Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @Jingchun333 )

On March 10, 2025, the Ethereum Foundation (EF) announced that Hsiao-Wei Wang (Chinese name Wang Xiaowei ) was promoted to the board of directors, becoming the first Chinese leader to be promoted from the technical grassroots to the board of directors in the seven years since the establishment of EF. This appointment is seen as a key signal for EF to respond to the ecological crisis and reconstruct the governance system. In the context of Ethereum facing the mid-life crisis of Solanas ecological impact, Layer 2 ecological fragmentation, and community trust deficit, the rise of technical bureaucrats may start a silent transformation.

Who is Wang Xiaowei? A wall breaker from code to power

Hsiao-Wei Wang ( @hwwonx ), Chinese name Wang Xiaowei (hereinafter referred to as Wang Xiaowei): one of the new executive directors, early core researcher, community and technology connector.

Technical authority: the driving force behind sharding and merging

Wang Xiaoweis career began with the deep binding of code and protocol. In 2017, she joined EF as a core researcher. With her technical background of Master of Network Engineering from National Chiao Tung University, she led the design of Ethereum beacon chain architecture and the smooth landing of The Merge in 2022. The sharding expansion plan she proposed was called the crystallization of Asian wisdom by Vitalik, and the EIP-4844 proposal written by her reduced the Layer 2 Gas fee by 90%, directly pushing the Base chains daily active users to exceed 2 million.

Community Bridge: Pioneer of the Asia-Pacific Ecosystem

The 2018 Taipei Sharding Workshop was Wang Xiaoweis famous battle - this event brought global core developers to Asia for the first time, breaking the prejudice of Western technology circles on the capabilities of Asia-Pacific developers. Dong Mo, founder of Celer Network, commented: She made EF hear the voices of Eastern developers. Since then, she has traveled to South Korea, Vietnam and other places to establish a fast track for developer funding, so that the proportion of Asian teams receiving EF Grants has jumped from 5% (2017) to 22% (2024), successfully merging the dual identities of tech geek and community operator into power capital.

The New Paradigm of Power: The Logic of the Rise of Technocrats

Wang Xiaoweis promotion path (core researcher → Asia-Pacific community ambassador → joint executive director) reflects the shift in EFs governance logic: from Vitaliks unipolar authority to technology + infrastructure dual track system . She and Nethermind founder Tomasz Stanczak form a complementary combination - the former is deeply engaged in sharding expansion and Asia-Pacific ecology, while the latter leads client development and MEV mechanism optimization. This power structure of Eastern technology geeks + Western infrastructure architects is exactly EFs active choice to deal with ecological fragmentation.

Sharding workshop in Taipei, image from Wang Xiaowei’s X platform sharing

Dr. Dong, founder of Celer Network, spoke highly of Hsiao-Wei Wang. He mentioned that from 2018 to 2019, Wang and Ken, the current head of Uniswap Foundation, jointly managed the Grant Program of the Ethereum Foundation. She not only actively promoted the implementation of the project, but also had a deep understanding of the Asian developer community, and won more voice for many Chinese and Asian builders, and promoted many fruitful cooperation with a pragmatic attitude.

Today, as the executive director of the Ethereum Foundation, Hsiao-Wei Wang is responsible for both RD insights and community building. Her joining is seen as an important signal that Ethereum is returning to its original technical spirit and grassroots spirit.

Ethereum’s dilemma and Wang Xiaowei’s “technical scalpel”

