Original author | Arthur Hayes (BitMEX co-founder)

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: Ethan ( @jingchun333 )

Editors note: The market took a sharp turn for the worse last night. For details, please see The effect of Trump Emperors call lasted only one day, and the crypto market fell overnight . Arthur Hayes latest article KISS of Death deeply analyzes the path that the Trump team may use to promote the America First strategy through debt monetization, and discusses in detail the possible policy game between the Federal Reserve and the Treasury. He believes that Trump may actively create an economic recession through creative destruction, forcing the Federal Reserve to relax monetary policy, thereby providing new liquidity to the market, which also brings new opportunities to the cryptocurrency market.

Arthur predicts that Bitcoin will perform well in the upcoming financial storm, becoming a safe haven asset in the global liquidity fluctuations, and may usher in a new rising cycle. Specifically, in terms of price points, Arthur believes that BTC may fall to around $70,000 in the near future, but there is a high probability that it will rebound quickly and rise violently thereafter. Therefore, it is recommended that investors adopt the non-leveraged fixed investment + double the plunge strategy and pay close attention to two major data indicators - changes in the balance of the U.S. Treasury Account (TGA) and the foreign exchange operations of the Peoples Bank of China.

The following is Arthurs original text, translated by Odaily. Because Arthurs writing style is too free and easy, there will be a lot of free play in the text that is irrelevant to the main content. In order to facilitate readers understanding, Odaily will make some deletions to the original text when compiling.

KISS principle: simplicity is the best

When faced with a huge amount of policy information from the Trump administration, many readers often overlook a basic principle - the KISS (Keep It Simple, Stupid) minimalist principle. The essence of Trumps media strategy is to create dramatic events every day , so that when you open your eyes in the morning, you cant help but exclaim: Oh my God! What big news did Trump/Musk/Robert Kennedy Jr. make last night? Whether you are passionate about his behavior or disgusted by it, this empire reality show narrative technique is indeed very emotionally appealing.

This constant emotional turmoil is particularly dangerous for cryptocurrency investors. You may rush to build a position due to a piece of good news, but then be shaken by subsequent reports and choose to sell. The market is repeatedly harvested in the violent fluctuations, and your assets are quietly evaporated in this emotional operation.

Please always remember: simplicity is the best way.

Who is Trump? In essence, he is a performative businessman who is well versed in the game of real estate capital. In this field, his core ability lies in leveraging huge leverage at the lowest financing cost, and then packaging steel and concrete into landmarks of the times through exaggerated marketing. Rather than how he stirs up public emotions, I am more concerned about how he uses financial engineering to achieve his political ambitions.

I think Trump is trying to implement the America First strategy through debt monetization. Otherwise, he should have allowed the market to clear the systemic credit bubble, but this would have triggered a depression far worse than the Great Depression of the 1930s. History has given us two references: Hoover, who was criticized for slow money printing, and Roosevelt, who was deified as a pioneer in saving the market. Obviously, Trump, who is eager to leave a name in history, will never choose to destroy the foundation of the empire through fiscal austerity.

Andrew Mellon, the Treasury Secretary during the Hoover era, once prescribed shock therapy for the economic crisis:

Clear the labor market, let the stock market crash, let agriculture go bankrupt, let the housing market collapse - this will cleanse the system of corruption. When the cost of living and overconsumption return to rationality, people will regain the virtue of diligence. After the value system is reconstructed, real entrepreneurs will rise from the ruins.

Such a tone would never come from current Treasurer Scott Bessent.

If my judgment is correct - Trump will advance the national strategy through debt expansion, what does this mean for risky assets such as cryptocurrencies? To answer this question, we need to predict the direction of two core variables: the supply of money/credit (the scale of money printing) and the price (interest rate level). This essentially depends on what kind of policy coordination will be formed between the US Treasury (Scott Bessant) and the Federal Reserve (Jerome Powell).

Power Game: Who is manipulating the dollar gate?

Where do Bessant and Powells allegiances lie? Do they serve in the same political camp?

