Investment Overview

Bittensor is a general incentive platform inspired by the Bitcoin network, based on subnet architecture and game theory. Bitcoin incentivizes miners to complete SHA 256 calculations and maintain network availability by issuing additional tokens. Bittensor incentivizes subnet miners to provide various resources, including AI reasoning, data storage, GPU computing power, bandwidth, etc.

1. Team: The three core members all have computer backgrounds. Ala is more interested in academic research and AI algorithms, Jacob is good at machine learning and blockchain architecture, and Garrett has experience in engineering implementation and product development. Overall, it is a strong technology entrepreneurial combination.

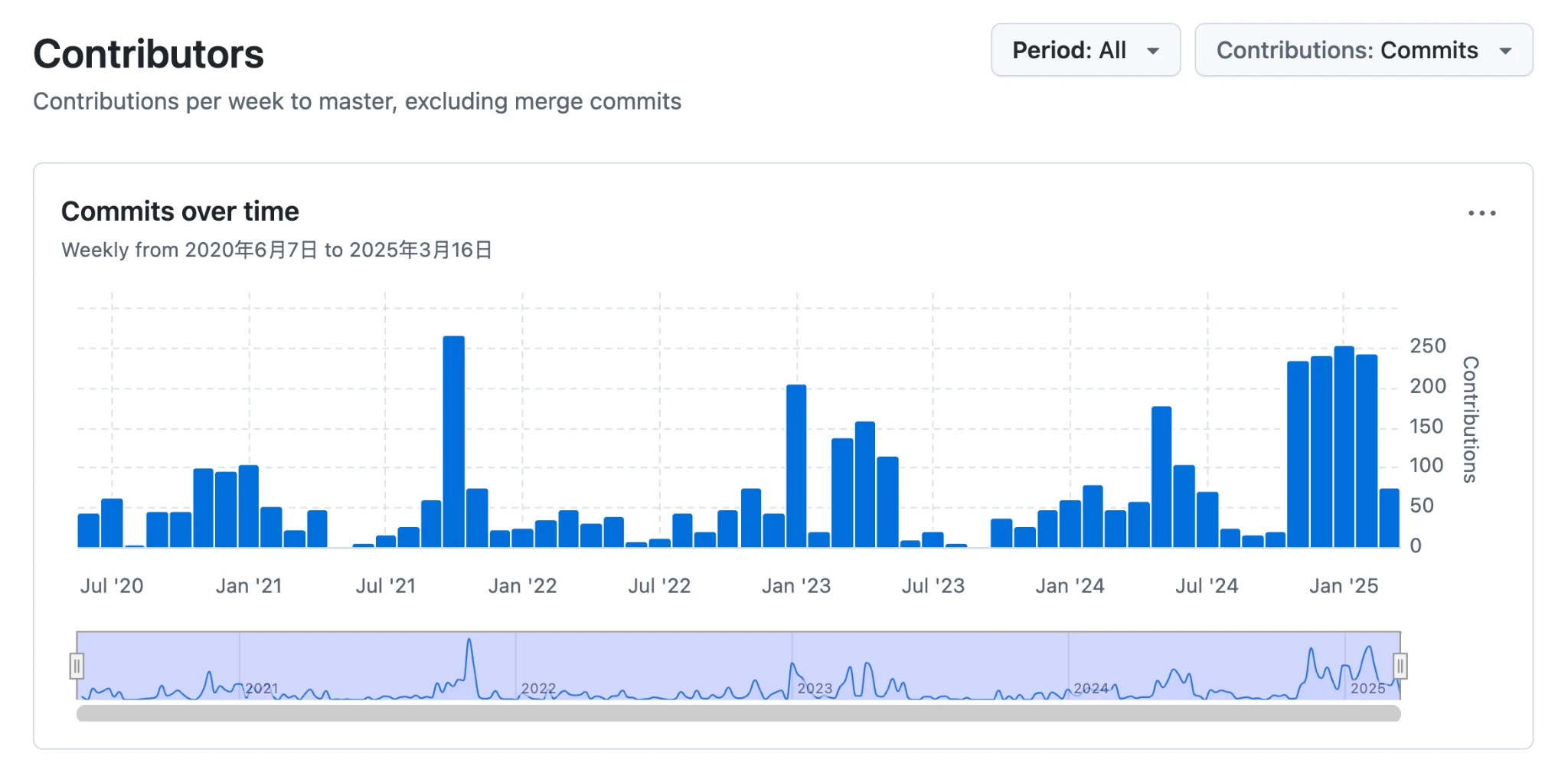

2. Development progress: The normal development progress has been maintained, and the development frequency has increased in the past three months.

3. Product: Innovative token economics. Only when the subnet team improves the quality of the project and then increases the price of the subnet token can they get incentives. Under Bittensors game theory mechanism, subnets compete to provide the best resources, including quantitative model performance, GPU computing power price, storage cost-effectiveness, folding protein discovery speed, etc.

4. Ecosystem development: There are currently 80 subnet projects in the ecosystem, and the number of ecosystems is showing an accelerating growth trend. However, there are a large number of duplicate and similar businesses.

5. Narrative aspect: Bittensor is closely related to narratives such as AI, DePin, and public chains.

risk:

1. Lack of infrastructure, insufficient marketing and community support, resulting in high opacity.

2. The ecosystem is highly repetitive and lacks an external independent development team. A Lab may build up to five or six subnet projects. This makes it impossible for the Lab to focus on a particular project, causing it to lose to external independent competitors.

3. TAO’s mechanism design is complex and involves many details. The learning cost for retail investors is high, and the knowledge reserve requirements for project parties are also high.

The ecological development of Bittensor is accelerating. Its architecture is relatively unique. There are no highly similar competitors at present. Most AI products are competitors of subnet projects. We are optimistic about the development of its ecology. Unlike Allora and Sentiment, miners can only provide large models, and Sahara AI can only provide data. Bittensors subnet (miner) is more like multiple countries operating under a world system. Bittensor rewards well-developed countries. Each country is completely free to develop specific businesses, but it cannot exceed the worldview set by Bittensor. The evaluation standard is whether the currency of each country is valuable. Under this more open and unique incentive structure with its own tokens, there is an opportunity to create a dazzling ecology. We have also seen VCs including YZi Labs start to invest in the Bittensor ecosystem.

Basic Information

1.1 Project Introduction

Bittensor is a general incentive platform based on subnet architecture and game theory, inspired by the Bitcoin POW network. Bitcoin incentivizes miners to complete SHA 256 calculations and maintain network availability by issuing additional tokens. Bittensor incentivizes subnet miners to provide various resources, including AI reasoning, data storage, GPU computing power, bandwidth, etc., through additional issuance. Through game theory and token incentives, a benign competition environment is built to provide distributed crowdsourcing services.

1.2 Basic Information

Note: Information source: CoinMarketcap Coinglass, statistical date: March 17, 2025

2 Project Details

2.1 Team background check

Jacob Robert Steeves: Founder, graduated from Simon Fraser University with a Bachelor of Applied Science, majoring in Mathematics and Computer Science. While in school, he participated in the ACM-ICPC programming competition and won the 8th place in the North American West Region in 2014. Jacobs career development experience covers machine learning research (Knowm), algorithm development (Google), and exploration of decentralized technology (Bittensor). His work areas mainly focus on machine learning, distributed computing and encryption technology, and he also has experience in traditional technology companies.

Ala Shaabana: Co-Founder, graduated from the University of Windsor with a bachelors degree in computer science and a doctorate from McMaster University. His career development experience covers software development (firmCHANNEL, VMware, Instacart) and university academic research. His work areas involve computer science, machine learning, and distributed computing, and he has both corporate RD experience and academic research background.

Garrett Oetken: CTO, graduated from the University of Idaho with a major in computer science, his career development experience covers software development (Safeguard Equipment), artificial intelligence research and technology entrepreneurship (Quantum Star Technologies, Opentensor Foundation). His work areas include AI, computer vision, natural language processing and distributed computing.

Opentensor is the development team of Bittensor. The Opentensor Foundation was founded in March 2023. The total number of employees is about 40, which has decreased by 3% in the past six months, and the average tenure is 1.3 years. The three core members all have computer backgrounds. Ala is more inclined to academic research and AI algorithms, Jacob is good at machine learning and blockchain architecture, and Garrett has experience in engineering implementation and product development. Overall, it is a strong technical entrepreneurial combination.

2.2 Funding/Financing

Bittensor has never disclosed its financing in the primary market. Currently, the publicly available information is the multi-million-dollar OTC token transactions of Polychain, DCG and DAO.

2.3 Code

Contributors, source: Github

The development of Opentensors Github main library Tensor is progressing well, and the code base updates have accelerated significantly in the first quarter of 2025.

2.4 Products

2.4.1 Background

The product conception of Bittensor began with the interpretation of the Bitcoin network. From Bittensors perspective, the Bitcoin network uses token economic incentives to encourage global miners to run algorithms to maintain the availability of the entire network. However, the computing resources contributed by the Bitcoin network are very basic and single. Inspired by this, Bittensor incentivizes miners to provide broader digital resources or intelligent computing resources in the AI era. In the Bitcoin network, all miners run the same algorithm SHA 256, but in Bittensor, miners can run different algorithms or provide different resources (AI reasoning, data storage, computing power, bandwidth, etc.), which can be further abstracted into a decentralized market and rewarded through Bittensors unified incentive mechanism.

2.4.2 Product Introduction

Bittensor is an open source platform where participants can produce digital goods, including computing power, storage space, AI reasoning and training, protein folding, financial market prediction, and more. Bittensor consists of different subnets. Each subnet is an independent community of miners (people who produce goods) and validators (who evaluate the work of miners). Subnet creators are responsible for managing the incentive mechanism, and TAO stakers can support specific validators by staking TAO.

