Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

For most traders today, making money is already extremely difficult.

On the one hand, in the Meme market, the craze for celebrity coins and presidential coins triggered by Trump has continuously drained the liquidity of the Meme market. The Argentine presidential coin LIBRA has become the last dance, and players have also lost confidence in Meme, which may take a long time to repair. On the other hand, traders continue to remain indifferent to the VC coin and altcoin markets, and shorting new coins has become the main profit strategy, but the methods of market makers seem to have changed. Recently, TEG new coins such as BERA, IP and KAITO have reversed after the tokens fell and washed out the airdrop profit, causing heavy losses to short traders.

Obviously, in such a market environment, blindly pursuing high returns in the Meme and altcoin markets is no longer advisable. Many people have refocused their attention on DeFi, the greatest application innovation of blockchain, and have begun to look for new ways of financial management that are both secure and profitable in various ecosystems.

Berachain, which uses a unique PoL (proof of liquidity) mechanism, is becoming a new gathering place for DeFi funds. According to DeFiLlama data , Berachain, which has been online for less than two weeks, has a TVL of 3.193 billion US dollars, surpassing Arbitrum to rank 7th, and is only 100 million US dollars away from Bases TVL.

The reason why DeFi funds choose Berachain is undoubtedly the lucrative returns. Moreover, BERA has risen by more than 47% in the past week. So how can retail investors use the Berachain DeFi ecosystem? What is the most capital-efficient DeFi strategy? Odaily Planet Daily will introduce how to play with Berachains DeFi ecosystem in this article.

LP+Infrared pledge (APR over 180%)

Group LP

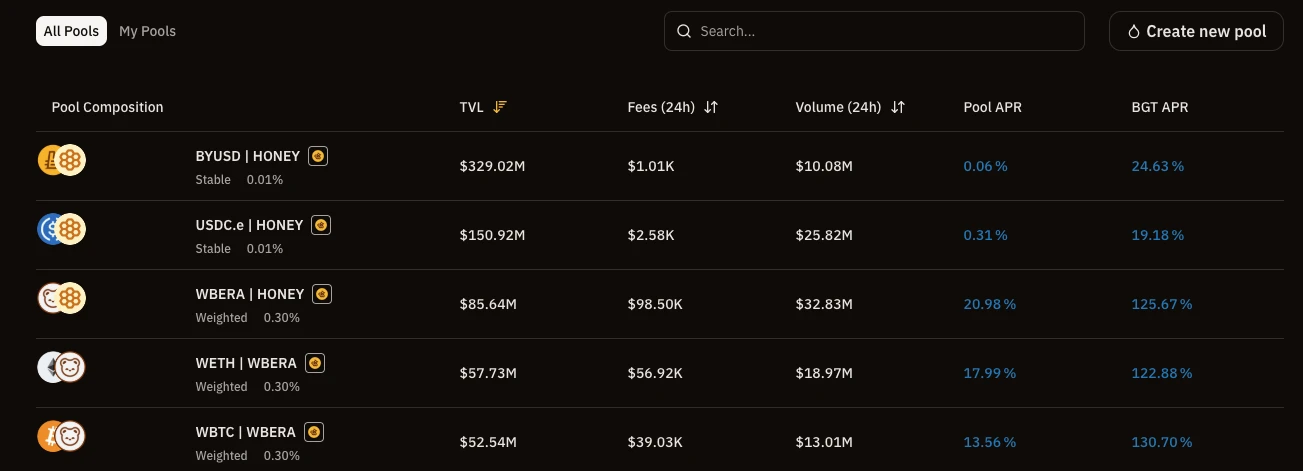

Currently, Berachain has 5 reward vaults. Staking the corresponding LP receipt tokens into the vault can earn Berachain governance tokens BGT (exchangeable with BERA 1: 1). Users can add bilateral liquidity to different pools in BeraHub . The pools that can be staked to earn BGT are shown in the figure below, namely BYUSD | HONEY, USDC.e | HONEY, WBERA | HONEY, WETH | WBERA and WBTC | WBERA.

If you follow the principle of maximizing returns, adding liquidity to the WBERA | HONEY pool and then staking the LP receipt tokens to the corresponding reward treasury can enjoy an APR of about 150%. For users who want to hold BGT to participate in Berachain network governance, this rate of return is attractive enough, but if you just want to make money, there are better strategies.

Infrared Staking

Infrared Finance is a liquidity proof protocol on Berachain that supports staking LP receipt tokens of Berachains official decentralized exchange (BEX) pool to earn iBGT. Although iBGT is a wrapped token of BGT, iBGT cannot be exchanged for BGT.

