Original article by Axel Bitblaze

Original translation: TechFlow

The retail market is sluggish, sentiment has hit rock bottom, and altcoins have continued to fall for months - but this may be the prelude to a new round of opportunities.

Although market conditions appear bad, I think this is more of a setup than an end point.

As key catalysts emerge, I believe the next leg of the market rally will be led by utility coins, not memes.

Here are my thoughts and when this change might occur.

Since December 2024, investors’ patience in waiting for the “altcoin season” has been worn out.

Since the fourth quarter of 2024, the market has actually ushered in a lot of good news, but the altcoin market has never responded positively.

Currently, market sentiment seems to be in a depressed phase, with retail investors and large capital holders (whales) selling out.

Does this mean that Copycat Season is just a gimmick?

Will this market cycle end without ETH reaching a new high?

Are there any positive factors that could drive capital into the altcoin market?

Next, let’s start the analysis from the positive factors and the timeline of the “copycat season”.

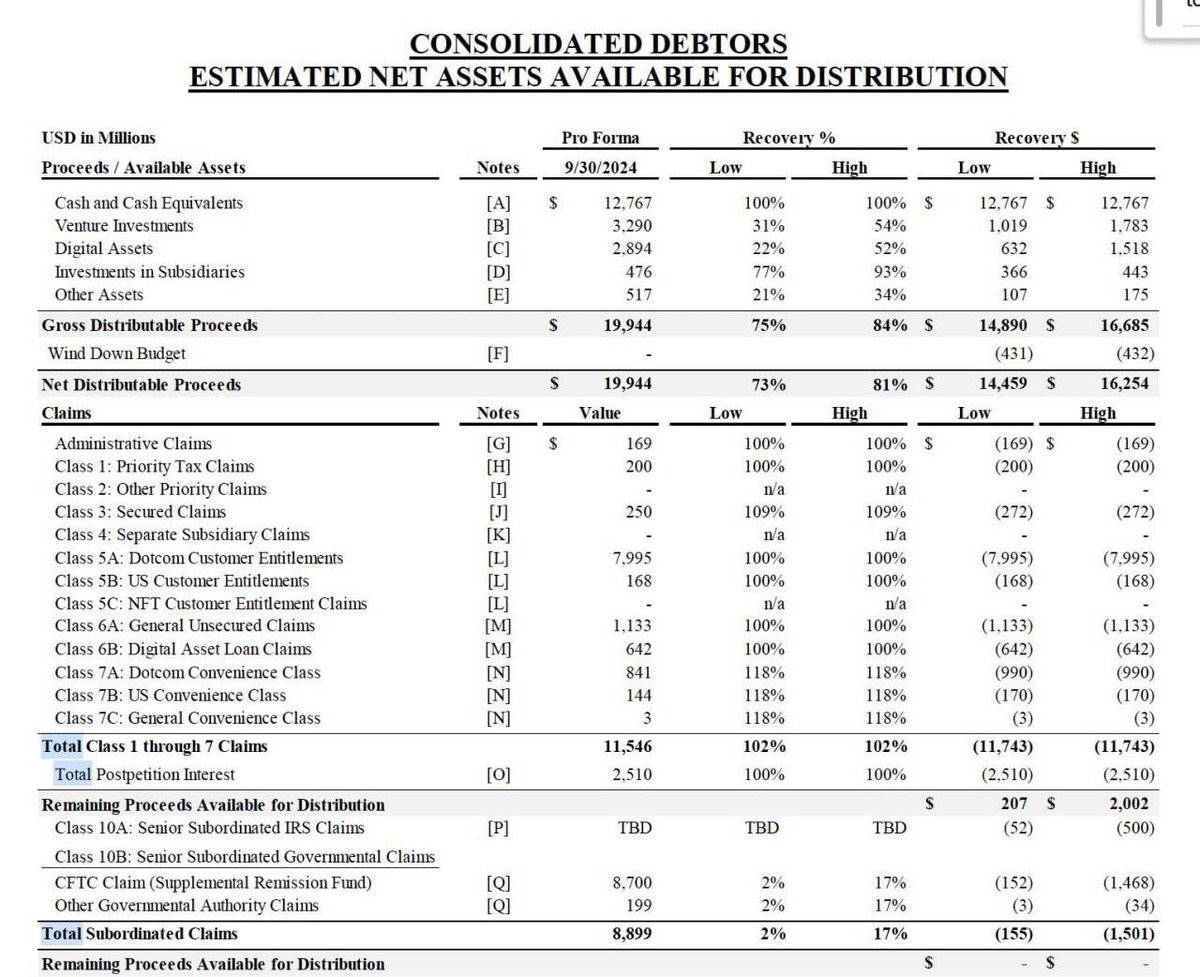

1. FTX Payouts: A New Variable in the Market

Previously, I thought that FTXs compensation would be delayed for years like the Mt. Gox incident. But it turns out that this process is accelerating.

Starting from February 18, 2025, FTX will initiate the first round of compensation, with the total amount expected to be between US$7 billion and US$8 billion, mainly in the form of stablecoins.

What does this mean for the copycat market?

First, most of FTX’s traders are investors with a higher risk appetite and hold mostly altcoins in their portfolios.