As the candidate for the Treasury Secretary in the Trump 2.0 era, Bessants public remarks and decision-making logic are deeply in line with the emperors mind. On the other hand, Powell, the chairman of the Federal Reserve promoted by Trump 1.0, has long turned to the camp of guardians of the Obama-Clinton political legacy. His forced interest rate cut of 50 basis points in September 2024 can be called a political pledge: at that time, the US economic growth rate exceeded expectations, and inflation was still there, so there was no need for easing. But in order to save the approval rating of puppet President Harris, Powell chose to overdraw the central banks credit for political donations. Although he ultimately failed to reverse the election situation, after Trump won the election, this inflation fighter suddenly announced that he would stick to his post and continue to raise interest rates.

Debt restructuring: the art of default of boiling a frog in warm water

When the debt scale exceeds the critical point, the economy will fall into a double dilemma: interest expenses devour fiscal space, and the soaring market risk premium blocks financing channels. At this time, the only way is to extend the debt maturity (debt long-termization) and reduce interest rates to achieve soft defaults - both operations are essentially to reduce the present value of debt through discount rate adjustments. In my in-depth analysis The Magic Bottle , I have disassembled this set of fiscal alchemy in detail. Its core is: reshape the balance sheet by exchanging time for space to create conditions for a new round of lending cycles. In theory, the Ministry of Finance and the Federal Reserve should have completed this financial operation together, but the reality is that the two heads belong to different camps, and policy coordination has become a luxury.

Credit manipulation: The Fed’s magic toolbox

Powell, who controls the tap of the US dollar, has four major policy levers: the reverse repurchase facility (RRP), the reserve interest rate (IORB), and the upper and lower limits of the federal funds rate. The essence of these complex mechanisms is to give the Federal Reserve unlimited power to print money and set interest rates. If the two major institutions can really work together, we can easily predict the tide of US dollar liquidity and the policy responses of China, Japan, and the European Union. But the reality is that Trump needs to solve an impossible triangle: forcing Powell to release money and cut interest rates to stimulate the economy, while maintaining the credibility of the central bank to fight inflation.

Recession: The Feds Kill Switch

There is an iron rule here: when the US economy falls into (or faces) a recession, the Federal Reserve will definitely start printing money or cut interest rates. At this moment, the strategic choice facing Trump is whether to actively create an economic contraction to force the Federal Reserve to change direction? Although this kind of creative destruction is painful, it may become the ultimate weapon to break the policy deadlock.

