Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

On April 7, Strategy, which has always been regarded as the most determined BTC diamond hand, submitted an 8-K form to the US SEC, which mentioned: Since the enterprise software business has not achieved positive cash flow, if the market value of Bitcoin drops sharply, the company may be forced to sell Bitcoin at a price below cost to fulfill its obligations, and the risk of default will increase. It may even be forced to enter bankruptcy or liquidation procedures. The company emphasizes that its future financing capabilities are highly dependent on the market value of its Bitcoin assets and changes in market sentiment. As soon as the news came out, the market was in an uproar, and many people wondered whether this move meant that Strategy couldnt hold on or was forced to sell BTC to maintain company operations.

Based on the current situation, Odaily Planet Daily believes that this move is just a risk disclosure statement that listed companies usually make. However, during this sensitive period, any disturbance may lead to a further deterioration of market sentiment. We will sort out and analyze this turmoil in this article.

Strategy Current Status Analysis: Floating losses in the first quarter of 2025 are nearly $6 billion

On March 31, Strategy Chairman Michael Syalor wrote that the company bought 22,048 BTC again for approximately $1.92 billion between March 24 and March 30, with an average purchase price of $86,969/BTC, and has achieved a return of 11.0% so far in 2025. As of March 31, 2025, Strategy holds 528,185 BTC, purchased at a price of approximately $35.63 billion, with an average purchase price of $67,458/BTC.

No one expected that just a few days later, as the Trump administration launched a tariff trade blitzkrieg, market sentiment took a sharp turn for the worse and the value of Strategys BTC asset holdings plummeted rapidly.

As of March 31, Strategys annual return remained above 10%

On April 7, as a listed company, Strategy submitted a current report, Form 8-K , to the U.S. SEC to ensure information transparency and timely disclosure of important changes or events of the company to investors.

Later, according to media reports , MicroStrategy did not increase its holdings of BTC between March 31 and April 6, and its current holdings remain at 528,185. As new accounting standards require crypto assets to be valued at market value, the company expects to record an unrealized loss of $5.91 billion in the first quarter due to its BTC holdings, and a net loss of approximately $4.22 billion after tax deductions. In addition, the company raised a total of $7.69 billion in the first quarter, of which $4.4 billion came from the issuance of common stock and the rest from preferred stock, almost all of which was used to buy BTC at a level higher than the current price.

Despite this, Strategys stock price has remained above 65% in the past year, and is currently trading at $237.95, compared to the price of around $144 on April 9, 2024.

Source: Google Finance

Taken together, Strategy’s “fundamentals” as a listed company – continuing to buy BTC to boost its stock price – have not changed significantly. The focus of the market is fundamentally on the 8-K form’s statement that “we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable”.

In fact, this is not the first time that Strategy has disclosed the word “Sell Bitcoin”.

Understanding Form 8-K and Form 10-K: Required Disclosure Documents for Public Companies

It is worth mentioning that the 8-K form submitted by Strategy to the US SEC is only one of the various reports that listed companies submit to regulatory agencies. In contrast, there is also a 10-K form. The main difference between the two lies in the purpose, content and submission timing:

Form 8-K (also known as Current Report, focusing on timeliness):

Purpose: To inform shareholders and public investors in a timely manner when major events or company changes occur.

Content: Covers important events that may affect investor decisions, such as: signing or termination of important contracts; bankruptcy or receivership proceedings; acquisition or sale of significant assets; changes in senior management or board membership; significant changes in financial condition.

When to file: Companies generally must file Form 8-K within four business days of the event.

Form 10-K (also known as the Annual Report, which emphasizes completeness):

Purpose: To provide an overall picture of the companys financial performance and operations for each fiscal year.

Content: Includes, but is not limited to, company history and organizational structure; financial statements and notes; management discussion and analysis; risk factors; corporate governance and executive compensation.

When to file: Typically between 60 and 90 days after the end of the fiscal year, depending on company size and classification.

