Original author: 0x Sketon , DeFi researcher

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

Editors note: After experiencing Black Monday and CNBCs blunder, the market has cooled down again. BTC remains at around $80,000, most altcoins have been halved compared to a year ago, and the secondary market is wailing. Friends who are betting on dogs may still encounter one or two golden dogs.

In general, the development of tariffs and Trumps big mouth characteristics have led to the current market being completely driven by news, and the difficulty of making money by speculating in cryptocurrencies has risen again. DeFi researcher 0x Sketon wrote about 11 DeFi protocols worth participating in on Solana to earn income recently, among which lending and stablecoin deposits are more common. Odaily Planet Daily compiled them as follows.

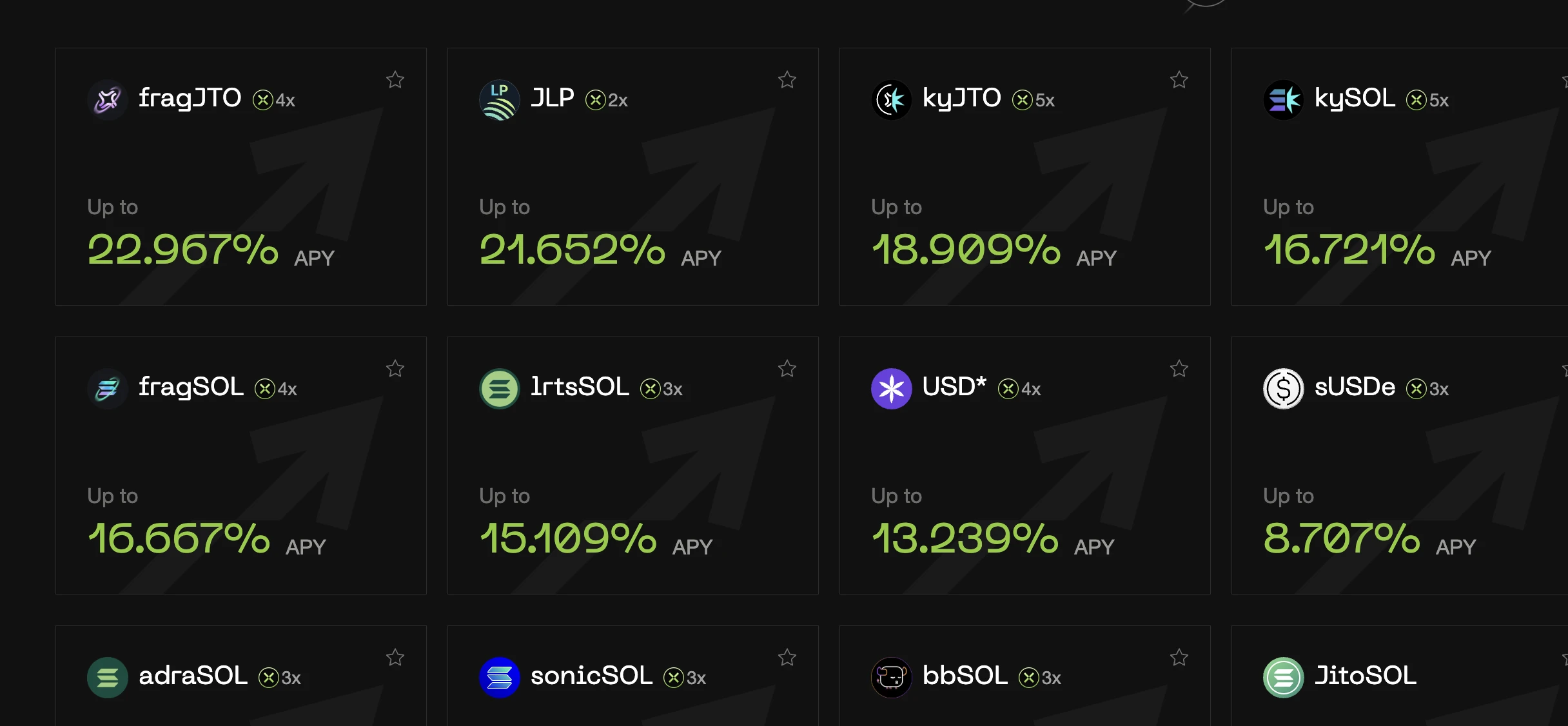

This article will introduce the top 11 DeFi strategies for earning passive income on Solana, looking for annualized returns of 15% to 50% through lending, Vault, and Farming. The following is a list of selected protocols for earning stable returns:

Lend USDC, offering 13.94% APY;

Provide SOL (Solayer) to participate in liquidity re-staking, with an APY of 9.7%.

2. NX Finance

Deposit SOL into the GMS lending pool (APR 16.68%) and “earn yield + double points” through a partnership with Fragmetric.

3. Vaultka

JLP mining (15% -20%), V1 version lending SOL (APY 16.65%), USDC (10.27%), USDT (12.65%);

In addition, you can also borrow JLP and SOL for leveraged mining (to maintain the health of lending), and the partners are: Jupiter, Solayer, and Jito.

4. RateX (also known as Little Pendle)

Choose a high APY pool to deposit your staking tokens and earn Fragmetric + native points.

5. DeFituna

Borrow tokens into the protocol pool. Currently, the pools with higher APY include SOL, Fartcoin, and USDS.

6. Pluto

Deposit money to borrow USDC, SOL, and PYUSD, and earn higher APY through its JLP and INF recurring compounding.

7. Exponent

A Pendle-style DeFi protocol on Solana that redeems corresponding tokens through Jupiter and deposits them into a matching pool. The protocol also has Farm and deposit rewards into liquidity vaults (including Points reward bonuses for staking token protocols: Fragmetric, Fyros).

8. Sandglass

Lending aggregator, choose JLP pool deposit, APY is 5 – 20%.

Delta neutral strategy, choose a vault to deposit USDC and earn 6-25% stablecoin APY.

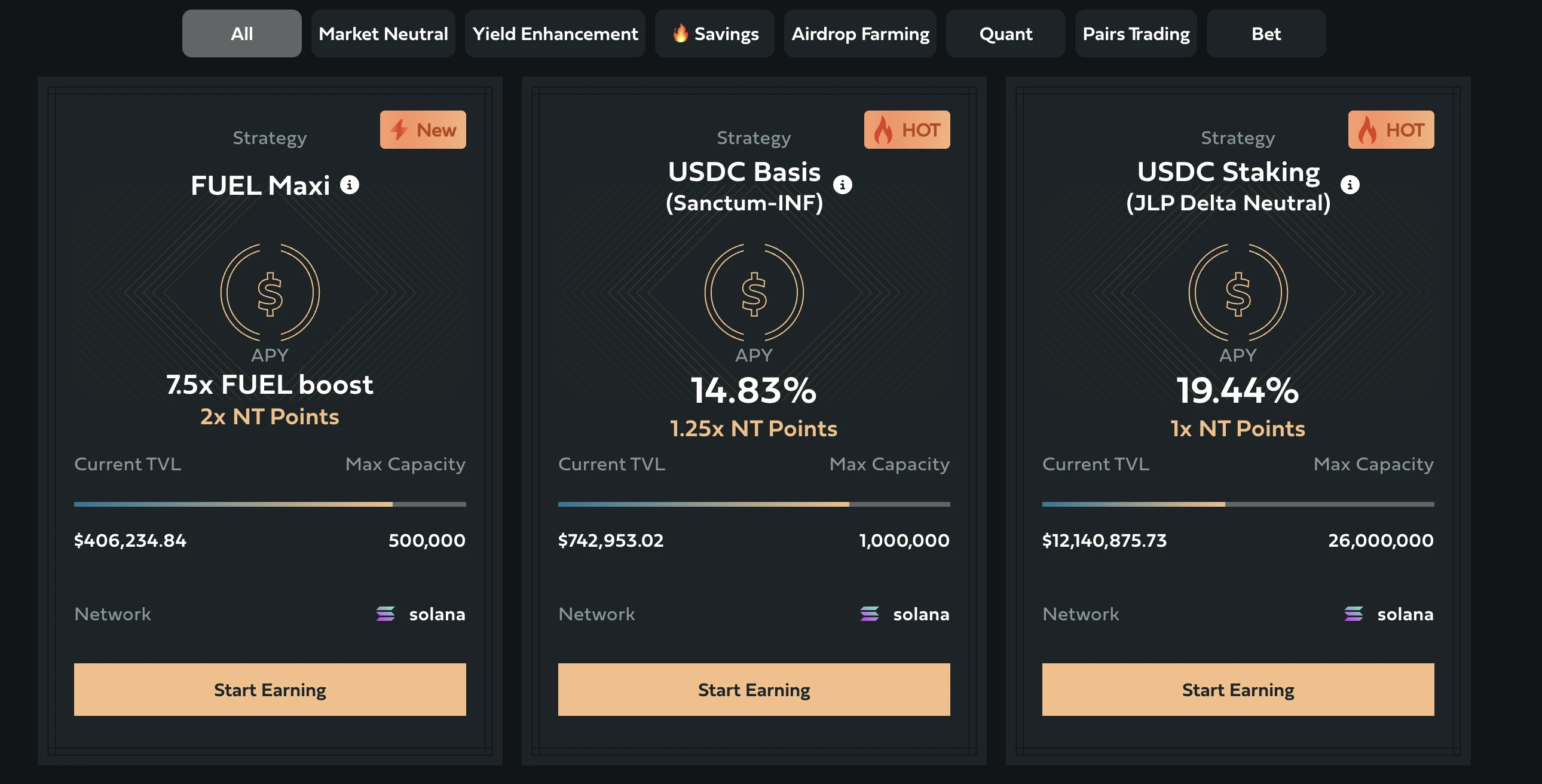

10. Neutral Trade

Led by a former Goldman Sachs team;

Choose a yield strategy and deposit funds to earn 1-2x NT points (airdrop).

11. synatra

Synthetic re-staking protocol to convert SOL into ySOL and earn 31 – 38% APY.

The above is the APY agreement for lending and deposits shared today. I suggest focusing on the following projects:

Neutral Trade: Created by quantitative analysts, traders and experienced Web3 developers from Goldman Sachs, Barclays and the worlds three largest hedge funds, it is also one of the winning projects of the Solana Radar hackathon.

RateX: The seed round of financing was participated by GSR, Animoca Ventures and others, funded by the Solana Foundation. It is also the first prize winner of the Solana 2024 Renaissance Hackathon MCM, with a clear mechanism;

Exponent: In 2024, it announced the completion of a $2.1 million financing led by RockawayX. Depositing and staking tokens can earn bonus points for multiple projects.

DeFituna: Founder Dhirk previously stated that the V2 version is being built and an independent product is also being developed. The token TGE news will be announced at that time, but DeFitunas token is first a revenue sharing token, and governance functions will be added in the future. Dhirk also previously revealed the M 3 M 3 platforms $200 million market manipulation plan involving tokens such as LIBRA and MELANIA (then called Moty);

NX Finance: It has reached cooperation with multiple DeFi protocols on Solana. Although the TVL is not high, its points system has airdrop expectations.

Finally, most of the projects, including those recommended for attention, are early-stage projects and involve certain risks. Please participate with caution, DYOR!

If necessary, several key projects will be selected for detailed introduction in the future.