Changes in the pledge landscape

Since the launch of Lido and stETH in 2020, the staking market has changed significantly thanks to new users, emerging use cases, and evolving challenges. Staking demand from institutions continues to grow, along with stricter regulatory and compliance considerations. While many institutions have already staked through Lido, others still face internal restrictions.

Ethereum and its vast ecosystem of protocols have been grappling with issues of scalability and staking centralization, while advanced users are seeking more customization in terms of reward structures.

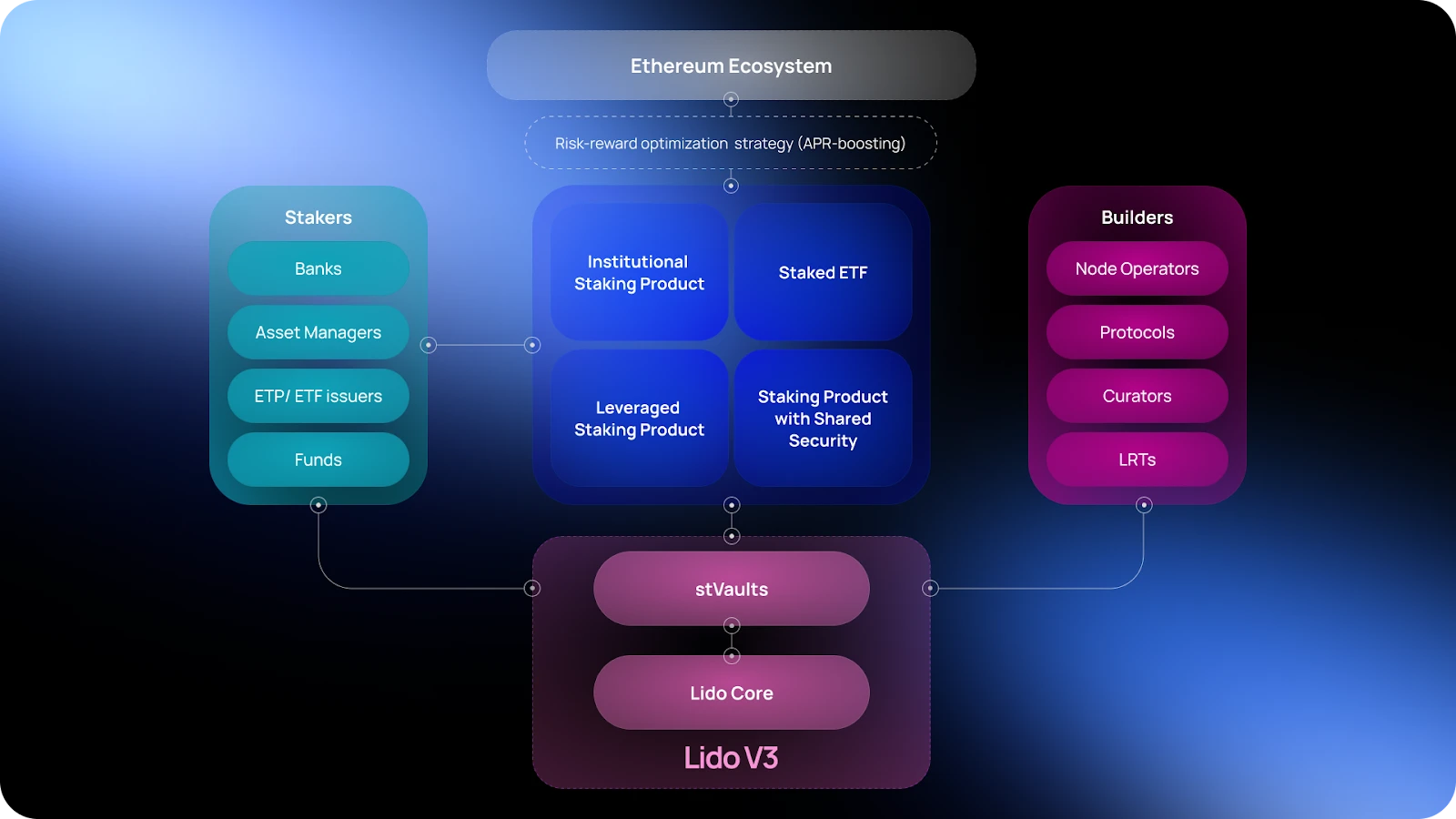

Therefore, Lido V3 introduces a new staking solution [stVaults], unlocking new tailor-made, customizable and modular Ethereum staking solutions, and is at the forefront of the industry.

