introduction

Bitcoin has fallen recently, but its status as a core asset of the US dollar has not been affected . With the trend of regulatory relaxation, US dollar assets are expected to maintain a volatile upward trend.

With the implementation of the Trump administrations crypto-friendly policies, the US crypto industry has ushered in unprecedented opportunities. Core institutions such as the Treasury Department, SEC, and CFTC are led by officials who support cryptocurrencies. The White House has established a digital asset working group , and Congress has established a crypto asset committee to promote the legalization and institutionalization of the industry. This policy orientation has boosted market confidence and accelerated the entry of mainstream financial institutions.

At the legislative level , the advancement of the FIT21 bill, the establishment of a stablecoin regulatory framework, and the softening of the SECs enforcement attitude indicate that the crypto industry is bidding farewell to policy uncertainty and moving towards a more stable and sustainable development path. Although the short-term market may fluctuate due to the impact of the macro economy and the timing of policy implementation, the long-term trend is positive. The United States is accelerating the construction of the worlds most competitive crypto financial ecosystem, and the industry is moving from the Wild West to the mainstream financial system.

1. The Trump administration appoints crypto-friendly officials, bringing development opportunities to the industry

1. Changes in leadership of key regulatory agencies

The Trump administration has demonstrated a crypto-friendly stance in its leadership arrangements at key financial regulators:

Treasury Secretary Scott Bessent: A hedge fund manager and cryptocurrency advocate, he supports Bitcoin and decentralized finance (DeFi), pushing the Treasury Department to relax regulation of crypto assets and give the industry more room in tax policy.

SEC Chairman/Paul Atkins : Former SEC Commissioner, supports free market development and reduces regulatory intervention. His appointment means that the SEC may reduce law enforcement actions and promote free market development.

CFTC Chairman/Brian Quintenz: As a former CFTC commissioner, he supports loose regulation of crypto derivatives and DeFi, and expects the CFTC to encourage innovation rather than restrict industry development.

The appointments of these key officials have boosted market confidence as investors expect the U.S. regulatory environment to become more open.

2. White House Digital Asset Task Force

The Trump administration established the Presidential Working Group on Digital Asset Markets, led by David Sacks, White House Special Advisor on AI and Cryptography, and its members include the Secretary of the Treasury, the Attorney General, the SEC, the CFTC and other key regulatory agencies.

The goals of the working group include:

Develop a national regulatory framework for cryptocurrencies – unifying market structure, consumer protection and risk management rules.

Assess the feasibility of Bitcoin as a national reserve - submit relevant policy recommendations within 180 days.

Preventing CBDC Development - Explicitly prohibiting the Federal Reserve from developing central bank digital currency (CBDC) and maintaining the private digital currency market.

The establishment of this working group has enabled the United States to move towards becoming a global cryptocurrency center and has made policy advancement more systematic.

3. U.S. Senate Banking Committee: Establishment of Digital Asset Committee

On January 23, 2025, the Senate Banking Committee established a Digital Assets Committee, chaired by Senator Cynthia Lummis, to promote industry compliance: through bipartisan legislation, promote stablecoin regulation, market structure optimization, and promote Bitcoin as a national strategic reserve asset. Supervise financial regulatory agencies to prevent discriminatory suppression of cryptocurrencies, such as Operation Chokepoint 2.0.

The Strategic Bitcoin Reserve Act proposed by Lummis suggests selling part of the Federal Reserves gold reserves and purchasing 1 million bitcoins to build a national bitcoin reserve, reflecting the Trump administrations emphasis on bitcoin.

