Original article by: Evan Lu, Waterdrip Capital; Leo, AISA

introduction

Over the past century, the basic unit of economic activity has always been human. Whether it is production, transactions, payments or financial services, they all revolve around human needs. However, the rise of AI technology is reshaping this landscape, allowing machines to gradually evolve from passive tools to active economic entities - AI Agents.

In addition, at the beginning of 2025, Tether announced that it would integrate USDT into the BTC ecosystem, covering its base layer and lightning network. Behind all these trends, a revolution is quietly brewing: AI Agent-driven payment infrastructure is pushing the crypto industry into a new wave of innovation with a breakthrough momentum. From BTCs consensus layer to the execution layer of smart contracts, and then to todays AI-driven application layer, the crypto industry is likely to usher in a paradigm innovation of AI + Pay Fi + BTC Infra, and force Web2 to self-reform to Web3 - the future of large-scale adoption is becoming a reality step by step.

1. Stablecoins: The cornerstone of a new era of global payments

The programmability, cross-border practicality and increasingly clear regulatory framework of stablecoins are expected to become the standard settlement currency for global payments. With the election of Trump, who is friendly to cryptocurrencies, as the US government will gradually provide regulatory clarity on cryptocurrencies, the application scenarios of stablecoins will gradually expand, and we can even estimate a beautiful vision of stablecoin payments in the next 10 years:

Short term (1-3 years): Stablecoins will dominate cross-border remittances, providing a faster and cheaper alternative to SWIFT. Cryptocurrency-linked debit/credit cards (such as Visa/MasterCard) will simplify spending and build a bridge between on-chain wealth and real-world transactions.

Medium term (3-7 years): Businesses will increasingly adopt stablecoin payments due to their low fees, instant settlement, and programmability. Companies will be able to seamlessly convert between cryptocurrencies and fiat currencies, providing customers with dual-track payment options.

Long term (7 years and above): Stablecoins will become mainstream legal tender, widely accepted for payments and even taxation, completely subverting traditional financial infrastructure.

In addition to the convenience of payment, stablecoins still have quite positive effects in other areas: for example, they provide entrepreneurs with an easier-to-access platform to develop new payment products: no middlemen, minimum balances or proprietary SDKs. In addition, it is roughly estimated that if medium and large enterprises can use service providers with stablecoin solutions in transactions, their profits can increase by 2%. In addition, countries under US sanctions such as Russia have tried to use stablecoins for trade between countries to bypass the US dollar settlement system. More and more cases show that stablecoins are gradually approaching the best position for their own market fit. This is not surprising-they are undoubtedly the most economical way to use US dollars for settlement and the fastest global payment.

2. Next Level: AI Agents will be the new user experience layer of future apps

Today, we no longer rely solely on AI to perform single tasks, such as image recognition, speech synthesis, or autonomous driving. Instead, we are entering an era where AI Agents become independent market participants. This change is not limited to AI-driven financial transactions and intelligent supply chain management, but also involves generative AI (AIGC) providing services to content creators, developers, and businesses. Going further, AI agents can even autonomously negotiate, trade, settle, and optimize their own resource utilization.

At the end of last year, we saw AI Agents redefine the application scenarios of DApps. The pioneer of this trend was @truth_terminal, an AI Agent that can promote its own token $Goat; followed by AI Agents such as Luna and AIxbt, which can use tokens to trade, generate content, and even manage their own crypto wallets and assets. The evolution of this ability has spawned innovations in narratives in the crypto field, such as Virtual Protocol, a protocol similar to Pump.fun, but its Pump object is no longer a simple token, but a variety of AI Agents.

The evolving capabilities of AI Agents, coupled with an out-of-the-box distribution platform, have opened up a market opportunity worth hundreds of billions of dollars for the concept of AI Agent + Crypto. AI is becoming an active participant in the on-chain ecosystem, driving blockchain applications from tooling to ecosystemization.

