Original author: Squads

Original translation: TechFlow

As President Donald Trump took office, stablecoin market capitalization reached a record $210 billion — a figure that is just a glimpse into how stablecoins are reshaping global money flows.

Along with this growth, competition among companies to integrate stablecoins and their payment infrastructure into products and services has intensified. In October 2024, Stripe acquired the stablecoin payment platform Bridge for approximately $1.1 billion, making it the largest acquisition in the history of the crypto space. In the same year, stablecoin payment companies received more than $309 million in financing, reflecting the markets growing confidence in the field.

Blockchain ecosystems are competing to position themselves as the ideal foundation for payment use cases, each with its own unique trade-offs that impact implementation costs, user experience, and market reach. This report explores the key factors that enterprises and developers should consider when choosing a blockchain platform to build stablecoin payment solutions, and identifies Solana and Base as the two most suitable blockchains for payments today.

On-chain payment landscape

As we have previously reported, stablecoins are evolving from a crypto-native tool to mainstream financial infrastructure, fundamentally reshaping how money moves:

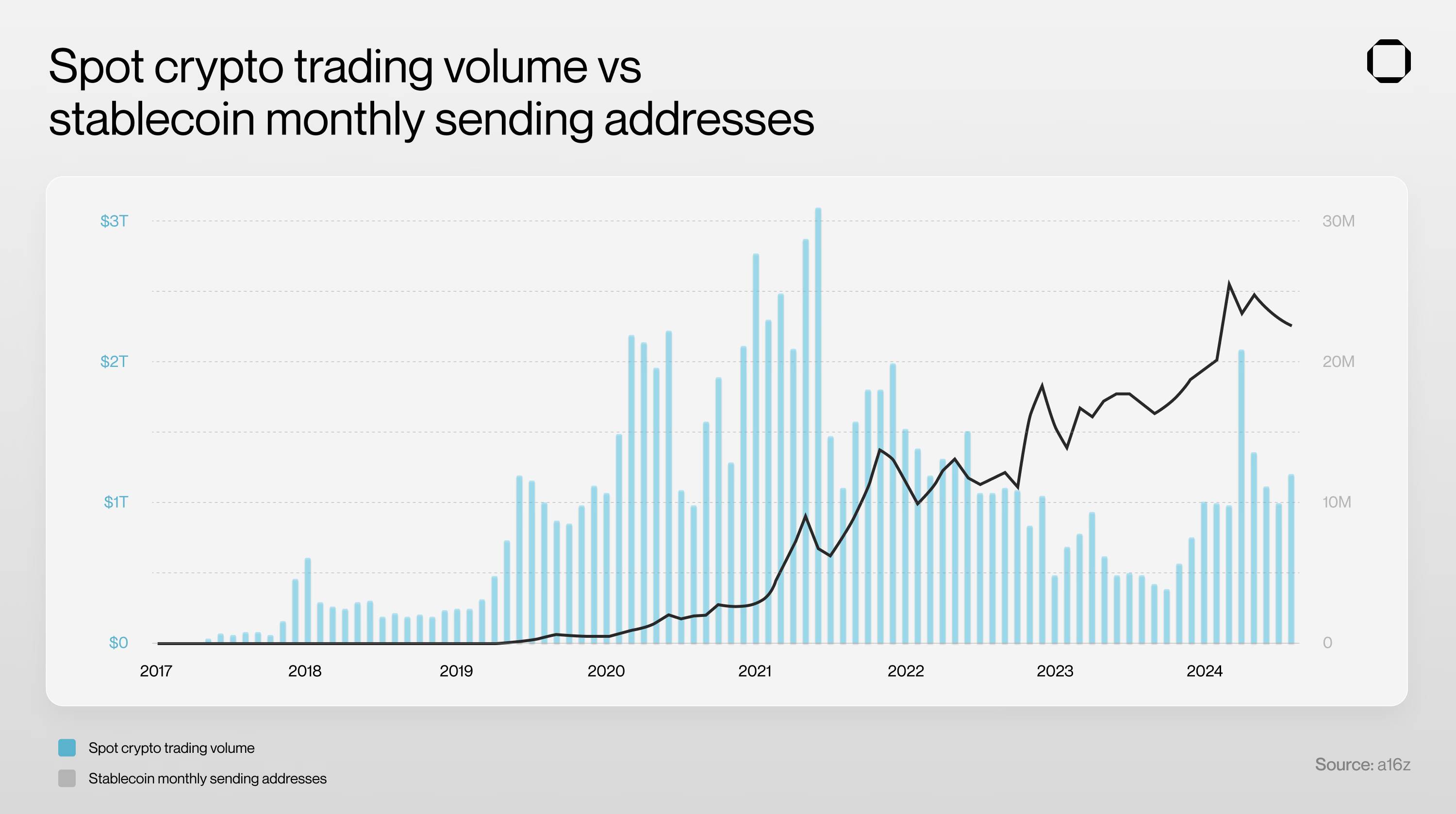

Annual stablecoin trading volume surges from $5.7 trillion in 2023 to $8.3 trillion by the end of 2024.

Active stablecoin users are spread across major blockchains, with a total of 29 million addresses.

Stablecoins now drive 32% of daily crypto activity, second only to decentralized finance (DeFi).

Crypto-native companies, traditional enterprises, and startups have embraced stablecoins and their payment rails, and their application has expanded to several major industries such as e-commerce (over $25 trillion), B2B payments (over $1.3 trillion), and cross-border remittances (over $700 billion).