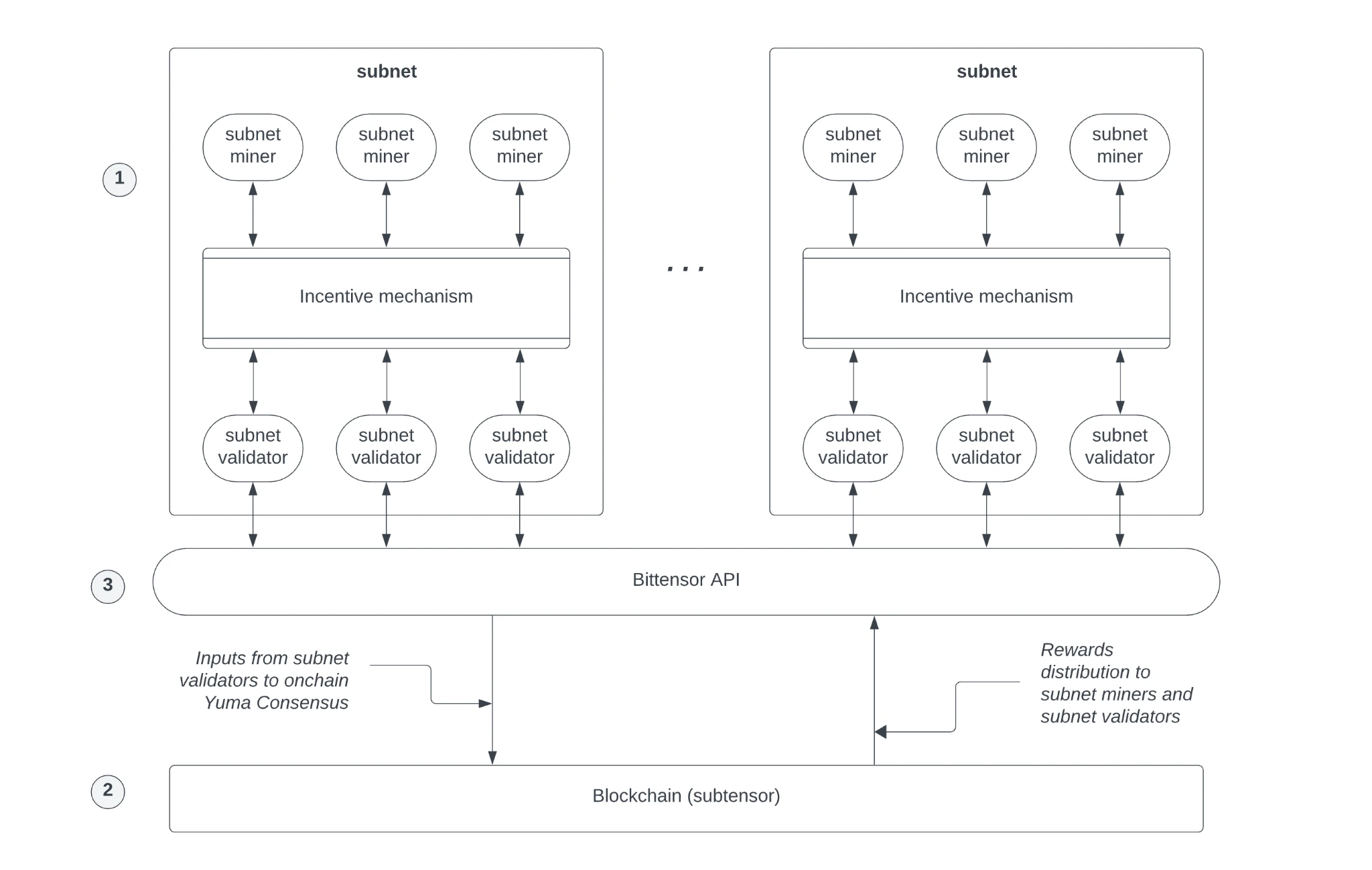

TAO architecture, source: Bittensor

TAO consists of several components as shown in the figure above:

1. Subnets. Each subnet is an incentive-based competitive market that produces a specific digital commodity related to artificial intelligence. It consists of miners who produce the commodity and a community of validators who measure the miners work according to subnet-specific standards to ensure its quality.

2. The Bittensor mainnet acts as a record system, and its token TAO serves as an incentive for participating in subnet activities. The Bittensor blockchain records the balances and transactions of miners, validators, and subnet creators.

3. Bittensor API, which supports interaction between miners and validators within a subnet and allows all parties to interact with the blockchain as needed.

Each subnet has two roles, miners and validators.

miner

● In Bittensor’s concept, “miners” do not just run computing power to mine PoW, but can provide training or reasoning resources (or other digital commodities, such as data bandwidth, etc.) for AI models.

● Different subnets may target different tasks (NLP, CV, multimodal, etc.). Miners can choose to join the subnet that suits their hardware/algorithm, contribute resources and obtain incentives.

Validator

● Validators still need to maintain the security of the Bittensor main chain, package blocks, verify transactions, etc. (refer to the Polkadot/Substrate mechanism) to keep the network running normally.

● There are also subnet-level validators to help verify whether the consensus rules are complied with within the subnet and prevent malicious behavior.

Subnet Mobility

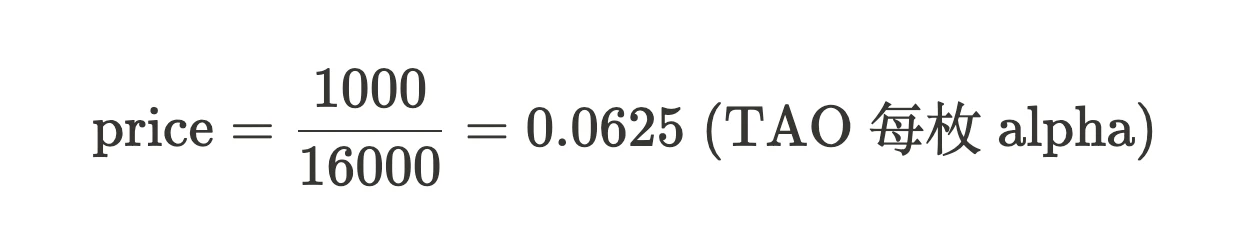

The key mechanism introduced by Bittensor is that each subnet has its own AMM mechanism. This AMM Pool has two token reserves, one containing the tokens of the TAO mainnet itself, and the other is the subnets own tokens (which we collectively refer to as Alpha Tokens). Subnet tokens require TAO tokens to be staked in the subnet reserve before they can be purchased. For example, assuming there are 1,000 TAOs and 16,000 subnet Alpha tokens in the pool, then according to the formula

This means that one alpha token is worth 0.0625 TAO. When people are optimistic about Alpha tokens, they will buy Alpha through TAO, so that the supply of Alpha decreases and TAO increases, which drives up the price of Alpha. It is worth noting that the network will also inject a portion of new TAO and new subnet tokens into the subnet according to certain rules in each block, which will also affect the price of the token.

However, how the subnet tokens are issued and how TAO incentivizes the subnet is related to Bittensor’s latest dynamic TAO mechanism, which we will introduce next.

2.4.3 Technical Details

In the past, Bittensor’s key technology was its Yuma Consensus algorithm, which aims to solve a problem: how to reach consensus and distribute incentives for “AI model contributions” in a decentralized network while resisting collusion and cheating among nodes. The algorithm is not only responsible for the consensus voting of validators, but also for determining which subnet should receive how much TAO incentive. However:

1. Validators are unable to fully evaluate a large number of subnets, resulting in inaccurate scoring, apathy, or bribery;

2. The subnet may privately “bribe” the validator to increase the vote;

3. High-quality subnets that deserve more incentives may be neglected in an unfair environment.

Therefore, Bittensor has built an improved mechanism to evaluate the contribution of subnets, which is called dynamic TAO. DTAOs new idea: Leave the decision of which subnet should get more tokens to the market, issue a subnet token (Alpha) on each subnet and combine it with the AMM pool, and judge the value of the subnet by market price. The more promising the subnet is, the higher the price of the subnet token will be, the higher the proportion of TAO obtained in each additional issuance, and the more incentives there will be for Alpha token issuance.

For example, let’s say we have two subnets, Subnet A and Subnet B, and one TAO is issued in each block.

1. When Subnet A and Subnet B are launched, their subnet tokens are alphaA and alphaB and the prices are P_a and $P_b. If there is no special configuration, the ratio of TAO and subnet tokens is generally 1:1. At the same time, the total amount of Alpha tokens is maintained at the same cap of 21 million as TAO.