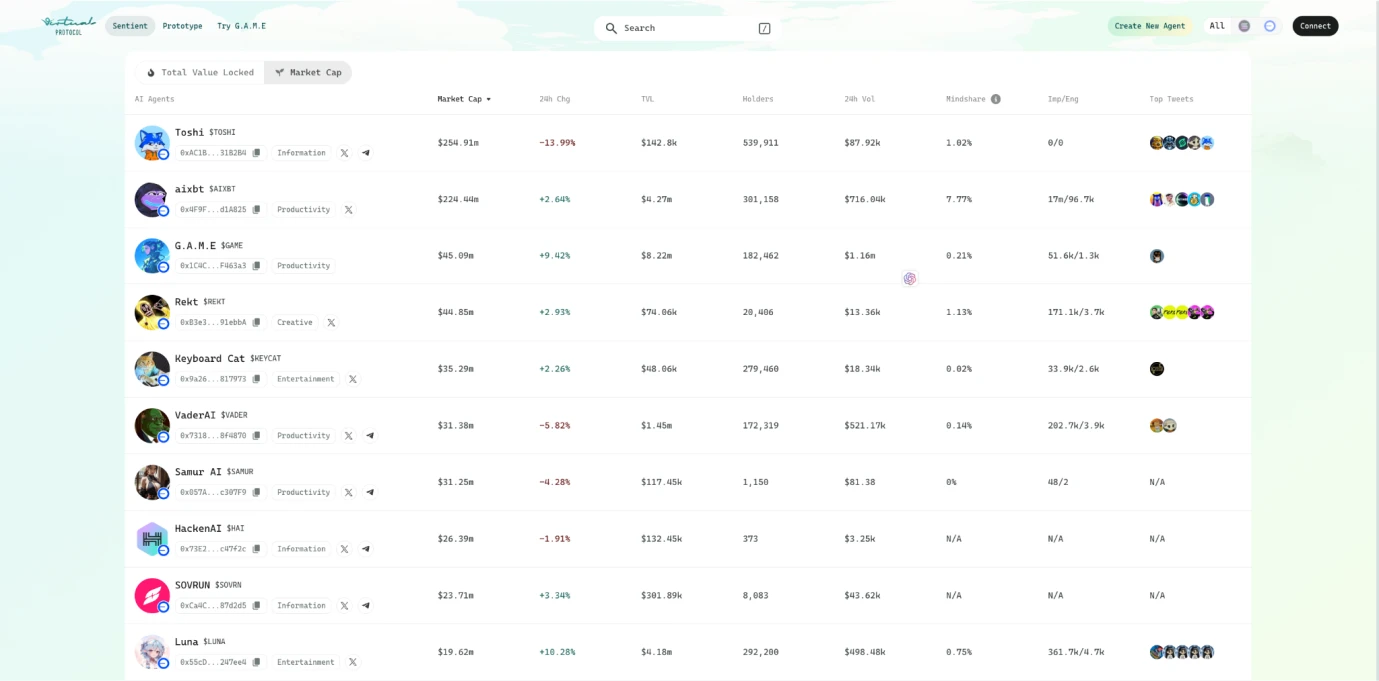

Top 10 AI Agents on Virtual Protocol by market capitalization, as of February 11, 2025

Data source: https://app.virtuals.io/sentients?sortBy=mcapInVirtualsortOrder=descpage=1