Lido V3: Ethereum Staking Infrastructure

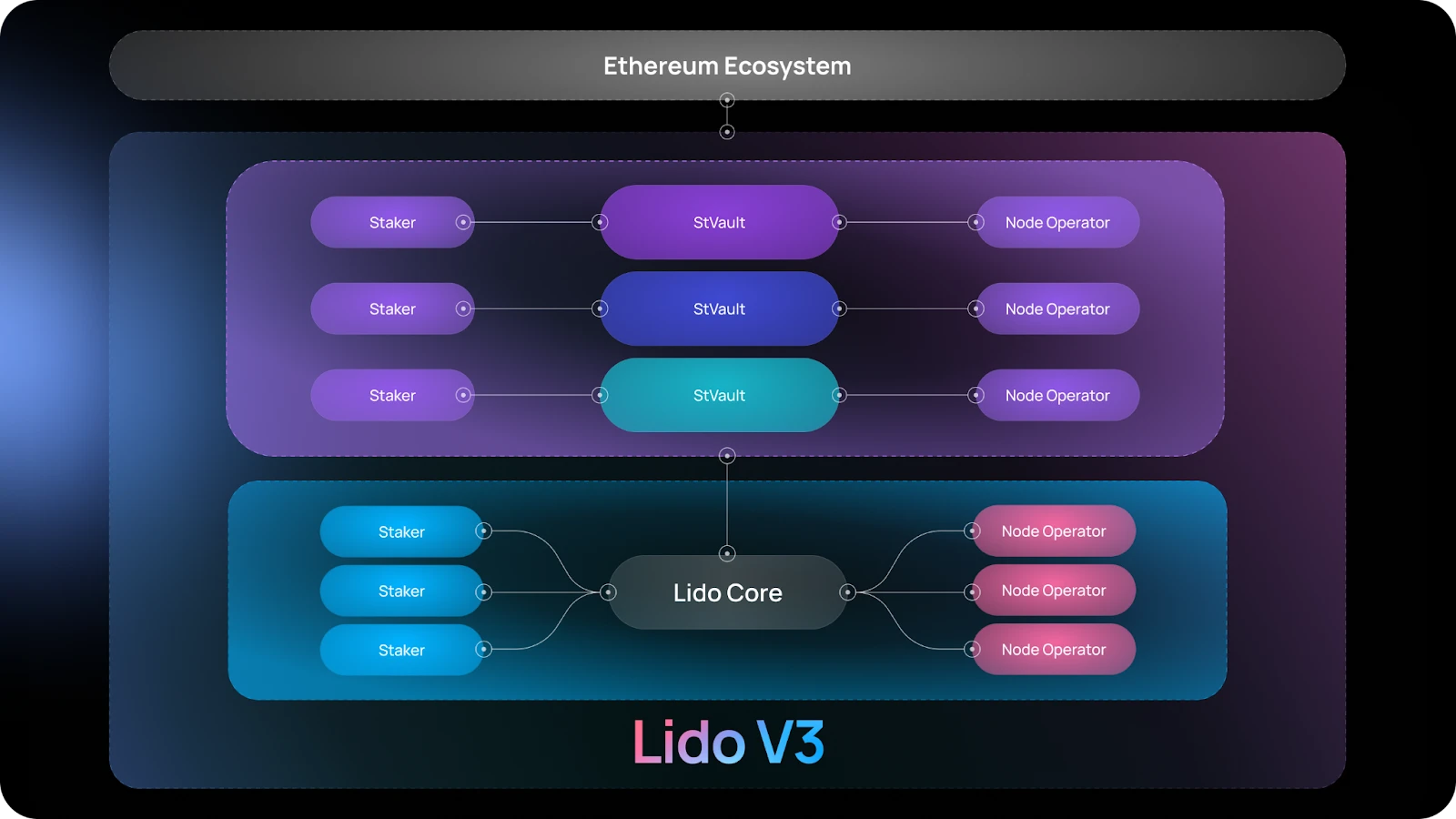

Lido V3 expands the functionality of the Lido protocol (Lido Core) on Ethereum, which currently consists of a staking router and its modules, and introduces staking vaults (stVaults), aiming to provide tailored solutions for a variety of use cases.

stVaults supports access to stETH liquidity in personalized settings, where users can set validation, fee structure, risk-reward profile, and other parameters to meet the needs of various stakers.