Infrared Finance completed a US$2.5 million seed round of financing on January 29, 2021, led by Synergis Capital, with participation from NGC Ventures, Shima Capital, dao 5, Signum Capital, Tribe Capital, Oak Grove Ventures, etc.; on June 24, 2024, YZi Labs also announced its participation, and the amount was not disclosed.

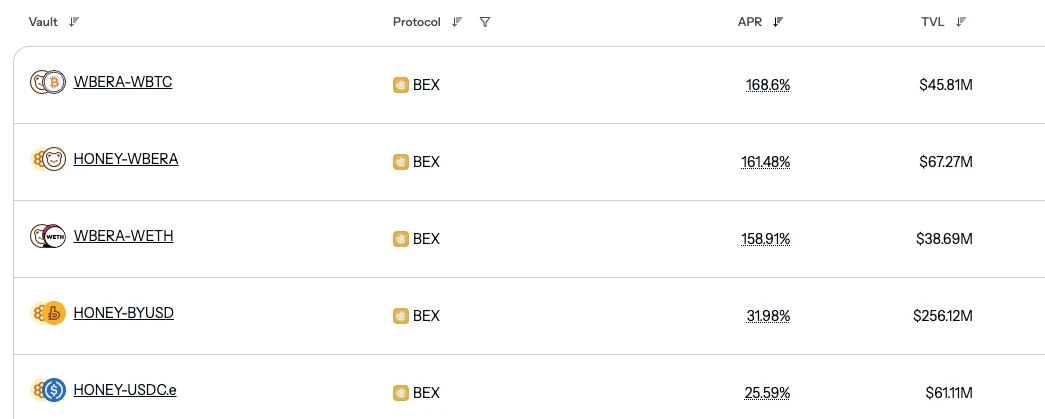

In addition to depositing in the official reward vault, another option for the LP receipt tokens obtained by adding liquidity to BeraHub is to stake them in Infrared . As of now, Infrareds TVL has reached 1.53 billion US dollars. The vaults that support staking BEXs LP receipt tokens to earn iBGT are as follows. The highest APR is the WBERA-WBTC vault, which is 168.6%.

However, if the APR of the liquidity pool on BEX is combined, the yields of WBERA-WBTC and HONEY-WBERA are similar, both reaching 180% (Pool APR + Infrared APR). However, considering stability, the HONEY-WBERA pool may be less affected by token fluctuations (HONEY is the stablecoin of the Berachain ecosystem).

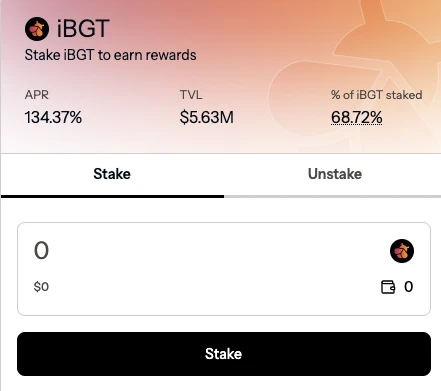

In addition, unlike the non-transferable nature of BGT, iBGT earned by staking in the Infrared vault can be staked again in Infrared with an APR of 134.37%. According to official information, more than 68.72% of iBGT has been staked, with a TVL of $5.63 million.

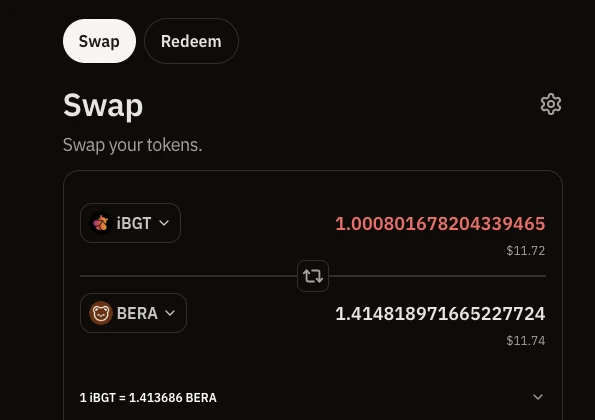

Even if users do not choose to pledge iBGT and adopt the strategy of mining, withdrawing and selling, the current value of iBGT is higher than BGT. According to the exchange rate of BEX , 1 iBGT can be exchanged for 1.4 BERA. Because the exchange rate between BGT and BERA always maintains 1: 1, the exchange rate between BGT and iBGT is also approximately equal to 0.7.