In the future, AI will become the user experience layer of blockchain technology, connecting the application layer and the blockchain infrastructure, and play a role both upward and downward in the technology stack. To give an example that is most understandable to crypto users, AI proactively recommends and executes on-chain DeFi operations based on the users intentions and preferences (such as security, yield, etc.), combined with real-time information from the forecast market. Users do not need to understand the difference between L1 and L2, or even know how the cross-chain bridge works. Broadening to daily life, imagine a scenario where an AI personal financial assistant can autonomously manage your tax, insurance, and rental income and expenditure, dynamically optimize your investment portfolio, and even automatically execute transactions based on market changes. Of course, while giving AI economic autonomy, security issues cannot be ignored. To this end, the Trusted Execution Environment (TEE) has become its key infrastructure - it isolates the computing environment to ensure that the behavior of the AI Agent fully follows the preset logic and is not subject to external manipulation. For example, an AI Agent running in a TEE can attract users and earn income by generating content, and can also use encryption technology to ensure absolute control of its asset keys. Going further, AI can operate Depin nodes or verify data, becoming the core executor of its distributed system.

The workflows and application scenarios of these AI Agents are outlining a new machine economy picture: from game players to Depin managers, from content creators to financial strategists, AI Agents will become the core driving force of the on-chain ecosystem.

3. The dilemma of the existing payment system: the invisible shackles of the AI economy

In the future, AI Agents will partially replace humans, become independent participants in the market, and form an important force However, this machine economy revolution is not without challenges. One of the most core issues is payment. The realization of the AI revolution is inseparable from an efficient, secure and decentralized payment network built using blockchain technology to provide AI Agents with seamless economic interaction capabilities.

3.1 Economic Imbalance of Micropayments

Imagine a scenario like this: an AI agent is running a high-frequency trading strategy that needs to complete 1,000 transactions per second, with each transaction amounting to only $0.0001. If a traditional payment network (such as Visa, PayPal) is used, each transaction will cost at least $0.30 in fees, which means that the AI agent will have to pay 3,000 times the fee for every $0.0001 transaction. This absurd cost structure directly makes it impossible for the AI economy to operate on the existing payment system.

3.2 The fatal flaw of settlement speed

For AI agents, transactions are not sporadic events, but a continuous flow process. However, the settlement method of traditional payment networks is extremely lagging:

Credit card payment: Usually takes 1-3 days to complete settlement.

International SWIFT transfers: may take 2-5 days.

Cryptocurrency payments (such as Bitcoin mainchain transactions): take an average of 10 minutes or even longer.

What the AI economy requires is millisecond-level settlement, but the existing payment system is clearly unable to meet this requirement.

3.3 Limitations of Centralized Architecture

AI agents are global in nature and are not limited by geographical boundaries. However, traditional payment systems are bogged down in issues such as bank accounts, fiat currency compliance, and regional payment rules.

Bank account dependency: Most payment systems (such as Visa and PayPal) require the transacting party to have a bank account, but AI agents cannot open bank accounts like humans.

Centralized control: The existing payment system relies on a small number of financial institutions for approval, and AI-agent transactions may be rejected at any time due to regulatory or compliance issues.

International payment barriers: Cross-border transactions brokered by AI are subject to cumbersome compliance requirements, increasing operational costs and complexity.

If the AI economy must rely on existing payment systems, it will be constrained by artificial limitations and will not be able to truly unleash its potential.

3.4 Five core requirements of the AI economic payment system

Considering the possible operating characteristics and usage scenarios of the above AI Agents, the payment system serving AI in the future must have the following five core capabilities:

Micropayment capability: AI agent transactions often involve extremely small amounts (such as $0.0001), and the handling fee must be extremely low, or even close to zero.

Millisecond transaction settlement: AI transactions occur on a sub-second time scale, and payment systems must be able to settle in real time rather than waiting for minutes or even days.

Decentralization and censorship resistance: AI agents need to trade autonomously and cannot rely on centralized financial institutions.

Global availability: AI agents are not restricted by national borders, and payment systems must support cross-border transactions and avoid bank account dependence.

Intelligent payment protocols: Payment systems must be able to interact seamlessly with AI agents to support functions such as automatic settlement, intelligent transaction routing, and liquidity optimization.

