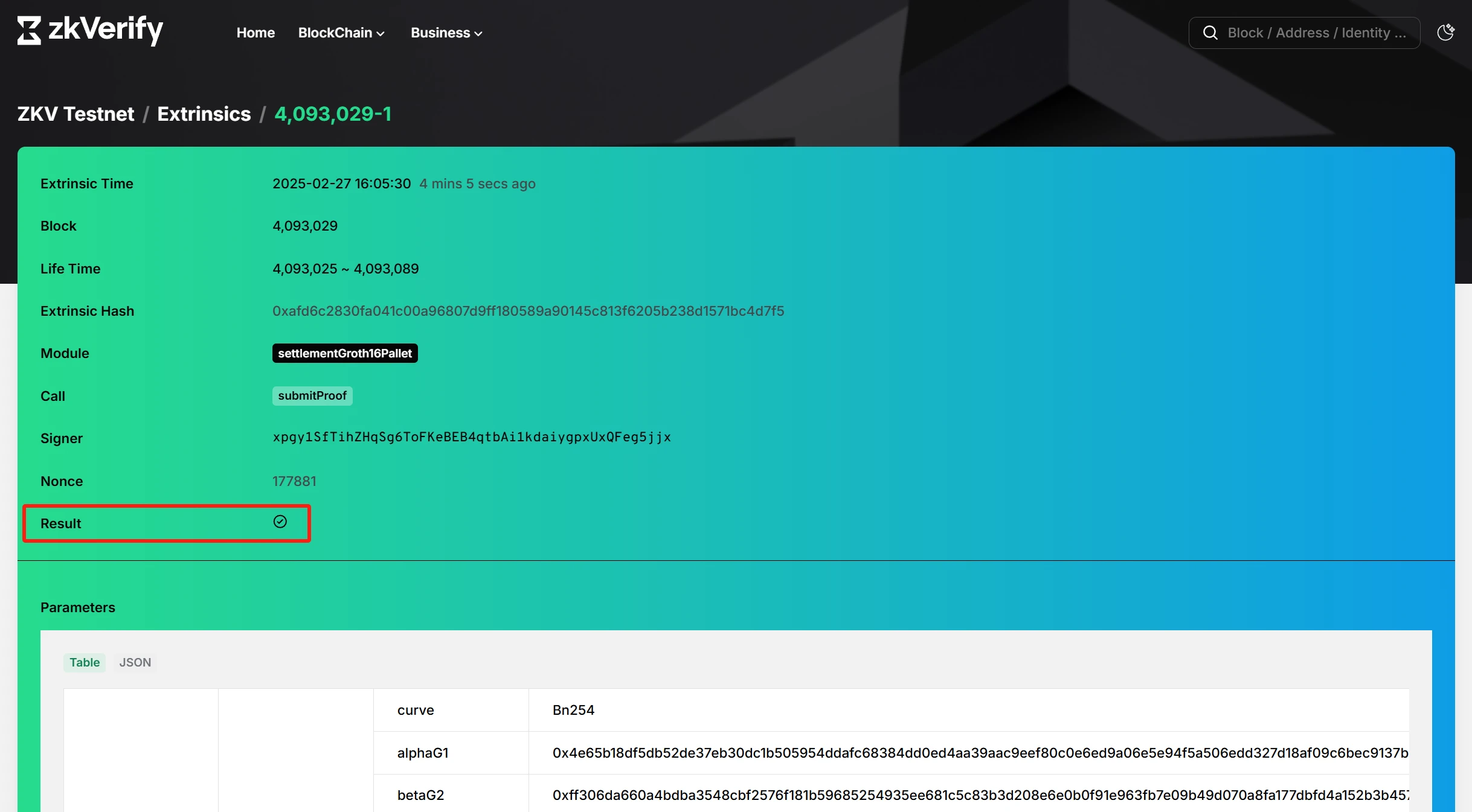

Click on any proof to view the verification result. If the result is ✔, it means that the verification is successful and the risk neutrality of the funding strategy is established.

3.4 Liquidity appreciation

Users use LP Token as collateral to borrow a certain amount of USDT/USDC.

Pledge rate = market value of pledged assets / loan amount

According to the pledge rate, users can borrow up to 95% of the value of USDT/USDC by pledging LP Token. The borrowed funds can be used immediately to meet payment, lending, leverage, arbitrage or other liquidity needs, avoiding the restriction of redemption waiting period.