Secondly, current market data shows that most altcoins (including ETH) are severely undervalued compared to BTC.

Looking back at the market conditions when FTX crashed, the price of BTC was around $16,000, the price of SOL was around $20, and ETH was around $2,500.

Today, as funds flow back into the market, many investors will reassess the current market environment and realize that ETH is undervalued.

In addition to ETH, there are many altcoins whose gains from the bottom of the cycle have lagged significantly behind BTC.

Coupled with the increasingly friendly policy environment of the US government towards cryptocurrencies, I believe that most of this money will flow into the altcoin market, especially those tokens with practical application value rather than simply relying on hype memes.

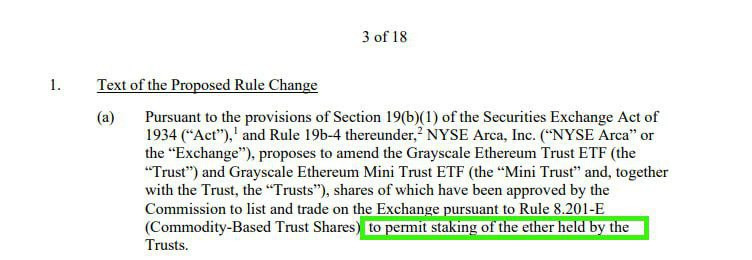

2.ETH ETF staking function: a new attraction for institutional funds

ETH holders have long been looking forward to applications related to the ETH ETF staking function. Now, this process has finally begun.

In the past three days, Grayscale and 21 Shares have filed applications with the U.S. Securities and Exchange Commission (SEC) to allow their Ethereum ETFs to be collateralized by ETH holdings.

While BlackRock has not yet filed a similar application, I expect this to happen within the next 2-3 weeks.

Currently, institutional investors have limited motivation to choose ETH ETF instead of BTC ETF. However, once the staking function is approved, ETH ETF will be able to provide an annualized yield of 3%-4%. For traditional financial institutions (TradFi), such a yield is undoubtedly attractive and will attract more institutional funds to the ETH market.

