A few days ago, the first White House Crypto Summit came to an end, and its impact has just begun...

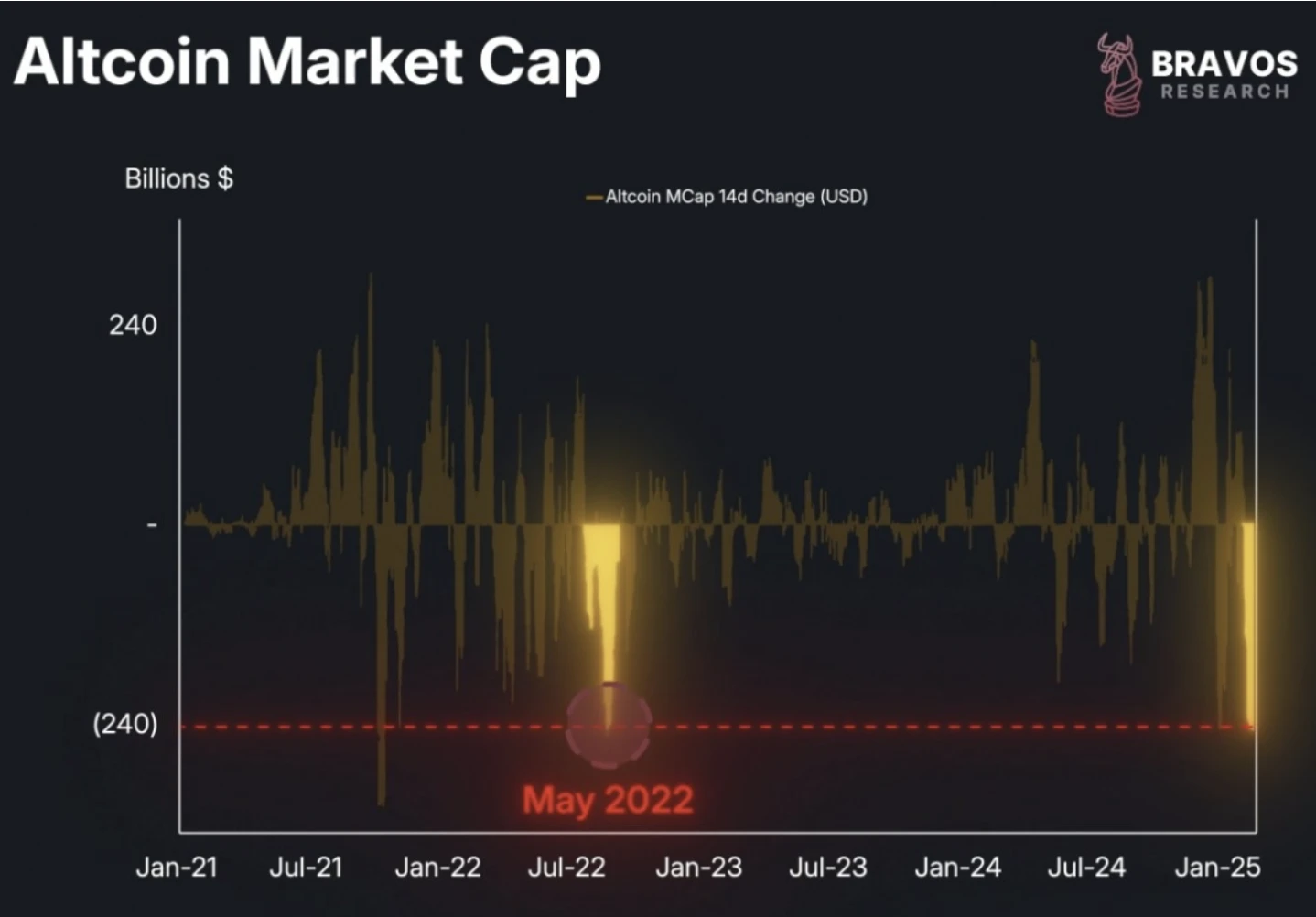

The price of BTC fell below $80,000. The crypto market is facing the largest liquidation since the collapse of LUNA. Investors sensitivity to risks has increased significantly, and funds are flowing to projects with anti-fall properties at an accelerated pace. At the same time, investors are increasingly scrutinizing the token economic model, and a key question has emerged: Is there a token model that can withstand market fluctuations and survive bull and bear cycles?