Ethereum’s triple crisis

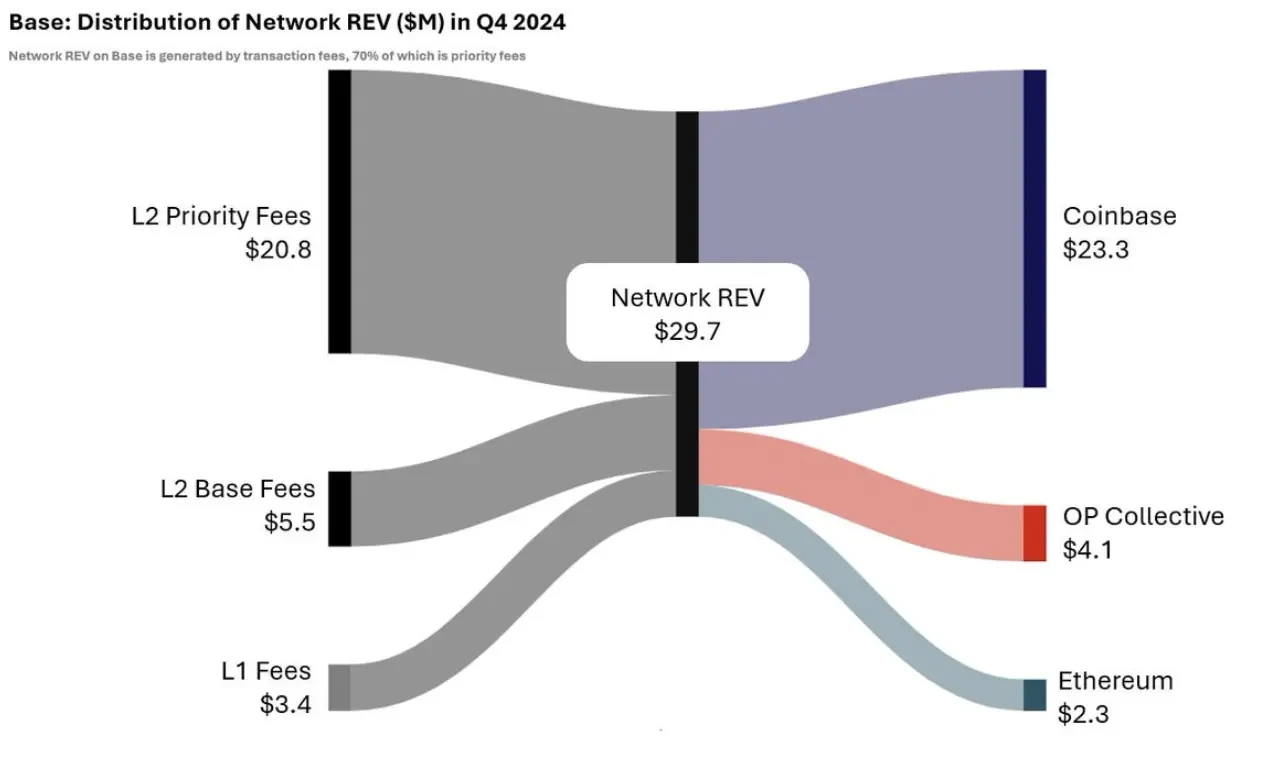

Technical debt and ecological division : Ethereum mainnet TPS has long hovered at 90 transactions per second, while Solana has snatched users with its single-chain high throughput and MEME wealth-creating effect. The wild growth of Layer 2 has exacerbated the ecological division: Base and other L2s transfer 90% of their income to Coinbase, and the funds fed back to the mainnet are less than 1%. There are even teams such as Optimism that have openly confronted EF over the Blob data profit-sharing agreement. The sharding + ZK-Rollup solution promoted by Wang Xiaowei needs to achieve a million-level TPS by 2026, otherwise it may be questioned by the community as a paper blueprint.

Governance trust deficit : EF sold 4,466 ETH in 2024, causing the market value to evaporate by 30%, and the community accused it of dumping the market to cash out. Although Vitalik explained that the sale was used for employee salaries and ecological donations, Aave founder Stani Kulechov pointed out after reading the budget report that EFs annual burn rate reached 130 million US dollars, which needed to be reduced to 30 million US dollars and the team streamlined. Even more serious is that core developer Eric Conner announced his withdrawal due to EFs resistance to change, and Lido founder Konstantin Lomashuk hinted at the establishment of a second foundation, pointing directly to EFs power monopoly.

Weak value narrative : The era of dual-drive of DeFi and NFT has ended, and Ethereums world computer narrative has been crushed by Solanas casino economics. Trumps issuance of TRUMP coins on Solana triggered a FOMO craze, and the issuance of USDC on the chain increased by 600% in half a year, while the high gas fee of Ethereum mainnet forced Meme coin developers to migrate collectively. Although the EIP-4844 proposal led by Wang Xiaowei reduced Layer 2 fees by 90%, the prosperity of 2 million daily active users on the Base chain did not translate into value capture for ETH.

Coinbase 2024 Q4 revenue distribution, image from X

Technocratic experiment in breaking the impasse

Power coding at the protocol layer : Wang Xiaowei is transforming technical ideals into governance rules. The social consensus layer is introduced through the Cancun upgrade to dynamically bind the EFs ETH selling amount to the main networks pledge rate to ease market panic; L2 is forced to pay a profit to the main network based on the amount of Blob data (similar to the Web2 platforms commission). Although it is opposed by Optimism, this may reshape Ethereums value distribution mechanism.

Game theory model of dynamic selling mechanism The EF selling ETH quota is bound to the main network pledge rate rule designed by Wang Xiaowei is not a simple administrative instruction, but an algorithmic constraint based on Nash equilibrium:

When the mainnet staking rate is ≥ 25%, the monthly selling limit of EF is 300 ETH;

If the pledge rate falls below 20%, the selling amount will automatically return to zero.

