On March 26, the decentralized derivatives trading platform Hyperliquid experienced a sudden test of trust.

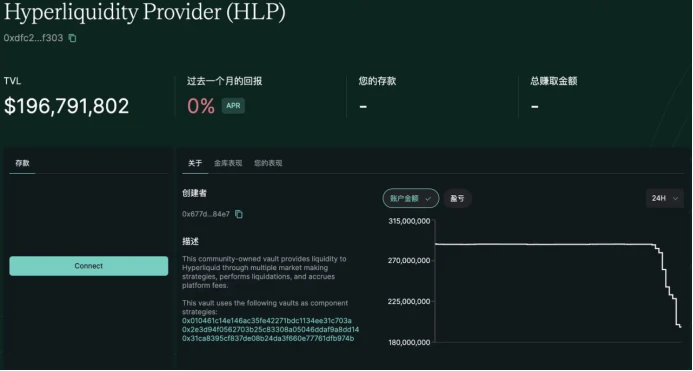

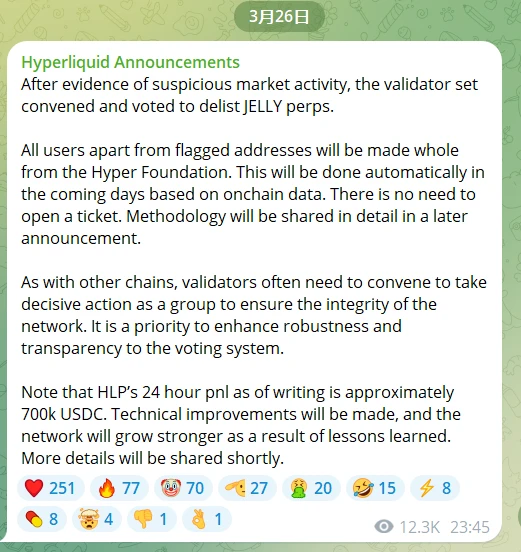

A price manipulation operation led by a whale account triggered abnormal volatility in the $JELLY perpetual contract, and the platform liquidity pool (HLP) was exposed to a potential risk exposure of up to $200 million. A few hours after the crisis, Hyperliquid quickly voted through the validator committee to delist the relevant contracts and promised that the foundation would automatically compensate non-violating users in full.

Image source: Internet

Although the incident has come to an end for the time being, what follows is a more concerning issue: When a platform that emphasizes decentralized governance chooses centralized decision-making and asset compensation in the face of risks, are its underlying governance logic, brand public relations strategy, and risk control system mature enough? And are they sufficient to support its sustainable development in a period of drastic fluctuations?

From processing speed to external statements, to mechanism transparency and user communication methods, Hyperliquids path to responding to this crisis provides a living practical example for Web3 projects. We tried to review this incident from the perspective of public relations and operations, trying to answer a core question: technical crises can be stopped quickly, but how can brand trust be repaired?

1. The initial rules for crisis response: quick stop loss and emotional comfort

1. Stop bleeding in time and control the spread of risks

Unlike some previous projects that responded slowly to crises, Hyperliquid showed a relatively mature crisis response and quickly seized the golden time of public relations:

Hyperliquid simultaneously released an official statement on Twitter and the Tegram community, stating that the governance committee quickly intervened and removed the assets involved, demonstrating the platforms consistent response to stabilizing the overall situation. Referring to the Solend incident in 2022, when the Solana lending protocol wanted to take over the assets of the giant whale account, it triggered controversy in the community over the principle of decentralization. In contrast, Hyperliquid completes emergency decisions through the on-chain governance process, achieving a certain balance between operational compliance and efficiency.

Image source: Internet

2. Automatic compensation to avoid repeated tug-of-war by users

Hyperliquid promises that the foundation will fully compensate non-violation users and adopt an automatic compensation processing path to reduce user anxiety and communication costs. This processing method is not common in DeFi protocols, and to some extent it also reflects Hyperliquids attempt to focus on user protection and narrow the trust distance between it and ordinary traders.

A similar bottom-line strategy also appeared in OptiFi, which proactively compensated all users for asset losses after the accidental closure of the mainnet contract in 2022. Practice has proved that clean and decisive admission of mistakes can effectively help the project regain trust to a certain extent.

3. Make data public and build confidence in processing

Although the announcement disclosed that HLP lost approximately 700,000 USDC within 24 hours, which is a large number, the rapid verification of the truth of the incident and the timely use of specific data to clearly convey the signal that the loss is controllable can be said to be a positive example of proven by facts.

