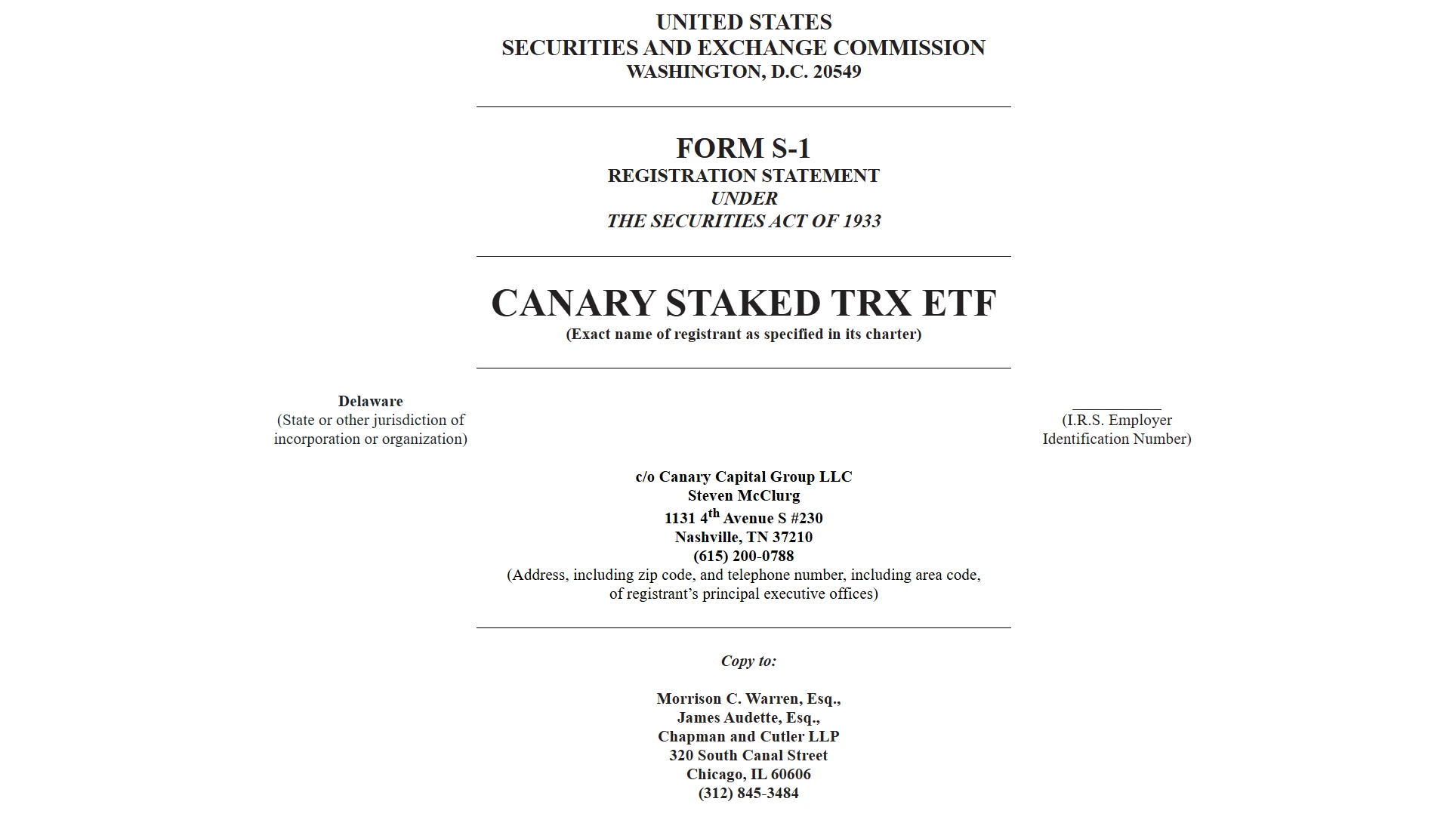

Recently, Canary Capital Group officially submitted an S-1 document to the U.S. Securities and Exchange Commission (SEC) to apply for the launch of the Canary Staked TRX ETF, marking an important step for TRONs native token TRX to integrate into the global mainstream financial market. This move not only highlights TRONs leading position in blockchain technology and financial innovation, but also sets a new benchmark for the compliance and global development of high-quality crypto assets.