History proves the Fed’s recession response mechanism

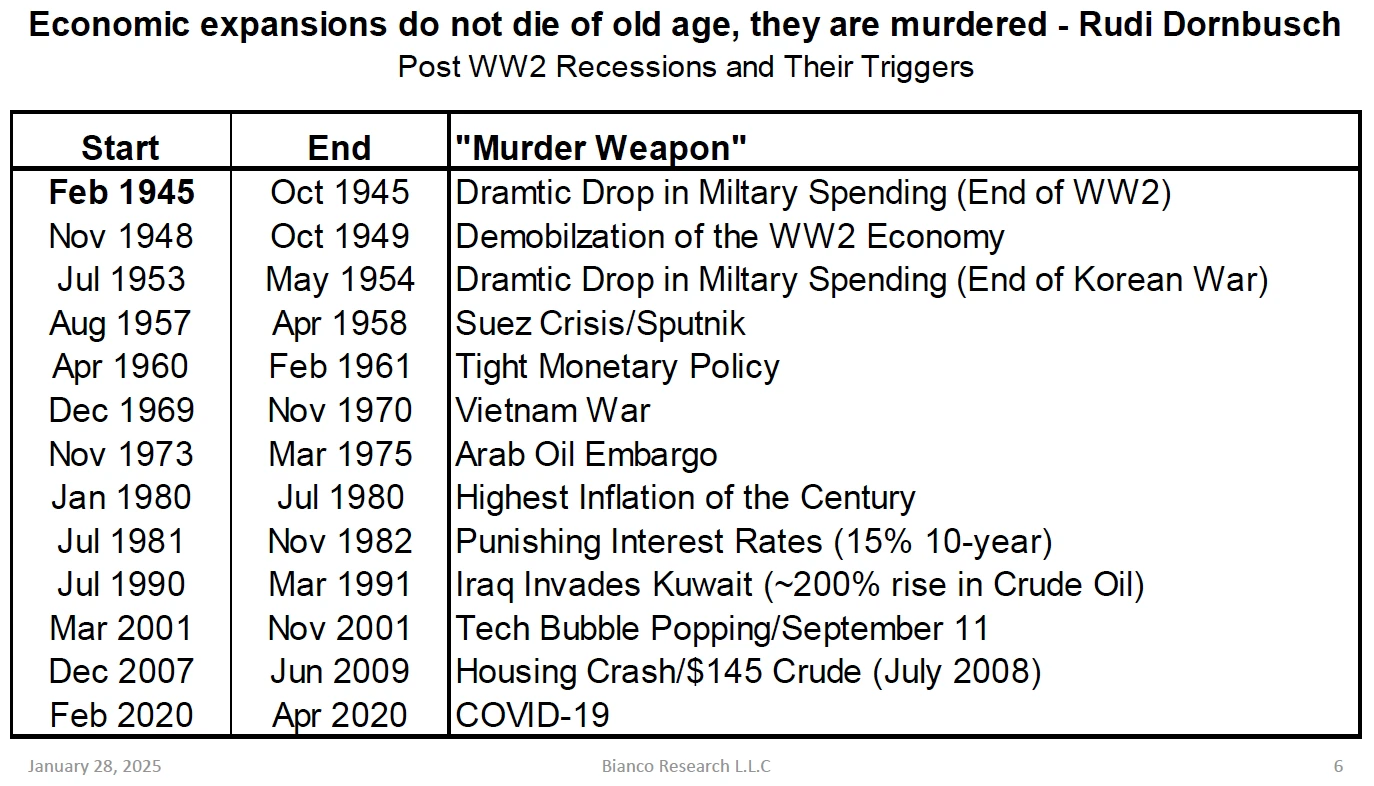

This is a list of the direct causes of modern post-WWII recessions in the U.S. A recession is defined as negative quarter-over-quarter GDP growth. I focus specifically on the period from 1980 to the present.