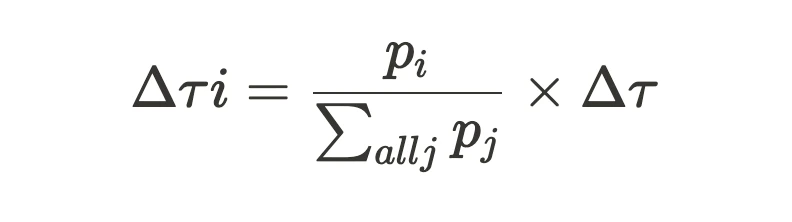

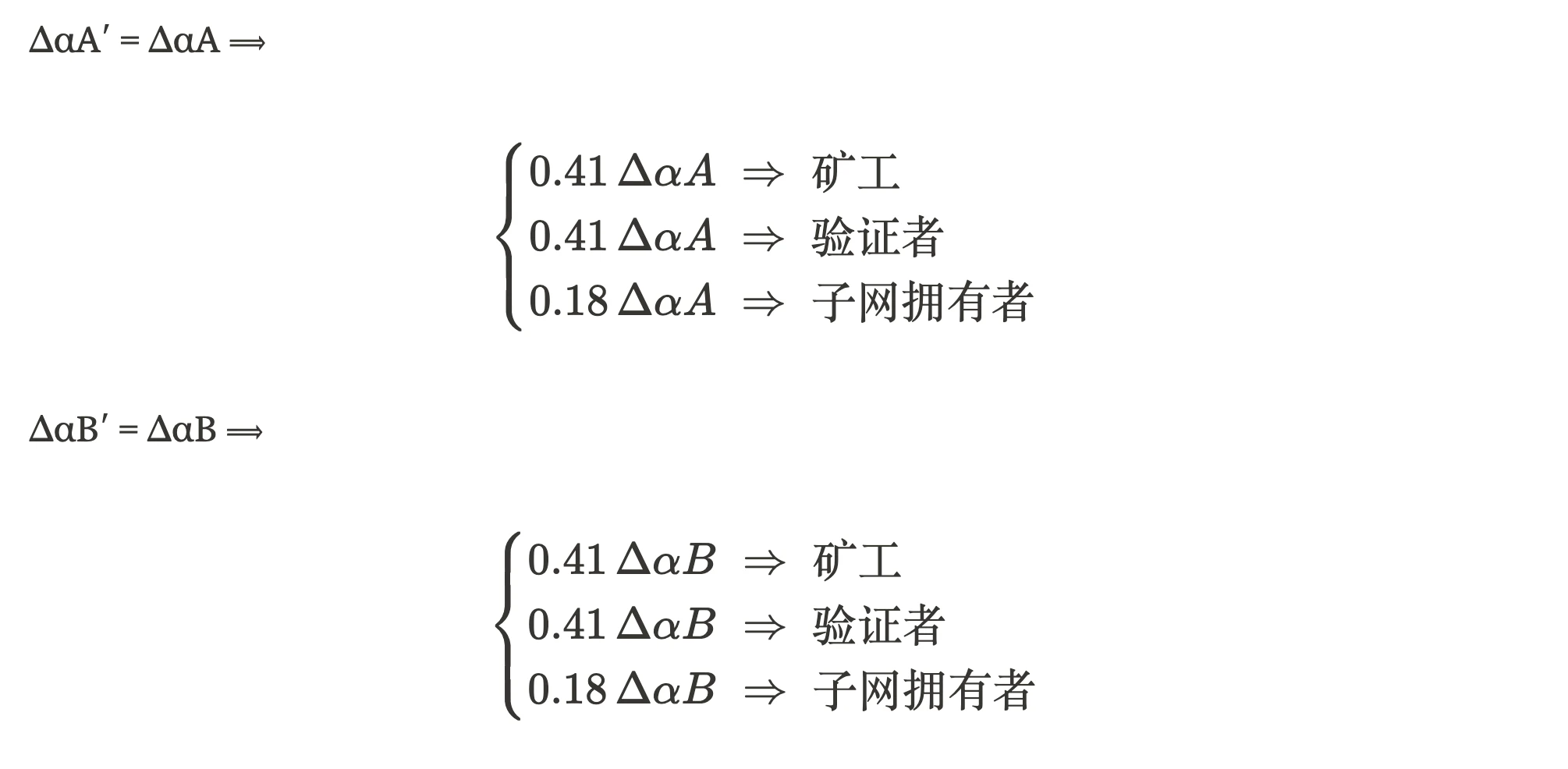

2. The total amount of TAO injected into each subnet, Δτ, is proportional to the proportion of its token price in the “total token price of the entire network”. The general formula is:

Therefore, assuming that the prices of the two subnets P_a and P_b are 1 TAO and 1 TAO respectively, the subnet can obtain 0.5 Δτ after each block issuance. If the market is more optimistic about alphaA, the market will inject more TAO into the A subnet AMM pool.

To keep the AMM pool price stable, the subnet will also receive corresponding Alpha injections.

1. Calculate Δαi first - How much Alpha needs to be injected while maintaining the current price pi

2. If the calculated value exceeds the subnets Alpha issuance upper limit (cap), the actual injection value is truncated (only injected up to the cap).

In the DTAO rules, in addition to the Alpha injected into the pool, an equal number of Alpha tokens will be directly distributed to subnet roles to replace the previous method of issuing TAO.

● Miners account for 41%

● Validators account for 41%

● Subnet Owners account for 18%

The purpose of injecting into the pool is to maintain the price; distributing to nodes is to motivate ecological roles. Alpha tokens are reserved and will be issued all at once after a Tempo time (360 blocks) to avoid too fragmented rewards. Miners are responsible for providing computing power, storage, reasoning and other functions of the subnet. The only token they can obtain is this additional issuance mechanism, and the validator is responsible for verification.

A common problem here is that each time TAO is injected, although Alpha tokens are issued to AMM, the price of this part of the pool is kept constant, but the additional issuance of corresponding tokens will lead to additional selling pressure. This is similar to the miner reward mechanism of Bitcoin. The equal proportion of TAO and ALpha tokens injected into the AMM pool is to deepen the liquidity of subnet tokens in the market, with low slippage, more accurate market pricing, and more confidence for token holders. The equal proportion of alpha token issuance rewards is to reward its high-quality miners and subnet developers. In fact, since the total amount of tokens is limited to 21 million, the subnet tokens will not be issued indefinitely, but will approach 21 million indefinitely. It is similar to the mechanism of Bitcoin miners and Bitcoin issuance.

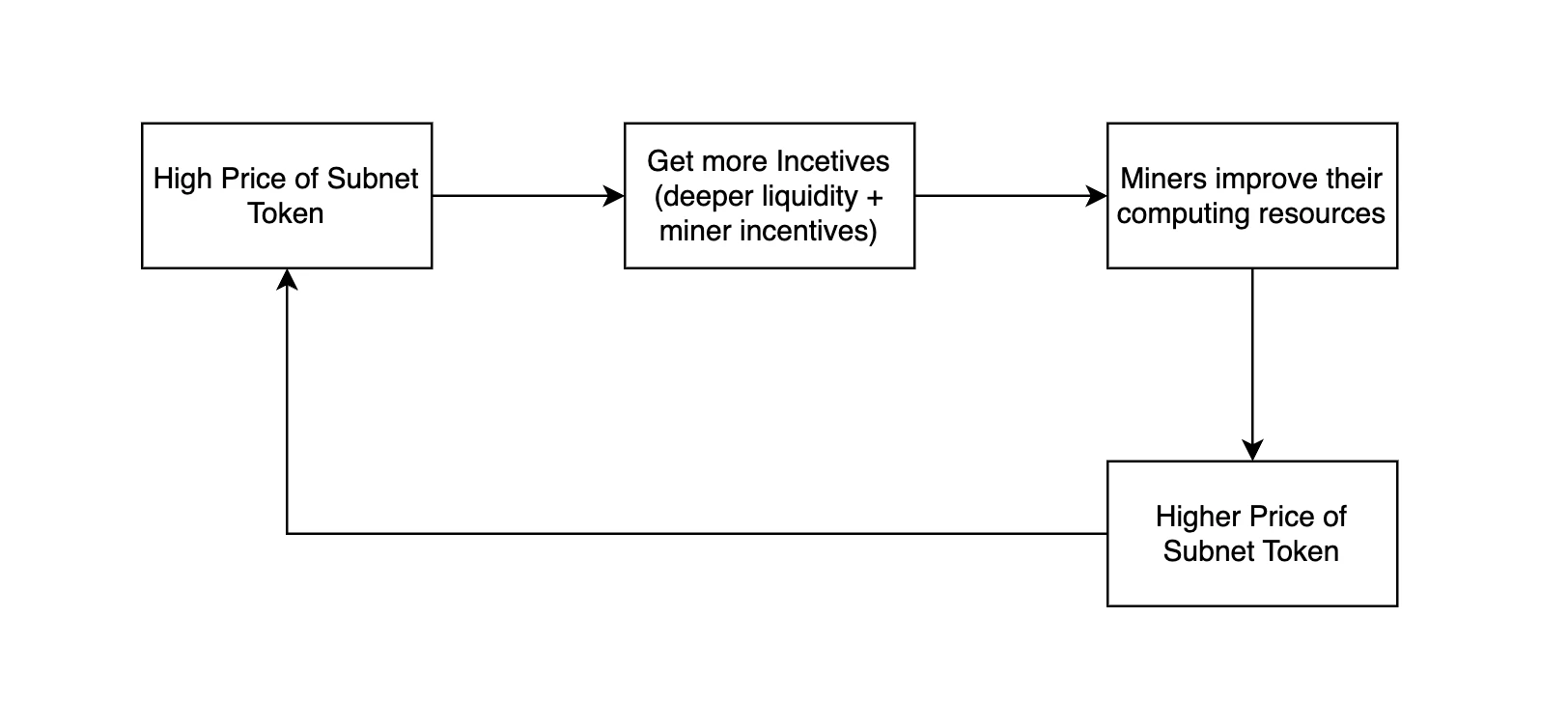

Positive cycle mechanism

Under the new Dynamic TAO architecture, there is a positive feedback loop to motivate subnet developers to build, and they often expect to receive fairer and more transparent rewards through additional issuance. This set of incentives can better prevent fraudulent voting, because fraudulent voting requires the use of real money to push up the price of the subnet, and only prices with good fundamentals can be stable at a high level for a long time. If a poor subnet relies on fraudulent voting to raise the price of the subnet, first of all, it is unsustainable, and secondly, the subnet holders themselves are also happy to see it happen.

3 Development

3.1 Past

3.2 Now

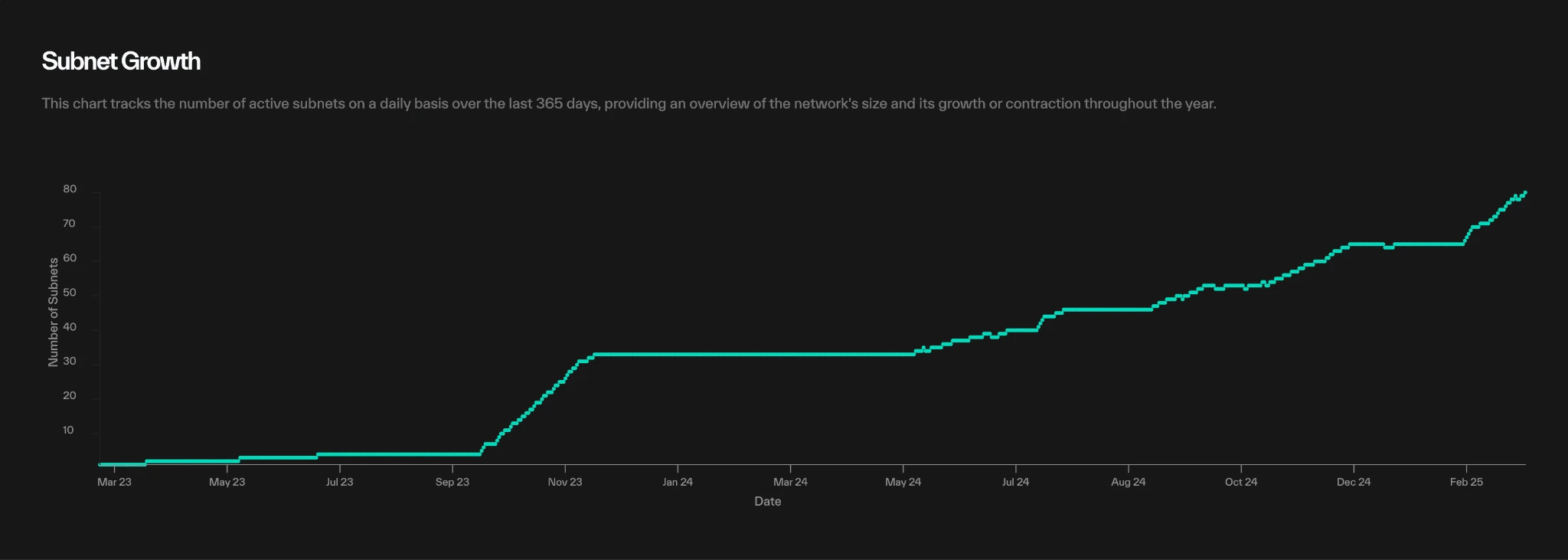

Subnet Growth, source: taostats

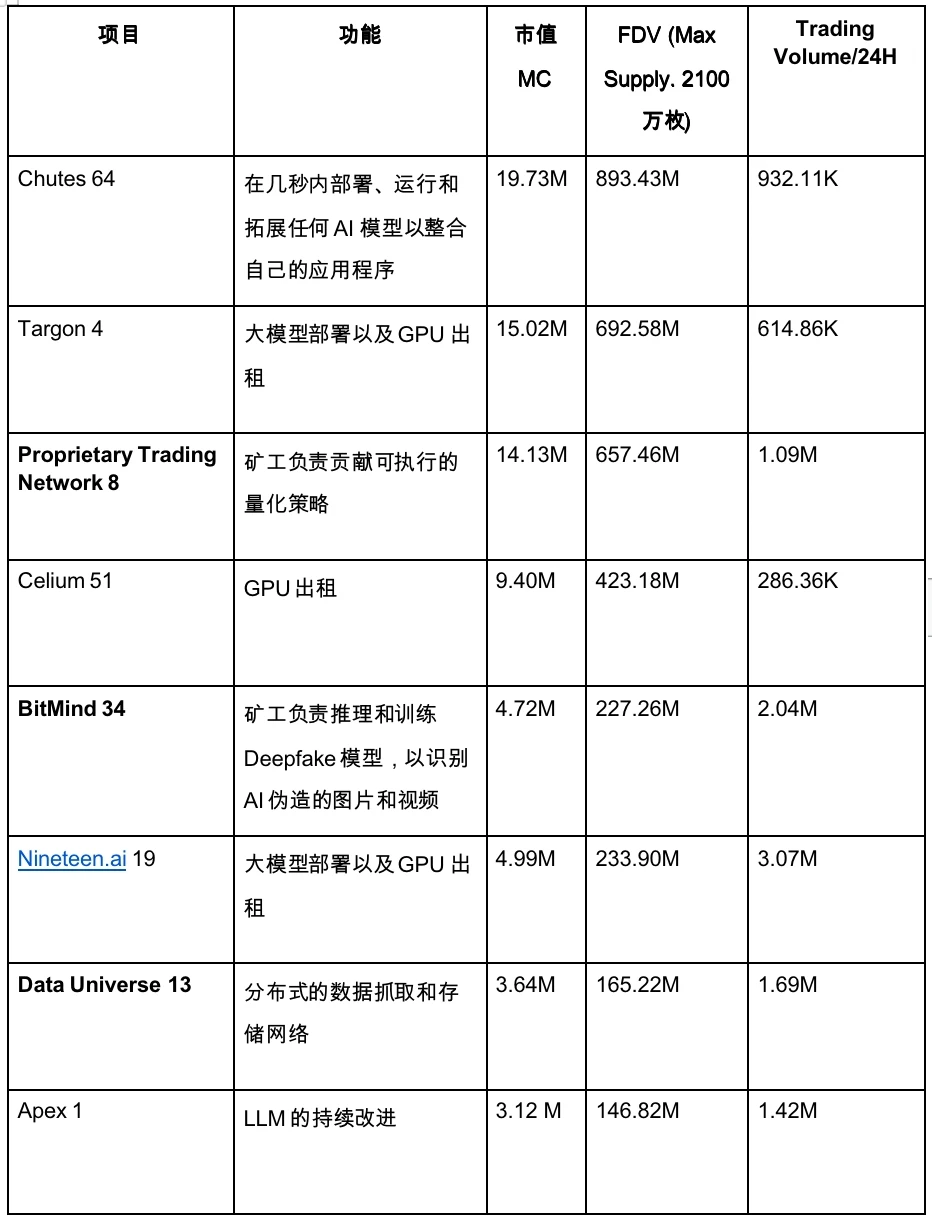

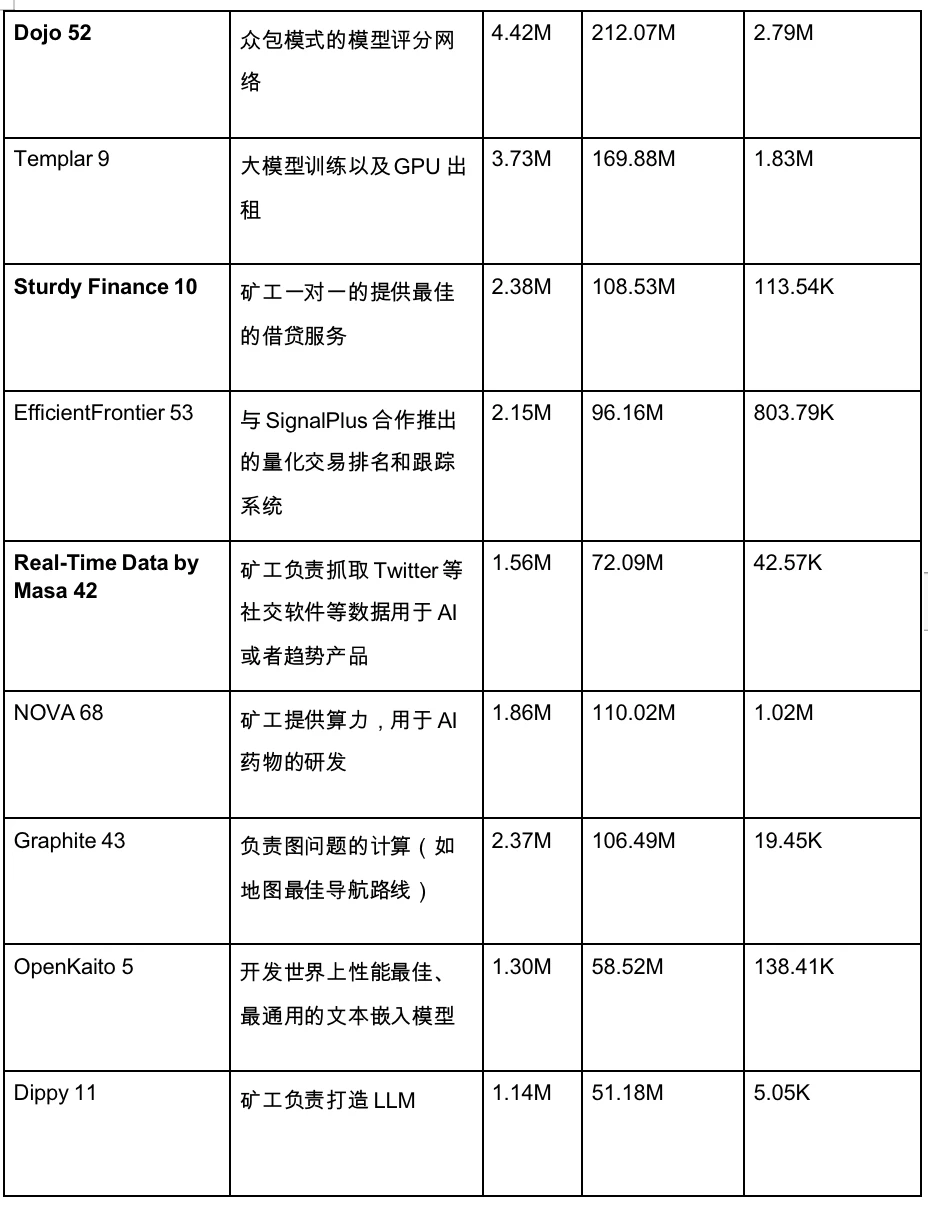

The subnet was launched in October 2023. After 1.5 years of development, Bittensor currently has 80 subnets (including the Root subnet), and the ecosystem is growing rapidly. As of March 23, the total market value of the ecosystem is 1.65 B, and the total 24-hour transaction volume of the subnet token is 47.66 m.

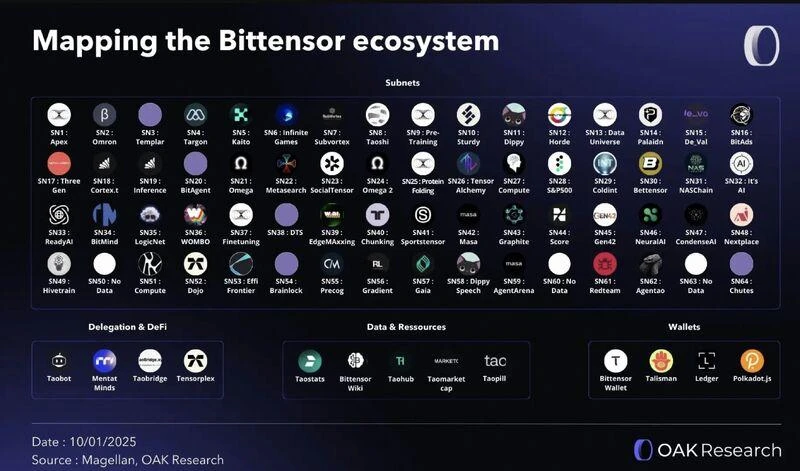

3.2.2 Ecological Development

Bittensor ecosystem, source: OKA Research

Top 20 rankings by Liquidity, source:Taostates

We counted the top 20 networks excluding the Root network (Bittensor’s previous token distribution mechanism, which relied on validators to determine contributions and has now been abolished) and ranked them by liquidity in the AMM Pool. This can reflect the long-term value accumulation and recognition.

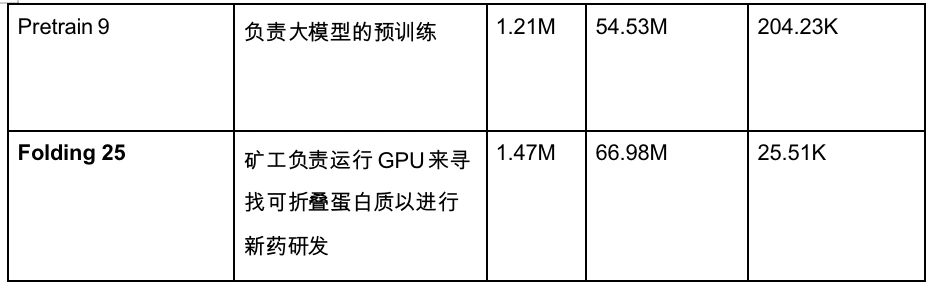

Bittensor has a high degree of ecological repetition. Among the 20 projects, 11 projects use existing GPUs for pre-training, training, fine-tuning, and reasoning of large models. However, we can also see in the ecosystem that Subnets use decentralized GPUs to perform operations including proteins, graph theory, and large models. It is worth noting that we found that many of its subnet ecosystems were developed by the same studio, such as Microcosmos (#1 #9 #13 #25 #37) and Rayon Labs (#64 #19 #Gradients). There may still be a lack of sufficient independent developer teams in the ecosystem.

In terms of the real utility of the ecosystem, there are indeed some voices from the community that deserve our reflection. For example:

1. Bittensor has evolved into a decentralized universal incentive network since the launch of the dynamic TAO mainnet. Due to the official offline of the Root subnet (loss of centralized regulation), and the mechanism relying on the market value of the subnet, some tokens such as MEME will be incentivized, thus invalidating the long-term vision of the network.

2. Some LLM subnets that focus on reasoning have a large number of miners, which leads to inefficiency and redundancy. At the same time, the incentive mechanism of the subnet itself and the level of reasoning quality judgment are different, and miners tend to use the same model to avoid misjudgment.

We believe that the first question is indeed worth noting. We can introduce more mechanisms to judge the value or reintroduce a DAO organization to avoid things that damage the network. As for the second question, we believe that this shows that the owner of the subnet has not done a good job. If the subnet loses its value, its price and incentives will gradually decrease, so this aspect can be adjusted autonomously by the market. If we look at it from a very long-term perspective, Bittensor, a universal incentive network, still has its significance. In the ecology section, we will discuss its suitable application scenarios.

In terms of capital support, the Bittensor ecosystem is also gradually expanding, and we have seen projects receiving VC financing one after another. For example:

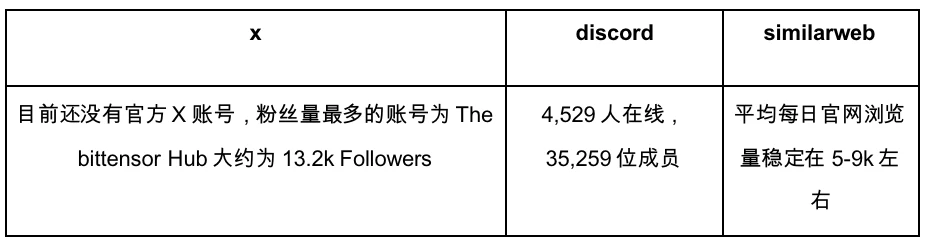

3.2.2 Social Media

Bittensor has little connection with the community. Apart from Discord, there is no official community communication channel, and there is also a lack of marketing promotion.

3.3 Future

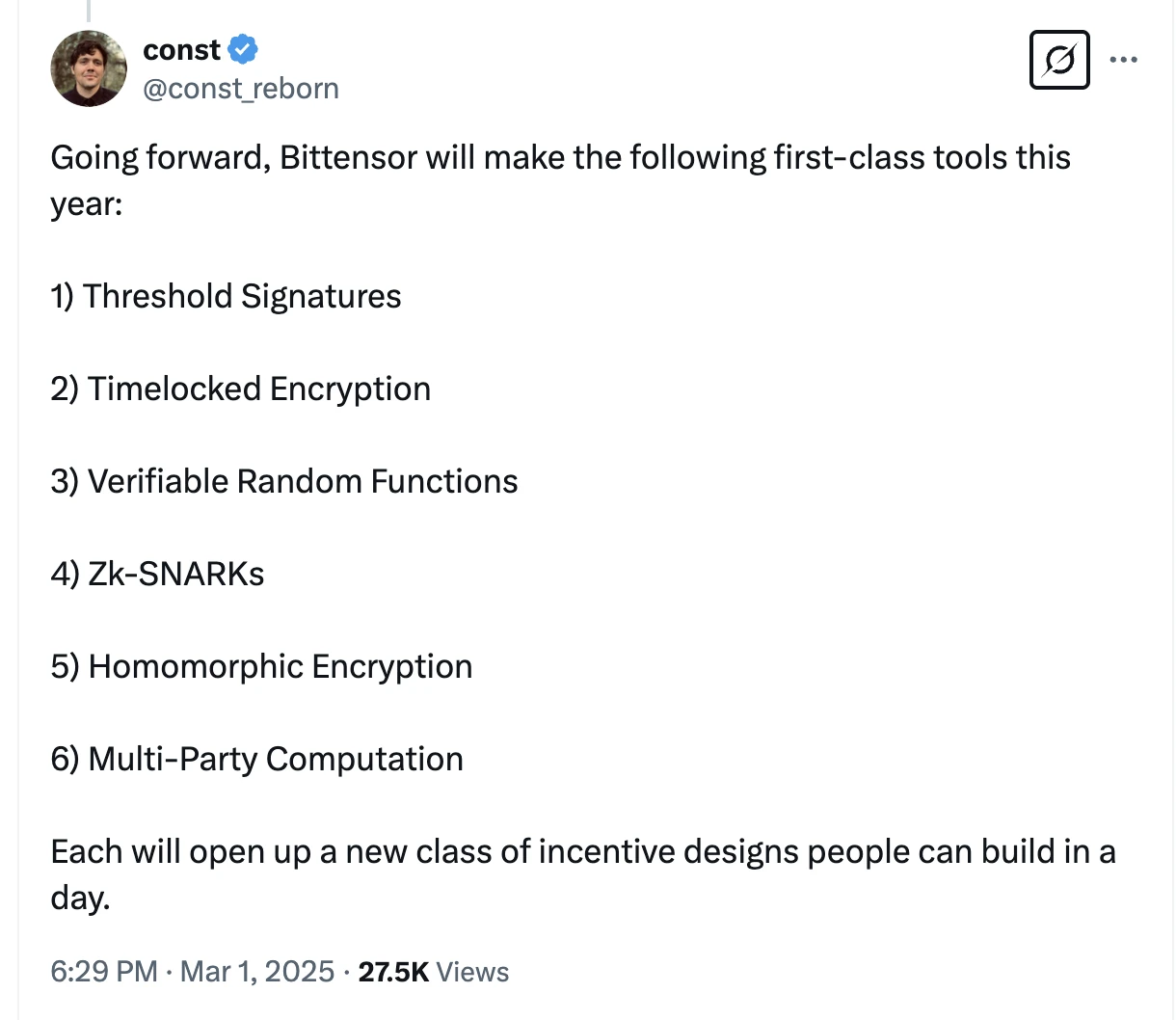

Team member X, source:const

The official blog stopped updating last year, and there is no official 2025 Roadmap. The team pays more attention to developers than the community. The founder has a general outline of its next goals on X, including: threshold signatures, time-locked encryption, verifiable functions, ZK-SNARKs, homomorphic encryption, and multi-party computing. These cryptographic tools are intended to help developers redesign the network incentive system.

4 Economic Model

4.1 Token Allocation

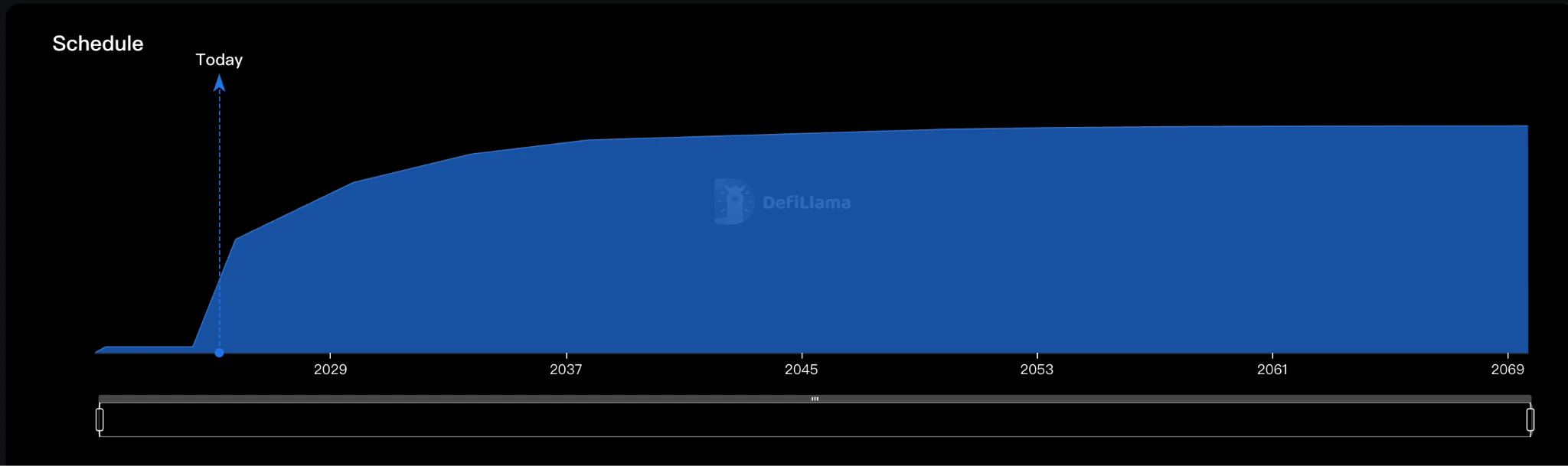

Vesting Schedule, source: Defillama

The Finney network will be launched on March 20, 2023, when the first batch of miners can go online to mine. Bittensor, like Bitcoin, has no primary market share of the team and VC. The total number of tokens is 21 million, and 36.95% (about 8.5 million) has been mined, and the remaining 68.05% is waiting to be mined. One TAO will be mined in each block, and one block is 12 seconds. About 7,200 TAOs will be mined in a day, which is roughly $1.8 million at a price of $250 (spot trading volume is $96.62 M per day).

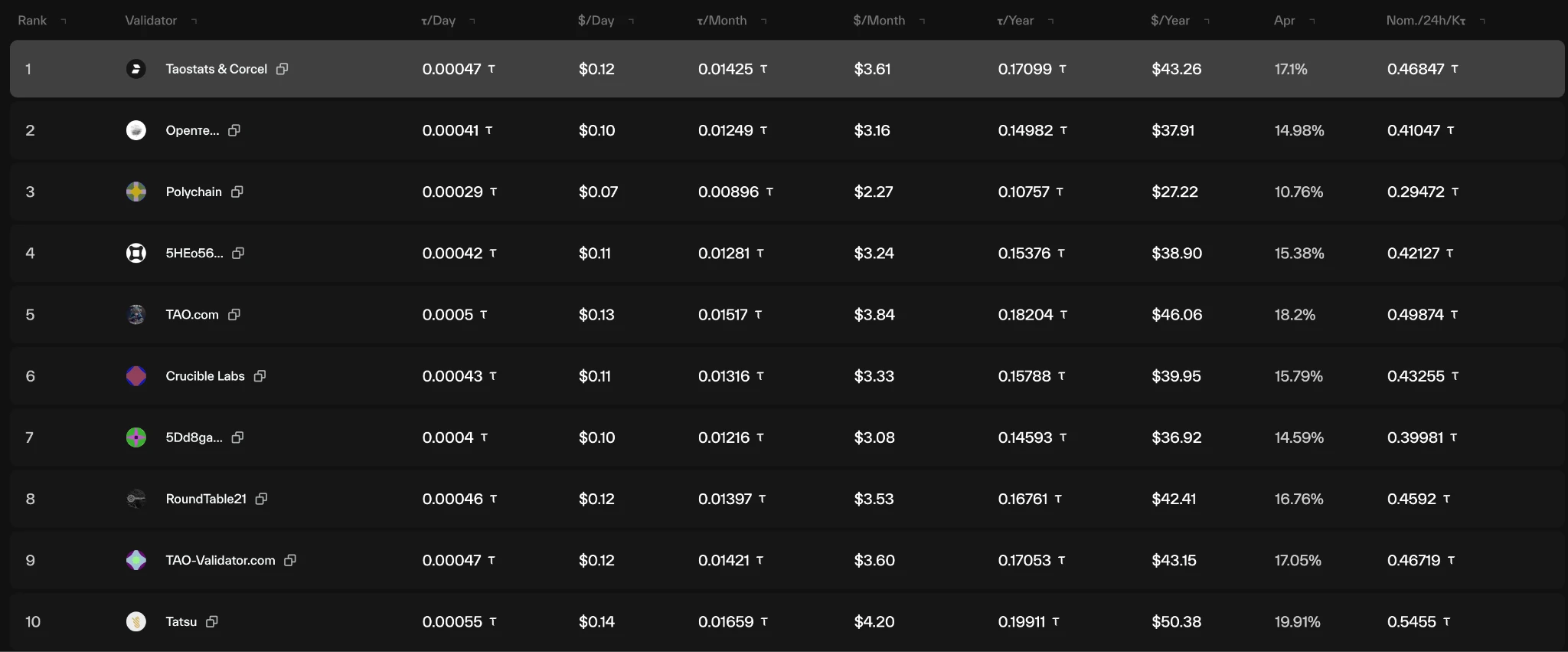

Staking Validators, source: Taostates

There are currently 6,143,675 TAO tokens staked (72.3% of all tokens in circulation), with the average annualized return on staked mining being between 15% and 17%. In comparison, Solana’s APR is 7.5%, NEAR’s is 9.2%, and Ethereum’s is 2.9%.

The token economics of TAO is completely consistent with BTC. The value of the entire network is the value of TAO. The token economics of TAO is completely used for the distribution of network validators and the incentives of subnets. At the same time, it takes hundreds of years to fully release, and the entire network maintains a stable and slow release rhythm.

4.2 Token Usage

● Governance and voting

● Registration fees (miners, validators, subnets)

● Recovery mechanism: TAO has a unique recovery mechanism. The TAO network is a universal incentive network. The token recovery mechanism is to put the rewarded TAO back into the reward pool. The TAO recovered in the network mainly comes from two places: the registration fees of new miners and validators and the closure of registered subnets.

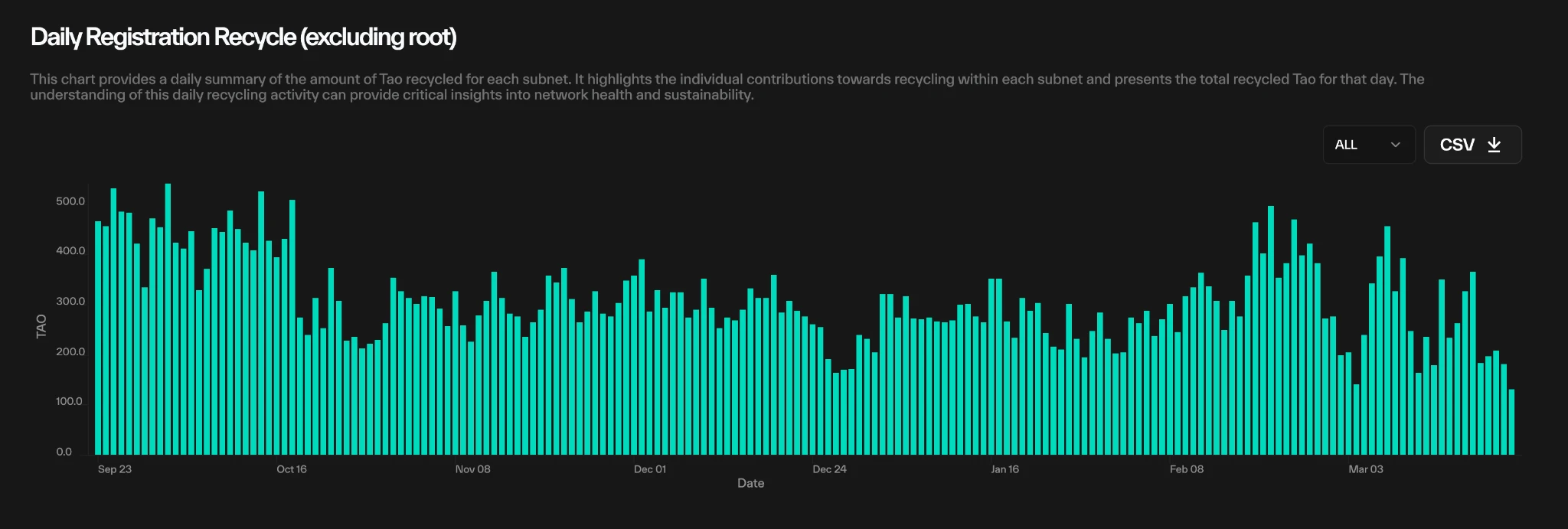

Registration Recycle, source: Taostates

The above picture shows the daily recycling situation. This recycling chart can partially reflect the degree of concern for ecology. The average daily recycled TAO is between 150-300.

4.3 Coin holding address

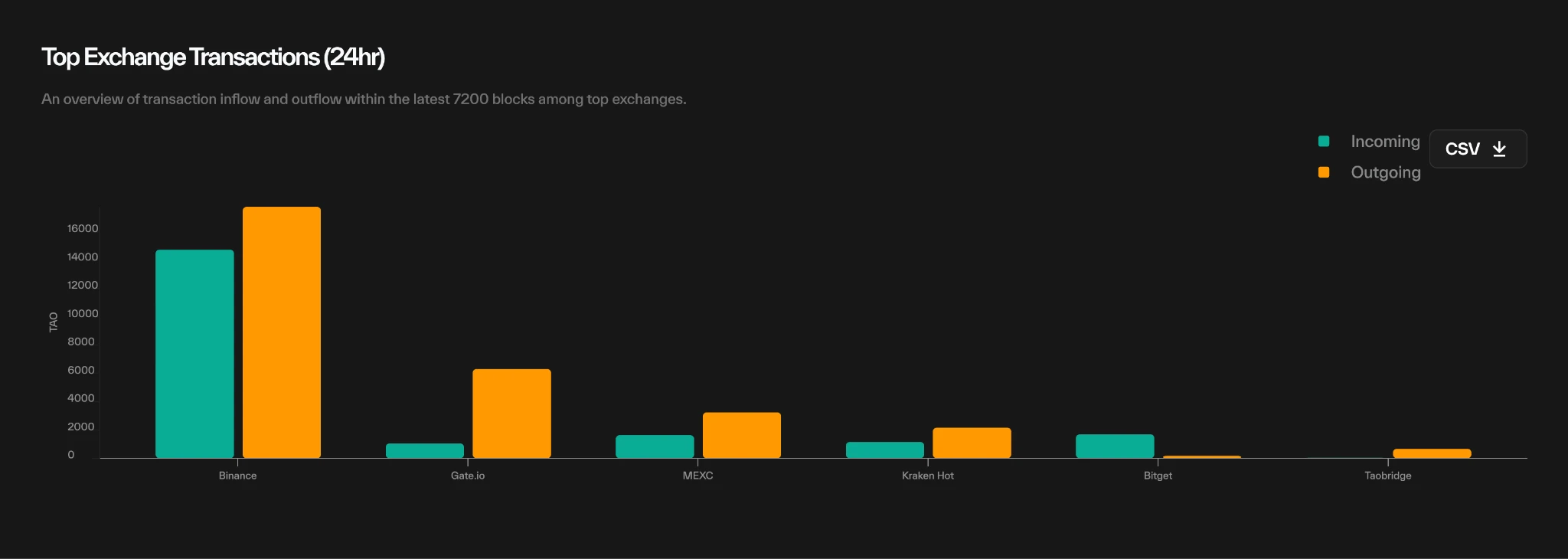

Exchange Transactions, source: Taostates

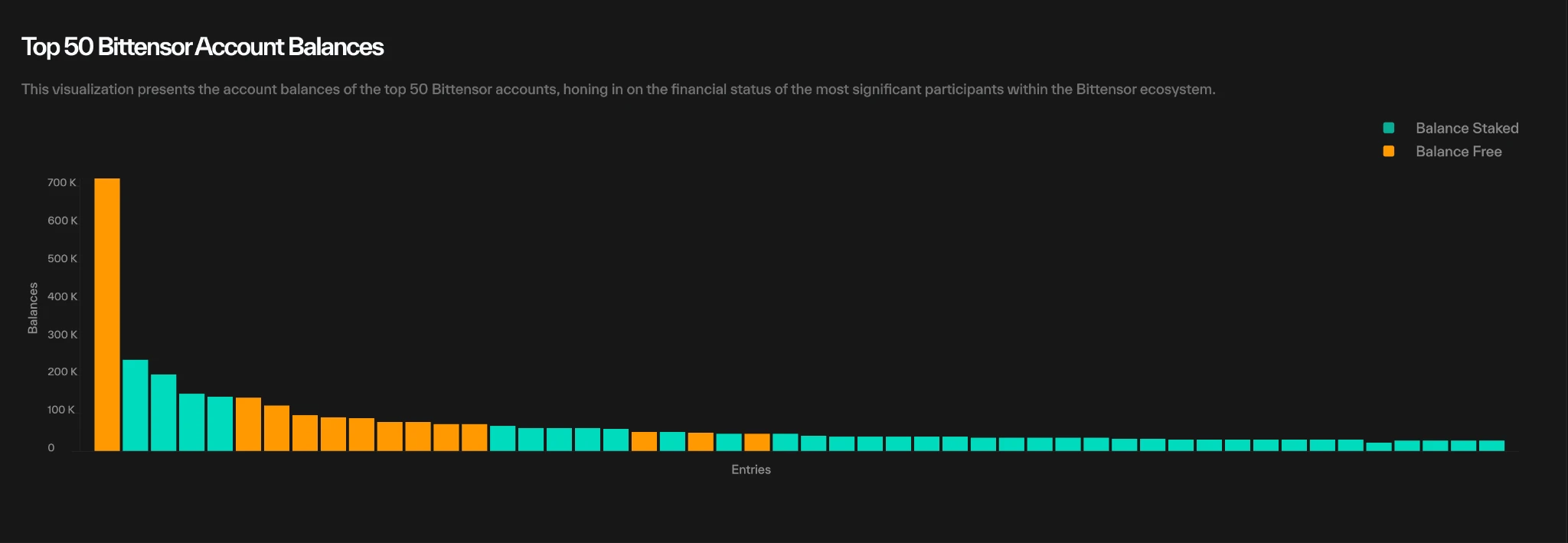

Top 50 Balance, source: Taostates

The top 50 addresses hold about 30% of the circulating chips. Among exchanges, Binance has the largest trading volume, far exceeding the total trading volume of other exchanges. MEXC has the most single verifiable addresses holding coins.

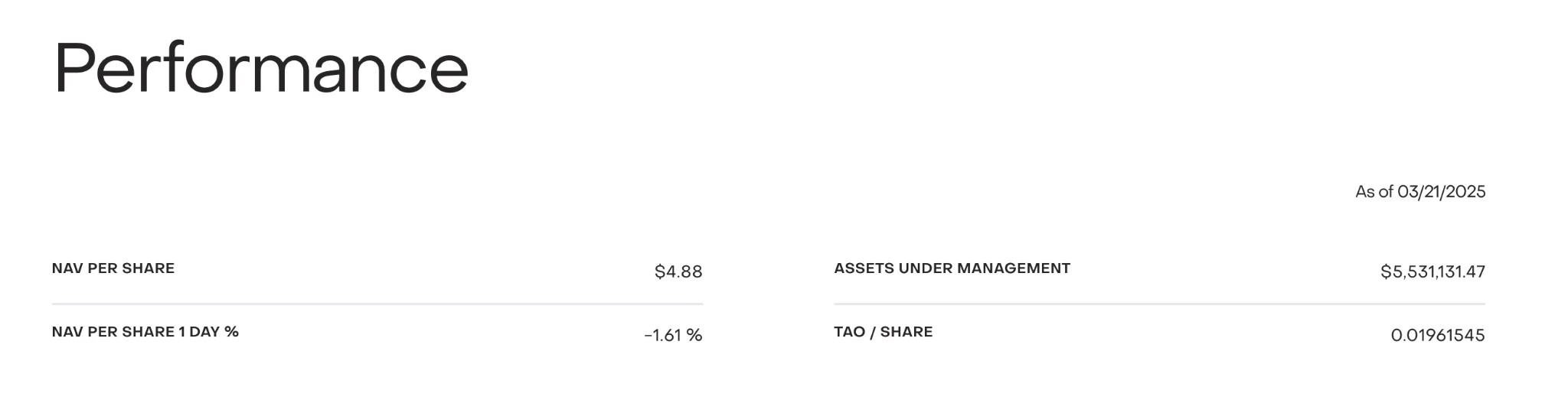

TAO Trust, source: Grayscale

On the ETF side, Grayscale holds $5.5 million worth of TAO.

5 Market and Competition

Bittensor uses a release mechanism similar to BTC, with no reservations at all. In terms of business, game theory is used to build a multi-task decentralized solution with competitive nature, including a series of application scenarios such as the GPU market, scientific research, data distributed storage and indexing, AI distributed training and reasoning, etc. Allora, Sentient (mainly providing model inference), and Sahara AI (mainly providing crowdsourced data) are regarded as its competitors, but Sentient and Sahara AI are more like competitors of subnets, while Allora is regarded as the most similar main competitor at the architectural level.