Other options for staking BERA

If users do not want to form LPs to bear the risk of impermanent loss and just want to hold BERA for a long time, Berachain also has a profit strategy for staking BERA.

Dolomite

Dolomite is a lending protocol on Berachain, with a total financing amount of US$3.4 million. On May 15, 2023, it completed a financing of US$2.5 million, led by NGC Ventures and Draper Goren Holm, with participation from Coinbase Ventures, 6th Man Ventures, WWVentures, Token Metrics Ventures, RR 2 Capital, Slappjakke, Matthew Finestone, etc.; on March 19, 2024, it completed a strategic financing of US$900,000, with participation from Optic Capital, Sandeep Nailwal, DCF GOD, Pentoshi, Marc Boiron, etc.

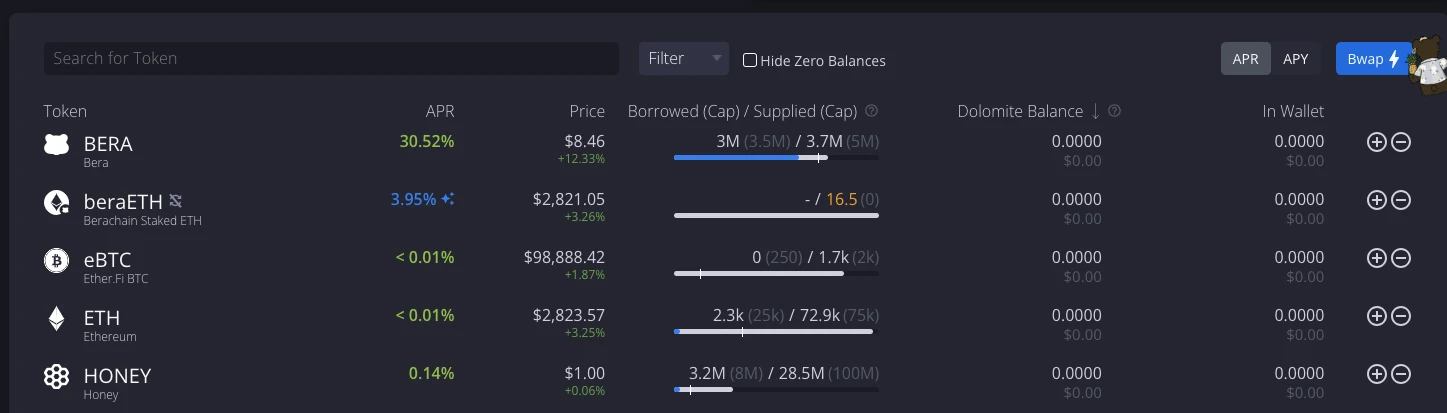

Currently, Dolomite TVL has exceeded 1 billion US dollars, and the loan amount has exceeded 68.35 million US dollars. Depositing BERA on the platform can enjoy an APR of over 30%, but the deposit supply is capped at 5 million.

Meanwhile, Dolomite announced during the Berachain mainnet launch that it will conduct a TEG in the coming weeks. The total supply of DOLO tokens is 1,000,000,000, 20% of which will be used for airdrops, of which 9% will be airdropped to Dolomite users, based on the users loan and asset deposit supply data on Dolomite. The official has not yet announced a snapshot.

Kodiak

Kodiak is Berachains native liquidity protocol. On February 5, 2024, it completed a $2 million seed round of financing, with participation from Amber Group, Shima Capital, No Limit Holdings, dao 5, Kenetic Capital, Ouroboros Capital, Tenzor Capital, Lotus Capital, ODA Capital, Wizards Capital, Baboon VC, Dewhales Capital, Owl Ventures and others.