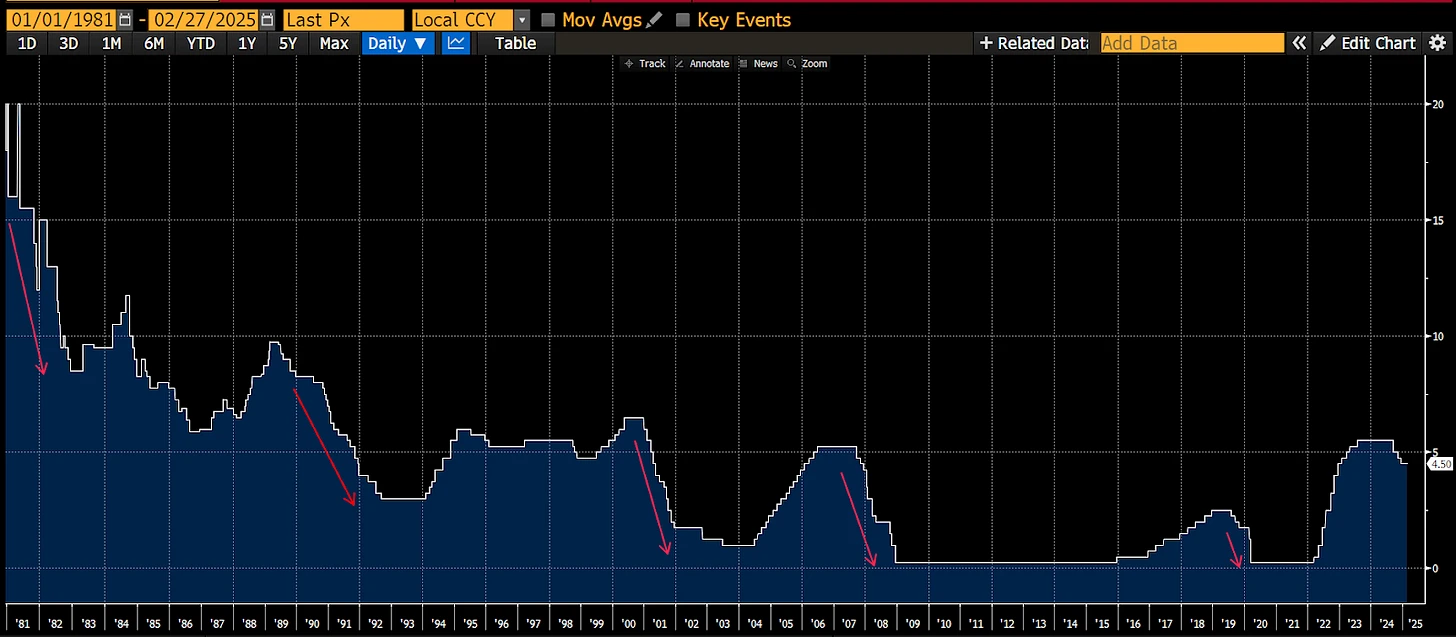

Here is a chart of the lower bound of the Fed Funds rate. Each red arrow represents the start of a rate cutting cycle, and these cycles coincide with recessions. It is clear that the Fed will at least cut rates during recessions.

Through the historical data of Bianco Research (see chart), we can clearly see the recession response mode of the Federal Reserve after World War II - whenever the quarterly GDP turns negative on a quarter-on-quarter basis (i.e. technical recession), the lower limit of the federal funds rate will definitely start to decline (marked by the red arrow in the figure). This policy inertia is particularly significant in the five economic cycles after 1980, forming an unbreakable recession-easing conditional reflex.

The Achilles heel of a debt economy

The modern U.S. economy is essentially built on a three-layered powder keg of debt:

1. Corporate side : SP 500 companies maintain operations and expansion through bond financing, and their debt certificates constitute the core assets of the banking system. When revenue growth stalls, the risk of debt default will directly shake the foundation of the financial system.

2. Households : The debt ratio of American households is as high as 76%, and consumption behavior is highly dependent on leverage tools such as mortgages and car loans. Income fluctuations will trigger chain defaults and impact bank balance sheets.

3. Financial side : Commercial banks earn interest rate spreads through maturity mismatch between deposit liabilities and risky assets (corporate bonds/MBS, etc.). Any depreciation of assets will trigger a liquidity crisis.

The Central Bank Prisoner’s Dilemma

Faced with this structural vulnerability, the Federal Reserve has actually lost its policy autonomy. When the economy shows signs of recession (or the market forms recession expectations), it must immediately activate at least one of the following rescue toolkits:

● Interest rate cuts (lowering the cost of rolling over debt)

● Stop quantitative tightening (stop withdrawing liquidity)

● Restart quantitative easing (direct purchase of risky assets)

● Relaxation of bank regulatory indicators (e.g. suspension of SLR restrictions on government bond holdings)

Trumps crisis game

At this moment, the Trump team is well aware of the weakness of this mechanism. Its policy toolbox contains two ways to trigger it:

1. Substantial recession manufacturing : Actively bursting the economic bubble through policies such as trade wars and tightening regulations

2. Expectation management manipulation : Using the president’s bully pulpit to reinforce the recession narrative

No matter which path is taken, Powell will eventually be forced to open the monetary floodgates. Although this kind of creative destruction will have a short-term impact on the market, it can win strategic space for debt restructuring - just as former Federal Reserve Chairman Ben Bernanke said: Sometimes you need to let the house burn down in order to rebuild a stronger fire protection system.