This mechanism forces EF to form a community of interests with pledgers. When the pledge rate fell to 18% in August 2024, EFs suspension of selling caused the ETH price to rebound 12% in a single day, verifying the markets positive feedback on the transparency of rules.The economic rationality of the L2 profit-sharing mechanism forces Layer 2 to pay 5% of its revenue based on the amount of Blob data (3% of which is injected into the mainnet staking pool and 2% is allocated to core developers). The essence of this is to solve the “tragedy of the commons”:

The Base chain generates about 2,000 blobs (worth $20,000) every day. According to this rule, it needs to pay $7.3 million to the main network every year, which is equivalent to Coinbase taking 15% of the profit;

Compared with competing chains such as Polygon, which charge node validators 10%-20% in fees, Ethereums commission rate is already moderate. This move can increase the main networks annual revenue by at least US$50 million and ease EFs financial pressure.

Fusion of Eastern and Western governance philosophies : The “Technology Teahouse” mechanism led by it invites Vitalik to dialogue with grassroots developers every month to weaken the authority worship of the “V God Cult”; at the same time, it tacitly allows the Chinese team to experiment with sharding variants on the Hong Kong Compliance Chain to reserve technical options for future upgrades.

Agenda Setting in Technology Teahouses

The monthly developer dialogues are not retreats but use a modified version of Roberts Rules of Order:

The priority of an issue is determined by the number of likes on the GitHub issue (to avoid internal manipulation by EF);

Each proposal must be accompanied by feasibility assessment reports from at least three Layer 2 teams. The EIP-7624 Proposal (optimizing the cross-chain gas fee prediction model) passed at the November 2024 meeting was proposed by the Metis team at the teahouse meeting and passed unanimously.

Technical Strategy for Hong Kong’s Sharding Trial

Allowing Chinese teams to test the dynamic sharding technology (automatically adjusting the number of shards based on transaction load) on compliant chains is actually a technical sandbox to deal with geopolitical risks:

Hong Kong Cyberport Chain has achieved 5,000 TPS on a single shard, and its compatibility with the Ethereum mainnet’s ZK-Rollup is 95%;

The experiment has reserved a switchable China solution for the mainnet upgrade in 2026 - if US regulation is upgraded, the technical modules of the Hong Kong chain can be quickly transplanted to the mainnet.

The compliance game of DeFi staking : setting up a 5-signature 3-multi-signature wallet, injecting $150 million of ETH into Aave and other protocols to earn interest, trying to reverse EFs image of only selling but not making profit, and testing the compliance resilience of decentralized finance on the edge of the SECs regulatory red line.

The checks and balances mechanism of the multi-signature wallet $150 million of ETH was injected into a 5-signature 3-multi-signature wallet consisting of Chainlink, Aave, EF, Gnosis, and Lido. Each step of the operation needs to leave a trace on the chain:

The profit distribution formula is written into the smart contract (60% for developer funding, 30% for repurchase and destruction of ETH, and 10% as risk reserve);

Even if it encounters an SEC investigation, the structure can defend itself by claiming that the protocol operates autonomously (the Uniswap case that won in 2024 has established relevant precedents). After six months of operation, the funds annualized return reached 8.2% (about $12.3 million), far exceeding the cash flow from EFs sale of ETH.

Unfinished Battles and Hidden Concerns

The collision of technological idealism and reality : Under the threat of Solanas single-chain TPS of one million, Wang Xiaoweis sharding + ZK-Rollup solution must be implemented before 2026, otherwise it will be questioned as a paper blueprint;

Risk of community division : Lido founder Konstantin Lomashuk hinted at the establishment of a second foundation, and radical reforms may anger V God fundamentalists;

Compliance minefield : The privacy cross-chain bridge jointly developed by EF and Coinbase may violate the US Mixed Assets Act. Wang Xiaowei also needs to prove the protocol neutrality at a congressional hearing to avoid repeating Ripples mistakes.

Cultural conflict : Western developers criticized its Asia efficiency first strategy, which led to a 30% increase in the test network vulnerability rate, and also needed to recalibrate between code rigor and iteration speed.

The 30% increase in the test network vulnerability rate criticized by Western developers is actually the inevitable result of the game between iteration speed and security:

The EF Asia Pacific team adopted Toyota-style Kanban Management to compress the upgrade cycle from 6 months to 3 months. However, according to a study by the Linux Foundation, a 50% reduction in code review time will lead to a 25%-40% increase in vulnerability rates.

Wang Xiaowei introduced formal verification tools (such as Certora) for automated auditing, which reduced the number of critical bugs by 60%, but at the cost of an increase in development costs of US$2 million per year.

Conclusion: A silent “technological breakthrough”

Wang Xiaoweis entry also indirectly confirms Ethereums transformation from a genius teenager to a technical middle-aged - no longer relying solely on Vitaliks inspiration, but relying on systematic engineering thinking and gradual reform. This transformation involving Chinese technocrats may indicate that Ethereum has to fight a last-ditch battle against the midlife crisis, and it is also a new chapter in which code politics meets Confucian wisdom and injects Eastern governance philosophy into the decentralized system.

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina