4 Alpha Core Views

1. Market Performance Review

U.S. stocks plummeted : the SP fell 10% in two days, VIX broke through 40, U.S. stocks entered a technical bear market, and the market was extremely panicked.

Safe-haven assets diverged : U.S. Treasury yields plummeted, gold fell after rising, and the U.S. dollar index weakened.

Commodity market collapse : Crude oil, copper and other commodities fell sharply, reflecting the pessimistic outlook for global demand.

Bitcoin exhibits a dual attribute : it initially rose with the US dollar credit crisis, and then fell due to the panic of global risk assets, showing the complexity of risk aversion + liquidity sensitivity.

2. Analysis of Trump’s Tariffs

More severe than expected: traditional allies set a minimum threshold of around 10%, Asian countries imposed tariffs as high as 25-54%, and the European Union was also subject to a 20% increase.

Political logic is stronger than economic logic: building legitimacy, increasing fiscal revenue, and paving the way for policies such as tax cuts; strengthening bargaining chips in foreign negotiations, and increasing pressure for the return of manufacturing.

The tariff strategy is rough but leaves room for negotiation , as countries such as South Korea and Japan have taken the initiative to negotiate tariff cuts.

China-Europe countermeasures are the biggest risk variable , especially since China has already introduced countermeasures, which may drag the situation into a long-term game.

3. Analysis of non-agricultural employment data

Appearing robust, but structurally weak: the official unemployment rate is 2%, but the U6 is as high as 7.9%, and has risen for two consecutive months.

Job growth was revised down as part-time jobs fell. Average hourly earnings growth slowed and the labor force participation rate remained low.

There is artificial distortion in the statistical caliber and the quality of employment has declined.

4. Liquidity and interest rate analysis

The SOFR forward interest rate has declined significantly, indicating that the market expects the Federal Reserve to cut interest rates ahead of schedule.

The 2-year and 10-year U.S. Treasury yields dived simultaneously, indicating that the market has fully shifted to a “pricing recession” mode.

Powells speech was cautious. He acknowledged the risk of stagflation but still did not express any easing stance, and the policy fell into a wait-and-see period.

5. Outlook and suggestions for next week

Risk factors:

There is a high degree of uncertainty regarding the escalation of tariff countermeasures , especially whether China and the EU will retaliate further;

The delayed response + data window of economic data intensifies the game between policies and markets;

The market lacks a priceable policy path and its structural fragility is extremely high.

Market pricing logic has changed:

From inflationary pressure to high inflation + high tariffs → suppressed demand → early recession;

The fluctuations of U.S. Treasury bond yields and risky assets jointly confirm pessimistic expectations + seeking a policy bottom.

suggestion:

Maintain a neutral stance and be cautious in dealing with drastic market fluctuations;

Bitcoin has the potential to be a long-term “US dollar liquidity proxy” and will benefit again if the Fed starts easing;

Control leverage in the short term and wait for policy easing and market bottom signal confirmation

What will be the impact of the implementation of reciprocal tariffs?

1. Macroeconomic Review of This Week

1. Market Overview

This week, Trumps reciprocal tariffs were implemented, but they far exceeded market expectations, and global risk assets plummeted.

US stocks: The SP 500 index fell 10% in two days, the biggest drop since March 2020; the Dow fell 7.6% for the week, and the Nasdaq fell into a bear market (down 22% from its December high). The semiconductor ETF (SOXX) plunged 16% in a single week, the worst performance since 2001. The VIX index soared to more than 40, showing the extreme of short-term panic in the market.

Safe-haven assets: The 10-year Treasury yield plummeted 32 basis points to 3.93%, the lowest since September 2022; spot gold surged to $3,023 an ounce before falling back, down 1.7% for the week; the U.S. dollar index fell 1.1% for the week.

Commodities: Brent crude oil plunged 10.4% to $61.8 per barrel, as OPEC+ production increases resonated with demand concerns. Copper prices plunged 13.9%, the biggest weekly drop since July 2022; iron ore fell 3.1%.

Cryptocurrency: Bitcoin briefly diverged from the U.S. stock market this week. After the reciprocal tariffs, the U.S. stock market plummeted, but Bitcoin rose instead. However, after China introduced countermeasures, it fell again, but the overall decline was better than that of the United States. This reflects the dual contradiction between Bitcoins safe-haven and risk attributes.