5.1 Market and upstream and downstream overview

When discussing the market and demand for Bittensor, we believe that its business model is similar to crowdsourcing. There are similar examples in the Web2 world, such as Scale AI. Its business model is to hire low-cost workers in Southeast Asia to label Internet data and distribute it to companies with data needs to train their own large models in specific fields. The companys current valuation has exceeded US$14 billion. The benefits of the crowdsourcing model compared to centralized operations are low cost and high flexibility, while centralized operations are more stable and standardized. The disadvantage of decentralization itself is efficiency, which is definitely not comparable to centralization. Therefore, most of the resources contributed by Bittensors subnets are idle resources, but these resources are not worthless. In fact, many idle resources have not yet fully utilized their potential value. At the same time, in order to cope with projects with large resource requirements and short business cycles, some companies will choose to outsource some tasks to third parties to achieve efficient resource utilization and reasonable cost control.

5.2 Track Project Introduction

Allora:

Allora is a self-improving AI network built by the community. Participants contribute to the network, and validators use context-aware reasoning techniques to evaluate the contributions of network participants. In the context of Allora, network participants include workers (who provide specific resources, miners in Bittensor), creditors (who evaluate the quality of work, Bittensors abandoned Root network validators), validators (who are responsible for instantiating most of the infrastructure of the Allora network through the Cosmos architecture), and consumers (developers who demand crowdsourced resources from the network).

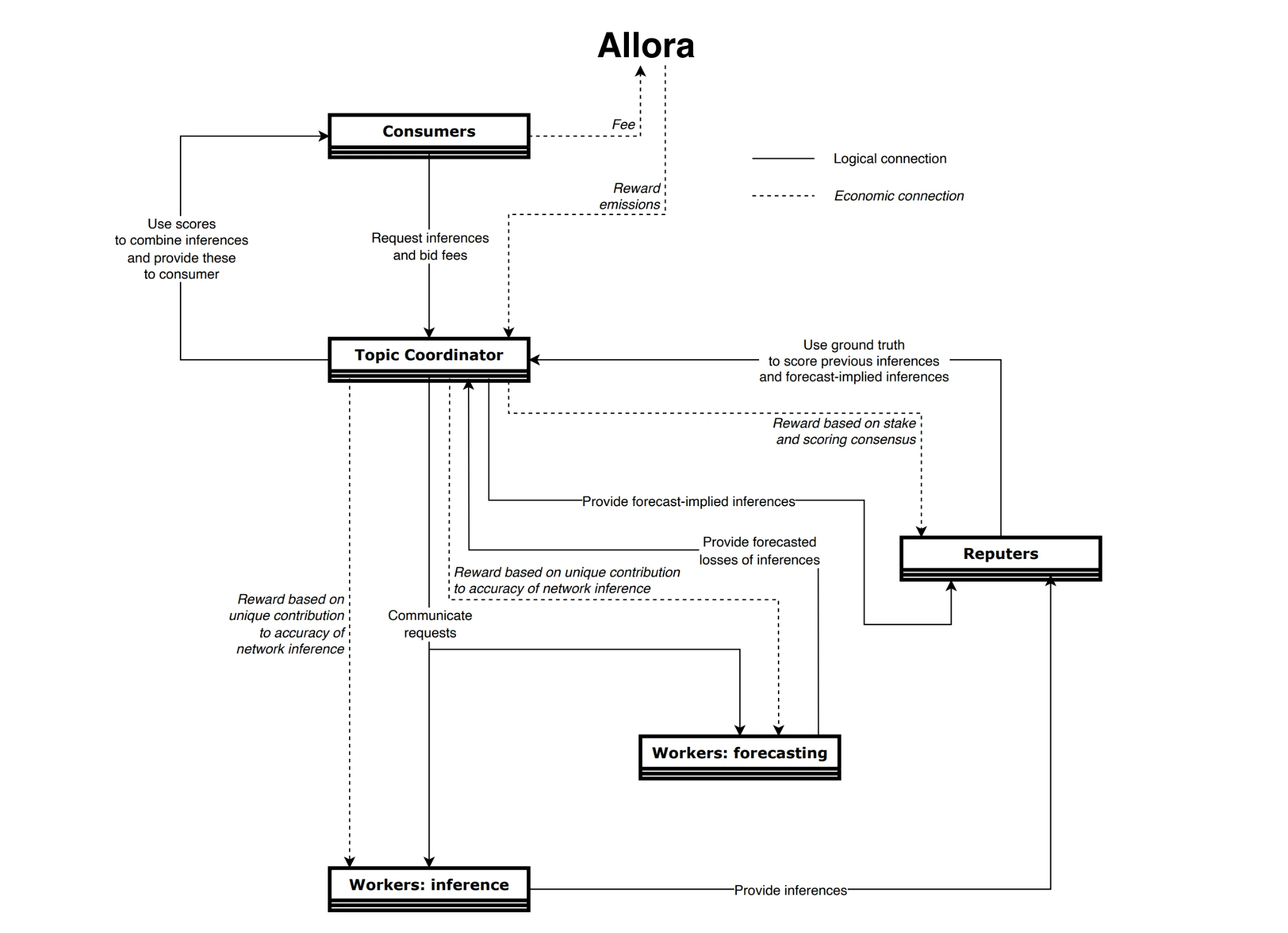

Allora Structure, source: Allora

In Alloras architecture, there are three main components that process Consumer requests. Workers: Inference is responsible for generating user requests, Workers: forecasting is responsible for evaluating possible inference losses, and then Reputers combine the results of the two Workers and give them to TopCoordinator. Top Coordinator is responsible for interacting directly with Consumer.

The key point here is that Workers: Forecasting is a global component that can obtain the results of Inference Workers. For example, in the scenario of predicting the price performance of a token, the Forecasting Worker knows based on the final result and the inference of the current Inference Worker that Worker A performs well in this scenario, and Worker B may be more suitable for predicting the weather. This is the Context-aware technology emphasized by Allora in the white paper. The core of Context-aware technology is the existence of Forecasting Worker, which will evaluate the performance of Inference Worker in different scenarios.

5.3 Comparison of Competitive Product Elements

Allora and Bittensor do roughly the same thing, both use game theory to find the best worker. But the main difference is:

Miner Quality Assessment Method

Bittensor adopts the token economics approach to measure the amount of subsidies through autonomous price discovery (subnet token price). The main goal of the project is to increase the subnet token price so that additional issuance rewards for subnet tokens can be obtained.

Alloras evaluation method uses the currently very popular Shapely method - if there is no worker, how much worse the network prediction will be to evaluate the contribution of the worker. After the event occurs, the Reputers will give a fair loss, which can be used by the next Forecasting Worker and can also be used to evaluate the fairness of the Forecast Worker. Assuming that there is one less worker, according to a certain formula, the greater the loss becomes, the greater the contribution and the greater the reward.

There is a ratio here, maybe one Worker contributes 10% and another contributes 20%. They share a reward pool based on the ratio. Forecasting Workers, Reputers, and Validators also share this reward pool based on their contributions in the network. The reward pool comes from each block issuance.

Ecosystem openness

The openness of Bittensors ecosystem is significantly higher than Alloras. In the Bittensor ecosystem, subnet developers have a high degree of autonomy and are free to provide any services they want to provide, while also needing to find target customers on their own. In contrast, in the Allora ecosystem, the role of miners is clearly defined as providing large model services, which may focus on the financial field or excel in predictive analysis. In addition, Alloras ecological docking is usually arranged by its collective. So Allora is more like a large model cluster that can adjust itself while providing real-time data, similar to Dubai Island. Bittensor is more like a cross-sea bridge built between multiple islands, each with its own currency and major industry.

Community and capital support

Allora has a clear advantage in community building and capital support. Bittensor did not seek external financing, while Allora received nearly $33 million in financing, led by Framework Ventures*, CoinFund*, Blockchain Capital*, Polychain and Archetype. Bittensor does not have any community or forum except Discord, while Allora TG, X, Discord, Forum, etc. are relatively complete. In general, Bittensors philosophy is more influenced by BTC and is more inclined to be led by the community.

Token Economics

Bittensors subnets are able to issue their own tokens, but Alloras miners can only provide models and use the same Allora token. Bittensor tokens are fair launch, but Allora has a large team and VC reserve. Both adopt Bitcoins release model and halve every four years.

In general, Bittensors architecture is more unique, bringing more open ecological possibilities. However, Alloras ecological cooperation will be faster than Bittensor. Bittensor requires independent developers to develop, which limits the scale of the ecosystem. Strictly speaking, there are still no similar competitors to Bittensor on the market. Bittensors subnet operates as an independent project and has a mechanism for issuing tokens independently, which further highlights the uniqueness and autonomy of its ecosystem.

6 Risks

1. Lack of infrastructure, insufficient marketing and community support, resulting in high opacity.

2. The ecosystem is highly repetitive and lacks external independent development teams. A Lab may build up to five or six subnet projects. This makes it impossible for the Lab to focus on a certain project, causing it to lose to external independent similar projects in competition.

3. TAO’s mechanism design is complex and involves many details. The learning cost for retail investors is high, and the knowledge reserve requirements for project parties are also high.

Reference Documentation

Bittensor (TAO): A comprehensive presentation of a protocol combining AI and blockchain: https://oakresearch.io/en/reports/protocols/bittensor-tao-presentation-protocol-combining-ai-blockchain

Bittensor Docs: https://docs.bittensor.com/

THUBA Research Report | Bittensor: When will the music stop: https://foresightnews.pro/article/detail/67830

Demystify Bittensor: Hows the Decentralized AI Network?: https://www.trendx.tech/news/comprehensive-analysis-of-the-decentralized-ai-network-bittensor-1215435

《Reflexivity Research》: https://x.com/reflexivityres/status/1843319486138474552

Disclaimer:

This content does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decision. Please note that Gate.io and/or Gate Ventures may restrict or prohibit all or part of the Services from restricted regions. Please read their applicable user agreements for more information.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web 3.0 era. Gate Ventures works with global industry leaders to empower teams and startups with innovative thinking and capabilities to redefine social and financial interaction models.

Official website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures