Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @Xi

In February 2025, OX.FUN was pushed to the forefront due to a storm. After JefeDAO deposited 1 million USDC on the platform, he was unable to withdraw cash. OX.FUN quickly froze his funds and accused him of suspected market manipulation. JefeDAO fought back, claiming that the platform was fraudulent and showing on-chain evidence that funds were transferred. The dispute quickly fermented, causing the price of OX to plummet by 60%, from $0.03 to $0.012, and the total market value shrank to $42 million, putting community trust at risk.

In March 2025, Zhu Su announced that he would take over OX.FUN. The co-founder of Three Arrows Capital (3AC) was once a shining star in the crypto investment community, but he fell from grace and controversy in the 2022 market crash due to the bankruptcy of 3AC. Now, he is standing on a new stage with the determination to make a comeback. Can he lead OX.FUN out of the double despair of trust crisis and market weakness? Will OX.FUN become his bargaining chip for a comeback, or the beginning of another failure?

Platform background: OX.FUNs foundation and event impact

OX.FUN is a perpetual futures trading platform with OX token as the core, focusing on the deep trading and ecological expansion of Meme coins. It is deployed on the Base chain and based on Optimism Rollup technology, providing low cost and high throughput. Its core mechanism includes supporting more than 600 tokens (covering BTC, ETH, SOL and popular Meme coins such as MOG, RETARDIO) as collateral, providing up to 100 times leverage, and all profits and losses and liquidations are denominated in its own token OX. This method closely links user returns to the price of OX, and enhances ecological stickiness through trading, liquidation and deflation design. 50% of the transaction fees are used for burning (500 million OX have been destroyed), 30% are rewarded to OLP pledgers (APR 10% -15%), 17.5% are used to increase Aerodrome liquidity, and 2.5% are used to incentivize ranking traders. This deflation and incentive parallel model attempts to inject vitality into the platform.

To further attract users, OX.FUN introduced gamification features such as OX Farm and leaderboard competitions to make the trading experience more interactive. OX Farm provides staking rewards, and the leaderboard stimulates trading enthusiasm through a competitive mechanism, trying to retain retail investors in the high-risk Meme coin market.

The development of OX.FUN has also been supported by capital. In February 2024, the platform completed a $4 million financing, with investors including GenBlock Capital and Foresight Ventures, and a valuation of approximately $40 million. This round of financing laid the foundation for OX.FUNs technology development and market expansion.

It can be said that before the JefeDAO incident, OX.FUN showed a certain growth momentum and development potential. As of January 2025, the cumulative transaction volume reached 20 billion US dollars, the deposit scale was 1.5 billion US dollars, the daily active users (DAU) were stable at around 50,000, and the monthly transaction volume was between 1 billion and 1.5 billion US dollars, of which Meme coin-related transactions accounted for about 60%. Social trading functions (such as copy trading) performed well, with daily copy trading volume accounting for 15% of the total, and the OX Farm staking pool locked about 50 million OX. The ranking of daily active traders is about 2,000, accounting for 4% of DAU. The low gas fee of the Base chain (only $0.01 per transaction on average) provides solid support for high-frequency trading.

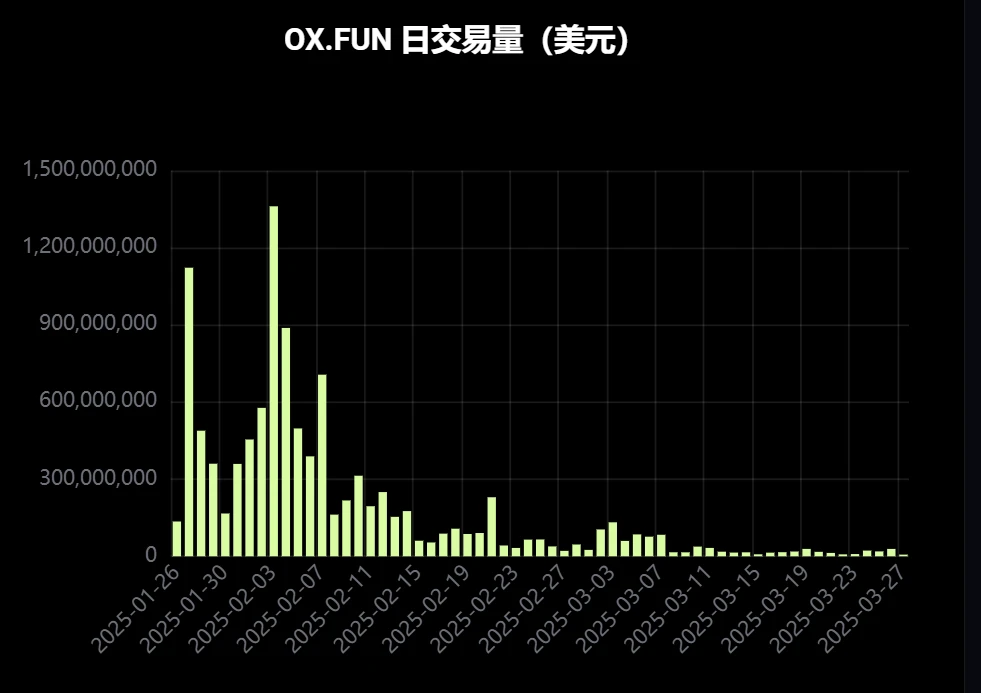

However, the JefeDAO incident was like a heavy hammer, breaking this prosperous scene. After the incident, the price of OX plummeted, which directly weakened user confidence, and the data fluctuated violently. As of early March, DAU fell from 50,000 to 42,000, a decrease of 16%, the monthly trading volume shrank to US$800 million, and the daily open interest fell to a historical low. Although the low-cost advantage of the Base chain is still there, the platforms attractiveness has been greatly reduced.

Turning point: Zhu Sus entry and initial response

Just when OX.FUN was in deep trouble, Zhu Su announced on X that he would take over the platform, promising to bring clearer strategic direction and execution. He said that Nico would continue to serve as co-leader, responsible for partnerships, and at the same time launch a team expansion plan, emphasizing that no employees were affected by the reorganization. This news was like a shot in the arm, and the price of OX briefly rebounded to $0.015, an increase of 25%, and market sentiment warmed up slightly. However, the communitys trust in this former general of Three Arrows Capital has not yet been fully restored. Doubts and expectations are intertwined on X. Some people joked: Is Zhu Su a savior or a hot potato?

In order to stabilize the situation, OX.FUN quickly adjusted its stance after the incident. In early March, the platform tried to quell the suspicion of misappropriation of funds by proving the safety of funds through on-chain audits, but some users questioned the independence of the audits, and the effect was limited. At the same time, OX.FUN added a feedback channel on Discord to try to repair the communication rift with the community. Zhu Su frequently spoke on X, saying that the expansion of the team will inject new energy and tried to rebuild confidence with actions.

Roadmap and Outlook: Breaking through the Blue Ocean in the Crisis

In order to completely reverse the downward trend, OX.FUN announced its latest roadmap on March 24, 2025. With the deep trading of Meme coins as the core and relying on the low-cost advantage of the Base chain, it revolves around four pillars and strives to be reborn from the crisis:

On-chain transparency

It is planned to achieve on-chain settlement and reserve proof in Q2 2025. The first batch of audits will be released in April, covering 90% of the platform reserves and responding to trust issues.Multi-chain collateral

Supports more than 500 tokens and NFTs as collateral. The cross-chain unified account is expected to be tested in Q3, supporting chains such as Ethereum and Solana. The first batch of pilots locked blue-chip NFTs, and internal testing showed that the average daily transaction volume of NFT mortgage users increased by 15%. The OX Chain test network was launched in January, and the main network was launched in Q4. The first batch supported $OX and 10 Meme coin staking pools.Liquidity Optimization

OX Quanto trading and Hyperliquid USDC futures were integrated on the Base chain at the end of March, with a daily trading volume of approximately $5 million, and plans to expand to $20 million in Q2. OX Quanto enhances the flexibility of perpetual contracts, and Hyperliquid provides stable settlement options.User Experience

The mobile-first app is expected to be launched in Q3, supporting one-click deposits and internal testing latency of less than 50 milliseconds. Automated trading strategies and Battle Vaults will be further integrated to optimize the retail investor experience.

The release of the roadmap shows OX.FUNs ambition to break through. If transparency is improved and multi-chain expansion is successfully implemented, the platform is expected to regain user trust, especially against the backdrop of a 30% increase in the trading volume of Meme coins on the Base chain in Q1. However, the volatility of OX prices, the complexity of technical execution, and the overall weakness of the market (Meme coin trading volume fell by 40%) are still obstacles.