Source: Bravos Research

The temptation and cost of inflation

It is no accident that most tokens choose an inflation model. By issuing more tokens, developers, communities, and early investors are rewarded, thus quickly launching the ecosystem. However, when market sentiment is low, the expansion of circulation combined with shrinking demand can easily lead to a downward spiral in prices. Ethereum is a typical example. The total supply was not set in its early design, leading to long-term inflation problems and causing anxiety among users. It was not until the EIP-1559 proposal introduced a destruction mechanism that the selling pressure was effectively alleviated. This mechanism has a profound impact on Ethereums economic model and its market performance.

But the question is: if inflation is the fuel that kick-starts the ecosystem, can deflation be the brake to fight the cycle?

The Scarcity Logic of Deflation

In stark contrast to Ethereum’s struggle is Bitcoin’s four-year halving cycle. After each halving, the rate of new coin production is halved, and scarcity drives prices into an upward channel - this mechanism allows Bitcoin to maintain its deflationary properties after multiple bear markets, making it the only “digital gold” in the crypto market that crosses cycles.

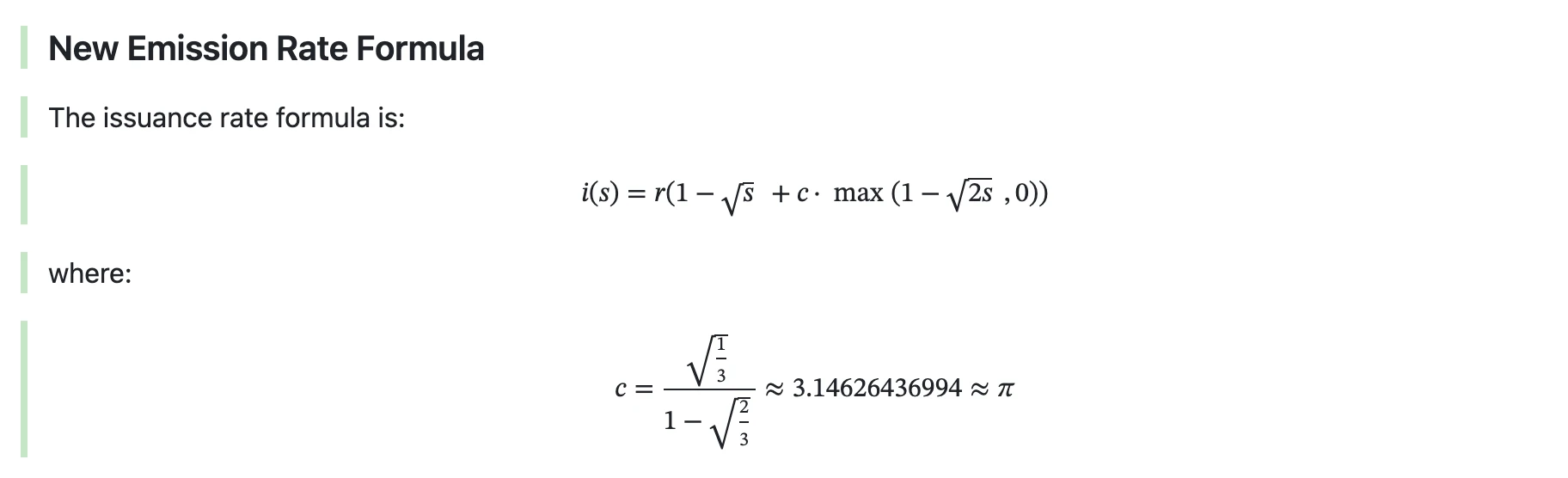

This logic is being used by more projects. For example, the Solana ecosystem, which is very popular in this cycle, has launched the SIMD-0228 proposal vote for the token SOL, which is trying to balance ecological incentives and value storage by dynamically adjusting the inflation rate. The proposal was proposed by Tushar Jain and others from Multicoin Capital. The core mechanism is: when the SOL pledge rate exceeds 50%, the issuance is reduced to curb inflation, and when it is below 50%, the issuance is increased to incentivize pledges. This elastic inflation design reveals a key principle-deflation is not a total negation of inflation, but a check and balance tool for dynamic game with it.

Source: SIMD-0228 proposal

Even during market downturns, the number of token holders of many projects has increased instead of decreased. Perhaps this is the most effective proof of the deflationary token model in the face of downward market conditions.

The triple value of deflation mechanism

In the current counter-cyclical environment, the value of the deflation mechanism has become increasingly prominent, and its breakthrough lies in three aspects:

First, the scarcity premium. When the growth rate of circulation is lower than the growth rate of demand, the value of the token will naturally rise.

Secondly, anti-inflation properties. Under the impact of excessive issuance of legal currency and regulation, deflation tokens have become a safe haven for funds.

Finally, the community consensus is strengthened. The transparent destruction behavior for the community conveys the long-term commitment of the project party and attracts value investors rather than short-term speculators.

However, to realize these values, specific tools are needed to support them. The current mainstream deflation mechanisms include:

Token destruction: transfer part of the circulating tokens to the black hole address, such as the daily destruction of BONK on the chain.

Staking and locking: Long-term holding is incentivized through returns, such as Solana’s dynamic staking rate adjustment mechanism SIMD-0228 proposal.

Ecological consumption: Tokens are used as gas fees or collateral, forming a positive cycle of use and destruction.

Microscopic sample of deflation design

$BONK has performed relatively stably in this round of crazy volatile market. The author found that it has a multi-level deflation model. The core of this model is the transparent destruction mechanism on the chain, including automatic destruction of ecological interactions and event-driven large-scale destruction. It continuously reduces its own circulation in the entire volatile market and realizes a deflationary economy. To a certain extent, it has achieved follow the rise but not the fall

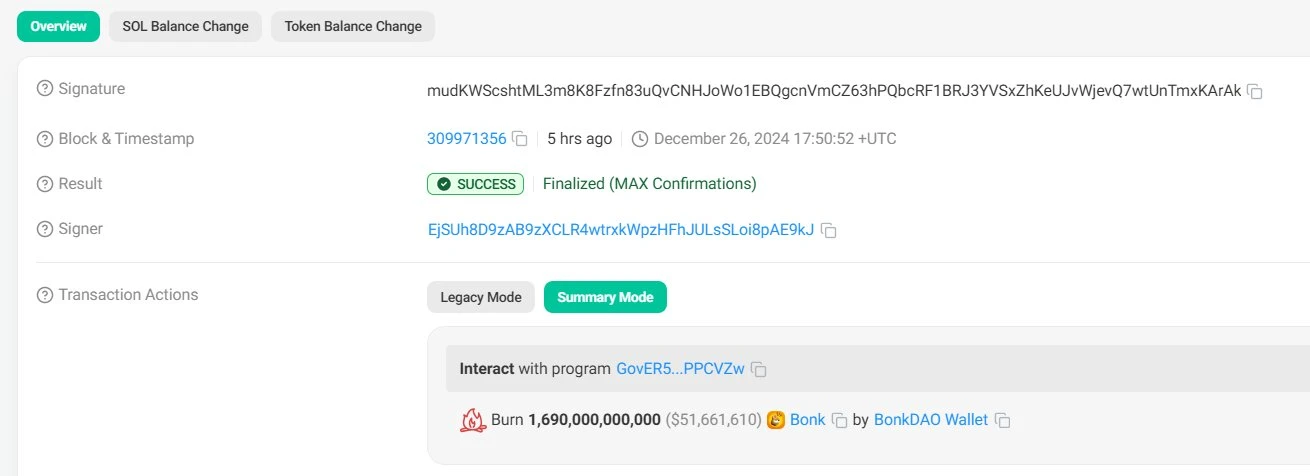

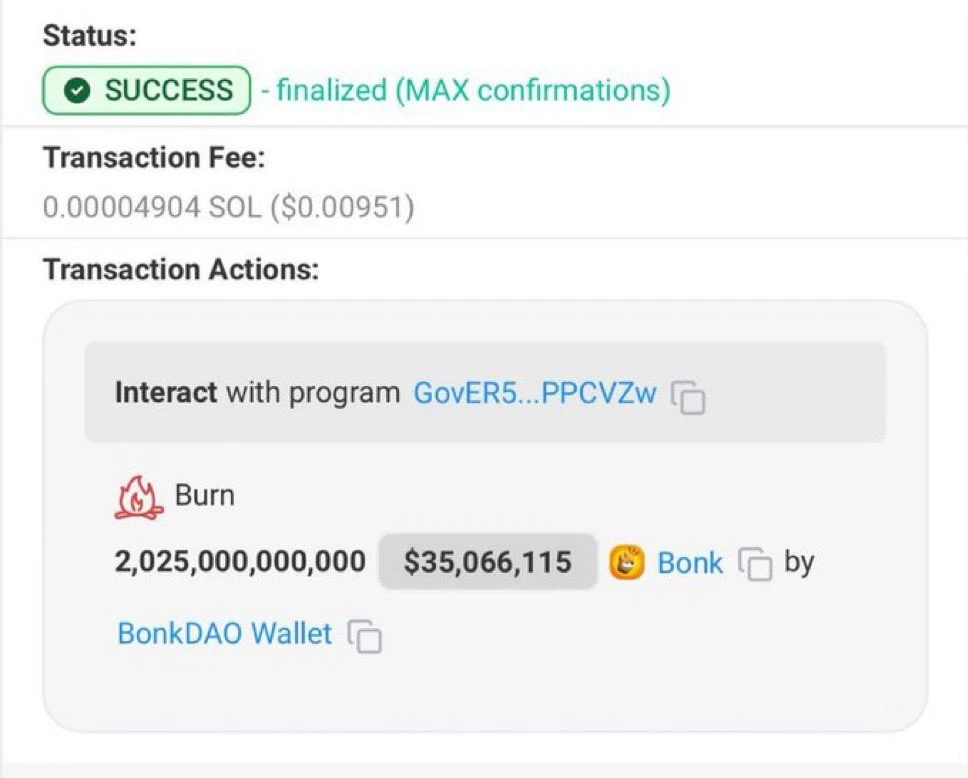

The daily destruction mechanism is connected to all Bonk ecosystem applications, and the destruction volume continues to increase. In addition, the BONK community also regularly launches event-driven large-scale destruction activities, such as the BURNmas plan for Christmas last December, which destroyed 1.69 trillion BONK (about 54.52 million US dollars), accounting for nearly 1.8% of the total supply of BONK (about 92.7 trillion pieces); in February this year, another 2.025 trillion BONK (about 36.956 million US dollars) was destroyed. These destruction measures not only enhance investor confidence, but also provide support for prices by reducing selling pressure.

Source: Solscan

These measures had a triple effect:

The first is scarcity reconstruction. As the supply of tokens in circulation decreases, the perception of their value increases, which may put upward pressure on the price of tokens.

The second is to build community trust: burning tokens also sends a positive signal to the community. It shows that the project governance is committed to the long-term growth and sustainability of the token, allowing the community to see the promise of real money.

The third is the possibility of exponential growth: due to the low price brought about by continuous destruction, the token has more room to grow. This is an attractive point for traders seeking high-risk investments but with high return potential.

In a highly volatile market environment, the value of token economics has gradually begun to emerge. It is no longer an abstract formula in a white paper, but a survival skill that determines the life and death of a project. When SOL uses SIMD proposal to balance staking and scarcity by using destruction to fight inflation, we see that the deflation mechanism is changing from an optional strategy to a survival necessity. At some moments in the crypto market, the design of the token economic model can determine life and death more than the marketing narrative.