Liquidation Mechanism

The borrowers Health Factor will be used to measure the health of the borrowers mortgage assets.

Health factor = total value of collateral / (loan amount + accumulated interest)

When a borrowers health factor drops to 1 or lower, it means that the value of the borrowers collateral assets is insufficient to cover the debt, and the liquidation process will be automatically triggered to protect the liquidity of the protocol and the financial security of other users.

1. Liquidation Trigger

If market fluctuations cause the price of the LP Token pledged by the borrower to drop sharply, the borrowers health factor will drop rapidly, which will trigger liquidation. Another less likely scenario is when the price of the borrowed asset USDT or USDC rises. Because USDT and USDC are stablecoins, even if their prices rise or fall, the changes are minimal.

2. Liquidation Execution

Liquidators actively monitor the health factors of borrowers and look for loans with a health factor below 1.

The liquidator repays part or all of the borrowers debt, thereby restoring the health factor to a safe range.

When the liquidator repays the debt, the system implements a dynamic closing coefficient, that is, the liquidator only repays the part of the debt that exceeds the borrowers health factor. This ensures that the borrowers collateral will not be over-liquidated, and avoids its health factor being restored too quickly or over-liquidated.

3. Liquidation Rewards

When the liquidator repays the loan, he will receive a certain percentage of the liquidation reward. The reward is calculated based on the additional portion of the repaid collateral as an incentive for the liquidator.

The advantages of this liquidity enhancement solution are:

Improve liquidity : Users can use LP Token to quickly obtain real USDT/USDC to meet short-term funding needs. There is no need to wait for the redemption period, optimize fund utilization, and provide users with great flexibility and convenience.

Ecological cycle support : The lending function of LP Token further expands its usage scenarios in the ecosystem and promotes efficient circulation of funds.

Security of liquidation mechanism : The set liquidation trigger conditions and discount auction mechanism effectively guarantee the stable operation of loan contracts and reduce capital risks. The liquidation and withdrawal process is orderly, ensuring the security of user redemption and avoiding market volatility risks.

Case Study: Leveraged Trading

Assuming Alice pledges 1,000 USDT in ZEROBASE Staking, she will receive 1,000 LP Tokens. Then, Alice uses 1,000 LP Tokens as collateral to borrow 95% of the value, or 950 USDT, based on ZEROBASEs liquidity value-added service, and uses this money for leveraged trading.

Case 1: Alice makes a profit and repays her loan

Assume that Alice uses the 950 USDT she borrowed to conduct leveraged trading and successfully makes a profit. After the leveraged trading, her assets grow from 950 USDT to 1,900 USDT. Therefore, Alice can use this profit to repay the loan. She repays the loan of 950 USDT, and the remaining 950 USDT is her profit.

Case 2: Alice’s assets are liquidated

Assume that the market fluctuates violently and the value of the collateral LP Token shrinks. Alices health factor drops to 0.63, triggering liquidation.

Health factor = collateral value / (loan amount + accumulated interest) = 600 USDT / 950 USDT = 0.63.

In order to protect the financial security of the ZEROBASE ecosystem, part of Alices collateral was liquidated to repay debts and ensure the liquidity and health of the protocol.

3.5 User Guide

4 Conclusion

ZEROBASE Staking provides innovative liquidity arbitrage and liquidity value-added functions. Users (stakers) can enjoy multiple advantages: risk-neutral stable annualized rate of return, fund security custody service provided by Binance, and risk-neutral and verifiable fund investment strategy based on zero-knowledge interval proof technology. In addition, stakers have the opportunity to obtain future tokens or airdrop rewards (in the form of ZB points), as well as a flexible operation experience of depositing and withdrawing at any time, making investment more convenient and flexible.

ZEROBASEs long-term value and actual profit guarantee

We are planning a series of product upgrades based on a tiered yield mechanism with multiple liquidity pools to ensure that the ZB price does not deviate from fundamentals through a yield-supported mechanism, thereby reducing excessive speculation and providing investors with a more stable and reliable choice.

ZEROBASE is committed to building an unprecedented ZK application ecosystem. By integrating technological innovation and sustainable business models, it not only creates greater value for users and ecosystem participants, but also aims to redefine the future of decentralized finance, promote ZKFi to become a new growth engine in the Web3 era, and open up new paths for the industry.