April 2 will be a day of liberation for America. Countries around the world, friends and foes alike, have taken advantage of us. - Trump said in the White House office last Friday.

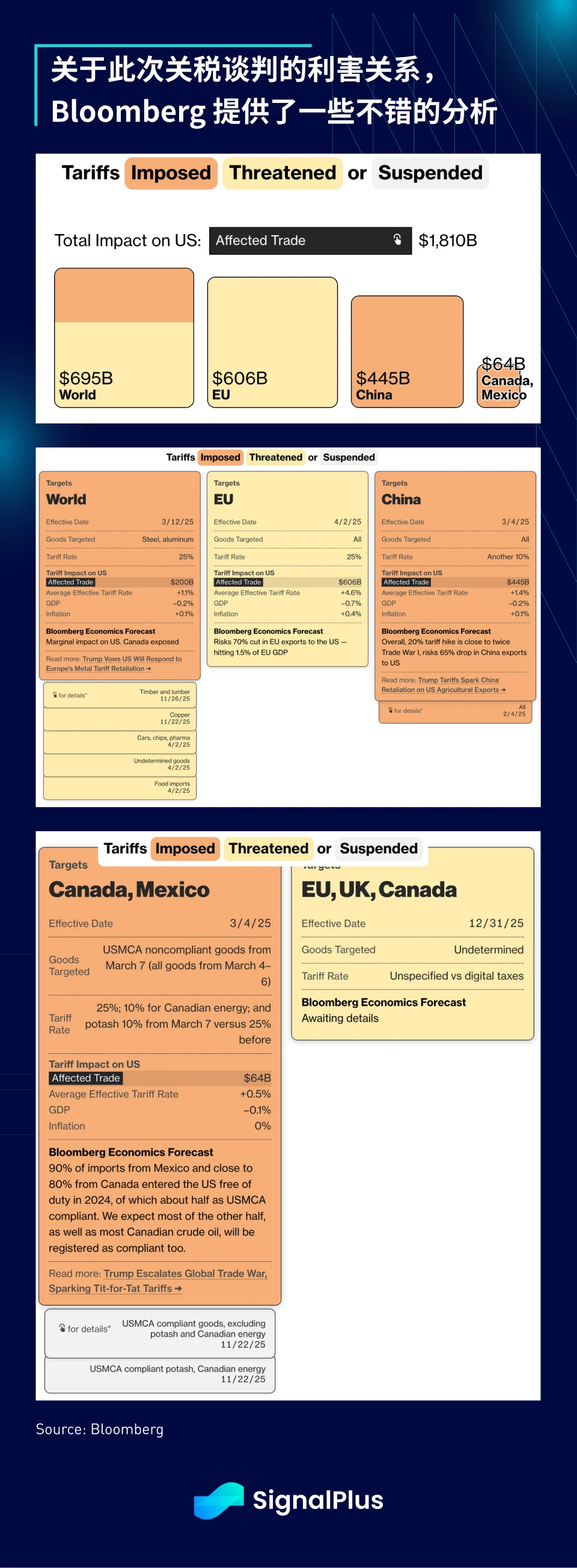

Market sentiment has stabilized significantly over the past week, and risk assets have stabilized after several weeks of intense selling pressure, and the Trump administrations recent words and deeds have been relatively mild. However, Trump said in a conversation in the Oval Office last Friday that the United States is preparing to announce Tariff Liberation Day next Wednesday (April 2), and will impose retaliatory tariffs on countries and allies that have taken trade actions against the United States.

According to White House officials, the tariffs are expected to be more targeted and effective immediately, with only countries that have a trade surplus with the United States and have not imposed tariffs on US goods being exempted. In addition, the Trump team seems to have softened the narrative recently, acknowledging that the list of targeted countries will not be comprehensive and that some existing tariffs (such as steel) will not necessarily be implemented cumulatively. The political focus this week will be on the initial details of the America First trade review, paving the way for an April announcement, as well as the US-Russia talks (Monday) and geopolitical developments in Turkey/Israel.