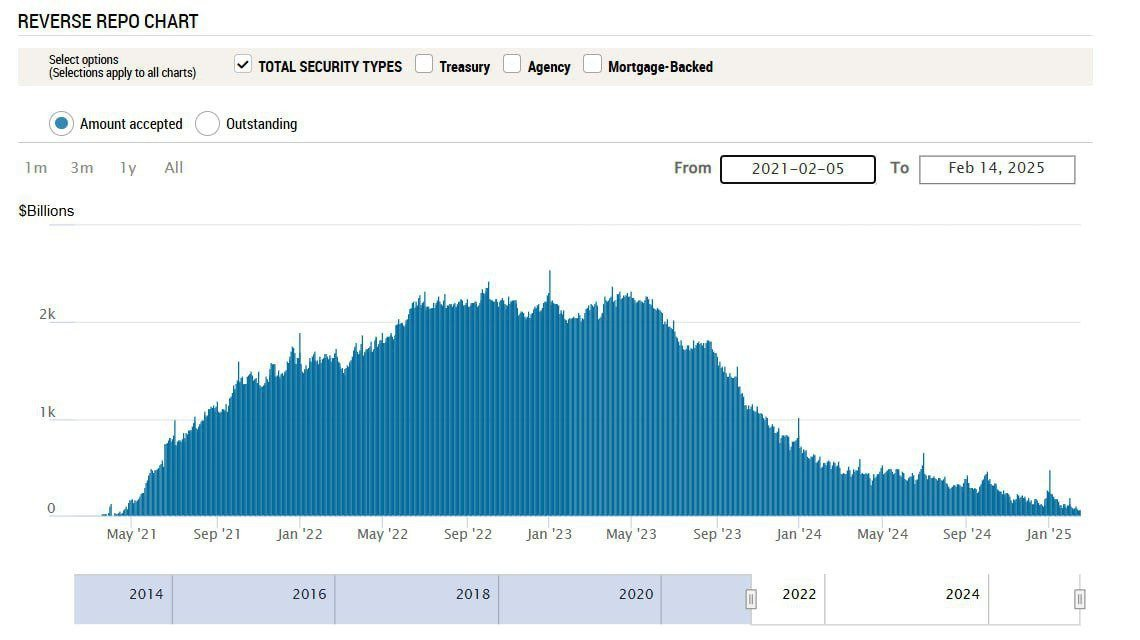

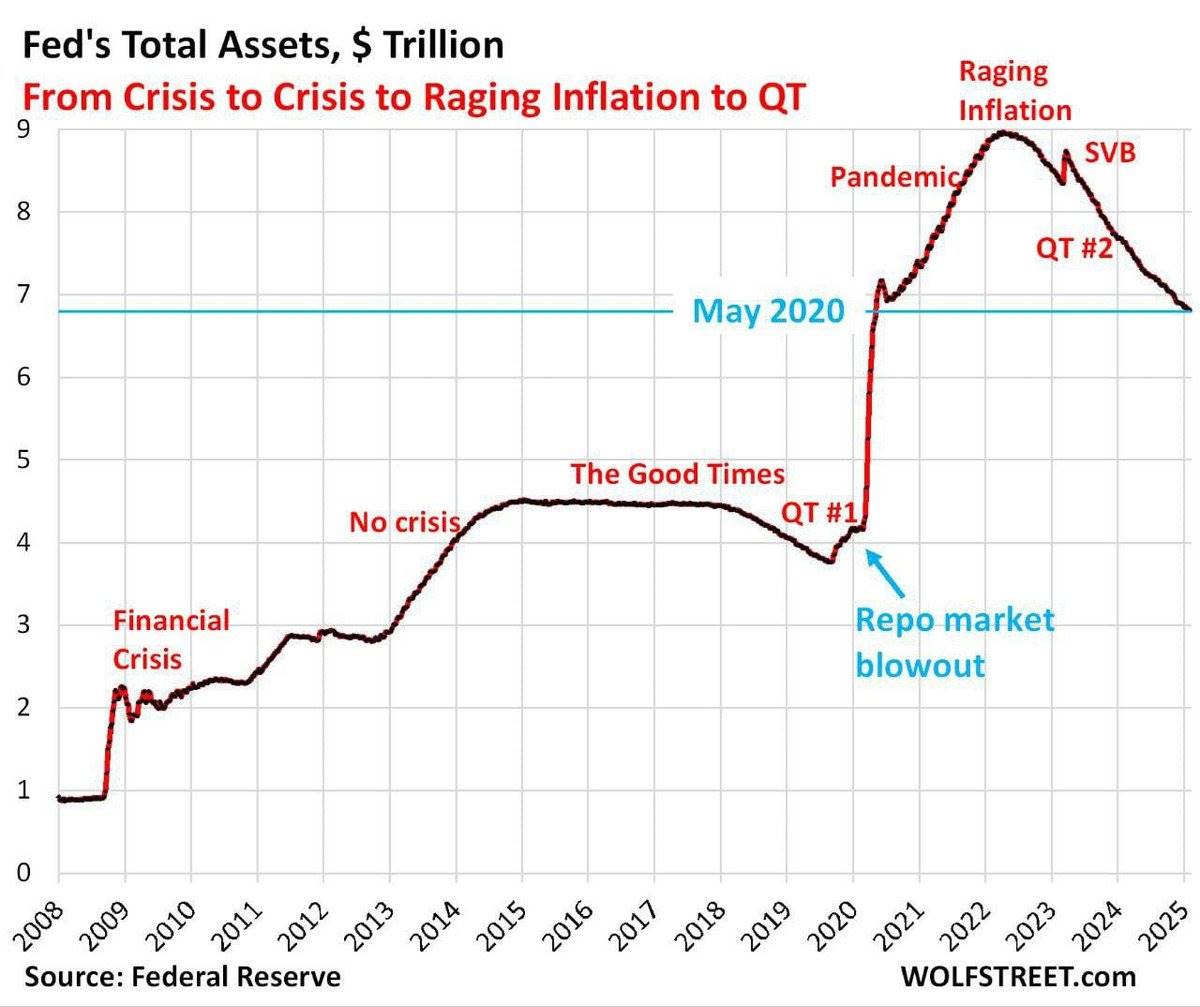

3. The decline of the Federal Reserve’s reverse repurchase facility (RRP): a turning point in market liquidity?

The Federal Reserves reverse repurchase facility (RRP) is an important tool for regulating liquidity in the financial system. When the RRP balance decreases, it generally means that excess liquidity is decreasing.

This phenomenon typically occurs when the Federal Reserve engages in quantitative tightening (QT) by shrinking its balance sheet, which is currently happening.

As of now, the Fed’s RRP balance has fallen by $2.5 trillion from its peak to April 2021 levels.

What does this mean for the market?

The end of quantitative tightening (QT) appears to be in sight.

It is worth noting that there has never been a cottage season during the period when the Federal Reserve implemented quantitative tightening.

4. Regulatory breakthrough for altcoin ETFs: a new dawn?

Since January 20, 2025, the U.S. Securities and Exchange Commission (SEC) has begun cooperating with issuers of altcoin ETFs.

In the past few days, the SEC has officially accepted spot ETF applications for XRP, DOGE, and SOL.

Although this does not mean that these applications will definitely be approved, it shows that the U.S. altcoin market may be about to usher in a clearer regulatory environment. This will play a positive role in restoring market confidence.

5. The deterioration of market sentiment: crisis or opportunity?

Market sentiment is currently at a low point:

Competition among developers and project founders is growing increasingly fierce.

ETH supporters even began removing their .eth logos to show their dissatisfaction with the market.

Bitcoin supporters are selling spot BTC and buying ETFs instead.