4. The promise and limitations of blockchain payments

In the past few years, the rise of blockchain technology has brought a glimmer of hope to the AI economy. The decentralization, smart contracts, and permissionless transactions of blockchain make it an alternative to the traditional payment system. However, mainstream blockchains still face the following problems:

4.1 High cost of ETH network payments

ETH (Ethereum) is the most important infrastructure of DeFi (decentralized finance), but its high transaction costs make it difficult for the AI economy to adopt. When the network is congested, a simple USDT transaction may require $10-$50 in gas fees, limited transaction throughput, and slow processing speed, making it difficult to support the high-frequency trading needs of AI agents.

4.2 Speed and centralization issues of other high-performance public chains

At present, a large number of high-performance public chains have emerged in the crypto ecosystem. These public chains do provide faster transaction processing capabilities, but they are often highly centralized and have security risks. In the past few years, some high-performance public chains have experienced downtime many times, affecting transaction stability. In addition, most public chains rely on only a few verification nodes, which is likely to affect the decentralized nature of the payment system.

4.3 BTC Mainnet Scalability Bottleneck

As the worlds most secure and decentralized blockchain, BTC has unparalleled security, but its payment capacity is limited. The transaction throughput of the BTC main network is extremely low (only 7 transactions per second), and when encountering large transaction volume requests, its gas fee soars, causing transaction fees to fluctuate greatly, making it unsuitable for small payments by AI agents.

Therefore, although blockchain technology provides a possible solution, the existing public chain alone cannot fully meet the payment needs of the AI economy.

4.4 Lightning Network - A New Stage for Stablecoin Payments

As the first second-layer expansion solution for BTC, the Lightning Network not only relies on the security of the BTC network (with 57,000+ nodes and PoW mechanism), but also realizes instant, low-cost and infinitely scalable transaction capabilities through two-way payment channels. This technical path is highly suitable for small-amount and high-frequency payment scenarios, and also meets the ideals of fundamentalist crypto enthusiasts - all transactions are based on the BTC network. At present, the Lightning Network has 15,000+ nodes and 50,000+ channels, showing strong ecological potential.

However, the Lightning Network is not perfect. Before the emergence of the Taproot Assets protocol, the Lightning Network only supported BTC as a payment currency, and its application scenarios were extremely limited. Today, when BTC has become digital gold, most people are not willing to spend their BTC easily. At this time, the importance of stablecoins is self-evident: throughout history, only currencies with stable value can be widely accepted and used in daily payment scenarios. For the technical principles of the Lightning Network and the TA protocol, please refer to this article: Taproot Assets: The next growth point for the stablecoin track to surpass a trillion-dollar market value .

There is no doubt that USDT issued by Tether is still the dominant stablecoin in the crypto world. As of today, the total issuance of USDC is 56.3 billion US dollars, while the total issuance of USDT is over 140 billion US dollars, which is twice as much as the second largest issuance of USDC. This time, Tether integrates USDT into the Lightning Network, which is of great significance. This behavior marks a kind of recognition in the eyes of users - after all, USDT is a real asset of gold and silver, and its casting means Tethers recognition of the security and ease of use of the public chain. More importantly, the real on-chain users and handling fee income brought by USDT are also the resources that all public chains dream of. This also marks that after years of construction, the era of the Lightning Network has come for it to truly display its opportunities.

5. Everything is ready, just waiting for the east wind to come

The explosive growth of AI Agent is giving rise to a trillion-dollar machine economy, but it is clear that traditional payment networks (high cost, low speed) and existing blockchain solutions are unable to support its needs. It seems that the integration of USDT into the Lightning Network has provided the industry with a key puzzle piece - a nearly zero-cost, censorship-resistant payment channel, coupled with the liquidity of stablecoins, which is perfectly adapted to the micropayment and real-time transaction scenarios of AI agents.

Therefore, AISA was born. It is not just a simple superposition of technology stacks, but also a financial operating system tailored for the AI economy, allowing the AI economy to truly break free from the shackles of payment and move towards the future of autonomous interaction. In the future AI economy, there is no need to wait - payment is efficiency, and transaction is intelligence.

