Author: Tiantian | Amber Group

secondary title

secondary title

How Gas Tokens Work

Gas tokens are essentially the tokenization of Ethereum block capacity rents. Gas tokens leverage Ethereum’s storage refund mechanism. The principle is very simple: users mint gas tokens by saving data into the GasToken contract storage, and then send the gas tokens back to the contract for destruction, releasing the previously saved storage elements. At the same time, this new transaction will also receive a refund, which is converted into a gas deposit. In this way, active users can mint or buy gas tokens when the price is low, and then burn them when the price is high, so as to get a gas refund to offset part of the expenditure. This model is very beneficial to chain arbitrageurs, deploying smart contracts, and batch traders whose gas costs are too high.

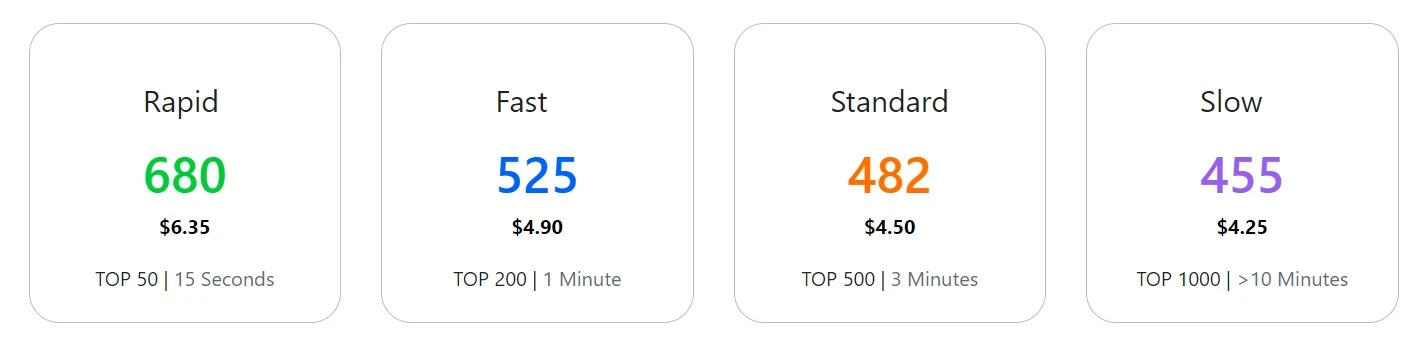

We might as well think of gas tokens as the tokenization of gas fees. Fees go up, gas tokens go up; fees go down, gas tokens go down: in general, there is a positive correlation between the two. There are two types of gas tokens currently used in the market, GST2 (https://gastoken.io/secondary title

GST2

https://www.coingecko.com/en/coins/gastoken

CHI

https://www.coingecko.com/en/coins/chi-gastoken

Positive feedback loop between Gas Tokens and resources on the Ethereum chain

Lets consider the following two extreme scenarios:

1) The liquidity mining boom continues, gas fees remain high, and Ethereum network congestion remains. In this case, gas tokens will still be high.

2) There was a correction in the market, the above-mentioned positions were greatly reduced, and users were eager to exit, which led to the shortage of resources on the Ethereum chain and the gas fee remained at a high level. In this case, gas tokens will still be high.