Under the impact of tariffs, Bitcoin has vividly demonstrated its interweaving of safe-haven and risk attributes. When the reciprocal tariffs were implemented, Trumps tariff increase caused credit concerns about the global legal currency system, and Bitcoins alternative currency attribute as digital gold was activated. However, after Chinas 34% counter-tariff was introduced, it triggered panic about the disruption of the global supply chain, the VIX index broke through 45, and all risky assets were sold indiscriminately. Bitcoins performance in this crisis reveals its essence as a complex of contradictions in the digital age: it is subject to the liquidity shackles of traditional risky assets, and it also carries a revolutionary vision to subvert the legal currency system.

2. Economic data analysis

This weeks data analysis focuses mainly on Trumps tariffs and non-farm data.

2.1 Analysis of Trump’s Tariffs

Although the market had long anticipated Trumps reciprocal tariffs, the scale and scope of the tariff increases introduced by Trump on April 2 far exceeded market expectations.

In terms of content, Trump’s reciprocal tariffs are mainly divided into two parts:

The United States has set a minimum base tariff of about 10% for its traditional trading partners, such as the Five Eyes Alliance (the United Kingdom, Australia, and New Zealand). It is worth noting that the tariff rates of these countries on the United States are also about 10%. This part of the tariff is generally in line with market expectations.

Higher tariffs were imposed on trading partners in certain countries and regions, mainly in Asia. China added 34% (plus the 20% already imposed, a total of 54%), Indonesia 32%, Vietnam 46%, Thailand 36%, South Korea 25%, and Japan 24%. In addition, the European Union added 20%

Figure 1: U.S. equivalent tariffs Source: The White House

In fact, reciprocal tariffs is not an exact economic concept. In Trumps political narrative, it is the core means of balancing trade deficits and an important tool for negotiations. Further analyzing its political purpose, logically, Trumps tariffs have two major effects:

Constructing legitimacy and gaining congressional support: On the one hand, Trump has covered high tariffs with the cloak of fairness and won public support from Midwestern manufacturing states; on the other hand, tariff revenue will indeed increase U.S. fiscal revenue, which will be very beneficial to his subsequent tax cuts and deregulation measures, especially in gaining congressional support.

Laying out bargaining chips for foreign negotiations to accelerate the return of manufacturing: creating uncertainty in advance to lower the optimistic expectations of Chinese and European exporters on the export prospects in 2025; exerting extreme pressure to force global manufacturing leaders to accelerate localized manufacturing in North America.

On a deeper level, its essence is that Trump creates a controllable crisis to reconstruct the order of interest distribution at home and abroad and transform short-term economic costs into long-term political capital.

Judging from the specific actions of Trumps tariffs, this tariff has another feature: it is simple and crude, but also leaves room for negotiation. The tariff rates imposed on specific countries/regions are mainly calculated based on the trade deficit; in addition, in terms of implementation time, other countries are given a certain amount of time. For example, South Korea, Japan, Vietnam, etc. have taken the initiative to speed up negotiations with the United States and actively reduce tariffs in order to obtain an equal reduction in tariffs.

The only thing that needs special attention is the countermeasures from China and the European Union. Since China took reciprocal countermeasures and took a firm stance last Friday, it is expected that the game cycle between China and the United States will be significantly extended.

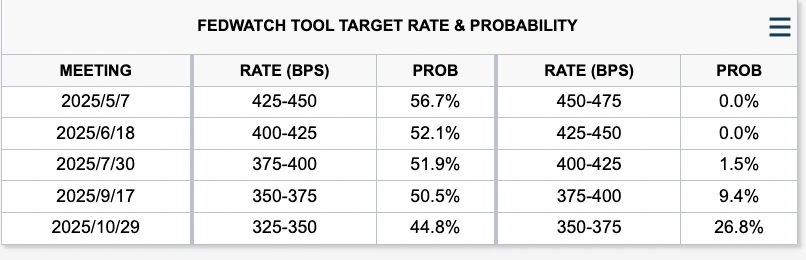

After the introduction of tariffs, risk assets fell sharply, and risk markets began to price in future recession risks. The number of interest rate cuts for the whole year has now reached 4.

Figure 2: Interest rate market expectations for full-year rate cuts Source: White House

2.2 Non-agricultural data

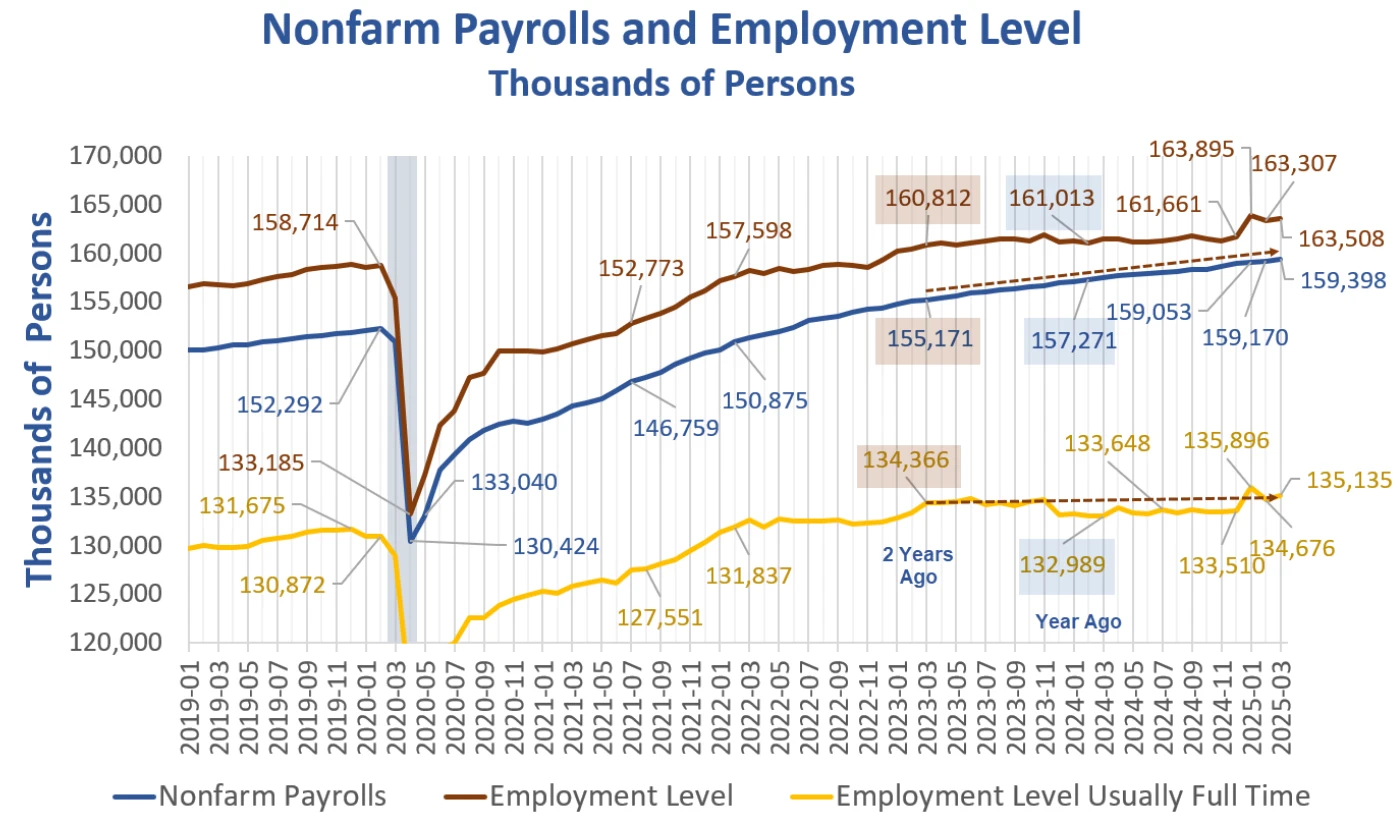

As we have previously judged, although the total amount of non-agricultural employment is relatively stable, further analysis shows that this is not the case. Most macroeconomic research is currently under the illusion that the job market is still strong, so the decline in inflation will continue naturally. However, we have noticed that the quality of employment is deviating from the surface strength of the data .

Figure 3: US non-farm payrolls data for March Source: MishTalk

The key structural data are as follows:

1) The official unemployment rate is 4.2%; the U6 rate is even higher at 7.9%.

2) The change in total nonfarm payrolls for January was revised down by 14,000; the change in February was revised down by 34,000; after these revisions, the total number of jobs in January and February was 48,000 less than previously reported.

3) The unemployment rate rose for the second consecutive month. As government layoffs increase, the unemployment rate is expected to rise further.

4) The average hourly wage increase for all non-agricultural workers was 8%. The average hourly wage increase for production and non-management workers was 3.9%, and the overall growth rate continued to slow down.

5) The labor force participation rate is still low at 5%; part-time employment decreased by 44,000, and full-time employment rebounded by 459,000 (partially correcting the 1.22 million plunge last month).

It is important to note that the U.S. Department of Labor uses statistics to calculate employment as long as you work one hour. If you do not have a job and are not looking for a job, you are not considered unemployed, but have withdrawn from the labor market; looking for job vacancies in job advertisements does not count as looking for a job and you need to participate in an actual interview or send a resume to be included in the employed population. In fact, these distortions artificially reduce the unemployment rate, artificially increase full-time employment, and artificially increase the monthly wage employment report.