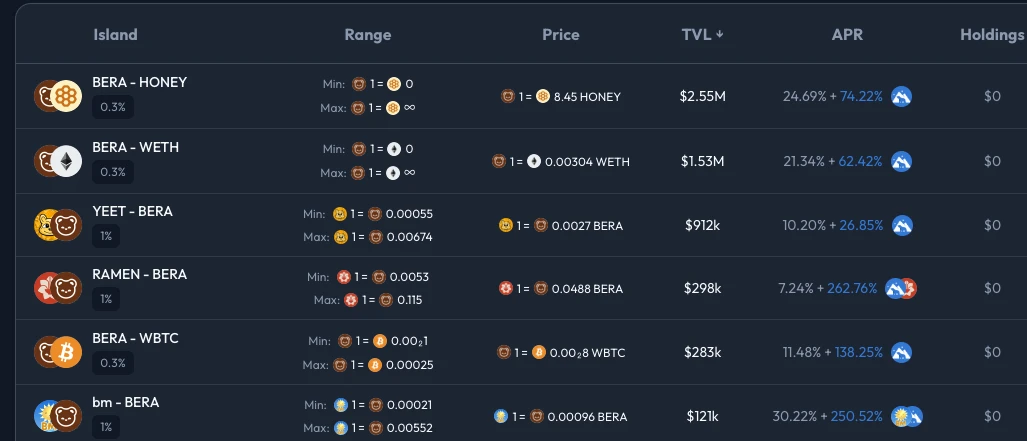

Kodiak currently has a TVL of $767 million, and the platform supports adding bilateral or unilateral liquidity. As shown in the figure below, the BERA-HONEY pool offers a 24.69% fee APR plus a 74.22% Farm APR, for a total yield of 98.91%.

According to official information, before the TGE of Kodiaks native token (KDK), the Kodiak protocol will use xKDK to incentivize users. xKDK is not transferable or staking. After the TGE, pre-TGE rewards can be converted to xKDK at a 1:1 ratio, and xKDK can be converted to KDK at a 1:1 ratio (through the redemption process). The maximum supply of KDK is 100M.

Memeswap

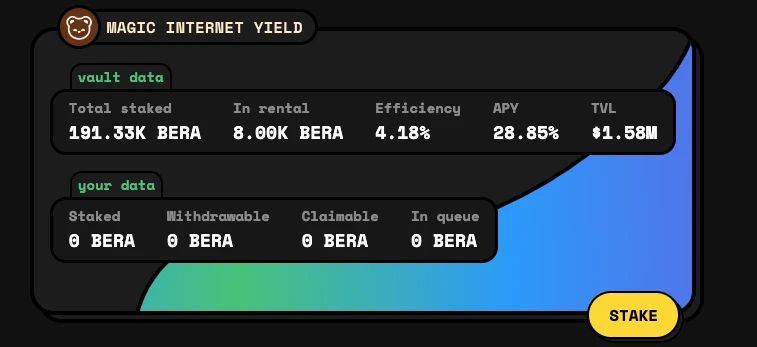

Memeswap is the Meme launch platform and DEX on Berachain. The platform currently also supports staking BERA, with an APY of 28.85%. The current staking volume is 191,330 BERA.

WeBera

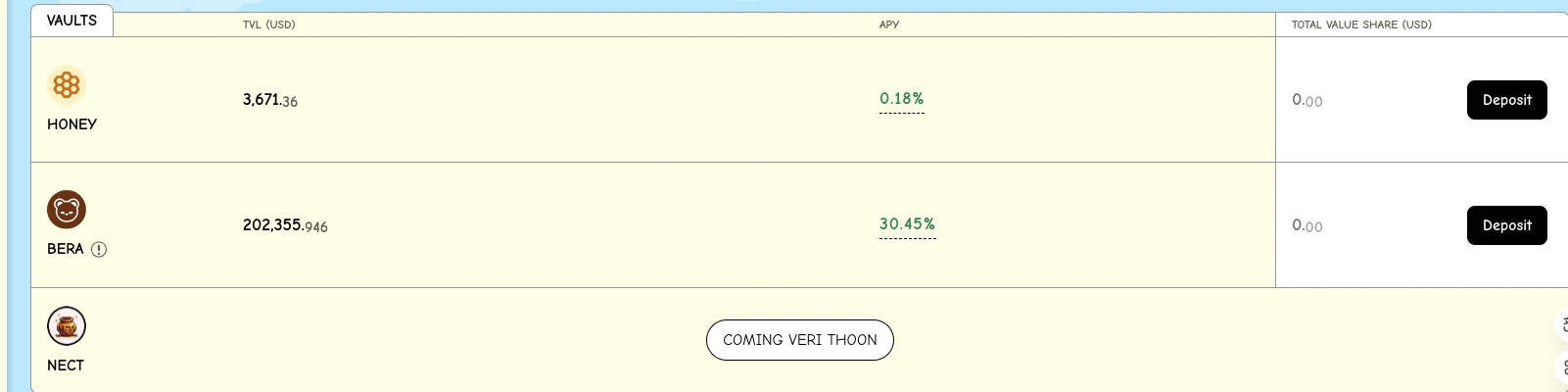

WeBera is a yield abstraction layer on Berachain, which aims to simplify participation in DeFi on the Berachain ecosystem and has passed the SlowMist audit. The platforms APY for staking BERA is 30.45%, and the current TVL is $202,355.946.