Compared with the public opinion chaos caused by highly asymmetric information and data concealment during the previous FTX collapse, this kind of information transparency can instead become a moat for brand credibility. After all, standing at attention and taking criticism, and correcting mistakes when they occur, is also a stop-loss strategy.

Image source: Nomos Labs

2. Risk control warning failure and unclear governance signals: systemic weaknesses in the crisis

1. Risk identification is delayed and early warning mechanism is absent

In essence, this crisis stems from the whales using the position leverage and spot price linkage mechanism to create market fluctuations without obvious restrictions, exposing the platforms blind spots in trading behavior monitoring and position risk warning. Although different from contract loopholes or flash loan attacks, its essence also reflects the general weakness of DeFi platforms in building on-chain risk control systems.

Similar to the flash loan attack that CREAM Finance suffered in 2021 due to the lack of a real-time risk control model, it also confirms from another perspective the industrys lack of ability to actively identify risks. The construction of a risk control system is still an unsolved issue for most DeFi protocols.

2. Ambiguous mechanisms and black box governance: Why is it difficult to allay user concerns?

Although Hyperliquid made a compensation commitment at the first time, the key details disclosed in its announcement were obviously insufficient. How is the compensation calculated? What on-chain data is the screening logic based on? Is the source of funds sustainable? These key points that should have been made clear at the first time were blurred, causing users secondary anxiety. Affected by the liquidation of $JELLY tokens, the platforms net outflow of USDC in a single day reached 184 million US dollars.

At the same time, the platform emphasized that deleting contracts is decided by voting by validators, but did not simultaneously announce the voting mechanism, participating nodes and governance process, causing some users to question whether its decentralized governance is just a formality. Especially when the processing results have been released but the process has not been seen, users have never been able to get a clear answer to the core question of who has the right to make the decision.

Image source: Telegram

3. When doubts come from peers, decentralized trust is challenged again

In addition to users concerns, Bitget CEO Gracy also publicly stated that Hyperliquid may be able to become FTX 2.0, and even compared it to a mirror image of a centralized platform, pointing out that its product architecture has risks such as insufficient position limits, lack of risk control models, and mixed use of insurance pools.

These voices reflect a new round of questions in the industry about the boundaries of governance and power: When decentralized platforms face systemic risks, is it necessary to set up a red line mechanism? And do project owners have sufficient professional capabilities to complete the risk control closed loop without destroying openness?

3. From compensation to reflection: A crisis should awaken the bottom line awareness of Web3

Hyperliquids rapid stop loss and compensation mechanism certainly prevented the situation from getting out of control, but the operational value it really brought was far more than just a review of an emergency plan. On the contrary, this incident is forcing Web3 projects to re-examine: in a market dominated by decentralized narratives, when a crisis really comes, can the platform assume the responsibility boundaries that match its vision?

The reason why this incident has sparked widespread discussion is not because of whether the compensation is enough, but because it touches on the most sensitive issues of users: Who has the right to decide the rules? Is the compensation fair? Should risk control have issued an early warning? These are not something that can be explained simply by writing a process.

Image source: Internet

Compared with the scripted crisis SOP, Web3 users care more about: Are you willing to speak from the users perspective at the first time? Are you brave enough to publish the complete process, accept questions, and open up governance? Can you let the community know that their assets are not handed over to a faceless entity, but to a platform that truly has the right to express and choose?

This is not a race about payment speed, but a long race about trust in the mechanism. Hyperliquid handed in its first response, but the real brand restoration only started after this response.

Conclusion: After the crisis, the real test begins

Hyperliquids shortcomings in risk identification mechanism, governance transparency, and information disclosure rhythm have been focused on. At present, the first phase of crisis response has been completed, and what really affects the future direction is the depth of the second phase of handling.

How to deliver compensation? How to upgrade risk control? How to make governance more transparent? The answers to these questions will determine the long-term positioning of Hyperliquid in the minds of users.

In Web3, an environment where everything is transparent, there are many nodes, and the community voice is extremely sensitive, not making mistakes is a luxury, but how to deal with mistakes after they happen is the core ability of whether a project can survive in the long run.

To some extent, the Hyperliquid incident is a real test for the entire DeFi narrative. It tests not only the technical architecture, but also the governance resilience and public relations capabilities.

Disclaimer: All images, data and information used in this article are from the Internet and are for reference only. If there are any copyright issues, please contact us in time and we will deal with it accordingly. The opinions, data and analysis in this article only represent the authors personal opinions and do not constitute any investment advice. All statistical data are from public channels. Although we try our best to ensure the accuracy of the information, we do not guarantee its completeness and timeliness. Please judge and verify it by yourself.