Original author: Fairy, ChainCatcher

Original editor: TB, ChainCatcher

This year marks the tenth anniversary of the birth of Ethereum.

Over the past decade, it has supported the prosperity of DeFi and ignited the wave of NFT. Countless developers and idealists have intersected, collided, and built on this chain, composing one crypto narrative after another.

But in its tenth year, Ethereum has reached a crossroads of fate. New public chains emerge one after another, the narrative leadership is frequently lost, and the price is losing momentum in a long period of adjustment.

After ten years of trials and tribulations, can Ethereum still usher in a huge pump?

Chips tend to be concentrated, is Ethereum changing dealers?

The rumor about Ethereum changing dealers has actually been circulating since last year. Some people believe that the industrys old OGs who held ETH in the early days are gradually withdrawing, and the chips are being quietly taken over by institutions such as Wall Street. Is this change really happening, or is it a story told to yourself?

According to the analysis of on-chain analyst @Murphychen 888, ETHs Herfindahl Index (a measure of chip concentration) has been declining since 2016, indicating that chips are being dispersed to retail investors. It bottomed out in March 2023, but suddenly rose from December 2024, indicating that funds have re-concentrated their holdings. Whether it is active or passive replenishment, the actions of whales are pushing up concentration.

Ethereum Herfindahl Index: Concentration of Chips

A high index indicates that a small number of large holders are dominating the market, while a low index indicates that the chips are more evenly distributed.

However, this is an extremely slow process, as some large investors are still shipping, reducing the concentration trend. Although this increase in concentration will help the price trend in the future, the process is slow and it may be a long and painful wait for market participants.

In addition, according to glassnode data, since the end of March, the RSI (Relative Strength Index) of ETHs belief buyers has always been as high as 80, while loss-making sellers have rapidly cooled down after reaching a peak in mid-April. This shows that despite the sharp price correction, there are still firm buyers who continue to take over, starting from March 26th and continuing to do so.

RSI is used to measure whether the market is overbought or oversold

The range is from 0 to 100. Usually RSI > 70 indicates overbought, and RSI < 30 indicates oversold.

It is still unclear whether Ethereum is really changing dealers, but on-chain data shows a trend of redecentrating chips. Perhaps behind this is the long-term layout of big funds and the persistence of buyers with faith.

Ethereum’s “heart change” proposal: The execution layer is expected to usher in the biggest upgrade

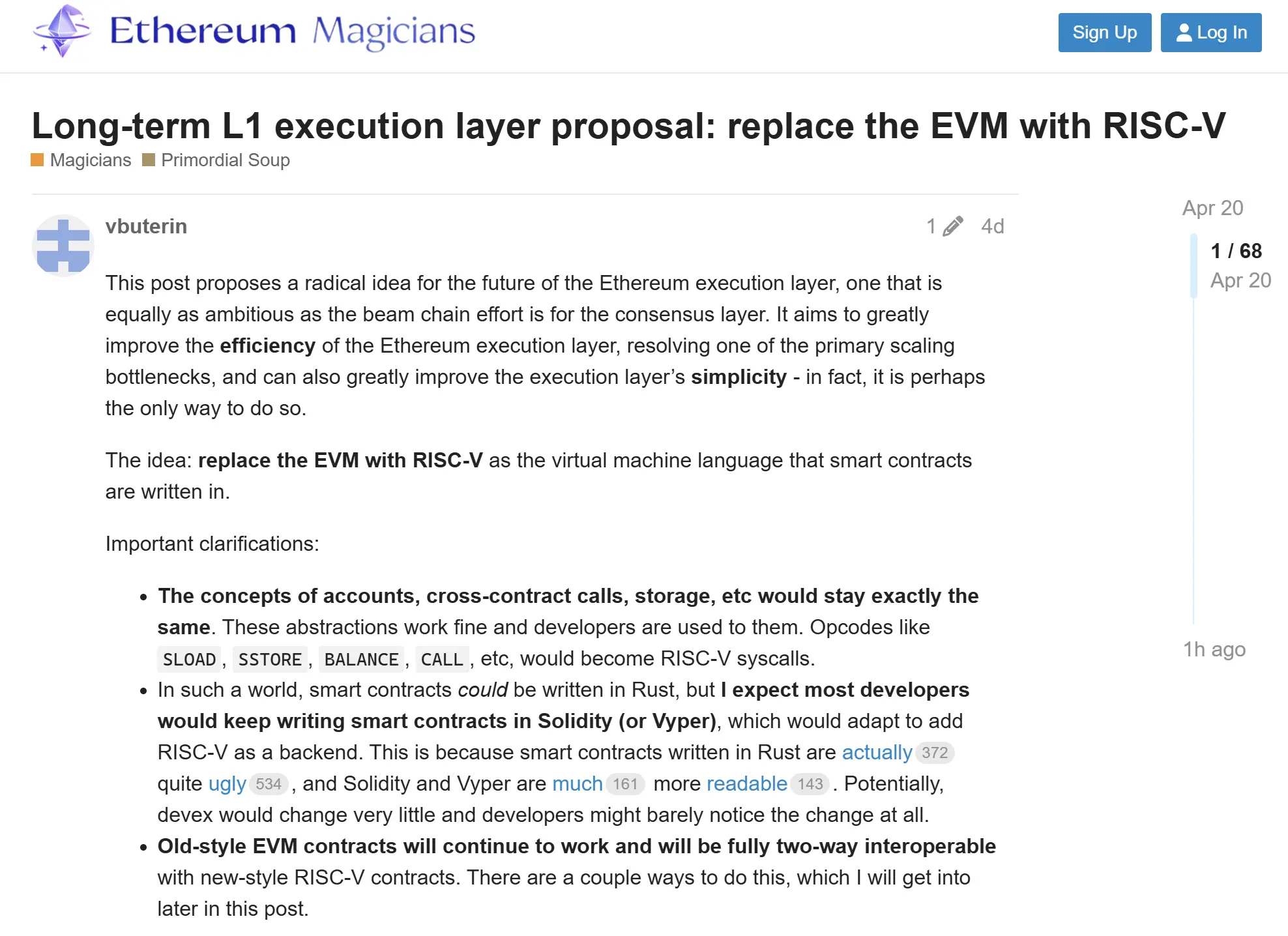

On April 20, Vitalik released a major proposal, proposing to replace the current Ethereum Virtual Machine (EVM) with the open source instruction set architecture RISC-V as the long-term evolution direction of Ethereum Layer 1 execution layer.

According to the design, the existing EVM contracts will continue to run and achieve bidirectional compatibility with the new architecture. The core abstractions such as account model, cross-contract calls, storage, etc. will also be fully retained. The original opcodes such as SLOAD, SSTORE, BALANCE, CALL, etc. will be mapped to RISC-V system calls. The new architecture supports writing contracts in languages such as Rust, and is compatible with existing languages such as Solidity and Vyper, and the developer experience is basically unaffected.

If this direction comes true, it will completely change the way Ethereum smart contracts operate and lay a technical foundation for its scalability in the next few decades. Crypto KOL Da Yu pointed out that if the proposal is successful, the speed of the Ethereum main network can be increased by 100 times, transaction fees can be reduced by more than 1,000 times, the value of Layer 2 may decline, and Ethereum will directly challenge high-speed public chains such as Solana and Sui, superimposing the advantages of decentralization and ecological accumulation, and adding the wings of speed.

Although the proposal is still facing risks such as community opposition, its emergence has released a strong signal: Ethereum is turning its attention back to the value of its own mainnet. As community user @shmula commented, Vitaliks proposals have always made Ethereum Layer 1 abandoned, but this proposal is expected to inject value back into it.

The “default choice” of traditional finance?

Traditional institutions also seem to prefer Ethereum. Bank of New York Mellon, one of the worlds largest custodian banks, recently launched the on-chain data tool Digital Asset Data Insights on Ethereum, and BlackRocks tokenized fund BUIDL has also deployed more than $2.3 billion in funds on Ethereum.

Data: Funding distribution of Deflama and BUIDL chains

Does this mean that traditional institutions are actively engaging with the Ethereum ecosystem and starting to experiment with its security, transparency, and composability? Crypto KOL Blue Fox also proposed a forward-looking concept: Will large financial institutions build exclusive L2 or private chains on top of the Ethereum security layer in the future?

The opinion of LXDAO initiator brucexu.eth may give us some inspiration. He said that some Hong Kong financial institutions and asset chain projects he has come into contact with recently generally choose Ethereum as the underlying platform because it is almost the only preferred option at the current stage. He pointed out: From the perspective of functionality, Bitcoin lacks flexible scalability; from the perspective of stability and neutrality, financial institutions cannot accept public chains that may be intervened by the state or face the risk of downtime; and emerging blockchains have not yet been tested by time and security, and their maturity still needs to be verified.

These early actions may just be the beginning. But in the short term, the explosion of the application layer is very important for Ethereum to realize its value.

Thousands of chains look up to him, or is he too old to be a hero?

From the replacement of the core team of the Ethereum Foundation in February this year to the recent proposal to support the RISC-V virtual machine, Ethereum is showing a proactive correction attitude. Tomasz K. Stańczak, executive director of the Ethereum Foundation, also recently admitted that Ethereums secondary goal is to become the preferred infrastructure for institutions and win the RWA and stablecoin markets.

All these trends are not pessimistic, and even the technical side has begun to turn around. According to Trend Research, ETH is at a critical position of support and resistance swap, and a breakthrough may usher in a favorable trend reversal. ETH has experienced a long decline of 5 months since December 2024, and the number of profitable addresses has dropped to a lower position in the bear market, and it continues to be oversold. Currently, with the recovery of the crypto market, it has entered a critical support and resistance swap range.

Profitable address data

Trend Research pointed out that a number of technical indicators also released potential bottoming signals. ETHs K-line pattern, moving average, MACD and Momentum, RSI and MFI and other multiple indicators all point to the possibility of a short-term bullish and bearish reversal. The current price is also approaching the upper edge of the falling channel and the horizontal pressure level, and is trying to break through.

Ethereum seems to be welcoming its own critical window period, but as the Chinese often say, Before thinking about victory, think about failure first. Even if the situation is beginning to show signs of hope, we cant help but ask: What if it fails in the end? If these efforts are ultimately unable to break through the performance bottleneck, the ecological development stagnates, or fails to regain price confidence, will Ethereum become the doomsday chariot of the new era?

Ten years is a milestone in time and a test of faith. The wheel of time rolls forward. Success is admired by all, and failure is a hero in his twilight years.