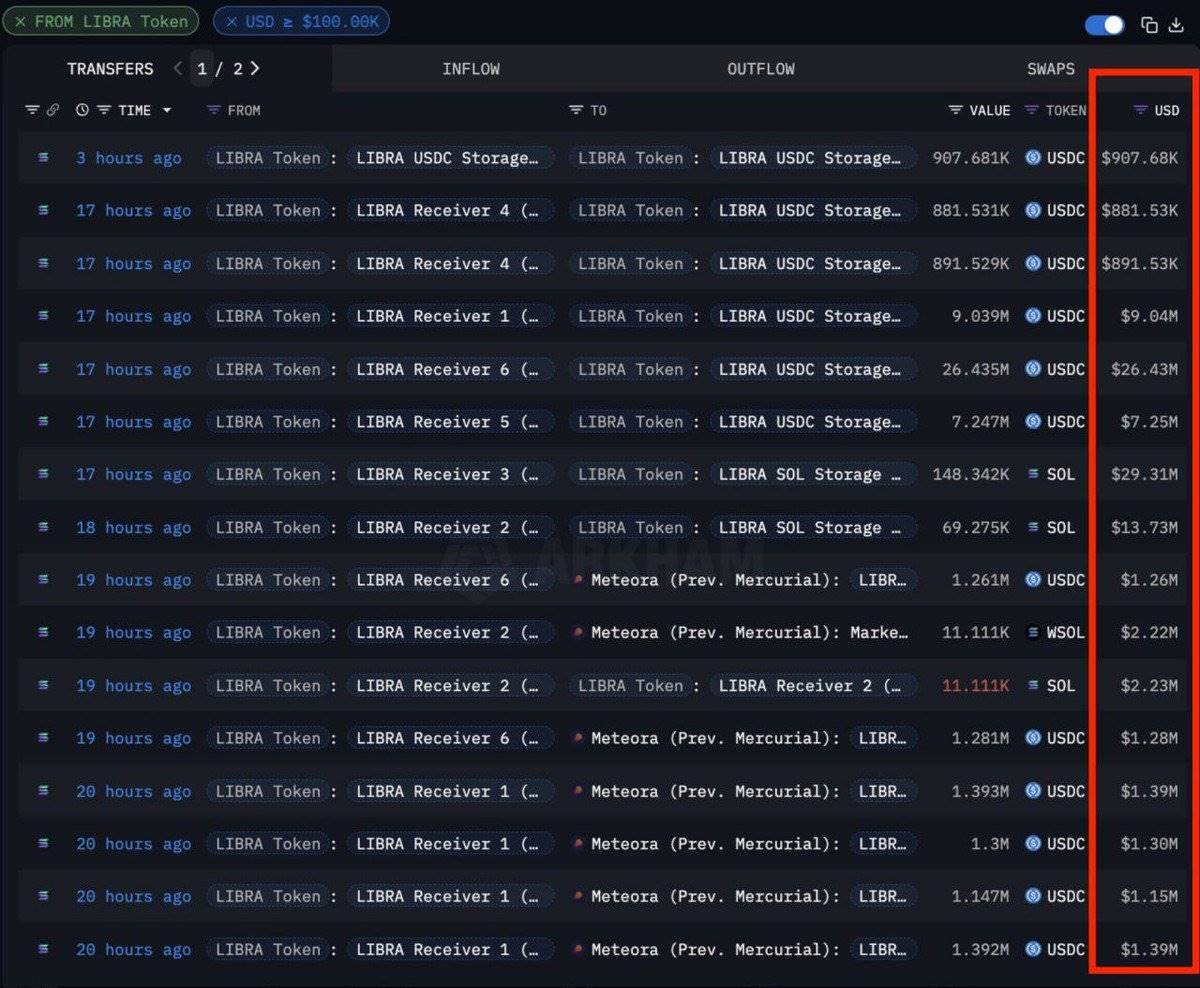

Some countries have even started issuing memes, cashing out hundreds of millions of dollars from retail investors.

Against this backdrop, altcoin trading has been sluggish, as if the market is experiencing a huge crisis of confidence.

However, history shows that extreme market sentiment is often a precursor to major turning points.

After the Luna and FTX crashes, market sentiment is even more depressed now

As a crypto industry practitioner who has experienced the Luna crash and the FTX crash, I can say that the current market sentiment is even worse than it was then.

Currently, 99% of retail investors’ portfolios are either zeroed out or down 90%-95% from their peak.

This is a classic sign of market capitulation.

The sell-off at the price level is complete, and now the market is experiencing time capitulation - where investors lose patience due to long-term losses.

Despite this, many people are so overwhelmed by the losses that they overlook a number of positive changes taking place in the industry, including:

Abu Dhabi’s sovereign wealth fund is buying Bitcoin (BTC) on a massive scale.

Several banks in the United States are preparing to launch cryptocurrency custody services.

Goldman Sachs has invested billions of dollars in buying BTC.

The United States is expected to introduce cryptocurrency regulatory policies in the next 60-90 days.

also:

Trumps company announced plans to buy BTC and other crypto assets.