For example, SpaceX aggregates part of Starlinks global revenue into stablecoins to avoid foreign exchange risks. In late September 2024, PayPal completed its first commercial transaction with Ernst Young through SAPs digital currency platform using its stablecoin PYUSD. In addition, major US retailers such as Overstock, Chipotle, Whole Foods and GameStop now accept stablecoin payments.

This surge in enterprise adoption underscores a key point: choosing the right blockchain infrastructure is no longer an inconsequential choice, but a strategic necessity that will determine an enterprise’s ability to compete in a rapidly evolving digital payments ecosystem.

Evaluating the stablecoin payment capabilities of blockchain

Successfully integrating a stablecoin and its payment rails into a product or service requires the blockchain to meet four key requirements:

High performance architecture

Low/predictable costs

Market demand

Regulatory clarity

We will take Solana and Base, two major public chains, as examples to analyze the implementation of these requirements.

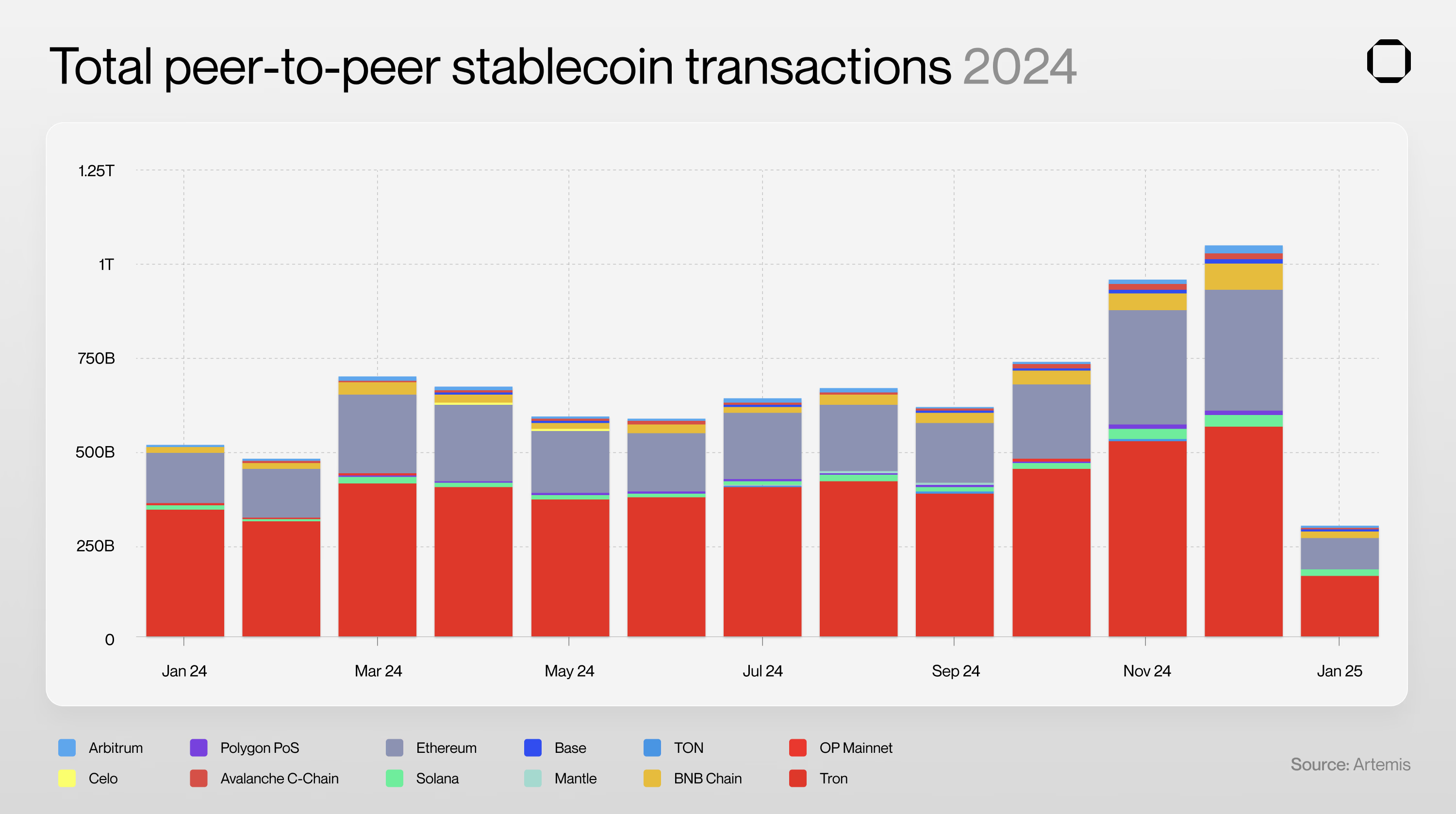

You might ask, why did we pick these two blockchains? After all, Ethereum leads by a wide margin in stablecoin total value locked (TVL), Tron is one of the most popular stablecoin payment blockchains, and Celo has driven significant stablecoin adoption through Minipay (Opera’s mobile wallet, which has attracted over a million users in Africa).

Although these blockchains have their own advantages, they were ultimately excluded from our analysis for the following reasons:

Ethereum: While suitable for high-value transfers, its high gas fees and slow transaction speeds limit its use in stablecoin payments. This has led to a bifurcated ecosystem: Ethereum retains high-balance holders, while payment applications and mainstream use cases are delegated to sidechains or appchains.

Tron: This blockchain is very active in the stablecoin payments space, particularly serving users without access to traditional financial rails. However, as we have previously reported, its prevalence in sanctioned regions, controversial links to Justin Sun, and reports of use by terrorist organizations have increased regulatory scrutiny. With Circle ending support for native USDC in February 2024, Tron’s ability to attract major stablecoin issuers is waning, making it unlikely to become the basis for new stablecoins and payment applications.