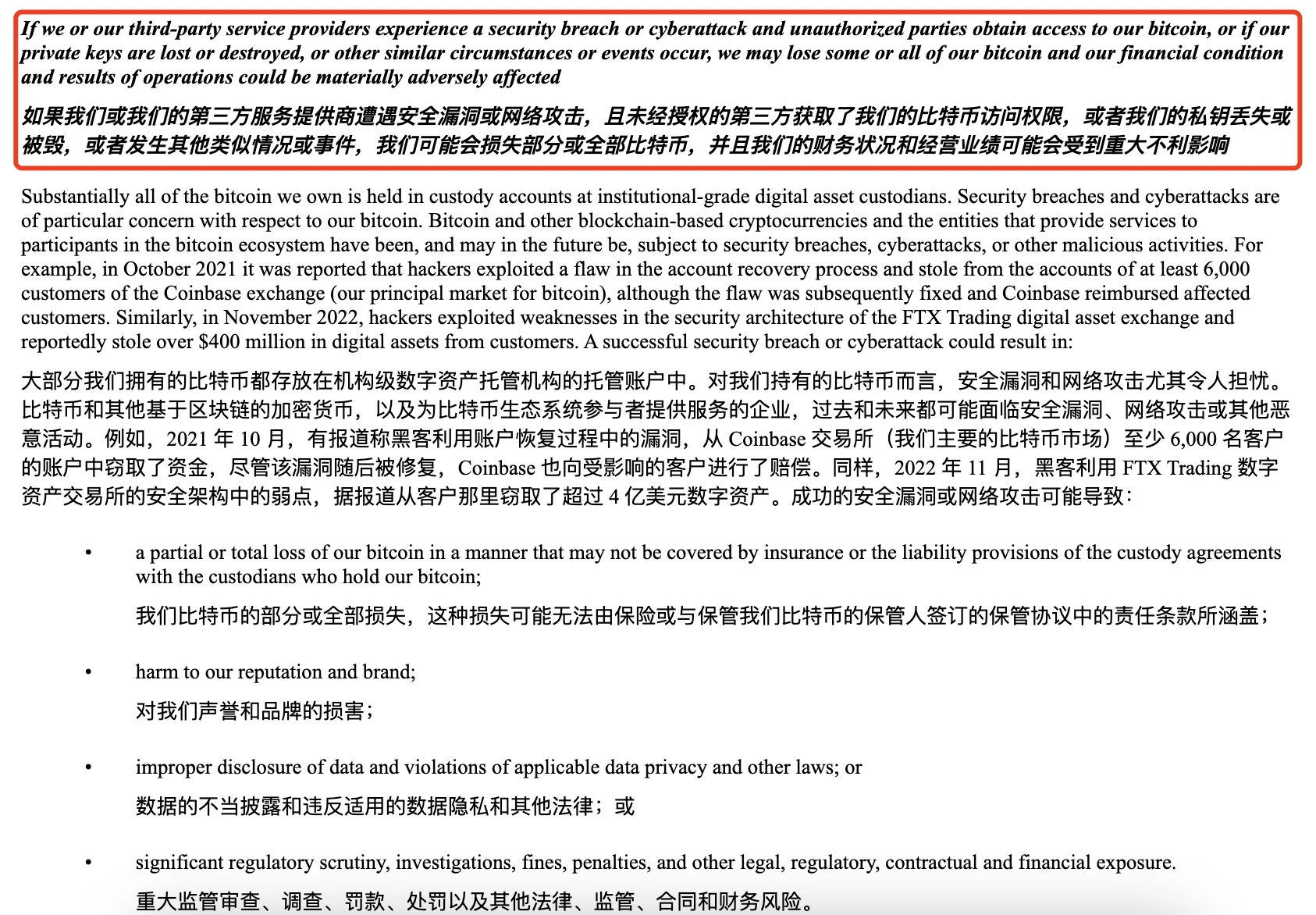

Specifically, in the 10-K form previously released by Strategy, the words “Sell Bitcoin” appeared five times, which also mentioned the potential purpose of the sale:

Form 10-K mentions potential sale of BTC and risk disclosure

Form 8-K mentions potential sale of BTC and risk disclosure

In this Form 8-K disclosure, the words “Sell Bitcoin” only appeared twice, and the wording was not much different from the required risk disclosure in the previous Form 10-K.