Were going to target the dirty 15 percent, which is a small fraction of the total, but represents a large portion of our trade. -- Treasury Secretary Bessent in an interview with Bloomberg

Regardless of the final outcome of the trade talks, the damage has already been done to market sentiment, with tariff-related topics dominating corporate earnings calls this year. Stocks highly correlated to trade have fallen about 15% since their January highs, while momentum stocks have seen their sharpest pullback in nearly 40 years, wiping out two years of gains in just three weeks.

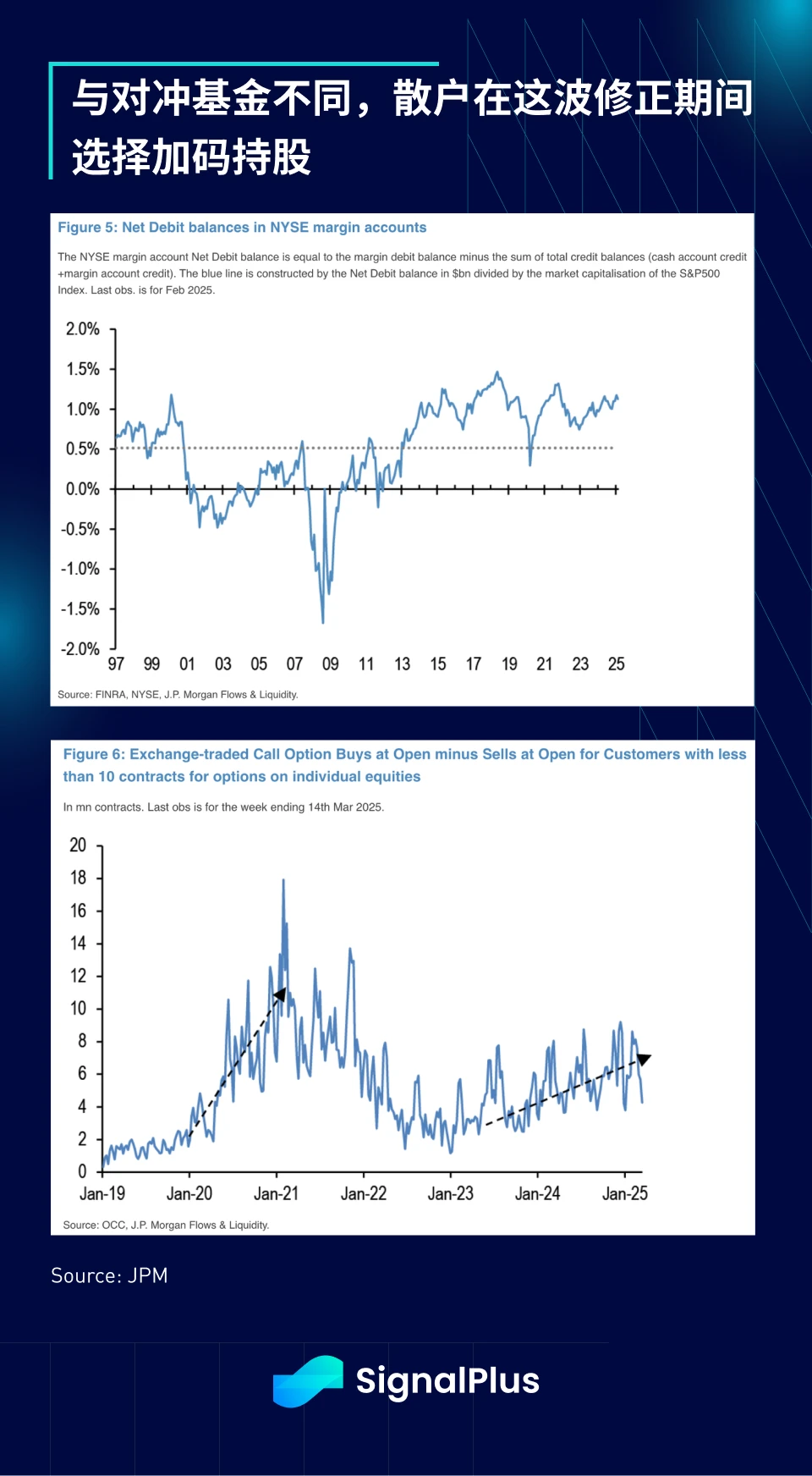

Faced with this situation, professional money managers are withdrawing their U.S. stock positions at an unprecedented rate, while Europe, the United Kingdom and China are the biggest beneficiaries due to their fiscal policy prospects.