Celo: Despite showing good user adoption in Africa via Minipay, the blockchain faces significant headwinds: low TVL, limited institutional adoption, a short track record, and an evolving technology roadmap after transitioning to L2 in 2024. Celo is a blockchain worth watching, but is not yet ready for mainstream stablecoin payment applications.

Of course, there are other blockchains that excel in stablecoin payment applications, such as BNB, Arbitrum, Avalanche, and TON. While these blockchains have great potential, they fail to meet the core standards for mainstream payment adoption that Solana and Base have achieved.

In addition to public chains, application chains such as SphereNet and Payy are also emerging in the field of stablecoin payments. However, no application chain has yet proven itself to be a dominant platform for stablecoins and payments, and they face major challenges such as limited developer and user infrastructure, long-term neutrality concerns, and difficulty in attracting institutional adoption and stablecoin issuers.

Launching an application chain is like opening a Shopify store and attracting traffic, but in the financial field, liquidity attracts more liquidity, so the challenge is much greater.

Based on the above analysis, let’s take a look at how Solana and Base currently meet the conditions for stablecoin payments.

High performance architecture

Stablecoin payment use cases require fast transactions, typically measured in transactions per second (TPS) and blockchain finality. Solana and Base functionally achieve high TPS and fast finality, making them ideal for stablecoin payments.

TPS reflects the capacity and efficiency of a network, and a higher TPS means the ability to handle a greater amount of real-time activity.

Finality refers to the time it takes for a transaction to be confirmed as irreversible. Fast and secure finality in payment systems is essential to ensure that transactions are irreversible and prevent double spending. If a blockchain cannot prevent double spending, its purpose as a ledger is lost. Finality also gives users confidence that their transactions have been settled and can be used for financial agreements.

Solana and Base achieve finality through two different mechanisms:

Solana’s transactions reach two levels of commitment (finality): confirmed and finalized. Confirmed transactions achieve supermajority (66% stake weight) consensus in 800 milliseconds, while finalized transactions require an additional 31 confirmation blocks (about 13 seconds) to ensure maximum security. In fact, in the four years of Solana’s existence, no optimistically confirmed blocks have been rolled back.

Base takes a different approach through a sorter operated by Coinbase, providing near-instant pre-confirmations with a block time of 2 seconds. These pre-confirmations rely on Coinbases reputation rather than economic incentives, and true finality takes about 15 minutes as transactions are settled on Ethereum. The centralized sorter design enables fast iteration, fast confirmation, and reduces toxic MEV, but also introduces censorship risks and single points of failure.

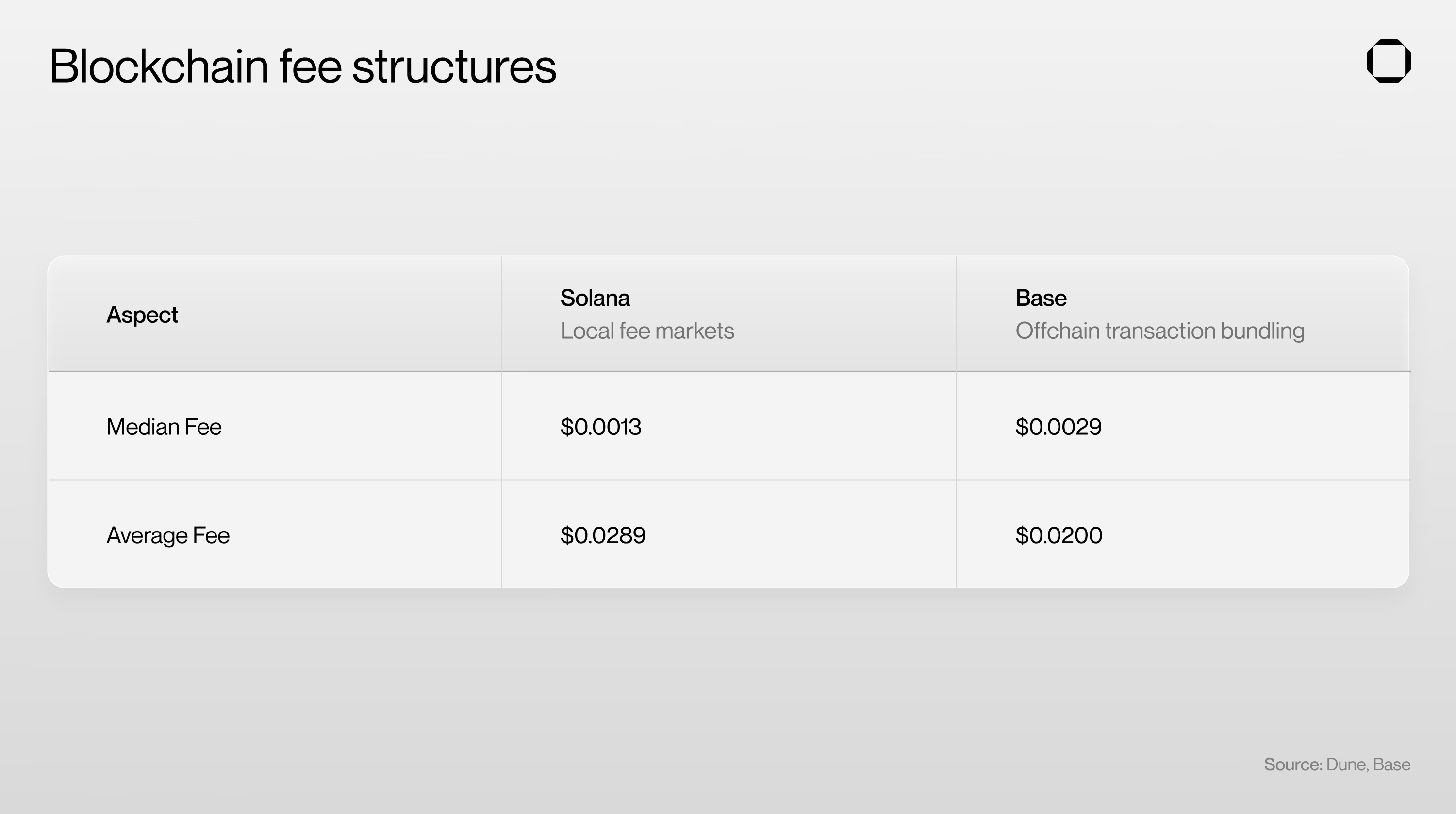

Low/predictable costs

It is essential for any payments use case that fees are low and predictable so that businesses and users can estimate transaction costs without significant fluctuations.

A key component of Solana’s payment capabilities is that, unlike Ethereum L1/L2, it segments database hotspots through a local fee market. The local fee market and Jito’s transaction segmentation engine make Solana’s transactions both cheap and predictable for ordinary users, which is a key requirement for stablecoin payment applications. Solana’s native parallelization further improves throughput by executing multiple transactions simultaneously rather than sequentially.

Also, don’t forget Firedancer. Firedancer is a standalone Solana validator client developed by Jump Crypto that has achieved 1 million TPS in a test environment and is expected to be launched in phases this year.

At the same time, Base runs on a single-threaded EVM (Ethereum Virtual Machine), improving performance through software optimization and hardware expansion. Its performance is steadily improving, and it is promised to increase Bases block capacity by 1 Mgas/s per week in 2025.

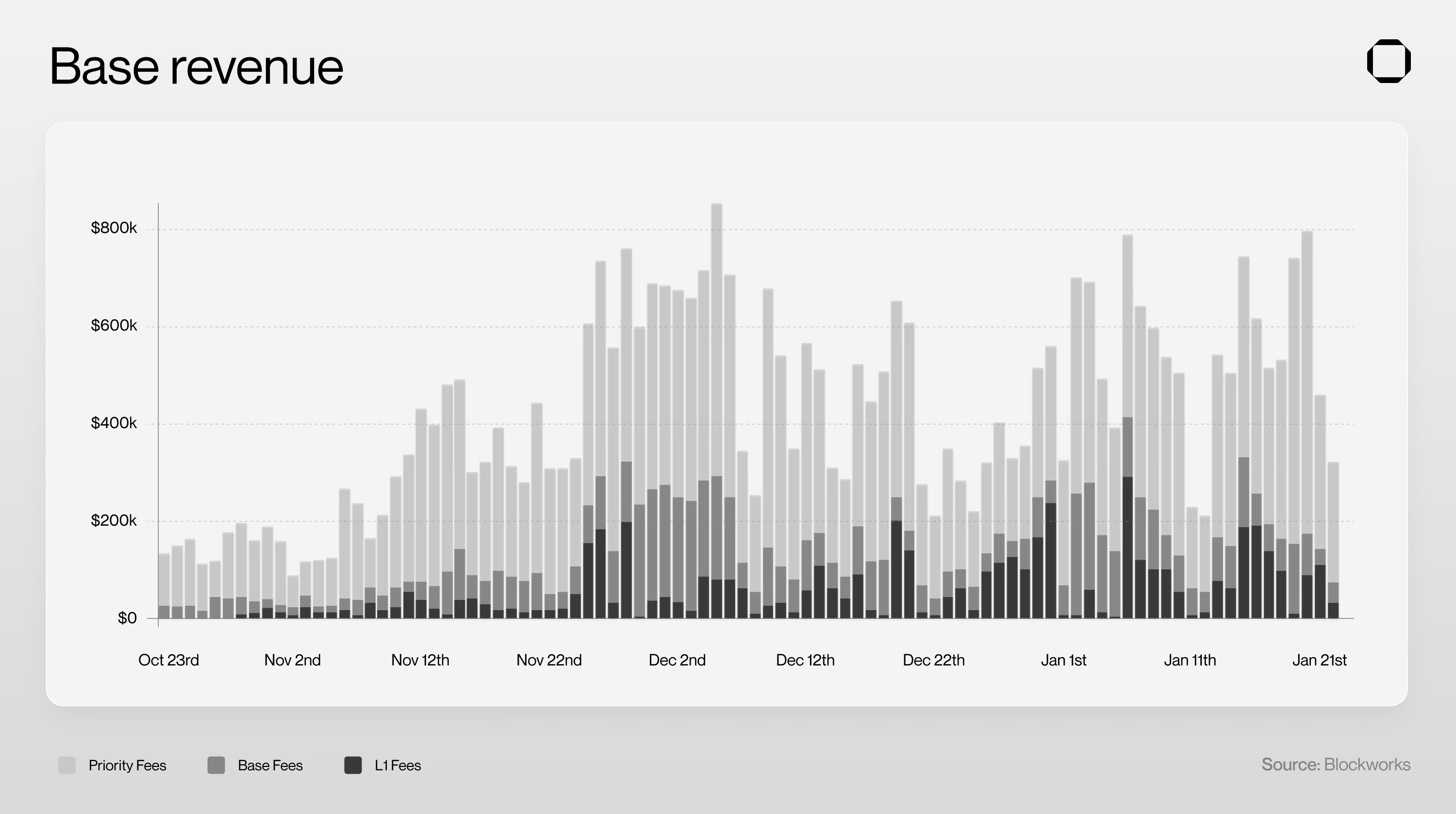

Additionally, Base’s sorter transactions are batched off-chain before being finalized to Ethereum. This approach decouples user fees from Ethereum’s congestion, and despite Base consuming more than 40% of Ethereum’s blob space, only 8% of fee revenue is used for settlement. This design allows Base to provide users with more stable and predictable transaction fees while reducing the burden on the Ethereum main chain.

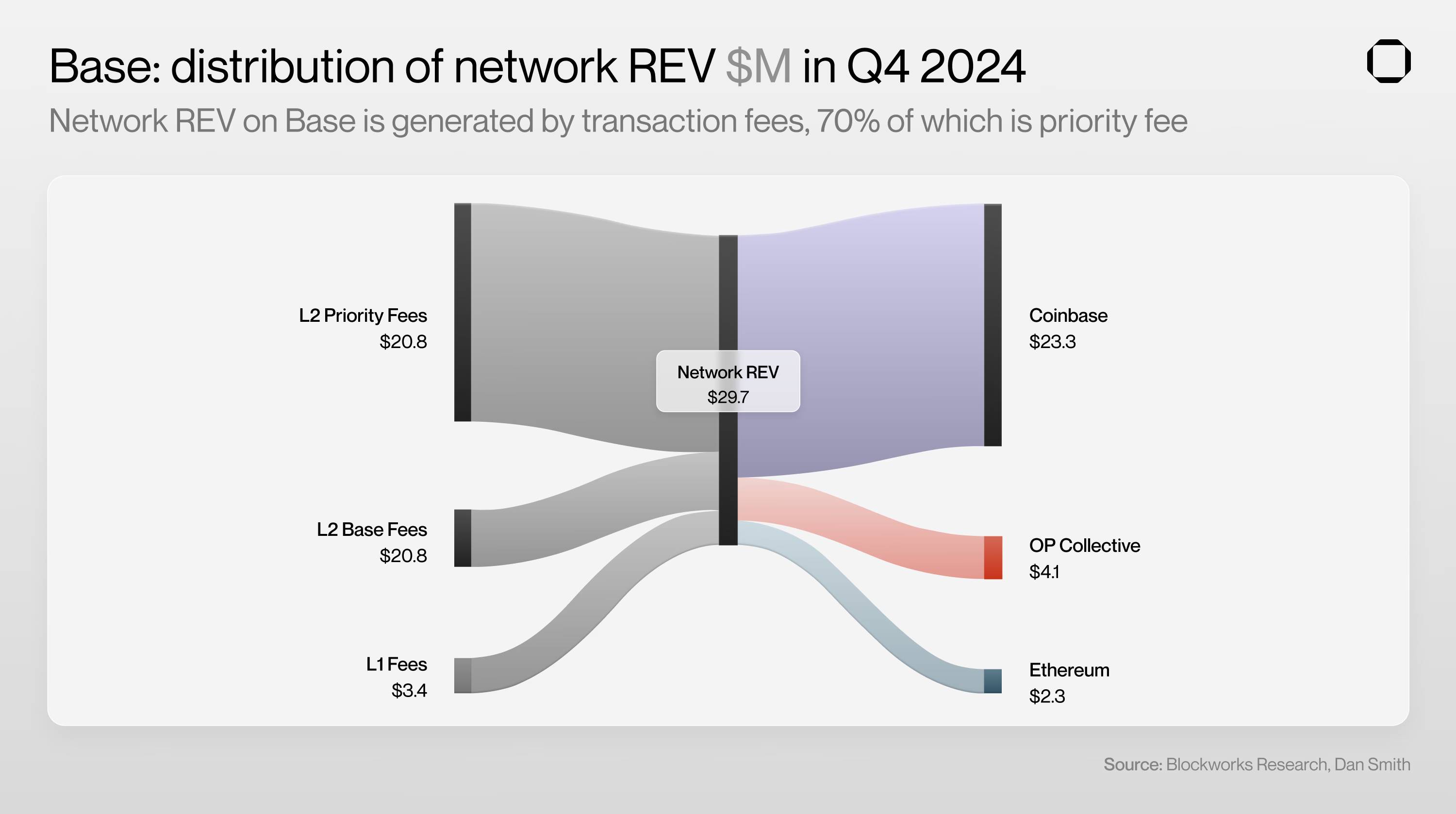

Another key difference between Solana and Base is the beneficiary of fee revenue. On Solana, fees are paid to a decentralized set of validators, while on Base, fees go directly to Coinbase. In 2024 alone, Coinbase generated at least $56 million in revenue from fees collected by its collators.

Solana has fostered a diverse ecosystem of companies working on scaling solutions, from validator client optimizations to ZK state compression. Base lacks this diversity; instead, it leverages Optimism’s OP stack and relies on Coinbase for its technology roadmap.

This reduces Base’s innovation surface, but enables it to adopt breakthrough technologies faster due to significantly lower coordination costs. Base can implement future upgrades and EVM research (such as Monad’s experiments with parallelization and EVM database optimization) at a faster pace than its decentralized counterparts (such as Solana).

Market demand

On-chain payments are only viable if there is enough demand to use stablecoins as “money.” With on-chain activity at all-time highs for Solana and Base, both blockchains are well-positioned to be in the stablecoin payments space.

The Real Economic Value (REV) of a blockchain is the best indicator of user demand. Daily or monthly active users (DAUs/MAUs) are unreliable metrics for evaluating blockchain usage because they are easily manipulated. In contrast, it is significantly more difficult and economically unfeasible to inflate REV. High REV (not DAUs/MAUs) shows businesses and developers that the blockchain is a powerful business platform, which triggers a powerful flywheel effect.

Solana

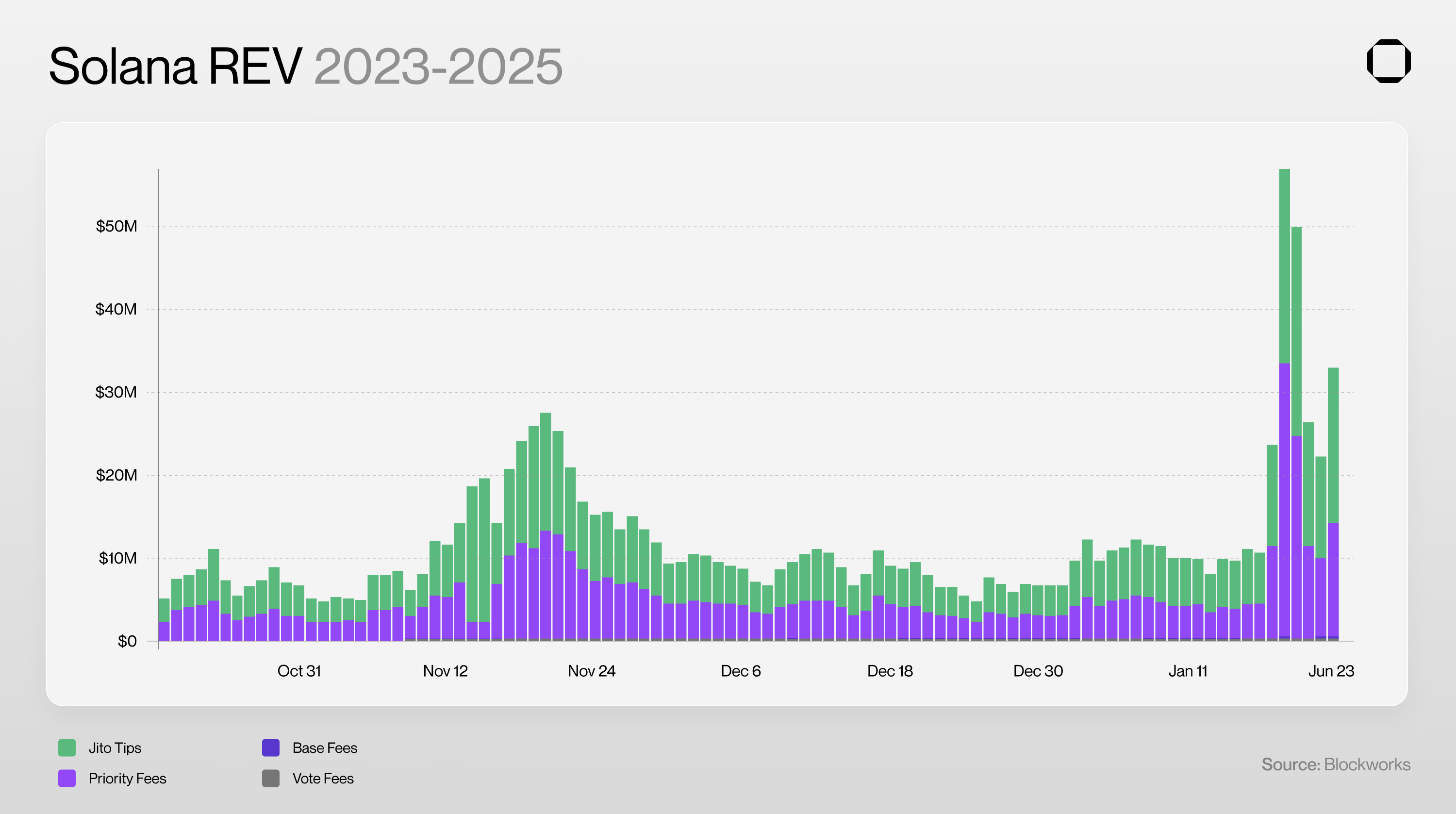

As of January 23, 2025, Solana leads all blockchains in REV, having generated $751 million in revenue in Q4 2024 alone.

Solana’s dominance is due to its relatively simple onboarding process, low fees, and a strong ecosystem of DeFi applications such as Jito, Jupiter, Kamino, Drift, Moonshot, and pump.fun. Pump.fun in particular has attracted a lot of trading activity and new users and generated more than $450 million in fees since its launch in March 2024. This clearly shows that Solana is a platform that can support a viable business model.

Speaking of getting started, on January 18, 2025, President Trump launched his official meme coin $TRUMP on Solana, generating over $7 billion in on-chain transaction volume in 24 hours. By January 19, 2025, Solana’s daily REV exceeded $56 million, and Moonshot — an app that allows users to purchase cryptocurrencies with Apple Pay — became the #1 financial app in the US App Store.

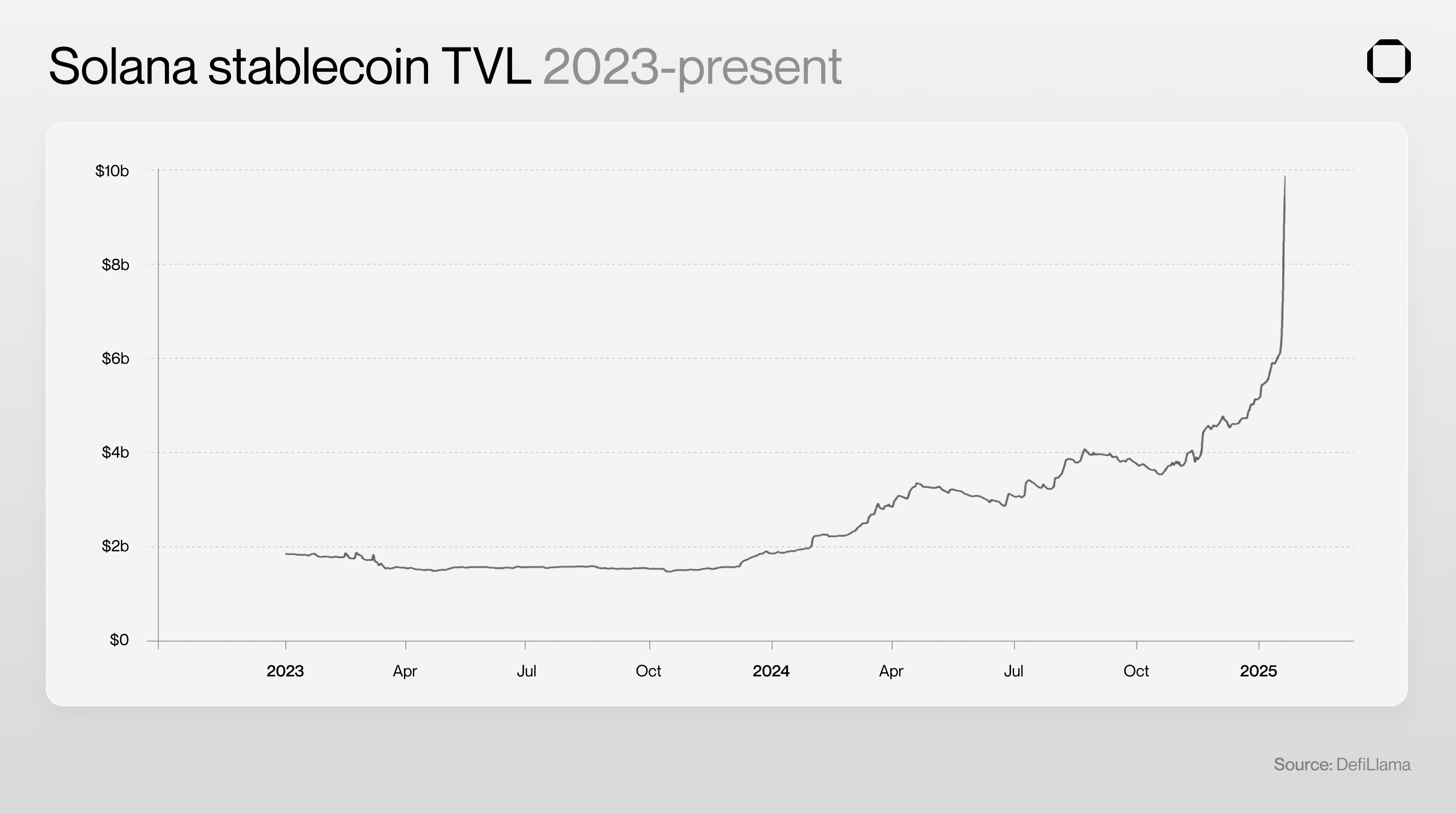

Other key metrics include the availability of stablecoins and the number of stablecoin payment applications being developed. As of January 2025, Solana’s total stablecoin locked value (TVL) reached $10.7 billion, a new all-time high. Between January 15-21, 2025, over $3 billion in stablecoins were minted on Solana alone. This significant growth shows that there is a huge opportunity for the stablecoin payment use case.

As a result, many stablecoin payment verticals have been developed on Solana, such as cross-border payments, point-of-sale payments, debit cards, yield generation, and more.

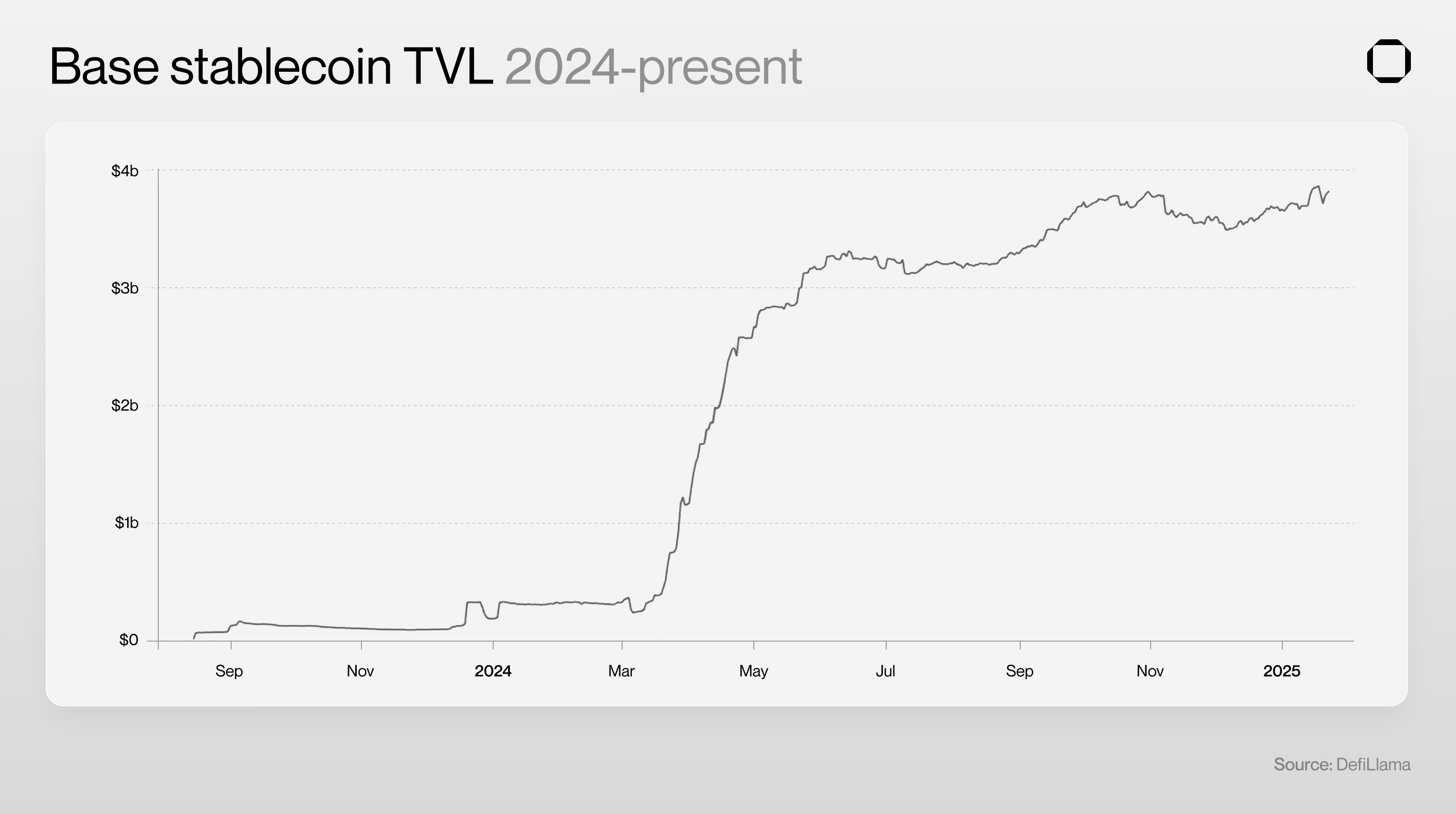

Base

Although Base’s total locked value (TVL) is much lower than Ethereum and Solana, it stands out in terms of real economic value (REV) and stablecoin growth.

Today, Base is the most widely used L2 network in the world, and Coinbase is increasingly storing user deposits on the blockchain - an important milestone in the history of the on-chain economy.

Bases users are unique in that most are likely bootstrapped directly from Coinbase, the largest centralized exchange in the United States.

Coinbase has a 45% market share in the United States, so many of Base’s users are likely North American. This metric is particularly important for U.S. businesses looking to integrate on-chain payments.

An important factor in Bases success is its unique partnership with Circle. In 2018, USDC was jointly launched by Circle and Coinbase, becoming the first stablecoin supported by a centralized exchange. In addition, Coinbase was initially responsible for the US dollar reserves behind USDC as a key member of the now-defunct Circle Consortium. As a subsidiary of Coinbase, Base provides developers and users with unparalleled advantages, such as free gas quotas for applications, gas fee discounts for users when paying with USDC, and zero fees for USDC on the chain.

Therefore, it is not surprising that new native stablecoin payment applications have emerged on Base, such as Peanut, LlamaPay, Superfluid, and Accutual. However, the overall stablecoin payment ecosystem on Base is still significantly smaller than Solana, and it is worth noting that Bases ecosystem is still in a relatively young stage.

Regulatory clarity

From a regulatory perspective, both Solana and Base are currently in good shape, and the incoming Trump administration is likely to further increase regulatory clarity.

Compared to other blockchains, Base is unique in that it has no native token and therefore has not faced any regulatory investigations. However, Coinbase has not had this luck and is still embroiled in litigation disputes with the SEC.

Additionally, Base’s design limits its neutrality in the face of changing regulation. As currently designed, Base can unilaterally geo-fence users, require KYC data for on-chain operations, blacklist tokens or applications, freeze wallets, or require verification by Coinbase to operate on its blockchain. Coinbase’s certification feature is already live, providing the necessary tools to enforce these rules. In contrast, Solana operates through more than 1,000 validating nodes, ensuring that regulatory requirements are not managed by centralized institutions, but rather enforced through front-ends or token extensions.

The regulatory challenges of stablecoins and on-chain payments are not insurmountable, and the adoption of blockchain technology by banks (such as Societe Generale and Deutsche Bank) or companies (such as Visa, Stripe, Venmo, PayPal, Robinhood, Nubank, and Revolut) suggests that the advantages of these technologies may outweigh the temporary risks.

in conclusion

Traditional enterprises and startups looking to integrate stablecoins and on-chain payments cannot ignore the rise of Solana and Base. Solana has significant advantages in terms of demand, diverse ecosystem, and censorship resistance. Base has an advantage with its strong presence in the United States, close ties with Coinbase, USDC subsidies, and rapid development.

The key differentiator is trusted neutrality. We believe Base will play an increasingly important role in onboarding new companies and users, especially in the U.S. However, in the long term, Solana will become the dominant platform for stablecoin payments.

Applications that facilitate borderless money movement will gravitate toward Solana’s neutral infrastructure, which is built on distributed innovation rather than relying on centralized sorters driven by a single incentive mechanism. Solana provides a fair and future-proof environment for businesses and developers to create innovative stablecoin payment applications.

The race to build the next on-chain payments super app is intensifying — and now is the best time to get started.