key points

Institutional investors dont necessarily perform better than amateur investors.

Galaxy Digital (Galaxy Digital Capital) suffered huge crypto trading losses, losing up to 96% of WAX trades.

Galaxy Digital lost 88% of its investment in Panteras ICO (initial coin offering) fund.

Amateur investors often believe that institutional investors can manipulate the crypto market and make huge profits. They dont know that these big players may also be slaughtered in this market. While most report only to their limited partners, there is one publicly traded asset manager that lifts the veil on institutional investor performance.

Galaxy Digital was founded by billionaire former Goldman Sachs partner Michael Novogratz. In January 2018, Novogratz contributed his digital asset portfolio and related investments to Galaxy LP, which was valued at approximately $302 million at the time.

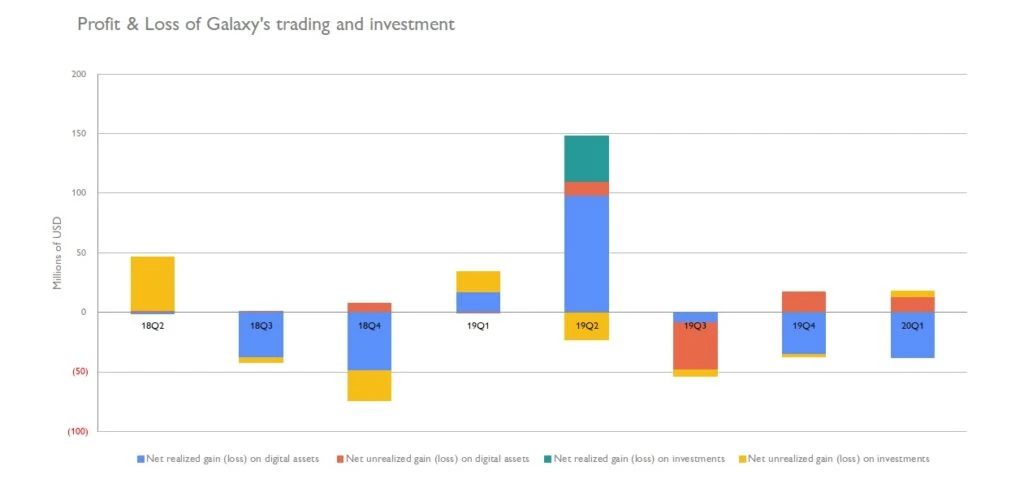

The companys business scope mainly includes four major areas: digital asset trading, asset management, entrusted investment and consulting. Judging from the companys reports, Galaxy Digital is not good at either trading or investing. Except for the second quarter of 2018, the first quarter of 2019, and the second quarter of 2019, Galaxy Digitals quarterly performance has always been in the red.

source:

source:Galaxy Digital, Bybit Insight

source:

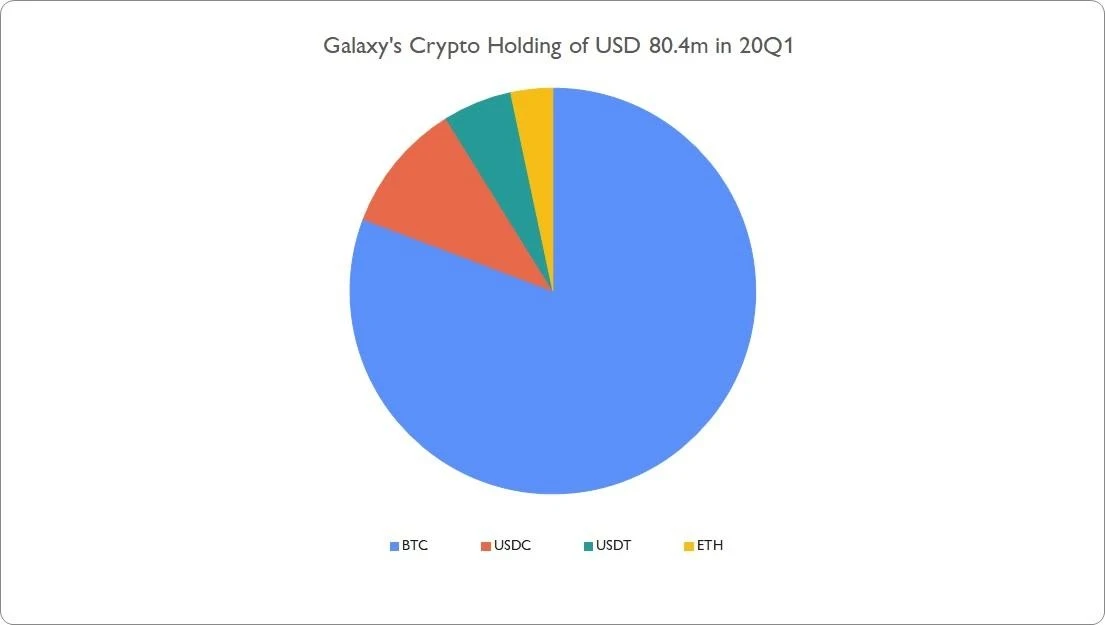

source:Galaxy Digital, Bybit Insight

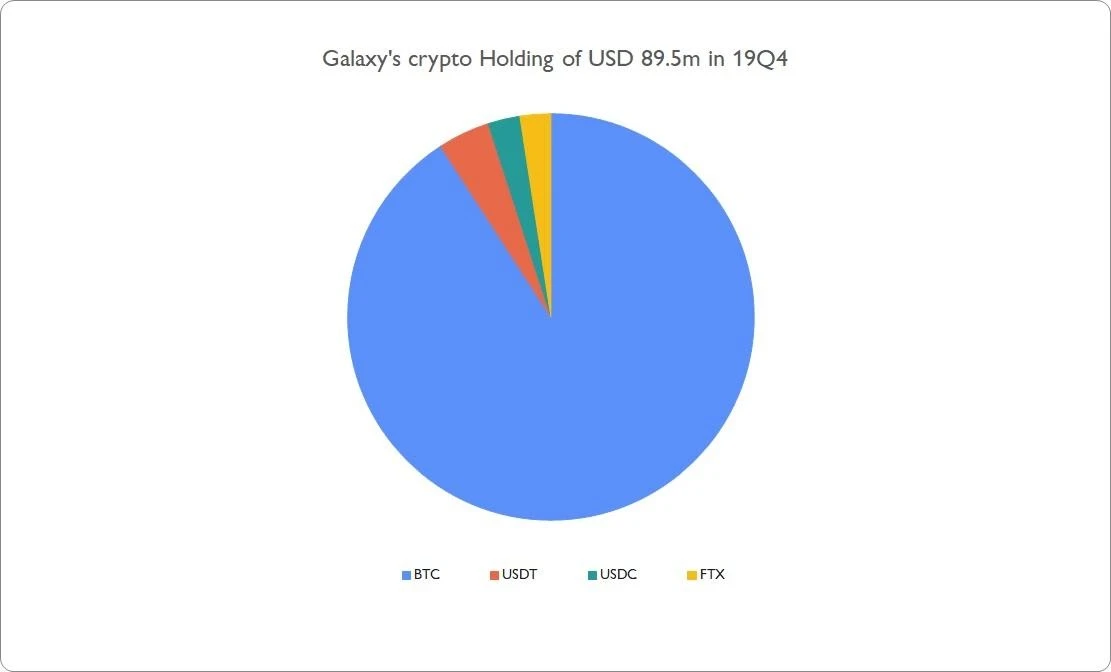

source:Galaxy Digital, Bybit Insight

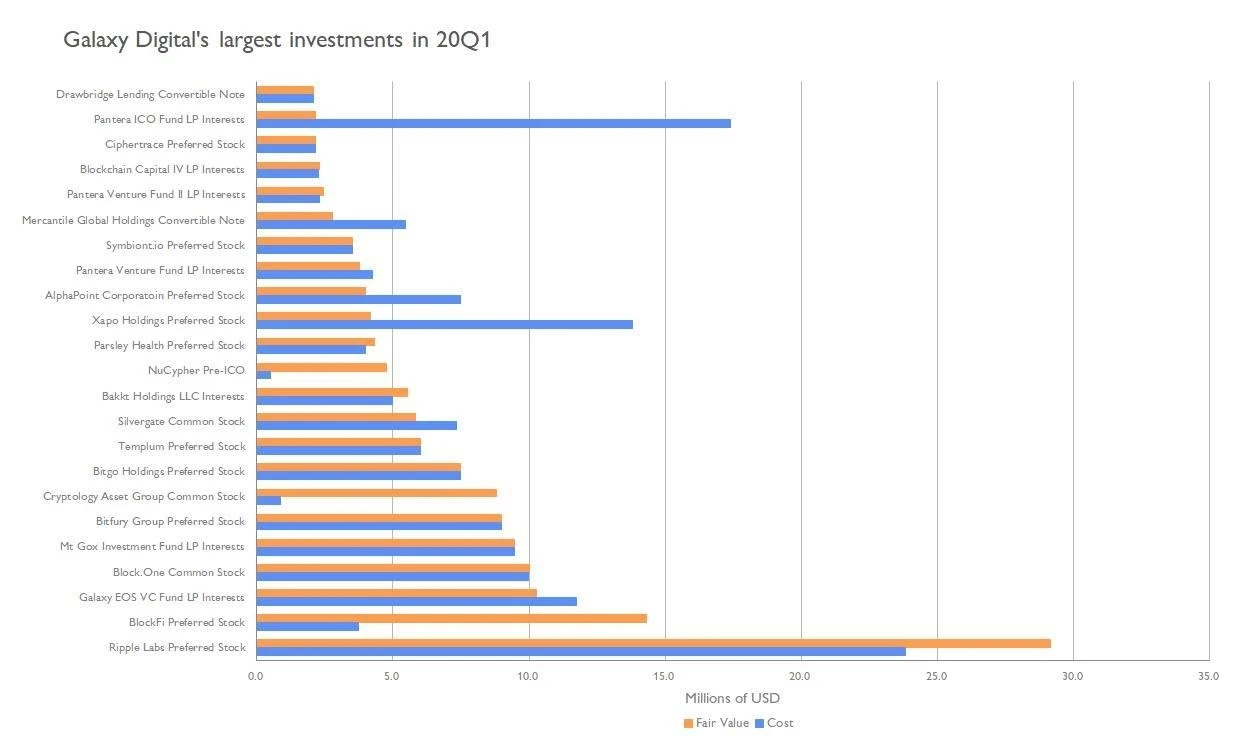

In the investment arena, Galaxys investment arm put $17.4 million into Panteras ICO (initial coin offering) fund and lost 88%, while it invested about $13.8 million in Xapo preferred stock, a 70% loss. Galaxy Digital invested $50 million in WAX in 2019 and ended up losing 96%.

source:

source:Galaxy Digital, Bybit Insight

If you compare the fair value of Galaxy Digitals fund investment, it is not difficult to see that in the first quarter of 2020, the Blockchain Capital Phase IV Fund fell by 18%, the Pantera Venture Fund Phase II fell by 10.7%, and the Pantera ICO (Initial Coin Offering) Fund down 6.2%. Pantera’s ICO fund, which was raised during the 2017 ICO bubble, lost 88% of its value by the end of Q1 2020.

The performance of Galaxy Digital and most of the institutional funds in which it invests has not matched the performance of amateur investors. On the bright side, the crypto market is not as prone to manipulation by large institutions as conspiracy theories suggest.