Although the data shows that the U.S. labor market is basically sound, the structure is not optimistic. The overall cooling expected by the market has not yet arrived, but signs of deterioration are accumulating.

3. Liquidity and interest rates

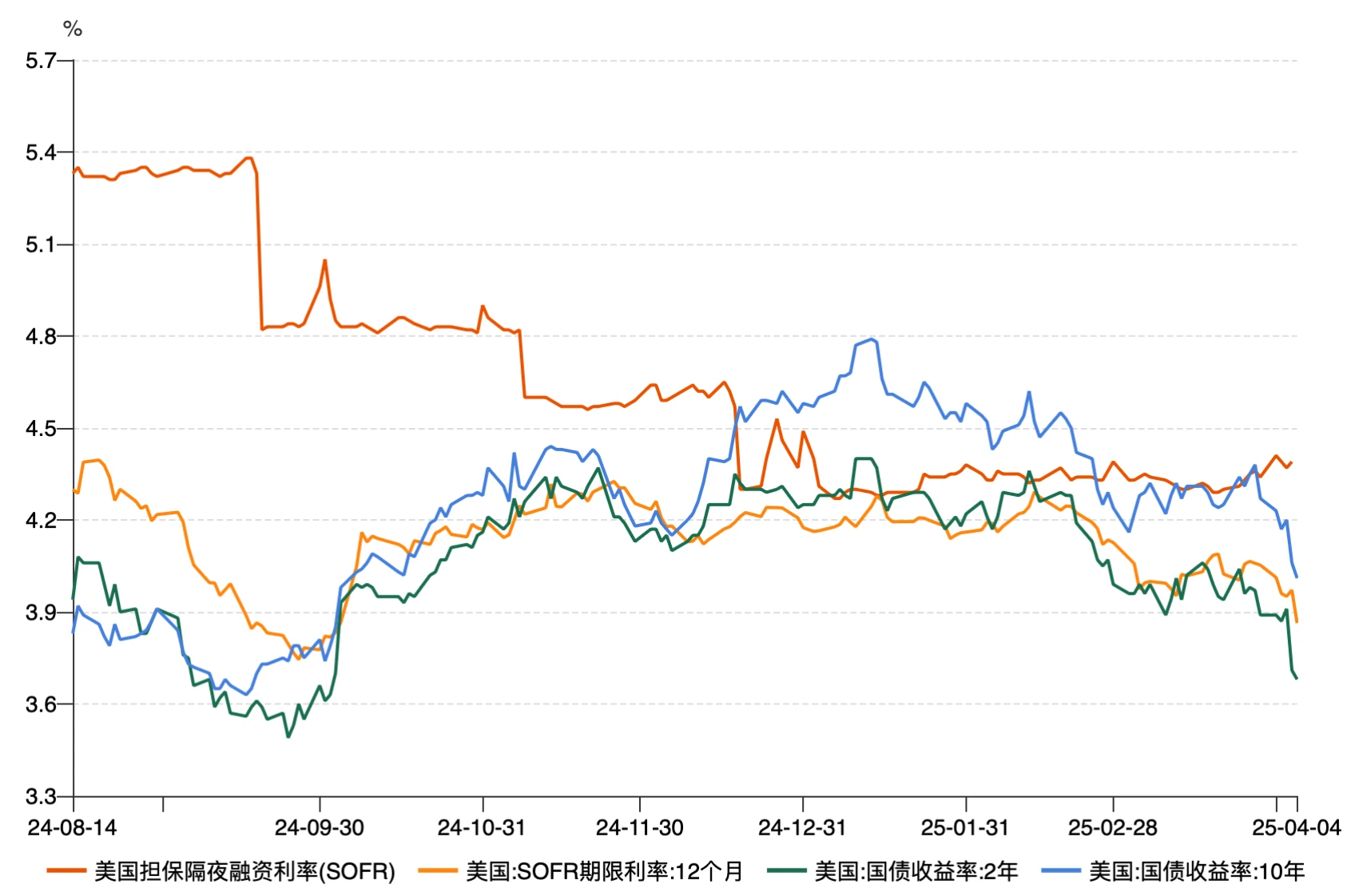

In terms of the Feds balance sheet, the Feds broad liquidity continued to remain at around 6.1 trillion this week. From the perspective of the interest rate and Treasury markets, we found that market expectations have undergone drastic adjustments since March.