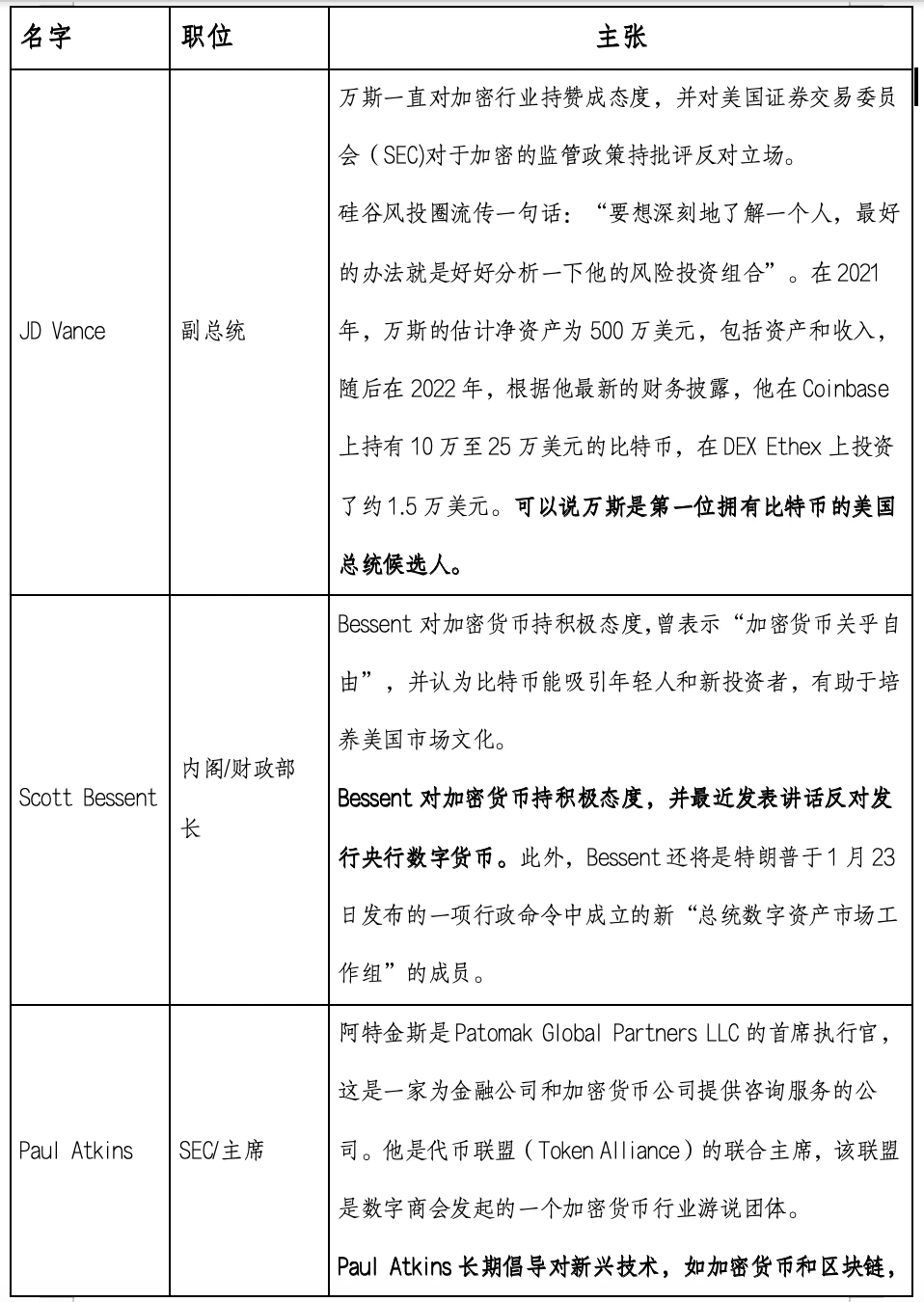

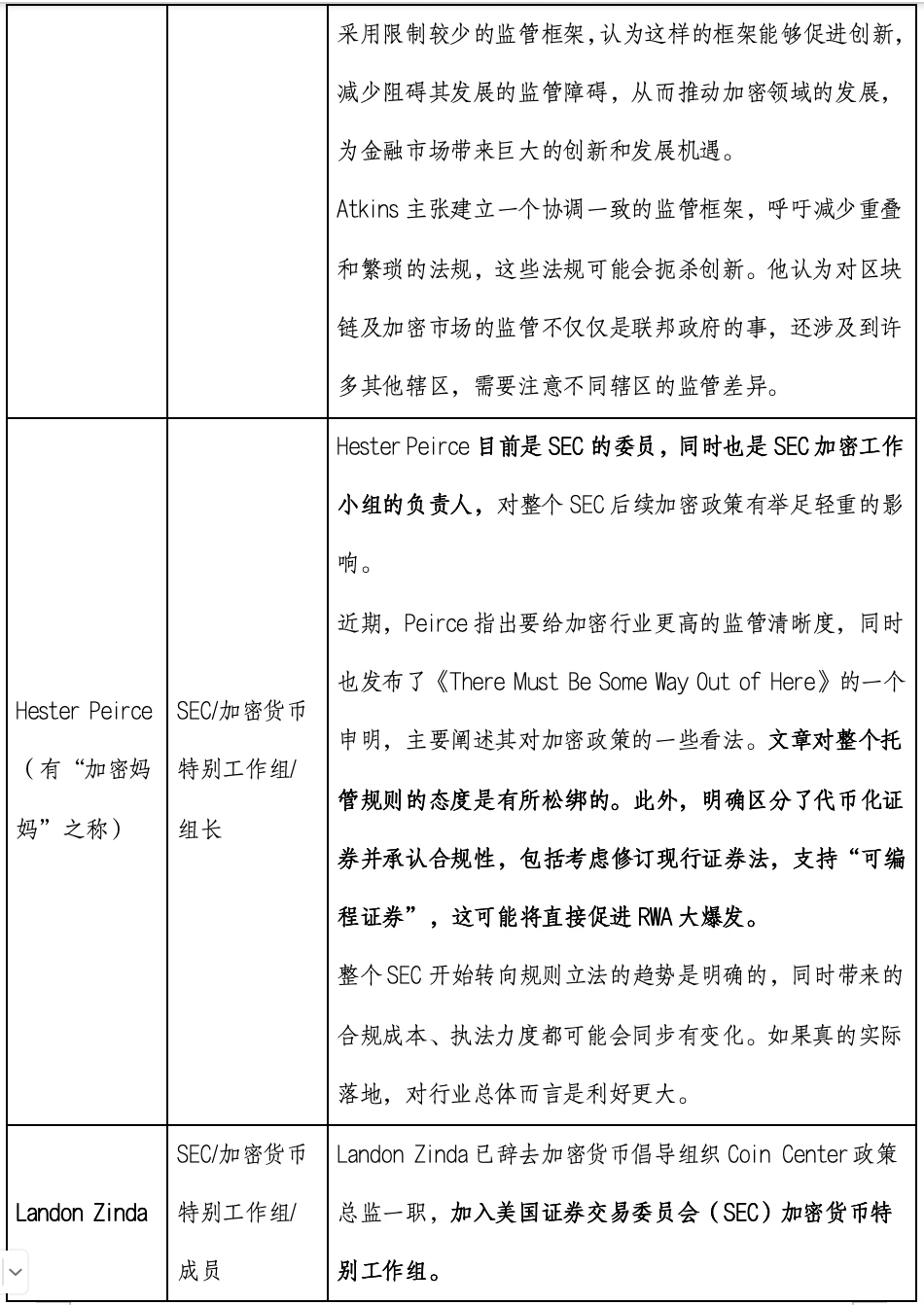

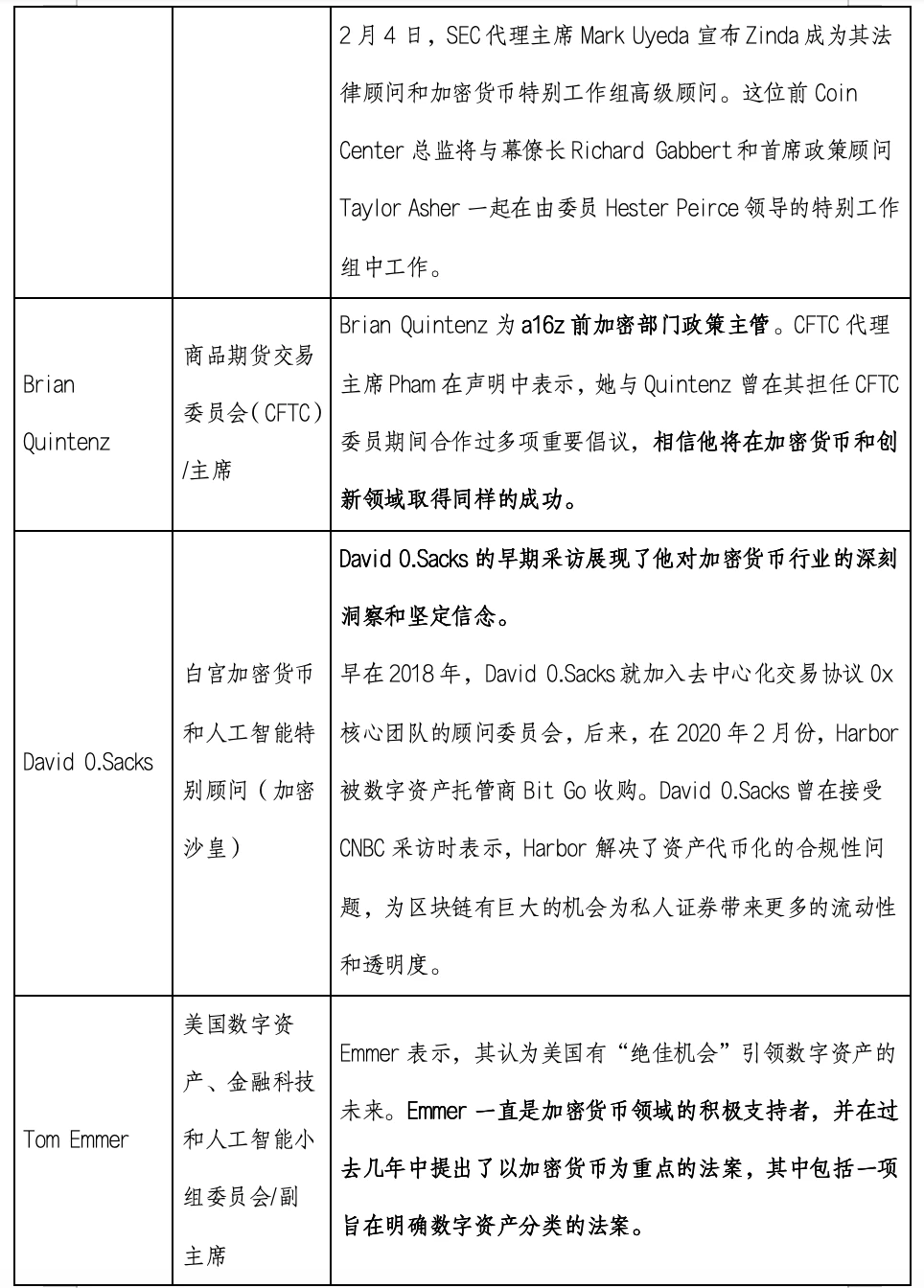

Here is a list of crypto-related officials Trump has appointed since taking office:

2. US encryption bill ushered in a turning point, regulation was relaxed, and the industry moved towards the mainstream

1. SEC regulation is relaxed, giving the crypto industry some breathing space

The SECs recent policy adjustments indicate a softening of its regulatory stance:

Dropping enforcement actions against crypto giants: Terminate investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognize Memecoin’s non-securities attributes: Allow some tokens to avoid securities regulations and promote market innovation.

Strengthen industry communication: SEC Commissioner Uyeda acknowledged that past supervision relied too much on law enforcement and pledged to promote policy transparency and engage in dialogue with major industry companies and leaders.

These measures have freed the U.S. encryption industry from frequent law enforcement pressure and enabled it to develop in a more stable and healthy direction.

2. Stablecoin legislation is on the agenda, and market confidence is enhanced

On February 5, U.S. Senator Bill Hagerty proposed a stablecoin regulation bill to include stablecoins such as USDT and USDC in the Federal Reserves regulatory framework and provide compliance guidance. The bill has received support from bipartisan lawmakers and is seen as a key step for the crypto market to move toward a mainstream financial system. After its passage, the legitimacy and security of stablecoins will be greatly improved, and it is expected to attract more traditional financial institutions to enter the market and promote further development of the industry.

3. Revocation of SAB 121, loosening of crypto accounting policies

On January 24, the SEC officially revoked the SAB 121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, the policy required custodians to include customer crypto assets in their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges and financial institutions can provide crypto asset custody services more freely, reducing the barriers for institutional investors to enter the market.

4. FIT21 Act: The crypto market has a clear regulatory framework

On May 22, 24, the FIT21 Act was passed by the House of Representatives, which was regarded as a historic breakthrough for the U.S. crypto industry. The bill resolved the long-standing disagreement between the SEC and the CFTC on cryptocurrency regulation and made it clear that:

Regulatory powers of the SEC and CFTC: Ending regulatory chaos and providing a unified regulatory framework.

Cryptocurrency securities and commodities classification standards: Resolving core legal disputes and avoiding regulatory overlap.

Clarify token issuance and trading rules: provide practitioners with clear compliance guidance and reduce uncertainty.

Promote DeFi regulatory research: Promote the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this bill will gradually legalize and institutionalize the U.S. crypto market and enhance market confidence. The United States may become the worlds most competitive crypto financial center.

4. Conclusion: The crypto industry is moving towards the mainstream and ushering in a golden period of development

After the Trump administration came to power, the policy environment for the U.S. crypto industry has undergone fundamental changes. The regulatory attitude has shifted from high pressure to friendly, and market confidence has increased significantly. The government has gradually clarified the regulatory framework for the crypto industry through the appointment of key officials, the establishment of a digital asset working group, and the promotion of congressional legislation, providing a more stable policy environment.

The SEC has relaxed its enforcement, stablecoin regulation has accelerated, and the FIT21 bill has passed the House of Representatives smoothly. The crypto market is rapidly moving towards legalization and institutionalization. As favorable policies continue to be implemented, the corporate innovation environment is further opened up, and investor confidence is enhanced, stablecoins, DeFi, custody and other fields may usher in a new round of growth.

The United States is accelerating the consolidation of its position as the global crypto-financial center. The industrys golden development period is about to arrive, and it is an inevitable trend for cryptocurrencies to move towards the mainstream financial system.

about Us

Metrics Ventures is a data and research driven crypto asset secondary market liquidity fund led by an experienced team of crypto professionals. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC works with senior influencers in the crypto community to provide long-term empowerment support for projects, such as media and KOL resources, ecological collaboration resources, project strategies, economic model consulting capabilities, etc.

Everyone is welcome to DM to share and discuss insights and ideas about the market and investment of crypto assets.

Our research content will be published simultaneously on Twitter and Notion, welcome to follow:

Twitter: https://twitter.com/MetricsVentures

Notion: https://www.notion.so/metricsventures/Metrics-Ventures- 475803 b 4407946 b 1 ae 6 e 0 eeaa 8708 fa 2 ?pvs=4

Hiring! We are looking for traders with good salary and flexible working location.

If you: bought sol below 40/ ordi below 25/ inj below 14/ rndr below 3.2/ tia below 10 and meet any two of the above, please contact us at admin@metrics.ventures, ops@metrics.ventures