Institutional Friendly: Institutional stakers can:

(1) using stETH liquidity, and (2) simultaneously keeping funds in non-custodial contracts to help ensure compliance with regulatory and risk management requirements;

Flexible nodes : Allow nodes to act as curators and customize solutions for high TVL customers to obtain higher income and more TVL;

Yield Enhancement: Asset managers can quickly adapt to market dynamics and leverage stETH’s universal collateral properties to develop innovative strategies, optimize capital efficiency, and integrate with emerging DeFi opportunities.

Ultimately, all parties should have long-term incentives that establish predictable, future-proof, and value-based sources of rewards in the Ethereum ecosystem.

Technical foundation: stVaults

stVault is a key smart contract that enables non-custodial delegated liquidity staking through a single node operator (or DVT NO cluster) and connects to Lido’s infrastructure, enabling stETH to be minted on behalf of this vault.

The goals of stVault are as follows:

(1) Allow users to customize the risk and return configuration of liquid staking without affecting the stability and fungibility of existing stETH tokens.

(2) Allow institutional stakers and node operators to designate each other

(3) Make stETH better integrated

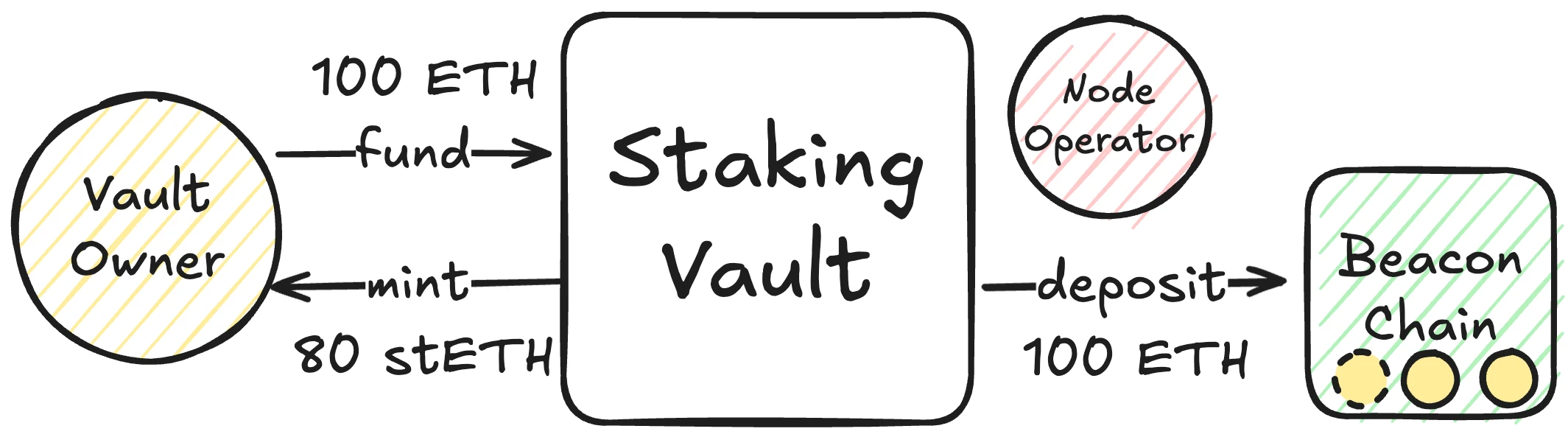

The following diagram shows how institutional pledgers can complete the pledge in a non-custodial manner and obtain a certain proportion of stETH:

When stETH is minted, the corresponding amount is locked for withdrawal from the vault. The locked amount is specified in stETH shares, and the share balance increases daily as stETH is rebased. To unlock ETH withdrawals, the vault must destroy the necessary amount of stETH.

In order to cover the risk of maintaining a custom collateral setup for stETH holders, the minting ratio of stETH is different from the 1:1 allowed by Lido Core, but instead has some reserve margin (called the reserve ratio or RR, such as 80% in the figure), which is determined by risk parameters and limits.

This ensures that stETH minted through stVaults maintains a reasonable over-collateralization. Over-collateralization enhances the economic security of stETH by increasing its resilience to possible slashing events and penalties. In addition, it enables dynamic adjustment of the reputation and collateral requirements of public node operators at the protocol level, ensuring network stability and supporting advanced integrations.

At a high level, stVaults is a non-custodial staking platform that runs alongside the existing Lido Core protocol, allowing any user to securely stake ETH with a node operator of their choice.

Through connection to Lido Core, stVaults can mint stETH backed by personalized validation setups, gaining access to the high liquidity and integration of LST provided by the market.

The biggest difference between using Lido stVault and Lido Core is that stVaults are independent smart contracts used by each institution, while Lido Cores ETH custody address is equivalent to a public pool.

Customizable vaults to meet every need

stVaults have flexible configuration options, enabling different builders to customize staking settings, optimize rewards, and develop tailored product lines while benefiting from the security and liquidity of stETH.

Institutional Staking: Institutional staking requires greater flexibility and control. stVaults addresses these needs by allowing institutional users to create dedicated stVaults that connect to specific node operators, configure integrations, and manage deposit and withdrawal access.

stVaults can support both custodial and non-custodial setups, meeting a variety of operational requirements while providing access to stETH liquidity.

Leveraged Staking: For advanced stakers, stVaults provides tools to implement leveraged staking strategies, supporting both manual and automated smart contracts.

Potential approaches include:

Primary Market: Get ETH directly from the Lido Core protocol.

Secondary market: Utilize ETH provided by DeFi lending platforms.

Re-Staking Risk Control: stVaults introduces an opt-in approach to shared security, which allows participants to explore customized strategies and participate in re-staking without creating socialized risks to the broader ecosystem.

Infrastructure for the future: stVaults is a modular foundation for builders and developers, enabling the creation of staking products and tools that adapt to the ecosystem. By leveraging stETH’s universal collateral properties, developers can seamlessly integrate with DeFi applications.

How does Lido V3 strengthen Ethereum’s decentralization?

Open coordination and competition in emerging markets

As we all know, Ethereum relies on nodes distributed around the world, and Lido V3 introduces stVaults to provide a modular, customizable staking framework that can make Ethereum more decentralized. Each stVault has an independent operator, thus reducing the Matthew effect of ETH nodes.

Balancing fluidity, performance, and security

stVaults has a mechanism to balance capital efficiency, validator performance, and stake concentration. ETH bonds mitigate slashing risk, while optional dynamic fees (based on the Lido Core protocol) associated with a subset of validators within the staking router help manage liquidity, evaluate performance, and support decentralization.

Voluntary upgrades and autonomy

stVault allows its stakers to choose if and when to adopt Lidos upgrade features. Minting stETH means opting in to the protocols evolving governance process, while returning stETH reverts the vault to native staking under the control of staker upgrade objections. This seamless on-off method maintains autonomy, reduces friction, and respects Ethereums openness and decentralization.

Roadmap

Lido V3 is designed as a builder-centric product that enables node operators, asset managers, LRT (Liquid Restaked Tokens) and other DeFi protocols to create optimal solutions for end users using stETH liquidity. The strategy prioritizes efficiently providing the necessary tools and building blocks and iterating with partners and the broader community.

The rollout is planned in three phases:

Phase 1: Early adopters can use the existing technology stack to build re-collateralized vaults and start a pre-deposit and early access program for stVault. These initial vaults will transition to full stVault functionality after mainnet launch.

Phase 2: Testnet deployment of stVaults will begin, allowing for rigorous testing and integration development with partners in preparation for mainnet readiness.

Phase 3: Mainnet launch of stVaults will enable key use cases including tailored institutional setups, leveraged staking, and shared security configurations.

Summarize

Lido V3 introduces modular innovation stVaults, which adds great flexibility to institutional stakers by enabling customizable stake settings, allowing users to choose node operators and verification infrastructure. Stakers can customize Ethereum staking strategies to meet their needs and optimize rewards based on priority, giving full play to the liquidity, security and integration advantages of stETH.

In a more relaxed regulatory environment, institutional interest in Ethereum staking will further increase. Therefore, the Lido V3 upgrade is specifically targeted at institutional stakers, node operators, and asset managers - institutional stakers can use stETH through fully customized settings that help meet internal compliance requirements while providing the operational control they need.

At the same time, node operators can design personalized staking products for large staking participants, providing functions such as validator customization and enhanced reward mechanisms; asset managers can develop future-oriented structured products, using stETH as the primary collateral in the Ethereum ecosystem.

In addition, Lido V3 also prioritizes Ethereums decentralization, liquidity, and security. Its design encourages healthy competition among validators while reducing governance and slashing risks. By balancing performance, liquidity, and risk, Lido V3 provides a solution that serves both the Ethereum community and its long-term vision.