Similarly, in terms of positions, fund managers are concentrating on allocating to low volatility strategies at an unprecedented rate. The performance of this factor has recently risen to above the 92nd percentile in history, indicating that funds have shifted to an extremely defensive position allocation.

One positive factor is that retail investors are still holding on to their stock positions, even buying on dips during the recent decline, and call option trading volume and margin account balances remain at high levels. In the past few years, retail investors have often outperformed professional funds. Will this strength continue?

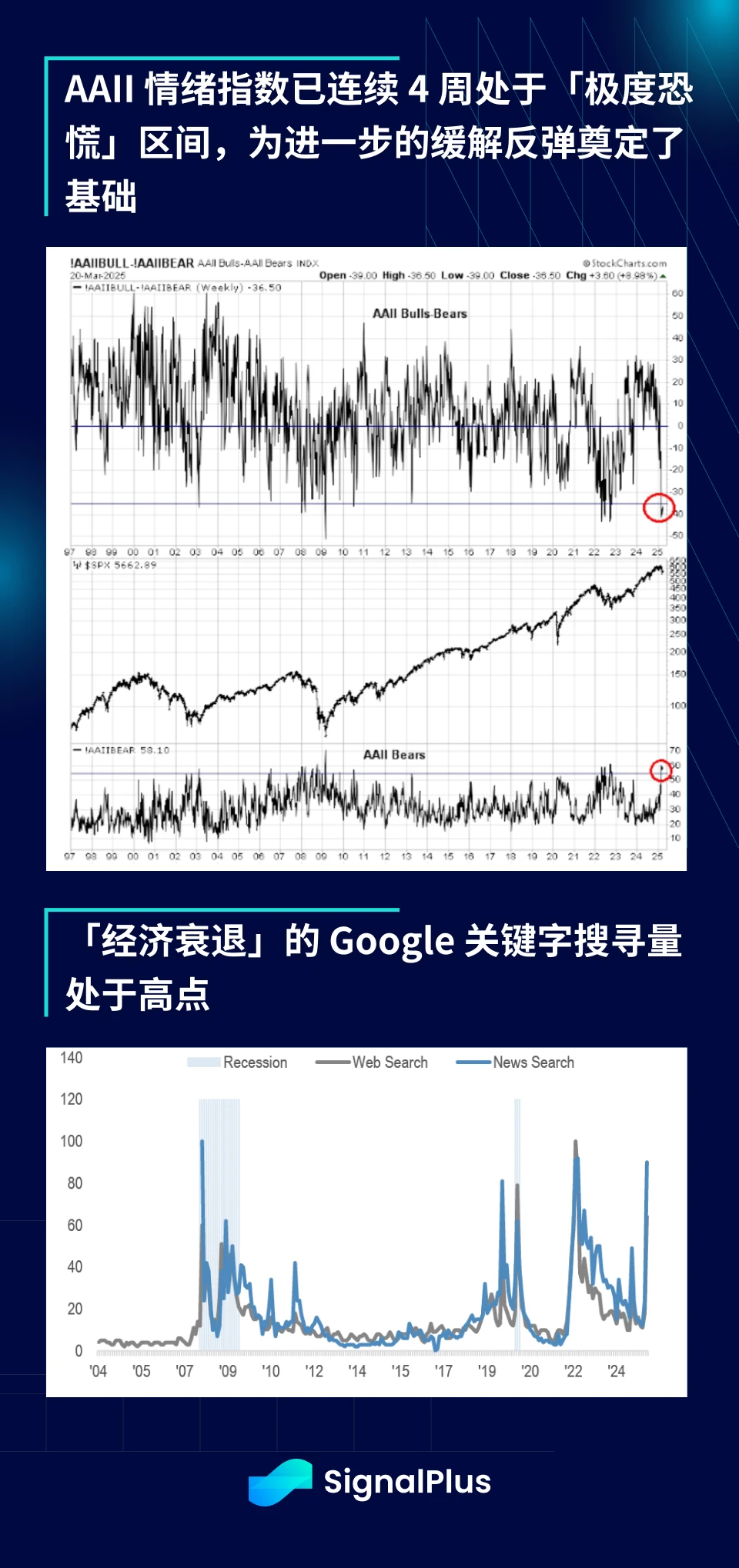

The overall market sentiment remains depressed and extremely oversold, laying the foundation for a rebound in risk assets in the short term. The number of searches on Google for recession is also close to multi-year highs (similar to the epidemic or financial tsunami), further supporting a possible relief rebound in the short term.

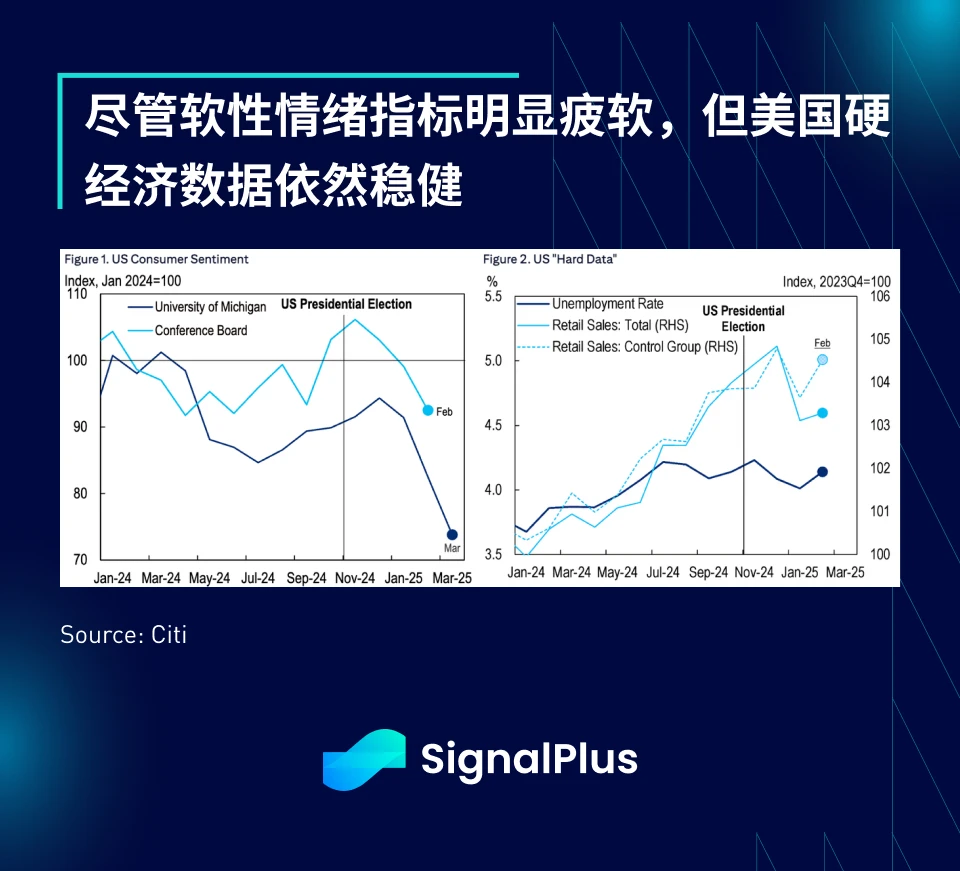

Most importantly, the US hard economic indicators remain solid, in stark contrast to the soft sentiment indicators, suggesting that the market may be over-reacting to the current weakness. In the past few years, macro observers have tended to be more pessimistic than the actual economic situation, and we believe that the US economic fundamentals are still much stronger than the market worries.

Most importantly, the US hard economic indicators remain solid, in stark contrast to the soft sentiment indicators, suggesting that the market may be over-reacting to the current weakness. In the past few years, macro observers have tended to be more pessimistic than the actual economic situation, and we believe that the US economic fundamentals are still much stronger than the market worries.

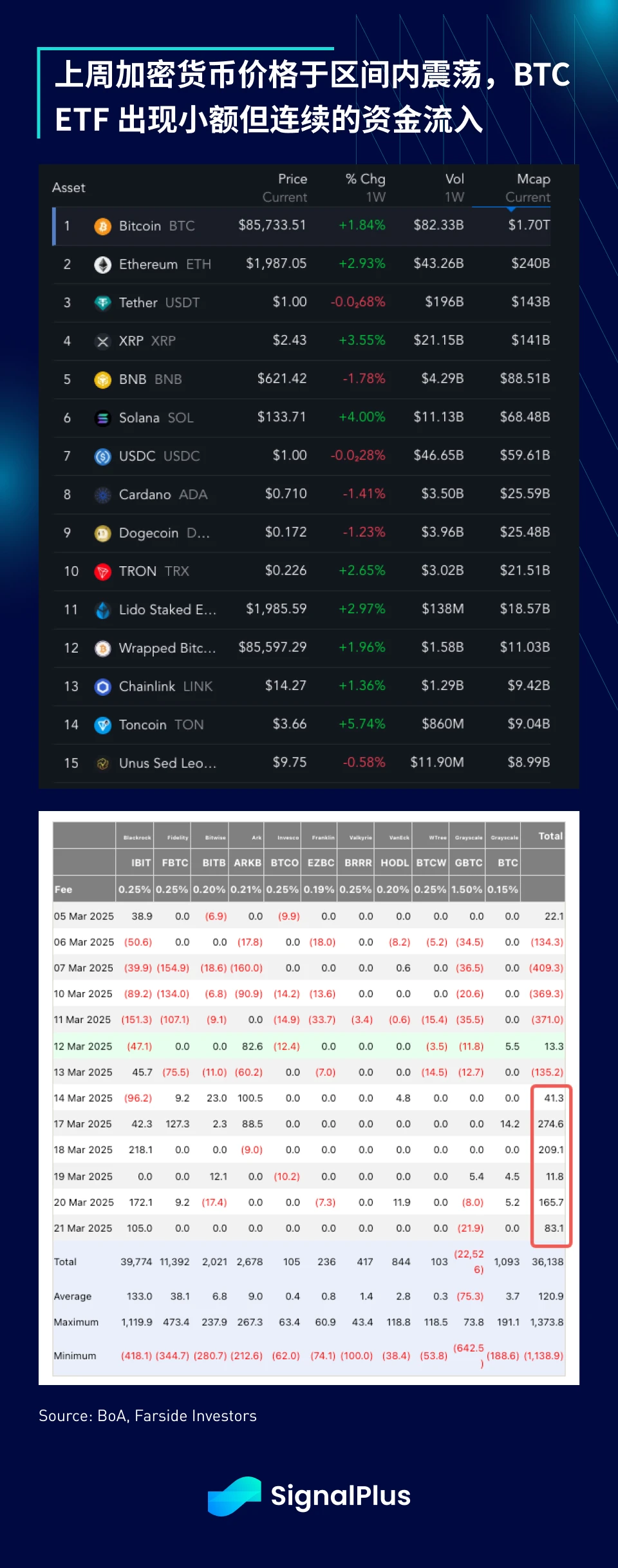

Cryptocurrencies also had a relatively quiet week, with prices mostly range-bound and bouncing off recent lows as U.S. stocks rebounded. A recent Bank of America survey on crowded trades found a similar decline in cryptocurrency longs following the recent capital flight from U.S. stocks. ETF inflows have been positive for six consecutive trading days, though volumes have been subdued.

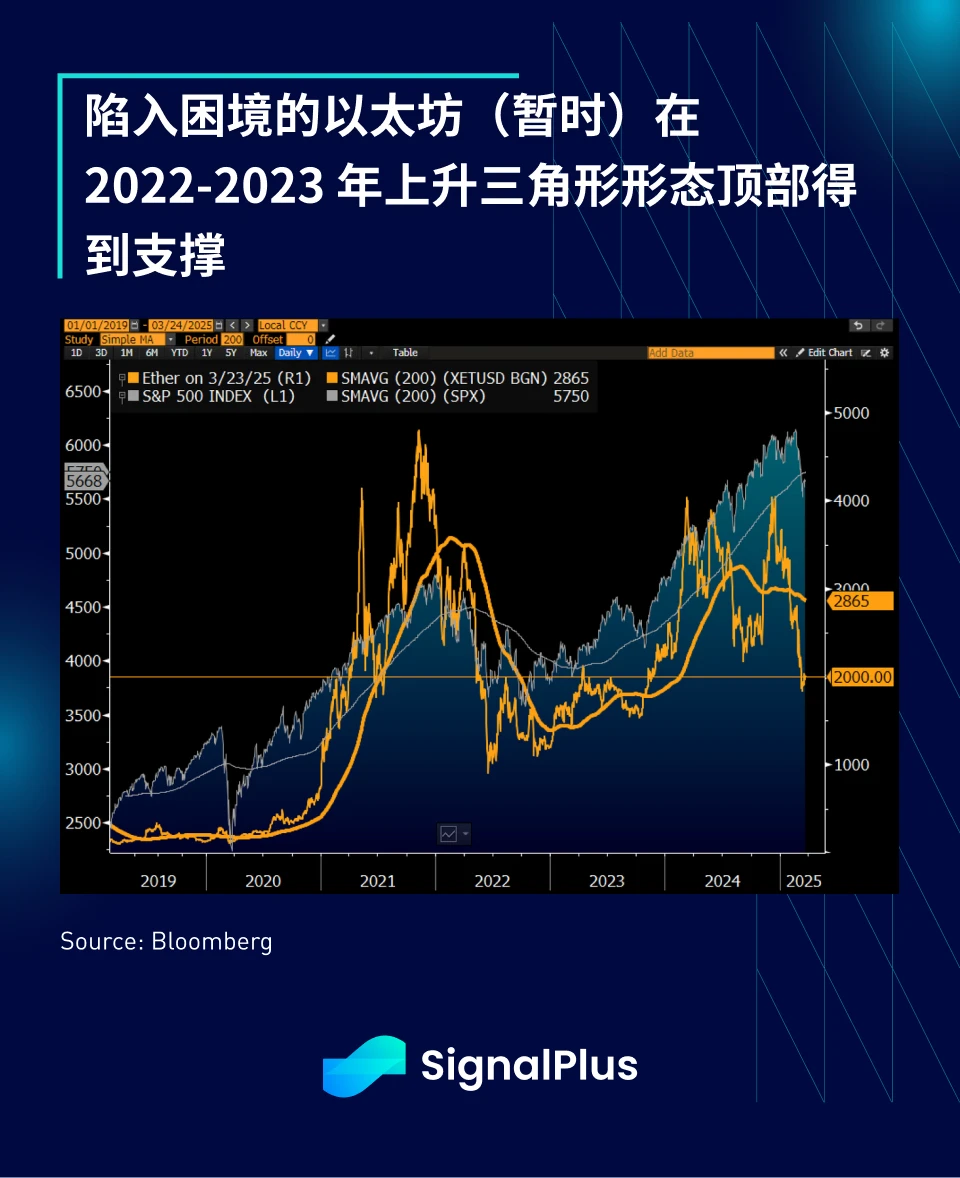

From a technical perspective, the price is still in a downward trend, but is currently stabilizing near key support levels. ETH is temporarily holding the 2022 range high, with the next important support level around 1500.

As an additional observation, Bloomberg has uncovered an interesting pattern: DOGE prices and the BTC/gold ratio have moved in uncanny sync over the past two years. We do not comment on the significance or logical interpretation of the transaction, and leave it to the readers to experience the coincidence or revelation of the industrys most representative meme coin.

Finally, despite the recent price correction, we still believe that 2024 will be a key breakthrough year for the virtual asset industry, mainly benefiting from a more relaxed regulatory atmosphere, optimistic expectations for legislation, and the continued expansion of mainstream adoption. The most representative case is the recent major mergers and acquisitions of several US cryptocurrency giants: Kraken announced the acquisition of NinjaTrader for US$1.5 billion, officially entering the traditional futures market; and Coinbase is reportedly in talks to acquire Deribit, the worlds largest cryptocurrency options exchange.

We believe that we are reaching a critical turning point in this growth journey as cryptocurrencies gradually become one of the main asset classes for mainstream investors. In the foreseeable future, cryptocurrency options trading, market clearing mechanisms, new stablecoin architectures and interest rate curves will flourish and be supported by a new wave of institutional players and professional talents, bringing the overall industry to new heights.

You can use the SignalPlus Trading Vane feature for free at t.signalplus.com/news . It integrates market information through AI and allows you to see market sentiment at a glance.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com