DOGE shockwave: Trump’s recession-making technique

Government spending: a double-edged sword for the U.S. economy

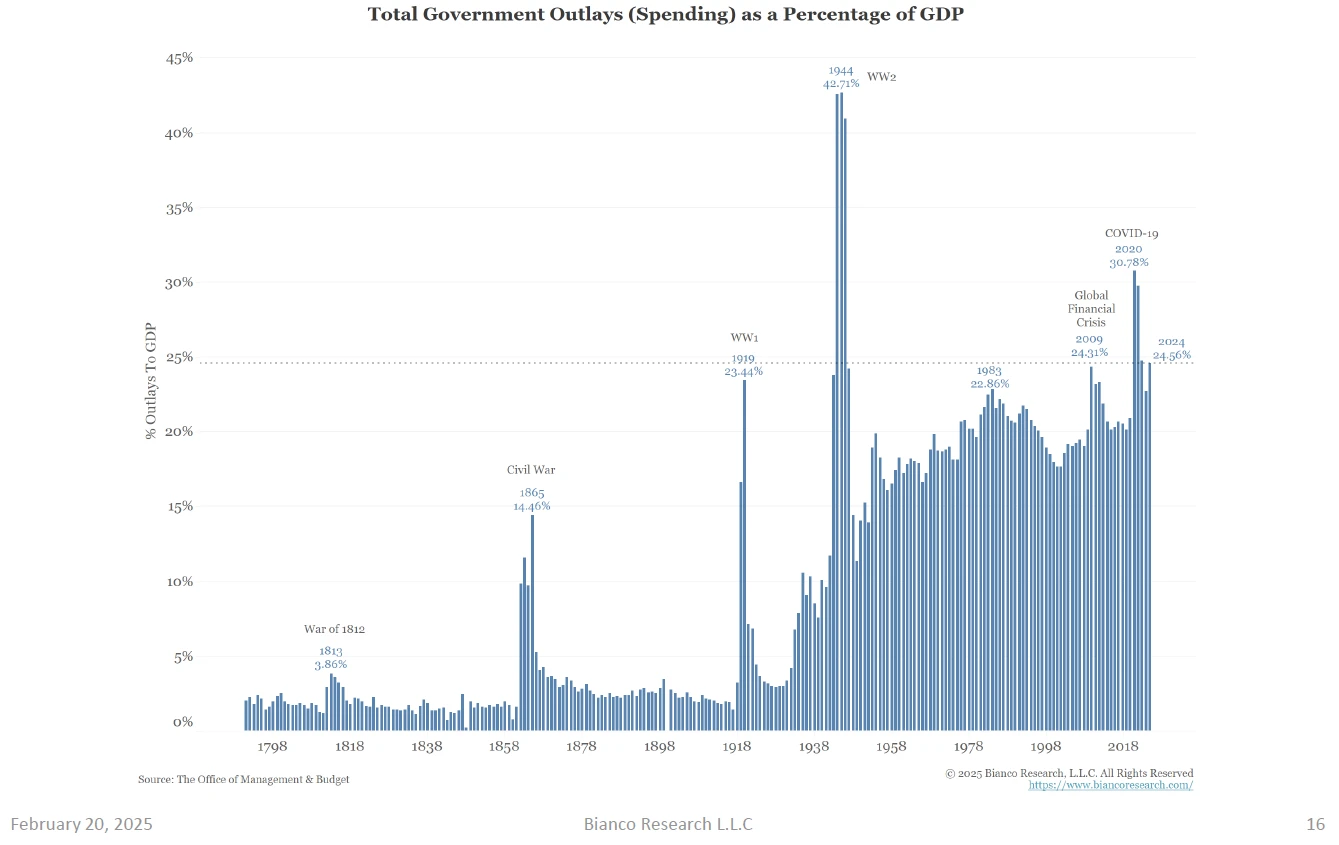

The engine of US economic growth is shifting from the private sector to government spending - whether it is necessary infrastructure or zombie projects, it is creating a GDP data boom. With a median household income of $122,246 (the top 4% in the US), Washington, DC, has become a living example of this fiscal drive. The policy rentier class here has built a revolving door economy with American characteristics through a complex fiscal transfer mechanism.

DOGE Blade: Precision Fiscal Surgery

The Department of Government Effectiveness (DOGE), led by Musk, is implementing an unprecedented financial liquidation:

● Fraudulent expenditure sniping : The Social Security Administration (SSA)s nearly trillion-dollar ghost payments each year have become the primary target of attack, and the AI audit system is used to trace the accounts of deceased beneficiaries

● Downsizing of the bureaucracy : 400,000 federal employees are expected to be cut by 2025. The initial layoffs alone have caused a 11% drop in housing prices in Washington, DC (Parcl Labs data)

● Anticipatory management deterrence : Establish a digital red wall monitoring system to enable gray income practitioners to proactively terminate illegal behaviors

This creative destruction has already shown economic transmission effects:

● Unemployment claims surge in Washington, D.C. (Fox Business)

● The discretionary consumer market contracted (23% lower than analysts expected)