World Liberty Financial is continuously buying altcoins using the time-weighted average price (TWAP) strategy.

More than 22 US states have filed bills to include Bitcoin in state reserves.

Companies like GameStop plan to include BTC on their balance sheets.

The above positive factors may become an important driving force for the next round of cryptocurrency increases.

Prediction of the recovery time of the altcoin market

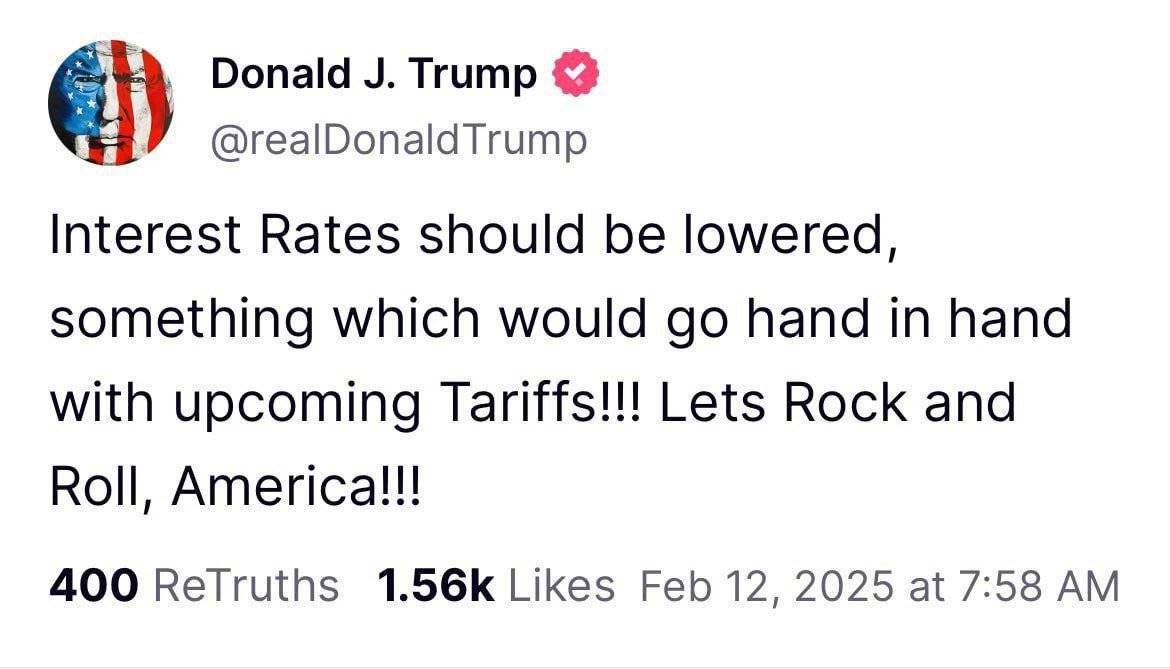

At this point, most of the tariff-related FUD has subsided or been postponed to 1-2 months later.

The main concern in the market right now is that rising inflation could force the Fed to take more aggressive interest rate hikes. However, I think this is unlikely to happen as the Trump administration continues to call for rate cuts.

The next Federal Open Market Committee (FOMC) meeting will be held in March, and I expect the rally in the altcoin market to start before then.

Another reason that supports a rebound in altcoins before the end of February is that investors’ patience with meme scams has run out and they are likely to redirect their funds to altcoins with real uses.

While this round of copycat season may not be as large as the peaks of 2017 or 2021, it may last 6-8 weeks and form a local high similar to the first quarter of 2024.

My summary and suggestions

The over-hype of memes has indeed delayed the arrival of the altcoin season, but as the bubble in the meme market bursts, the next round of altcoin rise may exceed the performance in the fourth quarter of 2024.

Since the market crash in February, I have been actively investing in altcoins that have real-world uses because I believe the market is about to reverse.

If there is one piece of advice for investors, it is this: Don’t chase those shiny new memes, but focus on accumulating altcoins that have real application scenarios and strong network effects.