Figure 4: Changes in U.S. overnight financing rates and Treasury yields Source: Wind

As shown in the figure above:

1) SOFR 12-month term interest rate (light orange line): This is the markets expectation of the Feds interest rate level in the next year. The data is obviously downward, and the deviation from the current SOFR interest rate is greater, from about 4.3% to below 4.0%, indicating that the market is re-pricing: the Fed is more likely to cut interest rates in advance or maintain looseness for a longer period of time.

2) The 2-year Treasury yield (green); the 10-year Treasury yield (blue) have both fallen rapidly and have now fallen below 4.0%, with the 10-year yield approaching 3.8%. This shows that the market has reached a consensus on the short-term policy path turning to easing (reflected in 2 Y); and expectations for long-term economic growth and inflation have also been significantly lowered (reflected in 10 Y). The market as a whole has entered the pricing recession stage, believing that interest rates are no longer the core risk, but that the economy itself is going to have problems.

Overall, Trump’s “reciprocal tariffs” speech has intensified the market’s pricing of stagflation risks, and the market’s main logic has shifted to: high inflation + increased tariffs → suppressing demand → early recession → the Fed may be forced to cut interest rates earlier.

In addition, Powells speech this week has attracted much attention from the market. However, judging from his speech, the Fed is deeply trapped in the policy dilemma of stagflation. Powells overall statement was cautious. On the one hand, he acknowledged the stagflation dilemma of rising unemployment and rising inflation risks, and stressed the need to wait for data clarity and not adjust the policy stance for the time being. Although the market is pricing in a 115 basis point rate cut by the Fed in 2024, and the probability of a rate cut in May has risen to 35.1%, Powell hinted that wait and see is still the main tone.

2. Macroeconomic Outlook for Next Week

For global assets, the current situation is a typical period of rising structural uncertainty: it is not the lack of market liquidity, but the lack of a priceable policy path. The risks facing the market mainly revolve around the following three points:

1) Tariff retaliation : It is unclear how the United States will respond to China’s countermeasures; in addition, it is still unclear whether the European Union, Asia and other economies will take retaliatory measures.

2) Economic data : The market is currently increasing its concerns about a recession. If tariff retaliation escalates, soft economic data may further suppress the markets risk appetite. However, at the same time, the lag in hard economic data cannot be responded to in a timely manner, making it more difficult for the Federal Reserve to make decisions, and market volatility may last longer.

Based on the conclusions of the interest rate market, risk market and economic data, we believe that the overall market is still in an extremely fragile form. In the vacuum period when data cannot be disproven, it is difficult for the market to have strong upward momentum. But at the same time, it should be noted that according to members of the Trump cabinet, the current tariffs are already the highest ceiling, and the subsequent easing of negotiations may gradually establish a policy bottom for the market.

Based on the above analysis, our overall view is:

The current trading benchmark is: high inflation plus tariff shocks trigger a repricing of global recession expectations.

The simultaneous decline in U.S. Treasury yields (especially the plunge in SOFR forward rates) has clearly reflected the opening of policy space + increased macro-pessimistic expectations; the sharp fluctuations in risky assets (U.S. stocks, raw materials) reveal that funds have an extreme lack of confidence in the priceable future; although alternative assets such as gold and Bitcoin have a safe-haven logic, they are still unable to strengthen independently due to liquidity constraints, reflecting that structural risks have not been cleared.

For cryptocurrencies, Bitcoins dual characteristics of safe haven vs. liquidity sensitivity were fully exposed in this tariff crisis; if the Federal Reserve is forced to quickly ease, BTC may once again be viewed by funds as a US dollar liquidity proxy asset; it is recommended to maintain a neutral stance, control leverage, and pay attention to sharp short-term market fluctuations.

The key macro data for next week are as follows:

Disclaimer

This document is for internal reference only and is based on 4 Alpha Groups independent research, analysis and interpretation of available data. The information contained in this document is not investment advice and does not constitute an offer or invitation to buy, sell or subscribe for any financial instrument, security or investment product to residents of the Hong Kong Special Administrative Region, the United States, Singapore or other countries or regions where such offers are prohibited. Readers should conduct their own due diligence and seek professional advice before contacting us or making any investment decision.

This content is protected by copyright and may not be reproduced, distributed or transmitted in any form or by any means without the prior written consent of 4 Alpha Group. While we endeavour to ensure the accuracy and reliability of the information provided, we do not guarantee its completeness or currency and accept no liability for any loss or damage arising from reliance on this document.

By accessing this document, you acknowledge and agree to the terms of this Disclaimer.

All information provided on this website is for reference only. This website does not guarantee the accuracy, validity, timeliness and completeness of the information. Any behavior that relies on the information provided on this website is at the users own risk.