From this, we can conclude that the disclosure of Form 8-K is still a necessary process for Strategy as a listed company, with the following main purposes:

First, to ensure information transparency and help investors make timely investment decisions;

The second is regulatory compliance to avoid legal issues or regulatory penalties caused by insufficient information disclosure.

Others Fud: Strategy conducts BTC splitting, suspected selling?

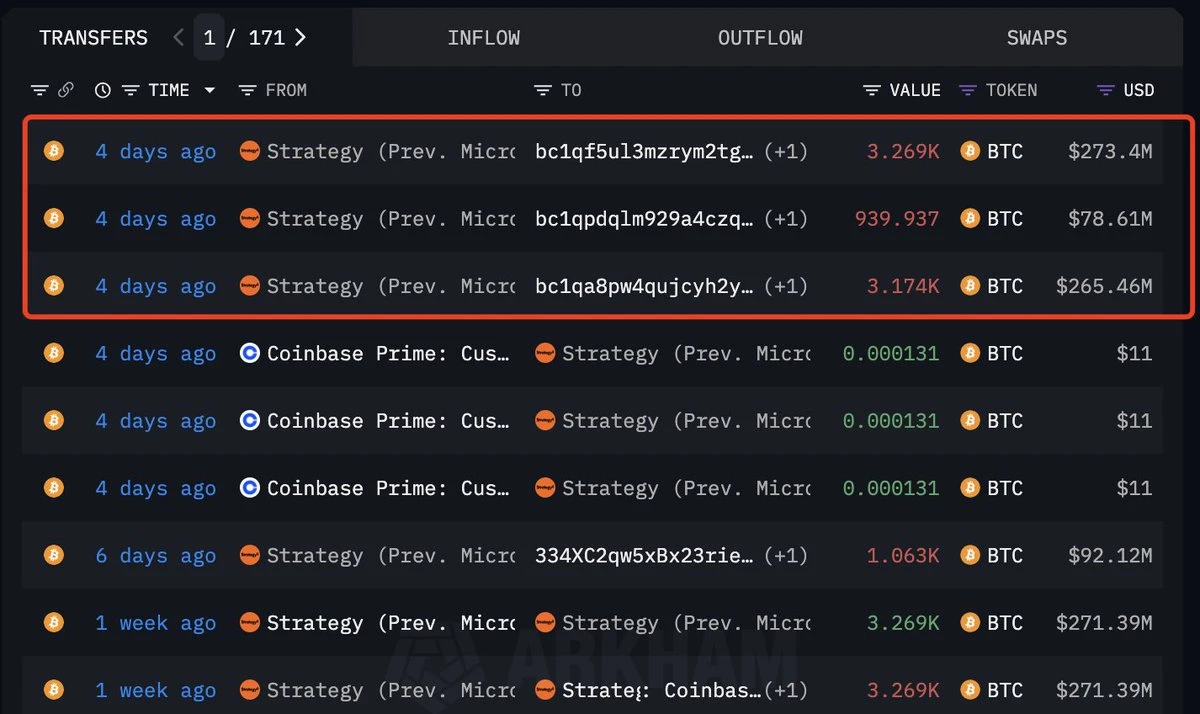

In addition to the information about possible sale of BTC mentioned in the 8-K form, some people in the market have observed that information from the on-chain data tracking platform Arkham shows that Strategy had conducted a split position operation 4 days ago. Many people also interpreted this as a sign that Strategy is suspected of dumping BTC.

On-chain data information

In fact, this is not the first time that Strategy has split its positions. On March 30 , Strategy transferred 7,383.25 BTC worth $612.92 million to three new addresses. Similarly, Strategy also made necessary position risk warnings in the 8-K form, and splitting positions is normal for cryptocurrency holding addresses.

Form 8-K Risk Warning

To sum up, this “Strategy may sell BTC” is nothing more than a panic interpretation during the market decline.

For current investors, what they should pay more attention to is whether there are other large changes in the Strategy chain address or subsequent official statements by Michael Saylor himself.

Also attached is the address of 322,000 BTC holdings on the Strategy chain:

https://intel.arkm.com/explorer/entity/microstrategy

Michael Saylors X platform account: