key points

key points

Bitcoin’s flash crash may be a result of short selling by whale traders or high leverage amplifying market volatility;

Speculation revolves around the combination of the two - selling by whale traders combined with runaway algorithmic trading, which ultimately crowds out overcrowded leveraged long positions in derivatives markets;

Despite the slump, market sentiment has not been dampened.

Bitcoin broke a multi-year downtrend, hitting a second all-time peak of $12,100 on August 2, 2020, before plummeting 13% to $10,550 within an hour. In trouble is ethereum, which has outperformed bitcoin since the start of the year, off to a dismal start to August, with prices plunging more than 20%.

Sudden price fluctuations caused the cumulative liquidation value of major exchanges to be about 1.4 billion US dollars. The largest liquidation was worth $10 million.

It is not unheard of for markets to be manipulated by whale traders. Let’s review the price pump on April 2, 2019. A mysterious whale bought $100 million worth of Bitcoin from Coinbase, Bitstamp, and Kraken, sending the price of Bitcoin up 20%. These three spot exchanges are the index price reference sources for most derivatives trading platforms.

image description

According to over-the-counter trading professionals, the execution of large orders on spot exchanges is highly unusual and it is recommended that these orders should be fulfilled through over-the-counter trading desks. The pattern highlights the potential for market manipulation, as people can profit from leveraged positions in price pumping.

secondary title

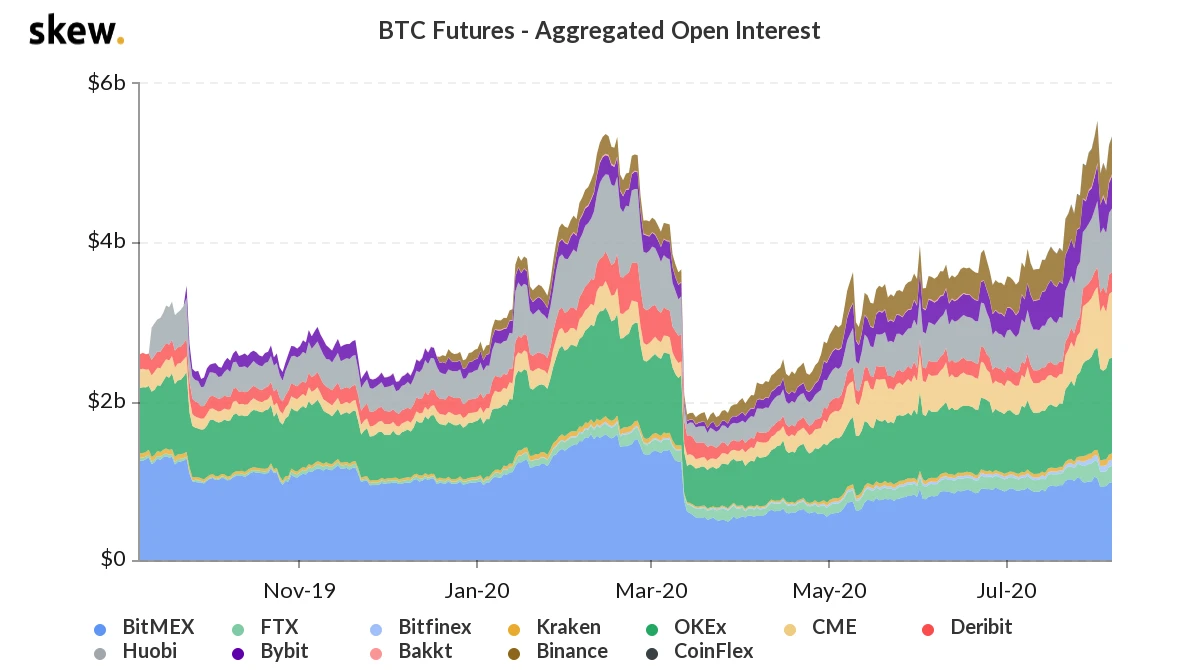

Total open interest in bitcoin futures on major futures exchanges rose sharply before the plunge, almost matching Februarys all-time high.

image description

Source: Skew

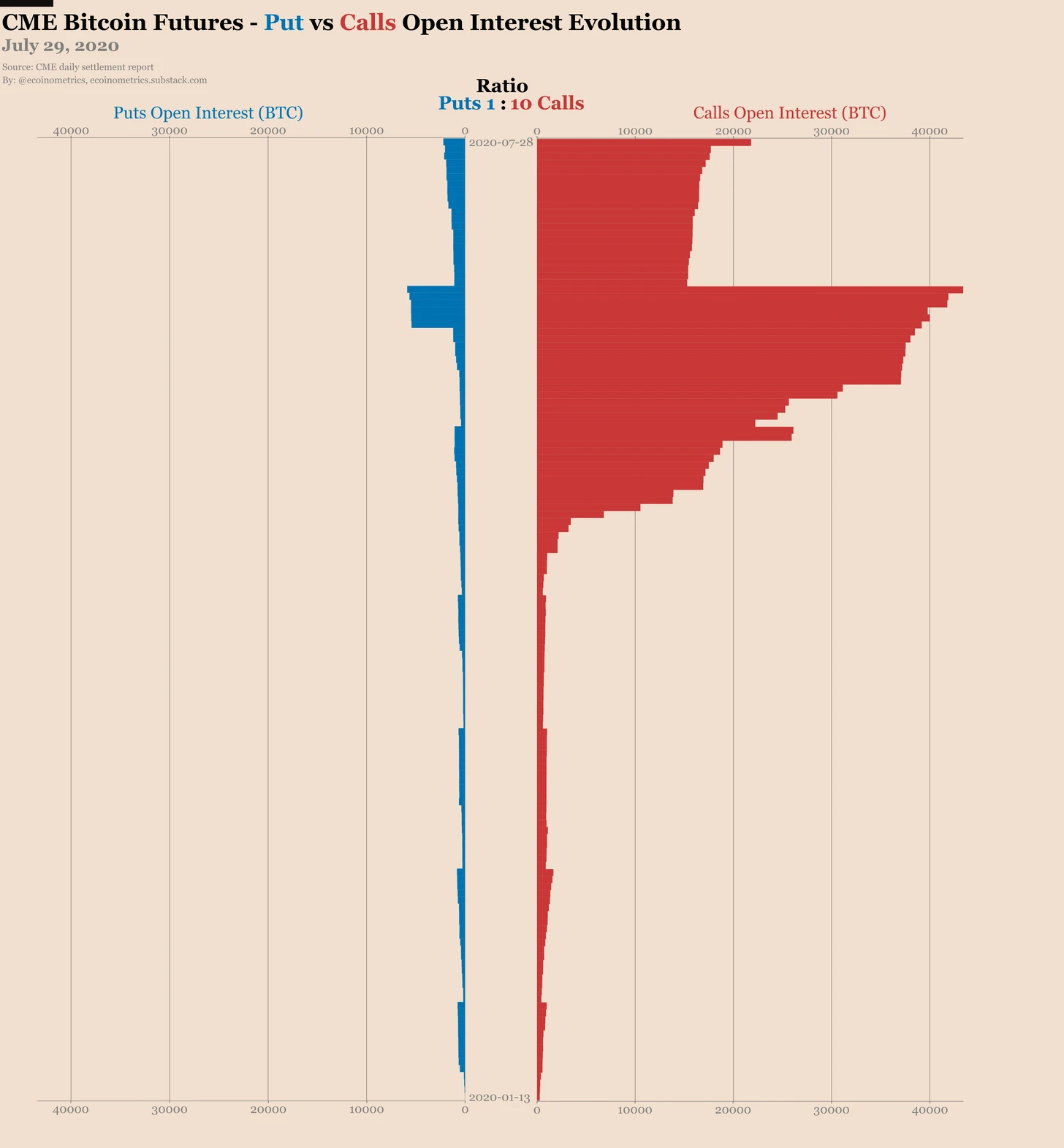

The long-short position ratio of BTC futures on several futures exchanges is around 1.5 to 2, and the Crypto Fear Greed Index (Crypto Fear Greed Index) was 80 (extreme greed) before the plunge. The put-to-call ratio in the chart below shows that this tendency is also present in the options market. Taken together, the data underscores that market expectations are skewed heavily on the bullish side. It is not surprising that there has been a sell greedy attack. At the same time, it is not entirely unfounded to speculate that this plunge may have been caused by manipulators deliberately using high leverage to squeeze out overcrowded long positions.

Although the crypto market is mainly dominated by retail investors, with the entry of more professional traders and institutional funds, retail investors are increasingly vulnerable to the risks of market manipulation and malicious price gouging.

For traders new to derivatives or leveraged trading, it is recommended to use lower leverage and look for products and services that can help mitigate losses due to sudden changes in the market. For example, most of the traders who purchased the risk management tool developed by Bybit - long protection (mutual insurance) did not suffer losses, and the largest single payout was 0.72 bitcoins.