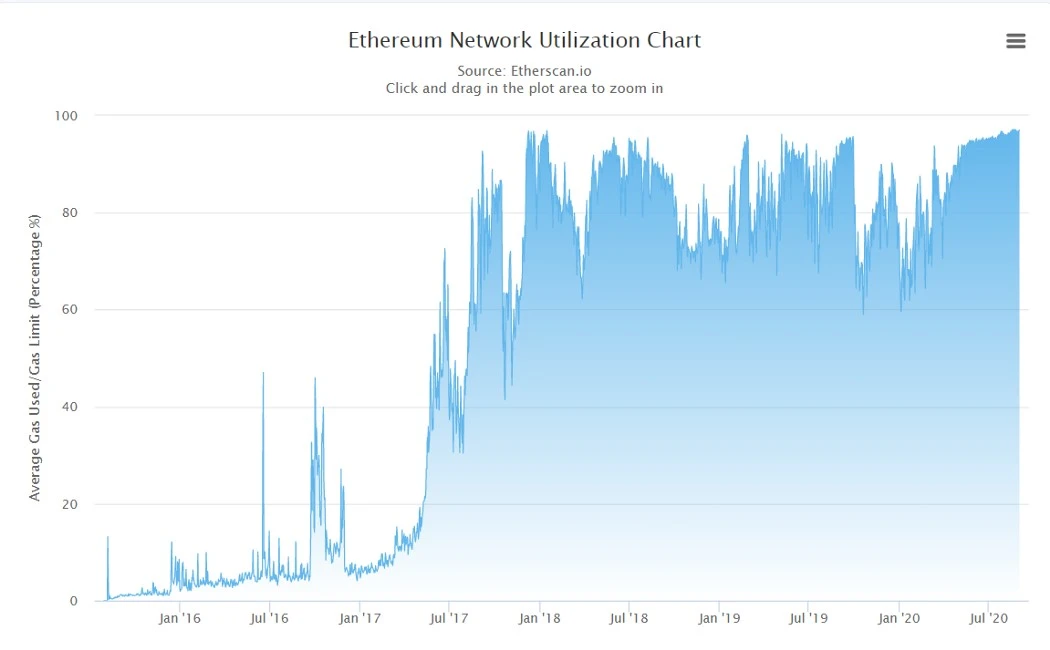

In the above two scenarios, it is not difficult to find a commonality, that is: changes in gas fees / gas tokens are usually combined with Ethereum network usage, forming a mutually reinforcing positive feedback loop between each other.

image description

https://etherscan.io/chart/networkutilization

This possible positive feedback loop,https://gastoken.io/Also mentioned above:

“Widespread use of GasToken could waste a lot of block capacity, driving up gas prices, which in turn pushes back GasToken use, so there is a potential for a positive feedback loop.”

epilogue

epilogue

Buying gas tokens in large quantities will take up more Ethereum block capacity.

The price of gas tokens has soared and gradually deviated from the fair value, attracting a large number of users to participate in the minting of gas tokens in order to sell them at high prices, thereby accelerating the utilization of Ethereum block capacity and boosting the increase in gas fees. The continuous increase in gas fees will undoubtedly intensify users demand for gas tokens, which in turn will push the price of gas tokens higher and attract more people to participate in coin mining. The minting process will take up more block capacity...resulting in higher gas fees...and so on, a positive feedback loop is formed.

Under the current market mechanism, the possibility of such a positive feedback loop being established is extremely high. Taking the most liquid gas token CHI as an example, the single minting limit is 140. Big players will continue to dig out CHI tokens with the maximum limit, occupying the already very tight block capacity of Ethereum, and making the network more congested. The liquidity of the secondary market is weak, and the total market value of GST2 and CHI is less than 5 million US dollars. When the total locked value (TVL) of the DeFi ecosystem breaks through billions of dollars, and the market value of new platforms reaches hundreds of millions of dollars, it is not difficult to imagine that the price of GST2 / CHI will usher in a new round of new pricing, opening this Positive feedback loop mode.

Imagine...

statement

statement

The information contained in this article (hereinafter referred to as information) is for general analysis and does not claim to be complete. It is for the purpose of providing information only, and it is not and should not be regarded as an offer to sell or an invitation to buy any securities.

This information does not provide and should not be considered as providing investment advice. This information does not and is not intended to take into account any potential investors specific investment objectives, financial situation or needs. No representation or warranty, express or implied, is made as to the fairness, correctness, accuracy, adequacy or completeness of the information. We make no commitment to update the information. Investors should not consider it as research or investment advice. Investors should consult with their own legal, regulatory, taxation, business, investment, financial and accounting advisors within the scope they deem necessary, and make any investment decisions based on the judgment and recommendations of the advisors they deem necessary, rather than this any opinions contained in the information.