Compliance: Building the cornerstone of digital asset trust

Canary Staked TRX ETF aims to provide traditional investors with a convenient and secure TRX investment channel, while combining the staking mechanism of the TRON blockchain to create additional returns for investors.

According to SEC filings, the ETF will directly hold TRX tokens, and its net asset value (NAV) will reference the TRX price benchmark provided by CoinDesk Indices to ensure pricing transparency and market consistency. Asset custody is handled by BitGo, the industrys leading crypto asset custodian. In addition, the subscription and redemption of the ETF will be carried out in cash through authorized participants, greatly reducing the technical barriers for traditional investors to enter the crypto market.

It is worth mentioning that the ETF innovatively incorporates the TRX staking function. Through third-party staking services, part of the TRX assets will be used in the delegated proof of stake (DPoS) consensus mechanism of the TRON network. This design not only enhances the attractiveness of the ETF, but also fully demonstrates the technical advantages of the TRON blockchain in the field of decentralized finance (DeFi).

The application of the Canary Staked TRX ETF comes at a time when the US crypto regulatory environment is undergoing profound changes. Since the beginning of 2025, the SEC has accepted dozens of crypto ETF applications, covering mainstream tokens such as Solana (SOL), XRP, Litecoin (LTC), etc., indicating the arrival of the Altcoin ETF Season. The uniqueness of the TRX ETF lies in the innovative design of its staking function, which not only provides investors with the opportunity to enhance their returns, but also provides an example for other crypto ETFs on how to balance returns and compliance.

At the same time, the approval result of TRX ETF will have a profound impact on the globalization process of TRON and the entire blockchain industry. If approved, this ETF will become the first crypto ETF in the United States to include a staking function, paving the way for the staking function of other PoS blockchain ETFs.

The application of TRONs native token TRX for a US ETF is an important milestone in the compliance and globalization of the blockchain industry. The Canary Staked TRX ETF demonstrates TRONs determination and ability to integrate into the mainstream financial market through innovative staking design, strict custody and pricing mechanisms, and a positive response to the regulatory environment.

TRX ETF The core issue of TRONs globalization strategy

Since its launch in 2017, TRON has grown into one of the worlds leading Layer 1 blockchains, attracting more than 300 million user accounts with its high throughput, low transaction fees, and strong DeFi and stablecoin ecosystem. The application for TRX ETF is not only another breakthrough for the TRON ecosystem, but also carries an important mission for its globalization strategy.

Currently, the TRON network has 68.6 billion USDT in circulation, ranking second in the world, and the total locked-in amount of its DeFi ecosystem has exceeded 20 billion US dollars. The launch of TRX ETF will further enhance the popularity and usage of the TRON network, attract more developers and institutions to participate in its decentralized Internet ecosystem, and consolidate its competitive advantage in the global blockchain industry.

For traditional investors, direct investment in crypto assets often faces obstacles such as wallet management and exchange risks. TRX ETF, through a standardized financial product form, allows global investors to invest in TRX through familiar securities accounts without having to directly access blockchain technology. This mechanism will significantly expand the audience of TRX and promote the popularity of the TRON ecosystem in the global market.

At the same time, as crypto asset ETFs gradually mature in the US market, such as the successful launch of Bitcoin and Ethereum ETFs, institutional investors are increasingly demanding diversified crypto assets. The launch of TRX ETF will provide hedge funds, pension funds and other institutions with a compliant channel to invest in the TRON ecosystem, helping TRX to become a mainstream investment portfolio.

As the global blockchain industry accelerates its development, the application of TRX ETF is not only an achievement of the TRON ecosystem, but also a microcosm of the integration of crypto assets and traditional finance. Through this compliance attempt, TRON has proven its technological strength and global vision to the world. In the future, as more institutions and investors join the TRON ecosystem, a more open and compliant decentralized financial era is coming.