6. AISA: The ultimate fusion of Lightning Network, Stablecoin and AI Agent - Reconstructing the AI economic payment foundation

6.1 AISA’s Four-Layer Technical Architecture

AIsa’s architecture can be divided into four core layers that work together to enable AI agents to make payments freely and efficiently.

a. Settlement Layer

Based on the underlying network: BTC network (L1) + Lightning Network (L2). The core advantages of its settlement layer are:

Security: Relying on Bitcoins PoW mechanism and decentralized network (57,000+ nodes worldwide).

Efficiency: Transaction confirmation in milliseconds, handling fees close to zero, completely solving the pain points of AI high-frequency micropayments

b. Payment Layer

Multi-chain support: Compatible with public chains such as Ethereum, Solana, Polygon, etc., AI agents can freely choose the optimal chain.

Stablecoin integration: aiUSD (native stablecoin) issued by AISA itself circulates on the Lightning Network as payment currency with USDT and USDC through the Taproot Assets protocol.

c. Smart Payment Layer (Programmable Layer)

AI Native Protocol (AIP): Empowers AI agents to make autonomous decisions.

Dynamic routing: Real-time analysis of transaction fees and network congestion, and automatic switching of payment paths (e.g. Lightning Network → Solana).

Automated micropayments: On-demand settlement (e.g. $0.0001 per API call) with no human intervention.

Liquidity management: AI agents can dynamically allocate funds to liquidity pools to optimize payment efficiency.

d. Governance Layer

DAO mechanism: jointly governed by LPT token holders to decide on protocol upgrades, fee allocation, etc.

Incentive mechanism: Liquidity providers pledge LPT to earn income (share of transaction fees). Part of the fees is used to destroy tokens to promote the deflation model.

6.2 How does AISA redefine AI economic payments?

AISA is not a simple extension of traditional blockchain payments, but a revolutionary infrastructure designed specifically for the AI economy. By integrating the decentralized efficiency of the Bitcoin Lightning Network, the liquidity guarantee of stablecoins, and the intelligent decision-making capabilities of AI native protocols, AISA has built a payment network with nearly zero cost and millisecond response, completely breaking through the high cost and inefficiency bottlenecks of the traditional system. Here, AI agents can independently complete micropayments (such as only $0.0001 per API call), real-time settlement of DePIN node contribution rewards, and even dynamically optimize cross-chain transaction paths without human intervention.

From cross-border corporate payments (replacing SWIFT to save costs) to high-frequency trading of automated financial strategies, AISAs adaptability is driving the rise of the machine economy - in the future, AI agents may manage taxes and investments autonomously, forming an independent economic closed loop. Through multi-chain compatibility and DAO governance, AISA not only solves the fragmentation problem of the existing payment ecosystem, but also sets a new standard for human-machine collaboration in the decentralized era as a financial operating system. When stablecoins become mainstream settlement tools and lightning networks connect global value flows, AISAs vision is to allow the machine economy to grow freely in a frictionless intelligent network.

7. Conclusion

When AI agents complete transactions, investments, and even pay taxes autonomously on the chain, payment is no longer a tool, but the blood circulation system of the machine economy. The Lightning Network provides blood vessels, stablecoins act as blood, and AI agents become the heart. This silent revolution lights up the future payment ecosystem like lightning. Future payments no longer belong to a certain institution or country, but to every autonomously operated AI and participating node. Here, code is law, efficiency is justice, and real innovation has just begun.

8. References

https://www.chaincatcher.com/article/2161702

https://www.chaincatcher.com/article/2161951

https://www.chaincatcher.com/article/2164512

https://www.techflowpost.com/article/detail_22877.html

https://www.techflowpost.com/article/detail_22533.html

https://x.com/tmel0 211/status/1878301327706694139