● Economists warn that Q3 may fall into a technical recession (Economic Times)

The Fed’s moment of salvation

Faced with the refinancing pressure of $2.08 trillion in corporate bonds and $10 trillion in Treasury bonds that are about to mature, Powell was forced to start the triple liquidity engine:

1. Interest rate arsenal : Every 25 basis point rate cut ≈ $100 billion in QE. If the interest rate is reduced to zero, $1.7 trillion in liquidity can be released

2. QT brake mechanism : Early termination of quantitative tightening can release $540 billion in stock funds

3. Regulatory relaxation : restarting the QE+SLR exemption combination, allowing banks to purchase government bonds with unlimited leverage

Liquidity Tsunami Simulation

Conservative estimates show that $2.74-3.24 trillion in liquidity will be injected in 2025, equivalent to 70-80% of the scale of COVID-19 liquidity injection. Referring to historical patterns:

● $4 trillion stimulus pushes Bitcoin up 24 times in 2020

● The current 3.2 trillion injection may catalyze a 10-fold increase (corresponding to the Bitcoin million-dollar mark)

Key hypothesis testing

1. Debt monetization becomes the core fuel of America First ✔️

2. DOGE policy successfully creates a controlled recession ✔️ (Washington DC has become a testing ground)

3. The Federal Reserve was forced to initiate crisis response procedures✔️ (historical rules + political pressure)

Strategic reserves: political statements vs market reality

On Monday morning, Trumps Crypto Strategic Reserve Plan released on Truth Social triggered market fluctuations. Although this was just a re-PR of existing policies (his campaign platform had already made similar statements), Bitcoin still surged by 12%, and Ethereum and several meme coins even saw a violent rise of 30%+. This reveals a deep market psychology: when the traditional legal currency system is in turmoil, any sovereign-level cryptocurrency endorsement signal will be multiplied.

But we need to be aware of the threshold for policy implementation:

1. Fiscal constraints : To build substantial reserves, the US needs to finance this through a debt ceiling increase or a revaluation of its gold reserves (currently book value vs market price is several trillions of dollars different)

2. Legal obstacles : Congressional approval is required to include digital assets in the official reserve asset category

3. Implementation lag : It takes at least 18-24 months from legislation to position building

This leveraged-fund-driven rally may fade quickly, but in the long run, this move marks the official entry of cryptocurrency into the chessboard of great power games.

Bitcoin: The Prophet of Global Liquidity

The current cryptocurrency market has become the most sensitive liquidity monitor:

● Bitcoin peaked at $110,000 in January before Trump’s inauguration

● It then fell back to $78,000 (-30%), warning of liquidity contraction in advance

● During the same period, US stocks hit a record high, forming a dangerous divergence

This divergence suggests that smart money is hedging tail risks in the fiat currency system in the cryptocurrency market.

Crisis simulation and tactical planning

Scenario 1: Soft Landing

● The Federal Reserve promptly released $3 trillion of liquidity

● Bitcoin retreated to the previous high support of $70,000 and then started the main upward trend

● Future target (quick rebound): $1 million or even higher

Scenario 2: Hard Landing

● SP 500 plunges 30%, triggering a full liquidity crisis

● Bitcoin price drops to $60,000-70,000 in the short term

● The central bank launched an epic rescue and then violently reversed

Regardless of the path, it is recommended to adopt the non-leveraged fixed investment + double the plunge strategy. Focus on two major signals:

1. Changes in the balance of the U.S. Treasury Account (TGA) (real-time liquidity indicator)

2. China’s central bank foreign exchange operations (to prevent competitive devaluation of the RMB)

Undercurrent of geopolitical game

We need to be wary of Chinas reverse operation: if the Fed starts printing money, China may simultaneously release money to maintain exchange rate stability, which will form a global liquidity resonance. At that time, Bitcoin will not only be an anti-inflation tool, but also the ultimate hedge against the collapse of legal currency credit.

The Ultimate Rule

Cut through the policy noise and grasp the core logic:

1. The monetization of sovereign debt is irreversible;

2. Cryptocurrency is the only non-sovereign highly liquid asset;

3. Every deep pullback is an opportunity to get on board.